Summary

Table of Content

Polyhydroxyalkanoate (PHA) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Polyhydroxyalkanoate Market Size

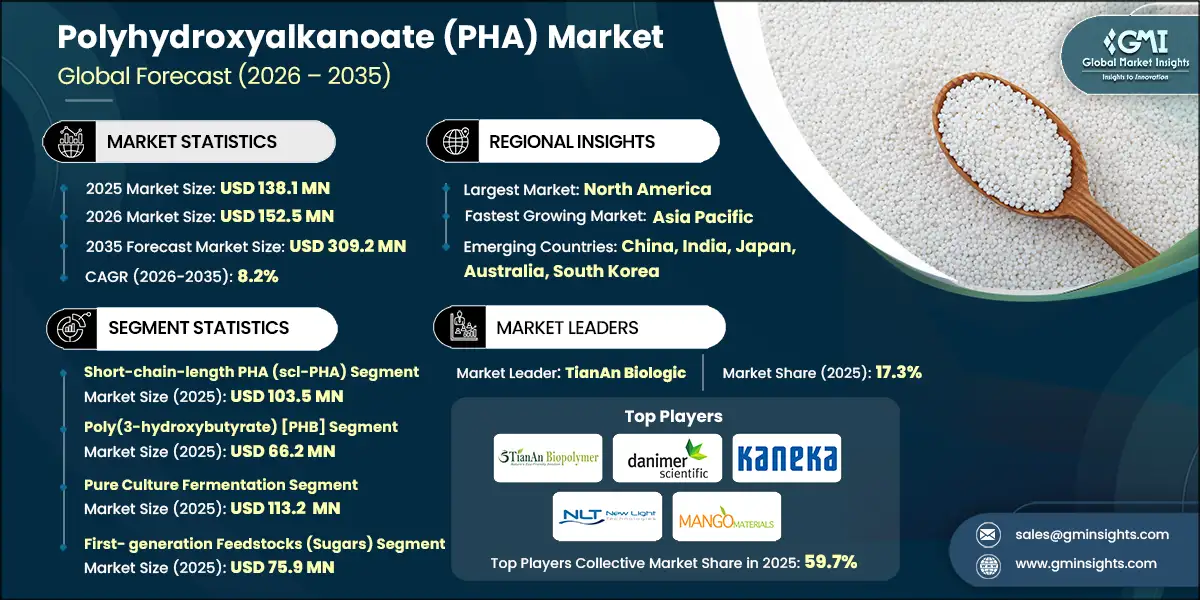

The global polyhydroxyalkanoate market was valued at USD 138.1 million in 2025. The market is expected to grow from USD 152.5 million in 2026 to USD 309.2 million in 2035, at a CAGR of 8.2% according to the latest report published by Global Market Insights Inc.

To get key market trends

- Polyhydroxyalkanoates (PHAs) belong to the group of biodegradable polymers produced naturally by certain microorganisms as internal energy-storage materials. When microorganisms grow under conditions of excess carbon and limited nutrients, the resulting polyhydroxyalkanoate (PHAs) material bears certain superficial properties that mimic those of conventional plastic. These polymers have aroused as biodegradable and biocompatible alternatives to petroleum-based plastics, thereby qualifying PHA for environmentally sustainable perspectives.

- Modern technology is facilitating further and faster shifts in PHA production as industries look to greener materials. Fermentation technology, genetic engineering, and low-cost feedstocks have made it economically feasible to produce PHAs on a commercial scale.

- Such technological enhancement has aided the gap that is usually existent between traditional and biodegradable plastics and is pushing PHAs toward more immediate application in food and packaging, medical, and consumer goods.

- The biodegradability of PHAs in such different natural environments as soil, freshwater, and marine ecosystems provides great benefits to the environment. PHAs degrade to harmless by-products like carbon dioxide and water, thus reducing long-term environmental pollution. They are also made from renewable substrates, which help to reduce fossil fuel dependence and ensure a valuable option towards a circular bioeconomy.

- PHAs are versatile materials that can be used for different mechanical and thermal properties, allowing for applications from flexible films to rigid containers. Packaging, agriculture, biomedical engineering, and even 3D printing industries are exploring or have adopted solutions based on PHAs. Driven by an increasing demand for greener materials and a reduction in price, PHAs emerge as a key player in sustainable materials and green manufacture.

Polyhydroxyalkanoate (PHA) Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 138.1 Million |

| Market Size in 2026 | USD 152.5 Million |

| Forecast Period 2026 - 2035 CAGR | 8.2% |

| Market Size in 2035 | USD 309.2 Million |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for biodegradable plastics | Increasing environmental awareness and global pressure to reduce plastic pollution are pushing industries toward sustainable alternatives like PHAs. |

| Technological advancements in microbial fermentation | Improved fermentation processes, genetic engineering, and optimized feedstocks are reducing manufacturing costs and increasing yield. |

| Expansion of end-use industries | Packaging, agriculture, biomedical, and consumer goods sectors are increasingly adopting PHA due to its biodegradability and versatility. |

| Pitfalls & Challenges | Impact |

| High production cost compared to fossil-based plastics | PHAs remain significantly more expensive, limiting their widespread adoption. |

| Competition from other bioplastics | PLA, starch-based plastics, and other lower-cost biopolymers may capture market share more quickly. |

| Opportunities: | Impact |

| High-performance PHA blends | By improving mechanical, thermal, and barrier properties, PHA are used in industries like automotive, electronics, and 3D printing beyond packaging. |

| Premium eco-friendly products | Positioning PHA-based products as sustainable and biodegradable helps attract environmentally conscious consumers and create a premium segment. |

| Circular economy integration | Using PHA in closed-loop systems, with collection, composting, or recycling, reduces waste, improves efficiency, and strengthens sustainability credentials. |

| Market Leaders (2025) | |

| Market Leaders |

17.3 % Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging country | China, India, Japan, Australia, South Korea |

| Future outlook |

|

What are the growth opportunities in this market?

Polyhydroxyalkanoate Market Trends

- The PHA market is expanding rapidly as industries and consumers search for sustainable alternatives to plastics. The increasing emphasis on environmental issues and the awareness of plastic pollution have been driving the application of PHAs in the packaging, single-use, and consumer goods industries. These biodegradable plastics are becoming one of the major solutions to the problems associated with global waste disposal.

- Technological advancements are a key driver for the PHA market's expansion. Continued success in improving production and cost efficiency, primarily through innovations in microbial fermentation, metabolic engineering, and the use of feedstocks like agricultural waste and CO2, are now making it possible to take PHA production to large-scale commercialization.

- Versatility applications of PHAs are leading their adoption across diversified industries. Besides packaging, the role of PHAs is increasingly being felt in biomedical devices, agriculture, textiles, and 3D printing applications. These materials can be tailored for biodegradability, biocompatibility, and other properties for possible targeting for high-value applications to meet differing performance requirements.

- Government actions and regulatory incentives are supporting PHA market globally. There are governmental incentives on sustainable materials, banning single-use plastics, and companies in general are being sustainable, driving further interest from manufacturers and end-users to adopt PHAs. All those factors are expected to favour long-term growth and entrench PHAs as mainstream alternatives to traditional plastics.

Polyhydroxyalkanoate Market Analysis

Learn more about the key segments shaping this market

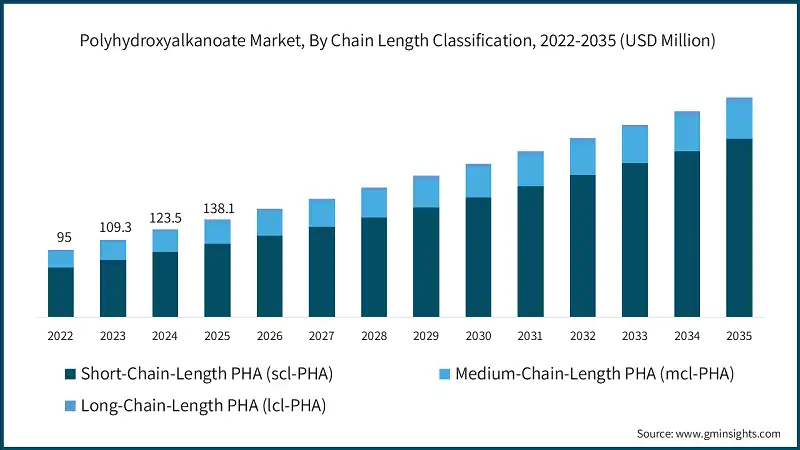

The polyhydroxyalkanoate (PHA) market by chain length classification is segmented into short-chain-length PHA (scl-PHA), medium-chain-length PHA (mcl-PHA) and long-chain-length PHA (lcl-PHA). Short-chain-length PHA (scl-PHA) hold the largest market value of USD 103.5 million in 2025.

- Rise in demand of short-chain-length PHA (scl-PHA) is being considered for a wider range of applications, such as packaging, agriculture, and veterinary use. Mechanical strength and biodegradability meet the demands of many sectors while production methods support the issues of supply and cost. Thus, it is an obvious choice for all markets targeting reduction of plastic waste by employing an established technology.

- Medium-chain-length PHA (mcl-PHA), being elastic and impact-resistant, is rapidly growing into wide applications such as medical devices, coating, and specialty films. Improvements in fermentation processes reduce the cost of producing mcl-PHA, thus encouraging its application in sectors where alternative materials are required. Applications for long-chain-length PHA (lcl-PHA) are slowly awakening because of its unique elastic properties and biodegradability. This fits in niche applications such as biomedical products and specialty packaging. Research and technological efforts are being put into further lowering costs and increasing production rates, thus facilitating its growth for such emerging applications.

The polyhydroxyalkanoate market by copolymer type is segmented into Poly(3-hydroxybutyrate) [PHB], Poly(3-hydroxybutyrate-co-3-hydroxyvalerate) [PHBV], Poly(3-hydroxybutyrate-co-4-hydroxybutyrate) [P3H4B], Poly(3-hydroxybutyrate-co-3-hydroxyhexanoate) [PHBH] and Other PHA Copolymers [P(3HB-co-3HP), P(3HB-co-LA)]. Poly(3-hydroxybutyrate) [PHB] holds the largest market value of USD 66.2 million in 2025.

- Poly(3-hydroxybutyrate) (PHB) and its copolymers such as Poly(3-hydroxybutyrate-co-3-hydroxyvalerate) (PHBV) continue to be of great interest owing to their favorable mechanical properties and biodegradability. PHB is generally used in packaging and agricultural films, while PHBV due to its increased flexibility and toughness, is also applied in medical and consumer products. The low production costs, combined with demand from an established market, guarantee consistent growth in these sectors.

- These less common copolymers, Poly(3-hydroxybutyrate-co-4-hydroxybutyrate) (P3H4B), Poly(3-hydroxybutyrate-co-3-hydroxyhexanoate) (PHBH), and other PHA copolymers given their better elasticity, strength, and biodegradability. They are creating some new uses in high-end biomedical devices, flexible packaging, and specialty films. Ongoing research and advancement of production technology improve their development towards an increased adoption driving growth in niche yet expanding markets.

The polyhydroxyalkanoate market by production method is segmented into pure culture fermentation, mixed microbial culture (MMC), halophilic/extremophilic production and genetically engineered systems. Pure culture fermentation holds the largest market value of USD 113.2 million in 2025.

- Production of PHAs via pure culture fermentation is still popular as it yields PHAs in high purity and quality, justifying their use in applications with high precision in material requirement. This method reaps maximum benefits from strains commonly used in fermentation and controlled conditions that help produce constant amounts while moving onward in details of process optimization.

- Emerging methods include the mixed microbial culture, halophilic/extremophilic, and genetically engineered systems. Mixed microbial culture techniques have cost advantages because they use waste streams and reduce feedstock costs, thus attracting attention from circular economy initiatives. Processes such as halophilic and extremophilic reduce contamination risks while minimizing sterilization costs, hence improving the economic viability. Genetically engineered systems allow the generation of specific properties and higher yields for PHA, which may be the future scale of commercialization as technology matures.

The polyhydroxyalkanoate market by feedstock type are segmented into first-generation feedstocks (Sugars), second-generation feedstocks (Vegetable Oils), third-generation feedstocks (Waste Streams), next-generation feedstocks (CO2, CO, CH4, C1 Compounds). First- generation feedstocks (Sugars) holds the largest market value of USD 75.9 million in 2025.

- First-generation feedstocks, essentially sugars obtained from agro-energetic crops such as corn and sugarcane, have been the conventional sources for PHA production owing to their high availability and well-established supply chains. However, the concerns around food security and the fluctuations in raw material prices are creating a slow but sure transition toward more sustainable feedstock alternatives. Second-generation feedstocks, such as oils from plants, are being considered because of their much higher carbon content and efficient utilization in the production of PHAs to ameliorate yield and cost-effectiveness.

- Third- and next-generation feedstocks are beginning to define the PHA market into the future. Waste streams include agriculture, industrial, and municipal which are considered for the purpose of reducing the cost of PHA production and assisting the circular economy. Next-generation feedstocks like carbon dioxide (CO2), carbon monoxide (CO), methane (CH4), and other C1 compounds provide innovative routes to carbon-negative or low-carbon alternative production of PHAs.

Learn more about the key segments shaping this market

The polyhydroxyalkanoate market by application is segmented into packaging, biomedical, agricultural, textile, consumer and other industrial application. Packaging holds the largest market value of USD 58 million in 2025.

- Packaging continues to create very active opportunities for PHAs application with increasing demand for biodegradable materials and existing global constraints on single-use plastics. Its compound properties, together with compostability, render PHAs attractive for food packaging, service ware, and consumer goods. There is growing use of PHAs in biomedical applications, where their biocompatibility and tunable degradation rates are suitable for a range of applications, including sutures, implants, and drug-delivery systems. Other rapidly growing applications are mulch films and controlled-release fertilizers as farmers seek environmentally friendly alternatives.

- Emerging sectors benefiting from innovative material development include textiles, consumer, and industrial applications. In textiles, demand for PHAs is towards biodegradable fibers and non-woven materials, thus aiding sustainability transitions in the apparel sector. Consumer applications such as cosmetic packaging, toys, and household products are increasing as brands switch into eco-conscious materials. Other industrial applications are growing with the use of performance-enhanced PHA grades in 3D-printing filaments, automotive components, and electronic casings. Together, these applications contribute to a broader and more diverse demand landscape for PHAs.

Looking for region specific data?

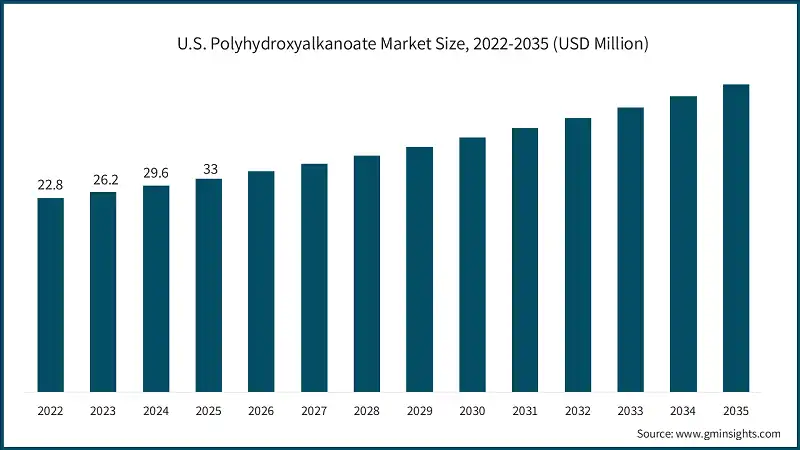

The market in the North America is expected to experience significant and promising growth from USD 38.6 million in 2025 to USD 86.6 million in 2035. The U.S. market accounted for USD 33 million in 2025.

- North America has a rapidly growing polyhydroxyalkanoate market as brands are making a gradual shift to renewable materials to create their sustainable profile. The United States generally witnesses an increase in food-service companies and consumer goods manufacturers looking for alternatives to traditional plastics. This region also benefits from efficient R&D ecosystems and pilot-scale projects focused on the optimization of fermentation and reduced production expenses. Increased interest from major retail chains is further speeding market adoption.

The market in the Europe is expected to experience significant and promising growth from USD 30.4 million in 2025 to USD 40.2 million in 2035.

- Europe is turning up to be a site for the development of advanced end-of-life facilities for biopolymers more on an integration basis. Germany is witnessing more interest from the packaging converters and chemical companies as they seek to pursue options for biodegradable film but more in the coating field for specialty applications. The drive toward further common EU standards for compostable packaging are delivering a clearer picture for manufacturers. Besides, local initiatives boosting biorefineries are fortifying the supply chain development for PHA-based materials.

The polyhydroxyalkanoate market in Asia Pacific is expected to experience increasing growth from USD 62.1 million in 2025 to USD 170.1 million in 2035 with a CAGR of 10.3%.

- The Asia Pacific area is fast progressing, as manufacturers are consequently upscaling their facilities to meet the demand within the domestic and export markets. The latest infrastructures development and bio-based industry support in China create conditions for large volume production of different kinds of PHAs. They are also experimenting with low-cost feedstock from agriculture residues to improve their competitiveness. This growth is further benefiting the increasing use of fast-moving consumer goods and e-commerce packaging, which have vastly been growing in the region.

Middle East & Africa market is expected to experience significant and promising growth from USD 2.1 million in 2025 to USD 1.9 million in 2035.

- In the Middle East & Africa, factors driving the development of PHA are often combined with growing interest in technologies for sustainability to achieve waste-to-value objectives. The GCC countries investigate PHAs for high-temperature applications in special niche markets, such as packaging and a few industrial segments. Early PHA production concepts are being supported by pilot operations targeted at organic waste conversion. Emerging innovation hubs and government-driven sustainability agendas motivate companies to assess including PHAs in broader long-term environmental strategies.

Latin America is expected to experience significant and increasing growth from USD 4.8 million in 2025 to USD 10.5 million in 2035.

- With a slow but progressive formation, Latin America become a promising market as bioplastics are being considered for converting or reducing reliance on imported petrochemical materials. Brazil is subjecting very strong growth in sugarcane sector to develop the production of PHAs through cost-effective means of fermentation that allow manufacturers to operate within the country to enjoy great economics. Interest has also increased among agricultural cooperatives in biodegradable alternatives for mulch films and seed coatings. In addition, some collaborations between research institutes and industries are boosting the region in terms of developing technical knowledge.

Polyhydroxyalkanoate Market Share

- Polyhydroxyalkanoate (PHA) markets are moderately consolidated with players like TianAn Biologic, Danimer Scientific, Kaneka Corporation, Newlight Technologies, Mango Materials holding 59.7% market share and TianAn Biologic being the market leader holding the market share of 17.3 % in 2025.

- The PHA market is growing as manufacturers look to improve process efficiency and technological innovation for higher yield in fermentation, improved microbial strains, and lower production costs so that they offer cheaper, better materials. It also guarantees customers that they will be supplied with materials that satisfy the increasing sustainable plastics market demand in the continuous evolving improvements.

- To ensure long-term market sustainability, several companies have put in place strategic partnerships with some of the biggest brands across packaging, consumer goods, and agriculture. Such partnerships promise relatively stable demands, allow for co-development on tailored PHA products, and hence lead to market entry on new applications. They all tend to increase visibility and credibility in the commercial environment.

- Feedstock diversification is the major factor on market competition. Producers look for cheaper or waste-derived materials as they want to stay ahead. They use agricultural residues, food waste, or even CO2-based feedstocks, thus they gain advantages over operational costs.

- Companies keep increasing their ranges of production and areas of operation for better service to the global market. Setting up new facilities, scaling existing plants, or moving to emerging areas lessen logistics costs and increase supply reliability. A wider footprint ensures that they respond quickly to regional shifts in policies and needs.

- Another important strategy to increase the competitive edge is the development of niche-specific PHA grades designed for high-priced industries such as biomedical, textile, electronics, and industrial applications. The introduction of different products with specific performance attributes helps to gain niche markets and create differentiation instead of price competition.

Polyhydroxyalkanoate Market Companies

Major players operating in the polyhydroxyalkanoate (PHA) market are:

- Biomer

- Bluepha

- CJ BIO (CJ CheilJedang)

- Danimer Scientific

- Full Cycle Bioplastics

- Kaneka Corporation

- Mango Materials

- Newlight Technologies

- Paques Biomaterials

- PhaBuilder

- Phangel Biotechnology

- Tepha Inc.

- TianAn Biologic

- Tianjin Green-Bio

- Weining Biotechnology

- Yield10 Bioscience

TianAn Biologic is a Chinese maker of polyhydroxyalkanoates (PHAs), with a well-recognized ENMAT brand for its PHB and PHBV materials, has carved out a niche within this area over the years. It possesses a growing expertise in fermentation-based biopolymer production, to industries ranging from packaging and agriculture to consumer goods.

Danimer Scientific is a U.S.-based leading biotechnology company since recognized for its Nodax PHA widely applied to biodegradable packaging and consumer applications. The company centres its activities like scalable fermentation technology and strong brand partnerships, with ongoing capacity expansion to meet rising demand. Continuous investment in R&D and commercial infrastructure places Danimer as an innovative market player.

Kaneka Corporation grew into a major Japanese producer of the PHBH® biodegradable polymer-a very versatile PHA copolymer used in the manufacture of films, packaging materials, plastics, and consumer goods. Kaneka combines strong material science and polymer engineering capabilities required to produce high-performance PHA grades, satisfying some of the most rigorous compostability standards around the world. it has developed a robust network of partnerships with large brands across the retail, electronics, and cosmetics sectors.

Newlight Technologies in the U.S., specializes in AirCarbon, a carbon-negative PHA made from greenhouse gases, including methane and CO2. Its contrasting approach places the company at the interface of sustainability and climate innovation. It supplies materials to packaging, fashion, and food-service applications in collaboration with leading brands that seek low-carbon alternatives. By placing a high focus on reducing environmental impact as well as advanced materials engineering, Newlight is rapidly growing to be recognized worldwide for its breakthrough production platform.

Mango Materials makes methane-based polyhydroxyalkanoate (PHA) biopolymers, transforming methane (usually from biogas or landfill gas) into sustainable, biodegradable plastics. Their PHA products are designed for various applications including packaging, textiles, molded goods, and consumer products. The technology promotes low-carbon or carbon-neutral production, using greenhouse gas resources to produce bioplastic feedstock.

Polyhydroxyalkanoate Industry News

- On November 2025, Trinseo and RWDC Industries have come together to partner in sustainable packaging for progress toward improved PHA dispersion technologies for broad application. The focus of this collaboration is improving the performance and processing of improved PHA for paper and board packaging applications.

- On January 2022, Danimer Scientific made a strategic alliance with Hyundai Oilbank, and this collaboration is intended for the commercial expansion and production of polyhydroxyalkanoate (PHA) in South Korea and other markets in Asia.

The polyhydroxyalkanoate market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and volume in terms of kilo tons from 2022–2035 for the following segments:

Market, By Chain Length Classification

- Short-Chain-Length PHA (scl-PHA)

- Medium-Chain-Length PHA (mcl-PHA)

- Long-Chain-Length PHA (lcl-PHA)

Market, By Copolymer Type

- Poly(3-hydroxybutyrate) [PHB]

- Poly(3-hydroxybutyrate-co-3-hydroxyvalerate) [PHBV]

- Poly(3-hydroxybutyrate-co-4-hydroxybutyrate) [P3H4B]

- Poly(3-hydroxybutyrate-co-3-hydroxyhexanoate) [PHBH]

- Other PHA Copolymers [P(3HB-co-3HP), P(3HB-co-LA)]

Market, By Production Method

- Pure Culture Fermentation

- Mixed Microbial Culture (MMC)

- Halophilic/Extremophilic Production

- Genetically Engineered Systems

Market, By Feedstock Type

- First-Generation Feedstocks (Sugars)

- Second-Generation Feedstocks (Vegetable Oils)

- Third-Generation Feedstocks (Waste Streams)

- Next-Generation Feedstocks (CO2, CO, CH4, C1 Compounds)

Market, By Application

- Packaging Applications

- Rigid Packaging

- Flexible Films

- Others

- Biomedical Applications

- Medical Devices

- Surgical Sutures

- Others

- Agricultural Applications

- Mulch Films

- Seed Coatings

- Others

- Textile Applications

- Fibers & Yarns

- Non-Wovens

- Others

- Consumer Goods

- Cosmetic Packaging

- Toys & Recreational Product

- Others

- Other Industrial Applications

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Who are the key players in the polyhydroxyalkanoate market?

Key players include TianAn Biologic, Danimer Scientific, Kaneka Corporation, Newlight Technologies, Mango Materials, CJ BIO, Bluepha, and Yield10 Bioscience. These companies are focusing on scalable production, feedstock innovation, and partnerships with end-use industries.

What are the key trends in the polyhydroxyalkanoate industry?

Key trends include adoption of advanced microbial fermentation technologies, use of waste and CO2-based feedstocks, development of high-performance PHA blends, and expanding applications in packaging, biomedical devices, and 3D printing.

What was the valuation of the PHB copolymer segment in 2025?

The Poly(3-hydroxybutyrate) [PHB] segment accounted for USD 66.2 million in 2025, leading the copolymer category. Favorable mechanical properties, biodegradability, and established demand in packaging and agricultural films are driving adoption.

Which region leads the polyhydroxyalkanoate market?

North America leads the global PHA market, valued at USD 38.6 million in 2025, with the U.S. accounting for USD 33 million. Market leadership is driven by strong R&D ecosystems, sustainability-driven brand adoption, and supportive regulatory frameworks.

How much revenue did the short-chain-length PHA segment generate in 2025?

The short-chain-length PHA (scl-PHA) segment generated USD 103.5 million in 2025, making it the largest chain-length category. Its dominance is supported by strong demand from packaging, agriculture, and veterinary applications.

What is the projected value of the polyhydroxyalkanoate market by 2035?

The polyhydroxyalkanoate market is expected to reach USD 309.2 million by 2035, growing at a CAGR of 8.2%. Growth is driven by technological advancements in microbial fermentation, expansion of end-use industries, and increasing regulations on conventional plastics.

What is the polyhydroxyalkanoate (PHA) market size in 2025?

The polyhydroxyalkanoate (PHA) industry is valued at USD 138.1 million in 2025. Rising demand for biodegradable plastics and increasing environmental awareness are supporting steady market growth.

What is the market size of the polyhydroxyalkanoate industry in 2026?

The market size for polyhydroxyalkanoate reached USD 152.5 million in 2026, reflecting expanding adoption across packaging, agricultural, and biomedical applications.

Polyhydroxyalkanoate (PHA) Market Scope

Related Reports