Summary

Table of Content

Plasma Protease C1-inhibitor Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Plasma Protease C1-inhibitor Market Size

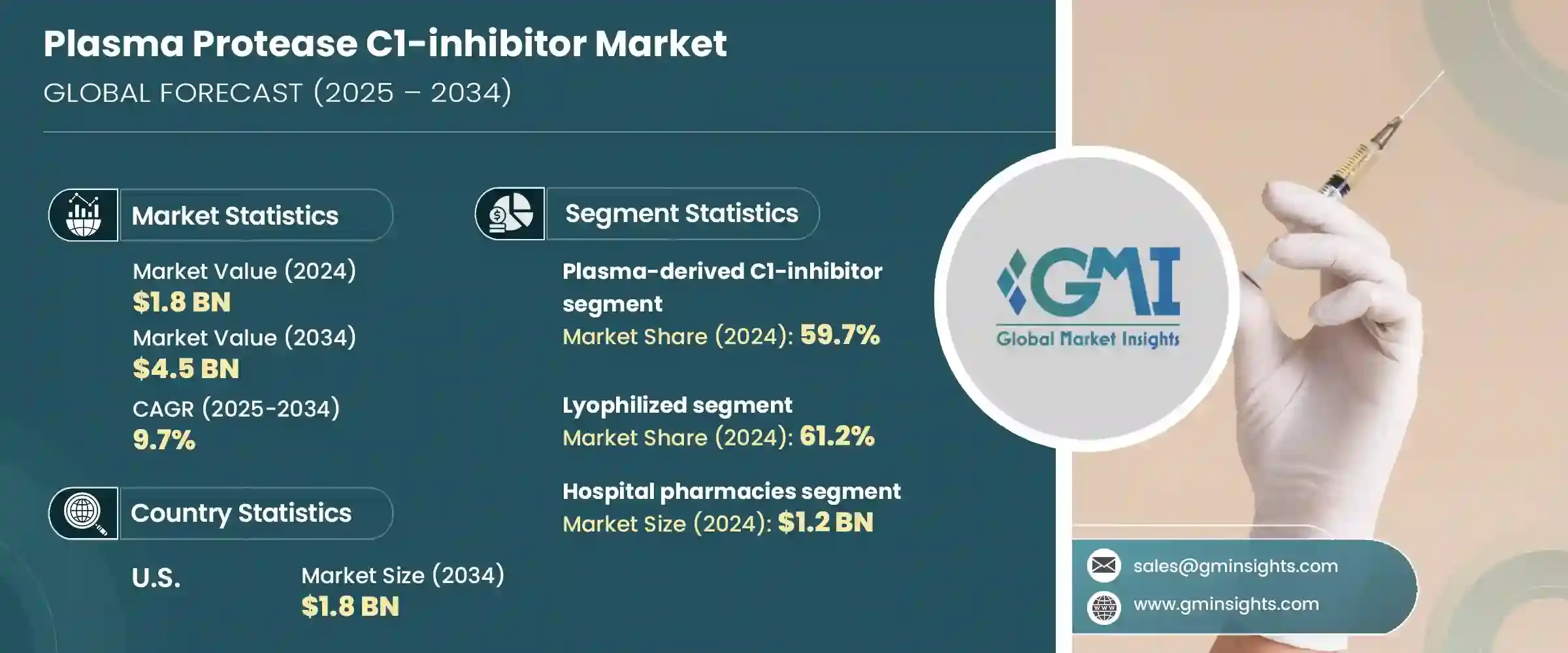

The global plasma protease C1-inhibitor market size was valued at around USD 1.8 billion in 2024 and is estimated to grow at 9.7% CAGR from 2025 to 2034. Plasma protease C1-inhibitors regulate the activation of the contact and complement systems. It is a serine protease inhibitor derived from plasma.

To get key market trends

The increasing incidence of hereditary angioedema (HAE) and other complementary system disorders is driving the plasma protease C1-inhibitor market growth. For instance, according to Medline Plus, approximately one in every fifty people globally is affected by hereditary angioedema. It is an autosomal dominant disease caused by the lack of either dysfunctional or normal C1-inhibitor protein. The disease causes recurrent episodes of severe swelling in the airway, legs, arms, feet, hands, and face. The aggressive nature of these diseases has heightened the demand for targeted therapies such as plasma protease C1-inhibitors, thereby facilitating market growth.

Plasma Protease C1-inhibitor Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.8 Billion |

| Forecast Period 2025 – 2034 CAGR | 9.7% |

| Market Size in 2034 | USD 4.5 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Additionally, growing awareness of HAE, its symptoms, diagnosis, and treatment options has promoted early diagnosis and treatment. Plasma Protease C1-inhibitor therapy aids in the prevention and management of these devastating effects of HAE attacks by restoring necessary control of the complement system, which is malfunctioning in HAE patients. Furthermore, regulatory approvals and orphan drug designations for novel plasma protease C1-inhibitors is driving the market growth. For instance, in May 2023, the Public Health Institute (ISP) of Chile granted marketing authorization for BioCryst Pharmaceuticals’ ORLADEYO (berotralstat) treatment indicated for HAE attacks in patients aged 12 years and above.

Plasma Protease C1-inhibitor Market Trends

- The market is witnessing a growing demand for subcutaneous formulations that enhance adherence and convenience by enabling patients to administer C1 inhibitors at home themselves. This has been preferred as an alternative to traditional intravenous (IV) infusions that necessitate hospital admission.

- Recombinant therapies that reduces reliance on human plasma are now replacing or complementing the traditional plasma-derived C1- inhibitors. Further, gene therapy interventions are being explored to modify the genes related to the synthesis of protease inhibitor for long-term or even curative treatment. For instance, Ionis Pharmaceuticals and Takeda Pharmaceutical Company are researching the possibilities of regulative antisense oligonucleotide therapy to regulate protease activity.

- Additionally, there are growing research and development (R&D) initiatives aimed at the expansion of plasma protease C1-inhibitors into new applications such as neurological conditions, autoimmune diseases, ischemia-reperfusion injury, and sepsis.

- Furthermore, growing healthcare infrastructure foreign investments, ever-increasing awareness regarding HAE, and rising insurance coverage has facilitated the increasing adoption and R&D of plasma protease C1 inhibitors in the Asia Pacific and Latin America regions. Market players are engaged in the development of novel treatments and gain regulatory approvals to capture untapped market opportunities.

Plasma Protease C1-inhibitor Market Analysis

Learn more about the key segments shaping this market

Based on drug class, the market is segmented into plasma-derived C1-inhibitor, selective bradykinin B2 receptor antagonist, and Kallikrein inhibitor. The global market for plasma protease C1-inhibitor was valued at USD 1.6 billion in 2023. The plasma-derived C1-inhibitor segment dominated the market with the largest revenue share of 59.7% in 2024.

- The increasing incidence of HAE is a significant driver of the plasma-derived C1-inhibitor segment over the forecast period. For instance, according to Discover HAE, in 2022, approximately 1,64,201 people were affected by HAE globally. This high incidence has emphasized the need for effective hereditary angioedema therapeutics, facilitating market growth.

- Moreover, increasing expansion in applications of plasma-derived C1-inhibitors is also driving revenue growth in the segment. For example, in April 2022, the U.S. FDA reported an update that CINRYZE could be prescribed for routine prophylaxis against angioedema attacks in patients suffering from HAE.

- Additionally, the purity and yield of C1-inhibitors derived from plasma have increased owing to the rising investments in plasma fractionation and collection technologies, thereby driving the demand for plasma derived therapies.

Learn more about the key segments shaping this market

Based on dosage form, the plasma protease C1-inhibitor market is bifurcated into lyophilized and injectables. The lyophilized segment dominated the market with the largest revenue share of 61.2% in 2024.

- Lyophilized formulations are more popular among healthcare professionals and patients due to their longer storage life without refrigeration. This is particularly beneficial in rural areas that lack proper cold chain infrastructure, guaranteeing a longer shelf life and improved distribution capabilities. Cinryze (offered by Takeda Pharmaceutical Company) and Berinert (CSL Behring) are key examples of widely used lyophilized C1-INH products.

- In addition, R&D initiatives aimed at expanding applications of lyophilized C1 inhibitors into immune-related and inflammatory conditions such as transplant rejection, ischemia-reperfusion injury, and sepsis.

Based on distribution channel, the plasma protease C1-inhibitor market is segmented into hospital pharmacies, retail pharmacies, and e-commerce. The hospital pharmacies segment dominated the market with the largest revenue of USD 1.2 billion in 2024.

- Acute HAE attacks can prove fatal if they are left untreated, thereby highlighting the importance of plasma protease C1 inhibitors in controlling them. Hospital pharmacies are critical distribution modalities as they ensure urgent availability of emergency HAE attack cases.

- Moreover, a large number of C1-INH therapeutics are lyophilized (freeze-dried) and have to be given via IV routes, making hospitals as the primary center for treatment. Hence, many formulations, particularly IV formulations like Berinert and Ruconest, are frequently available across the hospital pharmacies.

- Moreover, plasma protease C1-inhibitors necessitate specific delivery, storage, and handling procedures due to their biological nature. Hospital pharmacies possess the necessary infrastructure and facilities to adhere to the necessary storage guidelines, ensuring the integrity of the products and reducing unnecessary risks.

Looking for region specific data?

The U.S. plasma protease C1-inhibitor market revenue in North America has increased considerably from USD 729.4 billion in 2024 and is expected to grow significantly, reaching USD 1.8 billion by 2034.

- The growing demand for of HAE treatments in the U.S. due to various factors such as high prevalence of HAE, growing awareness towards timely treatment, increasing genetic screening, growing healthcare access is driving market growth in the region. For instance, according to Discover HAE, approximately 6000 people in the U.S. are affected by HAE.

- Also, regulatory authorities such as the U.S. FDA provides orphan drug designations and fast-track approvals for rare, targeted therapies such as C1-inhibitors. For instance, in September 2020, the U.S. FDA announced the approval of HAEGARDA to prevent HAE attacks in patients aged 6 years and above.

- Moreover, U.S. has presence of leading companies in the market such as Takeda Pharmaceutical Companies, CSL Behring, Pharming Group, and KalVista Pharmaceuticals, that primarily drives investments in research and development, and clinical trials, and primarily commercialize their approved products in the U.S., which contributes to the market growth.

Europe: The plasma protease C1-inhibitor market in UK is expected to experience significant and promising growth from 2025 to 2034.

- UK’s National Health Service (NHS) offers universal healthcare coverage, ensuring widespread patient access to expensive biologic therapies like C1-INH and kallikrein inhibitors. The UK has specialized HAE treatment centers such as HAE UK, making it a primary destination in Europe for HAE management.

- Further, guidelines and recommendations provided by NHS and National Institute for Health and Care Excellence (NICE) are ensuring widespread adoption of protease C1-inhibitor therapies across healthcare settings in the UK.

- In addition, the growing adoption of e-commerce in the UK, coupled with the increasing availability of self-administered C1-inhibitors is driving the demand for home-based C1-inhibitor treatment of HAE in the UK. The UK was one of the first European countries to approve key C1-INH therapies.

Asia Pacific: Japan plasma protease C1-inhibitor market is anticipated to witness lucrative growth between 2025 - 2034.

- Japan has an advanced healthcare infrastructure, with advanced diagnostic capabilities and an extensive distribution network. Further, clinical development programs that specifically focuses on long-term prevention of HAE attacks are ongoing in Japan. These factors promote the adoption of plasma protease C1-inhibitors for the treatment of HAE in the country.

- Furthermore, Japan has advanced research facilities working on HAE treatments, gene therapies, and monoclonal antibodies. Leading Japanese universities, like Tokyo University and Kyoto University, take part in international clinical studies testing plasma protease inhibitors. The nation’s pharmaceutical ecosystem is fostering innovation, which drives the use of recombinant and oral protease inhibitors in Japan.

- Additionally, the presence of Takeda Pharmaceutical Company, the developer of Cinryze, Firazyr, and Kalbitor, in Japan is also among the major driving factors of the market growth in the country.

Middle East and Africa: The plasma protease C1-inhibitor market in Saudi Arabia is expected to experience significant and promising growth from 2025 to 2034.

- Heavy investments in healthcare infrastructure through the establishment of dedicated research centers in organizations such as National Guard Health Affairs, King Faisal Specialist Hospital & Research Centre, and King Fahad Medical City is driving the development and clinical research of various novel plasma protease C1-inhibitor treatments.

- Additionally, the growing awareness regarding HAE among the population and healthcare professionals has promoted diagnosis rates, thereby driving the demand for effective treatment options in the region.

Plasma Protease C1-inhibitor Market Share

The market is concentrated, featuring 4 pharmaceutical firms having approved products. The top players in this market include CSL Behring, BioCryst Pharmaceuticals, Pharming, and Takeda Pharmaceutical Company are the only players with commercialized products and accounts 100% of the market share. These players are investing in the development of advanced treatments to enhance treatment efficiency. Moreover, strategic partnerships with research institutions and healthcare providers are critical for integrating modern technologies and expanding distribution, which has enabled the companies to address the surge in demand for treatment options. The market experiences a regulatory support and streamlined approval processes which further motivates to innovate and facilitates market entry. Additionally, emerging players are focussing on development of new treatment options which aim to improve disease management. These innovations continue to promote market progression.

Plasma Protease C1-inhibitor Market Companies

Some of the eminent market participants operating in the plasma protease C1-inhibitor industry include:

- Astria

- BioCryst Pharmaceuticals

- CSL Behring

- Fresenius Kabi

- Ionis Pharmaceuticals

- KalVista

- Pharming

- Pharvaris

- Takeda Pharmaceutical Company

- CSL Behring is a major leader in the plasma protease C1-inhibitors market. Its flagship product, Berinert, is a popular C1-inhibitor treatment indicated for HAE. The company’s advanced research and development capabilities coupled with its advanced distribution network, solidify its leadership in the market.

- BioCryst Pharmaceuticals is another major players in the market, owing to its Orladeyo (berotralstat) oral therapy. It is an oral plasma kallikrein inhibitor indicated for the treatment of HAE. The company’s growing initiatives towards the development of novel treatments to enhance HAE treatment outcomes position it as a major competitor in the market.

- Takeda Pharmaceutical Company has strong presence in the market through its C1-esterase inhibitors (Cinryze) and kallikrein inhibitors (Firazyr). The range of treatment options offered by the company enhances its ability to meet different patient requirements, from acute care to long term disease management.

Plasma Protease C1-inhibitor Industry News:

- In May 2023, BioCryst Pharmaceuticals announced the marketing approval of its ORLADEYO (berotralstat), an oral treatment for HAE attacks in patients 12 years and above, by the Public Health Institute (ISP) of Chile. This approval significantly expanded the reach of BioCryst Pharmaceuticals into the significantly untapped Latin America plasma protease C1-inhibitor market.

- In April 2022, Takeda Pharmaceutical Company announced a U.S. FDA approval of CINRYZE, a C1 esterase inhibitor, for use in routine prophylaxis against angioedema attacks in patients with Hereditary Angioedema (HAE).

- In September 2020, CSL Behring announced the expanded indication approval of HAEGARDA for the prevention of HAE attacks in patient aged 6 years and above. The approval significantly bolstered the company’s presence in the market.

The plasma protease C1-inhibitor market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 – 2034 for the following segments:

Market, By Drug Class

- Plasma-derived C1-inhibitor

- Selective bradykinin B2 receptor antagonist

- Kallikrein inhibitor

Market, By Dosage Form

- Lyophilized

- Injectables

Market, By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- E-commerce

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are some of the prominent players in the plasma protease C1-inhibitor industry?

Key players in the market include Astria, BioCryst Pharmaceuticals, CSL Behring, Fresenius Kabi, Ionis Pharmaceuticals, KalVista, Pharming, and Pharvaris.

How big is the plasma protease C1-inhibitor market?

The plasma protease C1-inhibitor industry was valued at USD 1.8 billion in 2024 and is estimated to grow at a 9.7% CAGR from 2025 to 2034.

How much is the U.S. plasma protease C1-inhibitor market worth?

The U.S. plasma protease C1-inhibitor industry recorded USD 729.4 million in 2024 and is expected to reach USD 1.8 billion by 2034.

Which segment dominates the plasma protease C1-inhibitor industry?

The lyophilized segment held the largest revenue share of 61.2% in 2024.

Plasma Protease C1-inhibitor Market Scope

Related Reports