Summary

Table of Content

Reusable Paper and Cardboard Packaging Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Reusable Paper and Cardboard Packaging Market Size

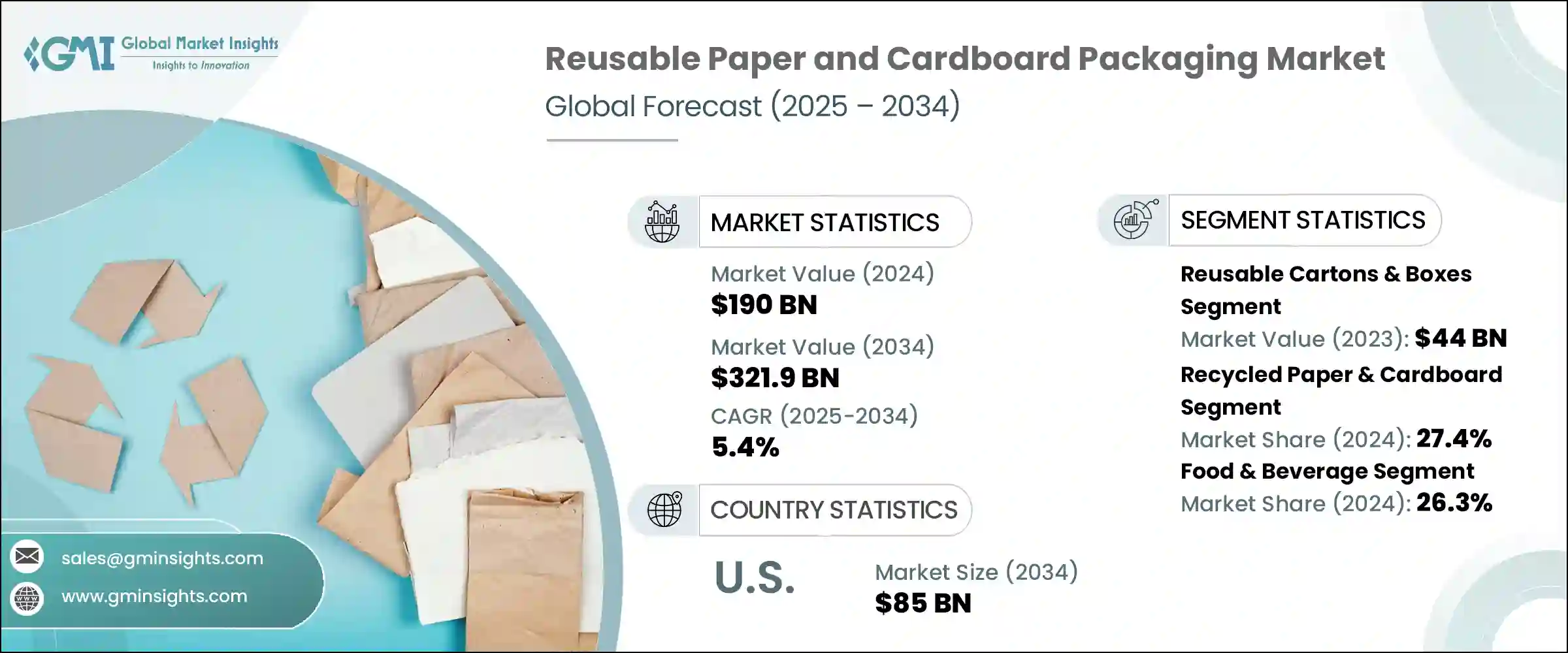

The global reusable paper and cardboard packaging market size was valued at USD 190 billion in 2024 and is estimated to grow at 5.4% CAGR from 2025 to 2034. The growing FMCG industry, rising government regulations on packaging and packaging waste, and growth of corrugated packaging in the automotive and pharmaceutical industry is driving the growth of reusable paper and cardboard packaging.

To get key market trends

The expanding FMCG industry is driving the demand for sustainable and reusable packaging solutions. As companies in the FMCG sector scale up their production to meet the increasing demand of the consumers, there is a parallel increase in the demand for sustainable, economical, and cost-efficient packaging solutions. This is more pronounced in developing economies with higher rates of urban migration, increasing disposable incomes, and changing consumer habits towards sustainable products. For example, in India, the overall FMCG market revenue is anticipated to increase at a CAGR of 27.9% during 2021-27, reaching close to USD 615.87 billion, according to IBEF. This fast-paced market growth requires packaging solutions that are not only scalable but also compatible with global sustainability objectives, making reusable paper and cardboard packaging a strategic option for FMCG brands.

Reusable Paper and Cardboard Packaging Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 190 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.4% |

| Market Size in 2034 | USD 321.9 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Stringent government regulations on packaging and packaging waste are accelerating the shift to sustainable options. Governments globally are implementing stricter regulations to minimize environmental harm and promote circular economy models. For instance, In March 2025, the European Parliament and the Council of the European Union proposed comprehensive measures aimed at improving the sustainability of packaged goods and reducing waste throughout the EU. These regulations push industries towards using reusable and recyclable materials, helping businesses become sustainable on a long-term basis.

Reusable Paper and Cardboard Packaging Market Trends

- An observable trend in the market is the increasing use of reusable paper and cardboard packing as businesses tend to adhere to global sustainability initiatives. These materials minimize packaging waste as they are recyclable, biodegradable, and help in adherence to circular economy principles. For example, Mars Wrigley launched paper packaging for its chocolate bars in March 2023, which was a sustainable move by the company. Most companies are switching to environmentally friendly substitutes and substituting single-use, long-lasting plastic with renewable and long-lasting options. This trend reflects the commitment of the industry towards sustainability and ensures that the packaging practices suit the brand's and customers' preference for environmentally friendly products.

- Another key trend fueling the growth of reusable paper and cardboard packaging is the implementation of cutting-edge coating technologies. Conventional paper-based packaging suffers from material weaknesses, but recent breakthroughs in biodegradable coating, water-resistance treatment, and barrier technology are enhancing its use. These innovations further increase the efficiency of paper packaging for food and beverage, personal care, and e-commerce applications, where goods protection is crucial. These innovations in coating enable a brand to switch easily towards reusable and recyclable packaging while retaining the same functional performance of the packaging, further boosting market penetration.

Reusable Paper and Cardboard Packaging Market Analysis

Learn more about the key segments shaping this market

On the basis of product type, the market is divided into reusable cartons & boxes, corrugated packaging, pallets & crates, protective packaging, bags & pouches, and wraps & sleeves.

- The reusable cartons & boxes market was valued at USD 44 billion in 2023 and dominated the reusable paper and cardboard packaging market. Companies are looking for sustainable alternatives to conventional packaging resulting in the growing demand for reusable cartons and boxes. Companies are designing collapsible and robust structures for enhanced reusability. With growing regulation on the environment, industries such as e-commerce and FMCG are attempting to reduce their waste and cost by adopting these solutions on a large scale.

- The protective packaging market was valued at USD 18 billion in 2024 and accounted for the fastest-growing segment during the forecast period. The shift towards biodegradable and eco-friendly protective packaging is mainly driven by sustainability concerns. Businesses are replacing traditional plastic-based cushioning with honeycomb paper and molded pulp alternatives. There is an increase in protective packaging demand that can be used for safeguarding products during transportation. The growing emphasis on product safety in e-commerce and logistics is fuelling the demand for protective packaging solutions that are reusable as well as recyclable.

Learn more about the key segments shaping this market

On the basis of material type, the reusable paper and cardboard packaging market is categorized into kraft paper, molded fiber, recycled paper & cardboard, and others.

- kraft paper market is anticipated to reach USD 116.8 billion by 2034. Kraft paper and cardboard boxes play an important role in reducing the carbon footprint while also complying with different policies. Companies are increasingly adopting kraft paper for bag packaging, void filling, and wrapping. New advancements, such as water-resistant coatings and stronger kraft materials, are improving its application in food, retail, and industrial settings, aiding the transition towards sustainable packaging options.

- The recycled paper & cardboard market held a market share of 27.4% in 2024. Recycled cardboard and paper boxes are becoming essential for mitigating environmental damage alongside ensuring compliance with regulations. Companies are sourcing high-grade recycled materials to enhance durability and reusability. With mounting consumer concern over sustainability, many industries, including e-commerce, retail, and FMCG, are actively integrating recycled materials into their packaging.

On the basis of distribution channel, the reusable paper and cardboard packaging market is divided into direct sales (B2B), distributors & wholesalers, retail stores, and e-commerce.

- The direct sales (B2B) market is anticipated to reach USD 117.2 billion by 2034. B2B companies are moving towards recyclable cardboard and paper packaging in a bid to save costs and achieve corporate social responsibility objectives. Customizable, durable industrial packaging solutions are being provided by manufacturers to serve the purpose. The demand for bulk packaging with longer life cycles is being witnessed in industries such as automotive, electronics, and manufacturing.

- The e-commerce market held a share of 29.8% in 2024. In order to attain sustainability goals and minimize waste, e-commerce companies are adopting reusable and recyclable paper-based packaging. Many companies are using returnable shipping boxes and recycled cardboard mailers that support the circular economy model. Due to rising regulations on single-use plastics, paper-based solutions are becoming a preferred choice for e-commerce businesses.

On the basis of end-use industry, the reusable paper and cardboard packaging market is divided into food & beverage, e-commerce & retail, consumer goods, healthcare & pharmaceuticals, automotive & industrial, and others.

- The food & beverage market accounted for 26.3% of the market share in 2024. Brands in the food and beverage sector are transitioning to recyclable and reusable paper-based packaging to meet regulations as well as consumer demands. Brands are switching from plastics to paper-based cartons, wraps, and molded fiber trays. Grease-resistant coatings and biodegradable barriers are some of the new innovations increasing the efficacy of environmentally sustainable food packaging solutions.

- The e-commerce & retail market is projected to grow at a CAGR of 8.3% by 2034. Retailers and online platforms are enhancing their brand image and minimizing waste by embracing sustainable packaging. There is a growing use of reusable shopping bags, recycled cardboard boxes, and kraft wraps. Companies are also modifying the packaging designs to enhance strength while minimizing the use of material, which enhances environmental sustainability and cost savings.

Looking for region specific data?

- The U.S. reusable paper and cardboard packaging market is projected to reach USD 85 billion by 2034. There is an emerging trend towards the adoption of reusable paper and cardboard packaging in the United States that is being fueled by both consumer push and corporate efforts to reduce plastic waste. Major companies are increasingly switching to more environmentally friendly paper alternatives. There is also an increase in government support for circular economy initiatives that make the use of eco-friendly packaging solutions more compelling.

- The Germany reusable paper and cardboard packaging market is anticipated to grow at a CAGR of 6.6% by 2034. Germany is at the forefront with their innovation in reusable packaging propelled by the country’s rigid environmental policies. Businesses are compelled to adhere to Germany’s packaging waste laws and deposit-return schemes, which drive the need for sustainable products. There is an increase in the use of reusable cardboard packaging in e-commerce and retail, which aids Germany’s objectives of reducing single-use packaging to create a circular economy.

- China reusable paper and cardboard packaging market is expected to grow at a CAGR of 8.5% during the forecast period. China is witnessing a fast transition to reusable cardboard and paper packaging as a result of growing environmental awareness coupled with more stringent regulations. Statista reported that in 2023, China produced around 130 million metric tons of cardboard and paper, making it the world's number one producer. This enormous production capability is pushing the way towards sustainable packaging solutions, with businesses capitalizing on local resources to develop reusable options.

- Japan is expected to account for a share of 12.3% of the market in Asia Pacific. Japan is concentrating on new advancements in paper-based packaging, such as the development of water-resistant and biodegradable coatings. The nation's emphasis on reducing plastic waste has led to extensive use of reusable packaging. To support Japan's sustainability regulations and goals, brands are developing novel solutions to improve the performance of paper-based packaging.

- The reusable paper and cardboard packaging market in India is anticipated to grow at a CAGR of 8.7% by 2034. Growing e-commerce, FMCG, and retail industries are fuelling the growth of the market in India. Increasing environmental concerns, as well as government initiatives for plastic usage reduction, are compelling businesses to move towards sustainable solutions. To satisfy consumer requirements and support the country's circular economy, businesses are creating innovative and cost-effective packaging designs.

Reusable Paper and Cardboard Packaging Market Share

The reusable paper and cardboard packaging industry is highly competitive. The top 3 players in the market are Amcor, International Paper, and Westrock, accounting for a significant share of over 45% in the market.

Sustainability is becoming the primary focus for companies, which is subsequently driving the growth of the reusable paper and cardboard packaging market. Established and new manufacturers are competing by providing sustainable, durable, and low-cost packaging solutions for e-commerce, food & beverages, and consumer goods industries. Companies are improving product durability and performance using advanced manufacturing technologies like automated assembly lines and water-resistant coating applications.

As companies aim to expand their technology scope and market share, the strategic mergers, acquisitions, and joint ventures are becoming more common. Some businesses are also engaging in partnership with recyclers and supply chain stakeholders to enhance material recovery and circularity.

The increased adoption of digitalization is also changing the industry, companies are utilizing custom AI design optimization and web-based packaging services. Furthermore, industry participants are developing reusable and biodegradable options to comply with rigorous packaging waste regulations, which promotes long-term sustainability of the market.

Reusable Paper and Cardboard Packaging Market Companies

Some of the prominent market participants operating in the industry include:

- Amcor

- DS Smith

- Huhtamaki

- International Paper

- WestRock

WestRock's strategic focus is on the development of sustainable alternatives for packaging by using recycled paper and cardboard, subsequently ensuring compliance with environmental regulations. The firm applies and integrates modern manufacturing technologies and works together with customers to design packaging that improves the efficiency of the supply chain. WestRock’s strategies mainly target waste reduction and the advancement of a circular economy.

International Paper emphasizes sustainability and the utilization of renewable materials. The firm is shifting its focus to creating more recyclable and reusable paper packaging and investing in emerging technologies to enhance packaging performance. Their approach is to encourage close collaboration with customers and other industry players to promote the use of environmentally friendly packaging.

Amcor’s strategy focuses on developing sustainable, recyclable, and reusable packaging solutions to cater to the increase in demand for eco-friendly products. The company emphasizes investing in research and development to design innovative packaging solutions while keeping a strong focus on lowering carbon emissions and pushing circular economy efforts within the packaging industry.

Reusable Paper and Cardboard Packaging Industry News

- In March 2025, Amcor launched the AmFiber Performance Paper stand-up pouch, a fully recyclable paper-based pack intended for dry drinks such as instant coffee. This pouch is part of Amcor’s sustainable packaging strategy while also catering to the rising consumer need for more environmentally friendly products.

- In September 2024, Sonoco collaborated with Marigold Health Foods to launch a novel recyclable paper can for plant-based foods such as stock cubes, sausces, and meat substitutes.

- In September 2023, Mondi and Veetee introduced the UK's first entirely recyclable paper-based packaging for dry rice. This new packaging solution can replace traditional plastic, which helps to meet the higher consumer demand for sustainable packaging.

The reusable paper and cardboard packaging market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue (USD Billion) and volume (Kilo Tons) from 2021 to 2034 for the following segments:

Market, By Product Type

- Reusable cartons & boxes

- Corrugated packaging

- Pallets & crates

- Protective packaging

- Bags & pouches

- Wraps & sleeves

Market, By Material Type

- Kraft paper

- Molded fiber

- Recycled paper & cardboard

- Others

Market, By Distribution Channel

- Direct sales (B2B)

- Distributors & wholesalers

- Retail stores

- E-commerce

Market, By End Use Industry

- Food & beverage

- E-commerce & retail

- Consumer goods

- Healthcare & pharmaceuticals

- Automotive & industrial

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- India

- Japan

- ANZ

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the reusable paper and cardboard packaging industry?

Prominent participants in the market include Amcor, DS Smith, Huhtamaki, International Paper, and WestRock.

How much is the U.S. reusable paper and cardboard packaging market projected to reach by 2034?

The U.S. market is projected to reach USD 85 billion by 2034.

How big is the reusable paper and cardboard packaging market?

The market was valued at USD 190 billion in 2024 and is expected to reach approximately USD 321.9 billion by 2034, growing at a CAGR of 5.4% during the forecast period.

What is the size of the reusable cartons & boxes segment in the reusable packaging market?

The market from reusable cartons & boxes segment was valued at USD 44 billion in 2023.

Reusable Paper and Cardboard Packaging Market Scope

Related Reports