Summary

Table of Content

Psoriasis Treatment Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Psoriasis Treatment Market Size

The global psoriasis treatment market was estimated at USD 28.1 billion in 2024. The market is expected to grow from USD 30.5 billion in 2025 to USD 68.4 billion in 2034, at a CAGR of 9.4%, according to the latest report published by Global Market Insights Inc. This growth is stimulated by the increasing prevalence of skin disorders, especially autoimmune disorders. According to WHO, more than 1.8 billion people are affected by any kind of skin diseases.

To get key market trends

Moreover, rising awareness amongst the patients and healthcare professionals along with the development of advanced biologics and small-molecule therapies further stimulate the market growth. Additionally, the rising burden of chronic inflammatory conditions, with innovations in drug delivery systems and personalized medicine, is further accelerating market expansion.

The prevalence of psoriasis globally is estimated to affect over 125 million people as mentioned by the National Psoriasis Foundation, stimulating demand for effective and long-term treatment options. Plaque psoriasis and psoriatic arthritis are the most common forms, with a most of the portion of patients experiencing joint inflammation, further increasing the need for systemic therapies. According to Cleveland Clinic, 80% to 90% of patients experiencing psoriasis have plaque psoriasis. Moreover, according to the Medscape, about 112 cases of 100,000 population experience psoriatic arthritis globally.

The psoriasis treatment market is defined as the segment of the dermatology and immunology industry focused on managing psoriasis a chronic, immune-mediated skin condition characterized by red, scaly patches and systemic inflammation. The market includes a wide range of therapeutic options such as topical agents that include corticosteroids, vitamin D analogs, oral treatments, injectable biologics such as IL-17, IL-23, TNF-α inhibitors, and biosimilars.

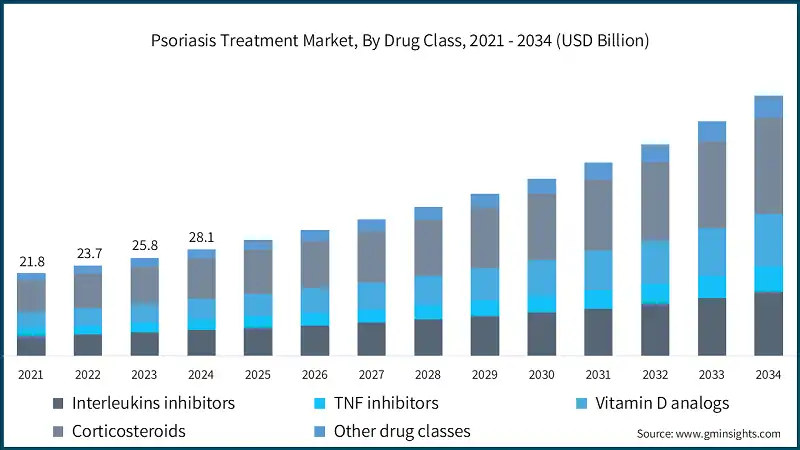

The market has shown consistent growth, rising from USD 21.8 billion in 2021 to USD 25.8 billion in 2023, this expansion is stimulated by increasing diagnosis rates, especially in aging populations and regions with high environmental stressors. The demand for steroid-sparing therapies, preservative-free formulations, and biologic innovations is reshaping the treatment landscape, improving patient compliance and minimizing adverse effects.

Key players such as AbbVie, Amgen, Johnson & Johnson, Eli Lilly and Novartis lead the market with robust product portfolios and strong research and development pipelines. These companies drive innovation, expand healthcare partnerships, and raise awareness, positioning psoriasis therapeutics as a rapidly growing segment in the autoimmune skin disorders landscape.

The market is further supported by increasing investments in dermatological research and healthcare infrastructure, particularly in Asia-Pacific, Latin America, and Middle Eastern regions. With ongoing research and development efforts focused on biologics, biosimilars, and targeted oral therapies, the market is poised for significant growth, driven by the rising incidence of autoimmune skin diseases and continuous innovation in therapeutic approaches.

Psoriasis Treatment Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 28.1 Billion |

| Market Size in 2025 | USD 30.5 Billion |

| Forecast Period 2025 - 2034 CAGR | 9.4% |

| Market Size in 2034 | USD 68.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing prevalence of psoriasis | Rising global incidence of autoimmune skin disorders is driving demand for long-term therapies and early diagnosis. |

| Demographic shifts and hereditary risk factors | Older adults and individuals with family history are more prone to psoriasis, expanding the treatment base. |

| Emergence of next-generation therapies | Introduction of advanced biologics and oral agents is transforming treatment precision and improving patient outcomes. |

| Heightened focus on systemic inflammation and comorbidities | Growing awareness of psoriasis-related complications such as psoriatic arthritis is driving interest in comprehensive care strategies. |

| Pitfalls & Challenges | Impact |

| Treatment-related complications and resistance | Adverse effects and diminishing response to conventional therapies may hinder long-term adherence and efficacy. |

| Healthcare disparities in underserved regions | Limited access to dermatological care and high drug costs restricts availability of advanced treatments in low-income areas. | Opportunities: | Impact |

| Innovation in targeted and combination regimens | Development of therapies addressing specific immune pathways and combining biologics with oral agents is enhancing clinical success. |

| Growth in precision dermatology and digital health | Expansion of personalized treatment approaches through genomic testing and tele dermatology is improving patient outcomes and accessibility. |

| Market Leaders (2024) | |

| Market Leaders |

~12% market share |

| Top Players |

Collective Market Share ~55% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Psoriasis Treatment Market Trends

- The market is changing as patients increasingly seek targeted immunotherapies that offer better symptom control, fewer side effects, and long-term relief from chronic inflammation.

- Further, the integration of AI-driven dermatology tools and molecular profiling is accelerating early diagnosis and enabling more personalized treatment strategies.

- Moreover, rising costs of hospital-based care and injectable biologics are encouraging a shift toward oral therapies that are more affordable and easier to manage at home. Growing interest in rare psoriasis subtypes, such as pustular and erythrodermic forms, is stimulating demand for innovative therapies and supporting orphan drug development.

- The emergence of combination regimens, including biologics with oral agents, is helping dermatologists address treatment resistance and improve outcomes in severe cases.

- Increasing investment in tele dermatology platforms and remote monitoring is expanding access to care, especially in underserved regions, and supporting long-term adherence.

- Rising awareness of disease recurrence and flare-ups is prompting both patients and clinicians to explore multi-line therapies and proactive management plans.

- Development of patient-friendly formulations such as foam-based topical drug delivery and extended-release oral drugs is enhancing convenience and boosting treatment compliance.

Psoriasis Treatment Market Analysis

Learn more about the key segments shaping this market

Based on drug class, the psoriasis treatment market is categorized into interleukins inhibitors, TNF inhibitors, vitamin D analogs, corticosteroids and other drug classes. The corticosteroids segment accounted for 37.4% of the market in 2024 which is stimulated due to their targeted mechanism of action and proven clinical efficacy. The segment is expected to exceed USD 25.2 billion by 2034, growing at a CAGR of 9.2% during the forecast period.

- The corticosteroids segment dominates the global psoriasis treatment market, due to its long-standing use, affordability, and rapid symptom relief. According to American Academy of Dermatology, corticosteroids are the first prescribed treatment for psoriasis, especially for sensitive skin.

- Moreover, corticosteroids are mostly prescribed for patients with mild to moderate psoriasis, especially in outpatient settings, because of anti-inflammatory and immunosuppressive properties.

- The drugs are available in various formulations such as creams, ointments, foams, and lotions, corticosteroids offer flexibility in treatment and are often used as first-line therapy or in combination with other agents for enhanced efficacy.

- The segment benefits from broad clinical acceptance, low cost, and easy accessibility, making it a preferred choice for both patients and healthcare providers. Despite concerns over long-term use and potential side effects, corticosteroids remain a cornerstone in psoriasis management, especially for short-term flare control and localized lesions.

- The interleukins inhibitors segment is expected to grow at a CAGR of 9.6%, gaining attention especially for moderate to severe cases. These biologic agents target specific cytokines in the inflammatory pathway such as IL-17, IL-23, and IL-12/23, that provide high efficacy and long-term disease control.

- Moreover, the vitamin D analogs inhibitors segment accounted for a market share of 19.6%, which is primarily used to regulate skin cell production and reduce inflammation. Often used in combination with corticosteroids, they offer a non-steroidal alternative with a favourable safety profile.

Based on type, the psoriasis treatment market is segmented into psoriatic arthritis, plaque psoriasis, inverse psoriasis and other types. The plaque psoriasis segment dominated the market in 2024 with the CAGR of 9.5% driven due to its high prevalence and chronic nature.

- The increasing cases of plaque psoriasis stimulates the market demand. According to NIH, plaque psoriasis accounts for 90% of all the psoriasis cases and is the commonest clinical type of psoriasis.

- This segment benefits from a wide range of approved therapies, including topical agents, biologics, and oral small molecules, which offer effective symptom control and long-term disease management.

- The dominance of plaque psoriasis is further supported by strong clinical research, regulatory approvals, and global treatment guidelines, making it the primary focus of pharmaceutical innovation.

- Additionally, patient awareness programs, insurance coverage, and ongoing research and development investments continue to drive growth in this segment, ensuring accessibility and improved outcomes for patients worldwide.

- Inverse psoriasis represents a niche but growing segment of the market. Characterized by its occurrence in sensitive areas such as skin folds, it requires specialized non-irritating topical formulations and gentle therapeutic approaches, further supported by targeted product development, clinical attention, and formulation advancements, which enhance patient comfort and treatment adherence.

- Moreover, psoriatic arthritis is a significant and expanding segment, particularly among patients with moderate to severe psoriasis. It is driven by the increasing adoption of systemic therapies, including biologics and small-molecule drugs, which provide comprehensive relief for both joint and skin symptoms.

Based on route of administration, the psoriasis treatment market is segmented into oral, parenteral and topical. The topical segment dominated the market with USD 15.6 billion in 2024, the segment domination is driven by its ease of application, minimal systemic side effects, and suitability for mild to moderate cases.

- Topical therapies are preferred option for initial treatment and maintenance, especially in outpatient settings, due to their accessibility and affordability formulations such as creams, foams, and gels.

- Moreover, topical route of administration is known to be patient friendly as these are easy to apply and convenient to use anytime and anywhere. According to Journal of Health Economics and Outcomes Research, topical treatments were the most preferred option of administration followed by oral agents and intravenous infusion.

- Whereas, the oral segment holds a significant share of the psoriasis treatment market, supported by the growing adoption of small-molecule therapies such as PDE4 and TYK2 inhibitors, which offer convenience and systemic control for moderate cases.

- Other segment including parenteral administration, are primarily used for biologic therapies targeting severe psoriasis, offering high efficacy and long-term disease control, especially in patients unresponsive to topical or oral treatments.

Learn more about the key segments shaping this market

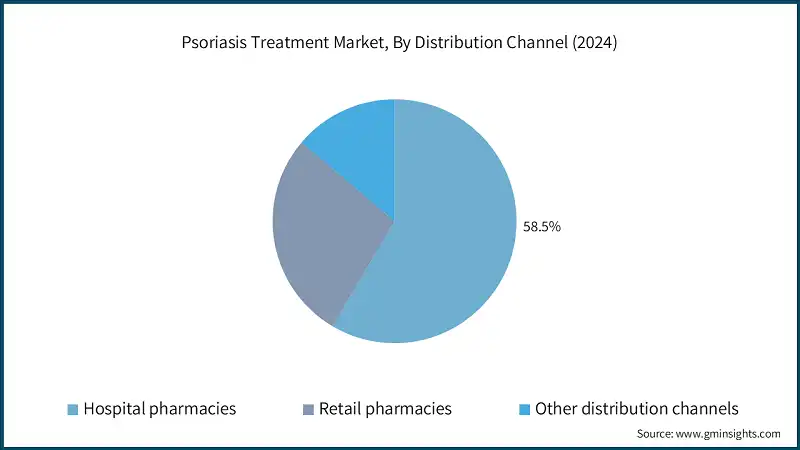

Based on distribution channel, the psoriasis treatment market is categorized into hospital pharmacies, retail pharmacies and other distribution channels. The hospital pharmacies segment is anticipated to reach USD 39.7 billion by 2034, growing with a significant CAGR of 9.3% during the analysis period due to the increasing reliance on specialized psoriasis care and the availability of advanced therapeutic services within hospital settings.

- Hospital pharmacies dominated the psoriasis treatment market owing to rising prevalence of chronic autoimmune skin conditions such as psoriasis, especially among aging populations, has led to a rising preference changing to hospital-based treatment where patients are able to access multidisciplinary care, including dermatologists, immunologists and diagnostic facilities.

- Moreover, hospital pharmacies have a central role in dispensing biologic and immunomodulatory therapies, ensuring accurate dosing and monitoring. The complexity of psoriasis treatment, which often involves multi-line therapy and management of flare-ups, makes hospital pharmacies the preferred location for initiating and adjusting treatment regimens.

- Additionally, government healthcare programs and insurance providers often route high-cost dermatology therapies through hospital systems to ensure proper administration and compliance. This is a key node in the psoriasis treatment supply chain, especially for therapies requiring close monitoring and specialist oversight.

- However, retail pharmacies serve as a convenient access point for patients undergoing maintenance therapy or those in stable post-hospital treatment. Their role is growing in regions with strong outpatient dermatology care systems.

- Also, other distribution channels, including specialty dermatology centers, specialty pharmacies, dermatology clinics, and biologic distribution networks, are gaining attention by offering personalized care, advanced biologic handling, and streamlined access to targeted therapies for complex psoriasis cases.

Looking for region specific data?

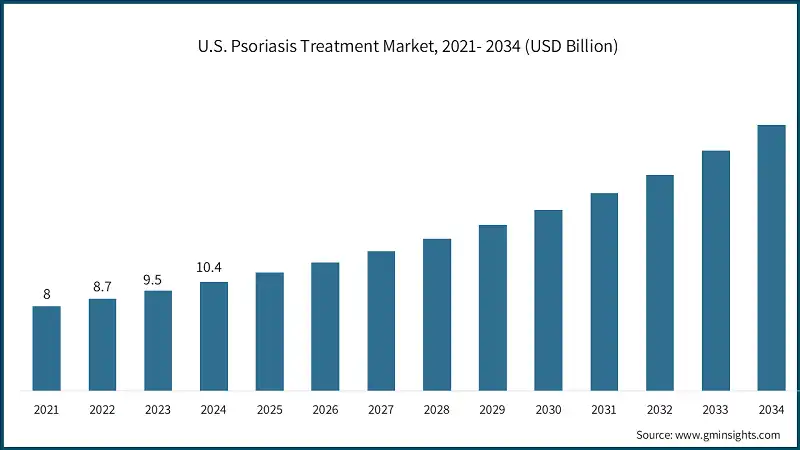

North America Psoriasis Treatment Market The North America market dominated the market with a market share of 41.1% in 2024. The market is stimulated by the rising prevalence of psoriasis cases and increased investment for innovative solutions. The U.S. psoriasis treatment market was valued at USD 8 billion and USD 8.7 billion in 2021 and 2022, respectively. The market size reached USD 10.4 billion in 2024, growing from USD 9.5 billion in 2023. Europe market accounted for USD 7.7 billion in 2024 and is anticipated to show lucrative growth over the forecast period. Germany psoriasis treatment market is anticipated to witness considerable growth over the analysis period. The Asia Pacific market is anticipated to grow at the highest CAGR of 9.7% during the analysis timeframe. China psoriasis treatment market is predicted to grow significantly over the forecast period. Brazil is experiencing significant growth in the Latin America market due to the increasing demand for psoriasis solutions and long-term care. Saudi Arabia market is poised to witness substantial growth in Middle East and Africa psoriasis treatment market during the forecast period. Leading companies such as AbbVie, Amgen, Johnson & Johnson, Novartis, and Eli Lilly collectively hold a dominant share of approximately 55% the global market. These companies maintain leadership through extensive biologic portfolios, strategic acquisitions, regulatory expertise, and continued investment in targeted immunotherapies and oral agents. AbbVie holds a strong competitive advantage with Humira and Skyrizi, offering broad coverage across psoriasis subtypes and deep market penetration. Amgen maintains its edge through biosimilar innovation and long-standing success with Enbrel in autoimmune therapy. Johnson & Johnson leads with Stelara, targeting IL-12/23 pathways and expanding into psoriatic arthritis treatment. Novartis dominates the IL-17 space with Cosentyx, backed by robust clinical data and global reach in moderate-to-severe cases. Eli Lilly competes with Taltz and Omvoh, leveraging dual expertise in biologics and TYK2 inhibitors for precision therapy. Emerging and niche players such as Merck & Co., Biogen, LEO Pharma, Pfizer, Bristol-Myers Squibb, UCB Pharma, Sun Pharma, Boehringer Ingelheim, Arcutis Biotherapeutics, and Biocon are gaining traction with biosimilars, topical innovations, and regional strategies. These companies contribute to market growth through cost-effective alternatives, localized distribution networks, and innovation in steroid-sparing and advanced-stage treatment options. Few prominent players operating in the psoriasis treatment industry includes: AbbVie leads the global psoriasis treatment market with a dominant share of 12%, driven by its flagship biologics Humira and Skyrizi, which offer high efficacy across multiple psoriasis types. The company’s strong immunology pipeline, global reach, and continued investment in next-generation therapies reinforce its leadership in chronic skin disease management. Novartis holds a strong presence with Cosentyx, a leading IL-17A inhibitor that has set a benchmark for biologic therapy in moderate-to-severe psoriasis. Its early-mover advantage, robust clinical data, and commitment to innovation in dermatology support its continued growth and global impact. Johnson & Johnson maintains a competitive position with Stelara, targeting IL-12/23 pathways and offering durable response in plaque psoriasis and psoriatic arthritis. The company’s integrated immunology approach, global distribution, and expansion into multi-indication therapies continue to drive its market strength. Europe Psoriasis Treatment Market

Asia Pacific Psoriasis Treatment Market

Latin America Psoriasis Treatment Market

Middle East and Africa Psoriasis Treatment Market

Psoriasis Treatment Market Share

Psoriasis Treatment Market Companies

Psoriasis Treatment Industry News

The psoriasis treatment drugs market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion from 2021 - 2034 for the following segments:

Market, By Drug Class

- Interleukins inhibitors

- Secukinumab

- Ustekinumab

- Other interleukin inhibitors

- TNF inhibitors

- Etanercept

- Certolizumab pegol

- Adalimumab

- Infliximab

- Golimumab

- Vitamin D analogs

- Calcitriol

- Calcipotriol

- Tacalcitol

- Corticosteroids

- Other drug classes

Market, By Type

- Psoriatic arthritis

- Plaque psoriasis

- Inverse psoriasis

- Other types

Market, By Route of Administration

- Oral

- Parenteral

- Topical

Market, By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Other distribution channels

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What are the upcoming trends in the psoriasis treatment industry?

Key trends include adoption of AI-driven dermatology tools, tele-dermatology platforms, precision therapies targeting IL pathways, rise of biosimilars, and patient-friendly drug delivery innovations.

Who are the key players in the psoriasis treatment market?

Key players include AbbVie, Amgen, Johnson & Johnson, Novartis, Eli Lilly, Pfizer, Biogen, UCB Pharma, LEO Pharma, Sun Pharma, Bristol-Myers Squibb, Boehringer Ingelheim, Arcutis Biotherapeutics, Biocon, and Merck & Co.

What was the valuation of the topical route of administration segment?

The topical segment dominated with USD 15.6 billion in 2024, supported by ease of application, minimal side effects, and suitability for mild to moderate psoriasis.

Which region leads the psoriasis treatment market?

North America led the market with 41.1% share in 2024, driven by high disease prevalence, early diagnosis, strong insurance coverage, and presence of leading pharmaceutical companies.

What is the market size of the psoriasis treatment in 2024?

The market size was USD 28.1 billion in 2024, with a CAGR of 9.4% expected through 2034 driven by the increasing prevalence of autoimmune skin disorders, rising awareness, and advancements in biologics and small-molecule therapies.

What is the projected size of the psoriasis treatment industry in 2025?

The psoriasis treatment market is expected to reach USD 30.5 billion in 2025.

How much revenue did the corticosteroids segment generate?

The corticosteroids segment accounted for 37.4% of the market in 2024 and is projected to exceed USD 25.2 billion by 2034, driven by their affordability, rapid symptom relief, and broad clinical acceptance.

What is the projected value of the psoriasis treatment market by 2034?

The market is expected to reach USD 68.4 billion by 2034, supported by precision medicine, next-generation biologics, and expansion of dermatology infrastructure in emerging markets.

Psoriasis Treatment Market Scope

Related Reports