Home > Construction > Construction Materials > Insulation Materials > Rigid Spray Polyurethane Foam Market

Rigid Spray Polyurethane Foam Market Analysis

- Report ID: GMI2464

- Published Date: Mar 2018

- Report Format: PDF

Rigid Spray Polyurethane Foam Market Analysis

Rigid spray polyurethane foam market is segmented, based on end-use, which include commercial buildings, residential buildings, industrial buildings, agricultural buildings and institutional buildings. Among these, commercial buildings segment accounted for over 30% share of the overall market in 2016 and is projected to show the sluggish growth in coming years. The product is extensively used for insulation, preventing cracks, etc. in building exterior and interiors due to their water resistant, antibacterial characteristics.

Residential buildings segment will grow with over 6% CAGR in the forecast timeframe. The product is highly used as insulating material on walls and roofs of buildings as it reduces the overall construction cost and utility bills.

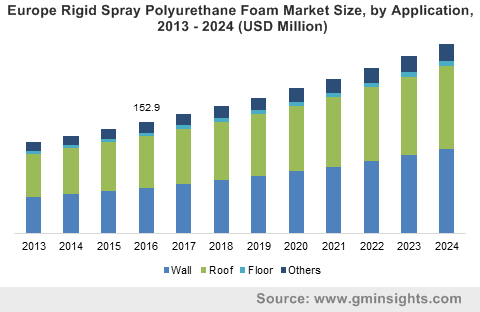

The rigid spray polyurethane foam market is further bifurcated into three major application categories which include wall, roof, and floor. Minor applications such as ceilings, plumbing systems, etc. have been included in the others segment. Walls application segment generated revenue of more than USD 250 million in 2016 and will grow at a significant CAGR through 2024. The segment growth will be driven by the increasing energy conservation demand and various advantages offered by the product such as moisture & termite control, fire protection, enhance the thermal performance, etc.

Roof application segment accounted for more than 45% of the entire rigid SPF market share in 2016 and is likely to lose its market share in coming years. This can be attributed to the wide usage of open cell SPF to prevent the cracks on the roofs in place the of rigid SPF. The open cell spray polyurethane is comparatively cheaper than rigid one and this is another key factor for the rigid spray polyurethane foam market segment demand in coming year.

The U.S. is a key contributor in rigid SPF market and accounted for over 70% of the entire share in 2016. The country is anticipated to witness a significant growth due to the supportive government protocols related to the energy efficient buildings and infrastructures. Positive demand for rigid SPF from commercial and residential end-use sector will likely enhance the rigid spray polyurethane foam market by 2024.

China was valued $81.6 million in 2016 and will likely grow at substantial annual growth rate by 2024. High population growth and technological advancement in the country is expected to propel the construction sector due to the increasing demand for houses and permanent shelters. The significant application of the product in tanks, pipes, plumbing systems and cold storage of the buildings. This in turn, will spur the Asia Pacific rigid spray polyurethane foam market in coming year.