Home > Chemicals & Materials > Advanced Materials > Polytetrafluoroethylene (PTFE) Market

Polytetrafluoroethylene (PTFE) Market Analysis

- Report ID: GMI4842

- Published Date: Oct 2020

- Report Format: PDF

Polytetrafluoroethylene Market Analysis

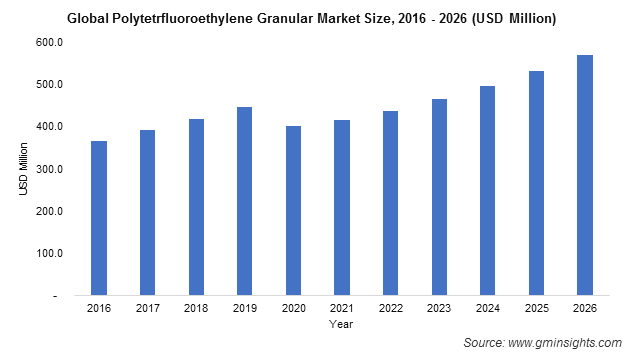

Granular PTFE accounted for substantial share of overall market in 2019 and estimated to grow at 6% CAGR by 2026. The form is ideally suited for molding variety of shapes including rods, ball valves, tubes, sheets, etc. Granular products are extensively used in making seal rings, valve seats, bearing pads, fittings, electrical insulations and many more components. Increasing demand for industrial parts in end-user industries will further create demand for this PFTE market segment.

Unmodified PTFE, also known as virgin polytetrafluoroethylene, is manufactured from 100% pure polytetrafluoroethylene. The product possesses superior chemical resistance and electrical insulation properties. Unmodified type is preferred in food & beverages, pharmaceuticals, cosmetics, etc. industries.

Suspension process will witness over 5% CAGR in global polytetrafluoroethylene market by 2026. This process produces granulated or powdered PTFE, which are utilized in manufacturing of gaskets, valves, seals, expansion joints, pipes, electrical insulators, etc. applications. Proliferation of industrial components manufacturing in emerging countries will create demand for suspension process during 2016 to 2026.

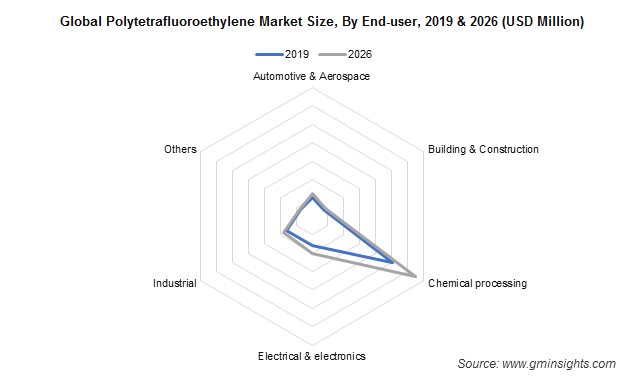

Chemical processing end use industry accounted for more than 45% share of global polytetrafluoroethylene market during 2016 to 2026. This can be attributed to superior product properties including corrosion resistance, chemical inertness, electrical insulation, heat resistance, etc.

Increasing production of chemicals worldwide will enhance penetration of PTFE over next few years. Globally, chemical production output has been estimated to cross USD 3 trillion by 2020, which can be contributed to rising consumption of variety of chemical products in end-user industries. Such trends will further provide opportunity to PTFE market manufacturers by 2026.

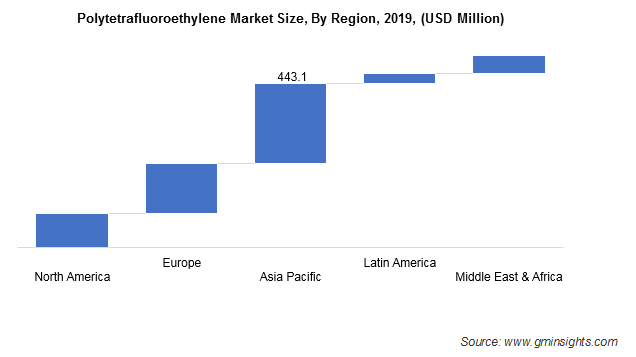

Asia Pacific was valued at over USD 440 million in 2019, which is expected to grow further by end of 2026. Presence of large number of chemical producers in major countries including China, India, Japan, etc. are expected to drive polytetrafluoroethylene market demand in near term.

Chinese chemical output is expected to cross a mark of USD 1.5 trillion by the end of 2020, which further drives their dominance in Asia Pacific polytetrafluoroethylene sector. Additionally, rising production of electrical & electronics products in major countries like, China, Japan and South Korea will increase the PTFE market consumption in Asian market.