Summary

Table of Content

Remote Patient Monitoring (RPM) Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Remote Patient Monitoring Devices Market Size

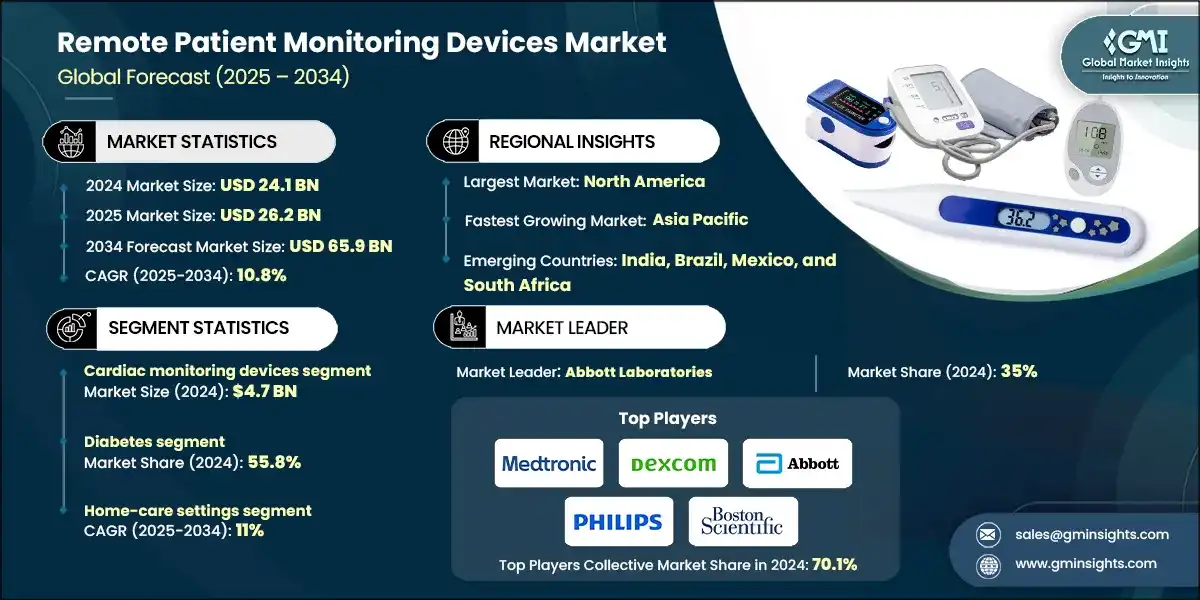

The global remote patient monitoring devices market was estimated at USD 24.1 billion in 2024. The market is expected to grow from USD 26.2 billion in 2025 to USD 65.9 billion by 2034 at a CAGR of 10.8% during the forecast period, according to the latest report published by Global Market Insights Inc. Major companies in the industry include Medtronic, Dexcom, Abbott Laboratories, Koninklijke Philips N.V., and Boston Scientific.

To get key market trends

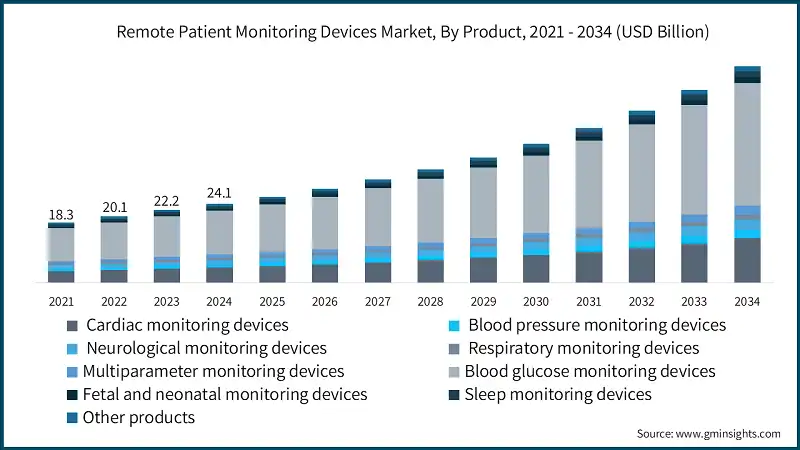

The market increased from USD 18.3 billion in 2021 to USD 22.2 billion in 2023. The increasing prevalence of chronic diseases, such as diabetes, cardiovascular diseases, cancer, chronic kidney diseases (CKD) are significant factors driving the market growth. For instance, in 2021, as per the data from the WHO, non-communicable disease was responsible for 43 million deaths worldwide among this cardiovascular disease was responsible for at least 19 million deaths followed by cancer with 10 million, chronic respiratory diseases with 4 million. Thus, this alarming statistic highlights the growing need for remote patient monitoring devices to support early detection, continuous management, and timely intervention in managing chronic disorders such as cardiovascular conditions.

Furthermore, the rising adoption of remote patient monitoring devices is due to government-backed initiatives that promote digital health transformation, which is a substantial catalyst for the market growth. RPM devices enable real-time health data collection, which allow for an early detection of irregularities and timely interventions. For instance, according to the National Institute of Health (NIH) report, in the U.S. between March 2020 and 2021 the use of RPM devices grew four times among the individuals. Moreover, RPM devices usage surged during the COVID-19 pandemic across the U.S. Thus, growing disposable income and healthcare expenditure in emerging countries and rising technological advancements in developed nations are the accelerating factors that are contributing to the growth of the market.

RPM devices are technologically advanced tools that allow for the continuous, real-time tracking of patient’s health apart from traditional clinical methods. These devices range from wearable sensors to implantable and handheld instruments, which monitor numerous physiological parameters such as heart rate, blood pressure, and blood glucose levels. By using RPM devices, data is transferred wirelessly to healthcare providers, allowing real-time health assessments, increasing patient engagement, and supporting value-based healthcare models.

Remote Patient Monitoring (RPM) Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 24.1 Billion |

| Market Size in 2025 | USD 26.2 Billion |

| Forecast Period 2025 - 2034 CAGR | 10.8% |

| Market Size in 2034 | USD 65.9 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising incidence of chronic diseases across the globe | Increasing demand for remote monitoring and diagnostic devices to manage long-term conditions. |

| Growing disposable income and healthcare expenditure in emerging countries | Expanding market in emerging economies with higher affordability and access to advanced care. |

| Technological advancement in developed nations | Improved device efficiency, accuracy, and integration with digital health platforms. |

| Growing adoption of remote patient monitoring devices | Enhanced patient engagement and reduced hospital visits through continuous health tracking. |

| Pitfalls & Challenges | Impact |

| High cost of devices | Limits affordability for patients and healthcare providers, slowing adoption rates. |

| Stringent regulatory framework | Longer approval cycles and compliance burden for manufacturers, delaying market entry. |

| Opportunities: | Impact |

| Increasing adoption for AI-powered predictive monitoring tools | Enables proactive care, early detection, and improved clinical decision-making. |

| Emergence of wearable biosensors for continuous, real time health tracking | Continuous health monitoring, personalized insights, and better chronic disease management. |

| Market Leaders (2024) | |

| Market Leaders |

35% market share |

| Top Players |

Collective market share in 2024 is 70.1% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, Brazil, Mexico, and South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Remote Patient Monitoring Devices Market Trends

- The growing technological advancement in the remote patient monitoring (RPM) devices has revolutionized healthcare in developing countries. Innovations in artificial intelligence in healthcare, which is estimated to reach USD 317.1 billion by 2032, along with the developments in wearable technology, sensor accuracy, and telehealth integration, have led to more effective and personalized monitoring solutions.

- Internet of Things (IoT) and artificial intelligence (AI) are integrated into modern RPM devices. These technologies allow real-time data collection, analysis and automated decision-making. AI algorithms can help to predict potential health issues by analyzing data trends, which improves early diagnosis and personalized care.

- For example, in January 2024, Blue Spark Technologies launched its first multi-sensor remote patient monitoring platform, VitalTraq, which uses AI driven contactless technologies. It utilizes 30 to 60 second selfie scans, wherein patients, clinicians, and researchers can collect digital measurements, including heart rate variability, blood pressure, and respiratory rate, vital signs in a single contactless manner, which set a new standard in patient centered vital sign monitoring.

- Furthermore, advancement in biosensors technology have led to more accurate and reliable monitoring devices. Modern sensors can track a wide range of physiological parameters such as blood oxygen levels, respiratory rates, and even sleep patterns.

- A notable example of this is BioIntelliSense’s BioButton, a multi-Patient wearable BioDashboard system, that offers continuous patient monitoring through advanced biosensor technology. Thus, this technological advancement is contributing to the growth of the market.

Remote Patient Monitoring Devices Market Analysis

Learn more about the key segments shaping this market

In 2021, the global market was valued at USD 18.3 billion. The following year, it saw a slight increase to USD 20.1 billion, and by 2023 and 2024, the market further climbed to USD 22.2 billion, and USD 24.1 billion respectively. Based on product, the remote patient monitoring devices market is divided into cardiac monitoring devices, blood pressure monitoring devices, neurological monitoring devices, respiratory monitoring devices, multiparameter monitoring devices, blood glucose monitoring devices, fetal and neonatal monitoring devices, sleep monitoring devices, and other products. The cardiac monitoring devices segment held revenues of USD 4.7 billion in the year 2024 and the segment is poised for significant growth at a CAGR of 11.4% during the forecast period.

- The rising technological advancement has significantly heightened the demand for cardiac monitoring devices, which leads to more precise and reliable remote patient monitoring (RPM). Innovations in RPM devices such as the integration of artificial intelligence in healthcare and development of advanced sensors have improved the accuracy of these devices in tracking vital cardiac metrics.

- For instance, the LINQ II, an insertable cardiac monitor by Medtronic uses AccuRhythm, an AI algorithm to detect arrhythmias with high precision.

- Similarly, Abbott’s Confirm Rx, is an insertable cardiac monitor (ICM) with SharpSense technology, which transfers data wirelessly via Bluetooth to patient’s smartphones, providing real-time access to cardiac performance data for healthcare professionals.

- Additionally, cardiac monitoring devices offer continuous, real-time tracking of heart rhythms, heart rate, and other vital cardiac metrics. This helps to detect any unusual heart activity quickly and allows for quick medical intervention if needed.

- Further, these cardiac monitoring devices continuously monitor heart activity and early signs of conditions such as irregular heartbeats, atrial fibrillation, and heart attacks. Thus, early detection improves the chances of successful treatment and minimizes the risk of serious complications. Thus, together, all these factors contribute to market growth.

Based on application, the global remote patient monitoring devices market is segmented into cardiovascular diseases, cancer, diabetes, neurological disorders, infectious diseases respiratory diseases, and other applications. The diabetes segment dominated the market with 55.8% market share in 2024.

- The increasing prevalence of diabetes has significantly created the demand for remote patient monitoring devices. For instance, according to the International Diabetes Federation (IDF), in 2024, approximately 589 million adults aged 20-79 years were living with diabetes worldwide. This number is projected to rise significantly, reaching an estimated 853 million by 2050, underscoring the growing global burden of the disease.

- Further, diabetes management requires continuous monitoring of key health metrics, including blood glucose levels, HbA1c, and insulin administration. Thus, to tackle this, RPM devices provide continuous real-time monitoring, allowing for better glucose control.

- Additionally, RPM devices help in the early detection of potential complications associated with diabetes such as hypoglycemia, hyperglycemia, and others. This early detection permits timely intervention, potentially preventing severe outcomes and hospitalizations, further contributing to the growth of the market.

Learn more about the key segments shaping this market

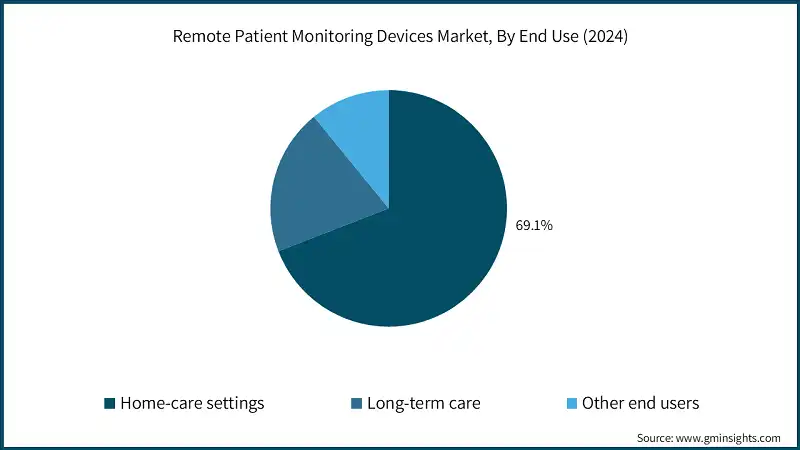

Based on end use, the remote patient monitoring devices market is segmented into home-care settings, long-term care, and other end users. The home-care settings segment dominated the market in 2024 and is anticipated to witness growth at a CAGR of 11%.

- The growing prevalence of chronic disorders globally, such as cardiovascular diseases, diabetes, cancer, among others are creating a demand for effective convenient remote patient monitoring devices for home use.

- Advanced RPM devices help patients by providing real time data and alerts and continuous tracking of vital signs, thus making home care a better and easier option for the patients.

- New technological innovations in RPM devices have made them more accurate, comfortable and easy to use, which is encouraging more individuals to adopt them. Many RPM devices have the ability to connect to smartphones and other digital devices or apps, which also makes it easier to track the data and to share it with healthcare providers.

- Furthermore, due to the COVID-19 pandemic, the adoption of home-based healthcare solutions such as RPM devices has increased. Since people desire to avoid hospital visits and limit the exposure to healthcare settings, RPM systems have become even more important for managing chronic conditions such as CVD’s, diabetes, among others at home, which aids in propelling market growth.

Looking for region specific data?

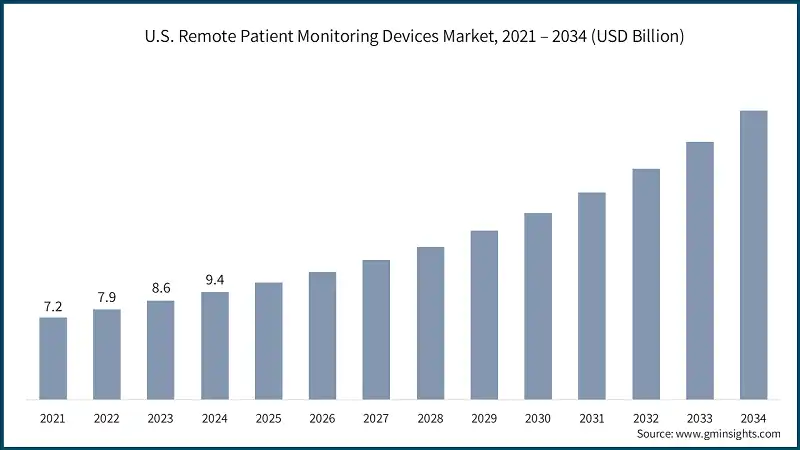

North America Remote Patient Monitoring Devices Market North America market dominated the global remote patient monitoring devices industry with a market share of 42.3% in 2024. The market is driven by rising incidence of chronic diseases such as diabetes, cardiovascular diseases, along with an increasing emphasis on home-based care. Advancements in wearable sensors, mobile health application and a growing focus on early and accurate diagnosis also support market growth. The U.S. remote patient monitoring devices market was valued at USD 7.2 billion and USD 7.9 billion in 2021 and 2022, respectively. The market size reached USD 9.4 billion in 2024, growing from USD 8.6 billion in 2023. Europe market accounted for USD 6.4 billion in 2024 and is anticipated to show lucrative growth over the forecast period. Germany market is anticipated to witness considerable growth over the analysis period. The Asia Pacific market is anticipated to grow at the CAGR of 11.2% during the analysis timeframe. China remote patient monitoring devices market is predicted to grow significantly over the forecast period. Brazil is experiencing significant growth in the Latin America market due to the increasing demand for advanced remote patient monitoring devices. Saudi Arabia market is poised to witness substantial growth in Middle East and Africa remote patient monitoring devices industry during the forecast period. The top 5 players of the global remote patient monitoring devices industry account for approximately 70.1% of the market share which includes companies such as Medtronic, Dexcom, Abbott Laboratories, Koninklijke Philips N.V., and Boston Scientific. These companies maintain their dominance in the market through innovative product launches, extensive distribution networks and strong regulatory approval. Moreover, strategic partnerships with research institutes, and government agencies play a primary role in advancing the development of advanced remote patient monitoring devices and getting the necessary permits. The development of public awareness about chronic diseases and its health impact through the social media platform, is expected to encourage more individuals to seek the treatment, enabling market players to strengthen their position in this growing sector. Some of the eminent market participants operating in the remote patient monitoring devices industry include: Boston Scientific has a strong product portfolio, leading to larger adoption and significant market expansion. Boston specializes in implantable cardiac monitoring solutions, such as LATITUDE, a remote patient monitoring system. Koninklijke Philips invests in research & development, fostering innovation and growth. The company continuously evolves with the newest advancement in RPM devices. Medtronic has strong geographical presence, which enables it to enhance its market reach. Medtronic operates in more than 150 countries, thus comprising a robust distribution network.Europe Remote Patient Monitoring Devices Market

Asia Pacific Remote Patient Monitoring Devices Market

Latin America Remote Patient Monitoring Devices Market

Middle East and Africa Remote Patient Monitoring Devices Market

Remote Patient Monitoring Devices Market Share

Remote Patient Monitoring Devices Market Companies

Remote Patient Monitoring Devices Industry News

The remote patient monitoring devices market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 - 2034 for the following segments:

Market, By Product

- Cardiac monitoring devices

- Blood pressure monitoring devices

- Neurological monitoring devices

- Respiratory monitoring devices

- Multiparameter monitoring devices

- Blood glucose monitoring devices

- Fetal and neonatal monitoring devices

- Sleep monitoring devices

- Other products

Market, By Application

- Cardiovascular diseases

- Cancer

- Diabetes

- Neurological disorders

- Infectious diseases

- Respiratory diseases

- Other applications

Market, By End Use

- Home-care settings

- Long-term care

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Poland

- Switzerland

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Thailand

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Israel

Frequently Asked Question(FAQ) :

Who are the key players in the remote patient monitoring devices market?

Major companies include Medtronic, Dexcom, Abbott Laboratories, Koninklijke Philips N.V., Boston Scientific, GE Healthcare, Johnson & Johnson, BIOTRONIK, OMRON, Sotera Wireless, Baxter International, Vital Connect, and F. Hoffmann-La Roche.

What are the upcoming trends in the remote patient monitoring devices industry?

Key trends include the rise of AI-powered predictive monitoring, expansion of wearable biosensor technology, and integration of IoT-based real-time tracking systems that enhance early diagnosis and patient engagement.

Which region leads the remote patient monitoring devices market?

The U.S. remote patient monitoring devices industry reached USD 9.4 billion in 2024, the largest regional contribution. Growth is fuelled by high prevalence of diabetes and hypertension, strong healthcare infrastructure, and rapid adoption of digital monitoring technologies.

What is the growth outlook for the home-care settings segment from 2025 to 2034?

Home-care settings are projected to grow at a CAGR of 11% through 2034. Growth is supported by rising chronic disease burden, smartphone-connected RPM devices, and reduced hospital dependency.

How much revenue did the cardiac monitoring devices segment generate in 2024?

Cardiac monitoring devices generated USD 4.7 billion in 2024, dominating the product landscape. The segment benefits from rising cardiovascular disease prevalence and improved diagnostic accuracy through AI-enabled sensors.

What is the market size of the remote patient monitoring devices industry in 2024?

The market size was USD 24.1 billion in 2024, with a CAGR of 10.8% expected through 2034, driven by rising global incidence of chronic diseases and growing digital health adoption.

What is the projected value of the remote patient monitoring devices market by 2034?

The market size for remote patient monitoring devices is expected to reach USD 65.9 billion by 2034, propelled by technological advancements and expanding integration of telehealth platforms.

What is the current remote patient monitoring devices market size in 2025?

The market size is projected to reach USD 26.2 billion in 2025, supported by increasing adoption of AI-enabled monitoring tools and home-based patient care.

Remote Patient Monitoring (RPM) Devices Market Scope

Related Reports