Summary

Table of Content

Reverse Logistics Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Reverse Logistics Market Size

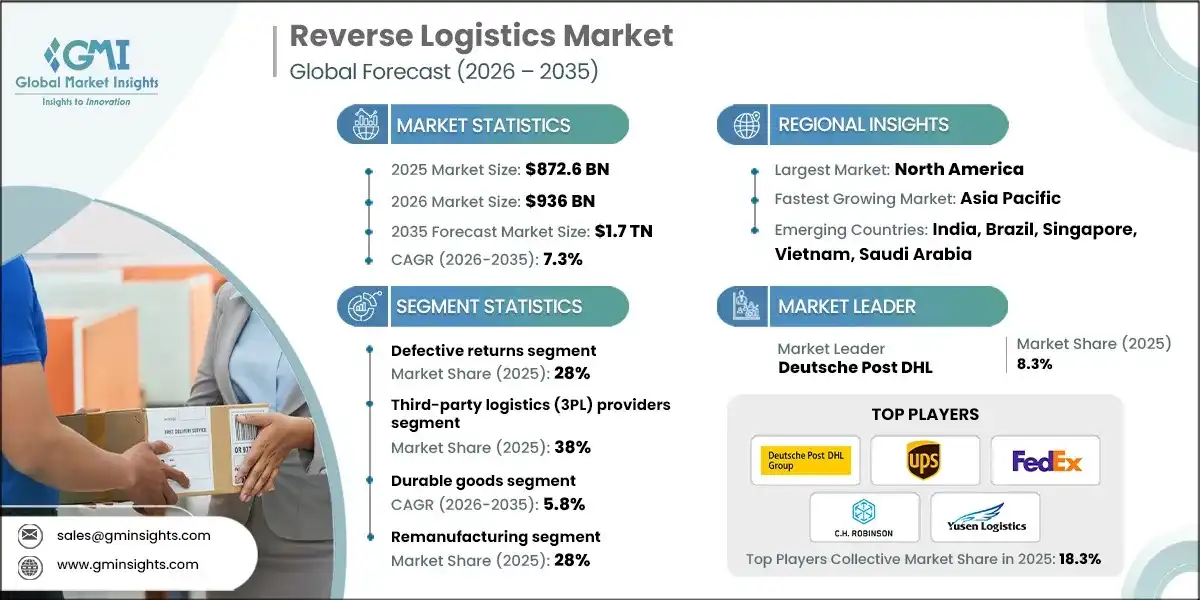

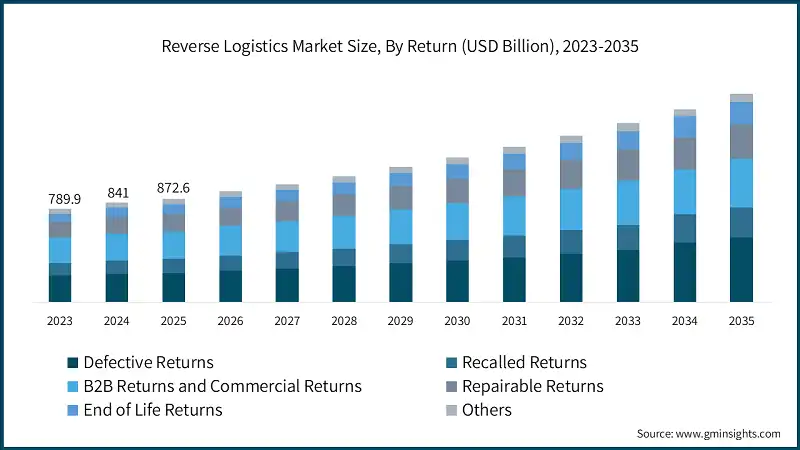

The global reverse logistics market was estimated at USD 872.6 billion in 2025. The market is expected to grow from USD 936 billion in 2026 to USD 1.75 trillion in 2035, at a CAGR of 7.3% according to latest report published by Global Market Insights Inc.

To get key market trends

Companies are increasingly prioritizing environmental conservation and aligning with global sustainability goals, such as the UN’s Sustainable Development Goals (SDGs). Reverse logistics plays a critical role by enabling the recycling, refurbishing, or proper disposal of returned products, thereby reducing waste and environmental damage. This helps companies lower their carbon footprint and enhance their corporate social responsibility (CSR) initiatives. Additionally, environmentally conscious consumers prefer brands that adopt green practices, making sustainability a competitive advantage.

The exponential growth of e-commerce has significantly increased product return volumes. Online shoppers often utilize flexible return policies to exchange or return goods due to size, quality, or preference mismatches. This trend has created a pressing need for efficient reverse logistics systems to handle the logistics of returns effectively. Companies aim to enhance customer satisfaction by streamlining return processes, as this directly impacts brand loyalty and customer retention.

In October 2024, FedEx acquired a European reverse logistics provider, strengthening regional capabilities in electronics refurbishment and regulatory compliance, and significantly expanding its footprint in Europe’s highly regulated and sustainability-driven reverse logistics market.

Reverse logistics is a cost-effective solution for managing product returns, minimizing waste, and recovering value from used goods. It enables companies to refurbish or recycle returned products, reducing dependency on new raw materials and optimizing production costs. For example, refurbished electronics or returned apparel can be resold, creating additional revenue streams. This resource recovery approach improves overall profitability while addressing sustainability goals. Furthermore, efficient reverse logistics systems minimize storage and disposal costs, saving operational expenses in the long run. Companies also benefit from better inventory management, as reverse logistics allows for quicker reintegration of returned goods into the supply chain, reducing stock obsolescence and enhancing operational efficiency.

In October 2024, Descartes Systems acquired Sellercloud, expanding its e-commerce fulfillment capabilities to better serve the growing demands of online retail.

Reverse Logistics Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 872.6 Billion |

| Market Size in 2026 | USD 936 Billion |

| Forecast Period 2026-2035 CAGR | 7.3% |

| Market Size in 2035 | USD 1.75 Trillion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing e-commerce returns due to online shopping growth | Drives higher reverse logistics volumes, forcing retailers and logistics providers to invest in scalable, automated, and cost-efficient returns infrastructure. |

| Regulatory mandates for waste management and recycling | Forces manufacturers and retailers to implement structured reverse logistics systems, increasing compliance costs while expanding demand for certified recycling services. |

| Rising focus on sustainability and circular economy adoption | Accelerates adoption of refurbishment, reuse, and recycling models, positioning reverse logistics as a strategic enabler rather than cost center. |

| Cost recovery potential from returned goods and recyclable materials | Transforms reverse logistics into revenue-generating function through resale, remanufacturing, and material recovery across multiple industries. |

| Technological advancements: AI, IoT, and blockchain for tracking and automation | Improves visibility, decision-making, and efficiency across reverse supply chains, reducing processing time, errors, and operational costs. |

| Pitfalls & Challenges | Impact |

| High operational costs for transportation and processing of returns | Limits profitability of reverse logistics, especially for low-value products, discouraging in-house operations and increasing outsourcing dependency. |

| Complexity in managing multi-channel returns | Creates operational inefficiencies, requiring advanced systems and coordination across physical stores, e-commerce platforms, and distribution networks. |

| Opportunities: | Impact |

| Integration with green logistics and carbon footprint reduction initiatives | Creates demand for sustainable reverse logistics solutions supporting emissions reduction, reusable packaging, and eco-friendly transportation practices. |

| Expansion of refurbished and secondary markets | Opens new revenue streams by monetizing returned products through resale, certified refurbishment, and alternative distribution channels. |

| Adoption of smart reverse logistics solutions (AI, predictive analytics) | Enables predictive returns management, optimized disposition decisions, and improved recovery rates across complex reverse supply chains. |

| Partnerships between manufacturers, retailers, and recycling firms | Strengthens circular ecosystems by sharing infrastructure, improving compliance, and maximizing value recovery from returned products. |

| Market Leaders (2025) | |

| Market Leaders |

held 8.3% Market Share in 2025 |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Brazil, Singapore, Vietnam, Saudi Arabia |

| Future outlook |

|

What are the growth opportunities in this market?

Reverse Logistics Market Trends

The integration of cutting-edge technologies like artificial intelligence (AI), blockchain, and the Internet of Things (IoT) is transforming the reverse logistics landscape. AI enables predictive analytics for better decision-making, while blockchain ensures secure and transparent transactions across the supply chain. IoT devices improve tracking and monitoring of returned goods, offering real-time insights. These technologies enhance process efficiency, reduce errors, and optimize resource utilization, making reverse logistics faster and more cost-effective. Automation in warehouses and sorting facilities further drives innovation, helping companies streamline operations and improve accuracy in managing returns.

Companies are increasingly embracing circular economy principles, which prioritize resource efficiency, waste reduction, and sustainability. Reverse logistics is central to this shift, as it facilitates the recycling, refurbishment, and resale of products. For example, industries like electronics and fashion are adopting practices such as remanufacturing and upcycling to extend product lifecycles. This trend is driven by both consumer demand for sustainable products and regulatory pressure to minimize waste. Circular economy initiatives not only reduce environmental impact but also open new revenue streams through the resale of refurbished goods.

In August 2024, Samsung launched a certified refurbishment program for returned and trade-in devices, establishing dedicated facilities to standardize testing, refurbishment, and resale, strengthening value recovery and supporting circular economy objectives globally.

Defective returns require specialized reverse logistics processes, such as inspection, repair, refurbishment, or recycling, which incur higher costs and operational complexities. Additionally, industries with stringent quality standards and warranty policies, such as consumer electronics, drive significant volumes of defective returns.

Stringent environmental regulations, such as the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive and the Circular Economy Action Plan, which mandate companies to manage product returns, recycling, and waste disposal responsibly. European consumers are also highly environmentally conscious, increasing demand for sustainable practices like recycling and refurbishment.

In September 2024, United Parcel Service (UPS) announced the acquisition of two Germany-based healthcare-logistics providers, Frigo-Trans and BPL, to enhance its temperature-controlled logistics capabilities in Europe.

Reverse Logistics Market Analysis

Learn more about the key segments shaping this market

Based on return, the market is segmented as defective returns, recalled returns, B2B returns and commercial returns, repairable returns, end of life returns and others. The defective returns segment dominated in 2025 with a market share of 28%.

- Defective returns continue to dominate reverse logistics volumes, particularly in electronics and consumer goods. Improved quality analytics, root-cause analysis, and supplier feedback loops are being implemented to reduce defect rates and associated reverse supply chain costs.

- Recalled returns are increasing due to stricter safety regulations and product transparency requirements. Companies emphasize rapid traceability, coordinated recall logistics, and regulatory reporting to protect brand reputation and minimize financial and legal exposure during recall events.

- B2B and commercial returns are growing with industrial leasing, bulk purchasing, and contract-based supply models. These returns involve higher-value assets, requiring specialized handling, refurbishment capabilities, and customized reverse logistics workflows to maximize asset recovery.

- Repairable returns are expanding as sustainability initiatives promote repair-over-replace models. Growth is supported by modular product designs, digital diagnostics, and service contracts, particularly in electronics, industrial equipment, and automotive components with long usable lifespans.

- End-of-life returns are driven by environmental regulations and circular economy mandates. Companies focus on material recovery, recycling partnerships, and compliant disposal to meet sustainability targets and reduce environmental liabilities associated with obsolete products.

Learn more about the key segments shaping this market

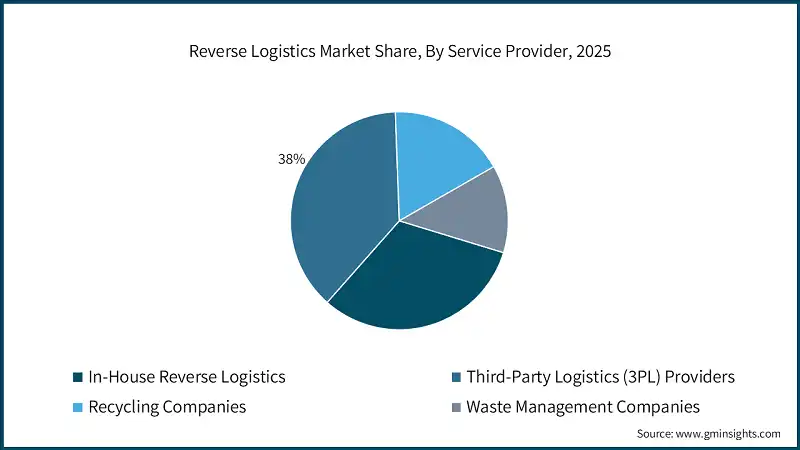

Based on service provider, the market is segmented into in-house reverse logistics, third-party logistics (3PL) providers, recycling companies, waste management companies and others. In 2025, the third-party logistics (3PL) providers segment held a market share of over 38% and was valued at around USD 330.7 billion.

- In-house reverse logistics is increasingly limited to large enterprises seeking control over customer experience and proprietary products. However, rising complexity, compliance costs, and technology requirements are gradually reducing in-house dominance across most industries.

- 3PL providers are strengthening their position by offering end-to-end reverse logistics solutions, including technology platforms, analytics, and value recovery services. Their scalability and expertise make them preferred partners for e-commerce, retail, and manufacturing companies.

- Recycling companies are expanding capabilities to handle complex waste streams such as batteries, electronics, and plastics. Investments in automation, compliance certifications, and material recovery technologies position recyclers as critical players in circular supply chains.

- Waste management companies are evolving beyond disposal toward integrated resource recovery models. Regulatory pressure and sustainability goals are driving partnerships with manufacturers and recyclers to reduce landfill dependency and improve environmental performance.

Based on category, the market is segmented as durable goods, consumables, industrial equipment, packaging materials, manufacturing and others. The durable goods segment led the market in 2025 and is expected to grow at a CAGR of 5.8% from 2026 to 2035.

- Durable goods dominate reverse logistics due to high return rates, refurbishment potential, and secondary market demand. Electronics, appliances, and automotive components drive growth, supported by repairability, warranty returns, and remanufacturing opportunities.

- Consumables reverse logistics is expanding due to regulatory scrutiny, expiration management, and sustainability concerns. Pharmaceuticals, food, and cosmetics drive demand for compliant handling, safe disposal, and recycling of packaging and expired products.

- Industrial equipment returns focus on refurbishment, remanufacturing, and asset recovery. High unit value and long lifecycles encourage repairable returns, resale, and leasing models, making reverse logistics a strategic cost-recovery function.

- Packaging materials represent a fast-growing segment driven by reusable packaging mandates and sustainability initiatives. Retailers and manufacturers emphasize collection, reuse, and recycling of plastic, cardboard, and pallets to reduce waste and costs.

Based on processes, the market is divided into returns management, remanufacturing, recycling, disposal and others. The remanufacturing segment held a major market share of 28% in 2025.

- Returns management is increasingly automated through AI-enabled grading, real-time tracking, and omnichannel integration. Retailers emphasize faster refund cycles, fraud prevention, and cost optimization as rising e-commerce volumes make returns a strategic, customer-experience-driven supply chain function globally.

- Remanufacturing is gaining traction as manufacturers pursue circular economy objectives and cost efficiency. Advanced diagnostics, modular product design, and standardized components enable higher recovery value, particularly in automotive, electronics, and industrial equipment sectors with extended product lifecycles.

- Recycling processes are evolving toward material purity, traceability, and regulatory compliance. Growth is driven by e-waste, battery recycling, and plastics recovery, supported by investments in automation, AI-based sorting, and extended producer responsibility frameworks worldwide.

- Disposal remains a compliance-driven process, increasingly regulated by environmental and safety standards. Companies focus on minimizing landfill use through pre-sorting, waste-to-energy initiatives, and certified disposal partners to reduce environmental impact and regulatory risk exposure.

Based on end use, the market is divided into retail & e-commerce, electronics, automotive, pharmaceuticals, manufacturing and others. The retail & e-commerce segment held a major market share of 43.1% in 2025.

- Retail and e-commerce remain the largest contributors to reverse logistics volumes. High return rates, flexible return policies, and customer experience expectations drive investments in automation, returns optimization, and outsourced reverse logistics solutions.

- Electronics reverse logistics is driven by rapid product obsolescence, warranty claims, and e-waste regulations. Growth is supported by refurbishment, component recovery, and recycling initiatives targeting smartphones, laptops, and consumer electronics globally.

- Automotive reverse logistics focuses on remanufacturing parts, battery recycling, and recall management. Electric vehicle growth intensifies demand for battery returns, compliance-driven recycling, and circular supply chain integration across OEMs.

- Pharmaceutical reverse logistics is governed by strict regulatory compliance for expired, recalled, and unused drugs. Secure handling, traceability, and environmentally safe disposal are critical, driving specialized service providers and controlled reverse logistics processes.

- Manufacturing end-use emphasizes recovery of defective parts, scrap materials, and surplus inventory. Reverse logistics supports cost reduction, sustainability targets, and operational efficiency through reuse, recycling, and supplier performance feedback mechanisms.

Looking for region specific data?

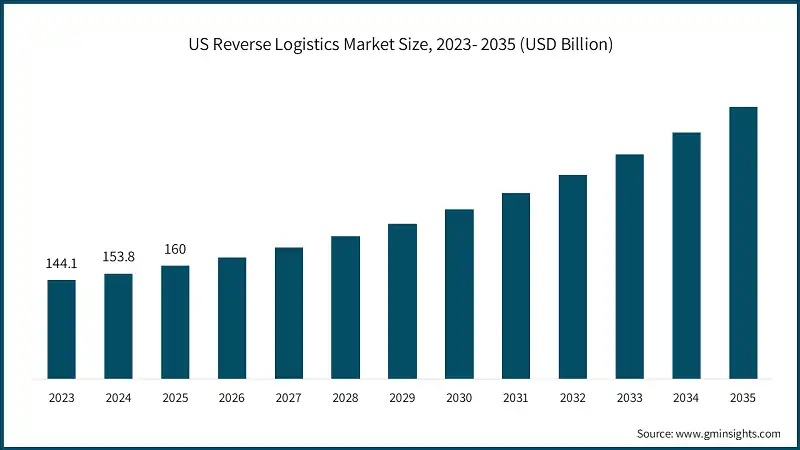

The U.S. reverse logistics market was valued at USD 160 billion in 2025 and is expected to experience significant and promising growth from 2026 to 2035.

- Reverse logistics in the U.S. is driven by high e-commerce return rates, prompting investments in automation, AI-driven returns grading, and faster refund cycles. Retailers increasingly outsource reverse operations to improve cost efficiency and enhance customer experience.

- Sustainability regulations and corporate ESG commitments are accelerating recycling, refurbishment, and resale initiatives. US companies increasingly integrate circular economy practices, particularly in electronics and automotive sectors, to recover value while meeting environmental compliance requirements.

- Advanced technology adoption, including predictive analytics and IoT-based tracking, is improving visibility across reverse supply chains. These technologies enable better demand forecasting, reduced fraud, and optimized transportation routes, lowering operational costs for large-scale reverse logistics networks.

- Growth in electric vehicles and battery-powered devices is strengthening demand for specialized reverse logistics focused on battery returns, recycling, and safe disposal. Regulatory oversight and safety standards are shaping specialized infrastructure development across the United States.

North America region in the reverse logistics market was worth USD 186.6 billion in 2025 and is anticipated to grow at a CAGR of 7.1% during 2026 to 2035.

- North America market benefits from mature logistics infrastructure and high consumer awareness. Cross-border returns between the US, Canada, and Mexico are increasing, driving demand for standardized, regionally integrated reverse logistics solutions.

- E-commerce expansion continues to fuel reverse logistics volumes, particularly in apparel and consumer electronics. Retailers focus on centralized returns hubs and shared processing facilities to improve scalability and reduce per-unit return handling costs.

- Extended producer responsibility regulations across North America are strengthening recycling and take-back programs. Manufacturers increasingly collaborate with third-party providers to ensure compliance while improving material recovery rates and reducing landfill dependency.

- Technology-enabled reverse logistics platforms are gaining adoption, offering real-time tracking, automated inspection, and data-driven decision-making. These platforms support improved asset recovery, reduced processing times, and enhanced transparency across complex reverse supply chains.

Europe reverse logistics market accounted for USD 156.5 billion in 2025 and is anticipated to show growth of 6.9% from 2026 to 2035.

- The European market is strongly influenced by circular economic policies and strict environmental regulations. Companies prioritize recycling, remanufacturing, and reuse to comply with directives such as WEEE and reduce environmental impact.

- Sustainability-driven consumer behavior in Europe encourages retailers to adopt transparent and eco-friendly return processes. Reverse logistics strategies increasingly emphasize carbon footprint reduction, localized processing centers, and optimized transportation networks.

- Rising electronics waste and battery regulations are accelerating investments in advanced recycling technologies. EU players focus on material traceability, compliance documentation, and cross-border coordination to meet regulatory and sustainability requirements.

- Collaborative reverse logistics ecosystems are emerging across Europe, involving manufacturers, logistics providers, and recyclers. These partnerships improve efficiency, share infrastructure costs, and support region-wide circular supply chain initiatives.

Germany dominates the Europe reverse logistics market, showcasing strong growth potential, and is expected to grow at a CAGR of 7.7% between 2026 and 2035.

- Germany market is driven by strong manufacturing, automotive, and electronics sectors. High emphasis on remanufacturing and precision recycling supports efficient resource utilization and aligns with the country’s advanced circular economy framework.

- Strict waste management laws and recycling targets push German companies to adopt highly structured reverse logistics processes. Automation, robotics, and AI-enabled sorting systems are widely deployed to improve efficiency and regulatory compliance.

- The automotive industry, including electric vehicle production, significantly influences reverse logistics demand. Battery returns, parts remanufacturing, and recall logistics are key growth areas requiring specialized handling and certified processing facilities.

- German enterprises increasingly integrate reverse logistics into core supply chain strategies. Focus areas include cost recovery, material reuse, and lifecycle optimization, reinforcing Germany’s leadership in sustainable and technologically advanced logistics operations.

Asia Pacific region leads the reverse logistics market, exhibiting remarkable growth with a CAGR of 8.1% during the forecast period of 2026 to 2035.

- APAC market is expanding rapidly due to rising e-commerce penetration and manufacturing output. High return volumes, particularly in consumer electronics and apparel, drive demand for scalable, cost-efficient reverse logistics infrastructure.

- Growing regulatory focus on waste management and recycling is shaping reverse logistics development across APAC. Governments encourage formalized recycling systems, pushing manufacturers to establish structured take-back and compliance-driven reverse supply chains.

- Cost sensitivity in emerging APAC markets drives hybrid models combining manual and automated reverse logistics processes. Companies balance labor availability with selective technology adoption to manage high volumes while controlling operational expenses.

- The region is witnessing increasing investment in electronics and battery recycling facilities. Rapid technology adoption and urbanization are intensifying e-waste generation, creating long-term growth opportunities for specialized reverse logistics providers.

China to experience substantial growth in the Asia Pacific market in 2025. The market in China is expected to reach USD 434.7 billion by 2035.

- China’s reverse logistics market is driven by massive e-commerce volumes and high consumer return rates. Major platforms invest in centralized returns centers, automation, and data analytics to manage scale and reduce return processing costs.

- Government-led environmental regulations are strengthening recycling and waste management systems. Mandatory recycling targets and extended producer responsibility policies are accelerating structured reverse logistics adoption across electronics and manufacturing sectors.

- Rapid growth in electric vehicles is increasing demand for battery reverse logistics, including collection, recycling, and safe disposal. Specialized infrastructure and partnerships are emerging to address safety, compliance, and material recovery challenges.

- Manufacturers increasingly focus on refurbishing and resale of returned products to capture secondary market value. This trend supports cost recovery while aligning with national sustainability and resource efficiency objectives.

Latin America reverse logistics market was valued at USD 38.3 billion in 2025 and is expected to experience substantial growth during the forecast period from 2026 to 2035.

- Reverse logistics in Latin America is gradually formalizing as e-commerce adoption increases. Retailers face challenges related to infrastructure gaps, driving demand for region-specific solutions and partnerships with local logistics providers.

- Regulatory frameworks for waste management and recycling are evolving across LATAM. Governments introduce new compliance requirements, encouraging manufacturers to invest in structured reverse logistics and certified recycling operations.

- Cost constraints remain a key challenge, limiting advanced automation adoption. Companies rely on labor-intensive processes while gradually introducing technology to improve efficiency and manage increasing return volumes.

- Growing awareness of sustainability and circular economy principles is creating long-term opportunities. Packaging recovery, electronics recycling, and refurbished goods markets are expected to expand across major Latin American economies.

MEA reverse logistics market was valued at USD 52.4 billion in 2025 and is expected to experience substantial growth from 2026 to 2035.

- Reverse logistics in MEA is emerging alongside industrialization and retail expansion. Limited infrastructure and fragmented supply chains present challenges, but increasing investment is supporting gradual market development.

- Government-led sustainability initiatives and waste reduction programs are driving formal reverse logistics adoption. Recycling and compliant disposal services are gaining importance, particularly in urban centers and industrial hubs.

- The region shows growing demand for reverse logistics in electronics, automotive, and construction sectors. Equipment returns, spare parts recovery, and waste management are key focus areas for service providers.

- International logistics companies are entering MEA markets through partnerships and acquisitions. These collaborations bring expertise, technology, and standardized processes, accelerating market maturity across the region.

Reverse Logistics Market Share

- The top 7 companies in the reverse logistics industry are Deutsche Post DHL, United Parcel Service (UPS), FedEx, C.H. Robinson Worldwide, Yusen Logistics, Kintetsu World Express, and NFI Industries contributed around 19.2% of the market in 2025.

- Deutsche Post DHL leads reverse logistics through extensive worldwide networks, industry-specific solutions, strong European compliance capabilities, and heavy investment in automation, AI-driven sortation, advanced analytics, and strategically located specialized reverse logistics facilities.

- United Parcel Service (UPS) delivers integrated reverse logistics leveraging its global transportation network, specialized returns facilities, and digital platforms enabling seamless returns management, tracking, refurbishment, and recycling for major retail, electronics, and automotive customers worldwide.

- FedEx provides end-to-end reverse logistics via FedEx Supply Chain and GENCO, emphasizing integrated forward–reverse capabilities, dense North American warehouse coverage, industry specialization, and investments in robotics, automation, and AI-enabled inspection technologies.

- C.H. Robinson Worldwide offers asset-light reverse logistics focused on transportation management, return coordination, and optimization, leveraging its Navisphere technology platform and extensive carrier network to deliver flexible, scalable solutions across retail and consumer industries.

- Yusen Logistics delivers comprehensive reverse logistics through its global forwarding network, contract logistics expertise, and strong presence in Asia-Pacific, supporting returns management, refurbishment, and recycling for automotive, electronics, and industrial customers.

- Kintetsu World Express provides specialized reverse logistics solutions focused on high-value and time-sensitive goods, leveraging airfreight expertise, regional logistics hubs, and compliance-driven handling to support electronics, automotive, and industrial supply chains.

- NFI Industries offers integrated reverse logistics across North America, combining contract logistics, warehousing, and transportation services to manage returns, refurbishment, and value recovery for retail, e-commerce, and consumer products clients.

Reverse Logistics Market Companies

Major players operating in the reverse logistics industry are:

- C.H. Robinson Worldwide

- CEVA Logistics

- DB Schenker

- Deutsche Post DHL

- FedEx

- Kintetsu World Express

- NFI Industries

- Optoro

- ReverseLogix

- United Parcel Service (UPS)

- Yusen Logistics

- Deutsche Post DHL delivers reverse logistics through extensive facilities, advanced automation, AI-driven inspection, blockchain visibility, and strong sustainability performance, serving retail, electronics, automotive, healthcare, and industrial sectors worldwide.

- United Parcel Service (UPS) provides large-scale reverse logistics leveraging its global transportation network, specialized facilities, and digital returns platforms, supporting high-volume retail, electronics, and healthcare returns with automation and advanced analytics.

- FedEx offers integrated reverse logistics through FedEx Supply Chain and GENCO, specializing in electronics testing, refurbishment, secure data handling, and value recovery across a dense North American facility network.

- XPO Logistics delivers technology-driven reverse logistics with strong retail and e-commerce focus, operating dedicated returns centers and analytics platforms that optimize inspection, sortation, and inventory disposition across North American and European markets.

- Ryder System provides reverse logistics services centered on automotive, industrial, and retail sectors, leveraging expertise in parts refurbishment, core management, remanufacturing support, and end-of-life asset processing.

- CEVA Logistics offers reverse logistics solutions across automotive, technology, healthcare, and retail industries, with specialized capabilities in electronics refurbishment, pharmaceutical compliance, and integrated reverse supply chain management.

- DB Schenker delivers reverse logistics primarily across Europe and Asia, supporting electronics, automotive, and retail sectors through specialized facilities, technology-enabled visibility, and integrated forward and reverse transportation networks.

Reverse Logistics Industry News

- In January 2025, Amazon expanded its return less refund program for low-value items, using predictive analytics to reduce processing costs, manage high return volumes, and maintain customer satisfaction by eliminating uneconomical physical returns for selected products.

- In January 2025, Deutsche Post DHL opened a highly automated reverse logistics facility in Singapore, strengthening Asia-Pacific operations with AI-enabled sortation, inspection, and refurbishment capabilities to support growing e-commerce and electronics returns demand.

- In December 2024, United Parcel Service launched an AI-powered disposition engine automating return routing decisions, significantly improving asset recovery rates and reducing cycle times while balancing economic value optimization and sustainability objectives across retail and electronics reverse logistics.

- In December 2024, The European Union expanded Extended Producer Responsibility regulations to new product categories, increasing collection targets and compliance obligations, driving higher reverse logistics demand and stimulating investments in collection, processing, and circular supply chain infrastructure.

- In November 2024, Walmart deployed autonomous mobile robots for returns sortation in major distribution centers, improving productivity and workplace safety, while signaling large-scale automation adoption in retail reverse logistics operations across its distribution network.

- In October 2024, H&M launched a clothing rental service in Nordic markets, introducing circular fashion models that rely on complex reverse logistics for collection, cleaning, refurbishment, inventory rotation, and end-of-life product management.

The reverse logistics market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Mn) from 2022 to 2035, for the following segments:

Market, By Processes

- Returns management

- Remanufacturing

- Recycling

- Disposal

- Others

Market, By Return

- Defective returns

- Recalled returns

- B2B returns and commercial returns

- Repairable returns

- End of life returns

- Others

Market, By Service Provider

- In-house reverse logistics

- Third-party logistics (3PL) providers

- Recycling companies

- Waste management companies

Market, By Category

- Durable goods

- Consumables

- Industrial equipment

- Packaging materials

- Manufacturing

- Others

Market, By End Use

- Retail & E-commerce

- Electronics

- Automotive

- Pharmaceuticals

- Manufacturing

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Portugal

- Croatia

- Benelux

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Singapore

- Thailand

- Indonesia

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- South Africa

- Saudi Arabia

- UAE

- Turkey

Frequently Asked Question(FAQ) :

Which region leads the reverse logistics market?

North America reverse logistics market was worth USD 186.6 billion in 2025, with a CAGR of 7.1% expected through 2035.

What are the upcoming trends in the reverse logistics market?

What are the upcoming trends in the reverse logistics market?

What is the current reverse logistics market size in 2026?

The market size is projected to reach USD 936 billion in 2026.

How much revenue did the third-party logistics (3PL) providers segment generate in 2025? 3PL

providers generated USD 330.7 billion in 2025, leading the market with 38% share.

What was the valuation of the defective returns segment in 2025?

Defective returns held 28% market share in 2025, dominating reverse logistics volumes particularly in electronics and consumer goods sectors.

What is the growth outlook for the Asia Pacific reverse logistics market from 2026 to 2035?

Asia Pacific is projected to grow at an 8.1% CAGR through 2035, driven by rising e-commerce penetration, manufacturing output, and regulatory focus on waste management.

Who are the key players in the reverse logistics market?

Key players include Deutsche Post DHL, United Parcel Service (UPS), FedEx, C.H. Robinson Worldwide, Yusen Logistics, Kintetsu World Express, NFI Industries, CEVA Logistics, DB Schenker, Optoro, and ReverseLogix.

What is the projected value of the reverse logistics market by 2035?

The reverse logistics market is expected to reach USD 1.75 trillion by 2035, propelled by regulatory compliance, technological advancements, and expansion of refurbished product markets.

What is the market size of the reverse logistics in 2025?

The market size was USD 872.6 billion in 2025, with a CAGR of 7.3% expected through 2035 driven by rising e-commerce returns, sustainability mandates, and circular economy adoption.

Reverse Logistics Market Scope

Related Reports