Summary

Table of Content

Pick and Place Machine Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Pick and Place Machine Market Size

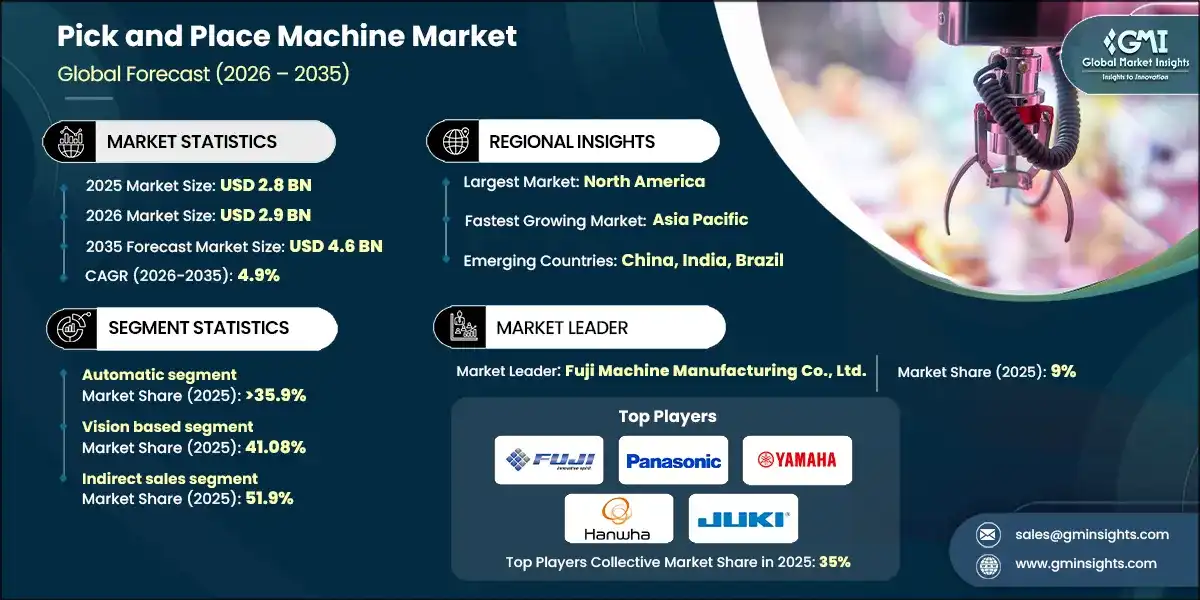

The pick and place machine market size was estimated at USD 2.8 billion in 2025. The market is expected to grow from USD 2.9 billion in 2026 to USD 4.6 billion in 2035, at a CAGR of 4.9% according to latest report published by Global Market Insights Inc.

To get key market trends

A large part of the efficiency gains and precision in electronics manufacturing, which have been heavily highlighted, has caused a rapid increase in the demand for high, speed SMT placement systems. This is due to the increase in mergers and acquisitions among the industry leaders, such as the strategic consolidation of the main robotics and assembly companies. The merging of the key players' forces resulted in more innovations, wider product portfolios, and a stronger market presence.

At the same time, the use of manual component placement methods or simple semi, automatic machines have become not only less economically viable but also less compatible with the requirements of miniaturized 5G and EV components. Currently, fully automated pick and place machine systems represent a more sustainable future as they have been fitted with energy, saving servo motors and materials with high thermal stability, thus limiting their environmental impact by reducing operational power loss. This green method is in line with the adoption of sustainable practices in high tech manufacturing, which is also a factor driving market growth.

The use of advanced robotics in electronics assembly has become a trend in North America, and demand is rapidly increasing. In addition, the rise of semiconductor and e, mobility infrastructure spending in Europe and parts of the Asia and Pacific region has created the conditions for the commercial viability of such equipment. Both consumers and professionals have opted for efficient, mechanized solutions to high, throughput PCBA (Printed Circuit Board Assembly); therefore, they no longer rely on the old, time, consuming manual assembly methods.Original Equipment Manufacturers (OEMs) and Electronics Manufacturing Services (EMS) providers are most of the time requiring faster placement speeds that cause fewer disruptions to tight production schedules.

As a result, modular pick and place machine are rapidly becoming the main decision due to their already, known advantages, such as the optimization of factory floor space and the reduction of the risk of defects caused by human handling errors. In fact, the market is essentially led by a heightened awareness of the long, term benefits of a fully integrated smart factory, which results in a wider acceptance of these powerful devices. Furthermore, the continuing improvements in vision inspection systems and linear motor technology will allow safety to be elevated even more.

Infrastructure support, industry, wide focus on AI, driven warehouse and assembly management, and a demand for high, efficiency convenience acting as a synergy are thus the factors behind the market's robust financial performance. One of the major factors behind the market continuous expansion is technological innovation in equipment; hence the traditional simple mechanical feeders are being gradually converted into highly intelligent, application, specific machinery. The industry is moving unmistakably towards the use of smart drive motors and sophisticated control systems that, on the one hand, enhance placement accuracy and, on the other hand, increase the machine's operational lifespan.

Therefore, the manufacturers are very much concentrated on improving the operators experience by providing such features as IoT, enabled remote monitoring for performance analytics, modular head designs for excellent maneuverability on irregular PCB layouts, and integrated AI and telematics for real, time defect management. The pick and place machine market would essentially be a fast, moving machinery market, thus demand and supply would be dependent on global consumption trends, e.g., the huge increase in consumer electronics and IoT devices demand, which, in turn, has led to a professional and industrial demand for error, free and high, speed production lines.

Pick and Place Machine Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 2.8 Billion |

| Market Size in 2026 | USD 2.9 Billion |

| Forecast Period 2026 - 2035 CAGR | 4.9% |

| Market Size in 2035 | USD 4.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Miniaturization of electronic components | The shrinking size of components (like 0201 and 01005 chips) in wearables and medical devices requires sub-micron placement accuracy, driving demand for advanced vision systems. |

| Transition to industry 4.0 and smart factories | The shift toward fully autonomous assembly lines necessitates pick and place machines that integrate with IoT ecosystems for real-time data exchange and optimization. |

| Rise in electric vehicle (EV) electronics | Increased electronics content in vehicles for ADAS, and powertrain management drives the need for high-speed, heavy-duty placement systems for complex PCBs. |

| Pitfalls & Challenges | Impact |

| High initial capital expenditure | The cost of high-speed SMT lines equipped with 3D inspection and specialized nozzles can be a barrier for small-to-mid-sized contract manufacturers. |

| Complexity of programming for high-mix production | Constantly changing PCB designs in consumer electronics requires frequent machine reprogramming, which can lead to downtime if sophisticated software is not used. |

| Opportunities: | Impact |

| Ai-driven predictive maintenance | Utilizing machine learning to monitor nozzle health and feeder alignment reduces unplanned downtime and allows manufacturers to offer performance-based service contracts. |

| Expansion of 5G and satellite communication | The global rollout of 5G infrastructure and low-earth orbit satellites creates a massive need for high-reliability, high-throughput assembly equipment. |

| Market Leaders (2025) | |

| Market Leaders |

9% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Pick and Place Machine Market Trends

The pick and place machine industry is witnessing a series of dynamic trends that are fundamentally changing its landscape and generating fresh possibilities for expansion. Largely technological innovations have emerged as the main propeller, the two significant factors being the embracement of ultra, precise vision systems and the invention of modular, flexible placement heads. The improved accuracy of the latest pick and place machine does not only extend their capability to handle sized components but also facilitates the creation of new applications in wearable technology and the medical device industry. The growth of SMT assembly lines specialized in different areas is also a major trend, which has been largely caused by the rapid rise of the electric vehicle (EV) and 5G infrastructure industries. Besides that, the trend towards smart factories has been instrumental in the adoption of advanced placement solutions that are compatible with Industry 4.0 and real, time manufacturing execution systems.

- Technology advancement and product innovation: Machines are becoming more advanced and efficient, which is also the reason for the integration of AI, driven defect detection and wireless control systems to provide better safety and performance. Alongside the linear motor development for higher speed and energy efficiency, companies are making the most of the efforts to produce long, lasting, high, tensile feeder systems and strong, reinforced gantry structures that will not only increase system uptime but also placement repeatability.

- Expansion of consumer electronics and automated fulfilment services: The good health of the smartphone and semiconductor industries has been one of the main reasons for the market growth. Together, telecommunications and automotive electronics companies make up the largest segment, where rapid turnover of designs requires fast changeover solutions. Consequently, the demand for efficient multi, functional placement heads and automated tray, handling systems resulting from high, speed production requirements and miniaturization trends is increasing. This increase is both fuelling the global electronics supply chain expansion and the growth of specialized OSAT (Outsourced Semiconductor Assembly and Test) centres where manufacturers are heavily investing in automated distribution infrastructure that requires secure, fast, acting entry points.

- Sustainable manufacturing and facility management: Energy waste and operational bottlenecks due to idle, time power consumption of traditional assembly lines are typical problems that are being solved by intelligent sleep modes and energy, efficient servo systems. These steps not only facilitate the development of healthier operational ecosystems but also make it easier to implement green manufacturing and factory efficiency initiatives. These measures harmonize with ESG objectives and carbon neutrality programs being implemented worldwide, where high, efficiency pick and place machine contribute to keeping the facility's overall energy footprint low while maintaining high throughput.

- Greater incidence of global supply chain disruptions: The volatility of global trade is the primary reason why local electronics manufacturers concentrate on resilience and flexibility, thus leading to a massive rise in the deployment of modular pick and place machine architectures. The situation is such that production floors are in a perpetual state of reconfiguration, hence the demand for versatile systems has risen among EMS providers and contract manufacturers who require adaptable assembly lines that can be quickly scaled or repurposed for different product generations.

- Emphasis on Industry 4.0 and smart warehousing: Production managers and industrial planners have shifted their focus towards the use of automation to ensure safety and stability of throughput on lines, which they accomplish through proactive maintenance. Consequently, they are heavily involved in the condition monitoring of the machines via predictive diagnostics, examining the wear of the nozzle and the straining of the motor so that they can keep expensive downtimes at bay. The continuous demand for integrated material flow leads to a constant need for industrial, grade, intelligent positioning systems throughout the year.

Pick and Place Machine Market Analysis

Learn more about the key segments shaping this market

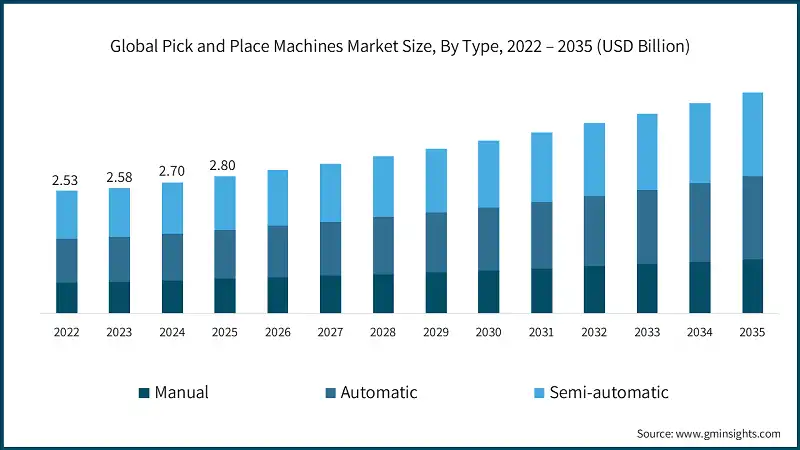

Based on the type, the market is divided into manual, automatic, and semi-automatic systems. The automatic segment accounted for over 35.9% of the market share in 2025 with a revenue of USD 1 billion.

- Automatic systems lead the market as they provide the high-speed and sub-micron precision required for modern electronics. This segment is the fastest growing with a 5.5% CAGR, driven by the transition toward Industry 4.0 and the need for high-volume production in the smartphone and automotive sectors.

- Semi-automatic machines remain a critical segment, valued at USD 1.1 billion in 2025. They are preferred by small-to-mid-sized enterprises (SMEs) because they balance cost-efficiency with improved accuracy through computerized guides and vision assistance.

- Manual systems continue to hold a stable share of 25.1% in 2025. They remain the go-to solution for prototyping, laboratory research, and low-volume rework where the high capital expenditure of fully automated lines is not justifiable.

Learn more about the key segments shaping this market

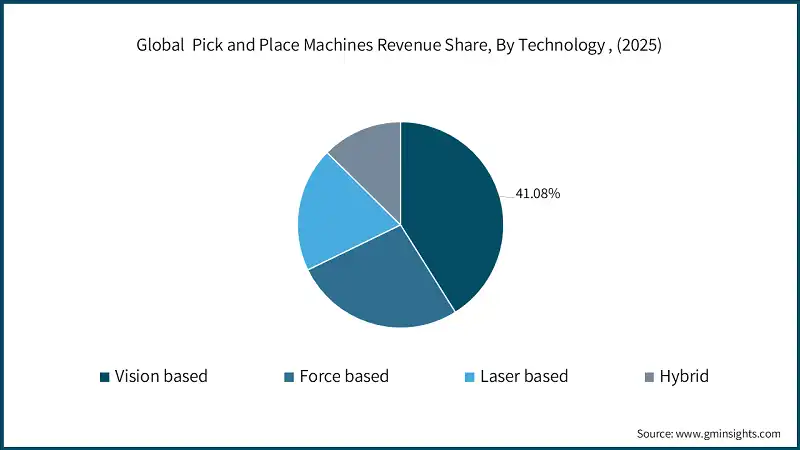

Based on technology, the market is segmented into vision-based, force-based, laser-based, and hybrid systems. In 2025, Vision based systems held the major market share of 41.08%, generating a revenue of USD 1.2 billion.

- Vision based technology dominates because it allows for real-time optical recognition and alignment of tiny components. It is essential for placing "fine pitch" components and ensures high yield rates by detecting defects before placement.

- Force-based systems account for approximately 26.7% of the market. These are specifically valued in semiconductor packaging and delicate assembly tasks where the pressure applied to the component must be precisely controlled to prevent damage.

- Laser based and Hybrid segments are gaining traction due to the demand for "all-in-one" machines. Hybrid systems, in particular, combine the benefits of optical vision with laser centering to offer the highest possible versatility for complex high-mix assembly lines.

Based on the distribution channel, the market is segmented into direct sales and indirect sales. In 2025, Indirect sales held a slightly larger market share of 51.9%, reflecting the industry’s reliance on specialized regional distributors and value-added resellers.

- Indirect sales are fueled by the need for local technical support, installation services, and maintenance. Distributors often provide "floor-ready" solutions and training that are vital for manufacturers in emerging markets like Southeast Asia and Mexico.

- Direct sales held 48.1% of the market and are preferred by large-scale Tier 1 manufacturers and OEMs. These players deal directly with brands like Fuji or Panasonic to secure customized, large-scale SMT lines and performance-based service contracts

Looking for region specific data?

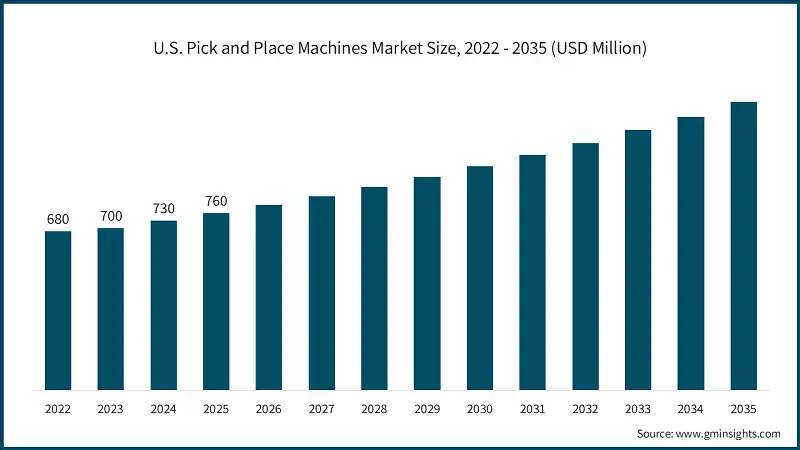

In 2025, North America remains a key regional market with an estimated value of USD 900 million and a projected growth rate of 5% through 2035.

- The U.S. leads the region, accounting for approximately 84.5% of the North American market in 2025. This growth is driven by the early adoption of advanced robotics and AI-integrated assembly systems.

- The market is heavily influenced by the automotive and aerospace sectors, where high-speed, high-accuracy pick-and-place machines are essential for assembling complex electronic control units (ECUs) and sensors.

- Increasing demand for medical device assembly is spurring a need for specialized machines that offer extreme precision and cleanroom compatibility.

- Recent trade dynamics and a push for reshoring electronics manufacturing have led to increased domestic investments in automated production lines to offset higher labor costs.

Europe is a significant market estimated at USD 600 million in 2025, with a projected growth rate of 5.2%. Germany leads the region, capturing nearly 23.2% of the European revenue in 2025.

- The European market benefits from a strong focus on automotive electronics and the transition to Electric Vehicles (EVs), which requires a high volume of sophisticated PCB assemblies.

- Germany and France together represent a substantial portion of the regional revenue, driven by advanced engineering sectors and a strict focus on manufacturing quality and precision.

- Innovation in the region is centred on vision-based and laser-based technologies, which allow for the placement of ultra-miniature components used in high-end industrial and medical applications.

- The market is also shaped by sustainability mandates, leading to the development of energy-efficient machines and modular systems that reduce electronic waste during the production process

Asia Pacific is the largest and fastest-growing regional market. It has an estimated market value of USD 800 million in 2025, with a projected growth rate of 5.3% from 2022 to 2035.

- China holds the largest market share of 33.3% in 2025, while India is a major contributor with an estimated value of USD 100 million in 2025, growing at a CAGR of 5.4%.

- The region’s dominance is fuelled by its status as a global electronics manufacturing hub, with massive production bases for smartphones, tablets, and IoT devices requiring high-precision SMT (Surface Mount Technology) placement.

- A rapid shift toward Industry 4.0 and smart manufacturing is driving demand for automatic machines, which are expected to outperform manual and semi-automatic segments in throughput.

- Government-led initiatives like "Make in India" and China’s focus on semiconductor self-sufficiency are accelerating the adoption of vision-based and hybrid pick-and-place technologies to handle miniaturized components

Latin America represents a developing segment crossed USD 300 million in 2025, growing at a rate of 4.5% through 2035.

- Brazil is the dominant player in the region, capturing 48.3% of the market share in 2025, followed by Mexico, which is benefiting from "near-shoring" trends from North American manufacturers.

- Market growth is sustained by the gradual modernization of consumer electronics assembly plants and an increasing presence of Tier-2 automotive suppliers.

- While the market currently has a higher reliance on indirect sales and semi-automatic equipment compared to other regions, there is a steady transition toward fully automatic systems as industrial automation becomes more affordable.

- Economic stabilization and investments in logistics and packaging are creating new opportunities for pick-and-place robots beyond traditional electronics assembly.

Pick and Place Machine Market Share

Fuji Machine Manufacturing Co., Ltd. is leading with a 9% market share. Fuji Machine Manufacturing Co., Ltd., Panasonic Corporation, Yamaha Motor Co., Ltd., Hanwha Corporation, Juki Corporation collectively hold around 35%, indicating a moderately fragmented market concentration with a strong tier of dominant global players. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions, and collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

Yamaha Motor Co., Ltd. strengthened its industrial robot and SMT portfolio by establishing the joint venture TY ROBOTICS Co., Ltd. in late 2025. This strategic move was designed to consolidate the production of single-axis and cartesian robots, allowing Yamaha to offer a broader range of automated transport solutions. By integrating these robotics capabilities with their high-speed mounters like the YRM10, Yamaha is reinforcing its commitment to "Total Line Solutions" for the smart factories of the future.

Mycronic AB unveiled the MYPro A41 series at Productronica 2025, specifically designed to expand "big board" PCB assembly capabilities for sectors like telecom and aerospace. This technology allows for the handling of boards up to 1,000 mm, significantly reducing interconnect complexity. Additionally, Mycronic introduced GenI, a generative AI programming tool that autonomously creates 3D AOI inspection programs, eliminating downtime and allowing manufacturers to introduce new products with total confidence.

Pick and Place Machine Market Companies

Major players operating in the pick and place machine industry are:

- ASM Assembly Systems GmbH & Co. KG

- Fuji Machine Manufacturing Co., Ltd.

- Juki Corporation

- Panasonic Corporation

- Yamaha Motor Co., Ltd.

- Hanwha Corporation

- Mycronic AB

- Nordson Corporation

- Hanwha Techwin

- ASM Pacific Technology Ltd.

- Universal Instruments Corporation

- Europlacer Group

- Essemtec AG

- Viscom AG

- Speedline Technologies, Inc.

SMTmax introduced the QM-4044, a new tabletop pick and place machine that has a precision camera for chip handling and four upward-looking cameras for small parts, guaranteeing precise and effective component placement. With an astounding production rate of 6000 to 7000 components per hour, the QM-4044 is a top option for companies looking to increase their output.

Pick and Place Machine Industry News

- In November 2025, Panasonic Connect demonstrated its "Autonomous Factory" vision, showcasing the NPM-GW modular mounter. The system utilizes AI to adapt to supply shifts in real-time and features the Auto Setting Feeder (ASF), which automates component loading and cover tape peeling, drastically reducing manual intervention on the factory floor.

- In January 2025, Juki Corporation launched the RS-2 Fast Smart Modular Mounter, achieving an industry-leading placement speed of 50,000 CPH (chips per hour) in a single-head configuration. This followed the 2024 rollout of the JM-E01 platform, which integrated automation for large, irregular-shaped components, bridging the gap between SMT and post-surface mount processes.

- In June 2025, Mycronic's Global Technologies division completed the acquisition of Surfx Technologies, a specialist in atmospheric plasma solutions. This acquisition allows Mycronic to integrate advanced surface treatment and cleaning capabilities directly into its electronics assembly flow, enhancing adhesion and reliability for high-end semiconductor packaging.

- In August 2024, Nordson Corporation completed the USD 800 million acquisition of Atrion Corporation, a leader in medical fluid delivery. This move, while expanding Nordson's medical portfolio, leverages their core precision dispensing and inspection expertise to serve the growing demand for high-reliability medical electronics assembly.

- In late 2024, Hanwha Precision Machinery redesigned its decan series, focusing on high-density series tailored for 5G and automotive electronics. The new iterations incorporate AI-powered predictive maintenance and real-time defect detection, addressing the needs of manufacturers aiming to maximize throughput while minimizing the energy footprint of high-speed assembly lines.

The pick and place machine market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Type

- Manual

- Semi-automatic

- Automatic

Market, By Technology

- Vision based

- Force based

- Laser based

- Hybrid

Market, By Capacity

- Up to 10,000 CPH

- 10,000-20,000 CPH

- Above 20,000 CPH

Market, By Application

- Consumer electronics

- Automotive

- Packaging industry

- Pharmaceutical

- Logistics

- Others

Market, By Distribution Channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the pick and place machine market?

Key players include Fuji Machine Manufacturing Co. Ltd., Panasonic Corporation, Yamaha Motor Co. Ltd., Hanwha Corporation, Juki Corporation, Mycronic AB, Nordson Corporation, Hanwha Techwin, ASM Pacific Technology Ltd., Universal Instruments Corporation, Europlacer Group, Essemtec AG, Viscom AG, ASM Assembly Systems GmbH & Co. KG, and Speedline Technologies Inc.

What are the upcoming trends in the pick and place machine market?

Key trends include AI-driven predictive maintenance for reduced downtime, expansion of 5G and satellite communication infrastructure, integration of ultra-precise vision systems, and shift toward autonomous, self-correcting SMT lines with IoT connectivity.

Which region leads the pick and place machine market?

The U.S. region dominated with around 84.5% market share in 2025, driven by early adoption of advanced robotics and AI-integrated assembly systems.

What is the growth outlook for Asia Pacific from 2026 to 2035?

Asia Pacific is projected to grow at a 5.3% CAGR through 2035, fueled by its status as a global electronics manufacturing hub and government initiatives like

What was the market share of the vision-based technology segment in 2025?

Vision-based technology held 41.08% market share in 2025, generating USD 1.2 billion in revenue, dominating due to real-time optical recognition and alignment capabilities.

How much revenue did the automatic segment generate in 2025?

Automatic systems generated USD 1 billion in 2025 and the fastest-growing segment with a 5.5% CAGR driven by Industry 4.0 transition.

What is the current pick and place machine market size in 2026?

The market size is projected to reach USD 2.9 billion in 2026.

What is the market size of the pick and place machine in 2025?

The market size was USD 2.8 billion in 2025, with a CAGR of 4.9% expected through 2035 driven by rising demand for high-speed, high-precision SMT placement systems in electronics manufacturing.

What is the projected value of the pick and place machine market by 2035?

The pick and place machine market is expected to reach USD 4.6 billion by 2035, propelled by miniaturization of electronic components, transition to Industry 4.0, and rise in electric vehicle electronics.

Pick and Place Machine Market Scope

Related Reports