Summary

Table of Content

Plus Size Clothing Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Global Plus Size Clothing Market Size

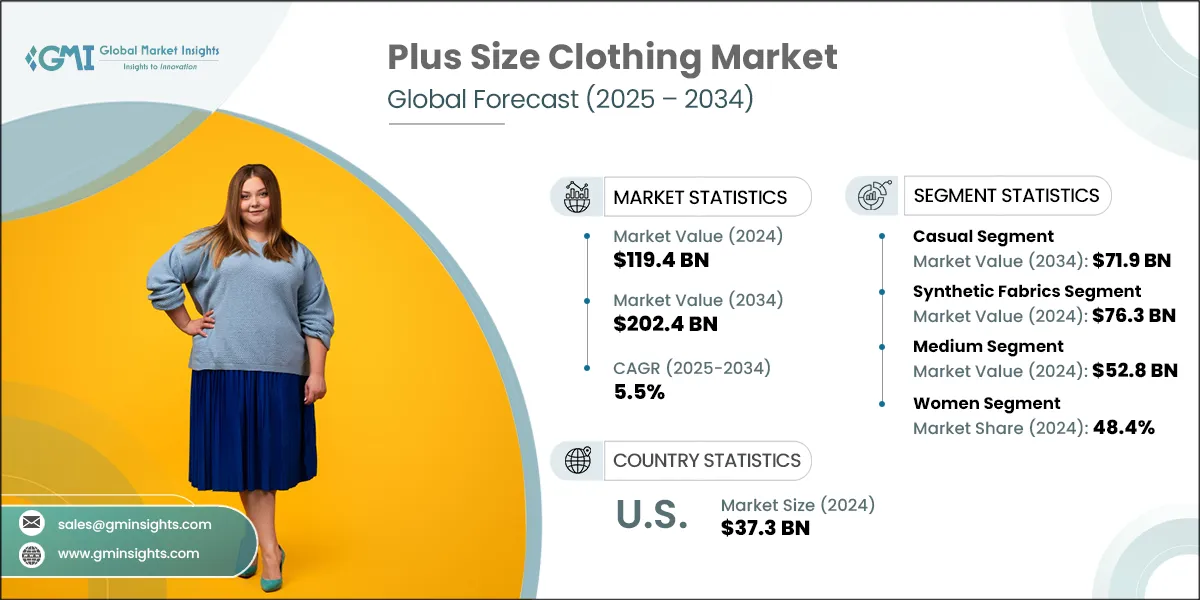

The global plus size clothing market was estimated at USD 119.4 billion in 2024. The market is expected to grow from USD 125 billion in 2025 to USD 202.4 billion in 2034, at a CAGR of 5.5%.

To get key market trends

- Recently the plus size clothing market has become highly popular, and the trend among the consumers has greatly changed, due to ever more people preferring comfortable, versatile, and interesting designs rather than traditional, frequently dull, ones. This has seen brands increase size lines and add plus size to the main line in the industry and there has also been greater consumer confidence in buying fashion that fits their individual style and body shape with the growing disposable incomes around the world.

- The industry is also showing healthy growth due to the soaring body positivity and inclusive movements that break the conventional standards of beauty. This is accompanied by the fact that the overweight and obese population of the world increases exponentially, which naturally leads to an increase in consumer base. There is also the ubiquitous use of e-commerce platforms where the number of options as well as access is unprecedented, and plus-size fashion is also normalized and popularized by celebrities and social media users with significant followings.

- The highest market share of more than 39% is in North America mainly because of the high proportion of the overweight and obesity population, and strong retail infrastructures. Another advantage the region has is the heavy focus on body positivity and dedicated spending on a wide range of sizes. Another significant region displaying promising market is Europe and Asia-Pacific region in relation to China and India, which is expected to grow faster as there is a rise in the number of disposal income and the perceptions of body image.

- The segment of the casual wear (with its dominant, having an approximate share of 33 percent), a significant share of the global plus-size clothing is a qualitative indicator of the fundamental alteration of both the priorities of the consumers and the overall fashion trends. In the past, it was extremely difficult to locate suitable and comfortable clothes that fit well on people with a larger body size and so in most cases, they would compromise to use practical outfits that are not stylish. Casual wear caters to this fundamental necessity of comfort by means of relaxed silhouettes and forgiving cuts that better conform to a wider variety of body shapes than to have more structured formal attire.

- E-commerce has been instrumental in democratizing the fashion industry in terms of more options and ease as well as where a plus-size customer cannot find what they want due to the few physical stores offering the merchandise. on-line stores and social networks are extremely relevant in giving a voice to plus-size consumers, presenting an array of body forms, and shaping desire to purchase, and sales of social commerce should reach high figures.

- The market is experiencing developments in sizing technologies, new fabrics and AI-based personalized suggestions to increase fitting, comfort and overall purchasing experience. The consumer interest in sustainability and ethical actions is also increasing, which leads to brands putting investment after eco-friendly materials and fair labor to cater to the conscious consumer market. Although issues that crop up include inconsistent sizes, less selection of trendy products and increased production costs, ongoing product development and real inclusion are refueling major opportunities in market growth.

- Based on recent statistics available at the U.S. Census Bureau, there are a little less than 40 percent of American adults who are obese, a factor that is directly impacting the demand of clothing in the plus-size category in one of the largest markets in the world.

- In India, 2019-2021 National Health Survey data show that 40 percent of the women are described as abdominally obese and it is more common age groups, are 49.3 percent of women aged 30-39 years.

Plus Size Clothing Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 119.4 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.5% |

| Market Size in 2034 | USD 202.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing body positivity and inclusivity movements | These movements are dismantling traditional beauty standards, leading to increased consumer demand for fashion that celebrates all body shapes and sizes, thereby expanding the market for diverse and stylish plus-size options |

| Expansion of e-commerce and online shopping platforms | The convenience and broader selection offered by online platforms make plus-size clothing more accessible to a global consumer base |

| Increasing overweight and obese population | The rising global prevalence of overweight and obese individuals naturally increases the consumer base that requires plus-size apparel, leading to a consistent and expanding demand for clothing tailored to larger body types |

| Pitfalls & Challenges | Impact |

| Higher production costs | Manufacturing plus-size garments often requires more fabric, larger patterns, and specialized processes, leading to increased production costs (sometimes 15-20% higher) |

| Supply chain challenges | Managing an efficient supply chain for plus-size apparel can be complex due to specialized manufacturing needs, finding reliable suppliers, and potential global disruptions |

| Opportunities: | Impact |

| E-commerce expansion | E-commerce expansion enhances market reach, increases sales and consumer access to diverse, inclusive fashion options |

| Collaborations with fashion influencers | Collaborations with fashion influences boost brand visibility, drive demand and foster greater acceptance of plus size apparel |

| Market Leaders (2024) | |

| Market Leaders |

2.5% market share |

| Top Players |

Collective Market Share in 2024 is 10-12% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, China |

| Future outlook |

|

What are the growth opportunities in this market?

Global Plus Size Clothing Market Trends

- There is a notable drive on social and cultural acceptance, with the growing focus on promoting the positive changes in the representation of different body types and the notion of body positivity that are actively gaining traction within the globe and actively shaping the traditional, and oftentimes restrictive, notions of beauty. It is a trend that has picked up enormous volume since these past-decade 2010s and has been gaining velocity moving to the current decade, enabling the plus-size consumer to demand, instead of simple basic, more trend-conscious fashion and well-fit garments, altering the market for the important purpose of expanding the number of addressable consumers significantly.

- The proliferation of e-commerce sites has been having a sea change in the availability of accessible and vast options to the plus-size consumers, namely the ability to traverse the vast ranges and overcome the shortage of frequently lacking in-store products. It is believed that this tendency, which started gaining pace similarly to the advent of the early 2020s, will keep being at its highest point until the default method of plus-size fashion discovery and acquisition turns out to be online shopping due to the improved user experiences provided, personalized suggestions, and fair pricing.

- The technological improvements on design and retail are greatly contributing to the quality, fitness and shopping behaviors to plus size consumers. The beauty of this trend started picking up steam in the middle of the 2010s when initial virtual try-on technology was deployed, and it is now being actively enhanced with artificial intelligence and 3D body scanners that make it a mature trend within 5-8 years when AI algorithms will be sophisticated and so will be virtual fitting rooms. Such developments are helping to make pattern-making more accurate, minimize fit variations (a key individual grievance), make better use of stock and deliver tailored suggestions, making production efficient and customer satisfaction.

- Consumers are no longer satisfied with merely fitting garments, they are demanding fashionable, comfortable and multipurpose clothes that can fit with their changing lifestyles. The rise of casual wear (athleisure, loungewear) and the trend towards the idea of a comfort-centered style, which has contributed partially to the atmosphere of remote work, is one of the prevailing factors. This movement has been forming more firmly since as recent as the last five years and it will carry on growing as companies invest in producing stylish yet flexible fashion lines, such as special niches in plus-size active wear or extended sized clothing, so that plus-size fashion becomes part of the mainstream trends and not an indecisive element to be an after-thought.

- Having acknowledged all this market potential, big-name fashion brands and even new narrow-niche labels are substantially expanding their involvement in extended sizes, providing wide options and styles. This is a pattern which has been gaining momentum over the past ten years, and which is likely to continue to develop, as companies compete to win adherence in this expanding customer base: the increasing inclusiveness of marketing campaigns that use the image and range of more bodies. This increased brand commitment is propelling the market development, and other factors such as increased environmental consciousness and consumer attitudes towards sustainable operations in plus-size industry are currently contributing to this trend.

Global Plus Size Clothing Market Analysis

Learn more about the key segments shaping this market

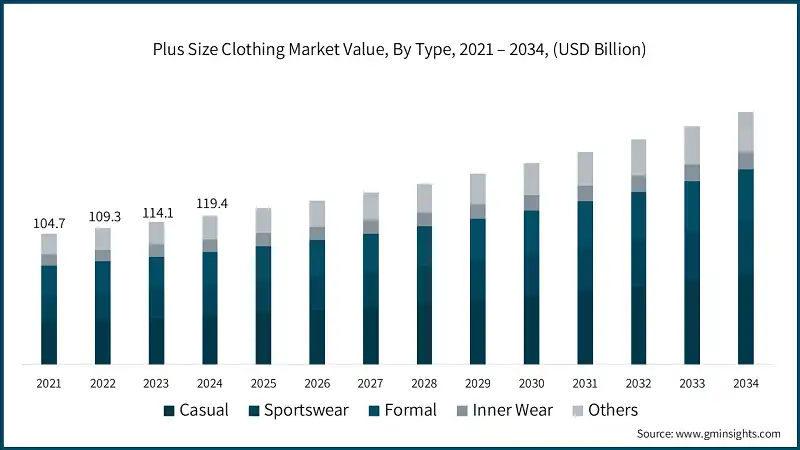

Based on the type of segment, the market is further bifurcated into casual, sportswear, formal, inner wear, and others. The casual segment was valued at USD 39.2 billion in 2024 and is projected to reach USD 71.9 billion by 2034.

- Casual wear always has the biggest share of the plus-size clothing market mostly due to its very nature of comfort, universality and adherence to more modern lifestyles with even greater flexibility of it, such as remote or hybrid work. This dominance is because of plus-size shoppers focusing on comfort and a loose fit; an age-old problem to which casual wear has been the solution. The demand is further supported by the mass acceptance and use of casual wear in various social functions, and the brands are regularly changing to the new demands of comfortable but stylish everyday clothes.

- Sportswear segment is also expected to realize the second-highest growth rate of 6.1 % within the plus-size market. The cause of such a surge is the actively growing population of plus-size millennials who are actively making a change in their lifestyles towards a healthier and more active environment. The major sportswear brands are paying a lot of attention dedicated to plus-size consumers with a set of apparel that provides proper functionality, support, and style regarding different forms of exercise.

- Although the market is not dominated by the formal wear of the plus-size people, there is a big growth opportunity in the sector. The trend is fueled by a cultural shift toward inclusion and body positivity, and thus, more plus-size women begin turning toward formal workwear, social dress, and special occasion formalwear, such as a wedding. Traditionally, there was not much plus-size formalwear to offer, and it was very unflattering. But increasing consumer demand of professional and high-quality clothes that can be characterized as stylish and at the same time comfortable is forcing brands to diversify and offer what can be dominant as a form of clothing as one suited to empowering situations and moments.

- The innerwear category (consisting of bras, undergarments and shapewear) is also immune and is growing at a steady rate with the primary driver being the growing need of comfortable, supportive and well-fitted garments amongst the plus-size consumers. The body positivity campaigns have increased the sensitivity of the need of having innerwear that will fit bodies of various sizes and therefore enhance self-worth. Brands are expanding size ranges, incorporating inclusive sizing, and utilizing advanced fabrics and designs (e.g., wireless bras, seamless technology, moisture-wicking materials) to enhance comfort and support.

Learn more about the key segments shaping this market

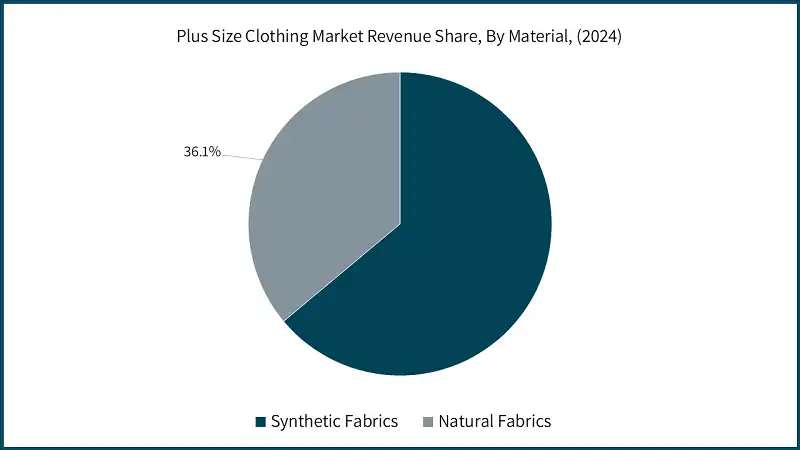

Based on material, the global plus size clothing market is segmented into synthetic fabrics and natural fabrics. The synthetic fabrics segment was valued at USD 76.3 billion in 2024 and is anticipated to grow with a CAGR of 5.9% during the forecast period.

- The synthetic fabric holds the highest percentage of the market of plus size clothes. This command is stimulated by the fact that they have high-level availabilities, use, and maintenance together with the fact that they are softer and lighter in pains. They are also affordable to the consumers who are conscious about cost.

- Spandex (elastane or Lycra) is also an essential element particularly when the material is mixed with others. It has amazing stretches and flexibility, and it gives you a nice and flattering fit as it can be worn by several body constructions. This stretch is crucial in mobility and comfort which is one of the major needs by plus-size customers who demand fashion and comfort.

- Natural fabrics have a central role in the plus-size apparel industry, as they are especially appreciated due to their natural comfort level, breathability, and softness to the skin. Of them, cotton is particularly a staple, and it is preferred due to its softness, good air circulation that ensures that the person is not hot, and it is hypoallergenic, hence best wore regularly and this is particularly true in places with warmer climates. Although a less numerous parts, wool has been able to provide unique thermal control, breathability and moisture wicking properties to give a natural insulation effect that keeps people comfortable or cool in cool and warm climates, as well as being naturally fire and odor resistant.

- The popularity of these natural fibers can be increasingly attributed to the trend of sustainable and ethically manufactured clothing desired by consumers nowadays. With an increasing concern about our planet and acting accordingly, plus-size consumers specifically are looking actively at brands that would use organic cotton or other natural sources of fabric and eco-friendly textiles that can be produced in a more sustainable manner than more traditional synthetic textiles. This wave forces the brand to move toward sustainably minded processing and blending and invest in sustainable dyeing practices and ethically-sound construction chains to cater to the demands of a social conscious consumer, so that when selecting items of clothing to wear, they know not only that they will be comfortable in them, but also that the environment was kept in mind.

Based on price range, the global plus size clothing market is categorized into economy, medium, and premium. The medium segment was valued at USD 52.8 billion in 2024 and is anticipated to grow with a CAGR of 6% during the forecast period.

- The economy price category possesses the significant portion of the plus-size apparel market. This indicates the high demand of quality affordable clothes to suit the budgetary accommodation of diversified consumers.

- It is a mass-produced segment where due to the need to maintain low prices, more cost-effective synthetic blends and less complex designs are usually used. The brands belonging to this group believe in selling their products in large quantities and reaching a greater number of people without focusing on class-based purchasing power. One of the most popular distribution channels of economy plus-size apparel is e-commerce business that offers competitive products and has regular sales. The largest share holding segment is the medium segment that makes up 44.2% and is frequently a very fast-growing category that reaches consumers who are willing to spend a small bit more on quality, fit and fashion-related designs but not reaching up to the premium price rate. There are reports which suggest that mid-range is the category that brings the highest revenue.

- This category of apparel is usually made with more durable, higher-quality, fabrics (fabrics that are often blends with a superior hand-feel and stretch), better-built, more modern design. Brands, in this region, aim to provide the combination of price and value, appealing to the customers in need of conveniently fitting and trendy clothes both in everyday life and on special occasions with higher levels of disposable income and more fashion-conscious tastes.

- Although it comprises a less portion than the economy and mid-range, the Premium price range is an expanding segment in the plus-size market. It sells to those consumers who will spend a lot of money on such attributes as the use of high-quality materials, top-notch craftsmanship, original designs, and brand reputation.

Based on consumer, the global plus size clothing market is categorized into men, women, and children. The women segment accounted for 48.4% market share in 2024 and is anticipated to grow with a CAGR of 6% during the forecast period.

- The women's segment consistently holds the largest revenue share in the overall plus-size clothing market, accounting for 48.4% in 2023. This dominance is largely attributed to the robust and increasingly vocal body positivity and inclusivity movements, which have historically been centered around female representation.

- Women are actively seeking fashionable, well-fitting, and diverse clothing that celebrates their bodies and reflects current trends, moving far beyond basic and unflattering options. Brands are rapidly expanding their offerings, incorporating a wider range of styles, from casual wear and active wear to formal dresses and intimate apparel, often investing significantly in design and marketing campaigns featuring diverse body types to cater to this highly engaged consumer group.

- The male segment is often cited as generating significant income and is projected to exhibit robust growth, sometimes even faster than the women's segment in certain regions. This growth is primarily fueled by the continuous rise in male obesity rates globally.

- The "below 15" age segment, which largely encompasses children's plus-size clothing, is projected to grow at a significant growth. This reflects a growing recognition of the need for inclusive sizing in children's apparel, driven by rising childhood obesity rates globally.

Looking for region specific data?

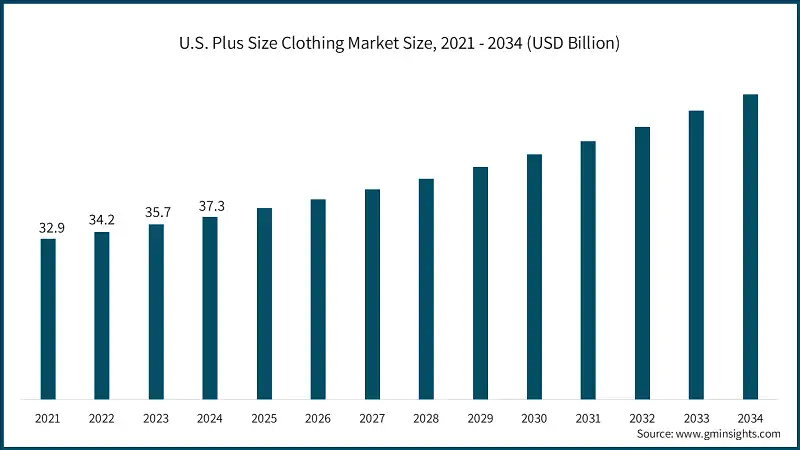

The U.S. dominated the North America plus size clothing market, which was valued at USD 37.3 billion in 2024 and is estimated to grow at a CAGR of 5.3% from 2025 to 2034.

- With a combination of major demographic, cultural and retail forces, the U.S. ranks first in the international plus-size clothing market industry in the North America region.

- This high market potential is also enhanced by the active and vocal body positivity movement, which has found huge popularity in and gained popularity via social media and the honor culture and currently demands a wide range of body types and shapes to have relaxed and attractive clothing styles with a lot of customers and popularity demanding actions and incentives to be taken by the brands regarding inclusion of different body types in their designs. As a result, there have been significant investments in the plus-size format in the US retail environment, not only by pure play specialty retailers but also by large scale mainstream players that are extending their size offerings and marketing to better appeal to this very influential consumer group.

The plus size clothing market in China is expected to experience significant and promising growth at a CAGR of 9.8% from 2025 to 2034.

- China has emerged as a vibrant and a fast-growing market in the plus-size clothing industry that has been fueled by a relatively new combination of the changing cultural norms and major socio-economic changes. Although the standards of beauty that involve thin bodies have historically been common, there is an increasing body-positivity movement that challenges notions and encourages the range of body shapes to be embraced increasingly so and is enabled using the social media named Douyin and WeChat.

- Together with a relatively rapid urbanization process and the growing Chinese middle class, such cultural development contributed to soaring living standards, and significant lifestyle changes, which led to growing disposable incomes, and to an alarming increase in the average body size of the population. As a result, the market of plus-size fashion that fits, is of high quality, and looks good, is becoming overwhelmingly broad, which forces both national and international companies to increase availability and create a deliberate effort to speak directly to and through this new and growing population whose voice cannot longer be ignored.

The plus size clothing market in Germany is expected to experience significant and promising growth at a CAGR of 4.8% from 2025 to 2034.

- Germany's significant role in the European plus size clothing market is influenced by a blend of changing consumer preferences and a heightened awareness of body positivity. The nation’s varied and inclusive fashion scene motivates brands to broaden their size offerings, in line with evolving cultural perspectives. Moreover, an increasing number of self-assured, fashion-savvy consumers in search of stylish and comfortable choices drives demand.

The plus size clothing market in Saudi Arabia is expected to experience significant and promising growth at a CAGR of 3.3% from 2025 to 2034.

- Saudi Arabia's role in the MEA plus size clothing market is fundamentally linked to changing societal norms and a rising consumer appetite for varied fashion choices. As cultural attitudes shift towards a more inclusive view of body diversity, both local and international brands are beginning to acknowledge the market's potential. The country's developing retail infrastructure, along with the emergence of digital platforms, enhances access to inclusive clothing lines, appealing to a wider audience.

Global Plus Size Clothing Market Share

- Global plus-size clothing market is extremely fragmented, neither a single giant with a technology lead, nor a small group with an extremely large share can be found. Nevertheless, H&M, Ralph Lauren Corporation, Adidas, Puma, Nike and ASOS are always listed as one of the biggest manufacturers and the big names in the world. According to some reports, the market share held by the five leading companies (in many cases including Adidas, Hennes & Mauritz, Nike, Puma and Under Armour) amounts to between 10%-12%, which is not a high concentration but a wide competitive environment.

- H&M strategizes on incorporating the recent fashion trends into their series commonly referred to as H&M+, providing stylish plus-size fashions at a reasonable cost to the world market. The company can use its large brick stores and dominant e-commerce network to access a vast consumer audience. Its business model focuses on fast fashion, mass market, and recently, sustainability in its mass scale manufacturing and involving clients with the latest fads, based on the style predilection.

- The strategic direction of Nike is towards the athletic and performance-based wear, and they have extended it to the realm of developing functional and empowering garments to the plus-size population. The company lays emphasis on high-tech fabric technology in moisture management, stretching and even ergonomics which always keep the wearer comfortable and in the best fit in terms of physical activities. Nike also strives to take the lead in the inclusive design in sportswear, as the company wants imperfect bodies to have access to healthy lifestyles by offering its worldwide brand name and commitment to high-quality development and marketing of specialized products.

- Adidas is moving towards the extension of its famous sportswear and lifestyle clothing to the plus-size market: they understand that there is a growing necessity in inclusive athletic gear. Its brand specializes in products that present elegant designs integrated with performance materials to provide both comfortable and attractive solutions to different body shapes and activities. Adidas uses the international presence of its distribution, as well as brand power, to supply the people with high-quality, durable plus-sized sportswear, which is in line with the more-encompassing trend of inclusivity of health and wellness and the increased demands of the people with an increasing plus-size athletic population.

- Universal Standard's core strategic focus is on revolutionizing fashion inclusivity by offering a truly universal size range, spanning from 00 to 40 (4XS to 4XL). Their philosophy aims to make size irrelevant in the shopping experience, ensuring that all women have access to the same styles, quality, and shopping experience regardless of their body size.

Plus Size Clothing Market Companies

Major players operating in the plus size clothing industry are:

- Adidas

- Aditya Birla Fashion

- Arula

- Ashley Stewart

- ASOS

- Billoomi Fashion

- City Chic

- FullBeauty Brands

- Hennes & Mauritz

- Lane Bryant

- Mango

- Nike

- Puma

- Ralph Lauren

- Under Armour

- Lane Bryant is a strategic brand that specializes in selling stylish, comfortable, and well-fitting clothing and fashion at some of the most reasonable rates to women outfits (sizes 10-40). They are well known especially in their line of intimate apparel Cacique line which focuses on a very good fit and support on bigger bust and figures. The main concepts are the combination of physical stores that provide personalized shopping and an extensive presence of e-commerce.

- The strategic priorities of Torrid are solely focused on the innovative, trendy, comfortable, and stylish apparel that will be made especially on gowns which are fashionable and fit plus-size women (sizes 10 to 30). Their main difference is the variety of apparel, intimates, and accessories that can fit the individual needs of the target audience in terms of fit and style, which is crucially important to the target audience. Among the most notable characteristics are a powerful omnichannel approach (comprising a large footprint of brick-and-mortar stores and a well-developed online presence) through which it offers an individualized experience and community-based brand experience. Torrid focuses on fashion trends, store seasons, and the promotion of the body-positivism, which makes it a reliable source of plus-size clothing.

- The strategic vision of ASOS as an online fashion leader is on becoming the one-stop shop to the fashion savvy 20-somethings worldwide with a consequent investment in plus-size sector via its ASOS Curve and ASOS Design Plus collections. Their main business model is e-commerce with a huge, curated assortment of more than 850 third-party brands, as well as their well-established own-label lines, entirely in extended sizes.

Plus Size Clothing Industry News

- In February 2024, Aditya Birla launches Honey Curvytude Plus-size line in fashion. Pantaloons as the fashion apparel of the Aditya Birla Group provides a new range of plus size women wear brand named Honey Curvytude. It will target plus-size buyers with fusion-style clothes in more sizes considering it as a strategic move of a large fashion company in India to meet the demands of inclusive fashion. It is to be adopted to catch the extensive and growing market of plus-size consumers in India.

- In January 2024, Henning and Universal Standard have collaborated to expand their business wear to a size 40. The sophisticated-designed business wear brand Henning that produces clothes that feature a professional twist revealed a partnership with the inclusive sizing company Universal Standard so that Henning professional clothing from size 0 to size 40 could be available. This collaboration represents an important milestone to deliver high-quality, work-appropriate fashion to a population of people who have been historically underserved in that sector, encouraging diversity in the workplace.

- In May 2024, Big Hello Opens Four New stores in Hyderabad. Big Hello, an Indian niche fashion house catering to plus size people, unveiled that four new physical stores will open in Hyderabad (Kukatpally, Upperpally, Miyapur, and Panjagutta). This is because this move in expanding physical retail networks of a niche brand signifies that there is growing confidence in the concept of direct-to-consumer channel, as well as the surging need to have affordable fashion choices with the various brands that can be accessible to a plus-sized population of men and women in emerging economies such as the one found in India.

- In July 2023, Dia & Co. Introduced a new virtual styling service and centers on inclusivity. One of the leading plus-size apparel brands, Dia & Co., launched a virtual Styling Service creating a match between the client and the personal stylist supporting his/her choosing the perfect plus-size clothes. To implement inclusivity, the company also utilized the idea of inclusiveness to diversify its size range. The innovation relies on technology and a personal approach to better the experience of shopping from plus-size consumers by supporting them through widespread fit issues and promoting body positivity.

The global plus size clothing market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue ($ Bn) & shipment (Units) from 2021 to 2034 for the following segments:

Market, By Type

- Casual

- Sportswear

- Formal

- Inner wear

- Others

Market, By Material

- Synthetic fabrics

- Polyester

- Nylon

- Natural fabrics

- Cotton

- Wool

- Others

Market, By Consumer Group

- Men

- Women

- Children

Market, By Age Group

- Below 15 years

- 16 to 45 years

- 45 years and above

Market, By Price Range

- Economy

- Medium

- Premium

Market, By Distribution Channel

- Online

- E-commerce

- Company website

- Offline

- Specialty stores

- Mega retail stores

- Other retail stores

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the global plus size clothing market?

Key players include H&M, Nike, Adidas, ASOS, Lane Bryant, Ralph Lauren, Under Armour, Mango, and FullBeauty Brands.

What are the upcoming trends in the plus size clothing industry?

Key trends include AI-powered virtual fitting rooms, use of sustainable fabrics, influencer-driven fashion collaborations, and expansion of athleisure and innerwear collections.

What was the valuation of synthetic fabrics segment in 2024?

The synthetic fabrics segment was valued at USD 76.3 billion in 2024.

Which region leads the global plus size clothing market?

North America held the largest market share in 2024, accounting for over 39% of revenue, supported by high obesity rates, robust retail infrastructure, and strong inclusivity advocacy.

How much revenue did the casual wear segment generate in 2024?

Casual wear generated USD 39.2 billion in 2024, dominating the market due to rising demand for comfort-driven, flexible, and fashionable apparel.

What is the projected value of the global plus size clothing market by 2034?

The market for plus size clothing is expected to reach USD 202.4 billion by 2034, fueled by rising obesity rates, expanding e-commerce platforms, and demand for stylish inclusive fashion.

What is the market size of the global plus size clothing in 2024?

The market size was USD 119.4 billion in 2024, with a CAGR of 5.5% expected through 2034 driven by growing body positivity and inclusivity movements.

Plus Size Clothing Market Scope

Related Reports