Summary

Table of Content

Sand Blasting Machine Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Sand Blasting Machine Market Size

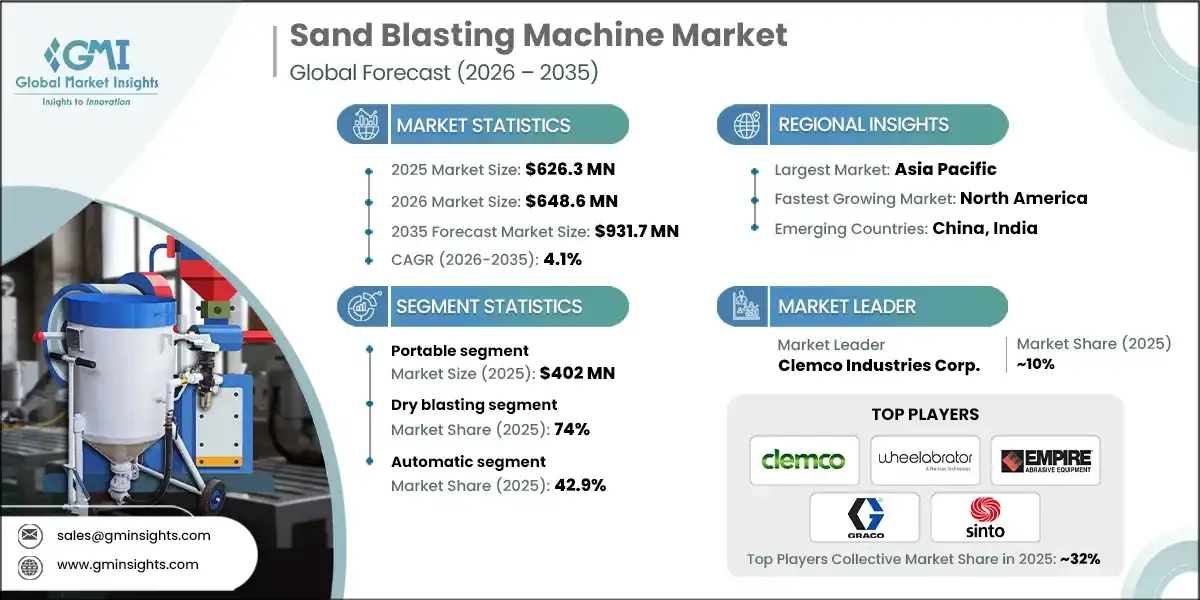

The sand blasting machine market was estimated at USD 626.3 million in 2025. The market is expected to grow from USD 648.6 million in 2026 to USD 931.7 million by 2035, at a CAGR of 4.1% according to latest report published by Global Market Insights Inc.

To get key market trends

- The expanding demand worldwide for substantial development of infrastructure, which encompasses major construction and renovation projects, is also pushing up the demand for sand blasting machines. Sand blasting machines are used extensively throughout all types of construction/renovation for cleaning and preparing concrete, steel structures and pipes before they can be coated or painted. As many developing nations heavily invest in urbanization and industrialization, there are huge opportunities for blasting equipment suppliers. Furthermore, the increasing importance of maintaining existing infrastructure through repair/refurbishment and anti-corrosion treatments will certainly increase demand for sand blasting machines as an effective means of carrying out this work efficiently.

- The automated and robotic blasting systems have gained momentum in the market due to the demand for precision, productivity, and the safety of workers. Automation replaces manual labor, reducing operational risks and enabling consistent quality performance; thus, it becomes a highly attractive choice for high-volume production environments. Blasting machines integrated with IoT and smart monitoring systems assure real-time performance tracking and predictive maintenance, thereby improving operational efficiency. These innovations are not only improving process reliability but also lowering the costs of end-users in the long run.

- Stricter environmental regulations with respect to dust emissions and the safety of workers are pushing manufacturers to develop cleaner and safer blasting technologies. Wet blasting systems, vacuum blasting, and dust collection units are fast gaining attention as industries strive to meet health and environmental standards. This growing inclination towards eco-friendly abrasives and low-dust processes is part of a wider trend in industrial operations toward sustainability. Those offering solutions aligned with these regulatory and environmental requirements are much better positioned to capture market share in the years to come.

Sand Blasting Machine Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 626.3 Million |

| Market Size in 2026 | USD 648.6 Million |

| Forecast Period 2026 - 2035 CAGR | 4.1% |

| Market Size in 2035 | USD 931.7 Million |

| Key Market Trends | |

| Drivers | Impact |

| Industrial automation and efficiency needs | Increasing demand for automated solutions in manufacturing and surface treatment is driving adoption. Automatic sand blasting machines reduce labor costs, improve precision, and enhance productivity, making them essential for high-volume industries like automotive and aerospace. |

| Infrastructure development and construction boom | Rapid urbanization and large-scale infrastructure projects globally require surface preparation for steel structures, bridges, and pipelines. This creates strong demand for durable and high-capacity sand blasting machines, especially in emerging economies. |

| Stringent quality and safety standards | Industries are focusing on achieving superior surface finishes and complying with safety regulations. Machines with enclosed systems, dust collectors, and eco-friendly abrasives are gaining traction, boosting market growth. |

| Pitfalls & Challenges | Impact |

| High initial investment and maintenance costs | Automatic sand blasting machines involve significant upfront costs and require regular maintenance, which can deter small and medium enterprises from adoption, limiting market penetration. |

| Environmental and regulatory challenges | Use of traditional abrasives and dust emissions can lead to compliance issues under strict environmental laws. Manufacturers face pressure to innovate and adopt sustainable practices, which can increase operational complexity. |

| Opportunities: | Impact |

| Eco-friendly and advanced technology integration | Development of machines using recyclable abrasives, water-based blasting, and IoT-enabled monitoring systems offers a major growth opportunity. These innovations align with sustainability trends and smart manufacturing. |

| Emerging markets and after-sales services | APAC, MEA, and Latin America present untapped potential due to rapid industrialization. Offering localized customization, training, and robust after-sales support can help manufacturers capture these growing markets. |

| Market Leaders (2025) | |

| Market Leaders |

Market share of ~10% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | North America |

| Emerging countries | China, India |

| Future outlook |

|

What are the growth opportunities in this market?

Sand Blasting Machine Market Trends

- The sand-blasting machines market is booming as a result of increased demand from the construction and automotive industries. Many infrastructure projects such as bridges and highways (including public buildings) rely on sandblasting as a means of preparing surfaces and sustaining structures. For the auto industry, sand-blasting machines provide rust removal, paint preparation and finishing of component parts. The Asia-Pacific region is leading the way in sand blasting machine sales due to rapid development of urbanization and industrialization, while both North America and Europe contribute substantially through continued openings and upgrading of infrastructure along with automotive manufacturing.

- Automation and robotics are changing: The way sand-blasting operations are processed and how we operate the Machines used; Improved precision control over process; consistency throughout multiple jobs; safety when working within hazardous areas. Robotic systems which are now being fitted out with sensors, programmable controls (enable robots) are quickly becoming the norm in industries such as aerospace, automotive and ship building. In addition to reducing labor costs and providing minimal human exposure to hazardous environments, these systems also allow for uniformity in surface finishing. Improved integration between machine control systems and increasing amounts of technologies being used for Computer Aided Design & Manufacturing (CAD/CAM) in addition to Internet of Things (IoT) enable remote monitoring, have greatly increased efficiencies of automated blasting; therefore, making this form of blasting a necessary means to accomplish complex applications.

- Technological advancements in equipment are driving innovation in the market. Modern machines feature precision nozzle designs, energy-efficient compressors, and advanced abrasive recovery systems. Eco-friendly technologies, including wet blasting and recyclable abrasives, are gaining traction, addressing environmental concerns while improving operational efficiency. These innovations enhance productivity, reduce material waste, and ensure compliance with stringent safety standards.

- The adoption of eco-friendly and dustless blasting methods is increasing as industries prioritize sustainability and workplace safety. Techniques such as wet blasting, enclosed blasting cabinets, and dust-free systems are becoming standard to minimize airborne particulates and hazardous waste. Recyclable abrasives are replacing traditional materials, reducing health risks, and aligning with global environmental standards.

- Regional demand patterns highlight the dominance of the Asia-Pacific region, driven by industrialization and infrastructure investments. North America and Europe focus on advanced automated systems and eco-friendly solutions, while emerging economies in Latin America and the Middle East are witnessing steady growth due to construction and energy projects.

- Portable and compact sand blasting machines are gaining popularity for on-site applications in construction, shipyards, and maintenance projects. Their mobility and ease of use make them ideal for contractors and small businesses. Manufacturers are developing lightweight, compact designs with integrated abrasive recovery systems to meet the growing demand for flexibility and cost-effectiveness in surface preparation operations.

- The sand blasting machine market is expected to grow steadily in the coming years, driven by technological innovation, automation, and rising demand across key industries such as automotive, aerospace, and construction. Portable machines and dry blasting methods are anticipated to dominate, while manufacturers focus on sustainability and advanced control systems to meet evolving industry requirements.

Sand Blasting Machine Market Analysis

Learn more about the key segments shaping this market

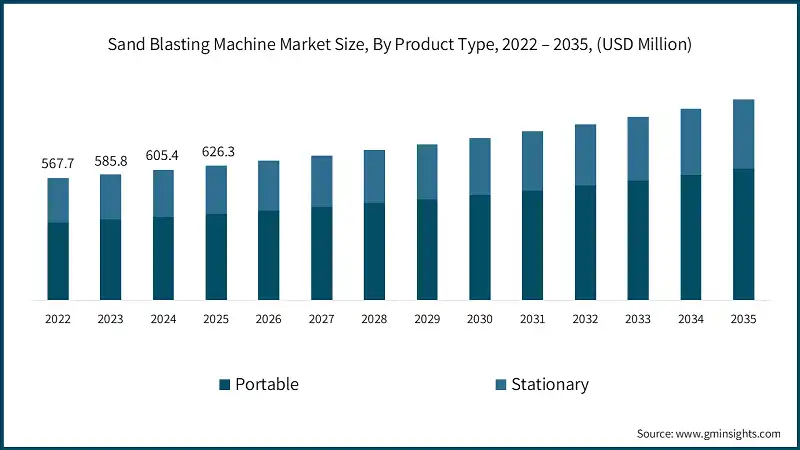

Based on product type, the market is categorized into portable and stationary. The portable segment accounted for revenue of around USD 402 million in 2025 and is anticipated to grow at a CAGR of 3.7% from 2026 to 2035.

- Portable sand blasting machines are designed to enhance mobility, enabling users to transport and operate the equipment effortlessly across various job sites. This adaptability is particularly advantageous in industries such as construction, automotive repair, and maintenance, where the nature of work often requires frequent relocation. The ability to move these machines with ease ensures that operations remain efficient and uninterrupted, even in dynamic environments.

- The versatility of portable sand blasting machines makes them an essential tool for professionals who need reliable equipment that can adapt to changing project demands. In construction, these machines are used for surface preparation, cleaning, and restoration tasks, which are often conducted in different locations.

- Moreover, the compact design and user-friendly features of these machines contribute to their growing popularity. They are engineered to deliver consistent performance while being easy to manage and maintain. This combination of efficiency, mobility, and adaptability has significantly increased their demand across various industries. As businesses continue to prioritize operational flexibility and productivity, the adoption of portable sand blasting machines is expected to rise, further solidifying their position as a critical asset in multiple sectors.

Learn more about the key segments shaping this market

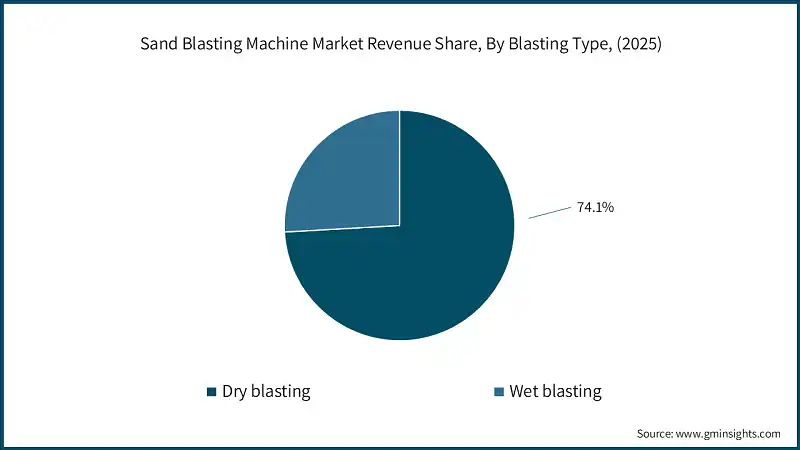

Based on blasting type, sand blasting machine market consists of dry blasting and wet blasting. The dry blasting emerged as leader and held 74% of the total market share in 2025 and is anticipated to grow at a CAGR of 4.2% from 2026 to 2035.

- Sand blasting plays a pivotal role in the automotive industry, serving as a critical step in surface preparation for painting or coating. This process efficiently removes rust, old paint, and other contaminants, ensuring a clean and smooth surface for subsequent applications. By delivering a pristine finish, sand blasting enhances the durability and aesthetic appeal of automotive components, making it an indispensable technique in the manufacturing process.

- The growing global demand for vehicles has placed increased emphasis on efficient and reliable manufacturing processes. Surface preparation, being a fundamental aspect of automotive production, has gained significant attention. Sand blasting machines are integral to this process, as they enable manufacturers to treat a high volume of parts with precision and consistency. These machines not only improve the quality of the finished product but also contribute to optimizing production timelines and reducing operational inefficiencies.

Based on control systems, of sand blasting machine market consists of automatic, semi-automatic and manual. The automatic emerged as leader and held 42.9% of the total market share in 2025 and is anticipated to grow at a CAGR of 4.3% from 2026 to 2035.

- An automatic sand blasting machine is a specialized industrial device designed to clean, smooth, or prepare surfaces by propelling abrasive materials, such as sand or grit, at high velocity using compressed air or a mechanical system. These machines are widely used in manufacturing, automotive, and construction industries for tasks like rust removal, paint stripping, and surface finishing.

- Equipped with automated controls, they ensure consistent performance, reduce manual labor, and enhance safety by operating within enclosed chambers to minimize dust exposure. Their efficiency and precision make them ideal for large-scale operations requiring uniform surface treatment.

Looking for region specific data?

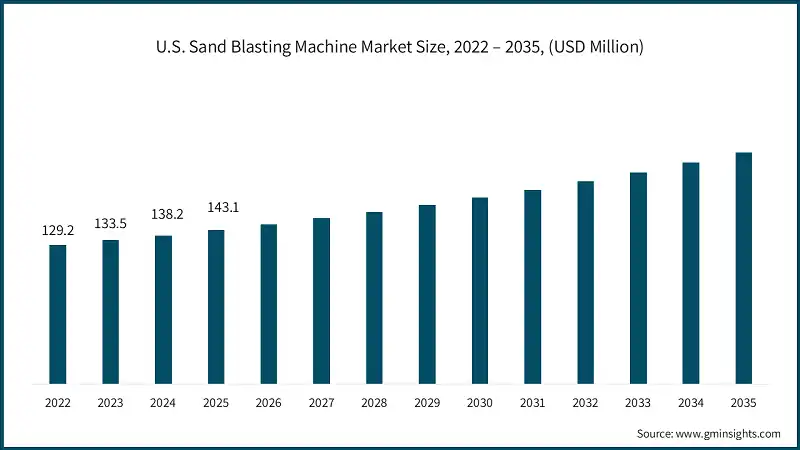

The U.S. dominates an overall North America sand blasting machine market and valued at USD 143.1 million in 2025 and is estimated to grow at a CAGR of 3.9% from 2026 to 2035.

- The North American market is driven by advanced manufacturing sectors, aerospace, and automotive industries that demand high precision and efficiency. Companies in this region prioritize automation and safety compliance, making machines with integrated dust collection systems and programmable controls highly attractive. Sustainability and environmental regulations also influence purchasing decisions, pushing for eco-friendly abrasive materials and energy-efficient designs.

In the European sand blasting machine market, Germany is expected to experience significant and promising growth from 2026 to 2035.

- In Europe, the market emphasizes stringent environmental and worker safety standards, which shape the adoption of automatic sand blasting machines with closed-loop systems and minimal emissions.

- The region’s strong automotive and industrial machinery sectors create consistent demand, while innovation in surface treatment for renewable energy components (like wind turbines) adds growth opportunities. European buyers often value durability, compliance with CE standards, and advanced automation features.

In the Asia Pacific sand blasting machine market, the China held 33% market share in 2025 and is anticipated to grow at a CAGR of 4.4% from 2026 to 2035.

- APAC represents the fastest-growing market, fueled by rapid industrialization, infrastructure development, and booming automotive and electronics manufacturing. Cost-effectiveness and scalability are key drivers, with many buyers seeking machines that balance automation with affordability.

- Countries like China and India focus on high-volume production, while Japan and South Korea lean toward precision engineering and advanced technology integration. Local customization and after-sales service are critical for success in this region.

In the Middle East and Africa sand blasting machine market, Saudi Arabia held 22% market share in 2025 promising growth from 2026 to 2035.

- The MEA market is characterized by demand from oil & gas, construction, and heavy equipment industries, where surface preparation is essential for corrosion protection. Buyers prioritize robust machines capable of handling harsh environments and large-scale projects.

- While automation adoption is growing, cost sensitivity and preference for durable, easy-to-maintain systems remain dominant.

Sand Blasting Machine Market Share

- In 2025, the prominent manufacturers in sand blasting machine industry are Clemco Industries Corp., Wheelabrator Group, Empire Abrasive Equipment, Graco Inc., Sinto Group collectively held the market share of ~32%.

- Clemco Industries holds a strong competitive edge through its reputation for high-quality, durable blasting equipment and advanced safety features. Its extensive product range, including portable and stationary systems, caters to diverse industrial needs. Clemco’s focus on operator safety and compliance with global standards makes it a preferred choice for industries with strict regulatory requirements.

- Wheelabrator stands out for its expertise in large-scale automated blasting solutions, particularly for heavy industries such as automotive, aerospace, and foundry applications. Its ability to deliver integrated surface preparation systems and global service support gives it a significant advantage in handling complex, high-volume projects.

Sand Blasting Machine Market Companies

Major players operating in the sand blasting machine industry include:

- Abrasive Blasting Service & Supplies Pty Ltd (ABSS)

- Airblast B.V.

- Burwell Technologies

- Clemco Industries Corp.

- Empire Abrasive Equipment

- Graco Inc.

- Guyson Corporation

- Kramer Industries Inc.

- Laempe Mössner Sinto GmbH

- Midwest Finishing Systems, Inc.

- Norton Sandblasting Equipment

- Sinto Group

- Torbo Engineering Keizers GmbH

- Trinco Trinity Tool Co.

- Wheelabrator Group

Empire differentiates itself through precision-engineered blasting systems and strong customization capabilities. Known for its automated blasting cabinets and robotic solutions, Empire appeals to sectors requiring high accuracy and repeatability, such as aerospace and electronics manufacturing.

Graco leverages its strength in fluid handling technology to design ergonomic and efficient blasting systems. Its competitive edge lies in innovation and user-friendly designs that improve productivity while reducing operator fatigue. Graco’s global presence and strong distribution network further enhance its market position.

Sinto Group offers a comprehensive portfolio of surface treatment solutions, including blasting, shot peening, and finishing systems. Its competitive advantage comes from strong R&D capabilities and integration of advanced automation technologies, enabling it to serve diverse industries from automotive to heavy machinery with cutting-edge solutions.

Sand Blasting Machine Industry News

- In August 2025, Graco completed acquisitions of Color Service S.r.l. and Radia Products to strengthen automation and precision dosing capabilities, complementing its blasting and finishing solutions.

- In April 2025, Clemco unveiled a unified global design and logo as part of modernization efforts, signaling a push toward automation and integrated blasting systems.

- In May 2024, ABSS highlighted its high-performance abrasive blasting equipment in industry publications, emphasizing precision and durability for metal, glass, and plastic applications. The company promoted customizable blast cabinets and soda blasting systems to improve efficiency and surface finish quality.

The sand blasting machine market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Million) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Product Type

- Portable

- Stationary

Market, By Blasting Type

- Dry blasting

- Wet blasting

Market, By Control Systems

- Automatic

- Semi-automatic

- Manual

Market, By Capacity

- Less than 1,000 L

- 1,000L to 2,000L

- 2,000L to 3,000L

- Above 3,000 L

Market, By End Use

- Automotive

- Construction

- Marine

- Oil & gas

- Petrochemicals

- Others

Market, By Distribution Channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Which region leads the sand blasting machine market?

The U.S. sand blasting machine market size was valued at USD 143.1 million in 2025 and is estimated to grow at a CAGR of 3.9% from 2026 to 2035.

What are the upcoming trends in the sand blasting machine market?

Key trends include adoption of automated and robotic blasting systems, IoT-enabled monitoring, eco-friendly dustless blasting methods, recyclable abrasives, and integration of AI-driven process optimization.

Who are the key players in the sand blasting machine market?

Key players include Abrasive Blasting Service & Supplies Pty Ltd (ABSS), Airblast B.V., Burwell Technologies, Clemco Industries Corp., Empire Abrasive Equipment, Graco Inc., Guyson Corporation, Kramer Industries Inc., Laempe Mössner Sinto GmbH, Midwest Finishing Systems, Inc., Norton Sandblasting Equipment, Sinto Group, Torbo Engineering Keizers GmbH, Trinco Trinity Tool Co., and Wheelabrator Group.

What is the growth outlook for automatic control systems from 2026 to 2035?

Automatic sand blasting machines are projected to grow at a CAGR of 4.3% through 2035, due to consistent performance, reduced manual labor, and enhanced safety features.

What was the valuation of dry blasting segment in 2025?

Dry blasting held 74% market share in 2025, widely used for surface preparation in automotive and manufacturing industries.

How much revenue did the portable segment generate in 2025?

Portable sand blasting machines generated USD 402 million in 2025, driven by enhanced mobility and adaptability across construction, automotive repair, and maintenance industries.

What is the current sand blasting machine market size in 2026?

The market size is projected to reach USD 648.6 million in 2026.

What is the market size of the sand blasting machine market in 2025?

The market size was USD 626.3 million in 2025, with a CAGR of 4.1% expected through 2035 driven by rising global infrastructure development and increasing construction and renovation activities.

What is the projected value of the sand blasting machine market by 2035?

The sand blasting machine market is expected to reach USD 931.7 million by 2035, propelled by industrial automation, eco-friendly technologies, and expanding demand across automotive and construction sectors.

Sand Blasting Machine Market Scope

Related Reports