Summary

Table of Content

Prepared Flour Mixes Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Prepared Flour Mixes Market Size

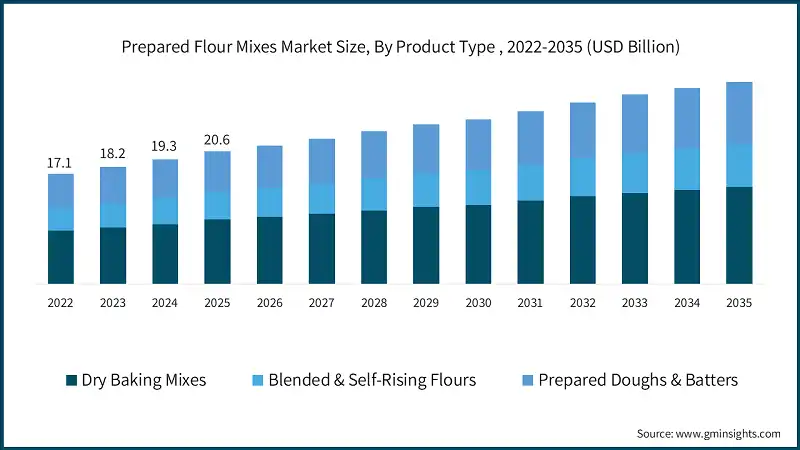

The global prepared flour mixes market was valued at USD 20.6 billion in 2025. The market is expected to grow from USD 21.6 billion in 2026 to USD 31.4 billion in 2035, at a CAGR of 4.3% according to latest report published by Global Market Insights Inc.

To get key market trends

- Prepared flour mix is transitioning into an essential strategic component underpinning modern food systems that enable manufacturers, food service operators, and retailers to achieve consistency, efficiency, and scalability of production. It represents the increasing search for solutions that would simplify operations while, at the same time, satisfying the constantly rising consumer aspiration for better and more creative product offerings.

- To meet the need for differentiation through health and wellness, the features include increase in demand for clean label ingredients, creating gluten-free products, and having multi-grain mixers in this dynamic marketplace with changing consumer preferences. These innovations also strengthen performance enhancement and at the same time, sustaining other requirements set by applicable regulations and the global transparency and nutrition trend.

- Sustainability now seems to be quickly taking center stage in broadening everyone's focus along the value chain. Among the key mantras that manufacturers now live by are following environmental regulations and enhancing brand image with eco-friendly formulations in addition to using recyclable packaging materials. Overall, the trend of responsible sourcing and packaging has much to do with activities, industry-wide, on the reduction of environmental damage as well as that of their products.

Prepared Flour Mixes Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 20.6 Billion |

| Market Size in 2026 | USD 21.6 Billion |

| Forecast Period 2026-2035 CAGR | 4.3% |

| Market Size in 2035 | USD 31.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising consumer demand for convenience foods | Emerging instant flour mixes featured as one of the key elements to prepare quick meal preparations |

| Growth in home baking trends post-pandemic | Boosts retail demand for versatile mixes and opportunities for premium and specialty variants |

| Expansion of food service & QSR sectors | Increased institutional consumption drives bulk format availability and consistent quality requirements |

| Pitfalls & Challenges | Impact |

| Commodity price volatility & inflation | Constrain margins and force manufacturers into reconsidering their sourcing and pricing strategies |

| Supply chain disruptions | Denies timely delivery and inventory stability and requires agile procurement and contingency planning |

| Opportunities: | Impact |

| Emerging dietary trends (keto, paleo, protein-enriched) | Creating differential formulations that suit consumer needs |

| Single-serve & portion-controlled formats | Create gates for innovations in packaging and product design focused on convenience and reducing waste |

| Market Leaders (2025) | |

| Market Leaders |

20% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | China, India, Japan |

| Future Outlook |

|

What are the growth opportunities in this market?

Prepared Flour Mixes Market Trends

- Prepared flour mixes are setting new global performance and sustainability standards for the food industry. Traditionally regarded as the convenient method for home and commercial baking, they have now become a means of contributing to efficiency, enhancing consistency, and fostering innovation across several foodservice and retail outlets. This transformation is in line with the consumer sentiments of operating simplicity to health consciousness and environmental friendly products.

- Innovation in packaging and design of products is yet another transformational trend. Single-serve and portion-control formats now come in vogue, catering to the convenience-oriented lifestyle, and contributing to food waste reduction. Sustainability imperatives, too, are driving the rethinking of packaging, with companies investing in recyclable and eco-friendly materials to fulfill global environmental objectives while strengthening brand equity.

- Prepared flour mixes are moving beyond being basic commodities; they are turning into value-added solutions that provide operational efficiencies, give support to health trends, and push sustainability objectives.

Prepared Flour Mixes Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market is segmented into dry baking mixes, blended & self-rising flours, prepared doughs & batters. The dry baking mixes dominated approximately 48.3%

of the market share in 2025 and is expected to grow with a CAGR of 4.2% by 2035.

- Dry baking mixes still form a prime ingredient of the market in terms of the convenience and consistency presented to home bakers and institutional kitchens. In this way, more clean label and fortified formulations are finding their way into these products, thereby addressing health consumers' needs while making preparation convenient.

- Blended and self-rising flour can be seen as a segment focused on performance functionality and experience. Such products combined with leavening agents and specialty grains provide accuracy in delivery and versatility to any consumer who wishes for quality or a manufacturer who wants ease of execution. Ready-to-use formats remove the need for preparation, cut labor costs and waste, thus proving very worthwhile for quick-service restaurants and institutional kitchens.

Learn more about the key segments shaping this market

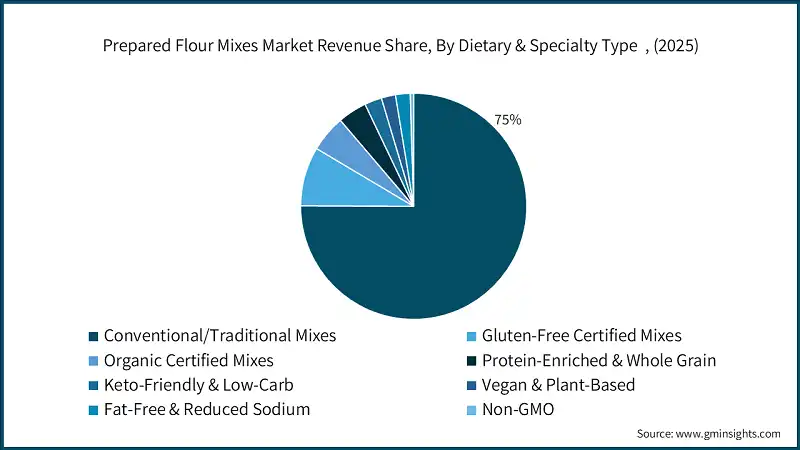

Based on dietary & specialty type, the prepared flour mixes market is segmented into conventional/traditional mixes, gluten-free certified mixes, organic certified mixes, protein-enriched & whole grain, keto-friendly & low-carb, vegan & plant-based, fat-free & reduced sodium, non-GMO. The conventional/traditional mixes segment held the largest market share of 75% in 2025 and is expected to grow at a CAGR of 3.8% during 2026-2035.

- Conventional and traditional mixes enjoyed being the bases of the category with their acceptance and versatility for any kind of day-to-day baking. However, with consumer expectations swaying toward transparency and a higher nutritional content, innovation is moving faster than ever beyond these more traditional offerings.

- The segments getting more in vogue now with the government regulations and compliance-oriented clean label trends reshaping the purchase behavior include mixes that are gluten-free certified, organic certified, and non-GMO. It intends to satisfy consumer ambition for products to be credible and sustainable but also gives a chance for brands to strengthen their premium positioning. The segments getting more in vogue now with the government regulations and compliance-oriented clean label trends reshaping the purchase behavior include mixes that are gluten-free certified, organic certified, and non-GMO. It intends to satisfy consumer ambition for products to be credible and sustainable but also gives a chance for brands to strengthen their premium positioning.

Based on distribution channel, the market is segmented into retail/consumer channel, food service/institutional channel, commercial bakery channel, private label & contract manufacturing. Retail/consumer channel segment dominated the market with an approximate 54.4% share in 2025 and is expected to grow with the CAGR of 3.9% by 2035.

- Retail and consumer channels viewed as the largest visible segment. Consumers are driven by easy availability and varied choices in home baking to supermarket shelves and ultimately stretched through hypermarkets and online sales, whose growth has become a norm with the digital adoption and direct-to-consumer models. The foodservice and institutional channel is the other cornerstone of growth for it, supplying bulk and ready-to-use solutions to quick-service restaurants, hotels, and catering businesses.

Based on packaging format, the market is segmented into consumer pack sizes (8 oz - 5 lb), bulk/institutional sizes (5 lb - 50 lb), single-serve formats, kit formats (Mix + Pan/Ingredients). Consumer pack sizes (8 oz - 5 lb) segment dominated the 51% market share in 2025 and is expected to grow with the CAGR of 3.6% by 2035.

- Prepared flour mixes are packaged to meet different consumer and operational needs. Sizes for consumer packs (8 oz – 5 lb) dominate retail store shelves, directed toward home bakers who want convenience and flexibility in portioning. Increasingly, these packs are also meeting sustainability considerations, with recyclable materials and compact designs maximized for shelf appeal.

- Bulk and institutional sizes (5 lb – 50 lb) are for the likes of foodservice operators, commercial kitchens, and bakeries, where consistency and cost efficiencies are critical. This format allows for high-volume production with streamlined logistics, making it an indispensable format among quick-service restaurants and institutional catering.

Looking for region specific data?

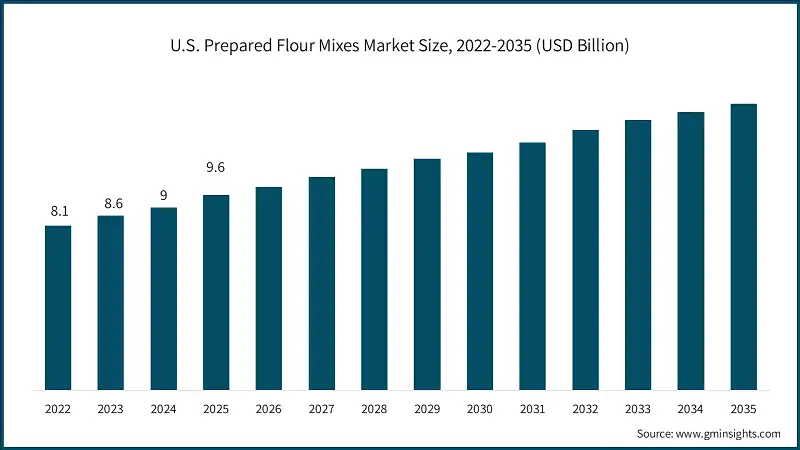

The North America prepared flour mixes market is growing rapidly on the global level with a revenue share of 56.2% in 2025.

- Prepared flour mixes have a tremendous potential for applying growth strategies in North America, based on strong consumer requirement for convenience and innovation. Advanced levels of manufacturing, distribution systems, and retail are already set up for quick product diversification in the region.

U.S. dominates the North America prepared flour mixes market with revenue of USD 9.6 billion in 2025, showcasing strong growth potential.

- The U.S. is spearheading this region's growth, complemented by a fast-growing foodservice sector and home baking culture.

Europe prepared flour mixes market leads the industry with revenue of USD 4.9 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- The region's legislative environment then goes on to favor clean label requirements as well as environmentally friendly practices, forcing the manufacturers to indulge in innovations such as organic, gluten-free, and plant-based formulations.

Germany dominates the European prepared flour mixes market, showcasing strong growth potential.

- Germany is the largest market by far in Europe, supplemented by the country's advanced food manufacturing infrastructure and high penetration of the retail channel. The combination of artisanal baking traditions with modern convenience trends makes for a compelling proposition to brands wanting to market performance mixes that promise authenticity with innovation.

The Asia Pacific prepared flour mixes market is anticipated to grow at a CAGR of 13.8% during the analysis timeframe.

- Urbanization, more changes to consumer lifestyles, and development of modern retail channels have combined to make the Asia-Pacific the most dynamic growth region.

China prepared flour mixes market is estimated to grow with a significant CAGR in the Asia Pacific region.

- China is leading the way in this emerging momentum, thanks to a sound manufacturing base and an interesting market for diversified bakery products.

Latin America prepared flour mixes market accounted for 4.2% share in 2025 and is anticipated to show highest growth over the forecast period.

- Latin America is a region where prepared flour mixes are generally thriving with its developing consumer taste, modernizing retail infrastructures, and increased convenience-based products. Aside from being affordable, the fascination with premium and health-oriented mixes gives opportunities to brands in diversifying portfolios.

Brazil leads the Latin American prepared flour mixes market, exhibiting remarkable growth during the analysis period.

- Brazil leads this regional momentum by its powerful food manufacturing base and growing retail networks. The featured trend setting for Latin America is found from a surge in different specialty mixes that the country prefers: gluten-free, organic, and fortified mixes.

Middle East & Africa prepared flour mixes market accounted for 1.9% share in 2025 and is anticipated to show lucrative growth over the forecast period.

- The Middle East and Africa are set to become promising markets for prepared flour mixes, with increasing consumption among urbanizing people, changing consumer patterns, and adaptation of infrastructures in retail and foodservice. Convenience foods and premium bakery products are increasingly gaining momentum, which creates opportunities in specialty mixes-giving rise to applications such as gluten-free, organic, and plant-based formulations.

Saudi Arabia prepared flour mixes industry to experience substantial growth in the Middle East and Africa Prepared Flour Mixes market in 2025.

- Saudi Arabia is considered one of the major nations that drive this region's growth. The economic diversification agenda and investment made within the country for modern food manufacturing facilities rapidly increase the demand for high-quality innovations in baking solutions.

Prepared Flour Mixes Market Share

The top 5 companies in prepared flour mixes industry include General Mills, Conagra, Ardent Mills, Continental Mills, Dawn Foods. These are prominent companies operating in their respective regions covering approximately 29.8% of the market share in 2025. These companies hold strong positions due to their extensive experience in prepared flour mixes industry. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

Prepared Flour Mixes Market Companies

Major players operating in the prepared flour mixes industry include:

- General Mills, Inc.

- Conagra Brands, Inc. (Duncan Hines)

- Ardent Mills

- Continental Mills (Krusteaz)

- Dawn Foods (Global)

- King Arthur Baking Company

- Bob's Red Mill Natural Foods

- Chelsea Milling Company (JIFFY Mix)

- AB Mauri (North America & Global)

- Puratos (Europe & North America)

- Zeelandia (Europe & Asia)

- Goodman Fielder (Asia-Pacific)

- Lesaffre (North America & Global)

- ADM (Archer Daniels Midland)

- Bay State Milling Company

- General Mills is a global food leader known for its diverse portfolio of branded products spanning cereals, baking mixes, snacks, and convenience meals. The company focuses on innovation, sustainability, and consumer-centric strategies, leveraging strong R&D capabilities to deliver health-forward and premium offerings across retail and foodservice channels.

- Conagra Brands operates as a major packaged food company with a strong presence in frozen, snack, and pantry categories. Its strategy emphasizes product innovation, brand modernization, and operational efficiency, supported by acquisitions that expand its reach into high-growth segments and strengthen its position in health-conscious and convenience-driven markets.

- Ardent Mills is a leading flour and grain solutions provider, specializing in wheat, specialty grains, and customized blends. The company focuses on innovation in nutrition and sustainability, offering clean-label, gluten-free, and plant-based solutions to meet evolving consumer demands while maintaining strong partnerships with food manufacturers and bakeries.

- Continental Mills, best known for its Krusteaz brand, delivers a wide range of baking mixes and foodservice solutions. The company emphasizes convenience, quality, and flavor innovation, catering to both retail and institutional markets.

- Dawn Foods is a global bakery ingredient manufacturer offering mixes, bases, icings, and specialty products. The company combines deep industry expertise with a commitment to cleaner-label formulations and sustainability.

Prepared Flour Mixes Industry News

- In August 2023, Puratos UK established a new standard in choux pastry with the introduction of its first Vegan Choux mix to empower pâtissiers in expanding its plant-based portfolio for meeting the growing market requirements.

- In May 2023, ADM launched HarvestEdge Oro to offer authentic pizza experiences made from sustainably sourced wheat in a bid to expand its HarvestEdge line of flours, specialty grains and blends.

These prepared flour mixes market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Product Type

- Dry baking mixes

- Cake mixes

- Brownie & bar mixes

- Pancake & waffle mixes

- Bread mixes

- Muffin & cornbread mixes

- Biscuit & scone mixes

- Doughnut mixes

- Cookie mixes

- Blended & self-rising flours

- Self-rising flour

- Cake flour

- All-purpose baking mix

- Prepared doughs & batters

Market, By Dietary & Specialty Type

- Conventional/traditional mixes

- Gluten-free certified mixes

- Organic certified mixes

- Protein-enriched & whole grain

- Keto-friendly & low-carb

- Vegan & plant-based

- Fat-free & reduced sodium

- Non-GMO

Market, By Distribution Channel

- Retail/consumer channel

- Supermarkets & hypermarkets

- Grocery stores & convenience stores

- Specialty food stores

- Food service/institutional channel

- Restaurants & qsrs

- Hotels & catering services

- K-12 schools

- Healthcare facilities

- Colleges & universities

- Retirement living facilities

- Commercial bakery channel

- In-store bakeries

- Specialty bakeries

- Industrial bakeries

- Private label & contract manufacturing

- Retailer private label programs

- Co-manufacturing partnerships

Market, By Packaging Format

- Consumer pack sizes (8 oz - 5 lb)

- Bulk/institutional sizes (5 lb - 50 lb)

- Single-serve formats

- Kit formats (mix + pan/ingredients)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the prepared flour mixes market?

Key players include General Mills, Inc., Conagra Brands, Inc. (Duncan Hines), Ardent Mills, Continental Mills (Krusteaz), Dawn Foods, King Arthur Baking Company, Bob's Red Mill Natural Foods, Chelsea Milling Company (JIFFY Mix), AB Mauri, Puratos, Zeelandia, Goodman Fielder, Lesaffre, ADM (Archer Daniels Midland), and Bay State Milling Company.

Which region leads the prepared flour mixes market?

North America held 56.2% share with strong growth potential in 2025. Advanced manufacturing infrastructure and strong consumer demand for convenience fuel the region's dominance.

What are the upcoming trends in the prepared flour mixes market?

Key trends include adoption of clean label ingredients, gluten-free and multi-grain formulations, single-serve and portion-controlled formats, sustainable packaging, and emerging dietary trends like keto, paleo, and protein-enriched products.

What was the market share of conventional/traditional mixes segment in 2025?

Conventional/traditional mixes held the largest market share of 75% in 2025 and are expected to grow at a CAGR of 3.8% during 2026-2035.

What is the growth outlook for Asia Pacific prepared flour mixes market from 2026 to 2035?

Asia Pacific market is anticipated to grow at a CAGR of 13.8% during the forecast period, driven by urbanization, changing consumer lifestyles, and development of modern retail channels.

How much revenue did the dry baking mixes segment generate in 2025?

Dry baking mixes dominated approximately 48.3% of the market share in 2025, leading the product type segment with its convenience and consistency.

What is the current prepared flour mixes market size in 2026?

The market size is projected to reach USD 21.6 billion in 2026.

What is the market size of the prepared flour mixes in 2025?

The market size was USD 20.6 billion in 2025, with a CAGR of 4.3% expected through 2035 driven by demand for consistent, efficient, and scalable food production across manufacturing, foodservice, and retail.

What is the projected value of the prepared flour mixes market by 2035?

The prepared flour mixes market is expected to reach USD 31.4 billion by 2035, propelled by convenience food demand, home baking trends, and expansion of foodservice sectors.

Prepared Flour Mixes Market Scope

Related Reports