Home > Automotive > Automotive Parts > Exterior Parts > Rear Spoiler Market

Rear Spoiler Market Analysis

- Report ID: GMI2135

- Published Date: Dec 2017

- Report Format: PDF

Rear Spoiler Market Analysis

Injection molding technology will exhibit significant growth in the rear spoiler market share owing to high efficiency and ease of molding complex component design. The technology offers superior design flexibility for molding different materials in different colors. Further, it ensures consistent production and enhanced strength as compared to other technologies. The technology has ability to reduce wastes and labor costs thereby augmenting the segment penetration.

Blow molding will dominate the market share in the forecast timeframe owing to rapid and high-volume production capabilities. It requires lower pressure that reduces the mold and machinery costs. Increasing automation in the process is improving the precision in manufacturing technology. Additionally, it enables three-dimensional molding for unified part integration, thereby, enhancing the industry growth.

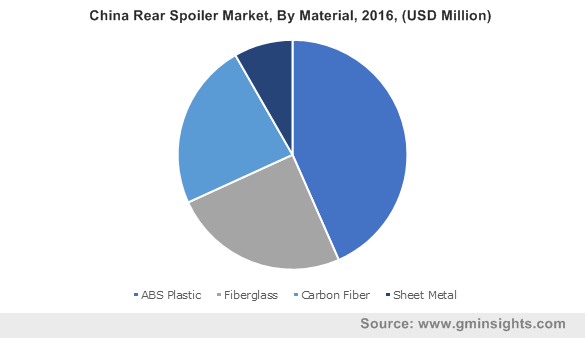

Carbon fiber segment will witness strong growth owing to superior weight to strength ratio and flexibility. The ability of carbon fiber to withstand high pressure allows its implementation for extreme conditions. Lower weight of carbon fiber spoilers reduces the overall weight of the car, lowering the center of gravity while offering superior road grip.

ABS Plastics dominates the industry size with high tensile strength coupled and shock absorbance capability. Lower melting point and glass transition temperature enables easy material handling. Moreover, superior impact and scratch resistance along with high heat resistivity of the material makes it suitable for automotive application.

Hybrid rear spoiler market size will witness a strong growth owing to increasing government support for low emission vehicles. Ongoing initiatives to reduce fossil fuel consumption and carbon emission will enhance the segment penetration. The hybrid and electric vehicle manufacturers are implementing the spoilers to improve drag performance.

The internal combustion engine leads the industry size owing to large vehicle fleet size. The vehicles deliver superior performance owing to higher power to weight ratio. Higher speed attained by the ICE vehicles increases the requirement of rear spoilers to balance the aerodynamic force developed on the vehicle.

Sports utility vehicle dominates the market share owing to increasing vehicle sales. Factors including superior comfort and seating space is driving the vehicle demand. The automotive OEMs are implementing the spoilers to eliminate the aerodynamic lift and improve fuel efficiency. The components increase the fuel economy by several miles per gallon.

Hatchback vehicle will foresee significant growth with its installation to improve braking stability. The spoilers impart downward force on rear vehicles that improves grip in high-speed cornering and braking condition. Further, growing demand for sedan vehicles will drive the segment penetration over the study timeframe.

OEMs will witness strong growth owing to the optimized costs of pre-installed products. The automobile manufacturers are offering vehicles with rear spoilers to enhance vehicle performance. In July 2019, Hyundai announced to launch Sonata with rear spoiler and cascading grille to improve vehicle handling capability.

Aftermarket leads the rear spoiler market size with its installation to improve vehicle aesthetics. The vehicle owners implement spoilers to improve turning, accelerating and smoothness. Emergence of DIY and DIFM activities will support the segment penetration. Aftermarket players are offering products at varied prices to increase product demand. Further, increasing vehicle refurbishment activities will induce significant growth potential in industry landscape.

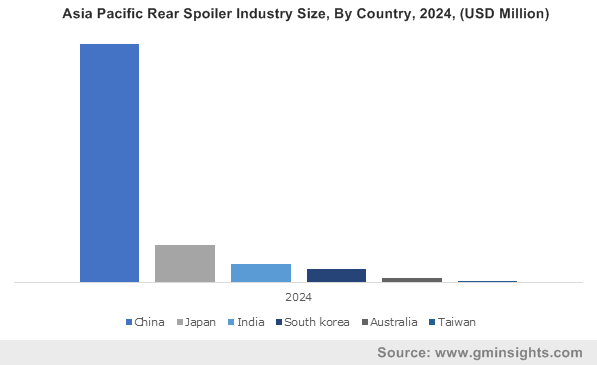

Asia Pacific leads the rear spoiler market size owing to increasing vehicle production in the region. According to OICA, in 2018, the vehicle production surged by around 8% as compared to 2017. Emerging nations are enhancing the production capability to strengthen their manufacturing sector. For instance, in 2017, China produced around 24.81 million units of passenger cars followed by Japan accounting for 8.35 million units, thereby enhancing the industry growth.

North America market will witness strong growth with the presence of manufacturers including DAR Spoilers and Magna International Inc. Growing demand for electric and hybrid vehicles is positively influencing the product demand. According to the U.S. Department of Energy, in 2017, the hybrid electric vehicles sales increased by over 6% as compared to 2016.