Summary

Table of Content

Polypropylene (PP) Nonwoven Fabrics Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Polypropylene Nonwoven Fabrics Market Size

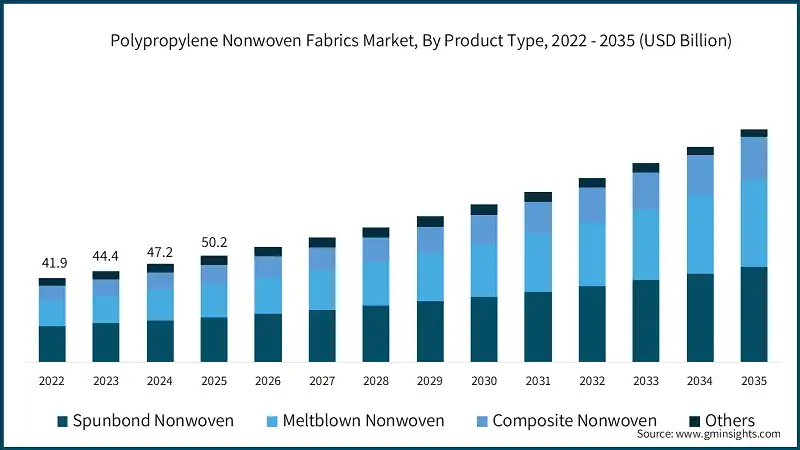

The global polypropylene nonwoven fabrics market was valued at USD 50.2 billion in 2025. It is projected to grow from USD 53.2 billion in 2026 to USD 100.3 billion by 2035, representing 7.3% CAGR from 2026 to 2035, according to latest report published by Global Market Insights Inc.

To get key market trends

- The polypropylene nonwoven fabrics market is expanding fast as there is an increasing demand for the products in medical and hygienic sectors. Due to its durability, lightweight and cost-effectiveness, PP nonwovens are commonly used in masks, gowns, diapers, and sanitary products. Greater medical rigidity and heightened health awareness have enhanced production and adoption in most parts of the world.

- The other area that has grown because of the application of PP nonwovens is the automotive industry where the material is used to make seat covers, headliners, and cabin filters. In electric vehicles and hybrids, lightweight and strong materials are popular, which makes the ride comfortable and efficient. These materials are rapidly being utilized by OEMs in order to cut down the weight and maximize costs.

- The demand for personal protective equipment (PPE) has been impressive, which favors the growth of the market. PP nonwovens have been found to protect against suits, masks, and gloves because they have an ability to protect against the barrier, and it is breathable. Increased production has been brought about by increasing workplace safety requirements in the health and industry sectors.

- The market has also been reinforced by the household products and the wipes segment. Wet wipes, cleaning cloth, and disposable kitchen items make use of PP nonwovens due to the softness and absorbency. The need to have convenient hygienic disposables has improved steady market acceptance.

Polypropylene (PP) Nonwoven Fabrics Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 50.2 Billion |

| Market Size in 2026 | USD 53.2 Billion |

| Forecast Period 2026-2035 CAGR | 7.3% |

| Market Size in 2035 | USD 100.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand in medical & hygiene products | Boosts market growth through increased healthcare and sanitation needs |

| Expansion of automotive interiors & filtration use | Enhances adoption in vehicle comfort and air quality applications |

| Growth in personal protective equipment (PPE) | Sustains demand due to ongoing safety and health compliance |

| Increasing use in wipes & household products | Strengthens consumer-driven segment for convenience and cleaning |

| Pitfalls & Challenges | Impact |

| Volatility in raw material prices | Creates cost uncertainty, impacting profitability and pricing strategies |

| Intense competition from alternative materials | Creates cost uncertainty, impacting profitability and pricing strategies |

| High energy & production costs | Reduces margins and challenges scalability for manufacturers |

| Opportunities: | Impact |

| Innovation in biodegradable PP blends | Opens eco-friendly product lines and attracts sustainability-focused buyers |

| Product diversification into specialty nonwovens | Enables entry into high-value niche applications |

| Digitalization in supply chain & quality control | Improves efficiency, traceability, and customer satisfaction |

| Market Leaders (2025) | |

| Market Leaders |

Market Share Approximately 4.8% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Latin America |

| Emerging countries | Brazil, Mexico |

| Future outlook |

|

What are the growth opportunities in this market?

Polypropylene Nonwoven Fabrics Market Trends

- One significant market trend in the PP nonwoven fabrics is the emphasis on sustainability and circular economy. The manufacturers are also embracing recycled material contents of PP and green production in order to comply with the requirements of the environment. The change is leading to recyclability redrafting, but it is still preserving the fabric performance, which are essential in making the market competitive.

- The market is getting changed due to technological developments in the manufacturing industry. The ability of meltblown and spunbond processes to be improved should provide better quality fibers and filtration performance and smart additives should offer antimicrobial, UV/resistant or flame resistant properties. These inventions increase applications of non-conventional courses.

- The market is being influenced by the optimization of supply chain and regional diversification. Firms are setting up nearer to end-users to minimize geopolitics risks and transport expenses. Localized production and localized alliances enhance resilience in supply especially in medical and industrial uses.

- Production is becoming increasingly digitalized and automated. High performance sensors, AI controlled systems and real time quality control enhance operational efficiency and eliminate defects and time-to-market. Such Industry 4.0 practices can be used to achieve high standards and resource optimization.

Polypropylene Nonwoven Fabrics Market Analysis

Learn more about the key segments shaping this market

Polypropylene (PP) nonwoven fabrics industry based on product type is segmented into spunbond nonwoven, meltblown nonwoven, composite nonwoven, and others. The spunbond nonwoven segment was valued at USD 21.7 billion in 2025, and it is anticipated to expand to 7.5% of CAGR during 2026-2035.

- The spunbond nonwoven segment is growing as a result of its lightweight, strong and multifunctional nature. It is popular in cleaning items, farming and car industries where strength and affordability are needed. The increase in demand of disposable and reusable products is pushing increased usage in a variety of industries.

- Meltblown and composite nonwovens have attracted special uses. Medical mask, respirator and filtration products Meltblown fabrics are also in the process of being used in medical masks, respirators and filtration products because of their fine fiber structure and high efficiency. Composite nonwovens, that is, when several layers are combined, find their application in the healthcare and automotive industries in which high durability and multi-functionality are needed, which contributes to a consistent growth in the market.

Learn more about the key segments shaping this market

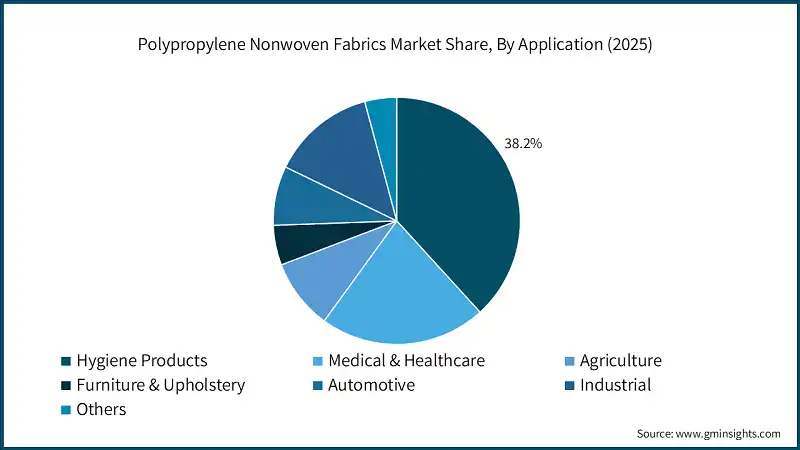

Polypropylene nonwoven fabrics market based on application is segmented into hygiene products, medical & healthcare, agriculture, furniture & upholstery, automotive, industrial, and others. The hygiene products segment was valued at USD 19.2 billion with a market share of with a market share of 38.2% in 2025, and it is anticipated to expand to 7.5% of CAGR during 2026-2035.

- The major areas of growth in the nonwovens in PP are hygiene, medical, and healthcare. Diapers, sanitary pads, surgical gowns, and protective equipment are some of the products that depend on these fabrics to make them comfortable, absorbent, and protective. These sectors are becoming more adopted as awareness on personal hygiene and infection control grows.

- Market growth is also caused by agriculture, furniture, automotive, and industrial uses. Nonwovens are employed in crop covers, insulation, seat covers, cabin filters and industrial filtration, have a long life and are cost-effective and functionally versatile. These fabrics are being used in many end-use applications that are expanding progressively due to the flexibility of these materials to various needs.

Looking for region specific data?

The North America polypropylene nonwoven fabrics market accounted for USD 12.9 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

In North America, the market of PP nonwoven fabrics is constantly growing due to the rising healthcare industry and hygiene industry. The market is adopted because of the rising demand on medical disposables, industrial wipe, and personal protective equipment. Automotive interiors and filtration are other markets that grow and add to the increasing consumption. To improve the quality standards, sustainability, and regulatory compliance, manufacturers are investing in high-quality production technologies and local facilities, which improves the development of the region market.

U.S. dominates the North America market, showcasing strong growth potential.

U.S. is also the fastest developed nation in the North America in terms of PP nonwovens consumption as a result of increasing awareness and health care consumption of hygienics. The demand is being driven by high uptake of PPE, surgical disposables and household wipes. The markets are being supported by technological development of meltblown and spunbond fabrics and investments in local manufacturing to minimize the risks associated with the supply chain. The emphasis on sustainable and high performance nonwovens is also boosting growth in this major market.

The Europe polypropylene nonwoven fabrics market accounted for USD 10.9 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

The market of Europe in PP nonwoven fabrics is growing owing to the robust industrial, medical, and hygiene usages. Surgical products, diapers and personal items are in demand. Automobile and filtration industries are also developing, which is an addition to market adoption. Strict environmental and safety policies are making manufacturers seek costly and recyclable nonwovens. Fabric innovations are being used to enhance the functionality, durability, and performance of fabrics to aid the growth of the entire market in the region.

Germany dominates the Europe market, showcasing strong growth potential.

The fastest growing country in Europe in terms of PP nonwoven is Germany, which is mostly driven by automobile and medical developments. The high level of usage of industrial filters, hygiene products, and PPE contribute to the development of the market. Research and development to create nonwovens that are eco-friendly and high performers increases adoption. Good industrial infrastructure, regulatory adherence, and sustainability orientation are driving the manufacturing and deployment of PP nonwovens, which will make Germany a prime growth driver to the region.

Asia Pacific polypropylene nonwoven fabrics market is anticipated to grow at a CAGR of 7.6% during the analysis timeframe.

The Asia Pacific PP nonwoven fabrics market is experiencing high growth rate, which is encouraged by the increased healthcare demand, awareness on hygiene and use by industries. Agricultural, automobile, and construction industries are on the rise, and this is putting pressure on the need to have durable and economical fabrics. Consumption is also being further facilitated by rapid urbanization and rising disposable incomes. Manufacturers are setting up local manufacturing centers and using hi-tech technology to support increasing regional demand as a way of increasing market penetration and application diversity.

China market is estimated to grow with a significant CAGR, in the Asia Pacific market.

China is the most rapidly developing nation in APAC in terms of the PP nonwovens because the country has good demand in medical, hygiene, and industrial fields. The fast rate of PPE, wipe, and filtration product adoption moves the market. Local manufacturers are scaled in production by investments in meltblown and spunbond production of high efficiency, as well as innovations in composite fabrics. The emphasis on sustainable and practical nonwovens helps expand its use in healthcare, agriculture, and automotive markets, and this is a strong point in China as far as the market is concerned.

The Latin America polypropylene nonwoven fabrics market is anticipated to grow at a CAGR of 8.6% during the analysis timeframe.

The Latin American market of nonwoven fabrics, especially the PP, is growing steadily due to the increased awareness of healthcare and adoption of hygiene products. Increased consumption is being encouraged by growth in agriculture, industrial filtration, and automotive application. The manufacturers are concentrating on domestic manufacturing to decrease the reliance on imports and enhance the reliability of supply. Growth of government efforts in healthcare infrastructure and sanitation is also contributing to the increased market in enhancing investments in the functionality and cost-effectiveness of nonwoven solutions.

Brazil leads the Latin America market, exhibiting remarkable growth during the analysis period.

The highest growing economy in Latin America to be used in PP nonwovens is Brazil since the country is experiencing increased demand of medical and hygiene products. Disposable surgical items, diapers, wipes, and PPE are increasing consumption. Investment in new manufacturing plants and the use of melting and spinning bond technologies are making the products more available. The hygienic and healthcare regulatory support, as well as the growing industrial and agricultural usage, are enhancing the market growth in Brazil.

Middle East & Africa polypropylene nonwoven fabrics market is expected to grow at a CAGR of 6.1% during the analysis timeframe.

The market of MEA PP nonwoven fabrics is booming as it is backed by health, hygiene and industry usage. Rising demand is being promulgated by the rise in awareness of sanitation, disposable products and PPE. Increased construction, automotive and filtration are also growth areas that lead to market adoption. The manufacturers are also looking into local production and regional alliances in order to fulfill changing needs. Emphasis on quality, strength, and light weight characteristics of nonwovens is assisting the market to grow in various final use industries.

Saudi Arabia market to experience substantial growth in the Middle East and Africa market in 2025.

The most rapidly developing country in MEA in terms of PP nonwovens is Saudi Arabia, the market of which is pushed by the healthcare and hygienic needs. The increase in demand for PPE, surgical supplies and household wipes encourages the development of the market. Local production and use of superior meltblown and spunbond technologies are improving the availability of products. Safety, quality and functional nonwovens are all contributing to fast market growth in the country.

Polypropylene Nonwoven Fabrics Market Share

- Freudenberg Group, Kimberly-Clark Corporation, PFNonwovens A.S., NW Fabric, and DuPont de Nemours, Inc. are a significant part of the global polypropylene (PP) nonwoven fabrics industry and with further standing highly fragmented with the top five players steadily holding 12.9% market share in the year 2025.

- Product innovation and technology acceptance are major concerns of the market players that create more sophisticated spunbond, meltblown, and composite nonwovens with greater durability, filtration capability, and performance, reinforcing their status in the most important markets such as medical, hygiene and industrial markets.

- To satisfy the increasing demand in all parts of the world, lessen the supply chain risks, and cater to the local markets effectively, companies invest in increasing their production capacities and creating regional manufacturing centers to ensure the high-quality PP nonwovens remain readily available.

- The collaboration and strategic partnerships with healthcare, automotive, and industrial end-users contribute to aligning products to the needs of the market and, therefore, adopting new ones faster and keeping a competitive advantage in such essential segments as PPE and filtration.

- The emphasis on sustainability efforts and recyclable nonwoven services enables players to address the changing regulatory and consumer needs and position themselves optimally in the light of increased environmental issues in the healthcare and hygiene usage of the product.

- Companies are constantly improving quality control and compliance norms, and the stringent regulations on medical and industrial nonwovens are considered and reinforcing trust amongst the buyers, which enhances their market credibility.

- Investments in research and development result in innovation of functional additives, composite structures, and specialty fabrics so that high value application may be broadened and that the company may be distinguished against other participants in the crowded market of nonwoven PP.

- Companies are deeply integrated with their distribution and supply channel, logistics and deliveries are streamlined to the industrial, medical and consumer sectors to keep the firm in the market and to effectively respond to the fluctuating needs in the region.

- Customer loyalty is increased through brand reputation and customer engagement models such as after sales services and technical advice which helps the company to maintain the market share and affect the trends in the adoption of nonwovens in hygiene and health care and industrial markets.

- Digitalization and automation of operations enable manufacturers to become more efficient, cost-effective, and flexible in scaling production, which supports their competitive advantage and forms the market by offering high-performance and credible PP nonwoven products.

Polypropylene Nonwoven Fabrics Market Companies

The major players operating in polypropylene nonwoven fabrics industry include:

- Freudenberg Group

- Kimberly-Clark Corporation

- PFNonwovens A.S.

- NW Fabric

- DuPont de Nemours, Inc.

- Others

DuPont de Nemours, Inc. has enhanced its market position in the nonwoven fabrics industry based on the high-performance materials in medical, hygiene, and industrial markets. Their stance is supported by the constant introduction of innovation, the development of production technologies, and the establishment of the strategic partnership with healthcare and industrial clients.

NW Fabric focuses on the individualized approach to filtration, hygiene, and industrial nonwovens. They maintain their positions in the market through special production facilities, quality continuity, and responsiveness to changing client demands.

Freudenberg Group can stay competitive as it provides a high variety of spunbond, meltblown, and composite nonwovens to be used in the automotive, hygiene, and industrial markets. They are engaged in environmental sustainability, investment in research and development and international distribution channels to retain market presence.

PFNonwovens A.S. builds its position in the market by introducing innovation in the high-quality nonwoven fabrics in hygienic, medical, and filtration uses. The company is at the forefront by increasing production capacities, compliance with regulations, and the delivery of reliable supply to its global customers of the company.

Kimberly-Clark Corporation specializes in hygiene and healthcare nonwovens with a combination of high technology and product development. They maintain their relevance in the market because they respond to consumer trends, maintain the quality of their products, and apply the powerful network of distribution and brand.

Polypropylene Nonwoven Fabrics Industry News

- In April 2025, Freudenberg Performance Materials released a new collection of thin spunbond nonwoven, which are customized to suit various industries such as filtration, construction and packaging. This advancement increased performance selections through PP nonwoven applications, which enhanced wider adoption and technical progress through hygiene and industrial applications.

- In November 2024, Berry Global and Glatfelter finalized the development of Magnera, which combined their nonwoven and films business units. This integration gave production scale and increased PP nonwoven portfolios, which affected the competitive positioning and product availability in hygiene and medical markets.

- In May 2024, DuPont declared that it would separate into three companies, restructure business units to focus on innovation and performance materials. This reorganization also had an impact on the nonwoven market because it allowed more specific investment and R&D of industrial and specialized nonwoven products, greater agility in medical and filtration divisions.

The polypropylene nonwoven fabrics market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) & volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Product Type

- Spunbond Nonwoven

- Single-layer spunbond

- Multi-layer spunbond

- Meltblown Nonwoven

- Pure meltblown

- Meltblown composites

- Composite Nonwoven

- Spunbond + Meltblown (SM)

- Spunbond + Meltblown + Spunbond (SMS)

- Others

Market, By Application

- Hygiene Products

- Baby diapers

- Feminine hygiene products

- Adult incontinence products

- Medical & Healthcare

- Surgical gowns

- Face masks

- Drapes and covers

- Agriculture

- Crop protection covers

- Seed blankets

- Furniture & Upholstery

- Mattress covers

- Cushion linings

- Automotive

- Interior trims

- Insulation layers

- Industrial

- Filtration media

- Geotextiles

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What are the key trends in the polypropylene (PP) nonwoven fabrics market?

Major market trends include increasing focus on sustainable and recyclable PP nonwovens, advancements in spunbond and meltblown technologies, and rising adoption in medical, hygiene, and filtration applications.

Which region leads the polypropylene nonwoven fabrics market?

North America accounted for USD 12.9 billion in 2025, making it one of the leading regional markets for polypropylene (PP) nonwoven fabrics. Growth is driven by strong demand for medical disposables, PPE, industrial wipes, and advanced healthcare infrastructure.

What was the valuation of the hygiene products application segment in 2025?

The hygiene products segment was valued at USD 19.2 billion in 2025, accounting for a significant share of the PP nonwoven fabrics market owing to high consumption of diapers, sanitary products, and adult incontinence items.

Who are the key players in the polypropylene nonwoven fabrics market?

Key players in the polypropylene (PP) nonwoven fabrics industry include Freudenberg Group, Kimberly-Clark Corporation, PFNonwovens A.S., NW Fabric, and DuPont de Nemours, Inc.

What is the growth outlook for the polypropylene (PP) nonwoven fabrics market from 2026 to 2035?

The PP nonwoven fabrics industry is projected to grow at a CAGR of 7.3% from 2026 to 2035, driven by expanding healthcare infrastructure, increasing hygiene awareness, and growing use in automotive and industrial filtration.

How much revenue did the spunbond nonwoven segment generate in 2025?

The spunbond nonwoven segment generated USD 21.7 billion in 2025, maintaining its leadership due to wide usage in hygiene products, agriculture, and automotive applications.

What is the projected value of the polypropylene nonwoven fabrics market by 2035?

The market size is expected to reach USD 100.3 billion by 2035, expanding at a CAGR of 7.3% from 2026 to 2035 due to sustained growth in hygiene products, PPE, and lightweight material usage across industries.

What is the current polypropylene nonwoven fabrics market size in 2026?

The PP nonwoven fabrics industry is projected to reach USD 53.2 billion in 2026, supported by rising adoption in healthcare disposables, automotive interiors, and filtration applications.

What is the market size of the polypropylene (PP) nonwoven fabrics market in 2025?

The market size for polypropylene nonwoven fabrics was valued at USD 50.2 billion in 2025 and is expected to grow at a CAGR of 7.3% during the forecast period, driven by strong demand across medical, hygiene, and industrial applications.

Polypropylene (PP) Nonwoven Fabrics Market Scope

Related Reports