Summary

Table of Content

Senior Mobility Aid Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Senior Mobility Aid Devices Market Size

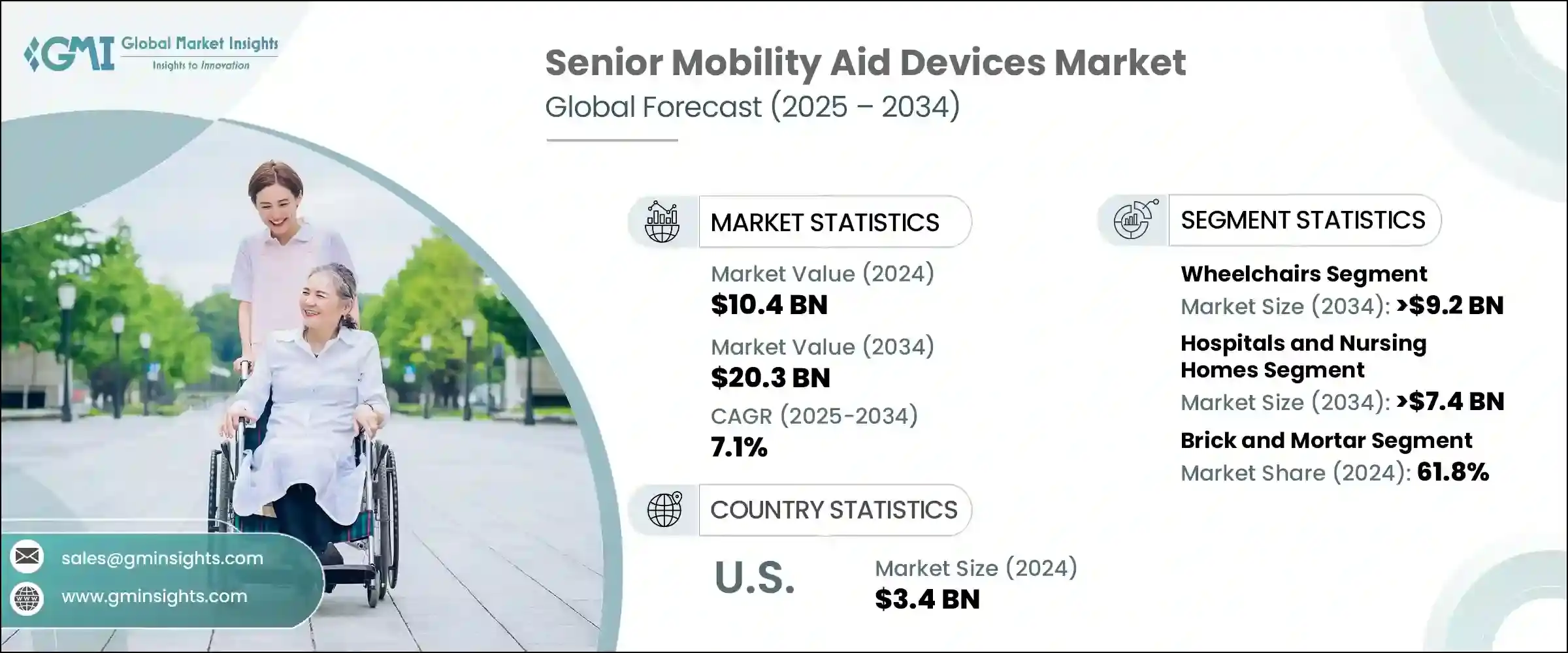

The global senior mobility aid devices market size was valued at USD 10.4 billion in 2024 and is expected to reach USD 20.3 billion by 2034, growing at a CAGR of 7.1% during 2025 to 2034. The high market growth is attributed to the rising incidence of mobility-related health conditions, technological advancements in mobility aids, growing aging global population, increased awareness and accessibility of assistive devices, among other contributing factors.

To get key market trends

The rising prevalence of conditions like Parkinson's disease, stroke, and musculoskeletal disorders in the aging population has increased the need for mobility aids. For instance, according to the World Health Organization (WHO) 2023 data, over 8.5 million individuals worldwide are diagnosed with Parkinson's disease. This figure is anticipated to reach almost 17 million by 2030. These diseases not only hinder movement but also impair balance and coordination, which makes mobility aids indispensable to maintain independence as well as reduce the risk of falls. There is a persistent recommendation from health professionals and caregivers for assistive devices, especially when it comes to daily task management due to increasing chronic conditions.

Senior Mobility Aid Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 10.4 Billion |

| Forecast Period 2025 – 2034 CAGR | 7.1% |

| Market Size in 2034 | USD 20.3 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Moreover, advanced technologies like GPS tracking and fall detection systems integrated within modern mobility aids have made significant progress in design and functionality. Improvements in construction ergonomics as well as electronic control systems for these aids greatly enhance their comfort level. Thus, these changes increase the appeal of aids among aged individuals since they make them easier to adjust to changing needs and use electronic controls much more safely, overall improving user experience. This tech-driven product evolution is spurring market growth across both developed and developing regions.

Senior mobility aid devices help older adults who have difficulty moving to get around on their own safely and independently. Examples include walkers, canes, wheelchairs, scooters, and rollators. Mobility aids assist seniors in improving balance while decreasing the chances of falls, resulting in better freedom of movement during daily activities and enhanced quality of life.

Senior Mobility Aid Devices Market Trends

The senior mobility aid devices industry is witnessing significant growth driven by the growing need for smart mobility devices with IoT and AI integration, rise in customizable and ergonomic designs, increased demand for multi-functional aids, and Growth in Online sales and DTC channels, among other factors are boosting the industry growth.

- The mobility aids market is increasingly adopting artificial intelligence (AI) in healthcare and internet of things (IoT) technologies. Smart mobility devices for seniors have adopted the use of IoT technology, which provides more enhanced independence. According to the US Department of Health and Human Services in 2023 about 65% of Americans aged 65 and above adopted the aforementioned devices.

- Smart canes and wheelchairs now offer real-time health monitoring, GPS tracking, voice assistance, and obstacle detection functionalities. Alongside remote caregiving support, these technological advancements enhance user safety and navigation. This feature helps older adults achieve their health goals while maintaining physiological independence.

- Further, many manufacturers are concentrating on ergonomic design as well as mobility aids that allow customization based on each individual user’s specific needs. Standards now include adjustable handles, foldable frames, and modular parts. The focus has shifted to ultra-lightweight materials that are still strong maximally comfortable while minimizing strain. Functionality combined with good design sought by active older people drives this trend further enhances growth in the sector.

Senior Mobility Aid Devices Market Analysis

Learn more about the key segments shaping this market

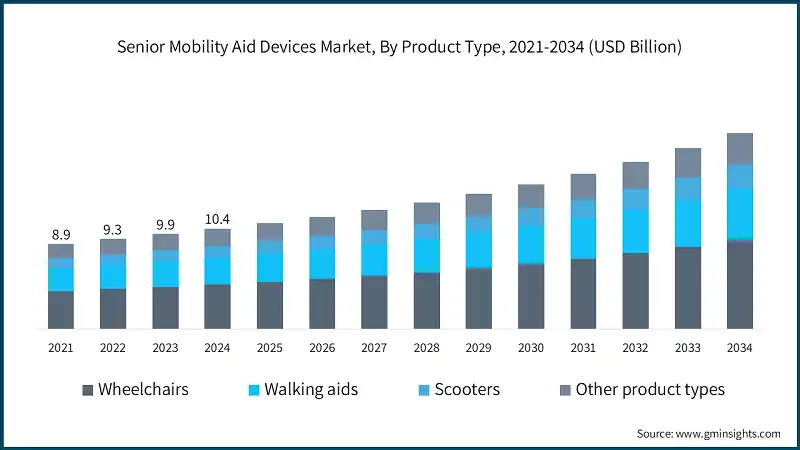

Based on product type, the market is segmented as wheelchairs, walking aids, scooters, and other product types. The wheelchairs segment is expected to drive business growth and expand at a CAGR of 7.3%, reaching over USD 9.2 billion by 2034.

- The global elderly population is affected by mobility limitations caused by various reasons such as arthritis, stroke, and other neuromuscular disorders. According to World Health Organization's (WHO) 2023 data, approximately 1.3 billion people globally face significant mobility disabilities. Affected individuals commonly require wheelchairs due to the desire to maintain independence in activities of daily living. With improving life expectancy, the prevalence of mobility impairments among the aging population is projected to increase.

- Additionally, post-operative and post-stroke recovery in outpatient therapy programs relies significantly on personal mobility devices like wheelchairs for effective physical rehabilitation. Institutional care is gradually shifting towards home-based elderly care, which requires personal mobility equipment for smooth transition within the home. These changes are expected to have a significant impact on healthcare systems focused on providing out-of-hospital care.

Based on end use, the market is segmented as hospitals and nursing homes, individual, assisted living, and other end users. The hospitals and nursing homes segment is expected to register at a CAGR of 6.9%, reaching over USD 7.4 billion by 2034.

- Hospitals and nursing homes serve large populations of elderly patients recovering from surgeries, strokes, and other chronic health issues, which greatly reduce their ability to move. These institutions need a steady supply of mobility support devices that include wheelchairs, walkers, and transfer devices to ensure safety and aid in rehabilitation. The need to prevent falls and facilitate daily movement drives significant procurement of these devices in institutional care settings.

- Policies in many countries mandate the servicing of seniors with mobility ailments in inpatient and residential care facilities. Standards related to fall prevention, patient handling, and care quality mandates encourage the use of well-maintained ergonomic mobility aids. Compliance with these protocols is a major driver for hospitals and nursing homes to invest in advanced mobility equipment.

Learn more about the key segments shaping this market

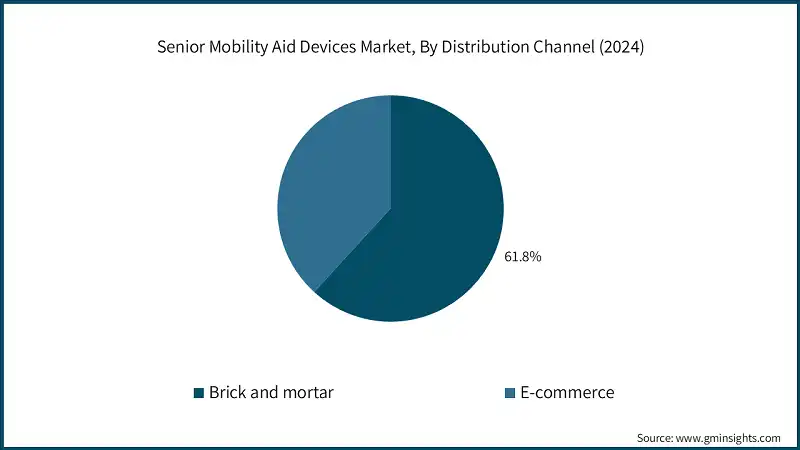

Based on distribution channel, the market is classified into brick and mortar and e-commerce. The brick and mortar segment dominated the market with a revenue share of 61.8% in 2024.

- A substantial number of seniors, as well as their caregivers, prefer examining and testing mobility aids such as wheelchairs, walkers, and canes directly prior to purchase. For these seniors, traditional stores provide the benefit of hands-on interaction with products while aiding in proper adjustment for comfort and ease of use. This direct experience builds buyer confidence and reinforces loyalty while minimizing disappointment or returns, which is crucial for hospital or clinical-grade items.

- Further, examining mobility aids at physical retail locations gives customers an added advantage to receive expert attention from staff who can assist them personally, which greatly impacts their selection because it takes into consideration their mobility level relative to height, weight and specific medical conditions. This personalized service, often lacking online, adds significant value and drives continued footfall among elderly shoppers and caregivers, thereby boosting segmental growth.

Looking for region specific data?

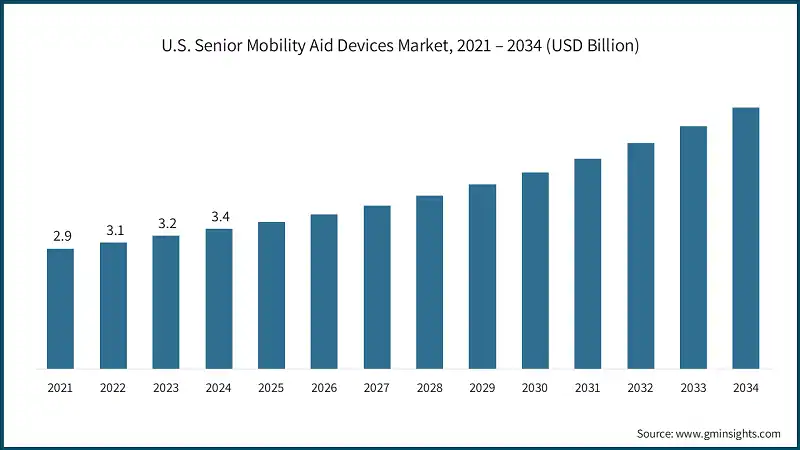

U.S. senior mobility aid devices market was valued at USD 2.9 billion and USD 3.1 billion in 2021 and 2022, respectively. The market size reached USD 3.4 billion in 2024, growing from USD 3.2 billion in 2023 and is anticipated to grow at a CAGR of 6.6% between 2025 to 2034 period.

- The U.S. has a comprehensive healthcare system which provides easy access to medical equipment through hospitals, home care agencies, and rehabilitation facilities. Senior citizens are particularly benefiting from public and private insurance policies including Medicare and Medicaid, which reimburse medically necessary mobility aids. This not only makes these devices affordable for aged individuals with limited financial means but also actively promotes growth in the market.

- Chronic conditions such as osteoarthritis, Parkinson's disease, strokes, and diabetes complications are common among older Americans. These conditions often result in long-term mobility difficulties, which generates persistent demand for assistive devices. The rising burden of chronic conditions within the senior population directly drives the demand for both manual and powered mobility aids as part of long-term care plans.

- In addition, there is an increasing number of seniors who prefer staying at home instead of relocating to nursing homes. This preference is facilitated by the increasing availability of home healthcare services and family-centered caregiving systems. As mobility limitations increase, seniors depend more on personal assistive devices like scooters, walkers, and stair lifts, enabling them to move around their homes independently, which fuels continuous market growth.

Europe senior mobility aid devices market accounted for USD 3 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- Countries in Europe tend to have comprehensive public healthcare systems that subsidize or fully reimburse the cost of essential mobility aids for elderly citizens. Such systematic assistive device coverage lessens economic burdens and facilitates acquisition, especially in Western Europe. National health services, like NHS in the UK and CNAM in France, promote their use through rehabilitation and fall prevention programs, which stimulates regional usage.

- Spain allocates significant funding for construction of age-friendly transport systems including public transport, barrier-free buildings and safe walking areas. The infrastructure integrates the use of mobility aids into daily life while enabling independence among elderly people. This accessibility and reduced environmental barriers increase the demand as well as the need.

U.K. senior mobility aid devices market in the Europe is projected to grow remarkably in the coming years.

- The National Health Service (NHS) offers financial assistance and cost-sharing options for vital mobility equipment such as sophisticated wheelchairs, canes, and walking frames for diagnosed persons with limited mobility. Many seniors are able to access wheelchairs, canes, or walking frames through GP and community healthcare team referrals at subsidized rates or completely free of charge. This type of public sector support increases usage and makes it easier for patients throughout the UK.

- In addition, the country is well-equipped with a wholesale and retail distribution network that includes specialized shops, pharmacies as well as online shopping portals. Mobility aids are now available to seniors as well as caregivers through NHS referrals and can be purchased directly from retail shelves. The cooperation of branded and non-branded retailers adds credibility to quality claims, which in turn aids market development.

The Asia Pacific senior mobility aid devices market is anticipated to grow at the highest CAGR of 8.2% during the analysis timeframe.

- Countries such as China and India are increasing their healthcare budgets and improving geriatric care facilities. In 2023, China allocated around USD 385 billion to healthcare expenditure, representing a 7.5% increase from the previous year. This expansion leads to greater adoption of mobility devices in hospitals, clinics, and homes, increasing access to assistive technologies such as wheelchairs, rollators, and powered scooters.

- In addition, governments in the APAC region are funding programs related to community caregiving for the elderly population that include help with mobility aids, community-based assistance, as well as at-home patient support services. Through public health system grants, tax breaks, as well as the provision of devices through public health centers, accessibility to mobility devices has become easier and more affordable. Getting such products is becoming effortless, especially in countries with aging demographics like Japan and Singapore.

China holds a dominant position in the Asia Pacific senior mobility aid devices market.

- China's elderly population is one of the largest in the world. The National Bureau of Statistics of China reported that in 2022, there were over 209.78 million citizens aged 65 and older. Increasing life expectancy alongside declining birth rates contributes to this age group's growing proportion. This demographic shift increases the supply as well as demand for mobility aids like wheelchairs and canes, which enable older individuals to lead more independent lives.

- China's growing middle class has higher purchasing power and hence is more willing to invest in quality healthcare and advanced assistive aids. Families are starting to purchase these mobility devices proactively even without reimbursement due to their increase in disposable income. There is an emerging demand for high-end, ergonomically designed systems which offer better comfort and improved durability.

The Brazil senior mobility aid devices market is experiencing robust growth in Latin America.

- The public healthcare system in Brazil, known as the Unified Health System (SUS), provides basic health care and mobility aids to elderly patients with physical limitations. These devices are being prescribed by rehabilitation hospitals and geriatric clinics. Government programs focused on healthy aging and fall prevention also promote awareness, subsidizing access in resource-poor areas.

- Both elderly individuals and their primary caregivers are becoming more aware of the advantages of mobility aids in reducing falls and enhancing independence. Despite cultural perceptions, the stigma related to using mobility aids is softening rapidly. In particular, urban dwellers respond positively due to informational campaigns, referrals from physical therapists, and outreach initiatives by local organizations.

Saudi Arabia senior mobility aid devices market is poised to witness substantial growth in Middle East and Africa during the forecast period.

- The Saudi government is focusing on enhancing the healthcare system and geriatric services under Vision 2030. Considerable strides are being made toward public long-term care as well as rehabilitation and homecare programs, which involve mobility support devices. There is also advancement in public health education that leads to greater utilization of assistive technologies by elderly citizens.

- In Saudi Arabia, all types of mobility aids can be purchased at medical supply stores, hospitals, and even online platforms. With urban expansion and increased digitization, not only caregivers, but aged individuals themselves can access mobility equipment with ease. Accessible primary and secondary level mobility devices are accelerating market development across all income brackets.

Senior Mobility Aid Devices Market Share

The key players such as Drive DeVilbiss Healthcare, Invacare, Medline, Ottobock, and Sunrise Medical collectively account for approximately 35% of the global senior mobility aid devices industry. The competitive landscape of this market is moderately fragmented, with a mix of multinational manufacturers and regional players competing on innovation, product variety, pricing, and distribution reach. Leading companies differentiate themselves through extensive product portfolios that include manual and powered wheelchairs, scooters, walkers, and other mobility aids, alongside robust R&D investments to develop smart, ergonomic, and customizable devices. Strategic collaborations with healthcare facilities, growing focus on e-commerce, and geographic expansion into aging populations across Asia-Pacific and Latin America further intensify market competition. Despite the dominance of the top players, niche companies continue to capture local market segments through targeted product offerings and customer-centric services.

Senior Mobility Aid Devices Market Companies

Prominent players operating in the senior mobility aid devices industry include:

- BESCO

- 21st Century SCIENTIFIC

- CAREX

- Drive DeVilbiss Healthcare

- GF Health Products

- Hoveround Mobility

- INVACARE

- LEVO

- MEDLINE

- MEYRA

- nova

- ottobock

- peromobil

- PRIDE MOBILITY

- SUNRISE MEDICAL

- Drive DeVilbiss Healthcare stands out for its comprehensive range of affordable, high-quality mobility aids including scooters, walkers, and wheelchairs. Its strong global distribution network and consistent product innovation, especially in compact, travel-friendly scooters and bariatric mobility solutions, make it a preferred choice among healthcare providers and aging consumers.

- Invacare Corporation is known for its advanced engineering and customization capabilities in both manual and powered wheelchairs. The company leverages strong R&D and clinical partnerships to deliver ergonomically designed products with superior durability and comfort, targeting both institutional and homecare markets worldwide.

Senior Mobility Aid Devices Industry News:

- In April 2025, Sunrise Medical announced the launch of the Empulse F35, a new addition to its expanding power assist portfolio. It was designed to enhance everyday independence by combining sleek, modern styling with practical urban mobility support. This launch strengthened the company's position in the senior mobility aid devices market by offering a technologically advanced solution that meets the growing demand for lightweight, user-friendly mobility assistance in urban environments.

- In July 2024, Drive DeVilbiss Healthcare (DDH) announced the acquisition of Mobility Designed, Inc.'s full product portfolio, expanding its range of innovative medical equipment and incorporating advanced industrial design capabilities into its operations. This strategic move enhanced DDH's competitive edge in the senior mobility aid devices industry by broadening its product offerings and improving the ergonomic and aesthetic appeal of its mobility solutions, thereby meeting evolving user needs and preferences.

The senior mobility aid devices market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Product Type

- Wheelchairs

- Manual

- Power

- Walking aids

- Crane

- Crutches

- Walker

- Mobility lifts

- Scooters

- Road scooter

- Boot scooter

- Midsize scooter

- Other product types

Market, By End Use

- Hospitals and nursing homes

- Individual

- Assisted living

- Other end use

Market, By Distribution Channel

- Brick and mortar

- E-commerce

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What trends are shaping the senior mobility aid devices market today?

Emerging trends include customizable and ergonomic designs, rising adoption of smart mobility aids, increasing online and direct-to-consumer sales, and a focus on home-based elderly care.

Who are the leading companies in the senior mobility aid devices industry?

Major players include Drive DeVilbiss Healthcare, Invacare, Medline, Ottobock, and Sunrise Medical. These companies offer a wide range of innovative mobility solutions and hold strong positions in global and regional markets

What factors are driving the growth of the senior mobility aid devices market?

Growing geriatric population, increased prevalence of mobility impairment disorders, technological advancements in mobility devices, and greater awareness and accessibility of assistive products worldwide are some of the major market growth drivers.

How is technology influencing the senior mobility aid devices sector?

Integration of IoT, AI, GPS tracking, and fall detection features in smart mobility devices is transforming user experience and promoting independence among elderly users, boosting demand significantly.

What challenges does the senior mobility aid devices market face?

Major challenges include the high cost of advanced mobility devices, limited access in rural areas, and user reluctance in adopting assistive technologies due to stigma or lack of awareness.

How is the U.S. senior mobility aid devices market performing?

The U.S. market for senior mobility aid devices reached USD 3.4 billion in 2024 and is expected to grow at a CAGR of 6.6% through 2034, backed by Medicare support, a growing senior population, and strong homecare infrastructure.

What are the top distribution channels in the senior mobility aid devices market?

Brick and mortar outlets segment held a dominant share of 61.8% in 2024, due to consumer preference for in-person product testing and expert assistance, especially for hospital-grade mobility aids.

Which product segment is expected to dominate the senior mobility aid devices market by 2034?

The wheelchairs segment is set to reach USD 9.2 billion by 2034 while growing at a CAGR of 7.3%, owing to its essential role in daily mobility and rehabilitation.

What was the market size of the senior mobility aid devices industry in 2024?

The global senior mobility aid devices market was valued at USD 10.4 billion in 2024.

What is the forecast value of the senior mobility aid devices market by 2034?

The senior mobility aid devices industry is projected to reach USD 20.3 billion by 2034. The market is growing at around 7.1% CAGR from 2025 to 2034, driven by rising demand for ergonomic and technologically advanced mobility aids.

Senior Mobility Aid Devices Market Scope

Related Reports