Summary

Table of Content

Pulp Molding Machines Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Pulp Molding Machines Market Size

Pulp Molding Machines Market size was USD 517.3 million in 2019 and is likely to witness gains of 3.3% CAGR between 2020 and 2026. Rapidly growing use for pulp & paper packaging in the food industry and increasing customer demand for environment-friendly and sustainable packaging solutions will have a constructive influence on the market.

Organic food items that use pulp and paper packaging materials are also expected to positively support the pulp molding machines market. Pulp molding machines are widely used across numerous end-use industries, such as food & beverage, electronics, healthcare, automotive, etc., to produce pulp packaging products.

To get key market trends

In addition, the increasing spending power coupled with healthier living standards is projected to limit the use of plastic packaging especially for food items, propelling the pulp molding machines market sales globally. Several emerging nations are creating regulations and guidelines to minimize the use of plastic packaging in the food & beverage sector.

Pulp Molding Machines Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 517.3 Million (USD) |

| Forecast Period 2020 to 2026 CAGR | 3.3% |

| Market Size in 2026 | 592.2 Million (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Moreover, the arrival of e-commerce companies is bolstering the consumption for molded pulp packaging items, such as molded cartons, trays, end caps, containers, etc., that are expected to provide a positive effect on the pulp molding machines market by 2026.

The coronavirus pandemic is generating multiple challenges for various industries across the globe. The major consumers of pulp molding machines are food & beverage and healthcare industries that require molded pulp products such as egg trays, fruit trays, food cartons, plates, cups, etc. The demand for these items has been rising constantly, however, the supply of these products has been hit harshly.

Due to limitations in the transportation of these products, the revenue of the industries fell by around 6% in 2020, lowering the molded pulp machinery consumption globally. Additionally, huge product prices and complex functioning of molded pulp machine units may become a hindrance in the pulp molding machines market.

Pulp Molding Machines Market Analysis

Learn more about the key segments shaping this market

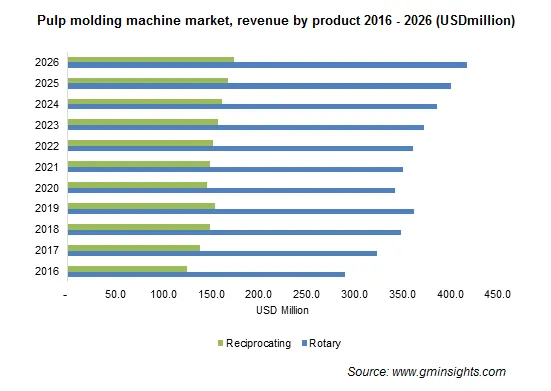

Rotary machines generated a revenue more than USD 350 million in 2019. Rotary pulp molding machines have the capability of manufacturing both large and small molded units. These molding units have simple functionality and reasonable expenses, making them appropriate for several applications. Moreover, rotary machines have the ability to alter heavy amounts of waste and recycled paper to various molded pulp products used in an array of industries.

Automatic machines are expected to grow at a CAGR over 3.5% by 2026. An automatic molding unit can perform definite tasks without being operated by a specialized person or employee. These machines possess automatic dry system, high rate of mold handling, and are easier to operate.

The demand for automatic molding units is estimated to grow profoundly as many end-use industries are requiring largely automated machines that enhance their production. Many producers of pulp molding machines are concentrating on manufacturing highly efficient, sophisticated yet easy to operate machines.

Molding machines with a capacity less than 1,500 units/hour will register a volume share over 20% in 2026. This series of machines is majorly preferable for small-scale industries, which can offer a low cost of capital venture. Its production capacity generally ranges from 700 pieces to 1,500 molded pulp pieces per hour, intaking minimum molding dies.

Furthermore, the integrated pulping structure can be applied to save construction expenses and plant space. Also, the assembly line here only requires three to six workers, resulting in minimum labor cost.

Learn more about the key segments shaping this market

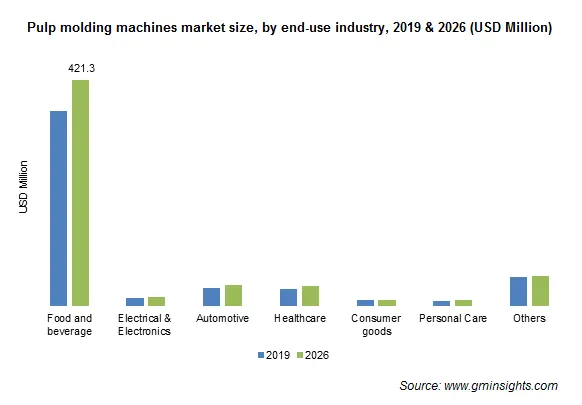

The food & beverage sector will record the highest revenue share of close to 70% in 2026. Strong advancements in the food industry are driving the development of sub-sectors such as foodservice packaging activities. The swelling number of quick service eateries around the world has been powering the consumption for foodservice disposables.

These restaurants are lessening their efforts to maintain and clean the used plates or trays. This has expanded the need for low-cost, single-use disposable packages, directly advancing the pulp molding machines market share in the near future.

Looking for region specific data?

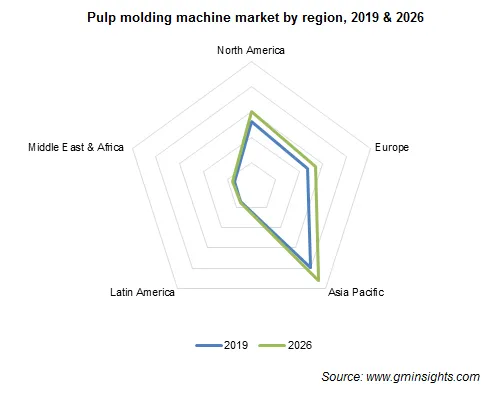

The industry size in Asia Pacific is expected to witness the fastest growing at a CAGR around 3.5% by 2026. The robust development in the region is attributed to the escalating usage of disposable packaging solutions. Presently, the Asian countries are shifting their preference toward sustainable materials in food and consumer products packaging, supporting the enhancement in the molded pulp machines market.

Pulp Molding Machines Market Share

The pulp molding machines industry is majorly contributed by

- Beston Group

- BeSure Technology

- Guangzhou Nanya Pulp Molding Equipment Co.

- Sodaltech

- Taiwan Pulp Moulding Co.

- Inmaco Solutions B.V.

- HGHY Pulp Molding

- Southern Pulp Machinery Ltd.

- Acorn Industry Co., Ltd.

- DKM Machine Manufacturing Inc.

The aforementioned companies are taking initiatives to create market dominance in underdeveloped countries. For instance, Beston Group, to expand its market presence, started supplying pulp molding units in Sudan from April 2019.

Pulp molding machines market research report includes in-depth coverage of the industry, with estimates & forecast in terms of volume & revenue in units and USD million from 2019 to 2026, for the following segments:

By Product:

- Rotary

- Reciprocating

Machine type

- Automatic

- Semi-automatic

- Manual

Power capacity (units/hr)

- Less than 1500

- 1500 - 3500

- 3500 - 5500

- Above 5500

End -users

- Food and beverage

- Electrical & Electronics

- Automotive

- Healthcare

- Consumer goods

- Personal Care

- Others

The above information is provided on a regional basis for the following:

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Why will rotary pulp molding machines garner popularity?

Rotary machines will garner popularity as they can produce both, small and large molded units. They also have reasonable expenses and simple functionality, owing to which the segment recorded USD 350 million revenue in 2019.

How will automatic pulp molding machines tun out to be lucrative for the market growth?

Automatic segment may register 3.5% CAGR through 2026, driven by the fact that these units can perform definite tasks even without the necessity of an employee. They have a high rate of mold handling, an automatic dry system, and are also easier to operate.

Which end-user industry is likely to push the demand for molded pulp machines?

The food & beverage segment may record 70% revenue share in 2026, driven by substantial advancements in the food industry and the advent of numerous quick service eateries worldwide.

What capacity range do small-scale industries prefer for molding machine operations?

Small-scale industries usually prefer molding machines that have a capacity of less than 1,500 units/hour, owing to their low-cost capital venture & general production capacity requirement of around 700-1500 pieces per hour. The <1,500 units/h segment may record 20% volume share in 2026.

Where will pulp molding machines gain traction?

These machines will gain traction across Asia Pacific owing to rising deployment of disposable packaging solutions in the region and shifting preference toward sustainable packaging. APAC market may register 3.5% CAGR through 2026.

Pulp Molding Machines Market Scope

Related Reports