Home > Construction > Construction Materials > Insulation Materials > Rigid Spray Polyurethane Foam Market

Rigid Spray Polyurethane Foam Market Size

- Report ID: GMI2464

- Published Date: Mar 2018

- Report Format: PDF

Rigid Spray Polyurethane Foam Market Size

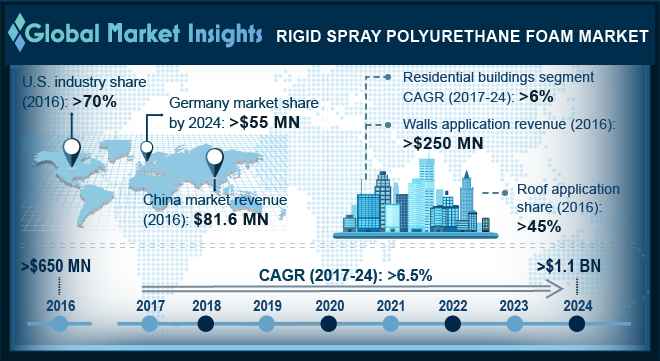

Rigid Spray Polyurethane Foam Market size was estimated over USD 650 million in 2016 and the industry will grow by a CAGR more than 6.5% through 2024. The growth in the U.S. construction industry will be a chief driver for the market growth during the forecast timeframe.

The recovery from the economic slowdown coupled with a stable GDP growth rate in the U.S. will be a major reason behind the nation’s construction business growth. Rigid SPF is extensively used for insulation and sealing purposes in building roofs and walls. It helps in reducing buildings energy requirements for heating or cooling by sealing air gaps in walls and roofs and by resisting heat transfer.

The U.S. Department of Energy estimates that more than 50% of the energy used in homes is for heating or cooling purposes. The department further stated that more than 30% of the buildings’ energy is lost due to air infiltration. The U.S. Environment Protection Agency (EPA) estimates that using insulation and sealing air gaps could save up to 20% of the monthly energy bills. These findings along with the rising demand for green buildings and energy-efficient buildings in the U.S. will propel the rigid spray polyurethane foam market demand in building construction activities.

The International Energy Conservation Code (IECC) and Leadership in Energy and Environmental Design (LEED) are some of the major standards implemented to conserve energy in the U.S. The Building Technologies Office (BTO) is tasked with the development and implementation of building energy codes. These codes are developed to ensure increased energy savings in line with the IECC and Standard 90.1. SPF is an effective economic tool to comply with these norms and the energy efficiency standards and government regulations will drive the rigid spray polyurethane foam market share in the years to come.

| Report Attribute | Details |

|---|---|

| Base Year: | 2016 |

| Rigid Spray Polyurethane Foam Market Size in 2016: | 650 Million (USD) |

| Forecast Period: | 2017 to 2024 |

| Forecast Period 2017 to 2024 CAGR: | 6.5% |

| 2024 Value Projection: | 1.1 Billion (USD) |

| Historical Data for: | 2013 to 2016 |

| No. of Pages: | 350 |

| Tables, Charts & Figures: | 417 |

| Segments covered: | Application, End-Use and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Rigid SPFs are primarily synthesized from petroleum-derived feedstock such as MDI and TDI. These materials are derived from benzene, a derivative of crude oil. The crude oil market is highly concentrated and oligopolistic in nature. Hence, the supply of crude oil has been a key factor restraining the market growth.

There has been an oscillation in the prices of crude oil due to the supply-demand gap. This has resulted in the price fluctuations of its derivatives. Factors include civil unrest in the Middle East region and embargo on Iran led to the crude oil supply disruption, which has affected the prices of petrochemicals. Therefore, the volatility in prices of raw materials has been a key factor hindering the rigid spray polyurethane foam market growth.