Summary

Table of Content

Polishers Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Polishers Market Size

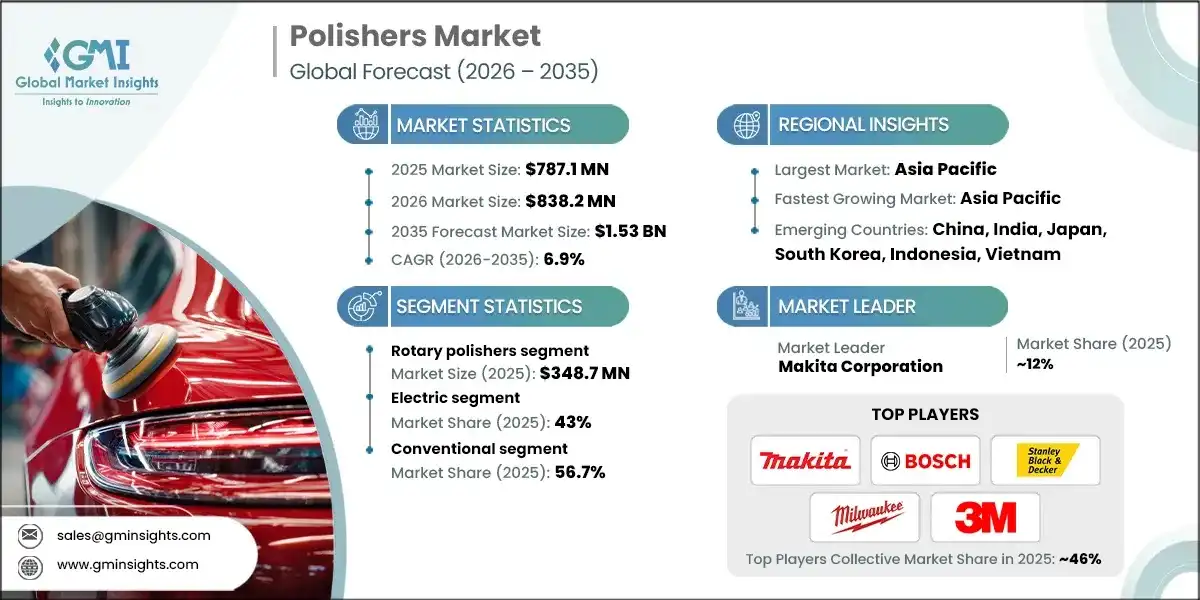

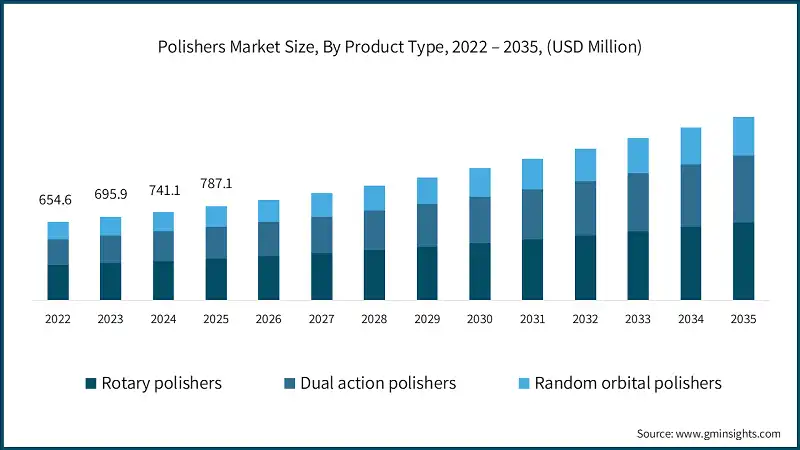

The polishers market was estimated at USD 787.1 million in 2025. The market is expected to grow from USD 838.2 million in 2026 to USD 1.53 billion in 2035, at a CAGR of 6.9%, according to latest report published by Global Market Insights Inc.

To get key market trends

- Polishers are being driven by increasing demand from growth in construction and renovation. New residential, commercial and infrastructure projects will require flooring, walls and fixtures to be finished with surfaces. Smooth finish and consistent surface quality will rely on contractors having polishers to perform this function. When contractors are renovating, they are often using polishing equipment more than once to restore the surfaces of older buildings. Before a surface can be considered durable, it must be polished, regardless of if it is stone, concrete or wood. Property owners will want to improve the visual impression that their property gives to increase property value and the overall enjoyment of the property by other users. A polished floor is essential in commercial buildings because of the amount of foot traffic and the importance of a long service life. Contractors will find equipment that performs efficiently will allow them to meet deadlines while working with limited labor resources. Development of urban areas has been creating opportunities for contractors to refurbish older residential and commercial properties. The availability of specialized polishers will also allow the use of polishing equipment to work on a variety of different material types and project sizes.

- The automotive manufacturing and repair industries' increased utilization of surface finishing and polishers has been a major influencing factor in driving the growth of the Polishers market. To achieve a high-quality paint job, cars manufactured today must be finished to a high degree of precision. Following an accident or damage to the car's exterior, automotive repair centres use polishers to restore the exterior panels of the car. Vehicle manufacturers have adopted polishers as a means of providing improved quality assurance due to their need to provide high-quality looking products. With continuous growth in the number of vehicles on the road today, there is a continued high demand for automotive repair and refinishing services. In addition, as the demand for repair/refinishing services continues to rise, so does the importance of being efficient in the use of time in automotive workshops, thus creating a greater reliance on power polishers. Technological advancements in polishers have allowed for the controlled and lower destructive way of operating polishers.

- The rotary polisher category is crucial in the polishers marketplace, as these tools allow for soft polishing and fine-tuning of surfaces, such as automotive, marine, or industrial finishes. The rotary polishers allow users to maintain a smooth surface by regularly turning the surface to achieve a high-quality finish. Rotary polishers produce a uniform rotating motion that makes it easy for professional detailers and shops to remove any scratches, oxidation or surface blemishes from their customers' vehicles and boats, in addition to their businesses' surfaces. Professional detailers and automotive shops prefer rotary polishers because they provide maximum efficiency and control and allow users to achieve a glossy finish. The operator's comfort and precision are enhanced by the ergonomic designs and variable speed settings available on most rotary polishers.

Polishers Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 787.1 Million |

| Market Size in 2026 | USD 838.2 Million |

| Forecast Period 2026-2035 CAGR | 6.9% |

| Market Size in 2035 | USD 1.53 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growth of construction and renovation activities | Increased use of polishers for floors, stone, and concrete expands market volume. |

| Rising demand for surface finishing in automotive manufacturing and repair | Consistent polishing requirements in vehicle production and refinishing drive equipment demand. |

| Expansion of metal fabrication and industrial manufacturing | Surface quality standards boost adoption of polishing tools in industrial settings. |

| Pitfalls & Challenges | Impact |

| High wear and tear of polishing pads and accessories | Frequent consumable replacement increases operating costs for users. |

| User fatigue and ergonomic limitations during prolonged use | Comfort issues reduce productivity and limit continuous operation. |

| Opportunities: | Impact |

| Growing demand for cordless and battery-powered polishers | Mobility-focused tools increase adoption among professionals and DIY users. |

| Integration of smart features such as load sensing and speed stabilization | Intelligent controls enhance performance consistency and product differentiation. |

| Market Leaders (2025) | |

| Market Leaders |

Market share of ~12% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Japan, South Korea, Indonesia, Vietnam |

| Future outlook |

|

What are the growth opportunities in this market?

Polishers Market Trends

- There is an increased demand for advanced power polishers with the increased demand for automotive detailing. Vehicle owners want an improved surface finish and paint restoration results. Professional workshops depend on polishers to get the same gloss and defect-free finish every time. With the increase in the number of vehicles on the road, there is also an increase in the number of customers looking for regular routine maintenance on their vehicles, and for appearance enhancement of their vehicles. Manufacturers are now producing variable-speed and ergonomic power polishers to provide the user with enhanced control.

- Several customers are turning to cordless polishers because of the increased freedom of movement and the ease of use that they provide. The advances in battery technology mean longer operation times and more consistent power output. The ability to reduce the amount of time spent setting up and the ability to move freely during operation is a great benefit for professionals. Cordless polishers are becoming increasingly popular for job sites that do not have easy access to direct power. Manufacturers produce cordless polishers in a lightweight design to help reduce operator fatigue.

- Polishing construction projects is also growing. There is an increasing demand for polished surfaces that are smooth and durable in both the commercial and residential sectors. Contractors are using polishing products to improve the appearance and increase the lifespan of the surfaces that they work on. The availability of adjustable speed and dust collection systems are increasing the quality and safety of jobs. To meet the needs of businesses and contractors, manufacturers are designing heavy-duty polishing units for continuous use in the construction industry.

- With growing numbers of DIY users purchasing polishers to improve their homes and care for their vehicles, manufacturers are also creating new product lines that provide easy-to-use controls and safety features for the non-professional user. The professional market continues to require high-performance products for more intensive applications, and manufacturers continue to create product ranges that address both user segments effectively. The improvement in retail access through both brick-and-mortar and online sales has increased the availability of polishers and, in turn, broadened the reach of the product market to both consumers and professionals alike.

- Polishers are designed and selected with user comfort as a primary consideration. Increased fatigue due to extended use negatively impacts productivity and quality of work. To mitigate this, manufacturers are providing polishers with balanced weight distribution and reduced vibration. Also, adjustable handles create improved grip and control while using polishers for extended durations of time. Professionals prefer tools that allow for prolonged usage to be performed safely. Therefore, the growing trend is for the increased adoption of ergonomically optimized polishers across a variety of industries.

Polishers Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market is categorized into rotary polishers, dual action polishers, and random orbital polishers. The rotary polishers segment accounted for revenue of around USD 348.7 million in 2025 and is anticipated to grow at a CAGR of 6.4% from 2026 to 2035.

- The rotary polishers segment leads the polishers market due to its effectiveness in achieving high-quality surface finishing across automotive, marine, and industrial applications. These polishers provide consistent rotational motion, enabling rapid removal of scratches, oxidation, and surface imperfections. Adjustable speed settings and ergonomic designs allow precise control and comfortable handling during extended use.

- Professional detailers, body shops, and restoration specialists prefer rotary polishers for their efficiency and ability to deliver a glossy, smooth finish. Growing demand for automotive refinishing, surface restoration, and high-quality polishing solutions drives adoption, reinforcing the importance of rotary polishers in the global market.

Based on power source, of polishers market consists of pneumatic, electric, and gas-powered. The electric emerged as leader and held 43% of the total market share in 2025 and is anticipated to grow at a CAGR of 7.5% from 2026 to 2035.

- The electric segment holds a strong position in the market due to its consistent power delivery, efficiency, and ease of use. Electric polishers provide stable rotational speed and torque, enabling precise surface finishing on automotive, industrial, and marine applications. Continuous operation without recharging interruptions makes them suitable for professional workshops and extended polishing tasks.

- Advanced features, including variable speed control and ergonomic designs, enhance user comfort and control. Growing adoption in automotive detailing, restoration, and industrial surface treatment is driving demand. The reliability, performance consistency, and suitability for heavy-duty applications support the prominence of electric polishers in the global market.

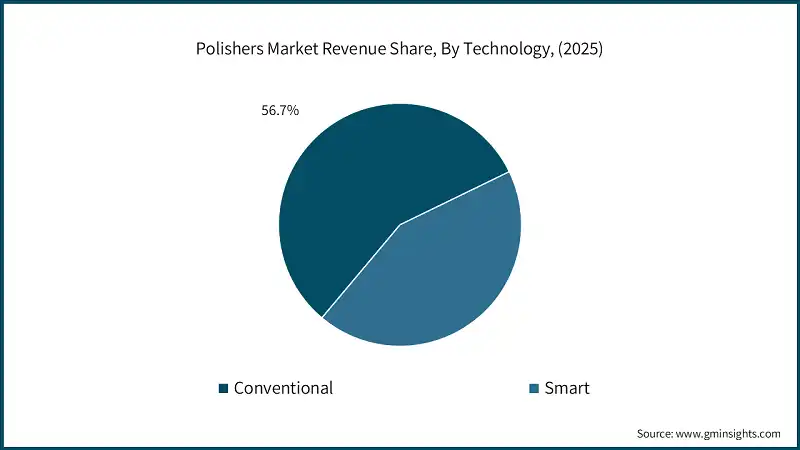

Learn more about the key segments shaping this market

Based on technology, polishers market consists of conventional and smart. The conventional emerged as leader and held 56.7% of the total market share in 2025 and is anticipated to grow at a CAGR of 6.6% from 2026 to 2035.

- The conventional technology segment holds a leading share in the polishers market due to its proven reliability, simplicity, and cost-effectiveness. These polishers use traditional motor and mechanical designs to deliver consistent rotational motion for surface finishing, scratch removal, and polishing applications. Professionals in automotive detailing, marine maintenance, and industrial surface treatment favor conventional polishers for their durability and ease of operation.

- Widespread availability, lower maintenance requirements, and compatibility with a variety of polishing pads and compounds further support adoption. The established performance and trusted functionality of conventional technology reinforce its strong presence in the global market.

Looking for region specific data?

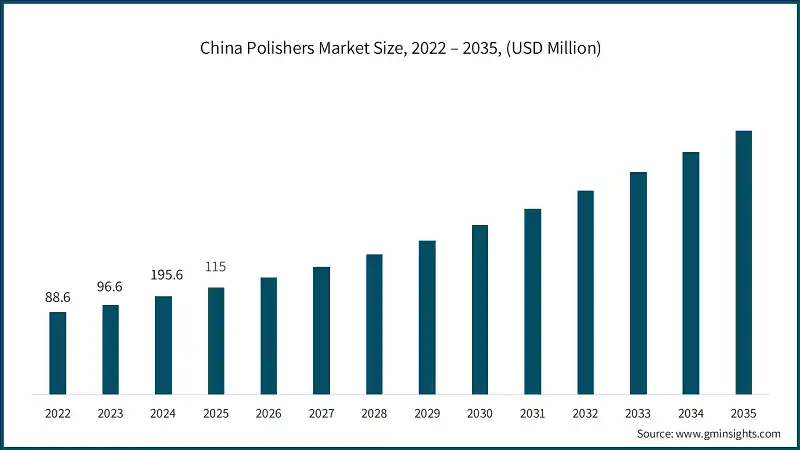

China dominates an overall Asia Pacific polishers market and was valued at USD 115 million in 2025 and is estimated to grow at a CAGR of 9.5% from 2026 to 2035.

- The China market is expanding due to strong demand from automotive, construction, and metal fabrication industries. Automotive manufacturers and body shops increasingly adopt high-performance polishers for surface finishing and paint correction. Growth in residential and commercial construction drives demand for polishing tools used on floors, tiles, and stone surfaces.

- Industrial applications, including metal and machinery maintenance, further support adoption of durable and efficient polishers. E-commerce platforms and modern retail channels improve accessibility to both professional-grade and consumer models. Rising urbanization, increasing disposable incomes, and a focus on aesthetics in residential and commercial projects contribute to steady market growth across China.

In the North America polishers industry, the U.S. held 80.1% share in 2025 and is anticipated to grow at a CAGR of 7% from 2026 to 2035.

- The U.S. polishers market is driven by the automotive detailing and repair industry, where professional workshops require high-efficiency polishers for paint finishing, scratch removal, and surface restoration. Commercial construction projects, including flooring, marble, and wooden surface finishing, increase demand for industrial-grade polishers with robust motors and durable components. The growing DIY culture has fueled adoption of compact, ergonomic polishers suitable for home use, particularly for furniture and small-scale flooring projects. Battery-operated and dual-action polishers are gaining popularity due to portability and reduced operator fatigue.

- Industrial maintenance sectors, including metal fabrication and machinery upkeep, require polishers capable of handling abrasive materials and high-temperature surfaces. Regional distributors and specialty retailers supply a wide range of professional-grade and consumer models, supporting diverse application needs. Technological enhancements, including variable speed control, dust management, and safety features, further expand market adoption.

In the Europe polishers market, Germany is expected to experience significant and promising growth from 2026 to 2035.

- The Europe market is shaped by stringent quality standards in automotive, construction, and luxury goods manufacturing. Countries such as Germany, Italy, and the UK demand precision polishing for vehicle exteriors, furniture, and decorative stone surfaces. Professional use in flooring, marble, and granite applications drives adoption of specialized polishers designed for durability and consistent surface finish. Industrial sectors require polishers capable of high-speed operation and handling abrasive materials while minimizing noise and energy consumption.

- Renovation and refurbishment of historic buildings and commercial spaces contribute to steady demand for polishing tools suitable for delicate surfaces. Energy-efficient, low-noise, and ergonomically designed polishers are increasingly preferred to comply with EU regulations on occupational safety and environmental standards. E-commerce platforms and specialized retailers provide access to advanced professional models and niche solutions, ensuring adoption across both commercial and residential segments.

In the Middle East and Africa polishers market, Saudi Arabia held a significant share in 2025 promising growth from 2026 to 2035.

- The Middle East and Africa market is driven by industrial, construction, and commercial projects in countries such as the UAE, Saudi Arabia, and South Africa. Large-scale construction activity, including commercial buildings, hotels, and infrastructure projects, increases demand for heavy-duty polishers capable of handling stone, concrete, and metal surfaces. Harsh climatic conditions, such as high temperatures and dusty environments, require robust and durable tools designed for extended operational performance. Industrial maintenance, particularly in metal fabrication and oil and gas sectors, further supports adoption of professional-grade polishing equipment.

- Limited local manufacturing leads to reliance on imported polishers, often from Europe, North America, and Asia, ensuring access to advanced technologies and high-performance tools. Multi-functional and high-capacity polishers are preferred for efficiency in large projects, while specialized equipment is used for finishing luxury or decorative surfaces.

Polishers Market Share

- In 2025, the prominent manufacturers in polishers industry are Makita Corporation, Robert Bosch, Stanley Black & Decker, Milwaukee, and 3M Company collectively held the market share of ~46%.

- Makita is a leading polisher and power tools provider with a broad lineup covering cordless, rotary and orbital models. The company focuses on advanced battery technology, brushless motors and ergonomic designs that appeal to professionals and DIYers. Strong global distribution, continuous product innovation and expanded e?commerce presence support Makita’s competitive strength

- Bosch competes globally with high?quality polishers and surface finishing tools featuring advanced vibration control, smart speed regulation and energy efficiency. The brand’s broad power?tool ecosystem and engineering focus drive adoption in automotive, industrial and construction segments. Strong retail and distribution networks help maintain Bosch’s durable market presence

Polishers Market Companies

Major players operating in the polishers industry include:

- 3M Company

- ARPAC

- Chicago Pneumatic

- Dynabrade

- Festool

- Flex?Elektrowerkzeuge

- Hitachi Koki Co.

- Makita Corporation

- Metabo Corporation

- Milwaukee

- Robert Bosch

- Ryobi Limited

- Stanley Black & Decker

- Vortex Tool Company

- WEN Products LLC

Stanley Black & Decker, through DEWALT and Porter?Cable brands, offers rugged polishers designed for professional demand. The company emphasizes durable construction, high torque and integrated battery systems for cordless models. Its wide dealer and retail footprint strengthens global reach across multiple end markets.

Milwaukee is known for high?performance cordless polishers targeting professionals. The company invests in brushless motors, advanced battery systems and ergonomic features that enhance runtime and control. Strategic use of professional distribution channels and tool?system integration helps sustain Milwaukee’s competitive position.

3M offers surface finishing and polishing solutions that combine abrasives and tool systems, appealing to automotive, industrial and professional detailing markets. Its materials science expertise support differentiated pads, compounds and accessories that complement power tools from OEM partners and enhance overall polishing performance.

Polishers Machine Industry News

- In March?2025, Makita USA expanded its cordless polisher portfolio with the introduction of 18V LXT and 40V Max brushless random orbital polishers. These include updated XOP02 and XOP03 models with improved brushless motors, variable speed control, and enhanced ergonomic grips.

- In May?2025, Festool unveiled the PX 150?Reb random orbital polisher, designed for high?precision finishing on automotive paint, gelcoat, and marine surfaces. The PX?150?Reb features an advanced electronic speed control system, low?vibration design, and optimized dust extraction compatibility, aimed at professional workshops and detailers emphasizing quality surface finish.

- In April?2025, Bosch Power Tools introduced the PLEX 250V?EC professional polisher with a brushless EC motor and integrated micro?filter for dust control. The tool is positioned for professionals in automotive, metalworking, and surface finishing sectors, enhancing precision and reducing airborne particulates during operation.

- In February?2025, DeWALT launched the DWP849X heavy?duty variable speed polisher targeted at construction and industrial finishing applications.

Features include a large?diameter backing pad, reinforced gearing for long life, and enhanced dust?sealing designed for drywall compound and floor finishing tasks.

The polishers market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Million) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Product Type

- Rotary polishers

- Dual action polishers

- Random orbital polishers

Market, By Power Source

- Pneumatic

- Electric

- Gas-powered

Market, By Technology

- Conventional

- Smart

Market, By End Use

- Residential DIY & home improvement

- Automotive

- Construction & infrastructure

- Others

Market, By Distribution Channel

- Online

- Offline

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the polishers market?

Key players include Makita Corporation, Robert Bosch, Stanley Black & Decker, Milwaukee, 3M Company, Festool, FLEX-Elektrowerkzeuge, Dynabrade, Metabo Corporation, Ryobi Limited, Chicago Pneumatic, Hitachi Koki Co., WEN Products LLC, Vortex Tool Company, and ARPAC.

What was the market share of the electric power source segment in 2025?

Electric polishers held 43% market share in 2025, driven by consistent power delivery, efficiency, and ease of use in professional applications.

What are the upcoming trends in the polishers market?

Key trends include growing adoption of cordless and battery-powered models, integration of smart features like load sensing and speed stabilization, and increasing focus on ergonomic designs to reduce operator fatigue.

Which region leads the polishers market?

China dominated Asia Pacific market with USD 115 million in 2025 and is expected to grow at 9.5% CAGR through 2035.

What is the growth outlook for electric polishers from 2026 to 2035?

Electric polishers are projected to grow at a 7.5% CAGR through 2035, due to stable performance, variable speed control, and suitability for heavy-duty applications.

How much revenue did the rotary polishers segment generate in 2025?

Rotary polishers generated USD 348.7 million in 2025, leading the product type segment with their effectiveness in achieving high-quality surface finishing.

What is the current polishers market size in 2026?

The market size is projected to reach USD 838.2 million in 2026.

What is the market size of the polishers in 2025?

The market size was USD 787.1 million in 2025, with a CAGR of 6.9% expected through 2035 driven by rising construction and renovation activities.

What is the projected value of the polishers by 2035?

The polishers market is expected to reach USD 1.53 billion by 2035, propelled by growth in construction, automotive detailing, and technological advancements in cordless and smart polishing solutions.

Polishers Market Scope

Related Reports