Summary

Table of Content

Prostate Cancer Diagnostics Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Prostate Cancer Diagnostics Market Size

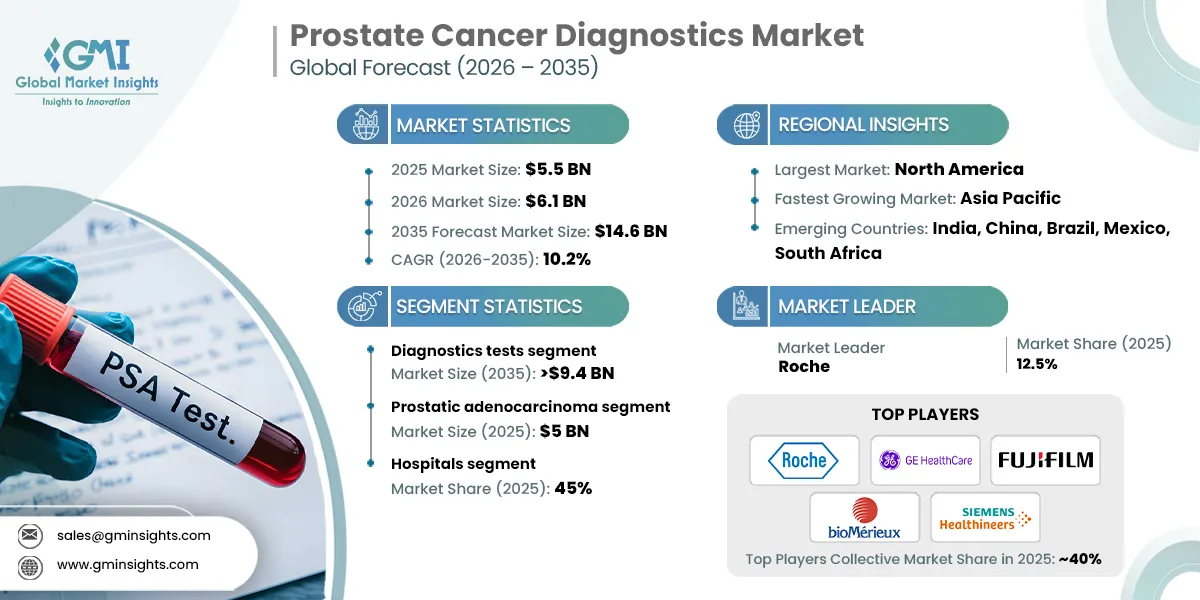

The global prostate cancer diagnostics market was valued at USD 5.5 billion in 2025. The market is expected to reach from USD 6.1 billion in 2026 to USD 14.6 billion in 2035, growing at a CAGR of 10.2% during the forecast period, according to the latest report published by Global Market Insights Inc. The high market growth is attributed to the advancements in diagnostic technologies, growing prevalence of prostate cancer, increasing awareness and screening programs, and expanding geriatric population, among other contributing factors.

To get key market trends

Prostate cancer diagnostics is the set of tests and interventions aimed at identifying prostate cancer, evaluating the extent of the disease, and determining the appropriate treatment. To this effect, it comprises PSA testing, various imaging methods, and biopsy procedures that help in confirming and monitoring the condition.

The major players in the global prostate cancer diagnostics market are Roche, GE HealthCare, FUJIFILM, bioMérieux, and SIEMENS Healthineers. These firms keep their competitive position through continuous product innovation, worldwide market presence, and hefty investment in research and development.

Prostate Cancer Diagnostics Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 5.5 Billion |

| Market Size in 2026 | USD 6.1 Billion |

| Forecast Period 2026 - 2035 CAGR | 10.2% |

| Market Size in 2035 | USD 14.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing prevalence of prostate cancer | This is expanding the patient pool and driving consistent demand for early and accurate diagnostic solutions. |

| Advancements in imaging and biomarker-based diagnostics | These innovations are enhancing diagnostic accuracy and boosting adoption across healthcare settings. |

| Surging awareness and screening initiatives | Awareness campaigns and routine screening programs are increasing testing volumes and supporting market expansion. |

| Growing demand for minimally invasive diagnostic procedures | Preference for safer, quicker, and less invasive options is accelerating the shift toward advanced imaging and biopsy techniques. |

| Pitfalls & Challenges | Impact |

| High cost of advanced diagnostic modalities | Elevated costs continue to limit widespread adoption, particularly for technologies like mpMRI and genomic assays. |

| Limited accessibility in low- and middle-income regions | Infrastructure gaps and affordability challenges are restricting market penetration in underserved areas. |

| Opportunities: | Impact |

| Expansion of AI-powered diagnostic tools | AI integration will significantly enhance accuracy, reduce diagnostic variability, and streamline clinical workflows, leading to broader adoption and faster diagnosis. |

| Growing adoption of personalized medicine | Tailored diagnostic approaches using genomic and molecular profiling will drive demand for advanced tests, improving treatment selection and expanding the premium segment of the market. |

| Market Leaders (2025) | |

| Market Leaders |

12.5% Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, China, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

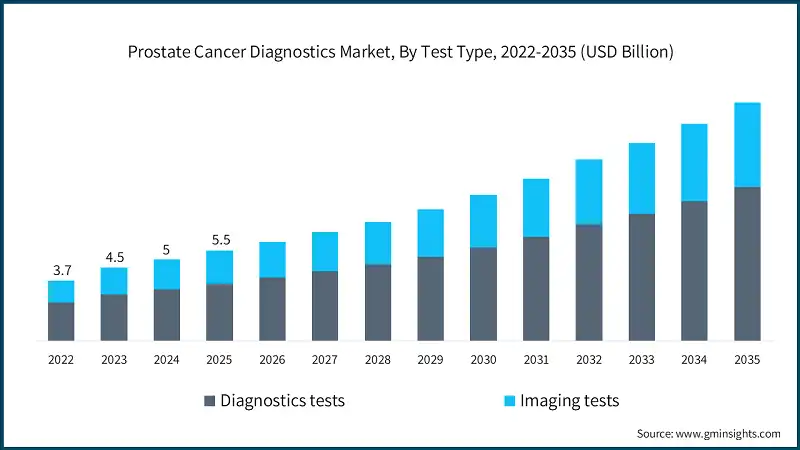

The market has increased from USD 3.7 billion in 2022 and reached USD 5 billion in 2024, with a historic growth rate of 16.3%. The market growth was driven by rising uptake of advanced imaging and biomarker-based tests, increasing adoption of early screening programs, and the growing prevalence of prostate cancer among ageing male populations.

As prostate cancer cases surge worldwide, particularly among older men, the demand for early detection tools is witnessing a significant uptick. For instance, according to the World Health Organization (WHO), prostate cancer accounted for over 1.4 million new cases globally in 2021, making it one of the most common cancers among men.

Additionally, the American Cancer Society reported that in 2025, approximately 313,780 new cases of prostate cancer were diagnosed in the U.S. alone. Contributing factors include lifestyle choices, genetic tendencies, and heightened awareness about screenings. Consequently, this growing patient demographic is fuelling the adoption of diagnostic tests.

Furthermore, innovations such as next-generation sequencing (NGS), liquid biopsy, mpMRI (multiparametric magnetic resonance imaging), and AI-enabled imaging have improved accuracy and reduced false positives associated with traditional PSA testing. These advanced technologies support precision diagnosis and staging. Their improved clinical utility drives wider adoption across hospitals and diagnostic centers.

Prostate Cancer Diagnostics Market Trends

The market is growing considerably with the shift toward multiparametric MRI (mpMRI) for initial diagnosis, the rising use of liquid biopsy & non-invasive biomarker tests, and growth of genomic & molecular diagnostics, among other factors collectively driving industry growth.

- mpMRI is being largely utilized pre-biopsy to confirm the diagnosis with higher accuracy and to avoid unnecessary invasive procedures. In fact, it makes it easier to detect only those cancers which are of clinical significance and at the same time, it reduces the number of false positives that are due to a PSA test. Currently, there are many guidelines that endorse mpMRI as a first diagnostic approach, thus its use is becoming widely adopted its use is becoming widely adopted.

- Genomic assays such as Oncotype DX, Decipher, and Prolaris are becoming central to risk stratification and personalized treatment planning. These tests provide deeper insights into tumour aggressiveness and recurrence risk. Their expanding clinical acceptance supports precision oncology adoption globally.

- Additionally, portable diagnostic devices are becoming more common in primary care and community screening settings. POC PSA tests offer rapid results, improving early detection and patient engagement. This trend is especially notable in regions with limited access to full-scale diagnostic infrastructure, thereby sustaining market growth.

Prostate Cancer Diagnostics Market Analysis

Learn more about the key segments shaping this market

Based on test type, the prostate cancer diagnostics market is segmented into diagnostics tests and imaging tests. The diagnostics tests segment has asserted its dominance in the market by securing a significant market share of 63.6% in 2025 owing to rising adoption of PSA testing, increasing use of advanced biomarker assays, and growing preference for early and non-invasive screening methods. The segment is expected to exceed USD 9.4 billion by 2035, growing at a CAGR of 10.4% during the forecast period.

On the other hand, the imaging tests segment is expected to grow with a CAGR of 9.9%. The growth of this segment is driven by increasing utilization of multiparametric MRI and advanced ultrasound technologies, along with rising demand for accurate tumor localization and staging to guide targeted treatment decisions.

- The diagnostic tests segment continues to dominate the market. The growing number of prostate cancer cases globally is directly increasing the need for early and accurate diagnostic tests. Higher prevalence among ageing men and better awareness contribute to more frequent screenings. This expanding patient base fuels steady demand for PSA, biomarker, imaging, and genomic tests.

- Targeted therapies such as PARP inhibitors and hormone-based drugs require molecular testing to identify eligibility based on BRCA1/2 or other mutations. This linkage between treatment selection and diagnostics boosts demand for advanced genetic tests. Precision oncology’s growth is reshaping diagnostic test portfolios.

- The imaging tests segment held a revenue of USD 2 billion in 2025, with projections indicating a steady expansion at 9.9% CAGR from 2026 to 2035. The segment is driven by the growing shift toward precision diagnostics, where clinicians rely on high-resolution modalities to differentiate aggressive from indolent tumors more effectively. Additionally, the rising adoption of image-guided biopsy and treatment planning techniques is boosting demand for advanced imaging solutions.

Based on cancer type, the prostate cancer diagnostics market is segmented into prostatic adenocarcinoma, small cell carcinoma, and other cancer types. The prostatic adenocarcinoma segment dominated the market in 2025, accounting for USD 5 billion and is anticipated to grow at a CAGR of 10.4% during the forecast period.

- Prostatic adenocarcinoma accounts for more than 90% of all prostate cancer cases, making it the dominant subtype requiring routine screening and diagnosis. Its high incidence among ageing male populations increases test volumes. This strong epidemiological burden drives continuous demand for PSA tests, biopsies, and imaging.

- Adenocarcinoma may develop without any symptoms for years, thus diagnosing it in time is the only way to prevent metastasis. Survival rates improve dramatically with early detection, which is the reason why clinicians are more willing to carry out comprehensive testing. The need for this clinical urgency is what drives the demand for sensitive and specific diagnostic tools.

- The small cell carcinoma segment accounted for significant revenue in 2025 and is anticipated to grow at a CAGR of 9.2% over the forecast period. The segment's expansion is attributed to the increased awareness of this subtype as a severely aggressive and hard-to-localize subtype of prostate cancer that necessitates specially designed and sensitive diagnostic approaches. Molecular profiling and advanced imaging to reveal neuroendocrine features have become more popular in clinics, which is therefore facilitating the demand for targeted diagnostic tools.

Learn more about the key segments shaping this market

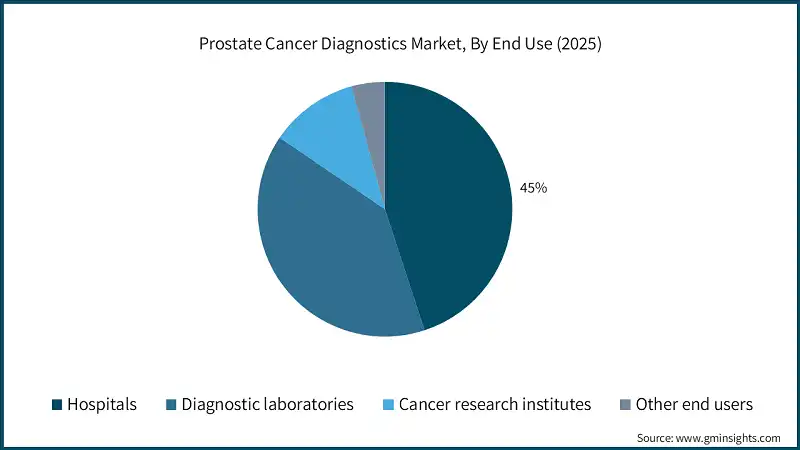

Based on end use, the prostate cancer diagnostics market is classified into hospitals, diagnostic laboratories, cancer research institutes, and other end users. The hospitals segment dominated the market with a revenue share of 45% in 2025 and is expected to reach USD 6.4 billion within the forecast period.

- Hospitals serve as primary centers for prostate cancer screening, imaging, and biopsy procedures. The increasing rate of prostate cancer is leading to more patients coming for their first check-up and diagnosis. As a result, there is a higher need for PSA tests, MRI, and pathology services in hospitals.

- Hospitals are typically equipped with mpMRI, PET-CT, digital pathology, and biopsy devices that are needed for a complete diagnosis of prostate cancer. Their combined system allows for precise staging and identification of the most invasive tumors. As a result, this facility has become a major driver of patient choice and the number of tests has gone up.

- The diagnostic laboratories segment accounted for significant revenue in 2025 and is anticipated to grow at a CAGR of 10.6% over the forecast period. The segmental growth is driven by the rising volume of prostate cancer screenings and the growing need for centralized, high-throughput testing facilities that offer accurate biomarker and genomic analyses.

- The cancer research institutes segment accounted for significant revenue in 2025 and is anticipated to grow at a CAGR of 10.3% over the forecast period. The segmental is driven by increasing investment in prostate cancer studies and the pursuit of novel diagnostic biomarkers, fuelling demand for advanced testing platforms and collaborative clinical research initiatives.

Looking for region specific data?

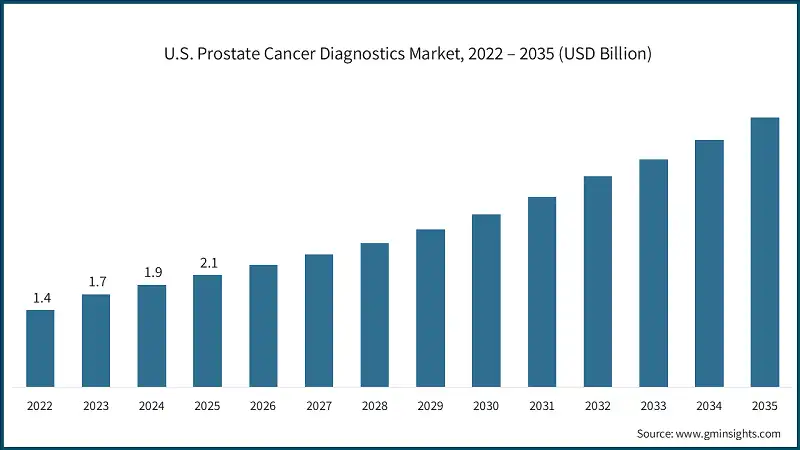

North America Prostate Cancer Diagnostics Market North America dominated the market with the highest market share of 40.4% in 2025. Europe market accounted for USD 1.7 billion in 2025 and is anticipated to show lucrative growth over the forecast period. The Asia Pacific market is anticipated to grow at the highest CAGR of 11.7% during the analysis timeframe. The Latin America market is experiencing robust growth over the analysis timeframe. The Middle East & Africa (MEA) market is experiencing robust growth over the analysis timeframe. The market is competitive, driven by the presence of global players and regional diagnostic companies offering a wide range of PSA tests, imaging solutions, biopsy tools, and advanced molecular diagnostics. Companies are focusing on technological innovations, such as AI-assisted imaging, liquid biopsies, and genomic assays, to improve diagnostic accuracy and reduce invasive procedures. Strategic collaborations with hospitals, research institutions, and oncology centers are also common to enhance product reach and clinical adoption. Key players include Roche, GE HealthCare, FUJIFILM, bioMérieux, and SIEMENS Healthineers, collectively accounting for ~40% of the total market share. Other regional and local players are actively expanding their portfolios to include high-value diagnostic solutions, such as biomarker assays and precision oncology tests. Mergers, acquisitions, and partnerships are frequently employed to strengthen market presence, expand geographic reach, and access emerging markets. The market is characterized by continuous innovation, competitive pricing strategies, and the increasing adoption of technologically advanced diagnostic tools. Few of the prominent players operating in the prostate cancer diagnostics industry include: Roche’s strong portfolio of PSA and molecular diagnostic assays, combined with advanced genomic testing capabilities, enables precision detection and risk stratification. Its extensive R&D and global presence reinforce its leadership in innovative prostate cancer diagnostics. GE HealthCare is anchored in its high-resolution imaging technologies, including multiparametric MRI and ultrasound systems, which support accurate tumor localization and staging. Its integrated solutions and widespread clinical adoption enhance diagnostic efficiency and reliability. FUJIFILM stands out for its cutting-edge imaging solutions and digital pathology platforms that improve visualization and analysis of prostate tissue. Its focus on AI-enabled diagnostic tools and workflow optimization boosts accuracy and clinical decision-making.Europe Prostate Cancer Diagnostics Market

Asia Pacific Prostate Cancer Diagnostics Market

Latin America Prostate Cancer Diagnostics Market

Middle East & Africa Prostate Cancer Diagnostics Market

Prostate Cancer Diagnostics Market Share

Prostate Cancer Diagnostics Market Companies

Prostate Cancer Diagnostics Industry News:

The prostate cancer diagnostics market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2022 – 2035 for the following segments:

Market, By Test Type

- Diagnostics tests

- PSA

- Prostate biopsy

- Molecular/ genomic test

- Other diagnostics tests

- Imaging tests

- Transrectal Ultrasound (TRUS)

- MRI

- CT Scan

- Other imaging tests

Market, By Cancer Type

- Prostatic adenocarcinoma

- Small cell carcinoma

- Other cancer types

Market, By End Use

- Hospitals

- Diagnostic laboratories

- Cancer research institutes

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What are the key trends in the prostate cancer diagnostics industry?

Key trends include the increasing adoption of multiparametric MRI (mpMRI) for initial diagnosis, the rise of liquid biopsies and non-invasive biomarker tests, and the growth of genomic and molecular diagnostics for precision oncology.

Who are the key players in the prostate cancer diagnostics market?

Prominent players include Abbott, Beckman Coulter, Becton, Dickinson and Company, bioMérieux, FUJIFILM, GE HealthCare, Glycanostics, HEALGEN, KOELIS, and Metamark Genetics.

What was the valuation of the prostatic adenocarcinoma segment in 2025?

The prostatic adenocarcinoma segment was valued at USD 5 billion in 2025 and is anticipated to grow at a CAGR of 10.4% during the forecast period.

What was the revenue share of the hospitals segment in 2025?

The hospitals segment accounted for 45% of the market revenue in 2025 and is expected to reach USD 6.4 billion during the forecast period.

Which region dominated the prostate cancer diagnostics market in 2025?

North America led the market with a 40.4% share in 2025, driven by advanced healthcare infrastructure, high awareness levels, and favorable reimbursement policies.

What was the market share of the diagnostics tests segment in 2025?

The diagnostics tests segment held a significant market share of 63.6% in 2025, driven by the adoption of PSA testing, advanced biomarker assays, and early screening preferences. It is projected to exceed USD 9.4 billion by 2035, growing at a CAGR of 10.4%.

What is the projected value of the prostate cancer diagnostics market by 2035?

The market is expected to reach USD 14.6 billion by 2035, fueled by the adoption of precision oncology, non-invasive diagnostic methods, and growing awareness through screening programs.

What was the market size of the prostate cancer diagnostics market in 2025?

The market size was valued at USD 5.5 billion in 2025, with a CAGR of 10.2% expected during the forecast period, driven by advancements in diagnostic technologies, increasing prevalence of prostate cancer, and expanding geriatric population.

Prostate Cancer Diagnostics Market Scope

Related Reports