Summary

Table of Content

Silanes Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Silanes Market Size

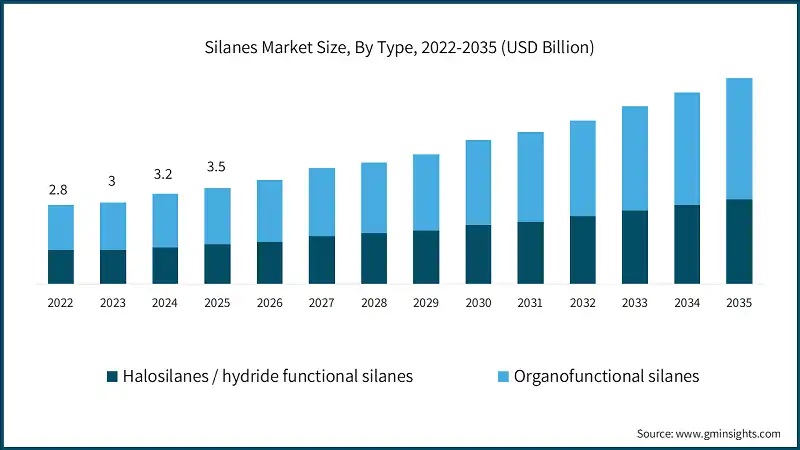

The global silanes market was valued at USD 3.5 billion in 2025. The market is expected to grow from USD 3.7 billion in 2026 to USD 7.3 billion in 2035, at a CAGR of 7.8% according to latest report published by Global Market Insights Inc.

To get key market trends

- During the years from 2021 to 2022, the silanes market benefitted from recovering construction, automotive, and electronics output. International Energy Agency and World Bank noted that there was a strong recovery in industrial production and expenditure on infrastructure in large economies, which increased the need for silane modified sealants, coatings, and fiberglass-reinforced materials in construction, automotive and electrical components.

- In the period between 2022 and 2023, more stringent regulations around the environment, and trends around light weighting, increased the consumption of organofunctional silanes as adhesion promoters and coupling agents. The Original Equipment Manufacturers (OEMs) more frequently called for silane-treated fillers and glass fibers to be added to reduce the weight and enhance the strength of the composites in the automotive, wind energy and consumer electronics in North America, Europe and Asia Pacific.

- In 2023, increasing investments in renewable energy and high-voltage (HV) transmission grids drove the consumption of silanes in cable insulation, crosslinked polyolefin (PEX/XLPE) and protective coatings. International Renewable Energy Agency and national grid operators provided the data for the Still expanding solar and wind projects and grid (which rely on silicone and silane-based materials for reliable operation).

- For the 2024-2025 period, silane demand as key intermediate for silicones, surface modifiers, and sol-gel coatings were further strengthened by the growth in semiconductor, display, and battery manufacturing according to UN Comtrade for major electronics export hubs including China, South Korea, and Taiwan, which reflects continued use of high-purity organofunctional silanes in advanced production lines.

Silanes Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 3.5 Billion |

| Market Size in 2026 | USD 3.7 Billion |

| Forecast Period 2026 - 2035 CAGR | 7.8% |

| Market Size in 2035 | USD 7.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Expanding electronics, semiconductors and displays production | Boosts demand for high-purity organofunctional silanes |

| Growth of construction and infrastructure coatings | Increased use of silane-modified sealants and paints |

| Rising use of reinforced plastics and composites | Drives coupling agent demand for glass-filled polymers |

| Pitfalls & Challenges | Impact |

| Environmental and health concerns around some silanes | Tighten regulations, increasing compliance and handling costs |

| Dependence on upstream chlorosilane, silicon supply | Supply volatility can disrupt pricing and availability |

| Opportunities: | Impact |

| Renewable energy, cable and grid modernization | Supports silane usage in XLPE, coatings and sealants |

| Lightweight automotive and EV component adoption | Encourages silane-treated fillers and composite structures |

| Market Leaders (2025) | |

| Market Leaders |

14% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Latin America |

| Emerging countries | Brazil, Mexico, Argentina |

| Future outlook |

|

What are the growth opportunities in this market?

Silanes Market Trends

- Sustainability and low-VOC formulations: In order to comply with the Euro and North American regulations regarding VOCs and low VOC coatings, sealants and adhesives, producers of silanes are developing tin free and solvent reduced systems. For instance, silane terminated polymer (STP) sealants are used to substitute polyurethane in construction and automotive for improved indoor air quality and better safety in workplaces since polyurethanes contain isocyanates.

- Electronics, semiconductors and displays expansion: As more organofunctional silanes are used as adhesion promoters, surface modifiers as well as sol-gel precursors, the demand for such silanes is on the rise. The construction of new fabs and new advanced packaging lines in Asia and the U.S. Europe is accelerating the demand for high purity silanes in the amino, epoxy and methacrylate class which are compatible with cleanroom and ultra-low defect processes.

- Rising use in reinforced plastics and composites: The demand in automotive, rail and wind energy is also increasing the demand for silane coupling agents which create better bonding between the glass fibers and polymer matrices as well as mineral filler. Vinyl and sulfur silanes are also used in the reinforcement of tires and rubbers. For high strength and corrosion resistance, epoxy and amino silanes are used for glass-fiber composites.

- Use of Silane in Protective Coatings, Concrete Treatments: Silane consumption is inflating in protective coatings, concrete treatments and Cable Systems due to Global Infrastructure Initiatives and grid upgrades. Silane-based water repellents help enhance the service life of concrete used in bridges and tunnels. Silane crosslinking technologies are also essential in XLPE power cables and in thermal stable pipe applications where superior electrical performance is needed.

Silanes Market Analysis

Learn more about the key segments shaping this market

Based on type, the market is segmented into halosilanes/hydride functional silanes, organofunctional silanes. The organofunctional silanes dominated with a market share of 58% in 2025 and is expected to grow with a CAGR of 8% by 2035.

- In the silanes market, the types are progressively becoming more of organofunctional grad, and, at the same time, halosilanes and hydrosilanes are still valuable as intermediates to silicones and other derivatives. While chlorosilanes and alkylsilanes are more upstream in silicon chemistry, hydrosilanes are more important in the area of hydrosilylation and surface modification, notably in advanced coatings, electronics, and specialty silicone systems.

- Crosser and adhesion promoters to composites, rubber, coatings, sealants and glass fiber are organofunctional silanes where dominant silanes are the amino, epoxy, vinyl, methacryloxy and sulfur. Demand in the automotive, construction and wind energy sectors is more prevalent where durability, lightweighting and chemical resistance are critical. Tailored performance in high-end electronics and specialty industrial applications is often addressed by custom “other” niche functionality

Learn more about the key segments shaping this market

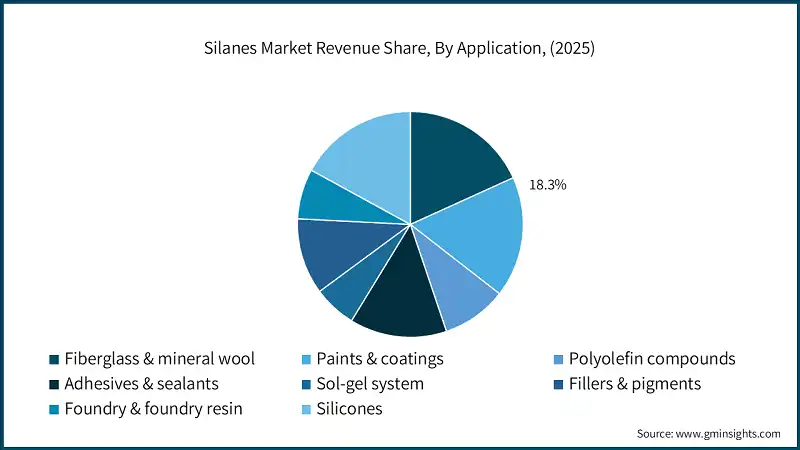

Based on applications, the market is segmented into fiberglass & mineral wool, paints & coatings, polyolefin compounds, adhesives & sealants, sol-gel system, fillers & pigments, foundry & foundry resin, silicones. The fiberglass & mineral wool segment dominated about 18.3% market share in 2025 and is expected to grow with the CAGR of 6.1% by 2035.

- Silanes are most demanded in their application in fiberglass and mineral wool, in paints and coatings, and in adhesives and sealants where silanes serve in coupling agent, adhesion promoter, and water-repellent additive roles. Using polyolefin compounds and silicones in cable insulation, construction, and automotive components, which require durability and improved mechanical performance, also demand considerable amounts.

- The use of sol-gel systems, fillers, pigments, and foundry resins represent an area of growing specialization and interest in the marketplace. In this case, silanes contribute to the enhancement of dispersion, bonding, and surface functionalization of coatings, castings, and engineered composites. Expansion of the additive silane chemistry functionality and value across electronics, silane-impregnated high-voltage and corrosion-resistant infrastructure coatings further informs the resource.

Looking for region specific data?

North America holds a significant share of the global silanes market, rising from USD 726.6 million in 2025 to about USD 1.55 billion in 2035, supported by a 7.9% CAGR and strong construction, automotive and electronics demand. The U.S. market was valued at USD 609.2 million in 2025.

- The U.S. is the key driver of North American silanes consumption. Robust usage in adhesives, sealants, coatings, composites and electronics, together with a strong focus on infrastructure renewal and high-performance construction materials, underpins steady adoption of organofunctional silanes.

Europe remains a major global hub for silanes, growing from USD 926.3 million in 2025 to roughly USD 1.92 billion in 2035, driven by 7.6% CAGR and strict environmental and performance standards. Germany market was valued at USD 164.1 million in 2025.

- Germany plays a central role in European silane demand. Its advanced automotive, construction chemicals and industrial coatings sectors rely on silanes for durability, corrosion protection and lightweight composites, with strong emphasis on low-VOC and high-performance formulations.

Asia Pacific is the largest regional silanes market, increasing from USD 1.35 billion in 2025 to around USD 2.89 billion in 2035 at a 7.9% CAGR, supported by rapid industrialization, electronics and infrastructure growth. China market was valued at USD 606.6 million in 2025.

- China anchors Asia Pacific demand through extensive electronics, construction, automotive and fiber-reinforced plastics production. Expanding use of organofunctional silanes in cables, composites, sealants and coatings is driven by large-scale manufacturing and ongoing investments in renewable energy and grid infrastructure.

Latin America represents a smaller but highest growing and steadily expanding silanes market, moving from USD 203.9 million in 2025 to about USD 409.5 million in 2035, supported by a 7.2% CAGR and gradual industrial and construction growth. Brazil market was valued at USD 63 million in 2025.

- Brazil is the leading Latin American consumer of silanes. Demand is linked to construction, automotive, mining and infrastructure coatings, where silane-modified sealants, paints and composites support improved durability in challenging climatic and operating conditions.

Middle East & Africa (MEA) shows healthy growth prospects in sales, increasing from USD 242.5 million in 2025 to roughly USD 520.5 million in 2035, underpinned by a 7.9% CAGR and ongoing infrastructure and energy investments. Saudi Arabia market was valued at USD 79.8 million in 2025.

- Saudi Arabia’s silane demand stems from construction, oil and gas, petrochemicals and power sectors. Using protective coatings, sealants and cable systems is rising as large industrial and infrastructure projects seek longer service life and better performance in harsh environments.

Silanes Market Share

The global silanes industry is moderately consolidated, with a few large chemical groups shaping technology, capacity and pricing. Top 5 are Evonik, Wacker, Dow, Momentive and Shin-Etsu together account for roughly 50% of global sales, leveraging integrated silicon value chains, strong R&D and broad application coverage across silicones, coatings, composites, electronics and high-performance construction materials.

- Evonik Industries AG: Evonik is a leading silanes producer with about 14% market share, offering a wide range of organofunctional silanes for adhesives, sealants, coatings, tires and composites. The company focuses on specialty formulations and application expertise, recently expanding portfolios for green construction, low VOC sealants and high-performance silane coupling agents.

- Wacker Chemie AG: Wacker holds roughly 12% share and is strongly integrated into silicone and silane chemistry. Its silanes support construction, automotive, electronics and textile applications, with emphasis on adhesion promoters and crosslinkers. Wacker has invested in new production capacities and sustainability-oriented grades, targeting low-VOC coatings and high-durability building materials.

- Dow Inc.: Dow controls around 10% of the silanes market, leveraging robust upstream silicon assets and broad downstream applications. It supplies silanes for glass fiber sizing, adhesives, sealants, coatings and polyolefin crosslinking. Recent efforts highlight high purity organofunctional silanes for electronics and durable infrastructure, alongside initiatives to lower environmental footprint in production.

- Momentive Performance Materials Inc.: Momentive has approximately 8% market share, with silanes tightly linked to its silicone and specialty chemical portfolio. The company is active in adhesives, sealants, coatings, tire reinforcement and electronics. It continues to develop advanced coupling agents and adhesion promoters designed for lightweight composites, high-voltage applications and demanding industrial environments.

- Shin-Etsu Chemical Co., Ltd.: Shin-Etsu holds about 6% share in silanes, supported by strong positions in silicones, semiconductors and electronic materials. Its silane products serve as intermediates and performance additives in construction, electronics and automotive. The company emphasizes high-purity, reliable supply for critical applications, including semiconductor processing, display technologies and specialty coatings.

Silanes Market Companies

Major players operating in the silanes industry include:

- Evonik Industries AG

- Wacker Chemie AG

- Momentive Performance Materials Inc.

- Dow Inc.

- Shin-Etsu Chemical Co., Ltd.

- Elkem ASA (Elkem Silicones)

- PCC SE

- Gelest, Inc.

- Nitrochemie AG

- Jiangxi Chenguang New Materials Co., Ltd.

- Nanjing Shuguang Chemical Group Co., Ltd.

- China National Bluestar (Group) Co., Ltd.

- Siltech Corporation

Silanes Industry News

- In March 2025, Evonik Industries AG announced an expansion of its organofunctional silanes capacity in Europe, targeting higher demand from adhesives, sealants and tire applications, and emphasizing products designed for low-VOC construction and mobility solutions.

- In September 2024, Wacker Chemie AG introduced new silane-modified polymer grades for high-performance construction sealants and industrial adhesives, focusing on isocyanate-free, low-emission systems that meet stricter building and environmental regulations in Europe and North America.

- In June 2023, Dow Inc. unveiled an advanced silane coupling agent portfolio aimed at glass fiber composites and high-voltage cable applications, improving adhesion, durability and moisture resistance for wind blades, automotive components and grid infrastructure projects.

- In February 2022, Momentive Performance Materials Inc. launched a line of specialty organofunctional silanes for electronics and semiconductor surface treatment, targeting improved adhesion, reliability and processability in advanced packaging, display and high-frequency communication devices.

This silanes market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Million) and volume (Kilo Tons) from 2026 to 2035, for the following segments:

Market, By Type

- Halosilanes /hydride functional silanes

- Chlorosilanes

- Alkylsilanes

- Hydrosilanes

- Organofunctional silanes

- Amino silanes

- Epoxy silanes

- Vinyl silanes

- Methacryloxy silanes

- Sulfur silane

- Others

Market, By Application

- Fiberglass & mineral wool

- Paints & coatings

- Polyolefin compounds

- Adhesives & sealants

- Sol-gel system

- Fillers & pigments

- Foundry & foundry resin

- Silicones

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Which region leads the silanes market?

North America market rising from USD 726.6 million to approximately USD 1.55 billion by 2035, supported by a 7.9% CAGR and strong construction, automotive, and electronics demand.

What are the key trends in the silanes market?

Key trends include low-VOC, sustainable formulations, rising use in electronics and semiconductors, growing demand for silane coupling agents in composites, and increased adoption in coatings and XLPE power cables.

Who are the key players in the silanes market?

Key players include Evonik Industries AG, Wacker Chemie AG, Dow Inc., Momentive Performance Materials Inc., Shin-Etsu Chemical Co., Ltd., Elkem ASA (Elkem Silicones), PCC SE, Gelest, Inc., Nitrochemie AG, Jiangxi Chenguang New Materials Co., Ltd., Nanjing Shuguang Chemical Group Co., Ltd., China National Bluestar (Group) Co., Ltd., and Siltech Corporation.

How much market share did the organofunctional silanes segment hold in 2025?

Organofunctional silanes dominated with 58% market share in 2025 and are expected to grow at a CAGR of 8% by 2035, driven by demand as coupling agents, adhesion promoters, and crosslinkers in automotive, construction, and wind energy sectors.

What was the market share of the fiberglass & mineral wool application segment in 2025?

The fiberglass & mineral wool segment held approximately 18.3% market share in 2025 and is expected to grow at a CAGR of 6.1% by 2035, serving as coupling agents and adhesion promoters in these applications.

What is the forecasted market size for silanes in 2026?

The market size is projected to reach USD 3.7 billion in 2026.

What is the market size of the silanes in 2025?

The market size was USD 3.5 billion in 2025, with a CAGR of 7.8% expected through 2035 driven by expanding production of electronics, semiconductors, displays, and growing demand for reinforced plastics and composites.

What is the projected value of the silanes market by 2035?

The silanes market is expected to reach USD 7.3 billion by 2035, propelled by renewable energy infrastructure growth, lightweight automotive component adoption, and expanding construction and infrastructure coatings applications.

Silanes Market Scope

Related Reports