Summary

Table of Content

Pretreatment Coatings Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Pretreatment Coatings Market Size

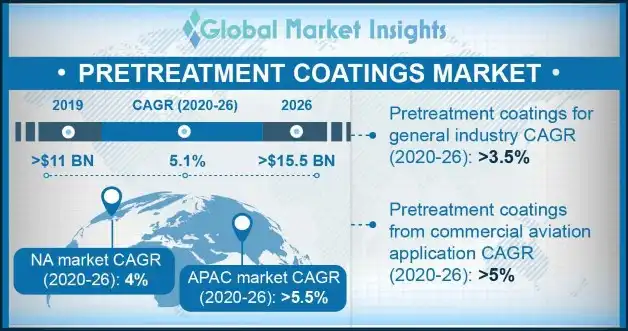

Pretreatment Coatings Market size exceeded USD 11 billion, globally in 2019 and is estimated to grow at over 5.1% CAGR between 2020 and 2026. Rising construction & renovation activities along with changing consumer perceptions towards the usage of high-quality materials in construction industry are likely to augment market share.

To get key market trends

Pretreatment coatings are materials utilized to minimize wear & tear, corrosion, increase thermal stability, and enhance aesthetics. They are made in different concentrations from various metals such as iron, zinc, and chromate with respect to end application industry. These coatings are also utilized to increase work life of spare parts, nuts and bolts in high pressure, stress, and heat conditions. Rising compliances on safety and changing consumer outlook towards the use of high-quality materials are likely to boost the pretreatment coatings market share.

Expanding end-use industries such as automotive, construction, and aerospace are likely to boost the consumption of aluminum pretreatment coatings. These coatings act as an important component at precursor stage for manufacturing powder coatings that offer superior finish.

Furthermore, their resonance with various preparation methods such as sandblasting, degreasing, and water rise is compatible with various applications which is likely to drive the pretreatment coatings market demand.

Pretreatment Coatings Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 11.13 Billion (USD) |

| Forecast Period 2020 to 2026 CAGR | 5.1% |

| Market Size in 2026 | 15 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Rapid demand for corrosion resistant coatings in construction, automobile, and aerospace industries is likely to boost product demand. Anti-corrosive coatings are expected to garner significant gains at over 4% through 2026. Aluminum coatings aid in protection of metal components against oxidation, salt spray, water, moisture, and other environmental susceptibilities.

Additionally, their high performance characteristics also help in increasing workability under high thermal stress and pressure along with providing extra protection against chemical reagents which should boost the pretreatment coatings market.

U.S. EPA directive for Pre-treatment Standards for Electroplating and Metal Finishing Point Source categorizes various types of pretreatment coatings. Also, these compliances regulate the use materials in manufacturing these coatings and restrict the use of lead along with other heavy metals. These regulations are helping industry players to safely manufacture high quality products, complete against global players, and gain brand recognition in the pretreatment coatings market.

Pretreatment Coatings Market Analysis

Learn more about the key segments shaping this market

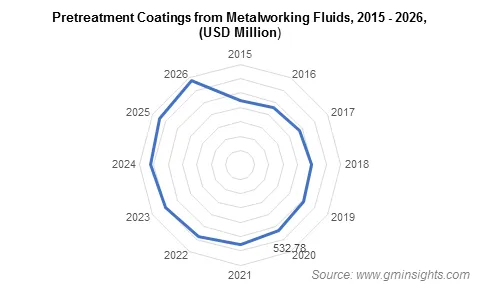

The market is segmented on the basis of product into pre-paint conversion, metalworking fluids, cleaners, final seals, and anti-corrosive coatings. The metal working fluids segment exceeded USD 510 million in 2019. Increasing demand for high quality ferrous and nonferrous metal products is likely to boost market demand.

These coatings help in improving the performance of metals to be used in manufacturing heavy or minute mechanical parts which is likely to boost the pretreatment coatings market growth.

Rapid utilization of high-quality metal solutions in automotive industry is likely to augment the pretreatment coatings market share as it used to provide stability and structural strength to vehicles. Pretreatment coatings are widely used to improve metal performance in difficult conditions and to improve aesthetic features.

Furthermore, metalworking fluid coatings are used in coolants metal treatment and forming applications owing to its economical nature which should accelerate the product demand.

Learn more about the key segments shaping this market

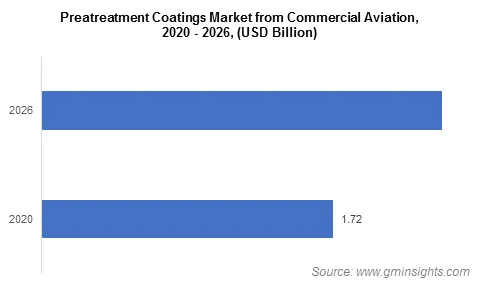

The global market is bifurcated based on end use into aerospace, general industry, automotive, metal packaging, cold forming, and coil. The aerospace sector is expected to register at above 5% CAGR through the forecast period.

Rising commercial aviation sector along with expansion of fleet lines is likely to boost market demand. Pretreatment coatings are widely used in manufacturing high performance precision parts for aviation industry which is likely to augment the pretreatment coatings market value.

Commercial aviation application is likely to register gains with CAGR of over 5% through 2026. Stringent regulations in general and commercial aviation industry and increasing demand for high quality coatings to reduce corrosion rates should boost the product demand. They are utilized to reduce for formation of rust & scales and increase protection against environmental susceptibilities in difficult conditions which is likely to drive the pretreatment coatings market.

Looking for region specific data?

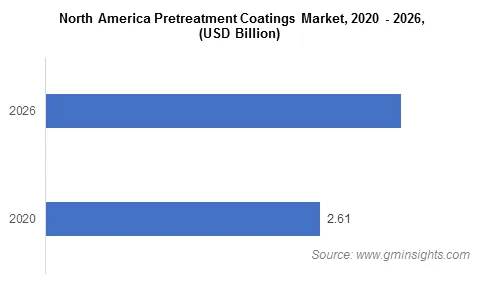

North America is likely to grow with CAGR of 4% through the forecast period owing to rising automotive industry. Factors such as easy availability of automotive loans and rising disposable income are increasing the sales of automobiles thus boosting pretreatment coatings market trends. These coatings improve the working life of vehicles along with reducing maintenance costs which is likely to encourage adoption and boost market demand.

Industry players in the region are rapidly investing in R&D to capitalize on emerging trends in market by introducing innovative products specifically designed for automotive applications. Furthermore, increasing demand for high performance vehicles and rapid tilt towards low maintenance automobiles are likely to boost the pretreatment coatings market demand.

They also provide enhanced protection from environmental susceptibilities such as acid rain, snow, moisture, and rust which is likely to augment pretreatment coatings market.

Pretreatment Coatings Market Share

Major players included in pretreatment coatings industry report are:

- AkzoNobel N.V.,

- Henkel AG & Co

- Chemetall GmbH

- Nihon Parkerizing

- 3M Company

- Nippon Paint

- Kansai Paint

- Sherwin Williams Company

- Axalta Coating Systems

- Abrasives

- Barton International

- Blastech

- Crystal Mark

- Cym Matriales S.A

- GMA Garnet

- BASF

- Hempel A/S

- Try Chemical Industries

- Jotun

- Plasma Coating Products

- NEI Corporation.

Industry players are rapidly moving to introduce industry specific targeted solutions to create unique and trusted brand name. Also, rapid investment in R&D and lowering the use of heavy metal concentration are increasing competition in market as industry players are moving towards strategic and consolidative measures in marker sphere.

In September 2016, PPG launched Aerocron e-coat primer pilot system in France for the aerospace industry. The company adapted the proven e-coat technology for corrosion resistance from automotive and industrial businesses to meet aerospace supplies. Also, in October 2015, PPG Industries acquired Chemfil Canada Limited. This acquisition would enhance the ability to supply pretreatment coatings to industrial customers and automotive manufacturers in Canada.

In October 2016, Chemetall introduced a non-phosphorous pretreatment for three-stage spray washers. Gardobond AP 9811 is a liquid, phosphorus-free, dry-in-place pretreatment that enhances the performance of subsequently applied organic liquid and powder coatings. This easy-to-use product may help in improving customers’ cycle time, capacity utilization, and yield.

Furthermore, in July 2016, Chemetall announced Tech Cool 35052CF, a chlorine-free semi-synthetic metalworking coolant and received Boeing Aircraft approval. This product would result in emulsion stability, extended tool life, low foam levels, corrosion resistance, and lower operational costs.

In July 2016, AkzoNobel launched a new water-based primer is applied in the pretreatment stage. This product reduces material handling and conversion costs by enabling a mono-bake satellite coil line to achieve a two-coat paint system in a single pass, to double the capacity.

Pretreatment coatings market research report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in Tons and revenue in USD Million from 2015 to 2026, for the following segments:

By Product

- Pre-paint Conversion Coatings

- Iron Phosphate

- Zinc Phosphate

- Chromate

- Chromate Free

- Blast Media

- Anti-corrosive coatings

- Metalworking Fluids

- Cleaners

- Final Seals

- Chromium Phosphate

- Corrosion Inhibitors

By End Use

- Aerospace

- Commercial Aviation

- Airlines

- General Aviation

- Military

- Commercial Aviation

- Automotive

- General Industry

- Coil

- Cold Forming

- Metal Packaging

- Others

By Application

- Metal

- Aluminum

- Zn-Al

- Alloys & Die Castings

- Others

The above information has been provided for the following regions:

By Region

- North America

- U.S.

- Europe

- Germany

- UK

- France

- Italy

- Poland

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Indonesia

- Malaysia

- Latin America

- Brazil

- MEA

Frequently Asked Question(FAQ) :

Which end-use industry segment is expected to drive the market during the forecast period?

The commercial aviation application segment registered the highest market share in 2019 and is projected to record a remarkable growth rate throughout the forecast period.

Which are the top companies in the pretreatment coatings industry?

Henkel AG & Co. KGaA, PPG Industries, Chemetall GmbH, Nihon Parkerizing Co. Ltd., AkzoNobel N.V., M Company, Nippon Paint Co. Ltd., Axalta Coating Systems LLC, The Sherwin-Williams Company, Kansai Paint Co. Ltd., Abrasives, Inc., ABShot Tecnics, S.L., are some of the top contributors in the industry.

What are the key factors driving the market?

Increasing application scope with powder coatings, growth in aerospace industry, and positive automotive growth indictors are the major key factors expected to drive the growth of global market.

How big is medical polymers market?

Pretreatment coatings market is expected to achieve $15.5 billion by 2026 and will observe a CAGR of over 5.1% from 2019 to 2026.

Pretreatment Coatings Market Scope

Related Reports