Summary

Table of Content

Skin Lightening Products Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Skin Lightening Products Market Size

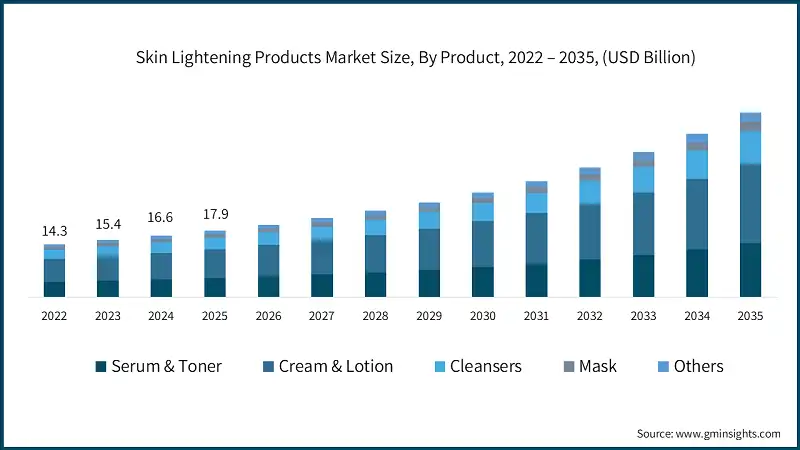

The global skin lightening products market was estimated at USD 17.9 billion in 2025. The market is expected to grow from USD 19.5 billion in 2026 to USD 49.9 billion in 2035, at a CAGR of 11%, according to latest report published by Global Market Insights Inc.

To get key market trends

- The growth of e-commerce and direct-to-consumer (DTC) sales has created greater opportunities for consumers to purchase beauty and grooming products via the internet. Shoppers can access much more inventory and selection from their own residences through the use of the internet than they would be able to do in only physical stores. The ability to shop from home for beauty products is an important resource for people who live in small towns or rural areas that do not have a physical retail store.

- In addition, the popularity of influencer-based marketing has helped to boost the popularity of many beauty products. Beauty influencers, are viewed with great respect and have created a sense of community around beauty products and brands. Because of this, beauty influencers have a huge amount of influence on consumers' purchasing habits. These factors have led to an increase in the accessibility of beauty products and created a more robust sense of community between brands and consumers.

- Product formulation innovation and product efficacy claims/functions are among the primary growth drivers for the industry. Multi-functional products that combine multiple product benefits (e.g., brightening with sun protection and hydration) appeal to consumers who value both convenience and effectiveness. These products address the demands of fast-paced lifestyles by providing a complete solution because they combine several products into one application. Another factor contributing to increased consumer confidence in skincare products is the use of dermatologically tested actives like niacinamide and tranexamic acid in many products.

- Due to growing consumer concerns regarding environmental impacts, consumers demand beauty product choices that are in line with their eco-friendly values. Consequently, most brands have adopted a commitment to sustainable packaging, waste reduction, and product formulations that contain natural and organic ingredients. This trend toward sustainability is not only aligned with consumer demand; it also allows brands to create differentiation in a competitive marketplace. Furthermore, there has been an increasing emphasis placed on cruelty-free and vegan cosmetics, which appeals to consumers who value ethical considerations when choosing which products to purchase.

Skin Lightening Products Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 17.9 Billion |

| Market Size in 2026 | USD 19.5 Billion |

| Forecast Period 2026-2035 CAGR | 11% |

| Market Size in 2035 | USD 49.9 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising beauty & grooming awareness | Increasing consumer focus on even skin tone and radiance, driven by social media influence and aspirational beauty standards. |

| Expansion of E-commerce & D2C channels | Online platforms and influencer-led marketing make products more accessible, especially in Tier-2/3 cities and global markets. |

| Innovation in formulations & claims | Introduction of multi-functional products (brightening + SPF + hydration) and dermatologically tested actives like niacinamide and tranexamic acid boosts consumer trust. |

| Pitfalls & Challenges | Impact |

| Regulatory and ethical risks | Growing scrutiny on fairness claims and advertising standards; risk of backlash if messaging is insensitive or non-compliant. |

| Ingredient safety concerns | Negative perception around hydroquinone, mercury, and harsh bleaching agents can erode brand credibility and invite bans. |

| Opportunities: | Impact |

| Shift toward natural & clean beauty | Rising demand for herbal, organic, and “free-from” formulations creates space for premium positioning and trust-building. |

| Personalization and tech integration | AI-driven skin analysis and customized brightening regimens can differentiate brands and improve consumer engagement. |

| Market Leaders (2025) | |

| Market Leaders |

Market share of ~6% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Emerging Country | China, India |

| Future Outlook |

|

What are the growth opportunities in this market?

Skin Lightening Products Market Trends

- One of the most notable changes in the market is the shift in focus from fairness to radiance and tone-enhancing claims. Historically, skin lightening products emphasized achieving a fair complexion, reflecting traditional beauty standards. However, ethical concerns and increasing regulatory scrutiny have prompted brands to move away from such messaging.

- Another significant trend is the rising demand for natural, herbal, and clean formulations. Consumers are increasingly seeking products that incorporate botanical extracts, organic certifications, and “free-from” claims, such as paraben-free and cruelty-free formulations. This preference is rooted in the country’s long-standing tradition of using natural ingredients in skincare, as well as a growing awareness of the potential risks associated with synthetic chemicals.

- The evolution of multi-functional and hybrid products is another key trend shaping the skin lightening products market. However, there is a growing demand for simplified routines that do not compromise on efficacy. As a result, skin lightening products are increasingly being developed as multi-benefit solutions, combining brightening properties with other functionalities such as SPF protection, hydration, anti-pollution, and anti-aging benefits.

- The rise of e-commerce and social commerce is another factor driving the growth of the market. E-commerce platforms, influencer marketing, and live shopping events are playing a pivotal role in expanding the reach of skin lightening products, particularly among younger consumers.

- Personalization, driven by advancements in technology, is becoming a defining feature in skin lightening products market. Artificial intelligence and machine learning are being used to analyze individual skin types and concerns, enabling brands to offer customized skincare solutions. Virtual consultations and personalized product recommendations are gaining popularity, as they provide consumers with a tailored approach to skincare. This trend reflects the high level of sophistication and innovation in the beauty industry, where consumers expect products and services that are not only effective but also tailored to their unique needs.

- Regulatory and ethical compliance is another critical aspect influencing market. The government and advocacy groups are increasingly tightening regulations around advertising claims and ingredient safety. This has prompted brands to adopt transparent labeling practices and ensure that their formulations are dermatologically tested.

Skin Lightening Products Market Analysis

Learn more about the key segments shaping this market

Based on product, the market is categorized into serum & toner, cream & lotion, cleansers, mask and others. The serum and toner segment accounted for revenue of around USD 7.8 billion in 2025 and is anticipated to grow at a CAGR of 10.9% from 2026 to 2035.

- The serum and toner segment has emerged as a dominant force within the skin lightening category due to its high concentration of active ingredients and targeted efficacy.

- Consumers increasingly prefer serums for their lightweight texture and ability to deliver potent brightening agents like niacinamide, vitamin C, and alpha arbutin directly to the skin. Toners complement this by prepping the skin for better absorption, creating a synergistic effect when used as part of a regimen. This segment appeals strongly to informed, ingredient-conscious buyers who prioritize visible results and are willing to invest in specialized treatments rather than basic creams.

- The rise of K-beauty and multi-step skincare routines has further fueled demand for serums and toners, positioning them as premium yet essential components of modern skin lightening solutions.

Learn more about the key segments shaping this market

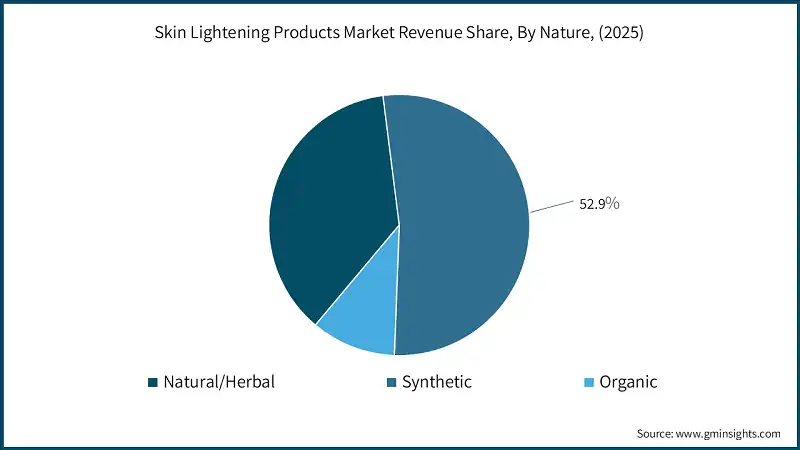

Based on nature, of skin lightening products market consists of natural/herbal, synthetic and organic. The cold water emerged as leader and held 52.9% of the total market share in 2025 and is anticipated to grow at a CAGR of 5% from 2026 to 2035.

- Despite the growing popularity of natural and organic alternatives, synthetic formulations continue to dominate the skin lightening market. The primary reason lies in their proven efficacy and stability—synthetic actives like hydroquinone, kojic acid derivatives, and lab-engineered vitamin C forms deliver faster and more consistent results compared to many natural extracts. Additionally, synthetic products allow brands to maintain cost efficiency while ensuring scalability and uniform quality across global markets. Regulatory-compliant synthetic formulations also enable precise concentration control, which is critical for addressing pigmentation concerns safely. While clean beauty trends are rising, the synthetic segment remains the backbone of the category, especially in mid-range and mass-market offerings where affordability and performance are key drivers.

Based on price, skin lightening products market consists of low, medium and high. The medium segment emerged as leader and held 46.1% of the total market share in 2025 and is anticipated to grow at a CAGR of 10.9% from 2026 to 2035.

- Mid-range products dominate the skin lightening market because they strike the perfect balance between affordability and perceived quality. Positioned between economy and premium tiers, these products cater to aspirational consumers seeking effective solutions without the high price tag of luxury brands.

- Mid-range offerings often feature clinically backed actives, attractive packaging, and strong brand credibility, making them accessible to a broad demographic, including urban and semi-urban markets. This segment benefits from aggressive marketing, influencer endorsements, and omnichannel availability both online and offline.

- As disposable incomes rise and beauty awareness spreads, mid-range products are expected to maintain their leadership, serving as the entry point for consumers transitioning from basic skincare to more specialized brightening regimens.

Looking for region specific data?

North America Skin Lightening Products Market

The U.S. dominates an overall North America market and valued at USD 2.1 billion in 2025 and is estimated to grow at a CAGR of 9.9% from 2026 to 2035.

- The U.S. skin lightening market is driven by demand for tone-evening and brightening products rather than fairness claims, reflecting a strong preference for inclusive beauty standards. Consumers prioritize dermatologist-tested, clean-label formulations with proven actives like niacinamide and vitamin C.

- Premium and mid-range segments dominate, supported by robust e-commerce penetration and influencer-led marketing. Regulatory compliance and transparency in ingredient labeling are critical for success in this market.

Europe Skin Lightening Products Market

In the European market, UK is expected to experience significant and promising growth from 2026 to 2035.

- In the UK, the market emphasizes ethical positioning and regulatory adherence, with brands avoiding fairness-centric messaging. Demand is concentrated in brightening serums, anti-pigmentation creams, and SPF hybrids.

- Consumers lean toward natural and organic formulations, aligning with sustainability trends. Online channels and specialty beauty retailers play a major role, while price-sensitive buyers still opt for mid-range products with clinically backed claims.

Asia Pacific Skin Lightening Products Market

In the Asia Pacific market, the China held 32.3% market share in 2025 and is anticipated to grow at a CAGR of 11.6% from 2026 to 2035.

- China represents one of the largest and fastest-growing markets for skin lightening products, fueled by cultural preferences for luminous, even-toned skin. The market is highly competitive, with global giants and local brands offering advanced formulations featuring whitening peptides and brightening complexes.

- E-commerce platforms like Tmall and JD.com dominate distribution, and KOL-driven social commerce significantly influences purchase decisions. Premium and luxury segments are expanding rapidly, supported by strong consumer spending power.

Middle East and Africa Skin Lightening Products Market

In the Middle East and Africa market, Saudi Arabia held 15.2% market share in 2025 promising growth from 2026 to 2035.

- Saudi Arabia’s market is characterized by strong demand for skin brightening and pigmentation control products, often linked to cultural beauty preferences. Premium and luxury brands perform well, supported by high disposable incomes and preference for international labels. Products with halal certification and dermatologist endorsements are competitive.

Skin Lightening Products Market Share

- In 2025, the prominent manufacturers in market are LOréal S.A., Procter & Gamble, Estée Lauder Companies Inc., Unilever PLC, and Shiseido Co., Ltd. collectively held the market share of ~20%.

- L’Oréal’s competitive edge lies in its extensive R&D capabilities and diversified brand portfolio. The company invests heavily in dermatological research and advanced formulations, enabling it to launch clinically proven brightening products under multiple sub-brands like Garnier and L’Oréal Paris.

- P&G leverages its consumer trust and mass-market positioning through brands like Olay, which dominate the mid-range skin lightening segment. Its strength lies in combining affordability with science-backed claims, making brightening products accessible to a wide demographic.

Skin Lightening Products Market Companies

Major players operating in the skin lightening products industry include:

- Avon Products, Inc.

- Beiersdorf AG

- Bio Veda Action Research Private Limited

- Civant LLC

- Clarins Group

- Estée Lauder Companies Inc.

- Eveline Cosmetics

- Himalaya Global Holdings Ltd.

- Kaya Limited

- L’Oréal S.A.

- Lotus Herbals Pvt. Ltd.

- Procter & Gamble

- RichFeel Hair & Beauty Pvt. Ltd.

- Rozgé Cosmeceutical

- Sabinsa Corporation

- Sanora Beauty Products

- Shiseido Co., Ltd.

- Unilever PLC

- VLCC Health Care Limited

Estée Lauder’s edge is its premium positioning and luxury skincare expertise. The company focuses on high-performance brightening serums and creams under brands like Clinique and Estée Lauder, targeting affluent consumers who value efficacy and prestige. Its ability to integrate cutting-edge technology with elegant packaging and aspirational branding gives it a strong foothold in the luxury segment, supported by personalized beauty experiences and loyalty programs.

Unilever dominates through scale and cultural relevance, particularly in Asia and the Middle East, with its Glow & Lovely (formerly Fair & Lovely) brand. Its competitive advantage lies in deep market penetration, aggressive pricing strategies, and localized product development tailored to regional preferences. Unilever’s strong distribution in traditional and modern trade channels ensures unmatched accessibility, while its recent shift toward inclusive messaging strengthens brand perception.

Shiseido’s strength is its innovation in cosmetic science and premium Asian heritage positioning. The company offers advanced brightening solutions under brands like Shiseido and Anessa, combining Japanese skincare traditions with modern technology. Its competitive edge includes strong consumer loyalty in Asia, premium product formulations, and a reputation for quality and safety.

Skin Lightening Products Industry News

- In September 2025, Estée Lauder’s Revitalizing Supreme+ Bright Radiance Power Soft Crème, featuring a vitamin C + Moringa blend for multi-dimensional brightening and spot correction. The product reaffirms the brand’s innovation in luxury brightening skincare.

- In July 2025, Glow & Lovely rolled out its “Apni Roshni Baahar La” empowerment campaign in India, promoting inner radiance and even-toned skin. The initiative established the “Glow Up Academy,” targeting digital creators across thousands of PIN codes.

- In April 2024, Avon launched the Anew Vitamin C Targeted Skin Brightener Serum, featuring 7% vitamin C and antioxidant blend for fading dark spots in one week.

The skin lightening products market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Million Units) from 2022 to 2035, for the following segments:

Market, By Product Type

- Serum & toner

- Cream & lotion

- Cleanser

- Mask

- Others (scrub, gels)

Market, By Nature

- Natural/Herbal

- Synthetic

- Organic

Market, By Price Range

- Low

- Medium

- High

Market, By End Use

- Women

- Men

- Unisex

Market, By Distribution Channel

- Online

- E-commerce

- Company websites

- Offline

- Specialty beauty stores

- Pharmacies & drugstores

- Dermatology clinics

- Others (aesthetic centres, etc.)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Who are the major players in the skin lightening products market?

Key players include Avon Products, Inc., Beiersdorf AG, Bio Veda Action Research Private Limited, Civant LLC, Clarins Group, Estée Lauder Companies Inc., Eveline Cosmetics, Himalaya Global Holdings Ltd., Kaya Limited, and L’Oréal S.A.

Which price segment led the skin lightening products market in 2025?

The medium-priced segment led the market with a 46.1% share in 2025 and is expected to grow at a CAGR of 10.9% through 2035.

Which region dominated the skin lightening products market in 2025?

The U.S. dominated the North American market, valued at USD 2.1 billion in 2025, and is projected to grow at a CAGR of 9.9% from 2026 to 2035.

What are the key trends in the skin lightening products industry?

Key trends include a shift from fairness-focused messaging to radiance and tone enhancement, rising demand for natural and clean-label formulations, and increasing consumer awareness of synthetic chemical risks.

What was the market size of the skin lightening products market in 2025?

The market size was USD 17.9 billion in 2025, with a CAGR of 11% expected through 2035, driven by increasing demand for radiance-enhancing and natural formulations.

What is the projected value of the skin lightening products market by 2035?

The market is expected to reach USD 49.9 billion by 2035, fueled by consumer preference for clean-label products and advancements in skincare formulations.

What was the market share of the cold water segment in 2025?

The cold water segment held 52.9% of the total market share in 2025 and is projected to grow at a CAGR of 5% from 2026 to 2035.

What was the revenue generated by the serum and toner segment in 2025?

The serum and toner segment generated approximately USD 7.8 billion in 2025 and is anticipated to grow at a CAGR of 10.9% from 2026 to 2035.

Skin Lightening Products Market Scope

Related Reports