Summary

Table of Content

Recreational Marine Scrubber Systems Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Recreational Marine Scrubber Systems Market Size

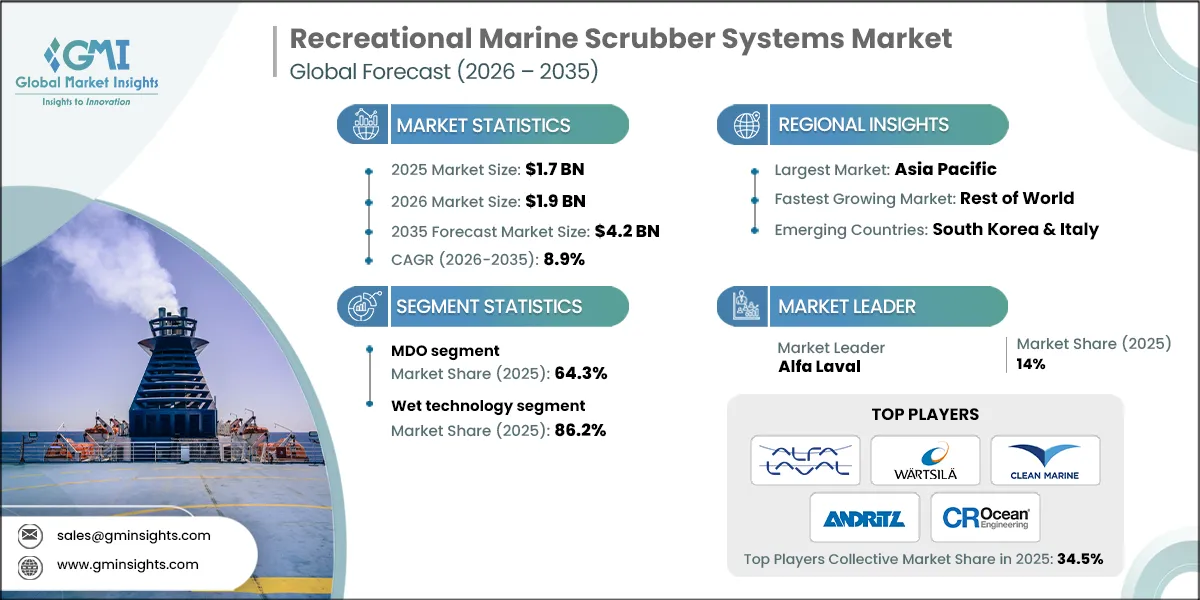

The global recreational marine scrubber systems market was estimated at USD 1.7 billion in 2025. The market is expected to grow from USD 1.9 billion in 2026 to USD 4.2 billion in 2035, at a CAGR of 8.9% according to Global Market Insights Inc.

To get key market trends

- The global emphasis on sustainability is compelling shipowners to adopt eco-friendly practices, boosting scrubber system penetration. These systems enable recreational vessels to continue using high-sulfur fuels while meeting emission standards, offering flexibility in managing fuel costs and fuel availability. This adaptability is particularly valuable when navigating regions with varying fuel quality regulations. As operators seek cost-effective compliance solutions without sacrificing operational efficiency, scrubbers emerge as a practical choice, driving their adoption across leisure and tourism-focused maritime segments.

- A recreational marine scrubber system is an emission-control technology installed on leisure vessels to remove sulfur oxides from exhaust gases. It enables compliance with international sulfur limits while allowing continued use of high-sulfur fuels, offering cost-effective, eco-friendly solutions for recreational boating under varying regional regulations.

- Increasingly strict environmental regulations and emission norms are accelerating scrubber adoption. IMO continues to tighten sulfur limits globally. Notably, in December 2023, the IMO designated the Mediterranean Sea as an Emission Control Area (ECA), enforcing a 0.10% sulfur cap on marine fuels effective May 2025. Such mandates compel shipowners to either install scrubbers or switch to costly low-sulfur fuels. This regulatory pressure ensures sustained demand for scrubber systems as operators strive to remain compliant while optimizing operating costs.

- Moreover, growing investments in ship retrofitting and refurbishment are fueling scrubber system demand. Shipowners are upgrading fleets to comply with environmental standards while maintaining operational efficiency. For instance, Carnival Corporation invested over USD 500 million to install scrubbers on 80 ships, covering 94% of its non-LNG fleet in 2024. Such large-scale retrofitting initiatives highlight the industry’s commitment to sustainability and cost optimization. As regulatory compliance becomes non-negotiable, retrofitting with scrubbers emerges as a strategic approach to extend vessel life and reduce emissions.

- Asia Pacific is among the dominant regions on account of increasing coastal tourism and recreational boating activities, boosting demand for eco-friendly solutions. Scrubbers allow vessels to comply with emission norms while using high-sulfur fuels, offering cost savings and operational flexibility. This trend aligns with sustainability goals and growing environmental awareness among leisure operators.

- Rest of world is the fastest-growing region in the recreational marine scrubber systems market. Countries in Latin America, Africa, and Oceania are promoting green maritime practices to protect coastal ecosystems. Recreational vessel operators are adopting scrubbers as a cost-effective solution to meet emerging emission norms without switching to expensive low-sulfur fuels, ensuring compliance while maintaining operational flexibility and affordability.

- Moreover, in Latin America, Africa, and Oceania, smaller boat fleets are expanding, increasing the need for localized emission control, including scrubbers. According to FAO 2023 data, Africa’s fleet accounts for ~19% of global vessels, excluding Asia, indicating a significant regional footprint that supports scrubber uptake among coastal leisure craft.

Recreational Marine Scrubber Systems Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.7 Billion |

| Market Size in 2026 | USD 1.9 Billion |

| Forecast Period 2026-2035 CAGR | 8.9% |

| Market Size in 2035 | USD 4.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Sustainability push | Global sustainability goals and emission norms encourage recreational vessel owners to adopt scrubbers, enabling compliance while using high-sulfur fuels, offering cost savings and operational flexibility across diverse maritime regions. |

| Growth in leisure boating | Increasing recreational boating activities worldwide drive demand for eco-friendly solutions. Scrubbers provide a practical, cost-effective alternative to expensive low-sulfur fuels, ensuring compliance without compromising affordability or performance. |

| Pitfalls & Challenges | Impact |

| High installation costs | Significant upfront costs and ongoing maintenance deter small recreational operators, limiting widespread adoption despite long-term fuel savings and compliance benefits. |

| Limited technical expertise | Lack of skilled technicians and retrofitting infrastructure in developing regions creates operational challenges, slowing adoption among recreational fleets seeking affordable compliance solutions. |

| Opportunities: | Impact |

| Compact scrubber designs | Advancements in smaller, lightweight scrubber systems tailored for leisure vessels create new market opportunities, making compliance solutions more accessible globally. |

| Strategic partnerships | Collaborations between technology providers and marina operators can accelerate adoption, offering integrated retrofitting services and financing options for recreational boat owners seeking sustainable solutions. |

| Market Leaders (2025) | |

| Market Leaders |

14% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Rest of World |

| Emerging Countries | South Korea & Italy |

| Future outlook |

|

What are the growth opportunities in this market?

Recreational Marine Scrubber Systems Market Trends

- Growing demand for advanced emission control technologies and rising investments in green fleets are accelerating scrubber adoption in recreational vessels. Industry players are expanding product portfolios through acquisitions, such as BW LPG’s purchase of 12 VLGCs for USD 1.05 billion in August 2024, including scrubber-equipped ships. This trend reflects the sector’s commitment to sustainability and compliance with stringent emission norms, driving significant growth opportunities for marine scrubber systems in leisure and recreational shipping markets.

- Increasing emphasis on sustainability and corporate social responsibility is reshaping purchasing decisions, compelling shipowners to adopt cleaner technologies. Stricter environmental regulations and growing consumer demand for eco-friendly solutions push operators toward marine scrubbers to enhance reputation and gain a competitive edge. These investments position fleets for long-term success, creating lucrative opportunities for scrubber manufacturers targeting recreational vessels amid global efforts to achieve greener marine operations and meet evolving compliance standards.

- Moreover, rising technological advancements are fueling marine scrubber adoption in recreational shipping. For instance, Wärtsilä’s IQ Series scrubber, launched in November 2021, is 25% smaller, 30% lighter, and 35% lower in volume than previous models. Its compact, lightweight design suits space-constrained recreational vessels, ensuring compliance without compromising performance. Such innovations make scrubbers more practical and attractive for leisure boats, driving widespread uptake in response to evolving emission standards and sustainability goals across the marine industry.

- Growth in recreational marine tourism and rising preference for eco-friendly vessels are boosting scrubber system adoption. Manufacturers are developing compact, efficient solutions tailored for leisure boats, supported by government incentives and consumer awareness. Increased investment in eco-friendly boating technology and emission control advancements further accelerate adoption. These trends create strong opportunities for sustainable marine technologies, ensuring compliance and operational efficiency while aligning with global sustainability initiatives and consumer expectations for greener recreational experiences.

- Rising global enforcement of IMO sulfur limits and regional emission standards is compelling recreational vessel operators to adopt scrubber systems. Compliance requirements, combined with penalties for non-adherence, are driving investments in advanced exhaust cleaning technologies, ensuring sustainable operations and positioning fleets for long-term environmental responsibility.

Recreational Marine Scrubber Systems Market Analysis

Learn more about the key segments shaping this market

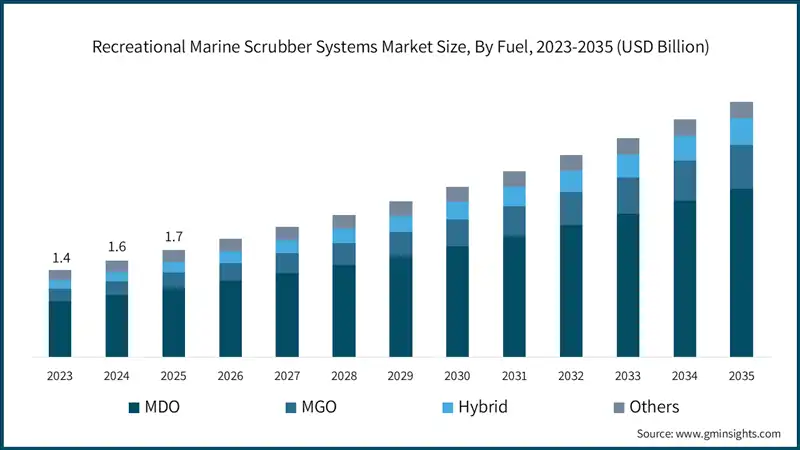

Based on fuel, the industry is segmented into MDO, MGO, hybrid and others. The MDO fuel dominated around 64.3% share in 2025 and is expected to grow at a CAGR of 9.2% through 2035.

- Growing demand for cleaner combustion and improved fuel efficiency is driving MDO adoption in recreational vessels equipped with scrubbers. MDO offers lower particulate emissions and better compatibility with exhaust cleaning systems, enabling operators to meet sustainability goals while maintaining performance and reducing maintenance costs.

- Moreover, increasing need for fuel flexibility and cost efficiency is driving MDO adoption in recreational vessels equipped with scrubbers. MDO offers a balance between compliance and affordability, enabling operators to meet emission norms while optimizing operational costs, making it a preferred choice for sustainable marine operations.

- The marine gas oil (MGO) segment accounted for 14.6% market share in 2025 and is projected to grow significantly by 2035, supported by stricter sulfur emission norms and fuel efficiency initiatives. Advancements in propulsion technology further strengthen MGO adoption. In January 2025, MOL introduced Prima Verde, a 129.66-meter, 17,611 DWT vessel featuring an MGO-exclusive engine and VentoFoil wind-assisted propulsion. This innovative design reduces fuel consumption and emissions, reinforcing the transition toward cleaner marine fuel solutions.

- The hybrid scrubber segment is forecasted to grow at a CAGR of over 9.4% from 2026 to 2035, driven by the maritime industry’s need for flexible emission control solutions. Increasing restrictions on open-loop systems in major regions are accelerating hybrid adoption. In September 2024, Color Line collaborated with Wärtsilä to retrofit four Ro-Pax vessels with hybrid scrubbers, achieving a 98% reduction in sulfur oxide emissions and reinforcing market expansion.

Learn more about the key segments shaping this market

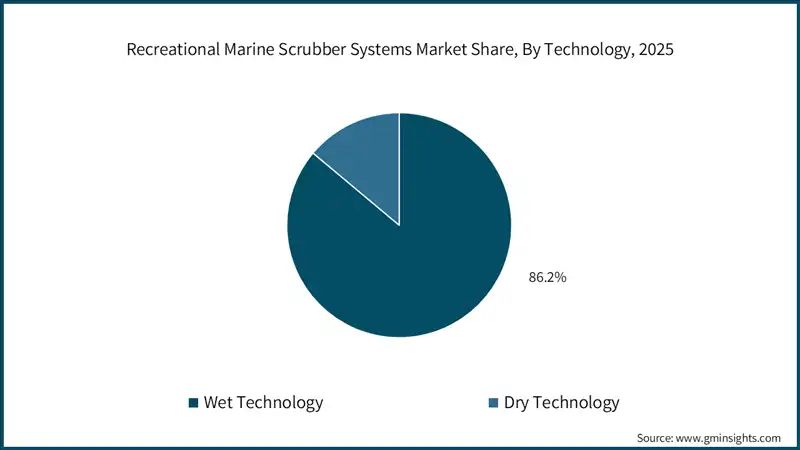

Based on technology, the recreational marine scrubber systems market is segmented into wet technology and dry technology. The wet technology dominates the market with a 86.2% share in 2025 and is expected to grow at a CAGR of 9.2% from 2026 to 2035.

- Wet scrubber technology continues to gain traction due to its high efficiency in removing sulfur oxides, nitrogen oxides, and particulate matter from exhaust gases, enabling vessels to meet stringent global emission standards. Rising demand for adaptable systems tailored to diverse vessel types and operating conditions is further boosting adoption, supporting a positive growth outlook for this technology segment.

- Rising demand for systems that simultaneously remove SOx, NOx, and particulate matter is boosting wet scrubber adoption. Their ability to deliver multi-pollutant control ensures compliance with evolving global regulations, making them a preferred choice for recreational vessels seeking comprehensive emission reduction.

- The dry scrubber segment is projected to grow at over 7.1% by 2035, driven by increasing demand for zero-discharge emission control in recreational vessels. These systems use sodium bicarbonate to eliminate sulfur oxides without wastewater discharge, making them ideal for eco-sensitive regions. In October 2022, Sodaflexx introduced a dry exhaust cleaning system that improved operational cost efficiency by 30%, accelerating adoption among vessel operators.

- Moreover, rising need for low-maintenance solutions is promoting dry scrubber adoption. Their design eliminates complex water treatment systems, reducing operational costs and downtime, which appeals to recreational vessel operators seeking efficient, eco-friendly emission control technologies.

Looking for region specific data?

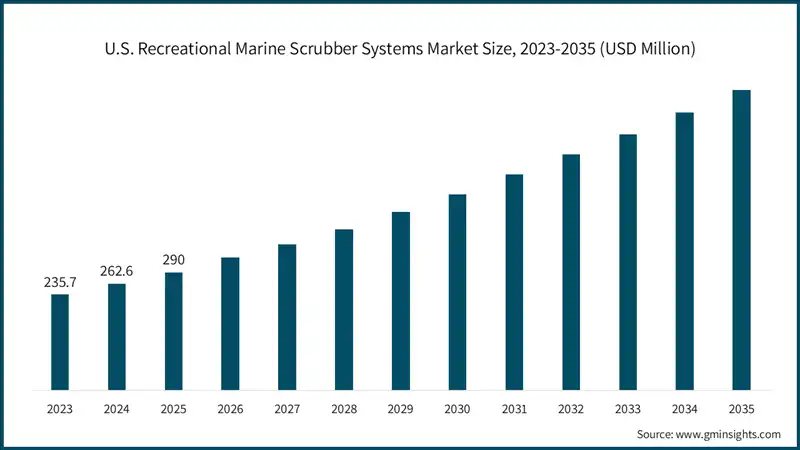

- The U.S. dominated the recreational marine scrubber systems market in North America with around 71.1% share in 2025 and is expected to generate over USD 735 million in revenue by 2035.

- Stricter emission standards from agencies including the EPA are driving scrubber adoption in recreational vessels across the U.S. Growing demand for eco-friendly boats and a large boating community, with 11.55 million registered vessels in 2023, reinforce this trend. Rising compliance requirements and consumer preference for sustainable solutions will accelerate marine scrubber installations, ensuring operators meet regulatory norms while enhancing environmental performance.

- The North America recreational marine scrubber systems market accounted for a market value of USD 408 million in 2025. Increasing emphasis on reducing long-term operational costs is driving scrubber adoption in recreational vessels. Scrubbers allow continued use of cost-effective fuels while meeting emission norms, minimizing fuel-switch expenses. Operators view these systems as strategic investments that balance compliance, sustainability, and affordability, ensuring competitive advantage in a market increasingly shaped by environmental regulations and consumer expectations for greener boating experiences.

- Asia Pacific recreational marine scrubber systems market is anticipated to grow at a CAGR of 8.3% by 2035, driven by rising maritime trade and stricter emission regulations. Intra-regional trade among China, Japan, South Korea, and ASEAN nations accounted for 60.1% of exports in 2023, increasing vessel traffic and compliance needs. Government initiatives promoting sustainable marine tourism and eco-friendly port infrastructure will further boost scrubber adoption in recreational vessels.

- Moreover, increasing government and private investments in eco-friendly marina facilities across the region are encouraging recreational vessel owners to adopt scrubber systems. For instance, in October 2025, India secured nearly USD 135 billion in investments at India Maritime Week 2025. Allocations include 30% for port development, 20% for shipping & shipbuilding, sustainability, and port-led industrialization, with the remaining 10% directed toward workforce development. These initiatives aim to reduce emissions in popular boating destinations, aligning with sustainability goals and supporting compliance with stricter regional environmental regulations.

- Europe held an 18.4% market share in 2025 and is projected to grow significantly by 2035, supported by investments in emission control technologies and government incentives for cleaner shipping. Upgrades in exhaust gas cleaning systems and carbon capture-ready scrubbers will help reduce CO2 emissions, ensuring long-term compliance with progressive environmental policies and reinforcing the region’s commitment to sustainability in recreational marine operations.

- Additionally, growing demand for luxury yachts with advanced environmental features is boosting scrubber adoption in Europe. Owners prioritize emission control to meet EU standards and appeal to eco-conscious consumers, driving manufacturers to integrate compact, efficient scrubbers into high-end recreational vessels for compliance and market differentiation.

Recreational Marine Scrubber Systems Market Share

- The top 5 companies, including Alfa Laval, Wartsila, Clean Marine AS, ANDRITZ and CR Ocean Engineering, account for around 34.5% market share. Companies are focusing on developing lightweight, modular scrubbers tailored for space-constrained recreational vessels. Hybrid-ready systems are gaining traction as they offer flexibility in regions with varying discharge restrictions. Continuous R&D ensures compliance with evolving emission norms while maintaining vessel aesthetics and performance, making these solutions attractive for yacht owners and leisure boat operators.

- Firms are forming partnerships with shipbuilders, marina operators, and retrofit specialists, helping them to expand their market reach. Offering turnkey retrofit programs for existing fleets ensures compliance with stricter emission standards. These collaborations strengthen distribution networks and build customer trust, positioning companies as reliable providers of sustainable marine technologies for recreational vessels.

- Moreover, companies are embedding IoT and AI-based monitoring systems into scrubbers to enable real-time compliance tracking and predictive maintenance. These smart solutions reduce downtime, optimize performance, and enhance operational efficiency, making scrubbers more appealing for recreational vessels operating in emission-controlled zones and aligning with the maritime industry’s digitalization trend.

- Additionally, to capture high-growth markets, companies are expanding their presence in regions such as Asia Pacific and Europe through localized service hubs. Strengthening after-sales support ensures timely maintenance and customer satisfaction, creating long-term relationships and reinforcing their position as trusted partners for emission compliance and sustainability in recreational marine operations.

Recreational Marine Scrubber Systems Market Companies

Eminent players operating in the recreational marine scrubber systems industry are:

- Andritz

- Alfa Laval

- CR Ocean Engineering

- Clean Marine AS

- Damen Shipyards Group

- EnviroCare

- Ecospray Technologies S.r.l.

- Fuji Electric

- Hitachi Energy

- KwangSung

- Keppel

- LiqTech

- ME Production

- Mitsubishi Heavy Industries

- Nicro

- SAACKE

- Valmet

- VDL AEC Maritime

- Wartsila

- Yara

- Alfa Laval, offers PureSOx scrubber systems for emission compliance, including compact designs suitable for recreational vessels. The company reported 2024 revenue of approximately USD 7.2 billion, driven by strong demand for sustainable marine solutions and aftermarket services.

- Wartsila provides advanced scrubber technologies such as the IQ Series, ideal for space-constrained leisure vessels. Its 2024 revenue reached USD 7.4 billion, supported by innovation in hybrid systems and digital monitoring solutions for emission control in marine applications.

- Clean Marine AS specializes in lightweight, modular scrubbers tailored for yachts and smaller vessels. Focused on sustainability and compliance, the company operates primarily in Europe. Revenue figures are private, but growth is driven by niche recreational marine markets.

- ANDRITZ delivers integrated exhaust gas cleaning systems, including carbon capture-ready scrubbers for marine vessels. The company reported 2024 revenue of USD 9.7 billion, leveraging engineering expertise and sustainability-focused solutions across multiple industries, including marine emission control technologies.

- CR Ocean Engineering offers modular open-loop, closed-loop, and hybrid scrubbers suitable for retrofits on recreational ships. The company’s growth strategy emphasizes flexible designs and global technical support for emission compliance.

Recreational Marine Scrubber Systems Industry News

- In September 2024, Norwegian ferry operator Color Line announced plans to upgrade exhaust treatment systems on four vessels by adding hybrid closed-loop capability to existing open-loop scrubbers. Marketed by Wärtsilä, this enhancement will improve efficiency, reduce emissions, and ensure compliance with global environmental regulations.

- In March 2023, Wärtsilä secured its first order for 35 MW scrubber systems designed for future carbon capture integration. The open-loop configuration requires additional engineering for CCS readiness and includes a particulate matter filter, reinforcing Wärtsilä’s commitment to advanced emission control technologies.

This recreational marine scrubber systems market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in “USD Billion & Units” from 2022 to 2035, for the following segments:

Market, By Fuel

- MDO

- MGO

- Hybrid

- Others

Market, By Technology

- Wet technology

- Dry technology

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Greece

- Asia Pacific

- China

- Japan

- South Korea

- Malaysia

- Indonesia

- Rest of World

Frequently Asked Question(FAQ) :

Who are the key players in the recreational marine scrubber systems market?

Key players include Alfa Laval, Wärtsilä, Clean Marine AS, ANDRITZ, CR Ocean Engineering, Damen Shipyards Group, EnviroCare, Ecospray Technologies S.r.l., Fuji Electric, Hitachi Energy, KwangSung, Keppel, LiqTech, ME Production, Mitsubishi Heavy Industries, Nicro, SAACKE, Valmet, VDL AEC Maritime, and Yara.

What are the upcoming trends in the recreational marine scrubber systems market?

Key trends include compact scrubber designs for leisure vessels, IoT-based monitoring integration, hybrid scrubber adoption, carbon capture-ready technologies, and strategic partnerships between technology providers and marina operators.

Which region leads the recreational marine scrubber systems market?

The U.S. led the North American recreational marine scrubber systems market with a 71.1% share in 2025 and is projected to generate over USD 735 million by 2035.

What is the growth outlook for the hybrid scrubber segment from 2026 to 2035?

The hybrid scrubber segment is forecasted to grow at a CAGR of over 9.4% from 2026 to 2035, driven by flexible emission control needs and restrictions on open-loop systems.

What was the market share of wet technology segment in 2025?

The wet technology segment dominated with 86.2% market share in 2025 and is expected to grow at a CAGR of 9.2% from 2026 to 2035, due to high efficiency in removing sulfur oxides and particulate matter.

How much market share did the MDO fuel segment hold in 2025?

The MDO fuel segment dominated with 64.3% market share in 2025 and is expected to grow at a CAGR of 9.2% through 2035, driven by demand for cleaner combustion and fuel flexibility.

What is the current recreational marine scrubber systems industry size in 2026?

The market size is projected to reach USD 1.9 billion in 2026.

What is the market size of the recreational marine scrubber systems in 2025?

The market size was USD 1.7 billion in 2025, with a CAGR of 8.9% expected through 2035 driven by rising sustainability focus, eco-friendly adoption by shipowners, and stricter emission regulations.

What is the projected value of the recreational marine scrubber systems market by 2035?

The market is expected to reach USD 4.2 billion by 2035, propelled by IMO sulfur limits, growth in leisure boating, and increasing investments in ship retrofitting.

Recreational Marine Scrubber Systems Market Scope

Related Reports