Summary

Table of Content

Security Control Room Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Security Control Room Market Size

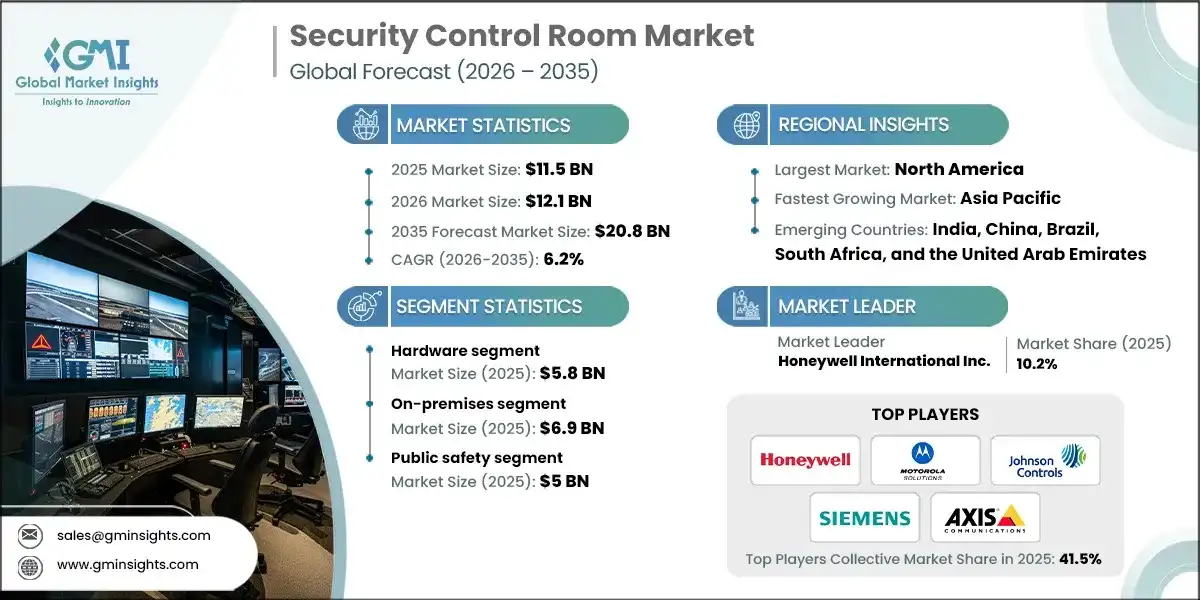

The global security control room market size was valued at USD 11.5 billion in 2025. The market is expected to grow from USD 12.1 billion in 2026 to USD 20.8 billion in 2035, at a CAGR of 6.2% during the forecast period, according to the latest report published by Global Market Insights Inc.

To get key market trends

The market for security control rooms is expanding, owing to rising urbanization and smart city investments, increasing public safety and homeland security concerns, expansion of critical infrastructure and transportation networks, growing adoption of integrated command and control systems and rising corporate demand for centralized security operations.

Rising urbanization requires governments to modernize infrastructure to manage dense populations, mobility, services, and safety. Integrated command and control centres (ICCCs) are core to smart city plans, consolidating surveillance, traffic, emergency response, and public safety systems into unified operations hubs. These facilities enhance and provide real-time situational awareness and enable rapid response in emergency management for city admins and first responders, and law enforcement officials, and thus, provide a necessary and pivotal impetus for the evolving public sector demand for sophisticated security control room public sector investments.

For instance, in June 2025, the Government of India reported that all 100 cities under its Smart Cities Mission have operational Integrated Command and Control Centers using technologies such as AI and IoT to enhance city management and service delivery, reflecting major public investments in urban tech infrastructure.

Governments are focusing on enhanced public safety and homeland security due to changing threats that require better surveillance, emergency coordination, and situational awareness. Security control rooms are being put in place as nerve centres for public space monitoring in cities, leveraging integrated data from cameras, sensors, and communication networks to provide everyday real-time response to crime, terrorism, and disasters.

Most national security strategies would emphasize such infrastructure to protect citizens and critical assets at the local and national levels. For instance, as recently as October 2025, the U.S. Department of Homeland Security released new information celebrating its ongoing commitment to improving the focus of its public safety and security priorities, showing the government’s intention to reinforce the command and control abilities essential to the Homeland Security functions.

The security control rooms market encompasses centralized facilities that monitor, manage, and coordinate security operations across multiple sites. The facilities are implemented using security cameras, access control systems, intruder alarm systems, and communication systems to enable real-time awareness of conditions, threat identification, and reactions to conditions requiring responses. These control rooms are predominantly utilized by the public sector, transportation, private enterprises, and critical infrastructure to expedite decisions and enhance safety and operational resilience.

Security Control Room Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 11.5 Billion |

| Market Size in 2026 | USD 12.1 Billion |

| Forecast Period 2026-2035 CAGR | 6.2% |

| Market Size in 2035 | USD 20.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Urbanization and Smart City Investments | Drives 27% market impact as governments deploy centralized command centers to manage surveillance, mobility, utilities, and emergency response. |

| Increasing Public Safety and Homeland Security Concerns | Contributes 25% market impact by accelerating investments in real-time monitoring, threat detection, and multi-agency coordination platforms. |

| Expansion of Critical Infrastructure and Transportation Networks | Adds 22% market impact as airports, metros, utilities, and borders require continuous operational visibility and centralized security control rooms. |

| Growing Adoption of Integrated Command and Control Systems | Provides 21% market impact by enabling unified situational awareness, faster decision-making, and coordinated emergency response across agencies. |

| Rising Corporate Demand for Centralized Security Operations | Accounts for 18% market impact as enterprises centralize monitoring to reduce risks, improve compliance, and protect distributed assets. |

| Pitfalls & Challenges | Impact |

| High Initial Capital and System Integration Costs | Restrains 30% market adoption due to expensive hardware, customization, infrastructure upgrades, and complex multi-system integration. |

| Cybersecurity Risks and Data Privacy Concerns | Limits 20% adoption as centralized data aggregation increases exposure to cyber threats and regulatory compliance challenges. |

| Opportunities: | Impact |

| Expansion of Cloud-Based and AI-Driven Control Room Platforms | Will create 24% market impact by enabling scalable, remote, and intelligence-led security operations across sectors. |

| Integration of Industrial IoT and Predictive Safety Analytics | Will generate 20% market impact by enabling proactive risk mitigation, operational continuity, and automated incident response. |

| Market Leaders (2025) | |

| Market Leaders |

10.2% in 2025 |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, China, Brazil, South Africa, and the United Arab Emirates |

| Future Outlook |

|

What are the growth opportunities in this market?

Security Control Room Market Trends

- Control rooms are increasingly using Artificial Intelligence (AI) and Machine Learning solutions in security to facilitate the translation of raw video and sensor data into actionable intelligence, thus taking the effectiveness of security operations to the next level. With the use of AI, control rooms will be in a position to detect patterns, anomalies, and threats, thus facilitating informed decision-making by security practitioners, hence changing control rooms from passive viewing facilities to proactive security operation centers.

- For instance, in April 2024, Immix introduced AutoPatrol, an AI-powered solution that automates scheduled patrols or guard tours. It automatically detects potential dangers or anomalies without requiring a human element for the execution of patrols. After detecting any anomaly, the system triggers alerts for the human element to take appropriate measures. Thus, it enhances resource efficiency by letting security providers dedicate manpower elsewhere, mainly on high-value tasks, while maintaining dependability and consistency of monitoring operations.

- The market is trending toward cloud-centric control room architectures that allow secure, scalable, and remote access to surveillance feeds and management tools from anywhere. Cloud platforms reduce reliance on on-premises hardware, offer centralized updates, and support multi-site operations, which is especially valuable for geographically dispersed public safety agencies and corporations. As remote work persists and hybrid operations expand, these cloud solutions become critical for resilient and flexible security infrastructures.

- Modern security control rooms are closing the gap between surveillance systems and cybersecurity systems to offer complete risk management. Integrated systems today offer control and monitoring of physical access, network activity, endpoint security, closed-circuit television (CCTV) systems and alarms, and allow for an integrated response to threats. The integration of systems reflects the conjoined threat of the digital and physical realms, driving the need for a complete surveillance control operating system to organizations and governments.

Security Control Room Market Analysis

Learn more about the key segments shaping this market

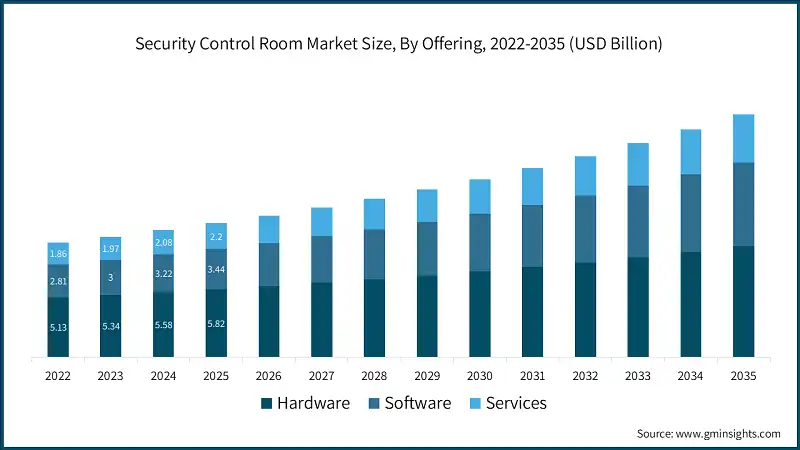

On the basis of offerings, the security control room market is divided into hardware, software, and services.

- The hardware segment accounted for the largest market and was valued at USD 5.8 billion in 2025. Rising demand for high-resolution video walls, network sensors, and display systems is increasing the growth of hardware in security operations control rooms. Modernization of the existing infrastructure in the government, transportation, and critical sectors is adding fuel to the adoption, ensuring real-time monitoring and reliability.

- The rising number of smart city and urban surveillance projects worldwide has created demand for an increase in hardware installations, with central command centers necessitating a need for robust, long-life, and scalable solutions.

- The software segment was the fastest growing market during the forecast period, growing at a CAGR of 7.6% during the forecast period. This is due to the increased adoption of AI-enabled analytics and monitoring and management software that provides situational awareness and the ability for real-time decision-making for multiple sites.

- Manufacturers should cater to AI-infused cloud-based software solutions which shall be modular and scalable to seamlessly integrate into existing hardware infrastructure and enable multi-agency coordination for quick adoption.

Learn more about the key segments shaping this market

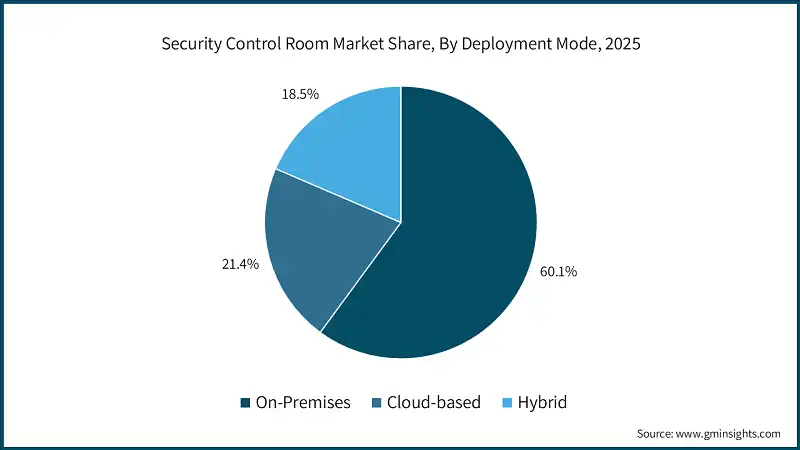

Based on the deployment mode, the security control room market is segmented into on-premises, cloud-based, and hybrid.

- The on-premises segment accounted for the largest market and was valued at USD 6.9 billion in 2025. Increasing demand from the government and critical infrastructure sectors propels the on-premises sector, where organizations require local management of critical surveillance, access, and communication data.

- Modernization of existing infrastructures in urban areas and transport systems drives on-premises installations because of their guaranteed low latency and reliability, especially when dealing with high-resolution video walls and sensors.

- The cloud-based segment was the fastest growing security control room market during the forecast period, growing at a CAGR of 9.9% during the forecast period. Growing adoption of cloud-based control room platforms for scalability, remote accessibility, and centralized management across multiple sites drives real-time analytics and multi-agency coordination-all without major investments in heavy hardware.

- Organizations increasingly prefer subscription-based, flexible deployment models that reduce upfront costs and support continuous software updates, AI-enabled monitoring, and integration with IoT devices for intelligent operations.

- Manufacturers must develop secure, scalable, AI-enabled, modular subscription-based cloud systems, with seamless integration of hardware, cross-agency interoperability, and multi-agency systems.

On the basis of application, the security control room market is categorized into public safety, corporate safety, and industrial safety.

- The public safety accounted for the largest market and was valued at USD 5 billion in 2025. Increasing urbanization and rising crime rates drive public safety adoption, requiring centralized control rooms for surveillance, emergency response coordination, and real-time monitoring to ensure citizen protection and effective law enforcement operations.

- Government initiatives for smart city projects are driving investments in public safety control rooms, thereby integrating AI-enabled video analytics, sensor networks, and multi-agency communication systems into it for the quick detection of incidents and efficient management of emergencies.

- The industrial safety segment was the fastest growing market during the forecast period, growing at a CAGR of 7.7% during the forecast period. This is due to rapid industrial automation, which is increasing the use of industrial safety control rooms for real-time monitoring of operations, hazards, compliance, and employee safety.

- Industries are increasingly turning to AI-driven surveillance and monitoring, predictive analytics, and integrated monitoring solutions that help prevent accidents, address environmental risk, and provide for business continuity.

- Manufacturers should develop modular, AI-powered industrial safety platforms with real-time hazard monitoring, predictive analytics, and seamless integration with IoT and existing operational systems to accelerate adoption.

Looking for region specific data?

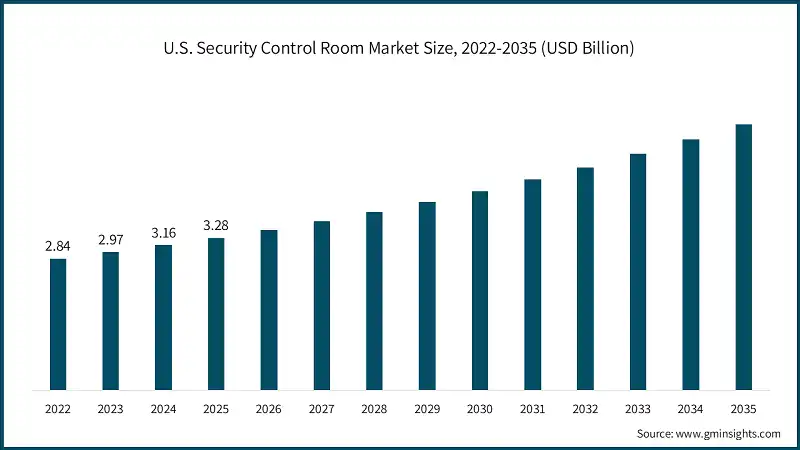

North America dominated the security control room market and held a market share of 34.6% in 2025 of the market.

- North American security control rooms are now being integrated with emergency public safety telecommunications communications, real-time analytics, emergency surveillance transition facilities, and tele-analytic workflows from federal, state, and local units.

- Funding focuses on investing in command structures that enhance interoperability, improving dynamic operating command and situational awareness for emergency response, disaster stratagem deployments, and multi-jurisdictional coordination.

- Modern initiatives for public safety are beginning to use the cloud, and it to deploy faster threat detection and responses within geographic borders, utilize advanced public visualization, and share data rapidly.

- Manufacturers should focus on interoperable, AI-driven control room solutions with cloud capabilities and multi-agency integration to enhance situational awareness, emergency response efficiency, and scalability across urban and critical infrastructure networks.

The U.S. security control room market was valued at USD 2.8 billion and USD 3 billion in 2022 and 2023, respectively. The market size reached USD 3.3 billion in 2025, growing from USD 3.1 billion in 2024.

- Security control rooms in the U.S. are becoming a key focal point in federal plans for improving public safety operations with innovations in computer-aided dispatch, records management, and real-time situational awareness.

- Cloud-based infrastructures and interoperable systems, as mandated by government directives, have the advantage of enhancing the processes of decision-making and information-sharing for law enforcement and homeland security.

- For instance, in October 2025, the U.S. Department of the Interior deployed a connected public safety platform across approximately 855 locations nationwide, establishing one of the largest interoperable public safety networks in operation.

- Market players should focus on providing the police with cloud-enabled, secure command center platforms that can integrate federal, state, and local law enforcement systems supporting real-time incident tracking, multi-agency coordination, and predictive analytics for improved public safety operations.

Europe security control room market accounted for USD 3 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- The security control rooms in Europe are evolving towards a centralized and interoperable public security system, enabling cooperation and crisis response across borders, within EU member countries.

- The government and EU authorities emphasize harmonizing emergency communications, digital warning systems, and data exchange to react promptly to natural disasters, terrorism, and major public gatherings. Control rooms are increasingly being used to interconnect surveillance, calling systems, and analysis solutions for enhanced situation understanding and interagency coordination.

- Strategic Initiatives involve efforts to standardize key communication infrastructure for mission-critical communication networks, as well as cooperating national systems with wider EU safety/civil protection agendas.

- Manufacturers must create customized control room solutions that fully comply with EU regulations, support cross-border collaboration, incorporate AI analytics, and advance crisis management and urban safety systems.

Germany dominated the Europe security control room market, showcasing strong growth potential.

- Security control rooms in Germany play a vital part in the development of national security, ensuring improved coordination, monitoring, and quick response mechanisms for all forms of law enforcement and emergency responses. They are used for the integration of data for emergency responses.

- German authorities are continuing to develop the technological backbone of security infrastructure to enhance the resilience to changing threats and facilitate activities in transportation centers and other important facilities.

- For example, in November 2025, the interior minister of Germany visited the crime control center at Munich's main railway station, underscoring the high priority of sophisticated command infrastructure to improve safety and coordination of activities.

- Manufacturers should invest in smart modular command systems for transport and urban centers with AI monitoring, high-resolution visualization, and multi-agency communication to streamline real-time responsiveness and efficient operations.

The Asia Pacific security control room market is the fastest growing market and is anticipated to grow at the CAGR of 7.5% during the analysis timeframe.

- Rapid urbanization and smart city investments are driving the adoption of advanced security control rooms in Asia-Pacific region, that integrate real-time analytics, AI-assisted video surveillance, and predictive monitoring.

- Governments are deploying these technologies to support public safety, traffic management, and emergency response within densely populated urban centers.

- Control room platforms increasingly connect diverse sensor networks, communication channels, and databases to enable rapid decision-making and cross-agency coordination. This trend underscores regional emphasis on digital transformation, urban resilience, and scalable security solutions tailored to complex metropolitan environments.

- Providers should focus on scalable, cloud-based, AI-enabled control room platforms that support dense urban environments, smart city initiatives, and multi-agency coordination for public safety and emergency management.

China security control room market is estimated to grow with a CAGR of 7.7% during the forecast period, in the Asia Pacific security control room market.

- In China, the security control rooms market is expanding as part of broader investments in public safety and smart city infrastructure.

- Municipal authorities are integrating extensive surveillance networks, AI-driven analytics, and centralized operations centres to monitor urban environments for law enforcement, emergency response, and even crowd management.

- These systems provide increased situational awareness, rapid incident identification, and coordination of responses among plural public safety domains.

Brazil leads the Latin American security control room market, exhibiting remarkable growth during the analysis period.

- Security control rooms in Brazil are gaining prominence as urban centers respond to public safety challenges and demand more coordinated emergency responses.

- Municipal and state governments are investing in centralized command centres that unify CCTV networks, emergency dispatch, and data analytics to monitor crime, traffic, and public events in real time.

- Furthermore, the adoption of integrated control room platforms reflects increasing governmental emphasis on leveraging digital technologies to improve safety outcomes and operational efficiency across major cities.

- Manufacturers should deliver modular, cost-effective command and control systems with integrated analytics and CCTV networks to support multi-agency coordination, urban safety, and public event monitoring.

South Africa security control room market to experience substantial growth in the Middle East and Africa security control room market in 2025.

- Surveillance control rooms are becoming integral to the technological system for the safety and emergency response for cities as they combine video surveillance, alarms and computers into one operational control center.

- These systems are designed for use by local and national governments to monitor and manage crime hot spots, enable prompt response coordination, and provide situational support for police and emergency services.

- Advanced analytics and mobile integration further strengthen control room capabilities, enabling more agile decision-making in the face of complex security challenges.

- Manufacturers should develop robust, centralized control room platforms with analytics, mobile integration, and scalable architecture to improve crime monitoring, emergency response, and coordination across municipalities and law enforcement agencies.

Security Control Room Market Share

The market scenario for security control rooms is a result of innovative advancements in technology and partnerships being forged among top security solution vendors, integrators, and smart technology vendors. Together, key players in this market, including Honeywell international inc., Motorola solutions, Johnson controls international, Siemens ag, and Axis communications ab, account for around 41.5% of market share in 2025. Key players in this market are focusing on R&D to enhance visualization solutions and incorporate AI analytics into their surveillance and security solutions.

Notably, there are collaborations, joint ventures, and acquisitions in the market for fast-tracking technology adoption along with geographical expansion. Apart from these, there are start-ups and emerging tech players developing economical solutions for a control room, advanced analysis tools, along with artificial intelligence monitoring platforms, thus promoting innovations in the market. This dynamic competitive setting further accelerates Adoption of Advanced Technology for a Security Control Room around the world.

Security Control Room Market Companies

Prominent players operating in the security control room industry are as mentioned below:

- ABB Ltd.

- Access Hardware, Inc.

- ATEN INTERNATIONAL Co., Ltd.

- Axis Communications AB

- Barco NV

- Buren Systems International BV

- Convergint Technologies LLC

- Eizo Corporation

- Genetec Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Hexagon AB

- Honeywell International Inc

- Johnson Controls International

- Kastle Systems

- Milestone Systems A/S

- Motorola Solutions

- Siemens AG

- Tyler Technologies

- RGB Spectrum

- Securitas Technology

- AxxonSoft

Honeywell International Inc. acquired 10.2% of the control room automation market by 2025, largely due to their extensive portfolio of integrated automation and security solutions, building control systems, and control room technologies. The company is particularly strong in offering high reliability devices, scalable command systems, and AI driven surveillance. Strong collaborations with commercial and governmental entities, operators of critical infrastructure, and extensive investments in analytics and software, broadens market adoption of public safety, industrial and enterprise software, and analytics.

Motorola Solutions held 9.6% of the market in 2025, as a result of their dominance in communications integrated security platforms, mission critical networks, and situational awareness. The company possesses considerable participation in government and emergency response programs, facilitating seamless coordination and management of multiple agencies. It is recognized as a leader in public safety and critical infrastructure control rooms due to its complete solutions encompassing software and hardware with network integration.

Johnson Controls International acquired 8.8% market share in 2025 due to its proficiency in building management systems, integration of surveillance, and cyber security monitoring solutions. The company is focused on control room platforms and their scalability and high performance. Johnson Controls has formed strong alliances with municipal, commercial, and industrial security programs which is a driving factor for their success in regulated and safety-critical markets.

Siemens had 8.1% of the security control room market due to its infrastructure the integration of advanced building automation systems, IoT enabled monitoring, and, intelligent systems. The company has seamless and modular control room systems for urban, industrial, and corporate environments. These systems are standardized control room systems. Siemens has streamlined the deployment of its systems to municipalities and enterprises due to their smart city programs, focus on standardization, and public private partnerships.

Axis Communications AB had 4.8% of the market due to their focus on networked surveillance cameras, AI video analytics, and integrated security systems. Axis is known for its high resolution imaging. Its hardware and software systems are modular and are made to be interoperable with other security systems. Its partnerships with municipalities and the private sector allow them to tailored deployments for security control rooms for monitoring, incident management, and operational efficiencies.

Security Control Room Industry News

- In December 2025, ServiceNow signed a monumental deal worth 7.75 billion dollars to buy Armis with the intention of incorporating Armis's asset intelligence into one of ServiceNow's strategic applications to build a single "AI control tower" for IT and OT security.

- In October 2025, Veeam finished acquiring Securiti AI and, with it, the introduction of a command center with one control plane for security and data privacy management across multi-cloud silos.

- In June 2025, Honeywell launched its updated Digital Prime platform, a digital twin technology for control rooms that allows operators to test security and process changes in a virtual environment before deployment.

- In October 2023, VIVOTEK and IDTECK announced a collaboration aimed at enhancing access control and surveillance solutions. This partnership integrates IDTECK's access control systems with VIVOTEK's VAST Security Station (VSS), which is designed to improve security measures, enable real-time monitoring, and facilitate incident management.

- In February 2023, Barco, a global leader in visualization and collaboration solutions, has partnered with GCCD (Global Control Center Design AS), a Norwegian company based in Drammen, to support the Norwegian control room market. The new partnership underlines the commitment of both Barco and GCCD to continue providing cutting-edge visualization and collaboration systems to the Norwegian market.

The security control room market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Offering

- Hardware

- Display systems

- Projectors

- KVM switches & control equipment

- Operator workstations & consoles

- Network infrastructure equipment

- Servers & storage systems

- Others

- Software

- Video Management Systems (VMS)

- Physical Security Information Management (PSIM)

- Access control management software

- Analytics & AI/ML platforms

- Incident management systems

- Command & control platforms

- Visualization & dashboard software

- Others

- Services

- System integration & installation services

- Maintenance & technical support

- Consulting & design services

- Training & operator development

- Others

Market, By Deployment Mode

- On-premises

- Cloud-based

- Hybrid

Market, By Application

- Public safety

- Corporate safety

- Industrial safety

Market, By End Use

- Government & Defense

- Law enforcement & police operations

- Military & defense

- Border security & immigration control

- Intelligence & national security agencies

- Others

- Transportation

- Airports & aviation security

- Seaports & maritime security

- Railways & mass transit systems

- Logistics & distribution centers

- Others

- BFSI

- Bank branches & ATM networks

- Data centers

- Others

- Manufacturing

- Automotive

- Electronics & semiconductor

- Aerospace & defense

- Chemicals & petrochemicals

- Food & beverage

- Others

- Utilities

- Power generation & distribution

- Water & wastewater treatment

- Oil & gas infrastructure

- Others

- Healthcare

- Hospitals & medical centers

- Pharmaceutical manufacturing

- Patient safety & access control

- Others

- Retail & Commercial Real Estate

- Shopping malls & retail chains

- Corporate office buildings

- Commercial complexes

- Others

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the security control room industry?

Key players include ABB Ltd., Access Hardware, Inc., ATEN INTERNATIONAL Co., Ltd., Axis Communications AB, Barco NV, Eizo Corporation, Genetec Inc., Hangzhou Hikvision Digital Technology Co., Ltd., and Hexagon AB.

Which region leads the security control room sector?

North America leads the market with a 34.6% share in 2025. The market is propelled by the integration of emergency public safety telecommunications, real-time analytics, and tele-analytic workflows.

What are the upcoming trends in the security control room market?

Key trends include AI/ML-driven intelligence, cloud-based architectures, integrated surveillance and cybersecurity, and AI-powered automated patrol systems.

How much revenue did the hardware segment generate in 2025?

The hardware segment generated approximately USD 5.8 billion in 2025, led by the demand for high-resolution video walls, network sensors, and display systems.

What was the market size of the security control room in 2025?

The market size was valued at USD 11.5 billion in 2025, with a CAGR of 6.2% expected through 2035. The growth is driven by urbanization, smart city investments, and increasing public safety concerns.

What was the valuation of the on-premises segment in 2025?

The on-premises segment accounted for USD 6.9 billion in 2025, supported by demand from government and critical infrastructure sectors requiring local management of surveillance and communication data.

What is the expected size of the security control room industry in 2026?

The market size is projected to reach USD 12.1 billion in 2026.

What is the projected value of the security control room market by 2035?

The market is poised to reach USD 20.8 billion by 2035, fueled by the adoption of integrated command and control systems and the expansion of critical infrastructure.

Security Control Room Market Scope

Related Reports