Summary

Table of Content

Plant Protein Hydrolysate Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Plant Protein Hydrolysate Market Size

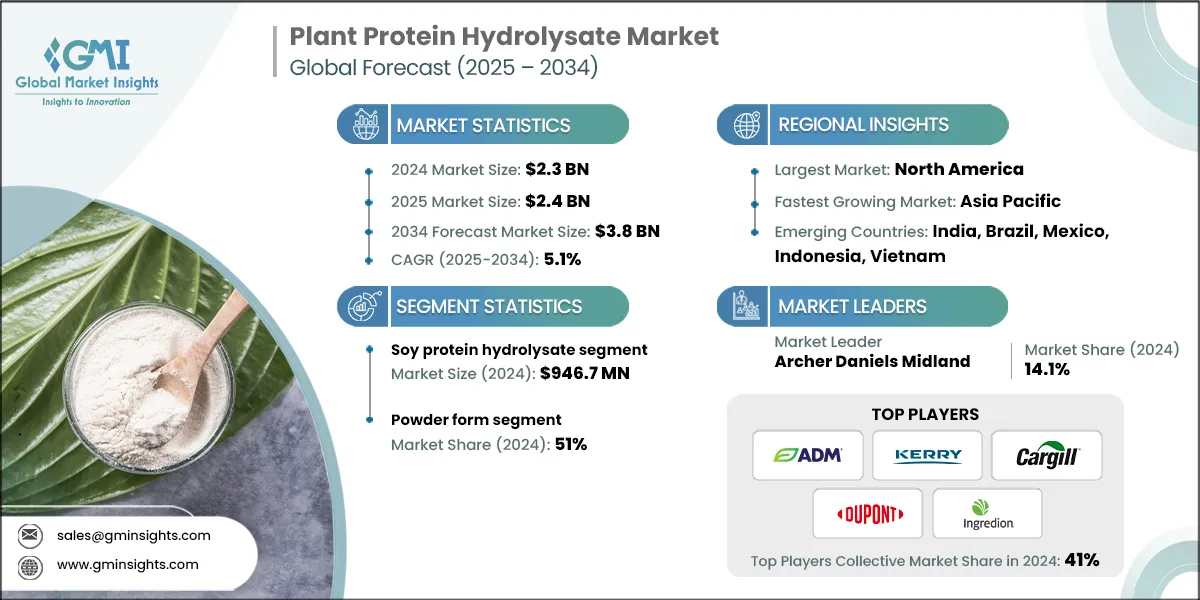

The global plant protein hydrolysate market size was valued at USD 2.3 billion in 2024. The market is expected to grow from USD 2.4 billion in 2025 to USD 3.8 billion in 2034, at a CAGR of 5.1%, according to latest report published by Global Market Insights Inc.

To get key market trends

- Meals these days have more focus on nutrition, which has been aided by reasons like health, its sustainability, or even dietary restrictions like being a vegetarian or vegan, or even allergies. People are now more aware of the advantages of plant protein hydrolysates, such as improved digestibility and bioavailability. These markets have experienced significant growth. These ingredients are ideal oat protein isolates where they act as a major health-benefiting protein source. This makes it useful in some of the most diverse fields, such as sports nutrition, functional foods, and infant formulas.

- A few points still determine the direction in which the market continues to open up. In particular, the growing demand for plant-based products is very favorable for the market, notably among health-conscious consumers. The shift towards plant-based diets across the globe, together with greater adoption of vegetarian and vegan diets, has changed spending habits profoundly.

- The spends are equally impacted, on the other hand, by the variety of the health and wellness trend in which the use of clean label products and natural ingredients is increasing. The need for hydrolyzed plant protein is rising because there is a search for non-processed, non-allergenic proteins. The industry is likely to grow at a staggering rate as the USD 12.2 billion plant-proteins market in 2022 is expected to increase to USD 17.4 billion by 2027, as stated by Statista.

- The other growing area of concern is the increasing incorporation of plant-based protein hydrolysates in functional foods and beverages. They are of utmost importance in sports and clinical nutrition. Furthermore, sustainability concerns are very relevant to the growth of the market. Plant-based proteins are more attractive to the consumers and marketers aiming at sustainability than animal proteins. As a result of the ever-growing need for health-oriented and sustainable proteins, the market for plant-based protein hydrolysates is expected to increase considerably in the next few years.

Plant Protein Hydrolysate Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.3 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.1% |

| Market Size in 2034 | USD 3.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for plant-based diets | The rising demand for plant-based diets drives increased market growth as consumers seek more plant-derived products. |

| Nutritional and functional benefits | The nutritional and functional benefits of plant protein hydrolysates enhance their application in health-focused foods, further fueling market expansion. |

| Clean label and natural ingredients trend | The clean label and natural ingredients trend encourages product development aligned with consumer preferences for transparency and simplicity, boosting market opportunities. |

| Pitfalls & Challenges | Impact |

| High production costs | High production costs pose a challenge by limiting profitability and price competitiveness in the market. |

| Opportunities: | Impact |

| Significant potential for product innovation | The significant potential for product innovation offers avenues for new and improved plant protein hydrolysate products, fostering market expansion and technological advancement. |

| Market Leaders (2024) | |

| Market Leaders |

14.1% market share |

| Top Players |

Collective Market Share in 2024 in 41% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging country | India, Brazil, Mexico, Indonesia, Vietnam |

| Future outlook |

|

What are the growth opportunities in this market?

Plant Protein Hydrolysate Market Trends

- Growing Demand for Plant-Based Protein Alternatives-Notable growth is being witnessed in the market for plant protein hydrolysates due to changes in consumer preferences, the development of new processing technologies, and increasing interest in sustainable and healthy food. With the increase in popularity of plant-based diets, there is a shift among manufacturers toward more innovation, clean label ingredients, and enhanced functional features to satisfy marketplace expectations.

- One of the most notable trends of the market is the growing search for plant-based alternatives to proteins. There is a notable search for protein-rich sources, which are plant-based and fit vegan and vegetarian as well as allergen-free diets. In comparison to intact plant proteins, plant protein hydrolysates possess superior digestibility and bioavailability compared to their plant counterparts. They easily find relevance towards sports nutrition, infant formula, medical nutrition, and functional foods.

- Consumer Shift Toward Clean-Label and Natural Ingredients-An important factor shifting the market is the increasing focus on clean-label products. Food labeling is no longer a secondary aspect; it is an expectation. A clear indication of this, according to industry experts, is that 50% of respondents pointed out clean labels as the ingredient that is expected most in the future.

- As people become more health-focused, the scrutiny on ingredient lists is increasing as consumers are looking for products that are more natural and less processed. There is also an increase in the acceptance of these foods termed functional foods, which are foods that offer health benefits beyond the basic nutritional value. Their acceptance is not as wide as clean-label foods.

- Rising Popularity of Functional Foods and Beverages- Functional foods and beverages are sharply on the rise, leading to increased growth in the market. As a result of their greater solubility and absorption, plant protein hydrolysates are now being incorporated into protein bars, premixed drinks, meal replacement shakes, and dietary supplements. This, in combination with their contribution to muscle repair, weight loss, and improvement of gut health, makes them much more appealing to the fitness and health-conscious consumer that is driving the market.

Plant Protein Hydrolysate Market Analysis

Learn more about the key segments shaping this market

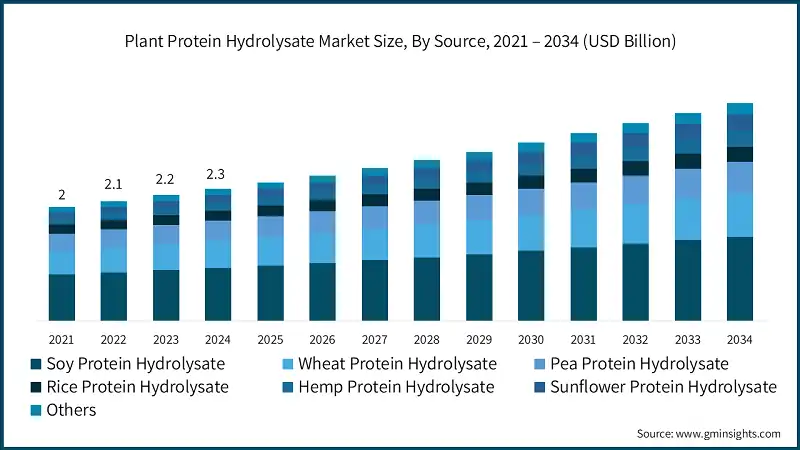

- The soy protein hydrolysate segment led the plant protein hydrolysate market in 2024, generating approximately USD 946.7 million in revenue. Its dominance is due to more acceptance and using soy protein hydrolysates in food and beverages. The amino acid rich composition has made soy protein hydrolysate a preferred ingredient among sports nutrition, infant formula, and functional food manufacturers, which lends to the rising demand for it by industry use. The good solubility and digestibility of the supplement also fuel the industrial demand for protein supplements and other health-related dimensions of service.

- Positioned next in importance is wheat protein hydrolysate, which offers gluten-free protein hydrolysates that appeal to a niche of glutens. As more people learn about gluten intolerance and celiac disease, the popularity of these substitutes has increased. The main reason for the increasing demand for gluten-free products is that they provide sufficient nutrition, devoid of adverse reactions. Their everyday functionality has also been enhanced by the use of wheat protein hydrolysates, which enhance texture and emulsion stability in bakery products, meat analogues, and dairy substitutes.

- The demand for plant-based, allergen-free, and high-nutrition ingredients hyped by consumers will definitely keep soy and wheat hydrolysates in the market for years to come. Their importance in nutrition makes them beneficially used with functional versatility in increasing plant food innovation into new product development and commercializing them.

- With increasing consumer demand for plant-based, allergen-free, high-protein ingredients, soy and wheat protein hydrolysates are expected to remain prime players in the field. Their nutrients coupled with functional versatility integrate them with the ever-evolving plant-based food innovation world.

Learn more about the key segments shaping this market

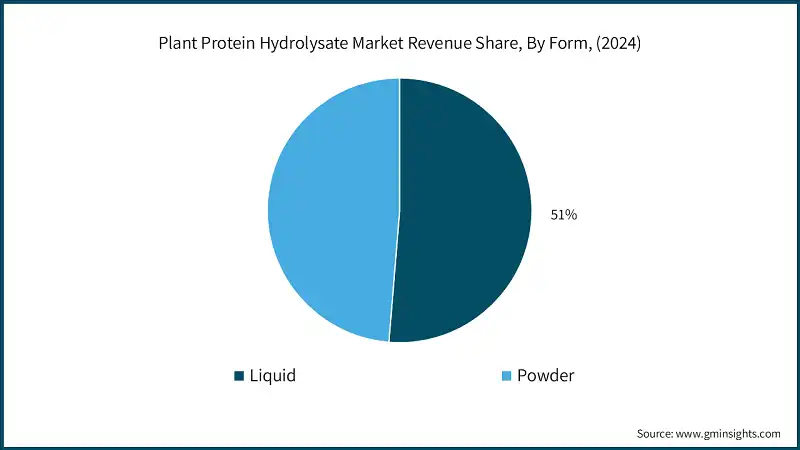

- Based on form, the powder form segment hold for 51% of market share in the plant protein hydrolysates market in 2024. It’s often used in baked goods, snacks, and nutritional supplements, and its easy handling makes it ideal for use by manufacturers.

- Apart from being functional, plant proteins serve an important value in the reduction of risk for metabolic syndrome and improvement of gut health, as noted by the National Library of Medicine. Protein supplementation in a 90-day clinical trial with 60 healthy adults resulted in an enhanced quality of life of 85.76%, 42.92% greater VO2 max, and increased physical functioning in the participants. Moreover, all participants noticed a reduction in 25% of Low Energy Events, in addition to the reduction of body weight (1.94 kg), waist (2.46 cm), and body fat percentage.

- As the demand for clean label and functional nutrition increases, Hydrolyzed Plant Protein Powders will continue to be in high demand due to their ease of use and proven health advantages.

- Based on application, the plant protein hydrolysate market from food and beverage industry will gain remarkable momentum during the forecast timeline. In the food & beverages segment, plant protein hydrolysates are extensively used in the formulation of protein bars, beverages, dairy alternatives, and plant-based meat substitutes which capture a significant share. The demand is stimulated by the increasing consumer adoption towards healthier and food options, which fosters innovation in plant-based protein sources.

Looking for region specific data?

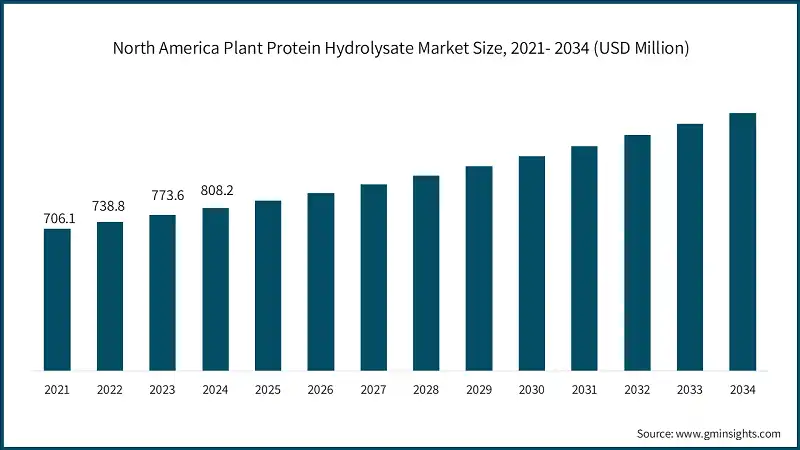

- The North American plant protein hydrolysate market reached USD 808.2 million 2024, owes its growth largely to demand coming from its counterparts in the northern stretch of the continent. The higher knowledge of the health and environmental benefits is accelerating the replacement of animal-sourced protein products with plant-sourced protein products, most especially in the food and beverage sector.

- The plant-based offerings were well-loved and brought new horizons to market, like novel cuts in alone dairy alternatives and drinks fortified with protein. Now the demand for clean-label, functional, and sustainable ingredients from the consumer forces the manufactures to adopt themselves to the new-age dietary requirements. The market is largely possible due to the advantage of having a culture of health and wellness existing in America to support the usage of plant-based products.

- With plant-based product advancement and other environmentally sustainable food areas continuously in the works, North America stands to turn a huge market in changing consumer behaviours and industry trends, thereby providing increased growth opportunities for this segment.

The plant protein hydrolysates market in Germany is expected to experience significant and promising growth from 2025 to 2034.

- Germany's plant protein hydrolysates market is expected to see a significant growth trajectory due to consumer awareness of health and sustainability, alongside the growing demand for plant-based foods and functional foods. The well-established food processing industry within Germany is presently adopting newer technologies, thereby catalyzing the growth of the market.

- Government efforts toward the promotion of plant-based diets and clean-label products further enhance the positive growth scenario. Rising interest in sports nutrition and medical foods, which require easily digestible, bioavailable plant proteins, is also keeping up the demand. Consumer preference for natural vs. synthetic ingredients in wellness-oriented products significantly contributes. The confluence of health trends, technology leverage, and regulatory support forms the optimistic spirit surrounding this outlook.

The plant protein hydrolysates market in China is expected to experience significant growth from 2025 to 2034.

- Remarkable growth of the market in China can be traced back to the increasing pace of urbanization, rising disposable incomes, and the evolving middle class that is demanding for options that are healthier and sustainable. Traditional diets were shifting toward plant-based and functional foods enhancing the demand for plant protein hydrolysates.

- The transforming food processing industry is adopting innovative approaches for extraction and processing methods for the enhancement of quality and diversity of products. Heightened awareness about health benefits related to plant proteins and government policies that encourage plant-based diets are additional stimuli for growth. The burgeoning fitness culture and demand for allergen-free, clean-label products are other contributors. Huge population base with a willingness to accept innovative nutritious functional food creates an expansion opportunity.

The plant protein hydrolysates market in Brazil is expected to experience growth from 2025 to 2034.

- A growing health consciousness and a powerful trend towards plant-based diets among consumers are pulling the growth of the Brazilian market. The most favorable view looks up on consumers whose concern is arising about sustainability and the environment associated with plant-derived ingredients. The food industry in its evolution is engaging in using plant protein hydrolysates for its functional benefits in snack foods and beverages amongst others.

- Government initiatives that seek to promote healthy living and sustainable agriculture then form an additional support to the observed trend. Furthermore, the rise in interest from active consumers in sports nutrition and functional foods fuels the demand. Brazil's prosperous agricultural production capacity offers raw materials for local production and innovations. These factors in combination fuel a steady upward trend for the market.

The plant protein hydrolysates market in Saudi Arabia is expected to experience significant and promising growth from 2025 to 2034.

- The Saudi Arabia market is projected to grow considerably aided by health awareness, shifting the youth population toward healthier lifestyles. Wellness and nutrition are the strategic thrusts of the Vision-2030 initiative, which promotes plant-based and functional foods. Additional disposable income together with urbanization is pushing consumers towards options for sustainable and healthy dietary practices.

- Among the growing food and beverage industry, plant protein hydrolysates have been integrated into products, sporting nutrition, and health supplements. Religious and cultural reasons provide added interest in allergen-free, naturally derived ingredients. All in all, investment views and a shift in consumer preferences underpin solid market growth in the region.

Plant Protein Hydrolysate Market Share

The hydrolyzed plant protein industry is very competitive, and major competitors are engaging in product and service acquisition and development through mergers and acquisitions to maintain their market shares. To meet the high demand for functional protein hydrolysates used in sports and clinical nutrition as well as in functional foods, these companies are pouring a lot of resources into research and development to offer premium quality.

Archer Daniels Midland Company (ADM), one of the top competitors in the industry, is U.S.-based and is a frontrunner in nutrition and agricultural processing. ADM has a wide portfolio of plant protein hydrolysate products and focuses on sustainability and the formulation of clean labels, innovative ingredients. These materials serve a number of sectors, such as food, beverages, and dietary supplements, which aim to meet the growing health consciousness in regard to proteins.

Plant Protein Hydrolysate Market Companies

Major players operating in the plant protein hydrolysate industry are:

- Archer Daniels Midland Company (ADM)

- Kerry Group

- Cargill

- DuPont

- Ingredion Incorporated

Archer Daniels Midland -Archer Daniels Midland Company is the largest agricultural processing firm in the world, manufacturing food ingredients worldwide. The firm offers numerous plant-based ingredients such as proteins and hydrolysates in various food applications. Given its extremely long supply chain, raw materials are collected, and innovative plant-based products will be constructed further. It provides sustainable solutions to meet functional demands brought by the customers.

Kerry Group- Kerry Group is one of the main manufacturers in food ingredients and flavor solutions. The company provides different plant-based protein ingredient types, including hydrolysates, dairy, snack, and health foods. Kerry gives importance to innovating functional ingredients to better the quality and nutrition of the products. It collaborates closely with the food manufacturers in adapting to the changing consumer tastes. The company has various markets that extend internationally.

Cargill- Cargill is a diversified company that one can classify under agri-food ingredients. It provides plant-based proteins and hydrolysates for sports nutrition, infant food, and functional foods. It puts focus mainly on sourcing sustainably and creating ingredients that improve functionality. It has done extensive research and development to push the high demands growing for nutritious plant-derived ingredients. The company supplies its clients in different regions to empower plant protein products.

DuPont-DuPont deals with scientific innovation in food ingredients such as plant proteins and hydrolysates. It is involved in creating novel solutions that boost potability and performance in plant-based proteins. In order to comply with health and wellness trends, the company engages in partnerships with food processors for the creation of related products. Investment in research with the objective of improving performance is done to maximize the benefits from its ingredients in various applications. This global profile bolsters the crowded market of plant protein hydrolysates.

Ingredion Incorporated- Ingredion Incorporated is the leading provider of ingredient solutions in further processing foods and beverages. Plant-based proteins such as hydrolysates are available from the company in order to boost the nutritional profile of the product and improve its functionality. Its vision is to produce clean-label, natural ingredients, which consumer demands require. The company works with food developers to incorporate plant proteins into their formulations. Its reach around the globe allows for support for the expanding market for plant-derived ingredients worldwide.

Plant Protein Hydrolysate Industry News

- In February 2024, Roquette, a plant-based ingredient manufacturer, released four new pea protein products designed to improve flavor, mouthfeel, and overall performance in plant and protein foods. Newest in the NUTRALYS offering are the isolates NUTRALYS Pea F853M and NUTRALYS H85 (hydrolysate) and textured versions NUTRALYS T Pea 700FL and NUTRALYS T Pea 700M. These innovations address key challenges associated with the use of plant proteins in the food and beverage industries whereby improved texturing, protein content, and aesthetic appeal are concerned in regard to bars, shakes, plant-based meat, and dairy products.

- In July 2024, Ingredion introduces all-new Pea Protein VITESSENCE Pea 100 HD, This new product is helpful in keeping cold pressed bars soft till the end of their shelf life. Along with nutrition benefits for consumer preference, that ensures the bars have the desired texture and sensory attributes throughout their shelf life.

- In November 2023, Agri Sciences Biologicals has introduced Yaarn, a hydrolyzed protein-based growth-promoting product for farmers' crop cultivation. Yaarn is made from sheep wool and uniquely contains a highly efficient and exclusive blend of hydrolyzed proteins, peptides, and amino acids which confer multiple benefits-much more to increase nutrient uptake, excellent quality of fruits, and overall yield.

The plant protein hydrolysate market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) & volume (Kilo Tons) from 2021 to 2034, for the following segments:

Market, By Source

- Soy protein hydrolysate

- Wheat protein hydrolysate

- Pea protein hydrolysate

- Rice protein hydrolysate

- Hemp protein hydrolysate

- Sunflower protein hydrolysate

- Others

Market, By Form

- Liquid

- Powder

Market, By Application

- Food & beverages

- Nutritional supplements

- Animal feed

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

What are the upcoming trends in the plant protein hydrolysates market?

Trends include demand for clean-label ingredients, growth in functional foods, and better processing for digestibility.

What was the valuation of the North American plant protein hydrolysates sector?

The North American market was valued at USD 808.2 million in 2024. The market growth in the region is fueled by increasing awareness of health and environmental benefits.

Who are the major players?

Key players include Archer Daniels Midland Company (ADM), Kerry Group, Cargill, DuPont, and Ingredion Incorporated.

What was the market share of the powder form segment in 2024?

The powder form segment held a 51% market share in 2024, driven by its ease of handling and extensive use in baked goods, snacks, and nutritional supplements.

What is the expected size of the plant protein hydrolysates market in 2025?

The market size is projected to reach USD 2.4 billion in 2025.

How much revenue did the soy protein hydrolysate segment generate in 2024?

The soy protein hydrolysate segment generated approximately USD 946.7 million in 2024, dominating the market due to its amino acid-rich composition and widespread use in sports nutrition, infant formulas, and functional foods.

What is the projected value of the plant protein hydrolysates market by 2034?

The market is projected to reach USD 3.8 billion by 2034, driven by rising demand for plant-based protein alternatives and advancements in processing technologies.

What was the market size of the plant protein hydrolysates in 2024?

The market size was valued at USD 2.3 billion in 2024, with a CAGR of 5.1% expected through 2034. Increasing consumer awareness about health benefits, sustainability, and dietary preferences is driving market growth.

Plant Protein Hydrolysate Market Scope

Related Reports