Summary

Table of Content

Residential Electrical Conduit Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Residential Electrical Conduit Market Size

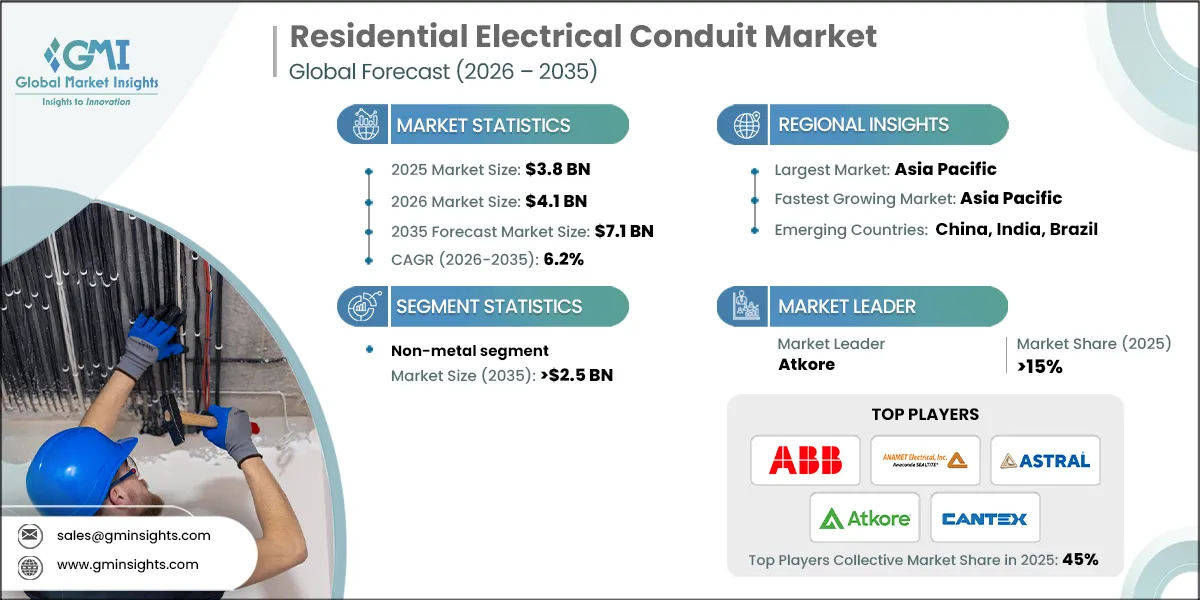

The global residential electrical conduit market was estimated at USD 3.8 billion in 2025. The market is expected to grow from USD 4.1 billion in 2026 to USD 7.1 billion by 2035, at a CAGR of 6.2%, according to a recent study by Global Market Insights Inc.

To get key market trends

- Electrification of mobility and the shift to at‑home EV charging are expanding low‑voltage circuits and protective raceways in residences. For instance, the IEA reports private chargers outnumber public chargers by almost ten to one, with home charging the most common globally; access exceeds 80% in markets like the U.S. and UK, anchoring overnight charging needs that require new branch circuits, conduit, and code‑compliant installations. These dynamic lifts demand for fittings, bends, and cable management in garages and parking.

- Energy‑efficiency retrofits are accelerating, boosting demand for wiring upgrades and conduit for heat pumps, induction, and insulation projects. For example, the IEA notes efficiency policy momentum has lifted annual efficiency investment about 45% since 2020, with robust 2023 gains across the EU, United States, Korea, Türkiye, and the UK; this uptick translates directly into more electrical scopes inside existing dwellings. Installers must route new circuits and protective raceways to accommodate higher loads, smart controls, and metering.

- U.S. home electrification incentives are catalyzing service‑panel upgrades and conduit runs for heat pumps, appliances, and rooftop PV. For instance, the Department of Energy’s Inflation Reduction Act Home Energy Rebates provide USD 8.8 billion, and in April 2024 New York became the first state to receive USD 158 million to implement panel, heat‑pump, and insulation rebates, stimulating contractor backlogs for residential electrical work. The funding mix directly raises demand for UL‑listed raceways, fittings, and meter‑base upgrades.

- EU renovation funding is scaling electrical refurbishment volumes across member states. For example, the European Commission estimates USD 97.2 billion for energy efficiency in buildings under Recovery and Resilience Facility plans, underpinning large‑scale residential upgrades and associated conduit demand. Member states use funds for insulation, heat‑pump rollouts, and electrical safety improvements that necessitate new wiring pathways. Installations scale across single‑family and multi‑family housing.

- Rooftop solar adoption is materially increasing AC/DC cabling and conduit needs in Indian homes. For instance, the Government’s PM Surya Ghar scheme has an outlay of USD 8.2 billion through FY 2026‑27 to accelerate household PV installations and balance‑of‑system wiring. Distributed installations in rooftops and yards will intensify demand for UV‑resistant conduit, combiner‑box wiring, and metering upgrades. Local codes also require protective routing in exposed runs.

- Heat‑pump deployment mandates electrical upgrades in British housing stock, boosting demand for conduit and cable management. For example, the Boiler Upgrade Scheme offers approximately USD 10,000 per heat‑pump installation, with the 2025/26 budget at over 400 million to sustain uptake, supporting extensive domestic rewiring and outdoor unit connections. Installers are adding dedicated circuits, isolators, and weatherproof raceways for compressors and indoor modules. Zero VAT on installations until 2027 further encourages adoption.

- Government‑backed finance for home energy retrofits is driving panel, circuit, and conduit additions across Australia. For instance, the 2023‑24 Energy Savings Package commits USD 1.13 billion, including USD 0.92 billion for a Household Energy Upgrades Fund via the CEFC, mobilizing upgrades for over 110,000 homes and around 60,000 social dwellings. These measures trigger widespread electrician demand for protective raceways, sub‑meters, and PV‑ready switchboards.

- Citizen housing programs in the UAE are accelerating new residential construction and lifting consumption of electrical raceways. For example, Abu Dhabi’s first 2025 package approved housing benefits worth USD 1.8 billion (loans, grants, exemptions), underpinning thousands of new or improved homes requiring modern wiring systems and protective conduits. This pipeline drives procurement of conduits, boxes, and fittings.

Residential Electrical Conduit Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 3.8 Billion |

| Market Size in 2026 | USD 4.1 Billion |

| Forecast Period 2026-2035 CAGR | 6.2% |

| Market Size in 2035 | USD 7.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growth in Residential Construction and Urbanization | Rapid urbanization and rising housing development significantly increase demand for electrical conduits. Expanding new construction and renovation activities, especially in emerging economies, drive the need for safe, durable wiring systems across modern homes, directly boosting conduit adoption. |

| Strict Electrical Safety Codes and Regulations | Increasingly stringent residential safety standards require high?quality conduit systems to protect wiring from fire, moisture, and physical damage. Regulatory updates, such as NEC changes, compel builders and homeowners to use compliant conduit solutions, reinforcing steady market growth globally. |

| Rising Adoption of Smart Home and Advanced Electrical Systems | Smart home technologies, energy?efficient devices, and integrated electrical networks demand reliable, organized wiring pathways. This shift toward technologically rich homes accelerates the need for advanced conduit materials that support evolving electrical loads and communication systems, driving sustained market expansion. |

| Pitfalls & Challenges | Impact |

| Slow Paced Technological Advancement | Slow-paced technological advancement in developing regions limits the adoption of modern conduit materials and installation methods. This lag reduces efficiency, increases installation challenges, and slows market modernization—hindering growth compared to regions rapidly integrating advanced electrical infrastructure solutions. |

| Opportunities: | Impact |

| Rise in Residential Construction | Rising global residential construction, driven by urbanization, population growth, and expanding housing projects, creates strong demand for safe, durable conduit systems. Increased renovation activities and modernization of aging electrical infrastructure further enhance market opportunities across both developed and developing regions. |

| Growing Adoption of Smart Home Technologies | Growing adoption of smart home technologies and energy‑efficient systems boosts demand for conduits supporting advanced wiring, data cables, and integrated electrical networks. Homes prioritizing automation, safety, and organized wiring infrastructure present significant long-term growth prospects for innovative conduit materials and designs. |

| Market Leaders (2025) | |

| Market Leader |

Over 15% Market Share |

| Top Players |

45% Market Share |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Residential Electrical Conduit Market Trends

- Distributed rooftop solar and behind‑the‑meter storage are scaling rapidly, increasing demand for residential conduits, fittings, and cable management. For instance, IRENA reports global renewable capacity grew +473 GW in 2023, with solar +346 GW and Asia accounting for 69% of new additions, much of it distributed PV, driving extensive AC/DC wiring and protective raceway needs across homes and small buildings. Installers are standardizing UV‑resistant conduit, rooftop cable trays, and compliant penetrations to meet accelerating volumes.

- European building policy is tightening, compelling electrical refurbishments and EV‑ready infrastructure in dwellings. For instance, the revised Energy Performance of Buildings Directive (EU) 2024/1275 entered into force in May 2024, requiring national renovation plans toward a zero‑emission building stock by 2050, spurring upgrades of wiring systems, sub‑metering, and charger‑ready circuits in residences across member states. These measures elevate specification rates for compliant conduits and low‑smoke halogen‑free raceways.

- In the U.S., public weatherization funds are sustaining retrofit pipelines that include panel, wiring, and conduit scopes. For example, DOE’s Weatherization Assistance Program received USD 326 million for Program Year 2024, alongside set‑asides for innovation and readiness, supporting energy retrofits that routinely entail new circuits for ventilation, heat pumps, and safety upgrades. This predictable funding underpins regional demand for listed raceways, fittings, and protective routing in older housing stock.

- UK social housing decarbonization is being scaled, multiplying electrical refurbishment work scopes. For instance, the government committed USD 1.78 billion to Warm Homes: Social Housing Fund – Wave 3 for 2025–2028, with projects already offered to landlords nationwide, catalyzing rewires, heat‑pump connections, and EV‑ready parking upgrades requiring new conduits and containment. The pipeline extends prior waves, signaling multi‑year demand for residential raceway products.

- Canada’s retrofit momentum is tangible, with funded projects translating into electrical upgrade tasks. For example, by June 2024 the Canada Greener Homes Grant had issued USD 0.78 billion across 239,696 households, with heat pumps the top measure, driving dedicated circuits, disconnects, and protective conduit runs in single‑family and multi‑unit dwellings. This confirmed uptake supports steady procurement of fittings, EMT/PVC raceways, and outdoor‑rated enclosures.

- Japan’s EV‑charging push in flats and destinations is expanding residential low‑voltage infrastructure. For instance, METI earmarked USD 0.30 billion in FY 2024/25 for charging and related infrastructure, including support for multi‑unit buildings and high‑output rapid chargers, stimulating feeder upgrades, cable routes, and code‑compliant conduits in parking structures and residences. Guidance targets 2030 goals and higher charger counts, reinforcing sustained materials demand.

- Brazil’s affordable‑housing acceleration is enlarging new‑build electrical volumes and conduit consumption. For example, the federal Minha Casa, Minha Vida program surpassed 1.26 million contracted residences between 2023 and end‑2024, with deliveries and restarts of previously stalled projects, expanding requirements for standardized conduits, junction boxes, and grounding across mass‑housing developments nationwide. The scale and timelines indicate durable procurement for electrical containment systems.

- Australia’s green‑finance instruments for households are activating retrofit projects that add circuits and raceways. For instance, the government‑owned Clean Energy Finance Corporation operates a USD 0.71 billion Household Energy Upgrades Fund with lenders (e.g., Westpac, ING, CommBank), supporting PV, batteries, heat pumps, and EV chargers, each requiring compliant wiring, isolators, and conduit pathways. Parallel policy work includes NatHERS expansion to existing homes, improving demand visibility for upgrades.

Residential Electrical Conduit Market Analysis

Learn more about the key segments shaping this market

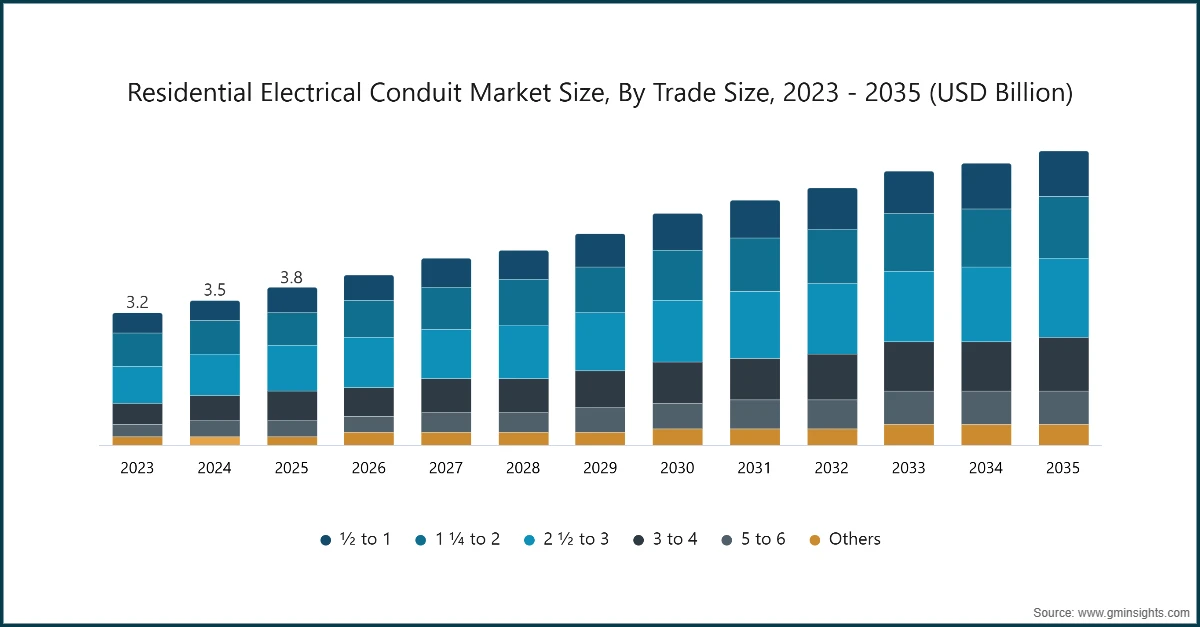

- The residential electrical conduit industry is categorized by trade size into ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others. The residential electrical conduit market was valued at USD 3.2 billion, USD 3.5 billion and USD 3.8 billion in 2023, 2024, and 2025 respectively.

- Energy‑efficiency retrofits and layout tweaks are lifting small‑diameter conduit adoption, because electricians can add protected branch circuits through finished spaces with minimal demolition, patching, and occupant disruption. Compact raceways also speed device upgrades for lighting controls, sensors, and receptacles while preserving code compliance and schedule certainty in occupied dwellings. Distributors benefit from high reorder frequency and broad fitting compatibility, making ½–1‑inch sizes the default choice for quick, low‑impact residential wiring enhancements across diverse retrofit scopes and maintenance programs.

- Electrification projects drive demand for 1¼–2‑inch conduit, because Level‑2 EV chargers, heat pumps, and induction appliances need higher‑ampacity conductors, improved heat dissipation, and future‑ready pathways. Installers upsize garage, exterior‑pad, and rooftop runs to accommodate spares, load‑management hardware, and potential storage, ensuring easier pulling, compliant fill, and thermal performance. This practice raises per‑project footage and fitting counts, standardizes elbows and LB bodies, and improves labor productivity, strengthening mid‑size conduit pull‑through for contractors and wholesalers.

- Service‑capacity upgrades and subpanel additions are expanding use of 2½–3‑inch conduit, because larger aluminum or copper feeders need generous bend radii, accessible pull points, and spare capacity for future circuits. Whole‑home electrification consolidates HVAC, domestic hot water, cooking, and EV charging loads, encouraging larger raceways that simplify parallel conductors and long pulls to remote equipment. Townhome clusters and ADUs sharing service laterals reinforce upsizing, increasing orders for long‑sweep elbows, pull boxes, and weather‑rated fittings matched to heavier conductors.

- Modernizing small multifamily distribution increases adoption of 3–4‑inch conduit, as expanded risers, meter stacks, and shared laterals require larger pathways to manage feeder counts and maintain separation. Resilience features, batteries, transfer equipment, and solar combiner feeds, further raise conductor volume, demanding robust raceways with expansion capability for exterior risers and compliant support spacing. Though project counts are fewer than smaller bands, each job consumes substantially more footage and premium fittings, improving revenue mix and driving predictable procurement cycles.

- High‑capacity residential developments and shared amenities sustain demand for 5–6‑inch conduit, where oversized pathways accommodate parallel runs, lower pulling tension, and manage thermal performance for dense electrical distribution. Developers oversize primary routes to avoid retrenching when adding EV arrays, large energy storage, pools, or irrigation, preserving headroom for new loads and evolving technologies. Engineered designs also specify corrosion‑resistant materials, long‑sweep elbows, and custom supports, creating niche yet high‑margin orders that stabilize volumes despite comparatively limited project counts.

- Flexible and specialty raceways gain traction as retrofits increasingly require vibration‑resistant, moisture‑rated, and quick‑install connections for outdoor heat pumps, rooftop photovoltaics, and exterior equipment. Liquid‑tight whips, ENT, and low‑smoke products minimize demolition, preserve aesthetics, and accelerate closeout while passing inspections across damp or corrosive environments. Growing use of mixed raceway systems, rigid feeders with flexible terminations, expands attach‑rates for fittings and adapters, improving installation speed, maintaining maintainability, and supporting standardized serviceability across varied residential applications.

Learn more about the key segments shaping this market

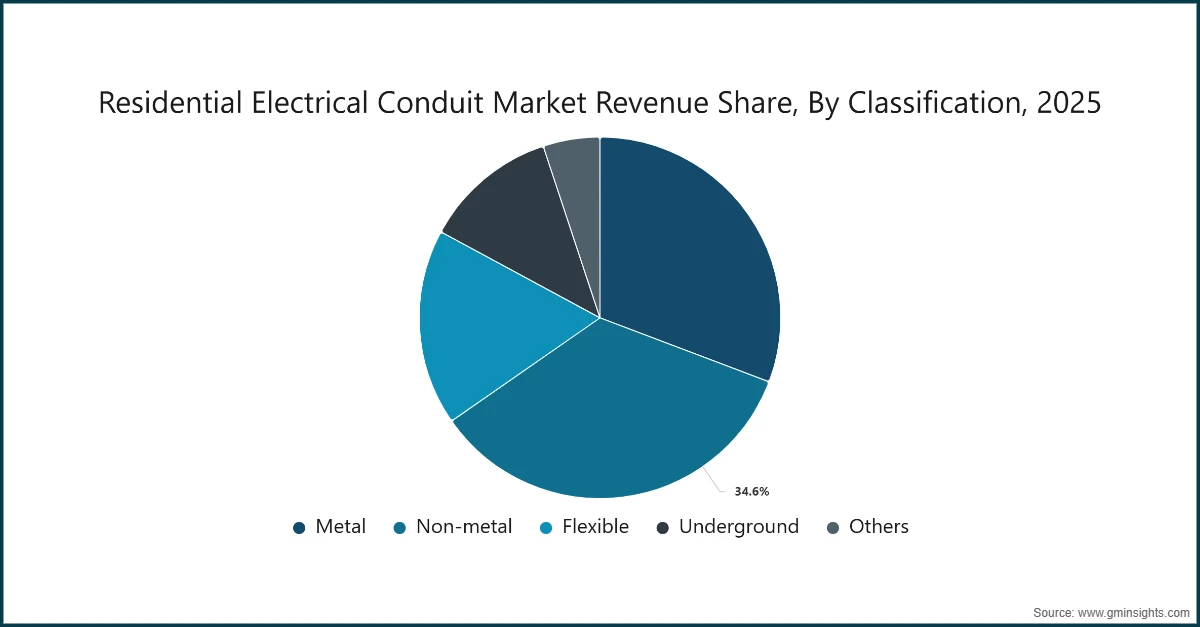

- Based on classification, the industry is bifurcated into metal, non-metal, flexible, underground, and others. The non-metal residential electrical conduit market holds a share of 34.6 % in 2025 and is set to reach over USD 2.5 billion by 2035.

- Metal conduit adoption is rising as electrification elevates fault currents and inspection scrutiny, prioritising mechanical strength, grounding continuity, and fire performance in dense residential installations with higher connected loads. Installers favour steel or aluminium raceways where physical protection, bonding reliability, and temperature tolerance are critical, such as service risers, meter stacks, and exposed garage runs. Wholesalers benefit from premium fittings, threadless couplings, and corrosion‑protected accessories, while contractors value predictable bend behaviour and fastening options that accelerate layout, prefabrication, and code‑compliant close‑out.

- Non‑metallic conduit gains share where corrosion resistance, weight reduction, and lower installed cost drive specifications, especially along coastal zones, rooftops, and moisture‑prone locations in contemporary residential projects. PVC and listed non‑metallic systems simplify cutting, solvent welding, and long sweeps, reducing labour and enabling cleaner aesthetics around façades and landscaped areas. Builders appreciate thermal and dielectric properties that support outdoor PV, pool, and irrigation circuits, while distributors capture recurring demand for expansion fittings, adhesives, bushings, and UV‑stabilised accessories tailored to climate conditions.

- Flexible raceways grow with retrofit complexity, vibration‑prone equipment, and tight spaces, because they route easily around obstructions and minimise demolition in occupied dwellings. Electricians deploy FMC, LFMC, and liquid‑tight non‑metallic whips for heat pumps, compressors, and rooftop PV BOS, balancing speed, protection, and inspection readiness. The format accelerates punch‑list closure by simplifying terminations at equipment, weatherproof boxes, and disconnects, while enabling late‑stage device changes without re‑pulls, driving high attach‑rates for connectors, strain reliefs, and sealing washers.

- Underground systems expand as subdivisions, townhomes, and estates prioritise aesthetics, resilience, and utility coordination, shifting feeders and communications below grade to protect circuits from weather and physical impacts. Contractors specify listed PVC, HDPE, or encased metal for primary and secondary routes, designing with thermal derating, separation distances, and sweep radii that support ampacity and future capacity. Developers value predictable trenching, locator access, and vault standardisation, while distributors benefit from bulk conduit reels, markers, spacers, and engineered transition fittings.

Looking for region specific data?

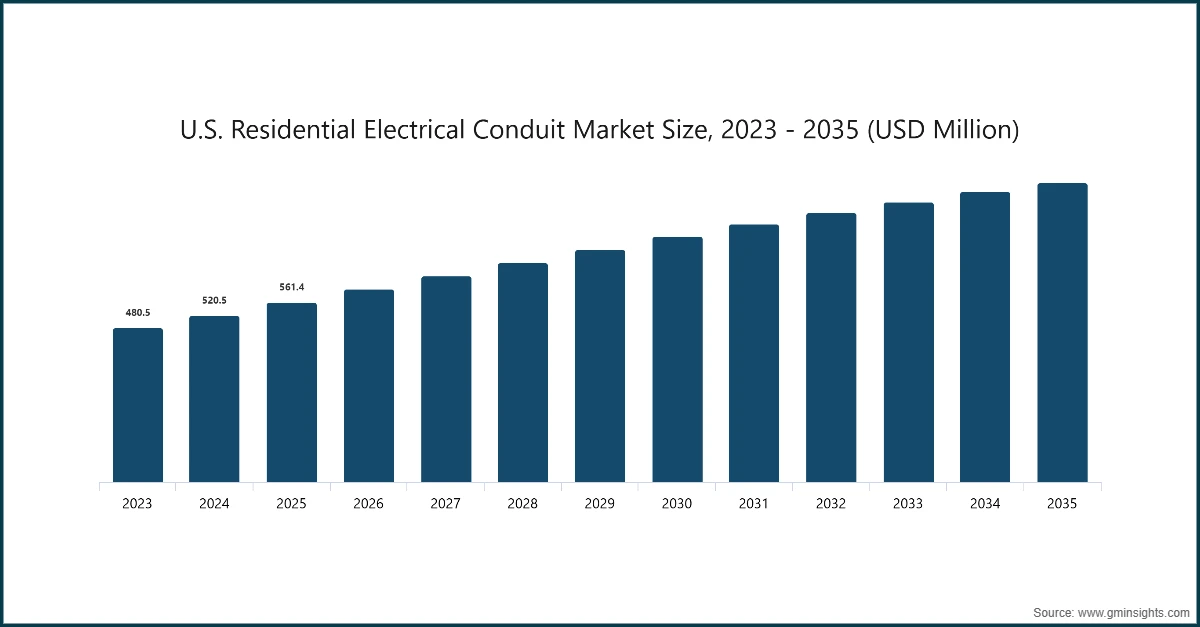

- The U.S. residential electrical conduit market was valued at USD 480.5 million, USD 520.5 million and USD 561.4 million in 2023, 2024 and 2025 respectively, driven by home electrification retrofits, EV chargers, heat pumps, rooftop PV, and associated service‑capacity upgrades that increase conduit footage, diameter, and fittings attach‑rates.

- In North America, rising social‑housing and self‑build programs stimulate conduit adoption by accelerating new connections, sub‑feeds, and compliant raceways in low‑income and peri‑urban developments across the region. For instance, Mexico’s CONAVI reported full execution of its 2023 social‑housing budget and continued 2025 allocations under the Programa de Vivienda Social, with over 114,000 improvement actions shown in SIESCO. This sustained pipeline translates into steady purchases of listed PVC/EMT, elbows, boxes, and fittings, reinforcing the driver.

- Policy‑led renovation in European countries drives conduit demand by adding circuits for heat pumps, ventilation, and sub‑metering in occupied dwellings, where compliant containment minimizes disruption and speeds inspection. For instance, France’s MaPrimeRénov’ funds large‑scale residential energy retrofits under the national plan and EU Recovery Facility, targeting hundreds of thousands of homes with grant support. These incentives catalyze electrical refurbishments, new runs, protection, and device upgrades, directly backing the adoption driver across European housing stock.

- Electrified mobility and appliance shifts across Asia Pacific region expand conduit usage by requiring higher‑amp circuits, longer runs to parking areas, and safer, code‑compliant raceways in multi‑unit residences. For instance, South Korea approved USD 430 million in 2025 subsidies for EV charging facilities, prioritizing slow chargers in residential settings and boosting installation capacity. This targeted funding accelerates charger installations that need protected pathways, validating the region’s electrification‑driven conduit growth.

- Mass‑housing delivery programs in Middle East & Africa lift conduit consumption by scaling standardized wiring, feeders, and protective containment across rapidly built apartment blocks and serviced plots. For instance, Egypt’s Social Housing and Mortgage Finance Fund reported thousands of monthly unit allocations in 2024, including 6,644 units in September under Housing for All Egyptians. These allocations trigger consistent procurement of conduits, fittings, and accessories, reinforcing the driver throughout affordable schemes.

- Across Latin America, affordability subsidies and credit programs boost conduit demand by unlocking starts for social and entry‑level homes, which require complete electrical fit‑outs and compliant containment. For instance, Peru’s Fondo MIVIVIENDA reports extensive coverage via Techo Propio and Crédito Mivivienda, benefiting over 220,000 Peruvians in 2025 and offering defined bonuses for VIS purchases. This consistent throughput of financed projects sustains conduit purchasing and installation, directly supporting the regional growth driver.

Residential Electrical Conduit Market Share

- In 2025, the top five companies, ABB, Anamet Electrical, Astral, Atkore, and CANTEX, captured roughly 45% of the global residential electrical conduit market, highlighting their strong technological capabilities and well‑established global presence.

- Atkore holds substantial share through a broad conduit portfolio spanning PVC Schedule 40/80 (½–8 in.) and an extensive fittings ecosystem marketed under brands such as Allied Tube & Conduit, giving it deep residential channel reach. Its bolt‑on M&A has reinforced supply and product breadth; for example, the 2022 purchases of Cascade Poly Pipe & Conduit and Northwest Polymers expanded HDPE conduit capability and recycled‑materials sourcing, strengthening cost position and geographic coverage in North America.

- CANTEX is a U.S. mainstay in residential PVC raceways with a full line of Schedule 40/80 conduit, elbows, boxes, and ENT/fittings that conform to UL 651/NEMA TC‑2 and carry ETL listings, making it a default spec for installers and distributors. Its 2025 $120 million investment to open a new manufacturing site in Nashville, Arkansas expands capacity and shortens lead times for conduit, fittings, and boxes, cementing coverage across fast‑growth Sun Belt markets.

- Astral commands share in India’s residential segment with Wire Guard rigid uPVC electrical conduit and fittings (20–63 mm; IS 9537‑3 light/medium/heavy grades), engineered for fire resistance, impact strength, and solvent‑welded joints, ideal for concealed wiring in apartments and high‑rise projects. In April 2025, Astral approved the acquisition of Al‑Aziz Plastics (electrofusion/compression and electrical fittings) to broaden components for water, gas, electricity, and solar distribution, expanding its cable‑protection ecosystem and channel leverage.

Residential Electrical Conduit Market Companies

- Hubbell sustains a strong residential position through its Electrical Solutions portfolio, conduit fittings, boxes, raceways and accessories widely specified by U.S. distributors, complemented by scale in utility and grid equipment that strengthens channel leverage and brand preference. Operationally, the company has been expanding margins while unifying product lines and pruning non‑core exposure, which supports service levels and inventory breadth at the point of sale. In FY‑2024, Hubbell delivered approximately USD 5.63 billion in revenue and raised its 2025 EPS outlook; Q3‑2025 results showed continued organic growth in Electrical Solutions and robust margins.

- Legrand commands share through a broad cable‑management and wiring‑device portfolio, e.g., DLP trunking systems and wire/cable management accessories used in residential refurbishments and new builds across EMEA/APAC, supported by continuous new‑product flow and an active M&A cadence. Despite a soft building backdrop, Legrand reported 2024 sales growth, 20.5% adjusted operating margin, and USD 1.55 billion free cash flow; it announced 9 acquisitions over the last 12 months to deepen coverage in growth adjacencies. This mix of product breadth and balance‑sheet firepower keeps Legrand top‑of‑mind with installers and distributors.

- Schneider Electric reinforces residential conduit/cable‑management presence via Square D / Clipsal wiring devices and cable‑management lines (trunking, posts, desk/bench systems), plus connected X‑Series devices that pull through enclosures and accessories at retail/wholesale. Financially, Schneider posted record 2024 results: USD 45.6 billion revenue and 18.6% adjusted EBITA margin, with 2025 guidance for further organic growth and margin expansion, funding continued product launches and channel investments. The combination of connected devices and comprehensive raceway/cable‑management keeps Schneider well‑positioned in residential fit‑outs and upgrades.

- Zekelman is a North American leader in steel EMT/IMC/RMC and accessories, supplying residential electricians through Wheatland Tube and Western Tube with U.S.‑made EMT, RMC/IMC, aluminum rigid, PVC, EC&N, and ZI‑Strut, all positioned on quality, availability, and next‑day logistics from regional warehouses. The company’s “Demand Domestic” program emphasizes UL/ANSI/NFPA compliance and manufacturing consistency that installers value in single‑family and multifamily work.

- HellermannTyton’s HelaGuard line is widely used for residential cable protection, especially retrofits and equipment drops, thanks to quick‑fit IP‑rated connectors and halogen‑free, flame‑retardant options. The firm continues to expand catalog depth and launches across connectivity/cable‑management that support pull‑through with electrical wholesalers. In India, HellermannTyton Pvt. Ltd. disclosed strong FY 2023‑24 growth and profitability, evidence of momentum in regional cable‑management demand.

Major players operating in the residential electrical conduit industry are:

- ABB

- Anamet Electrical

- Astral

- Atkore

- Austro Pipes

- CANTEX

- Champion Fiberglass

- Electri-Flex

- Guangdong Ctube Industry

- HellermannTyton

- Hubbell

- IPEX Electrical

- JM Eagle

- Legrand

- Liberty Electric Products

- Robroy Industries

- Schneider Electric

- Tubecon

- Wienerberger

- Zekelman Industries

Residential Electrical Conduit Industry News

- In April 2025, Legrand expanded its strategic footprint in Australia through the acquisition of Australian Plastic Profiles (APP), a prominent PVC conduit manufacturer known for its AussieDuct and Pipe King brands. The acquisition strengthens Legrand’s local manufacturing capabilities and broadens its reach into Australia’s residential and commercial infrastructure segments.

- In May 2024, Atkore introduced Environmental Product Declarations (EPDs) for its PVC and steel conduit lines, offering independently verified data on their environmental impacts. This initiative underscores Atkore’s commitment to sustainability and reflects the rising market demand for construction materials with transparent, eco‑friendly performance profiles.

- In May 2024, ABB inaugurated a new injection molding facility in Evergem, Belgium, following an investment of USD 2 million. The company noted that the plant enhances automation and energy efficiency by integrating advanced numerical control machinery, modern molding technologies, and a fully digitalized infrastructure. ABB’s AMMS power distribution enclosures produced at the site support the safe distribution of power control components, including circuit breakers, fuses, switches, and meters, across commercial, residential, and industrial facilities.

- In May 2024, ABB partnered with the Niedax Group to form a joint venture, ABNEX, Inc., aimed at meeting the rising demand for cable management systems throughout North America. By combining ABB’s automation capabilities with Niedax’s deep expertise in cable management, the venture intends to serve growing commercial and infrastructure development in the region with high‑performance, standards‑compliant solutions. The collaboration is expected to expand manufacturing capacity while strengthening the focus on safety and energy‑efficiency requirements.

The residential electrical conduit market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) from 2022 to 2035, for the following segments:

Market, By Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

Market, By Classification

- Metal

- Non-metal

- Flexible

- Underground

- Others

The above information has been provided for the following regions & countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Latin America

- Brazil

- Argentina

Frequently Asked Question(FAQ) :

What is the market share of the non-metal residential electrical conduit segment in 2025?

The non-metal residential electrical conduit segment holds a 34.6% market share in 2025. Its growth is supported by cost-effective solutions, ease of installation, and suitability for expanding residential construction projects.

What is the projected value of the residential electrical conduit market by 2035?

The market size for residential electrical conduits is expected to reach USD 7.1 billion by 2035, growing at a CAGR of 6.2%. This growth is fueled by increasing demand for durable and safe wiring systems in modern homes and the adoption of energy-efficient technologies.

What is the market size of the residential electrical conduit industry in 2026?

The market size for residential electrical conduits is projected to reach USD 4.1 billion in 2026, reflecting steady growth driven by rising adoption of advanced wiring systems and smart home technologies.

What is the residential electrical conduit market size in 2025?

The market size for residential electrical conduit is valued at USD 3.8 billion in 2025. Rapid urbanization, increasing residential construction, and stringent safety regulations are driving market growth.

What was the valuation of the U.S. residential electrical conduit market in 2025?

The U.S. market was valued at USD 561.4 million in 2025. Growth is driven by home electrification retrofits, EV chargers, heat pumps, rooftop PV installations, and associated service-capacity upgrades.

What are the upcoming trends in the residential electrical conduit industry?

Key trends include the adoption of smart home technologies, energy-efficient systems, and advanced conduit materials. Increasing focus on safety, organized wiring infrastructure, and compliance with stringent electrical codes are shaping the market.

Who are the key players in the residential electrical conduit market?

Key players include ABB, Anamet Electrical, Astral, Atkore, CANTEX, Champion Fiberglass, Electri-Flex, Guangdong Ctube Industry, HellermannTyton, and Hubbell.

Residential Electrical Conduit Market Scope

Related Reports