Summary

Table of Content

Pump Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Pump Market Size

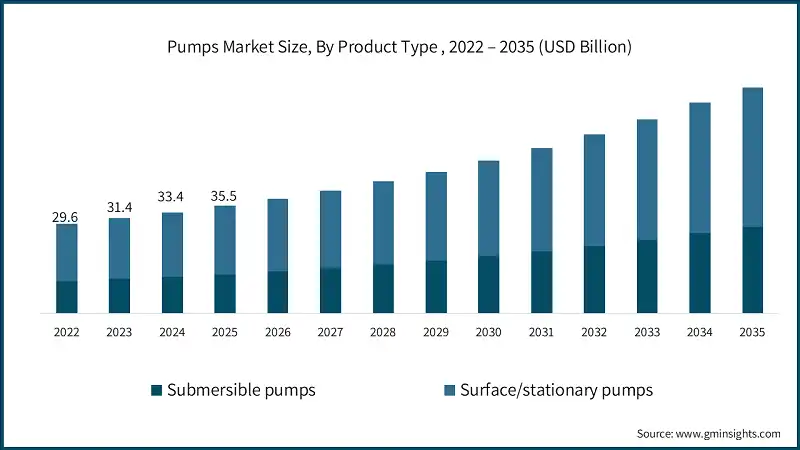

The pump market was estimated at USD 35.5 billion in 2025. The market is expected to grow from USD 37.9 billion in 2026 to USD 74.4 billion in 2034, at a CAGR of 7.8% according to latest report published by Global Market Insights Inc

To get key market trends

As pump technologies continue to evolve, new designs of pumps are becoming more efficient. Innovations developed by innovative manufacturers, such as Grundfos and Xylem, have produced energy-efficient pumps that will help both manufacturers meet their sustainability goals. Grundfos' most efficient circulator pumps, for example, have shown reduced energy consumption of up to 80% and are aligned with initiatives that are targeting the global reduction of energy consumption. The oil and gas industry will continue to be an important user of pumps for many years into the future, regardless of fluctuations in the price of oil. In the oil and gas sector, pumps are key components for extraction, refining, and transportation activities. Flowserve, for example, has developed several pumps that have been tailored to handle the specific needs associated with shale gas fracking and addressing the increased demand for the technologies used to extract oil and gas from unconventional sources.

High capital investment for pump installations poses a challenge, particularly in developing regions. Large-scale industrial applications require significant upfront costs for equipment and installation. Manufacturers like KSB are mitigating this by offering cost-effective solutions and maintenance services to reduce financial burdens on end-users.

Government policies promoting energy efficiency and sustainability are shaping the pumps market. For example, the European Union’s Energy Efficiency Directive mandates the adoption of energy-efficient equipment, including pumps, to reduce carbon emissions. Such initiatives are expected to accelerate the replacement of outdated systems with modern, efficient alternatives, driving pump market growth during the forecast period.

Modern pump systems present a more environmentally friendly option as they are equipped with Variable Frequency Drives (VFDs) and high, efficient electric motors that not only reduce carbon footprints but also operational costs considerably. This change is in line with the growing demand for sustainable practices in industrial and municipal water management, thus contributing to the market's strong growth. The need to modernize aging infrastructure in North America, alongside the rising federal expenditures such as the U.S. Infrastructure Investment and Jobs Act and Canadas CAD 6 billion water, infrastructure funding the commercial viability of this equipment. Municipalities and industrial operators look for efficient, mechanized solutions for wastewater treatment and dewatering and at the same time, they abandon older systems that have become less reliable.

Advanced pumping solutions are becoming a choice favorite among a wide range of industries. One of the major reasons is that they can help mitigate the risks of floods on sites, especially when installations go wrong and also help comply with EPA water, quality mandates (e.g., PFAS regulations). The demand for advanced pumping solutions is influenced by a long list of factors including the expanding awareness of the long, term advantages of predictive maintenance, real, time monitoring, and the ongoing enhancements in the machinery design (e.g. better user safety and prevention of hazardous leaks through seal less and magnetic drive configurations). Besides the support from the government, led infrastructural program, the industry, wide focus on energy conservation and the demand for high, efficiency convenience is pushing the market upward financially. The evolution of equipment technology is one of the key factors that have contributed to the gradual expansion of the market. It is basically a transformation that changed simple mechanical units to highly durable, IIoT, enabled machinery. The industry is witnessing a significant shift towards smart Pump which use sensors to detect flow rate, pressure, and motor health with a goal to extend system life and minimize periods of inactivity.

Manufacturers have put a lot of emphasis on improving operator experience through features such as remote-control operation via cloud, based platforms, priming surface pump designs for superior maneuverability in construction dewatering, and integrated GPS/telematics for fleet management. Motor technology is also a focus area, as the rising consumer demand for quieter, carbon, neutral operation is leading to the creation of new solar, powered and hybrid electric models for off, grid agricultural and remote industrial sites. The pump market is mainly driven by the huge increase in construction, infrastructure, and oil & gas extraction projects, along with the essential need for reliable wastewater management in growing urban centers.

Unlike traditional fluid handling, modern submersible pump can operate in harsh, submerged environments without the risk of cavitation, thus they can handle large volumes of liquid while the energy required for site preparation is greatly reduced. This kind of efficiency has been warmly accepted by both municipal water authorities who want to modernize treatment plants and mining/construction firms that need consistent and timely site dewatering. This shift in preference is directly mirrored in market composition: the Centrifugal segment is consistently the one that accounts for the largest revenue share more than 50% of the North American market due to its versatile performance and durability. Furthermore, technology is becoming increasingly important, because of features such as automated hydraulic controls.

It is further fueled by the growing recognition of sustainable water management practices that, among other things, promote the efficient reuse of treated wastewater and the conservation of groundwater resources. Moreover, industrial developers and municipal authorities are, consequentially, very much inclined to spend money on top, notch pumping solutions due to the enhanced operational reliability and the reduction in lifecycle costs of well, maintained, smart infrastructure.

Pump Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 35.5 Billion |

| Market Size in 2026 | USD 37.9 Billion |

| Forecast Period 2026-2035 CAGR | 7.8% |

| Market Size in 2035 | USD 74.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Infrastructure Modernization & Federal Funding | Massive reinvestment via the U.S. Infrastructure Investment Act and Canada’s water funds drives mandatory upgrades in municipal wastewater and stormwater systems, favoring high-capacity submersibles. |

| Massive reinvestment via the U.S. Infrastructure Investment Act and Canada’s water funds drives mandatory upgrades in municipal wastewater and stormwater systems, favoring high-capacity submersibles. | Resurgence in Permian Basin oil extraction and lithium mining in Nevada increases the need for heavy-duty dewatering and slurry Pump, boosting the surface/stationary segment. |

| Stringent Environmental & PFAS Regulations | New EPA mandates for water quality require advanced filtration and high-pressure pumping systems, pushing utilities toward modern, zero-leakage, and chemical-resistant pump designs. Impact: |

| Pitfalls & Challenges | Impact |

| High Operational & Energy Costs | High Operational & Energy Costs |

| Supply Chain Volatility for Specialized Alloys | Fluctuations in the price of nickel and stainless-steel impact the manufacturing cost of corrosion-resistant Pump used in chemical and offshore applications, squeezing OEM margins. |

| Opportunities: | Impact |

| IoT Integration & "Smart" Pumping | IoT Integration & "Smart" Pumping |

| Growth of the Pump Rental Model | To avoid high upfront capital expenditure (CAPEX), many construction and mining firms are shifting to rentals, providing a steady revenue stream for equipment providers like United Rentals and Xylem. |

| Market Leaders (2025) | |

| Market Leaders |

6% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest market | U.S. |

| Fastest growing market | Zambia |

| Emerging countries | Zambia, Ghana |

| Future outlook |

|

What are the growth opportunities in this market?

Pump Market Trends

The submersible and surface pump sector in each region is experiencing rapidly changing trends, which are largely driven by a plethora of innovative product launches and technological advancements resulting from industry leaders' efforts. Prominent firms like Xylem, Grundfos, and Flowserve, are consequently rolling out the most modern pumping solutions equipped with numerous enhancements such as IE5 ultra, premium efficiency motors, better hydraulic designs, as well as smart integrated technologies. Such upgrades serve to meet the timely requirements of municipal, industrial, and agricultural users who are looking for energy, efficient and stable solutions for fluid management. The industry's endorsement of these trends through the market is a clear indication of the ongoing renewal cycle, which ultimately delivers the users with advanced tools that elevate the performance, lower the energy consumption, and facilitate the water management process to be more digitized and streamlined.

- Technology advancement and product innovation: The evolution has been quite considerable in a direction of "Smart Pump" and intelligent fluid handling systems, which now also include the use of IIoT, enabled sensors and wireless remote, monitoring for enhanced predictive maintenance. The companies are ensuring that the electric drives are more powerful, energy, efficient, and that the materials used for the pump are corrosion, resistant (e.g., super, duplex stainless steel) as they are aimed at improving the effectiveness of the pump in harsh

industrial and wastewater environments. It has become a norm to utilize Variable Frequency Drives (VFDs) for the purposes of optimizing the flow rates and cutting down the operational costs. - Expansion of municipal water and infrastructure services: The vitality of the municipal water and wastewater sectors is, in fact, the main reason for the growth of these industries. Public utilities and private water service companies constitute the largest segment, which is responsible for about 50.3% of the total pump market. As a result of the pressing need for the rehabilitation of old infrastructures as well as the extension of water treatment plants, the demand for efficient submersible and surface Pump remains steady. This increase is supported by federal funding, such as the U.S. Infrastructure Investment and Jobs Act, as municipalities are placing heavy investments in modernizing their distribution networks.

- Sustainable water management and ESG compliance: The use of energy, efficient pumping technologies is indispensable for water reuse and circular economic activities, which in turn contribute to improved ecosystems by enabling the treatment and recycling of industrial process water. This is in line with the North America sustainable land management and water conservation programs. Producers are progressively turning their attention to zero, leakage and seal less pump configurations to eliminate the release of pollutants into the environment, thus complying with strict environmental, social, and governance (ESG) requirements that are being implemented in North America.

- Greater incidence of severe weather and flood events: Climate change is causing more severe weather events, such as hurricanes, flash floods, and rising sea levels. High, capacity stormwater and dewatering Pump are in tremendous demand to handle the resulting water volumes. Disaster recovery organizations, municipal authorities, and construction firms are constantly faced with the need for emergency flood control systems, which is why the demand for both portable surface Pump and permanent submersible installations is increasing.

- Emphasis on urban water security and asset management: Property management companies and smart cities are becoming more concerned about the preemptive maintenance of urban water systems to guarantee safety and uninterrupted service. This means that the old, inefficient, or failing Pump in residential height, rises, public works, and commercial complexes are being replaced regularly. The perpetual urban water security challenge and AI, driven diagnostics integration ensure a year, round, steady demand for commercial, grade pumping equipment as utilities transition from reactive repairs to data, driven asset management.

Pump Market Analysis

Learn more about the key segments shaping this market

Based on product, the market is categorized into submersible and surface/stationary pump. The surface/stationary pump segment accounted for over 63.4% of the market share, with USD 22.5 billion in 2025.

- Surface/stationary Pump segment remains the largest due to its extensive use in industrial processing, oil and gas refineries, and large-scale municipal water intake. The high volume of fluid handling required in these sectors maintains its leading market position.

- Submersible pump segment is projected to register at 8.3% CAGR by 2035. The surge is driven by increasing wastewater management needs and the demand for efficient dewatering solutions in the mining and construction sectors.

- Efficiency shift for self-priming and submersible units that integrate IE4 and IE5 efficiency motors, helping operators meet new North American energy standards.

Learn more about the key segments shaping this market

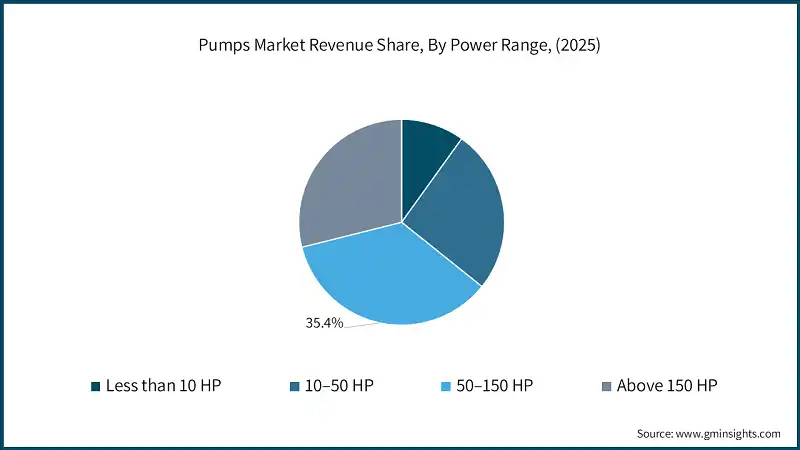

Based on the power range, the pump market is segmented into less than 10 HP, 10–50 HP, 50–150 HP, and above 150 HP. In 2025, the 50–150 HP segment held a major market share of 35.4%, generating a revenue of USD 12.6 billion.

- 50–150 HP segment represents the largest portion of the market and exhibits the strongest growth rate of 8.2%. These "workhorse" units are critical for municipal water treatment and industrial processing, highlighting the industry's focus on mid-to-high-capacity machinery that balances power with energy efficiency.

- Above 150 HP segment maintains a solid presence 28.9% share, primarily serving heavy-duty mining and large-scale infrastructure projects that require extreme pressure and flow capabilities.

- Less than 10 HP segment is the smallest and slowest growing. This trend is consistent with an industrial market that is moving toward higher-capacity, automated systems to handle larger volumes of fluid, gradually shifting away from smaller, manual-scale residential units.

Based on the end use sector, the pump market is segmented into mining, construction, municipal water & wastewater, industrial, and others. In 2025, the industrial sector held the major market share of 26.7% in forecasting period.

- Industrial segment is the primary revenue generator, supported by the massive North American manufacturing and chemical processing base. These industries require constant, 24/7 pumping operations, leading to steady demand for both new equipment and high-value replacement parts.

- Mining segment shows the highest growth rate of 8.4%. The resurgence of North American mining for critical minerals (like lithium and copper) necessitates advanced slurry and high-head dewatering Pump, creating a high-growth vertical for specialized manufacturers.

- Municipal water & wastewater segment is bolstered by aging infrastructure upgrades and new federal environmental regulations, ensuring a stable, long-term trajectory for large-scale submersible and surface pump installations.

Looking for region specific data?

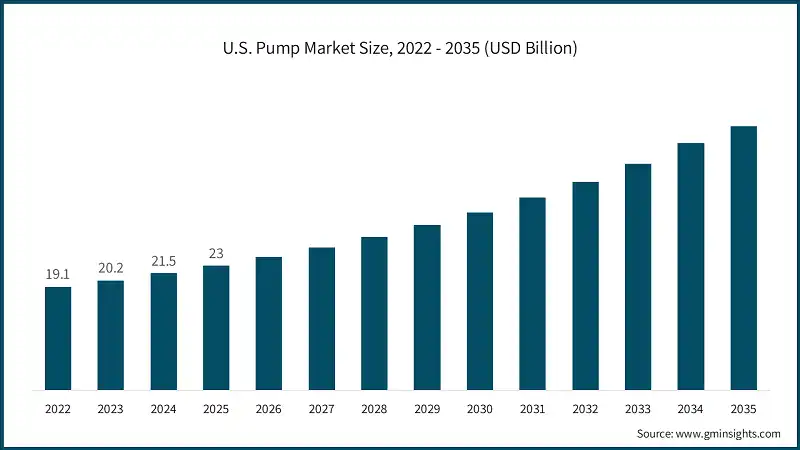

U.S. pump market generating USD 23 billion in revenue in 2025, with a strong 7.9% CAGR expected through 2035.

- Growth is heavily driven by the Infrastructure Investment and Jobs Act (IIJA), which has funneled billions into upgrading aging municipal water and wastewater treatment plants across the country.

- High labor costs are pushing U.S. manufacturers toward "Smart Pumps" equipped with IIoT sensors and Variable Frequency Drives (VFDs) to enable predictive maintenance and reduce energy consumption.

- The resurgence of domestic oil and gas production, particularly in the Permian Basin, has created a massive demand for high-spec electrical submersible pumps (ESPs) and high-pressure surface units.

- Stricter Department of Energy (DOE) efficiency standards are forcing a market-wide shift, where older, inefficient pumps are being replaced by high-efficiency models that meet new federal carbon-reduction goals.

Canada pump market size reaching USD 2.94 billion in 2025 and is set to register at a 7.8% CAGR through 2034.

- A significant portion of demand stems from the mining sector, specifically for critical minerals like lithium and copper. This requires heavy-duty slurry pumps capable of handling abrasive materials in remote northern environments.

- Canadian provinces are investing heavily in climate-resilient infrastructure to combat increased flooding and drought cycles, leading to high demand for large-scale dewatering and stormwater submersible pumps.

- Despite a shift toward green energy, the existing oil sands operations in Alberta continue to drive substantial revenue through the need for constant maintenance, repair, and replacement of industrial process pumps.

- Government initiatives like the Affordable Housing Initiative (AHI) are boosting residential construction, which in turn increases the sales of domestic booster pumps and sewage ejector systems.

Brazil leads the South American pump market with USD 2.35 billion revenue in 2025, supported by a growth rate of 7.1% till 2035.

- As a global agricultural powerhouse, Brazil’s demand for high-capacity irrigation pumps for soybean and corn cultivation is a primary market driver, especially in the Central-West region.

- The Legal Framework for Sanitation aims to provide 99% of the population with drinking water by 2033. This has triggered massive public-private partnerships, requiring extensive new pumping stations across underserved municipalities.

- Brazil's Pre-salt oil reserves require highly specialized, ultra-deepwater submersible pumping technology, positioning the country as a key high-value market for global pump OEMs.

- With some of the world's largest iron ore mines, Brazil remains a critical market for high-volume dewatering solutions and specialized industrial pumps used in mineral processing.

Mexico pump market is generating USD 1.62 billion revenue in 2025, with a 7.4% CAGR.

- The "Mexico Plan" and the relocation of manufacturing from Asia to North America have led to the construction of hundreds of new industrial parks. This has created a surge in demand for industrial processes and HVAC pumps.

- The expansion of EV and battery manufacturing plants in northern Mexico (e.g., Saltillo and Monterrey) is driving the need for precision chemical and cooling pumps used in high-tech manufacturing lines.

- This federal initiative aims to reduce untreated wastewater by 40% by 2025, necessitating the procurement of advanced aeration and submersible sewage pumps for new treatment facilities.

- Increased private investment in the Gulf of Mexico's oil exploration has revitalized the demand for offshore pumping solutions and midstream pipeline transport pumps.

Pump Market Share

Xylem Inc. is leading with 6% market share, Xylem Inc., Grundfos, Flowserve Corporation, ITT Inc., and KSB SE & Co. KGaA collectively hold around 26%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Grundfos signed a definitive agreement to acquire Newterra Corp., a leader in modular water and wastewater treatment solutions based in Pennsylvania. This strategic move significantly expanded Grundfos’ water treatment portfolio in the U.S. and Canada, allowing them to offer more comprehensive, "plug-and-play" treatment solutions to industrial and municipal customers.

- Xylem Inc. finalized the integration of Evoqua Water Technologies, a multi-billion-dollar acquisition that solidified Xylem’s position as the world’s largest pure-play water technology company. This integration has enhanced their ability to offer advanced treatment services and digital monitoring across their submersible and surface pump lines.

Pump Market Companies

Major players operating in the pump industry are:

- Atlas Copco

- Baker Hughes

- Crane Pump & Systems

- Ebara America Corporation

- Flowserve Corporation

- Franklin Electric Co., Inc.

- Gorman-Rupp Company

- Grundfos Holding A/S

- ITT Inc.

- KSB SE & Co. KGaA

- Pentair plc

- Sulzer Ltd.

- Tsurumi America, Inc.

- Weir Group PLC

- Wilo USA LLC

- Xylem Inc.

- Zoeller Pump Company

In February 2025, SLB (Schlumberger) received antitrust clearance to close its acquisition of ChampionX, a move that strengthens its artificial lift and submersible pump portfolio for the North American oil and gas sector.

Pump Market News

- In October 2025, Grundfos unveiled the next-generation TPE3 pump for North American HVAC and industrial applications. The TPE3 features integrated smart sensors and IoT connectivity, allowing the pump to automatically adjust its performance based on real-time system demand, which can reduce energy consumption by up to 25% compared to traditional fixed-speed surface Pump.

- In October 2025, KSB Group launched the AmaCan D, a new submersible pump in a discharge tube equipped with an open multi-vane impeller. Designed for high-volume municipal and industrial water transport, the AmaCan D is engineered to handle large-scale drainage and stormwater management, specifically addressing the rising demand for flood-resilient infrastructure in coastal North American cities.

- In July 2025, Pioneer Pump (a Franklin Electric brand) introduced a new line of industrial Pump certified to the NSF/ANSI 61 standard. This certification allows these high-performance surface Pump to be used in municipal potable water applications, meeting strict North American health and safety regulations for wetted components.

- In 2025, Flowserve Corporation reported a surge in its aftermarket segment, which grew by 8.8% year-over-year. This trend highlights the North American market's shift toward the Flowserve Business System (80/20 initiatives), focusing on high-value maintenance and "Pump-as-a-Service" models that utilize vibration sensors and predictive analytics to extend the life of existing industrial pump fleets.

- In July 2025, Alfa Laval completed the acquisition of Fives Energy Cryogenics, a French cryogenic business specializing in heat exchangers and Pump for LNG and hydrogen applications. This strategic move strengthens Alfa Laval’s position in energy transition technologies. The acquisition aligns with its long-term goal of expanding sustainable solutions for industrial flow processes.

- In late 2025, Grundfos announced the acquisition of Newterra, a U.S.-based water and wastewater treatment company. This strategic deal strengthens Grundfos’ presence in water treatment solutions and expands its North American operations. The acquisition aligns with its vision of providing integrated pumping and water management systems.

- In August 2025, Tsurumi America expanded its AVANT Series of submersible Pump with new IE3 premium efficiency motors. These Pump are now certified for FM North America explosion-proof specifications, targeting the North American mining and oil & gas sectors where high-torque, explosion-resistant dewatering tools are critical for safety and productivity.

The pump market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Submersible pump

- Surface/stationary pump

Market, By Power Range

- Less than 10 HP

- 10–50 HP

- 50–150 HP

- Above 150 HP

Market, By Material/Construction

- Body and chassis parts manufacturing

- Powertrain components

- Interior and exterior components

- Battery and EV components

- Others

Market, By End Use Sector

- Mining

- Construction

- Municipal water & wastewater

- Industrial

- Others

The above information is provided for the following countries:

- U.S.

- Canada

- Mexico

- Brazil

- Chile

- Peru

- Spain

- Australia

- New Zealand

- South Africa

- DRC (Democratic Republic of Congo)

- Zambia

- Ghana

- Tanzania

- Botswana & Namibia

Frequently Asked Question(FAQ) :

What are the upcoming trends in the pump market?

Key trends include adoption of smart pumps with IIoT sensors, integration of IE5 ultra-premium efficiency motors, digital twin technology for performance simulation, and growth of pump-as-a-service models with predictive maintenance.

Which country leads the pump market?

The U.S. pump market generated USD 23 billion in 2025 and is projected to grow at a 7.9% CAGR through 2035. Infrastructure Investment and Jobs Act funding and domestic oil and gas production fuel the country's dominance.

Who are the key players in the pump market?

Key players include Atlas Copco, Baker Hughes, Crane Pump & Systems, Ebara America Corporation, Flowserve Corporation, Franklin Electric Co. Inc., Gorman-Rupp Company, Grundfos Holding A/S, ITT Inc., KSB SE & Co. KGaA, Pentair plc, Sulzer Ltd., Tsurumi America Inc., Weir Group PLC, Wilo USA LLC, Xylem Inc., and Zoeller Pump Company.

What is the growth outlook for submersible pumps from 2025 to 2035?

Submersible pumps are projected to grow at an 8.3% CAGR till 2035, driven by increasing wastewater management needs and demand for efficient dewatering solutions in mining and construction sectors.

How much revenue did the surface/stationary pump segment generate in 2025?

Surface/stationary pumps generated USD 22.5 billion in 2025, leading the market with 63.4% share.

What was the valuation of the 50-150 HP power range segment in 2025?

The 50-150 HP segment held 35.4% market share and generated USD 12.6 billion in revenue in 2025.

What is the market size of the pump in 2025?

The market size was USD 35.5 billion in 2025, with a CAGR of 7.8% expected through 2035 driven by U.S. and Canadian infrastructure investments boosting demand for high-capacity submersible pumps.

What is the projected value of the pump market by 2035?

The pump market is expected to reach USD 74.4 billion by 2035, propelled by infrastructure modernization, IoT integration, and expansion of industrial and mining operations.

What is the current pump market size in 2026?

The market size is projected to reach USD 37.9 billion in 2026.

Pump Market Scope

Related Reports