Summary

Table of Content

Polyisobutylene Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Polyisobutylene Market Size

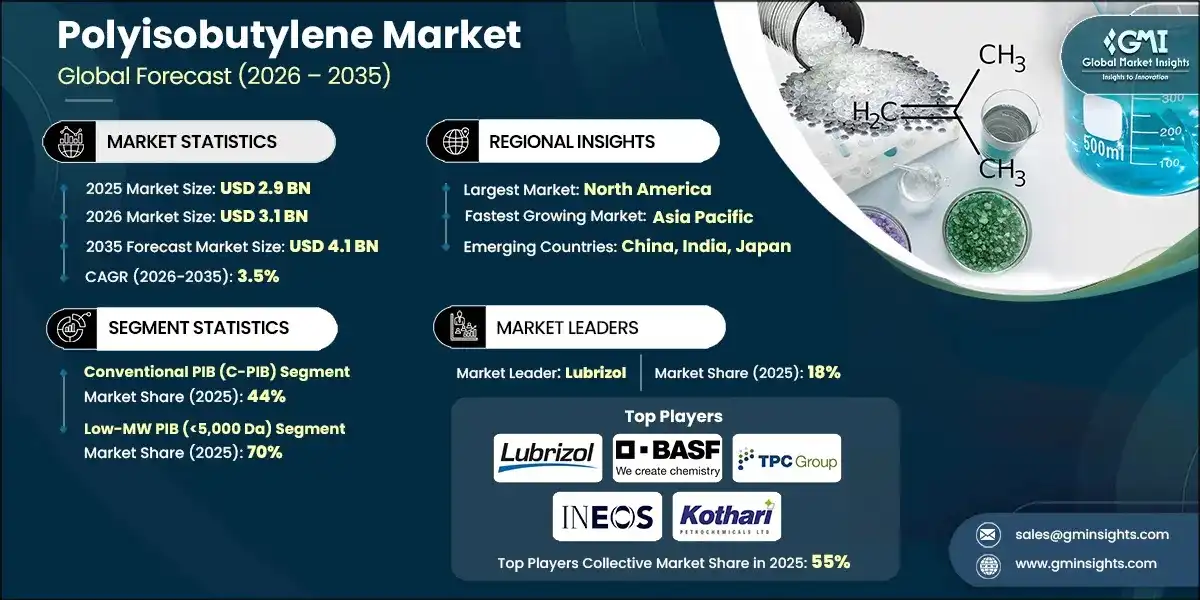

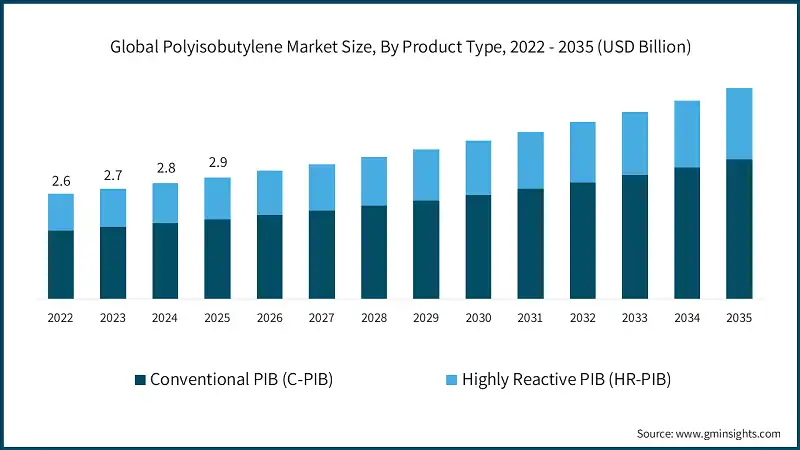

The global polyisobutylene market was valued at USD 2.9 billion in 2025 and is projected to expand from USD 3.1 billion in 2026 to USD 4.1 billion by 2035, translating to a 3.5% CAGR over 2026–2035 according to latest report published by Global Market Insights Inc.

To get key market trends

- Rising automotive production and EV adoption boosts the polyisobutylene market through tires, inner liners, and dispersant-rich lubricants; global vehicle output hit 85.4 million units in 2023, while EV production rose ~35% YoY, reinforcing lubricant and tire raw_material demand. Tires account for 80–85% of butyl elastomer use, where PIB chemistry ensures low gas and moisture permeability which is key for retention and efficiency.

- Safety and quality standards in food contact and personal care continue to expand use of compliant PIB grades. U.S. FDA authorizes PIB in food-contact adhesives and coatings with minimum number_average MW requirements (≥ 37,000 Da for direct food contact; specific ranges for incidental contact in lubricants). Cosmetic and hydrogenated PIB grades offer stability and skin compatibility for emollient/film_former roles, supporting premium pricing in niche volumes.

- Infrastructure build_out in emerging markets fuels adhesives, sealants, and glazing demand, segments where PIB’s tack, flexibility, chemical resistance, and very low moisture vapor transmission stand out. APAC construction pipelines and policy programs (India’s PLI for auto components; Gulf mega_projects) sustain long_dated demand for PIB_based materials.

Polyisobutylene Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 2.9 Billion |

| Market Size in 2026 | USD 3.1 Billion |

| Forecast Period 2026-2035 CAGR | 3.5% |

| Market Size in 2035 | USD 4.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising automotive production and electric vehicle adoption boosting demand | Rising automotive production and adoption of electric vehicles boost demand for PIB, driving market growth. |

| Expanding use of PIB in food contact and personal care products | Expanding use of PIB in food contact and personal care products increases market versatility and demand. |

| Growing infrastructure and construction activities in emerging markets | Growing infrastructure and construction activities in emerging markets create new opportunities for PIB applications. |

| Pitfalls & Challenges | Impact |

| Fluctuating raw material prices impacting manufacturing costs | Fluctuating raw material prices impact manufacturing costs, potentially affecting profitability and price stability. |

| Opportunities: | Impact |

| Expanding applications in packaging, and sealant industries | Expanding applications in packaging and sealant industries present growth opportunities for the Polyisobutylene market. |

| Market Leaders (2025) | |

| Market Leaders |

18% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging country | Asia Pacific |

| Future outlook |

|

What are the growth opportunities in this market?

Polyisobutylene Market Trends

- Growing demand for bio_based and sustainable PIB Regulatory tightening is putting a premium on greener routes and cleaner plants. TSCA proposals remove certain exemptions, increasing the burden on new chemicals with PBT profiles, while EU REACH programs keep raising the bar on dossier depth and ongoing compliance conditions that redirect R&D toward bio_based feedstocks and lower_impact catalysts. Multiple pilot efforts are testing isobutanol_to_isobutylene pathways, with more than 20 bio_isobutylene projects in development worldwide and roughly 18% of industry R&D spend aligned to these alternatives a marker of strategic commitment even if scale_up hurdles persist.

- Polyisobutylene market draws most of its value from lubricant additives, and regulation keeps turning the screw. Euro_7 lands in late 2026, while ILSAC GF_7 specification updates push for tighter discrepancy, oxidation control, and low_SAPS chemistry which is perfect territory for HR_PIB_based PIBSI systems. HR_PIB’s terminal vinylidene content (70–95%) enables efficient derivatization to PIBSA/PIBSI, and case studies show lower deposits and better oxidation resistance when optimized for high_vinylidene content and lower viscosity indices. Asia Pacific already accounts for about 40% of automotive lubricant demand, so that’s where additive_driven growth amplifies. On the rubber side, tire raw_material consumption reached 57.2 million tonnes in 2025 and is trending toward 67.42 million tonnes by 2030.

- Manufacturing advances improve quality and efficiency breaking it down, three vectors matter, catalysts, process intensification, and digitalization. Industry is stepping away from corrosive AlCl3/BF3 systems toward solid acids, supported ionic liquids, and even single_site metallocenes that run at milder conditions, cut waste, and tighten molecular_weight distribution and vinylidene control. Supported catalysts have been shown to halve AlCl3 dosage without sacrificing performance, while continuous flow and solvent_free approaches raise yield and improve consistency. Innovators report routes to high_MW PIB at higher temperatures than legacy cryogenic specs and improving yields from ~70% to near_quantitative levels.

Polyisobutylene Market Analysis

Learn more about the key segments shaping this market

Based on product type the market is segmented as conventional PIB (C-PIB), and highly reactive PIB (HR-PIB).

- Conventional PIB (C_PIB) held dominant market share of about 44% in 2025, serving broad use in adhesives, sealants, industrial oils, chewing gum base, and coatings where cost and established specs take priority over extreme reactivity. Demand in the polyisobutylene market for C_PIB tracks construction and packaging, which favor PIB’s tack, flexibility, and moisture barrier. Pricing for C_PIB typically spans USD 0.8–1.5/kg depending on MW and purity, and producers like BASF, INEOS, and TPC maintain significant supply positions.

- Highly reactive PIB (HR_PIB) accounted for USD 1.6 billion market size in 2025, and remains the faster_growing tier as lubricant specifications tighten and EVs raise cleanliness and oxidation bars. HR_PIB’s 70–95% vinylidene content enhances derivatization efficiency into PIBSA/PIBSI dispersants critical for API SP/ILSAC GF_7 and Euro_7_aligned

Learn more about the key segments shaping this market

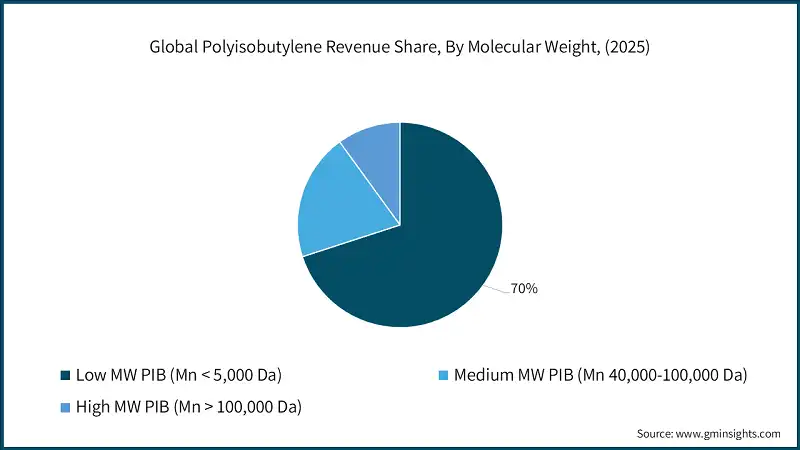

Based on molecular weight the market is segmented as low MW PIB (Mn < 5,000 Da), medium MW PIB (Mn 40,000-100,000 Da), and high MW PIB (Mn > 100,000 Da).

- Low_MW PIB (<5,000 Da) dominates market at 70% share in 2025, anchored in dispersants and fuel detergents that require fluid processing and high_vinylidene variants for efficient functionalization. Fuel additive roles include deposit control for injectors and intake valves in DI engines, supporting fleet efficiency improvements where combustion remains relevant. Medium_MW PIB (40,000–100,000 Da) carries roughly 20% market share in 2025, targeting pressure_sensitive and hot_melt adhesives and construction sealants, especially insulating glass units where ultra_low moisture transmission and adhesion to glass/metals matter.

- High_MW PIB (>100,000 Da) holds 10% market share in 2025, serving chewing gum base, medical devices, and specialized sealants that require non_toxicity, tastelessness, and formidable barrier strength a niche supported by FDA frameworks. Process advances are raising yields and lifting temperature windows for high_MW production, widening the feasible spec envelope for medical and food_grade uses.

Looking for region specific data?

The U.S. polyisobutylene market was valued at USD 798.3 million in 2025 and estimated to grow to almost USD 1.1 billion by 2035. North America holds around 33% of the market share in 2025.

- The North America market is anchored by automotive hubs, merchant HR_PIB supply, and a dense network of additive formulators. The U.S. contributes the bulk of capacity, supported by shale_derived C4 streams and integrated petrochemical complexes like ExxonMobil’s Baytown, which produces over 8 billion pounds of petrochemicals annually including isobutylene feedstocks used in butyl and PIB chains. Canada’s lubricant blenders and automotive OEM suppliers pull PIB for dispersants, sealants, and packaging, complementing U.S. production and downstream qualification activity. While regional capacity has declined on net since 2000, merchant leaders such as TPC Group maintain flexible HR_PIB and conventional lineups serving lubricant and adhesive customers. EPA TSCA oversight and FDA approvals shape compliance_intensive niches like food contact adhesives and food_grade lubricants that value PIB’s inertness.

- The Europe polyisobutylene market holds around 31% of global share in 2025, with production concentrated in Germany, France, and Belgium. BASF’s Ludwigshafen and Antwerp Verbund sites are cornerstones for medium_ to high_MW Oppanol and HR_PIB Glissopal supply. REACH compliance and carbon policies push low_VOC and recyclable solutions, and producers report sizable emissions reductions through purification and recycling projects, reaching ~30% improvements in some cases. Premium automotive, pharma, and specialty packaging uses sustain higher_value mix and encourage ongoing debottlenecking, despite modest regional auto growth. Capacity utilization has been trimmed by roughly 9% under stricter emissions rules, and at least 15 facilities completed capital upgrades to comply both supportive of higher_spec, higher_margin product mix. Expect continued focus on HR_PIB and medium_/high_MW specialties where EU customers prioritize performance, traceability, and sustainability-linked attributes.

- The Asia Pacific polyisobutylene market is driven by automotive production, construction activity, and lubricant demand centred in China, India, Japan, and South Korea. China produced 30.2 million vehicles in 2023, and its construction output reached around USD 4.11 trillion in 2022, both supporting PIB pull through dispersants, sealants, and tire inner liners. South Korea’s Daelim brought a 25,000 t/y HR_PIB line online in 1Q 2024 to meet regional lubricant additive needs, while India’s PLI program and lubricant growth underpin HR_PIB expansion from domestic suppliers like Kothari Petrochemicals.

Polyisobutylene Market Share

The polyisobutylene industry shows moderate concentration, with the top five players Lubrizol, BASF SE, TPC Group, Ineos, and Kothari Chemicals held about 55% market share in 2025 which is enough to influence pricing and specs but leaving room for challengers with process or materials breakthroughs. Cabot Corporation is one of the major players owing to conductive carbons, CNTs, and specialty additives backed by a global footprint and fresh capacity moves, Kuraray follows through leadership in EDLC grade activated carbon, particularly into China. Haycarb’s coconut shell base provides renewable feedstock scale; and Applied Graphene Materials plus Skeleton anchor the innovation edge in engineered carbons and high throughput ultracap production.

- Lubrizol

- Lubrizol anchors the HR_PIB value chain through PIBSI dispersant technology used in modern engine oils. Its stewardship notes typical PIBSI molecular weights around 1,000–3,000 Da and details applications across gasoline/diesel engine oils, transmissions, and industrial lubricants capabilities that align directly with API SP/ILSAC GF_7 and emerging OEM specs. Strategy-wise, Lubrizol prioritizes value_added derivatives, extensive OEM approval pipelines, and technical service to reduce customer time_to_qualification in critical engine tests.

- Lubrizol anchors the HR_PIB value chain through PIBSI dispersant technology used in modern engine oils. Its stewardship notes typical PIBSI molecular weights around 1,000–3,000 Da and details applications across gasoline/diesel engine oils, transmissions, and industrial lubricants capabilities that align directly with API SP/ILSAC GF_7 and emerging OEM specs. Strategy-wise, Lubrizol prioritizes value_added derivatives, extensive OEM approval pipelines, and technical service to reduce customer time_to_qualification in critical engine tests.

- BASF SE

- BASF SE operates a comprehensive PIB platform under Oppanol (medium/high_MW) and Glissopal (HR_PIB) brands with integrated Verbund economics across Ludwigshafen, Antwerp, Kuantan, and Nanjing. The company expanded medium_MW capacity at Ludwigshafen by ~25% and launched OPPANOL C in North America to simplify handling and enable tighter formulation control in gum, sealants, and specialty uses. BASF’s roadmap emphasizes sustainability, high_spec grades, and collaborative application development.

- BASF SE operates a comprehensive PIB platform under Oppanol (medium/high_MW) and Glissopal (HR_PIB) brands with integrated Verbund economics across Ludwigshafen, Antwerp, Kuantan, and Nanjing. The company expanded medium_MW capacity at Ludwigshafen by ~25% and launched OPPANOL C in North America to simplify handling and enable tighter formulation control in gum, sealants, and specialty uses. BASF’s roadmap emphasizes sustainability, high_spec grades, and collaborative application development.

- TPC Group

- TPC Group supplies both conventional and HR_PIB to merchant markets in North America with proprietary process flexibility. Its PIBplus epoxidized PIB platform extends functional chemistry for dispersants and specialty derivatives, enabling improved oxidation stability vs. conventional PIBSI in select use_cases. TPC’s positioning blends capacity optimization with targeted innovation and a strong regional distribution footprint.

- TPC Group supplies both conventional and HR_PIB to merchant markets in North America with proprietary process flexibility. Its PIBplus epoxidized PIB platform extends functional chemistry for dispersants and specialty derivatives, enabling improved oxidation stability vs. conventional PIBSI in select use_cases. TPC’s positioning blends capacity optimization with targeted innovation and a strong regional distribution footprint.

- Kothari Petrochemicals

- Kothari Petrochemicals dominates India’s HR_PIB supply, meeting 91% of 2024 domestic needs and announcing land acquisition investments to add capacity. The company is well_positioned to benefit from India’s PLI program and lubricant demand growth tied to vehicle production and industrialization.

- Kothari Petrochemicals dominates India’s HR_PIB supply, meeting 91% of 2024 domestic needs and announcing land acquisition investments to add capacity. The company is well_positioned to benefit from India’s PLI program and lubricant demand growth tied to vehicle production and industrialization.

- INEOS

- INEOS offers Indopol grades with breadth across conventional PIB molecular weights, serving adhesives/sealants, gum base, and industrial lubricants in North America and Europe. Its competitive edge stems from operational flexibility and application support for customers optimizing tack, viscosity, and barrier traits in pressure_sensitive and hot_melt systems.

- INEOS offers Indopol grades with breadth across conventional PIB molecular weights, serving adhesives/sealants, gum base, and industrial lubricants in North America and Europe. Its competitive edge stems from operational flexibility and application support for customers optimizing tack, viscosity, and barrier traits in pressure_sensitive and hot_melt systems.

Polyisobutylene Market Companies

Major players operating in the polyisobutylene industry are:

- Braskem SA

- RB Products

- TPC Group

- Lanxess

- Nfineum International Ltd

- Kothari Petrochemicals

- Janex

- ExxonMobil Corporation

- Berkshire Hathaway

- Lubrizol

- Chevron Oronite Company

- Mayzo

Polyisobutylene Industry News

- In November 2024, Kothari Petrochemicals announced land acquisition of USD 9 million to expand HR_PIB capacity and sustain its 91% share of India’s HR_PIB supply, aligned to PLI_driven lubricant demand growth.

- In August 2023, BASF completed ~25% capacity expansion for medium_MW Oppanol at Ludwigshafen. This expansion is expected to further strengthen BASF’s supply reliability. The investment came in response to the rising demand for high quality polyisobutenes.

The polyisobutylene market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Kilo Tons) from 2021 to 2034, for the following segments:

Market, By Product Type

- Conventional polyisobutylene (C-PIB)

- Highly reactive polyisobutylene (HR-PIB)

Market, By Molecular Weight

- Low molecular weight PIB (Mn < 5,000 Da)

- Medium molecular weight PIB (Mn 40,000-100,000 Da)

- High molecular weight PIB (Mn > 100,000 Da)

Market, By Application

- Lubricant additives

- Fuel additives

- Adhesives & sealants

- Tires & rubber products

- Electrical insulation

- Personal care & cosmetics

- Food contact applications

- Stretch films & packaging

- Others

Market, By Grade

- Food-grade PIB

- Cosmetic-grade PIB

- Pharmaceutical-grade PIB

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Which region leads the polyisobutylene market?

North America held approximately 33% market share in 2025. The region benefits from automotive hubs, merchant HR-PIB supply, and shale-derived C4 feedstock streams.

What is the market share outlook for low molecular weight PIB in 2025?

Low molecular weight PIB (<5,000 Da) dominated the market with 70% share in 2025, anchored in dispersants and fuel detergents that require fluid processing and high-vinylidene variants for efficient functionalization.

What was the market share of the conventional PIB (C-PIB) segment in 2025?

Conventional PIB (C-PIB) held approximately 44% market share in 2025, serving broad applications in adhesives, sealants, industrial oils, chewing gum base, and coatings where cost and established specifications take priority.

What are the key trends in the polyisobutylene market?

Key trends include rising demand for bio-based and sustainable PIB, driven by bio-isobutylene projects and stricter Euro-7 and ILSAC GF-7 lubricant standards.

Who are the key players in the polyisobutylene market?

Key players include Lubrizol, BASF SE, TPC Group, INEOS, Kothari Petrochemicals, Braskem SA, RB Products, Lanxess, Infineum International Ltd, Janex, ExxonMobil Corporation, Berkshire Hathaway, Chevron Oronite Company, and Mayzo.

How much revenue did the highly reactive PIB (HR-PIB) segment generate in 2025?

Highly reactive PIB (HR-PIB) generated USD 1.6 billion in 2025, driven by its 70-95% vinylidene content that enhances derivatization efficiency into PIBSA/PIBSI dispersants critical for advanced lubricant specifications.

What is the projected value of the polyisobutylene market by 2035?

The polyisobutylene market is expected to reach USD 4.1 billion by 2035, propelled by expanding applications in packaging and sealant industries, infrastructure build-out in emerging markets, and tightening lubricant specifications.

What is the forecasted market size for polyisobutylene in 2026?

The market size is projected to reach USD 3.1 billion in 2026.

What is the market size of the polyisobutylene market in 2025?

The market size was USD 2.9 billion in 2025, with a CAGR of 3.5% expected through 2035 driven by rising automotive and EV production boosting demand for tires, inner liners, and lubricant additive applications.

Polyisobutylene Market Scope

Related Reports