Summary

Table of Content

Semi-Rigid Spray Polyurethane Foam Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Semi-Rigid Spray Polyurethane Foam Market Size

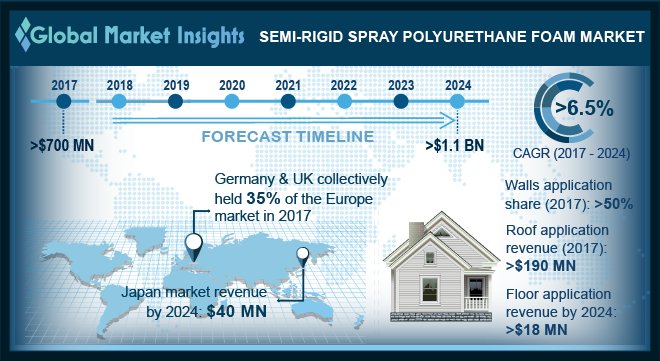

Semi-Rigid Spray Polyurethane Foam Market size was estimated over USD 700 million in 2017 and the industry will grow by a CAGR more than 6.5% through 2024. Steady recovery from economic slowdown coupled with the stable GDP growth will be the chief reason behind the North America’s construction industry growth thus spur the market growth over the forecast time frame.

The product is widely used for resistance, sealing and insulation purpose in roofs and walls of various infrastructures and buildings. Semi-rigid SPF helps to reduce the overall energy requirements for cooling and heating by filling the gaps and cracks in the building. In North America, the U.S. construction industry has been witnessing a steady growth in the last few years. Construction spending has been increasing at a healthy rate owing to a rise in private construction projects across the country.

To get key market trends

The U.S. construction spending increased from USD 787.9 billion in 2010 to USD 1,181.5 billion in 2016 and is likely to witness further gains in coming years. This trend of increasing construction spending will spur construction activities in the country, which will further boost the semi-rigid spray polyurethane foam market demand for use in insulation and sealing.

Oscillation in the raw material prices and health issues related to manufacturing of the product are the key restraining factors which will hamper the semi-rigid spray polyurethane foam market over the forecast period. Basically, the product is manufactured from crude oil derivative products and the continuous changes in the crude oil prices will have significant impact on the prices of the product. Crude oil cost was USD 128.94 per barrel in July 2008. By July 2009, the price fell to USD 63.42 per barrel, a decline of over 50%, followed by a steady rise till the latter half of 2013, post which there was a fall again in 2014.

The unpredictable pricing trend has been prevalent in the market and is expected to continue in future. Prices of MDI and TDI have been adversely affected due to high volatility in prices of crude oil. The volatility in these essential raw material prices has led to obscure profitability forecast for investors, thus restraining the semi-rigid spray polyurethane foam market growth.

Semi-Rigid Spray Polyurethane Foam Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2016 |

| Market Size in 2016 | 700 Million (USD) |

| Forecast Period 2017 - 2024 CAGR | 6.5% |

| Market Size in 2024 | 1.1 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Semi-Rigid Spray Polyurethane Foam Market Analysis

On the basis of end-use, the semi-rigid spray polyurethane foam market is divided into residential, industrial, commercial, institutional and agricultural buildings. From these, the institutional buildings accounted for close to a quarter of the market in 2017 and is expected to grow at a slower pace by 2024. Semi-rigid spray polyurethane foam is basically used to fill the gaps on the walls, attics, etc. in new as well as old structures which find applications in schools, colleges, and government buildings such as museums, libraries as a sealant and insulator.

Commercial buildings segment will grow by 6.5% year on year during the forecast period. Substantial usage of this product for insulation and sealing of shopping malls, hotels, and corporate structures due to its extreme heat and water-resistant characteristics, will drive the demand of spray PU foam. Also, this material reduces the overall utility bills and construction cost.

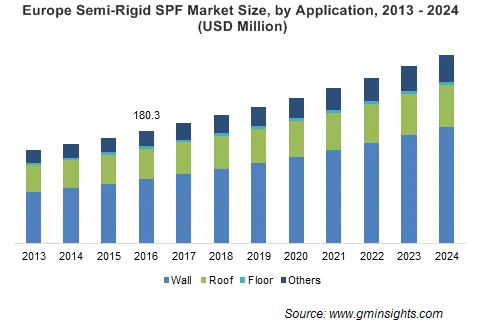

The semi-rigid SPF market is divided based on application, which includes floors, walls and roofs and others. The other applications include attics, plumbing systems, ceilings. Among these, walls accounted for over 50% share of the market in 2017 and is set to grow at substantial annual growth rate by 2024. This is due to the extensive product usage to cover and fill the gaps and cracks on the walls. The product also offers several benefits; for instance, it expands 100 times to its original volume, provides superior air barrier facility, and enhances the water adsorption property up to 40%.

In 2017, roof application segment generated revenue over USD 190 million and is projected to grow at a steady rate over 2018 to 2024. Significant demand for energy efficient and eco-friendly buildings with superior resistance to the regularly changing climatic conditions are the key driving factors for the semi-rigid spray polyurethane foam market segment growth in forecast period.

Learn more about the key segments shaping this market

Germany and UK are major markets in the semi-rigid spray polyurethane foam market share and collectively accounted for more than 35% share of the Europe in 2017. This can be attributed to the supportive government regulation and increasing demand for energy efficient infrastructure in the region. In Europe, buildings accounted for more than 40% share of the entire energy consumption and also produces close to 35% of the greenhouse emissions. This will be the key factor for the industry growth in coming years as the product is majorly used to reduce the energy consumption.

Asia Pacific accounted for around a fifth of the entire semi-rigid SPF market in 2017 and this share is expected to rise in the forecast timeframe. China and Japan will lead the Asia Pacific industry owing to the significant construction activities in these countries. Although the eastern Asian countries will have comparatively lower share, the annual growth rates will be higher due to greater potential for market penetration.

Semi-Rigid Spray Polyurethane Foam Market Share

Global semi-rigid spray polyurethane foam industry is characterized by the presence of various large scale and small-scale producers. Some of them include

- BASF Corporation

- Gaco Western

- Lapolla Industries, Inc

- NCFI Polyurethanes

- Honeywell

- Icynene

- Rhino Linings Corporation

- JJD Urethane

- Demilec

- Premium Spray Products

- The Dow Chemical Company

- International Cellulose Corporation

- Mitex International

- Foam Supplies

- Henry Company

- CertainTeed Corporation

- Specialty Products Inc.

Most of the companies are engaged in mergers, acquisitions and joint venture activities in order to expand their presence worldwide. For an instance, in July 2014, BASF announced the acquisition of Polioles’ PU business activities. Polioles operates in the field of performance materials, isocyanate, PU-systeme, polyurethanes, and polyol. This in turn will enhance the entire product range of BASF& increase its presence globally.

Industry Background

Semi-rigid spray polyurethane foam is a chemical product, mainly produced by polyols, isocyanate, etc. and commonly known as open cell spray polyurethane foam. The market will be primarily led by the construction sector growth, specifically in North America and Asia Pacific. It is basically used for insulation and sealing on the exterior and interiors of building due to their superior structure and inherent properties.

Growth in commercial and residential building construction in North America and Asia Pacific, coupled with increasing infrastructure restoration activities, will spur the Semi-rigid spray polyurethane foam market demand. Supportive protocols and energy conservation norms will also create a huge opportunity for market penetration in coming years.

Semi-Rigid spray polyurethane foam market report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD million from 2013 to 2024, for the following segments:

By Application

- Wall

- Roof

- Floor

By End Use

- Commercial

- Residential

- Industrial

- Agricultural

- Institutional

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- Malaysia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Frequently Asked Question(FAQ) :

How will Germany and UK emerge as strong avenues for the European semi-rigid spray polyurethane foam market?

Germany and the UK collectively account for over 35% share of the European market in 2017. The supportive government regulations and rising demand for energy-efficient infrastructure will foster industry growth in the region.

What factors will drive the growth of the roof as an application segment of the global semi-rigid spray polyurethane foam industry?

The roofs application was valued over USD 190 million in 2017 and is anticipated to witness a substantial growth through 2024 owing to the rising demand for energy-efficient and eco-friendly buildings.

How much valuation did the global semi-rigid spray polyurethane foam market accrue in 2017?

The global semi-rigid spray polyurethane foam industry revenue exceeded USD 700 million in 2017 and is projected to expand at over 6.5% CAGR through 2024.

How will commercial building as an end-use segment spur the global semi-rigid SPF market share?

The commercial buildings segment is projected to grow at 6.5% Y-O-Y, through 2024. The substantial use of semi-rigid spray polyurethane foam for insulation and sealing of hotels, shopping malls, and corporate structures will fuel the market growth.

Semi-Rigid Spray Polyurethane Foam Market Scope

Related Reports