Home > Chemicals & Materials > Polymers > Industrial Polymers > Polypropylene Absorbent Hygiene Market

Polypropylene Absorbent Hygiene Market Analysis

- Report ID: GMI11860

- Published Date: Oct 2024

- Report Format: PDF

Polypropylene Absorbent Hygiene Market Analysis

Environmental concerns over plastic waste present a significant restraint for the polypropylene absorbent hygiene industry. Polypropylene, a key material in baby diapers, adult incontinence products, and feminine hygiene items, is not biodegradable, contributing to the growing issue of plastic waste in landfills. As disposable hygiene products become more popular, particularly in developing regions, the environmental burden of these items has increased. Consumers and environmental advocacy groups are raising awareness about the long-term impact of such waste, putting pressure on manufacturers to adopt more sustainable practices.

This has led to a shift in consumer preferences toward eco-friendly or biodegradable alternatives, which can impact the demand for traditional polypropylene-based products. Additionally, stricter regulations regarding plastic usage and waste management are being implemented in several regions, further challenging market growth. As a result, manufacturers in the market must navigate these environmental concerns while balancing the demand for cost-effective, high-performance products.

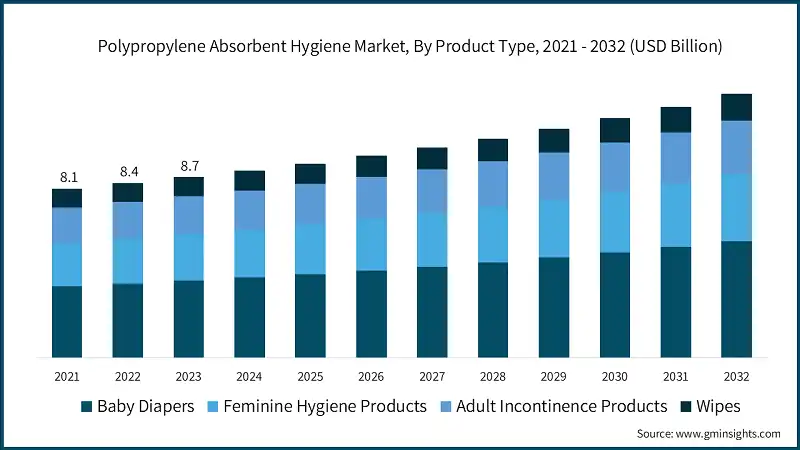

Based on product type, the market is segmented into baby diapers, feminine hygiene products, adult incontinence products and wipes. Baby diapers dominates the market by generating USD 3.7 billion revenue in the year 2023. Baby diapers dominate the polypropylene absorbent hygiene industry due to their high demand driven by increasing birth rates and growing awareness of infant hygiene among parents. The convenience and effectiveness of disposable diapers, which utilize polypropylene for superior absorbency and leak protection, make them a preferred choice for modern families. Additionally, innovations in diaper design, such as thinner and more comfortable options, further enhance their appeal, solidifying their market leadership. The continuous focus on product quality and safety also contributes to the sustained dominance of baby diapers in this sector.

Based on end use, the market is segmented into infants, women and adults. Infants hold a dominant market share of 49.1% in the market. Infants dominate the global market primarily due to the high consumption of baby diapers, which are essential for newborn care. The increasing birth rates in many regions and the emphasis on maintaining hygiene for infants drive substantial demand for disposable diapers. Parents prioritize convenience, comfort, and safety, leading to a preference for high-quality polypropylene products. Moreover, ongoing innovations in diaper technology enhance their absorbency and skin-friendliness, further solidifying the dominance of the infant segment in the market.

Based on distribution channel, the market is segmented into hypermarkets/supermarkets, pharmacies, e-commerce, wholesalers/distributors, hospitals and clinics. Hypermarkets/supermarkets hold a dominant market share of 34.6% in the market. Hypermarkets and supermarkets dominate the polypropylene absorbent hygiene market due to their extensive product offerings and convenience for consumers. These retail formats provide a one-stop shopping experience, allowing customers to easily purchase a variety of hygiene products, including baby diapers, feminine hygiene items, and adult incontinence products. The large floor space enables them to stock multiple brands and sizes, catering to diverse consumer needs. Additionally, promotional deals and discounts in these stores attract price-sensitive shoppers, further solidifying their market dominance. The ability to provide instant access to hygiene products makes hypermarkets and supermarkets a preferred choice for many consumers.

The U.S. polypropylene absorbent hygiene market was valued at USD 1.7 billion in 2023. In the U.S. market, the demand for disposable products such as baby diapers, adult incontinence products, and feminine hygiene items continues to rise. Factors driving this growth include an increasing focus on personal hygiene, a growing aging population, and higher disposable incomes that allow for premium product purchases. Additionally, innovative product designs and features, such as enhanced absorbency and skin-friendly materials, appeal to health-conscious consumers. The U.S. market also benefits from well-established retail channels, including hypermarkets, supermarkets, and e-commerce platforms, ensuring easy accessibility for consumers.

In North America, the polypropylene absorbent hygiene industry experiences similar growth trends, supported by strong demand across all demographic segments. Consumers in North America increasingly prioritize convenience and product quality, which drives the adoption of advanced hygiene solutions. Moreover, sustainability concerns are shaping market dynamics, prompting manufacturers to explore eco-friendly alternatives alongside traditional polypropylene products. Overall, North America remains a key player in the global market, characterized by a blend of innovation and consumer-centric approaches.