Summary

Table of Content

Poultry Probiotic Ingredients Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Poultry Probiotic Ingredients Market Size

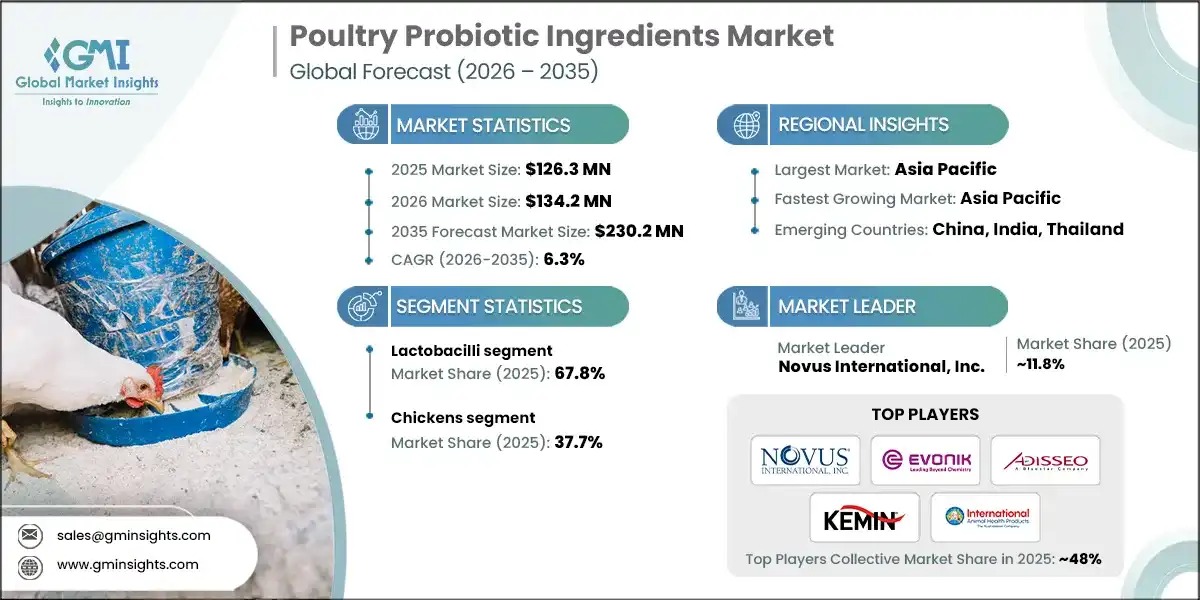

The global poultry probiotic ingredients market was valued at USD 126.3 million in 2025. The market is expected to grow from USD 134.2 million in 2026 to USD 230.2 million in 2035, at a CAGR of 6.3%, according to latest report published by Global Market Insights Inc.

To get key market trends

- Poultry probiotic ingredients are specialized microbial formulations and beneficial bacteria used in poultry feed and nutrition to enhance gut health, improve feed conversion efficiency, boost immunity, and promote overall bird performance across commercial poultry operations. Available in various strains including Lactobacilli, Bifidobacterium, Streptococcus, Bacillus, and other beneficial microorganisms, these performance-critical ingredients provide essential functions including pathogen inhibition, digestive optimization, nutrient absorption enhancement, disease resistance improvement, and antibiotic alternative solutions in poultry production systems.

- Currently, Asia Pacific dominates the poultry probiotic ingredients market, accounting for approximately 35.7% of global market value in 2025, driven by extensive poultry production capacity, robust broiler and layer operations, and expanding antibiotic-free poultry farming initiatives. North America represents a significant market with established commercial poultry infrastructure, while Europe maintains substantial market presence with stringent antibiotic regulations and advanced animal welfare standards requiring natural growth promotion solutions.

- Chickens represent the largest application segment, accounting for approximately 37.7% of the market, reflecting the dominant role of broiler and layer production in global poultry operations, followed by ducks, geese, turkeys, and other poultry species. Among product types, Lactobacilli leads with approximately 67.8% market share, followed by Bifidobacterium, Streptococcus, Bacillus, and other probiotic strains, reflecting the widespread adoption of lactic acid bacteria formulations offering balanced efficacy and proven performance in poultry gut health management.

- The convergence of expanding poultry production, growing antibiotic-free farming initiatives, and advancing probiotic technologies creates a dynamic environment for the global poultry probiotic ingredients market. As producers invest in advanced strain development technologies, multi-strain formulations, and performance optimization for diverse poultry species, the market continues to evolve, ensuring sustained global demand across diverse poultry production systems and geographic markets.

Poultry Probiotic Ingredients Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 126.3 Million |

| Market Size in 2026 | USD 134.2 Million |

| Forecast Period 2026 - 2035 CAGR | 6.3% |

| Market Size in 2035 | USD 230.2 Million |

| Key Market Trends | |

| Drivers | Impact |

| Expanding poultry production capacity globally | Driving substantial poultry probiotic ingredients consumption as commercial poultry farming remains the dominant end-use sector, supporting broiler production, layer operations, and breeding programs across meat production, egg laying, and hatchery operations in developed and emerging poultry markets worldwide |

| Growing antibiotic-free & natural farming initiatives | Increasing demand for probiotic alternatives to antibiotic growth promoters, driven by regulatory restrictions on antibiotic use in livestock, consumer preferences for antibiotic-free poultry products, and industry commitments to sustainable and responsible animal production practices addressing antimicrobial resistance concerns |

| Advanced probiotic technologies & multi-strain formulations | Expanding poultry probiotic applications in precision nutrition programs, targeted gut health solutions, and species-specific formulations, driven by research advancement, microbiome understanding, and technical requirements for heat-stable strains, encapsulation technologies, and synergistic bacterial combinations in modern poultry nutrition |

| Pitfalls & Challenges | Impact |

| Strain viability & stability challenges in feed processing | Create technical challenges for producers and feed manufacturers, requiring investment in encapsulation technologies, heat-resistant strains, storage optimization, and quality control systems to maintain probiotic viability through pelleting, extrusion, and storage conditions in commercial feed production |

| Variable efficacy & inconsistent field performance | Creates adoption barriers from strain-specific responses, environmental factors, management variations, and interaction effects with feed formulations, potentially affecting producer confidence and requiring comprehensive technical support, application protocols, and performance validation across diverse production systems |

| Opportunities: | Impact |

| Next-generation probiotic strains & precision formulations | Offers opportunities for premium positioning in advanced poultry operations, enabling market differentiation through novel bacterial strains, targeted mode-of-action profiles, customized multi-strain combinations, and application-specific formulations addressing specific health challenges, production stages, and performance objectives |

| Integrated gut health solutions & technical services | Present significant growth potential through comprehensive nutrition programs combining probiotics with prebiotics, organic acids, and enzymes, enabling value-added services, on-farm technical support, and performance monitoring systems for optimized gut health management and total production cost reduction for poultry producers |

| Market Leaders (2025) | |

| Market Leaders |

~11.8% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging country | China, India, Thailand |

| Future outlook |

|

What are the growth opportunities in this market?

Poultry Probiotic Ingredients Market Trends

- Advanced strain development and formulation optimization are revolutionizing poultry probiotic ingredients development, enabling producers to achieve superior gut colonization characteristics, enhanced pathogen inhibition, improved feed conversion ratios, and optimized immune response across diverse poultry species and production systems. These technological improvements address critical requirements for heat stability, storage viability, and consistent field performance in commercial feed manufacturing, significantly enhancing bird health, reducing mortality rates, and improving production efficiency through optimized strain selection, encapsulation technologies, and synergistic multi-strain formulations tailored to specific poultry applications.

- The antibiotic-free transformation is reshaping the poultry probiotic ingredients industry as producers demonstrate increasing commitment to sustainable animal production through natural growth promoters, reduced antibiotic dependence, and comprehensive gut health management programs addressing regulatory restrictions and consumer demands. This shift encourages investment in research and development of novel probiotic strains, alternative antimicrobial solutions, and integrated gut health approaches, with several major poultry producers implementing complete antibiotic-free production systems to address regulatory requirements regarding antibiotic growth promoter bans, food safety standards, and antimicrobial resistance concerns, while meeting consumer expectations for natural poultry products and responsible farming practices.

- Strategic partnerships between probiotic manufacturers, feed producers, and poultry integrators are creating integrated nutrition solutions and optimizing production performance across the poultry value chain. These collaborative relationships enable coordinated product development with feed formulation requirements, application-specific strain optimization, and comprehensive technical services including on-farm support, performance monitoring, and nutrition consulting, positioning integrated solution providers with competitive advantages in technical expertise, total cost of ownership reduction, and long-term customer relationships compared to commodity ingredient suppliers.

- Geographic capacity expansion in Asia Pacific, particularly in China, India, Thailand, and Vietnam, is fundamentally reshaping global poultry probiotic ingredients supply dynamics, with significant production capacity additions and technical service infrastructure development supporting rapidly growing regional poultry production, expanding broiler operations, and increasing layer farming industries. These investments reduce import dependence for regional feed manufacturers, improve supply chain responsiveness, and enable closer technical collaboration with poultry integrators, commercial farms, and feed mills in high-growth markets, while creating competitive pressure on established North American and European producers.

- Product specialization and species-specific formulation development are emerging as critical differentiation strategies, with producers expanding beyond general-purpose poultry probiotics to offer specialized products for broiler performance optimization, layer egg production enhancement, breeder fertility improvement, and turkey-specific applications.

- This trend addresses evolving requirements in intensive broiler production, cage-free layer systems, antibiotic-free turkey operations, and specialty poultry farming, enabling premium pricing and stronger customer relationships through customized formulations, technical application support, and collaborative problem-solving with nutritionists and production managers in integrated poultry operations, independent farms, and specialty poultry sectors.

Poultry Probiotic Ingredients Market Analysis

Learn more about the key segments shaping this market

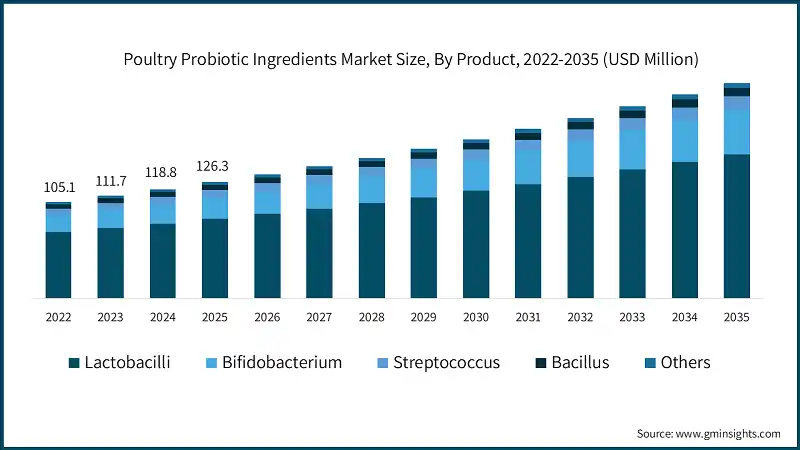

Based on product, the poultry probiotic ingredients market is segmented into Lactobacilli, Bifidobacterium, Streptococcus, Bacillus, and others. Lactobacilli dominated the market with an approximate market share of 67.8% in 2025 and is expected to grow with a CAGR of 6.2% from 2026 to 2035.

- Lactobacilli dominates due to its optimal balance between gut colonization capability, pathogen inhibition efficacy, and proven performance across diverse poultry species and production systems, providing excellent acid tolerance, versatile application suitability, and demonstrated benefits across broiler production, layer operations, and breeding programs. This probiotic strain provides superior intestinal health support through lactic acid production while maintaining competitive exclusion against pathogenic bacteria in commercial poultry operations. Its established position in antibiotic-free broiler production, commercial layer farms, and integrated poultry operations, coupled with proven compatibility with diverse feed formulations and production environments, solidifies its leading market position across poultry-producing regions globally.

- Bifidobacterium represents the fastest-growing segment with a CAGR of 8.0% from 2026 to 2035, driven by superior performance characteristics including enhanced immune modulation, excellent gut barrier function improvement, superior nutrient absorption enhancement, and synergistic benefits when combined with Lactobacilli strains compared to single-strain formulations. Advanced Bifidobacterium formulations enable application in demanding production scenarios requiring stress resistance, disease challenge protection, and early-life gut development in day-old chicks and young poultry. Growing adoption in premium poultry production, organic farming systems, and high-performance breeding operations, coupled with research validation of immunological benefits and multi-strain synergies, drive accelerating market penetration, particularly in developed markets with advanced poultry nutrition programs.

- Streptococcus occupies a significant segment with 6.5% market share in 2025, serving applications requiring performance characteristics complementary to Lactobacilli, combining rapid gut colonization with effective pathogen competition and feed fermentation enhancement. This probiotic strain provides enhanced performance for stress management in poultry operations, improved biological stability in diverse environmental conditions, and cost advantages through efficient production processes. Its established market presence in commercial broiler production, turkey farming, and waterfowl operations maintains steady demand supported by a CAGR of 5.5% through 2035, driven by balanced efficacy-to-cost ratios and versatility across diverse poultry species requiring gut health support beyond conventional single-strain Lactobacilli products.

Learn more about the key segments shaping this market

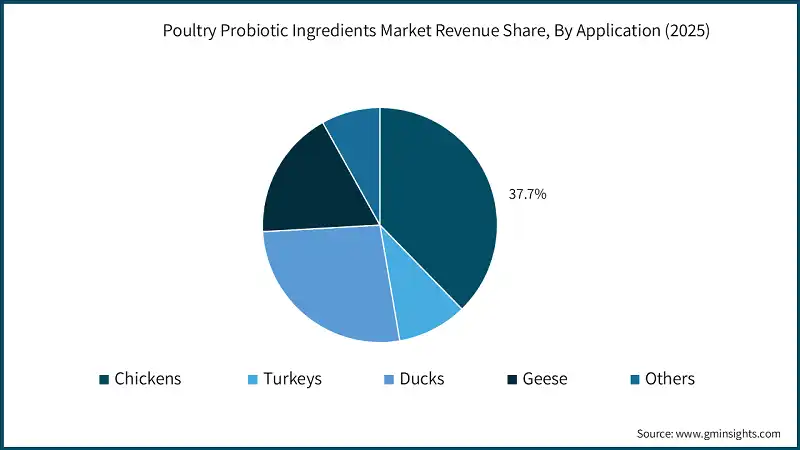

Based on application, the poultry probiotic ingredients market is segmented into chickens, ducks, geese, turkeys, and others. Chickens dominated the market with an approximate market share of 37.7% in 2025 and is expected to grow with a CAGR of 6.6% from 2026 to 2035.

- Chickens dominate due to their overwhelming representation in global poultry production volumes, accounting for the majority of commercial meat and egg production worldwide, with extensive broiler operations and layer farms requiring comprehensive gut health management solutions. This application segment benefits from well-established probiotic protocols, extensive research validation across production stages, and proven return on investment through improved feed conversion ratios, reduced mortality, and enhanced production efficiency. The segment's dominance is reinforced by large-scale integrated operations, antibiotic-free production initiatives, and continuous optimization of broiler performance and layer productivity across North America, Europe, and Asia Pacific markets, driving sustained probiotic adoption in conventional, cage-free, and organic chicken production systems.

- Ducks represent the fastest-growing segment with a CAGR of 7.1% from 2026 to 2035, driven by expanding commercial duck production in Asia Pacific, particularly in China, Vietnam, and Thailand, coupled with increasing adoption of intensive farming systems requiring advanced gut health management solutions. Growing consumer demand for duck meat in Asian markets, expansion of commercial duck farming operations, and increasing recognition of probiotic benefits for waterfowl digestive health and disease resistance drive accelerating market penetration.

- The segment benefits from rising production standards, transition from traditional to commercial farming methods, and expanding export-oriented duck production facilities requiring consistent performance and food safety compliance, particularly in high-growth Asian markets with strong cultural preferences for duck consumption.

- Geese occupy a significant segment with 17.8% market share in 2025, serving commercial goose production operations primarily concentrated in Asia Pacific and Europe, requiring specialized probiotic formulations adapted to waterfowl digestive physiology and production systems. This application segment provides opportunities for premium probiotic products addressing specific challenges in goose farming including seasonal production patterns, foie gras production requirements, and traditional farming practices transitioning to commercial operations. Its established market presence in China, Hungary, France, and Poland maintains steady demand supported by a CAGR of 6.1% through 2035, driven by growing commercialization of goose production, increasing quality standards in specialty meat markets, and expanding applications in both meat production and down feather operations requiring optimal bird health and performance.

Looking for region specific data?

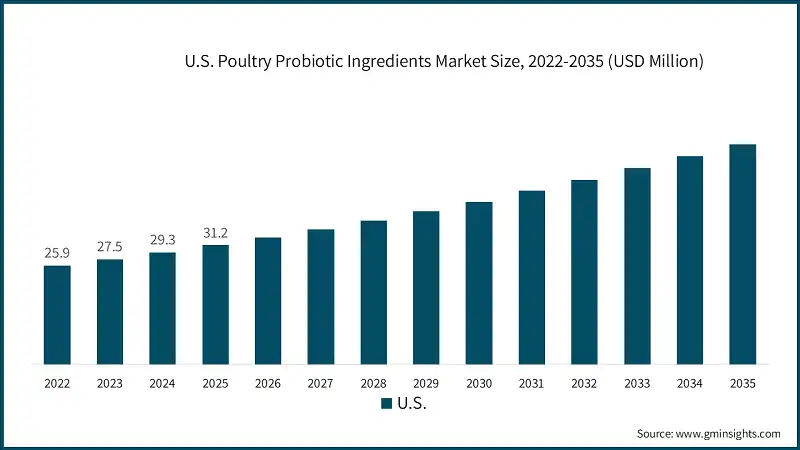

The U.S. poultry probiotic ingredients market accounted for USD 31.2 million in 2025.

- The strong momentum for poultry probiotic ingredients in North America comes primarily from the U.S., wherein consistent demand is driven by well-established commercial broiler production facilities consuming Lactobacilli formulations for gut health optimization and feed conversion improvement, extensive antibiotic-free poultry farming initiatives requiring multi-strain probiotic solutions for natural growth promotion and disease resistance, and robust integrated poultry operations utilizing advanced probiotic protocols for layer productivity enhancement. Constant emphasis on sustainable poultry production and antibiotic reduction commitments, sophisticated nutrition programs incorporating precision probiotic applications across production stages, and established technical service capabilities consistently elevate the country's market position. The presence of major producers including Chr. Hansen Holding A/S, Novus International, Inc., and Kemin Industries, Inc. ensures sustained supply and market leadership.

The poultry probiotic ingredients market in Germany is estimated to experience significant and promising growth from 2026 to 2035.

- Poultry probiotic ingredients growth in Europe is integral due to strong regulatory restrictions on antibiotic use in livestock, mature organic and free-range poultry production systems, and well-established animal welfare standards requiring natural health solutions. In Germany, producers focus on high-quality multi-strain formulations meeting stringent EU regulations for feed additives, encapsulated probiotic products addressing heat stability requirements in pelleted feed production, and specialty formulations for organic broiler and layer operations. Germany's leadership in sustainable agriculture and animal welfare standards, combined with premium poultry production systems, antibiotic-free farming operations requiring advanced gut health solutions, and organic poultry sectors utilizing specialized probiotic protocols, positions the market for sustained expansion as producers prioritize novel strain development and scientifically validated formulations for demanding European poultry production standards.

The poultry probiotic ingredients market in China is estimated to experience significant and promising growth from 2026 to 2035.

- Asia Pacific is the fastest-growing region in the market and includes China, India, Thailand, Vietnam, and Indonesia. China remains the most essential growth driver, increasingly driven by massive poultry production capacity representing the world's largest broiler and duck farming base generating enormous probiotic consumption, explosive growth in commercial poultry farming transitioning from traditional backyard systems requiring comprehensive gut health management solutions, and expanding antibiotic-free production initiatives driven by food safety regulations and export requirements. The country is experiencing both increased domestic poultry probiotic ingredients production from Chr. Hansen, Biomin, and local manufacturers and rising consumption across broiler production, layer operations, and waterfowl farming, thus becoming the dominant regional player.

The poultry probiotic ingredients market in Saudi Arabia is estimated to experience significant and promising growth from 2026 to 2035.

- The market keeps steadily growing in the Middle East and Africa catered by expanding poultry production self-sufficiency initiatives, massive commercial broiler farming investments supporting food security objectives, and developing integrated poultry operations requiring modern nutrition solutions. Development of large-scale poultry complexes, government-supported agricultural diversification programs, and increasing quality standards drive demand for poultry probiotic ingredients across the region. In Saudi Arabia, Vision 2030 food security programs promoting domestic poultry production capacity expansion and modern farming practices, growing commercial broiler operations consuming Lactobacilli and multi-strain formulations for performance optimization, and emerging layer farming capacity drive increased poultry probiotic adoption for antibiotic-free broiler production, layer productivity enhancement, and disease prevention supporting the Kingdom's agricultural self-sufficiency goals beyond oil-dependent economy.

Brazil is estimated to experience significant and promising growth from 2026 to 2035.

- Brazil is contributing to the poultry probiotic ingredients market in Latin America owing to its position as a leading global poultry exporter producing chicken meat for international markets with stringent antibiotic residue requirements, extensive integrated broiler operations requiring comprehensive gut health programs for export compliance, and growing domestic consumption driving production expansion. With Brazil's poultry production accelerating and demand for probiotic ingredients in broiler performance optimization and feed conversion improvement, antibiotic-free production for European and Middle Eastern export markets.

Poultry Probiotic Ingredients Market Share

The markets are moderately consolidated, with players such as Novus International, Inc., Evonik Industries AG, Adisseo France SAS, Kemin Industries, Inc. and International Animal Health Products. collectively accounting for a significant share of global supply in 2025, supported by their comprehensive strain portfolios, global production footprints, and long-term relationships with feed manufacturers, poultry integrators, and commercial farming operations.

- Poultry probiotic ingredients producers are actively engaged in strain development and R&D to improve gut colonization efficiency, enhance pathogen inhibition capabilities, increase heat stability for feed processing, and optimize multi-strain synergies including Lactobacilli-Bifidobacterium combinations, Bacillus spore formers, and targeted Streptococcus strains. Continuous innovations in encapsulation technology, spore-forming strain selection, microencapsulation techniques for viability protection, and controlled-release formulations enable manufacturers to meet specifications for pelleted feed production, antibiotic-free broiler systems, high-performance layer operations, and waterfowl applications, supported by advanced testing including in vitro pathogen challenge assays, heat stability validation, and field performance trials.

- Through strategic collaborations with feed manufacturers, poultry integrators, nutrition research institutes, and commercial farming operations, suppliers strengthen market positioning and demand stability. These partnerships support co-development of application-specific formulations, secure long-term supply agreements with technical service commitments, and enable integration of comprehensive gut health programs across production systems, improving bird performance while supporting regulatory compliance including EU feed additive regulations, FDA GRAS status requirements, and antibiotic reduction initiatives for sustainable poultry production practices.

Poultry Probiotic Ingredients Market Companies

Major players operating in the poultry probiotic ingredients industry are:

- Novonesis (formerly Chr. Hansen)

- Novus International

- Biomin Holding GmbH

- Evonik Industries AG

- Adisseo France SAS

- Huvepharma AD

- Kemin Industries

- International Animal Health Products

- Pic-Bio, Inc.

- Neospark

- Lallemand Animal Nutrition

- Alltech

- Arm & Hammer Animal Nutrition

Novus International operates as a global leader in animal health and nutrition solutions, serving the animal agriculture industry across multiple species including poultry, swine, aquaculture, and ruminants. The company focuses on developing science-based feed additives and nutritional programs that improve animal performance, feed efficiency, and production sustainability.

Novus emphasizes an innovation-driven approach through internal R&D capabilities and open innovation partnerships with external scientists and research institutions. The company positions itself as a strategic partner to feed manufacturers, integrators, and commercial producers worldwide, offering comprehensive technical support and application services alongside its ingredient portfolio to address evolving industry challenges including antibiotic reduction and sustainable farming practices.

Evonik operates a dedicated Animal Nutrition division within its Nutrition & Care business segment, positioning itself as a science-driven solutions provider for sustainable animal protein production. The company offers integrated system solutions combining amino acids, functional feed additives including probiotics, feed quality services, and digital monitoring tools across poultry, swine, ruminants, and aquaculture sectors. Evonik emphasizes biotechnology expertise, fermentation capabilities, and microbiome modulation technologies to deliver gut health solutions and antibiotic alternatives.

The company maintains a global manufacturing footprint with multiple R&D centers and positions itself as a partner enabling efficient, sustainable livestock farming through precision nutrition, analytical services, and formulation support that reduce environmental impact while improving animal performance and producer profitability.

Adisseo operates as a worldwide leader in animal nutrition, focusing exclusively on developing and supplying nutritional solutions and feed additives for livestock and aquaculture industries. The company serves feed manufacturers, integrators, and producers across poultry, swine, ruminants, and aquaculture sectors with a comprehensive portfolio spanning essential nutrients, vitamins, enzymes, and specialty ingredients.

Adisseo positions itself as a science-based innovator with extensive R&D infrastructure and decades of nutritional expertise, offering integrated solutions that address feed efficiency, digestibility, animal health, and sustainability challenges. The company maintains a global presence with multiple research centers and production facilities, emphasizing technical service, formulation support, and sustainability-focused offerings including lifecycle analysis and feed digestibility services to support customers in achieving performance and environmental objectives.

Kemin Industries operates as a global ingredient manufacturer and biotechnology company serving animal nutrition and health markets through science-driven specialty ingredients and integrated services. The company provides solutions across livestock, poultry, and aquaculture sectors addressing feed quality, gut health, pathogen control, and nutritional optimization. Kemin emphasizes proprietary technologies including encapsulation, enzyme development, and intestinal health solutions, positioning itself as a trusted partner offering comprehensive support through customer laboratory services, application solutions, and technical consulting.

The company maintains a family-owned structure with global manufacturing facilities and regional technical teams, focusing on innovation, sustainability, and customer-centric problem-solving to improve animal performance, feed efficiency, and production outcomes while supporting antibiotic reduction and sustainable farming initiatives across diverse species and production systems.

International Animal Health Products operates in the animal health and nutrition sector, focusing on developing and supplying health solutions and nutritional products for livestock and poultry production systems. The company serves commercial farming operations, integrators, and animal health professionals with products and services aimed at improving animal welfare, disease prevention, and production performance.

The company positions itself within the competitive animal health marketplace alongside established global players, offering specialized formulations and technical support to address industry challenges including disease management, performance optimization, and sustainable production practices. The company maintains market presence through distribution partnerships and technical service relationships with producers and veterinary professionals, supporting the transition toward modern, efficient animal production systems in various regional markets.

Poultry Probiotic Ingredients Industry News

- In February 2025, Novonesis announced an agreement to acquire dsm-firmenich’s share of the Feed Enzyme Alliance for approximately USD 1.62 billion, dissolving the long-standing joint venture. The deal gives Novonesis full control over sales and distribution activities, strengthens its vertical integration across the animal biosolutions value chain, and enhances its market position by expanding its combined enzymes and probiotics portfolio for animal nutrition and health.

- In July 2022, Kemin Industries launched ENTEROSURE, a next-generation probiotic solution designed to improve intestinal health and resilience in poultry and livestock. Unveiled at a global event in Dubai, ENTEROSURE uses a proprietary blend of Bacillus strains to help control pathogenic bacteria such as Clostridium perfringens, Escherichia coli, and Salmonella, supporting gut health, animal productivity, and reduced reliance on antimicrobials.

The poultry probiotic ingredients market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and volume in terms of Kilo Tons from 2022–2035 for the following segments:

Market, By Product

- Lactobacilli

- L. acidophilus

- L. plantarum

- L. reuteri

- L. salivarius

- Others

- Bifidobacterium

- B. bifidum

- B. longum

- B. animalis

- Others

- Streptococcus

- S. thermophilus

- Enterococcus faecium

- Bacillus

- B. subtilis

- B. licheniformis

- B. amyloliquefaciens

- Others

- Others

Market, By Application

- Chickens

- Broilers

- Layers

- Breeders

- Turkeys

- Ducks

- Geese

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

What are the upcoming trends in the poultry probiotic ingredients industry?

Key trends include advanced strain development, formulation optimization, the shift towards antibiotic-free production systems, and increased investment in research for novel probiotic strains and alternative antimicrobial solutions.

What was the market share of chickens in the application segment in 2025?

Chickens held a dominant market share of approximately 37.7% in 2025 and are expected to grow at a CAGR of 6.6% from 2026 to 2035.

What was the valuation of the U.S. poultry probiotic ingredients market in 2025?

The U.S. market accounted for USD 31.2 million in 2025.

Who are the key players in the poultry probiotic ingredients market?

Key players include Novonesis (formerly Chr. Hansen), Novus International, Biomin Holding GmbH, Evonik Industries AG, Adisseo France SAS, Huvepharma AD, Kemin Industries, International Animal Health Products, and Pic-Bio, Inc.

What was the market share of Lactobacilli in 2025?

Lactobacilli dominated the market with an approximate share of 67.8% in 2025 and is projected to grow at a CAGR of 6.2% from 2026 to 2035.

What is the projected value of the poultry probiotic ingredients market by 2035?

The market is expected to reach USD 230.2 million by 2035, driven by advancements in strain development, formulation optimization, and the shift towards antibiotic-free production systems.

What is the projected size of the poultry probiotic ingredients market in 2026?

The market is expected to reach USD 134.2 million in 2026.

Poultry Probiotic Ingredients Market Scope

Related Reports