Summary

Table of Content

Photoelectric Sensor Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Photoelectric Sensor Market Size

The global photoelectric sensor market was valued at USD 2.4 billion in 2025. The market is expected to grow from USD 2.5 billion in 2026 to USD 5.1 billion in 2035, at a CAGR of 8.1% during the forecast period according to the latest report published by Global Market Insights Inc. The growth of the Photoelectric Sensors industry is being fueled by the increasing prevalence of process automation and smart manufacturing across all businesses. From manufacturing plants and their assembly lines to the manufacturing of packaging, photoelectric sensors are being utilized more frequently than ever before to detect, count, and inspect products accurately. Therefore, manufacturers have been able to lower their error rates and increase the number of finished products they produce. For instance, according to research published in Institute of Electrical and Electronics Engineers, it is estimated that in 2024 over 54 % of automotive assembly lines worldwide utilized photoelectric sensors for position verification and defect detection, underscoring their importance in advanced production environments.

![]()

To get key market trends

Another key growth driver is the integration of IoT and Industry 4.0 technologies, with intelligent sensor systems enabling real‑time monitoring, predictive maintenance, and data analytics in smart factories. Installation of IoT‑enabled photoelectric sensors to rise sharply between 2023 and 2024, allowing manufacturers to reduce operational errors and downtime while improving asset tracking and remote diagnostics.

Furthermore, with the increased demand for automated logistics and e-commerce, distribution centers are utilizing sensors for faster sorting/tracking & managing inventories. This is further emphasized by the increase in automated systems for online retail & will drive sensor usage making photoelectric solutions an essential part of the supply chain and solidifying their long-term market trend.

Photoelectric Sensor Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 2.4 Billion |

| Market Size in 2026 | USD 2.5 Billion |

| Forecast Period 2026-2035 CAGR | 8.1% |

| Market Size in 2035 | USD 5.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Widespread adoption of industrial automation | The global shift toward automated manufacturing processes is driving significant demand for photoelectric sensors, as these devices ensure accurate object detection, positioning, and process monitoring. By replacing manual inspection and enhancing production efficiency, sensors reduce errors and downtime, enabling manufacturers across automotive, electronics, and consumer goods sectors to optimize throughput and maintain consistent product quality. |

| Industry 4.0 & Smart factory initiatives | Industry 4.0 adoption is boosting the integration of IoT-enabled photoelectric sensors into smart factories. These sensors provide real-time monitoring, predictive maintenance, and data analytics, allowing companies to optimize operations, reduce machine failures, and support connected manufacturing ecosystems. The enhanced visibility and control offered by these sensors accelerate digital transformation across multiple industrial verticals. |

| Growing demand in packaging & logistics | Photoelectric sensors are increasingly utilized in automated packaging lines, warehouses, and distribution centers for object detection, sorting, and inventory management. The rise of e-commerce and the need for faster, more accurate logistics operations are expanding sensor adoption. Their ability to improve operational efficiency, reduce human error, and maintain high-speed throughput makes them critical for modern supply chains. |

| Rising Demand for high precision sensing in sectors | Sectors such as pharmaceuticals, electronics, and semiconductors require precise detection and measurement to ensure quality and compliance. Photoelectric sensors provide non-contact, high-accuracy monitoring, making them ideal for inspection, defect detection, and positioning tasks. Increasing quality standards and automation in high-tech industries are therefore driving robust demand for advanced, precision-focused photoelectric solutions. |

| Growing focus towards energy efficiency sensors | Companies are prioritizing low-power, energy-efficient technologies to reduce operational costs and support sustainability initiatives. Photoelectric sensors with energy-efficient designs help minimize electricity consumption while maintaining high detection performance. This aligns with corporate sustainability goals and regulatory mandates, particularly in industrial and smart building applications, enhancing the market appeal of energy-optimized sensor solutions. |

| Pitfalls & Challenges | Impact |

| Significant capital and operational expenditure | High upfront costs for advanced photoelectric sensors, coupled with ongoing maintenance and calibration expenses, can deter small and medium enterprises from adoption. These financial constraints slow market penetration, particularly in cost-sensitive industries, limiting the widespread deployment of sensors despite their operational efficiency and long-term benefits. |

| Integration challenges with legacy systems | Incorporating modern photoelectric sensors into existing manufacturing or automation setups can be complex due to compatibility issues with older equipment. Integration difficulties may lead to increased installation time, higher engineering costs, and potential system inefficiencies, posing a barrier to adoption, especially in facilities with legacy infrastructure lacking smart or IoT-enabled capabilities. |

| Opportunities: | Impact |

| Growing regions with rising industrialization and automation | Rapid industrialization in emerging regions, particularly in Asia Pacific and MEA, is creating new demand for photoelectric sensors. Increasing investments in automated manufacturing and smart production lines drive adoption, offering manufacturers opportunities to expand market presence while supporting operational efficiency, quality control, and advanced automation in high-growth industrial hubs. |

| Expanding adoption in smart buildings | The rise of smart infrastructure and building automation is boosting the use of photoelectric sensors for occupancy detection, lighting control, and energy management. Integrating these sensors into intelligent building systems enhances safety, reduces energy consumption, and improves operational efficiency, creating a growing market opportunity in residential, commercial, and institutional sectors. |

| Market Leaders (2025) | |

| Market Leader |

~12.4% Market Share |

| Top Players |

Collective Market Share is ~29.6% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | U.S., China, France, Germany, Japan |

| Future outlook |

|

What are the growth opportunities in this market?

Photoelectric Sensor Market Trends

- The global photoelectric sensor industtry is experiencing significant transformation driven by the integration of IoT and Industry 4.0 technologies, enabling real-time monitoring, predictive maintenance, and seamless connectivity within smart factory ecosystems.

- The connected sensors allow manufacturers to collect actionable data, optimize production processes, and reduce downtime, accelerating adoption across automotive, electronics, and packaging sectors.

- Additionally, miniaturization and compact designs are becoming increasingly important, with smaller, space-efficient sensors being integrated into automated robots, PCB-mounted equipment, and other confined applications. These compact sensors deliver high-precision detection while minimizing installation complexity and energy consumption, making them ideal for electronics manufacturing, medical devices, and smart infrastructure projects.

- Furthermore, advancements in detection technologies, including laser-based, fiber-optic, and AI-assisted sensing, are enhancing accuracy, detection range, and operational reliability in challenging environments such as dusty, humid, or high-speed production lines. These innovations are expanding the applicability of photoelectric sensors in high-precision sectors such as semiconductors, pharmaceuticals, and automotive assembly.

- Moreover, emerging applications in logistics automation, smart buildings, and agri-tech are creating new growth opportunities, driven by the rise of e-commerce, automated warehouses, and energy-efficient infrastructure. Together, these trends are expected to sustain market growth while enabling broader adoption across traditional and non-traditional industries worldwide.

Photoelectric Sensor Market Analysis

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

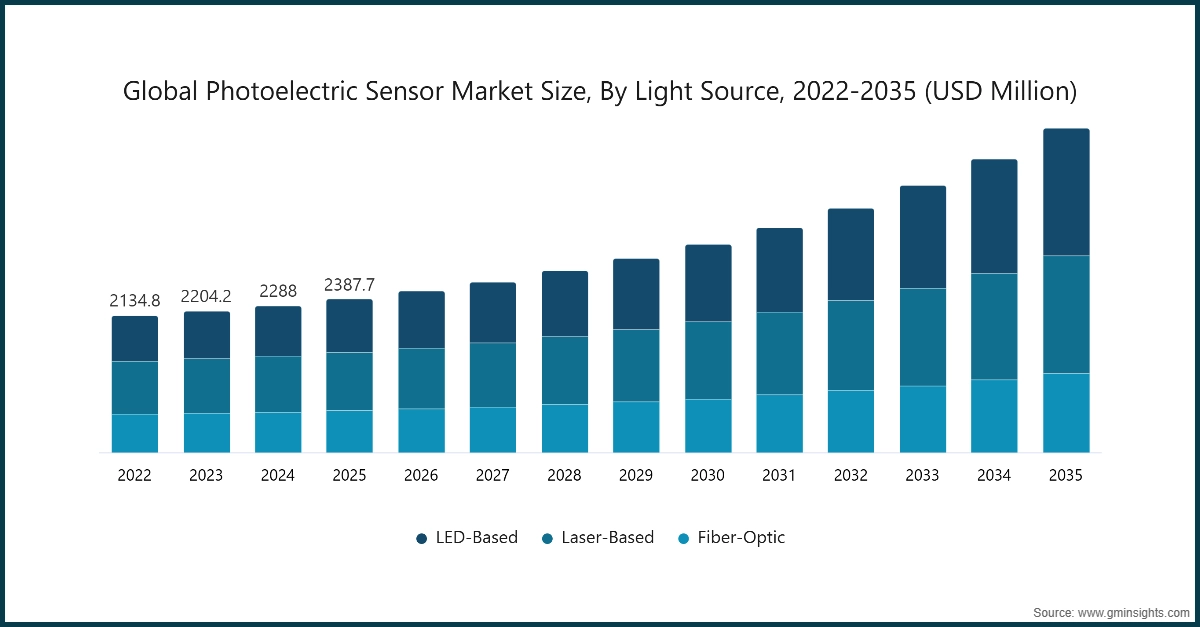

Basec on the light source, the market is segmented into LED-Based, Laser-Based, and Fiber-Optic.

- The laser-based segment is anticipated to reach USD 1.8 billion by 2035. The segment is driven by increasing demand for high‑precision, long‑range detection in automated industrial environments. Laser photoelectric sensors offer exceptionally focused light spots that enable reliable detection of small objects and detailed positioning, which is critical in automotive assembly lines and semiconductor production where precision and consistency are paramount.

- Additionally, the adoption of new laser sensor technology has accelerated as a result of manufacturers creating new products that include IO-Link capable laser units with real-time diagnostic capabilities and detection of contamination events which results in improved uptime and predictive maintenance efficiency for production lines. In addition, the reduced pricing of high-powered laser diode components has also contributed to the proliferation of advanced laser sensors from the automotive industry to other markets such as smart logistics and robotics for inspection applications.

- The LED-Based segment was valued at USD 831.8 million in 2025 and is anticipated to grow at a CAGR of 9.4% over the forecast years. The growth is being driven by its energy efficiency, long operational lifespan, and versatility across industries. LED technology is increasingly integrated in sensors for automotive automation, consumer electronics assembly, and industrial robotics, where reliable, low‑power detection is critical. Recent innovations include compact, IoT‑ready LED sensor modules that support real‑time diagnostics and remote monitoring for smart manufacturing systems.

On the basis of optical configuration, the photoelectric sensor market is divided into through-beam, retro-reflective, and diffuse.

- The retro-reflective segment held a market share of 42.7% in 2025, driven by expanding safety and infrastructure demand, such as high‑visibility road signage and reflective safety gear. Market players are innovating with high‑intensity microprismatic films and lightweight EV body tapes, while stringent regulations and smart highway projects continue to boost adoption in transportation and industrial applications.

- The through-beam segment is anticipated to grow at a CAGR of 9.5% during the forecast period 2026 – 2035. The growing demand for high-precision, long-range detection equipment is driving growth in the long-range, high-precision detection equipment (e.g., photoelectric sensors). Recent product innovations include new sensing and control technologies enabled by the Internet of Things (IoT), as well as advanced photoelectric designs that enhance product reliability. Equipment manufacturers are deploying through-beam solutions to support the development of smart factories and high-speed package handling applications, contributing to global adoption.

![]()

Learn more about the key segments shaping this market

On the basis of end-user industry, the photoelectric sensor market is segmented into industrial manufacturing, automotive & transportation, food & beverage processing, pharmaceuticals & medical devices, building automation & smart infrastructure, electronics & semiconductor manufacturing, energy, utilities & infrastructure, aerospace & defense, and others.

- The pharmaceuticals & medical devices segment held a market share of 25.3% in 2025, is driven primarily by the continued demand for health care around the world from an increasing number of older individuals as well as from ongoing development of new treatments for diseases (new drugs) and the use of state-of-the-art technology (AI enabled diagnostic devices, wearable medical devices). The development of biologics, precision medicine, and minimally invasive surgical technologies has allowed many more ways to treat and monitor conditions, and, through the integration of digital health, has made these types of technologies also widely accepted by hospitals, outpatient treatment centers and physicians.

- The automotive & transportation segment is anticipated to grow at a CAGR of 19.2% during the forecast period 2026 – 2035, due to continued growth in demand for automobile technology innovations to provide new levels of safety (advanced driving assistance systems including radar, LiDAR, and camera-based systems as well as those to allow vehicles to perform autonomously). AI enabled sensors, connected vehicles and smart mobility systems are accelerating the use of sensor technology in the transition to using electric and/or autonomously powered vehicles, improving the potential to prevent collisions, achieving adaptive cruise control, and providing improved telematics.

North America Photoelectric Sensor Market

![]()

Looking for region specific data?

The North America photoelectric sensor market holds a significant share of the 28.2% in 2025.

- North America’s growth is driven by by rapid adoption of industrial automation across manufacturing, packaging, and logistics sectors, where sensors enable precise object detection and workflow efficiency. Strong integration of IIoT and smart factory solutions, alongside stringent safety and quality regulations, has accelerated deployment in automotive plants and warehousing systems, while established sensor makers continuously innovate to meet advanced industrial requirements.

The U.S. photoelectric sensor market was valued at USD 486.8 million and USD 503.2 million in 2022 and 2023, respectively. The market size reached USD 546.3 million in 2025, growing from USD 522.9 million in 2024.

- The U.S. market is expanding due to surging automation in manufacturing and logistics, increased integration of smart and IoT‑enabled sensor technologies for real‑time monitoring, and rising demand for energy‑efficient, high‑precision detection solutions. Growth is further supported by strong emphasis on workplace safety compliance, expansions in e‑commerce fulfillment centers, and ongoing R&D investments that drive product sophistication and broad industrial adoption.

Europe Photoelectric Sensor Market

Europe photoelectric sensor industry accounted for USD 557.8 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- Europe’s photoelectric sensor industry growth continues to be influenced by expanding industrial automation investments and the widespread use of photoelectric sensors in automotive, packaging and manufacturing. Efficient use of photoelectric sensors can lead to improved efficiency and more effective methods of quality control via precise measurement capabilities. The rapidly increasing regulatory requirements for energy efficiency and environmental sustainability will continue to increase the use of advanced photoelectric sensors. Emerging developments in business sectors related to automation include smart factory concepts and new IO-Link and digital filtering technologies, which support increases of reliability and automation of photoelectric sensors throughout Europe.

- Germany dominates the Europe photoelectric sensor market, due to the country's existing automotive industry and advanced manufacturing activities that utilize photoelectric sensors for automation, robotics, and precision production. The ongoing R&D activities by manufacturers, both in Germany and worldwide, in conjunction with the strength of the industry 4.0 ecosystem in Germany, enable innovation and sustained market leadership for the use of photoelectric sensors. The rapid growth of logistics, warehousing and quality control segments will also support greater use of photoelectric sensors across the country.

Asia Pacific Photoelectric Sensor Market

The Asia Pacific market is anticipated to hold significant share of 42.8% in 2025 and is expected to grow at the highest CAGR of 8.8 % during the forecast period.

- The Asia-Pacific market is experiencing rapid growth, driven by accelerated industrialization, expanding manufacturing bases, and widespread automation adoption across automotive, electronics, and packaging sectors. Integration of IIoT and smart factory technologies boosts demand for precise, non‑contact sensing solutions, while supportive government policies and infrastructure investments in China, India, and Southeast Asia further enhance regional uptake and technological innovation.

- China photoelectric sensor market is estimated to grow with a CAGR of 9.9%, The country remains a key growth engine within Asia-Pacific, driven by robust manufacturing modernization, surging automation investments, and strategic initiatives like “Made in China 2025” that prioritize smart production systems. This fuels heavy deployment of sensors in automotive assembly, consumer electronics, and logistics automation, supported by innovation in high‑performance sensing technologies.

Latin American Photoelectric Sensor Market

- The Latin America particulate matter monitoring market, valued at USD 47 million in 2025, driven by increasing is driven by rising regulatory pressure to enforce stricter air quality standards and growing public concern over urban pollution health impacts. Investment in fixed and portable PM monitors is increasing as governments and industries adopt advanced optical and sensor technologies to track PM2.5/PM10 levels, while awareness and environmental initiatives strengthen regional monitoring networks.

Middle East and Africa Photoelectric Sensor Market

Saudi Arabia photoelectric sensor industry to experience substantial growth in the Middle East and Africa.

- The Saudi Arabia market is expected to experience substantial growth during the forecast period due to the expanding adoption of automation and smart infrastructure technologies across manufacturing, logistics, and industrial sectors, aligned with Vision 2030 diversification and smart city initiatives. Increased deployment of sensors in process automation, safety systems, and industrial IoT networks is accelerating demand for advanced photoelectric sensing solutions.

Photoelectric Sensor Market Share

The global photoelectric sensor industry is moderately consolidated, with key players such as OMRON Corporation, Panasonic Industry Co., Ltd., SICK AG, KEYENCE CORPORATION, and Rockwell Automation collectively accounting for approximately 39% of the market. These companies capitalize on extensive expertise in industrial automation, sensing technologies, and factory integration, delivering high-precision, reliable sensors for applications across manufacturing, logistics, automotive, and robotics.

While these leading vendors dominate, the market remains partially fragmented, with numerous regional and specialized suppliers catering to niche segments such as smart factories, AI-driven production lines, and harsh-environment automation. Smaller players differentiate through tailored solutions, cost-efficient models, AI-enabled detection, and rapid deployment support. These competitive dynamic drives innovation in multi-mode sensing, long-range detection, compact designs, and seamless integration with industrial IoT and automated control systems, underpinning steady growth in the global market.

Photoelectric Sensor Market Companies

Prominent players operating in the photoelectric sensor indusyry are as mentioned below:

- OMRON Corporation

- Panasonic Industry Co., Ltd.

- SICK AG

- KEYENCE CORPORATION

- Rockwell Automation

- Balluff Inc

- OPTEX FA CO., LTD.

- Baumer

- Pepperl+Fuchs SE

- TAKEX EUROPE LTD.

- Wenglor

- Schneider Electric

- Banner Engineering Corp.

- Hans Turck GmbH & Co. KG

- Leuze electronic Pvt. Ltd.

- OMRON Corporation

OMRON Corporation is a global leader in industrial automation and sensing solutions, leveraging its core “Sensing & Control + Think” technology to deliver advanced photoelectric sensors (including diffuse‑reflective, through‑beam, and retro‑reflective types) integrated with automation and IoT platforms. Its broad portfolio supports packaging, assembly, and material handling applications, with continuous R&D investments driving innovations in high‑precision detection and smart factory connectivity.

Panasonic Industry Co., Ltd. offers a comprehensive range of photoelectric and laser sensors as part of its factory automation portfolio, including compact, thru‑beam, retro‑reflective, and IO‑Link‑enabled models designed for object detection, positioning, and measurement tasks. By combining robust optical sensing with electronic control expertise, Panasonic’s sensors optimize production processes across automotive, packaging, and electronics industries while supporting integration with broader automation systems.

SICK AG is a leading German manufacturer of intelligent sensors and sensor solutions, with a strong footprint in industrial automation, logistics, and factory applications. Its photoelectric sensor portfolio delivers reliable object detection and advanced diagnostics under challenging conditions, supported by modular design and integration with sensor intelligence features. SICK’s global R&D and broad product range have reinforced its position as a preferred provider of precision sensing technologies.

Photoelectric Sensor Industry News

In December 2025, SICK AG launched the W12 NextGen series of photoelectric sensors, expanding its industrial automation portfolio with high-performance, precision detection solutions. The new range enhances the capabilities of the established W12 series, offering improved reliability, versatility, and repeatability even under challenging operating conditions. With advanced sensing features and intelligent usability, the W12 NextGen supports complex manufacturing processes, reinforcing SICK’s position as a leader in industrial sensor innovation.

In January 2024, Panasonic Industrial Automation partnered with Mouser Electronics through a new distribution agreement to expand access to its industrial automation solutions. The collaboration enables Mouser to offer Panasonic’s portfolio, including EX-10 ultra-slim photoelectric sensors and FP0R programmable controllers, that are supporting automotive, semiconductor, packaging, and biomedical applications, while enhancing availability and support for design engineers in the IIoT and automation markets.

The Photoelectric Sensor market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion from 2022 – 2035 for the following segments:

Market, By Light Source

- LED-Based

- Laser-Based

- Fiber-Optic

Market, By Optical Configuration

- Through-Beam

- Retro-Reflective

- Diffuse

Market, By Sensing Range

- Short Range: ≤ 100 mm

- Medium Range: >100 mm – ≤1,000 mm

- Long Range: >1,000 mm – ≤10,000 mm

- Ultra-Long / Extended Range: >10,000 mm

Market, By Housing Geometry

- Cylindrical

- Rectangular / Box

- Slot / Fork

Market, By End-User Industry

- Industrial Manufacturing

- Automotive & Transportation

- Food & Beverage Processing

- Pharmaceuticals & Medical Devices

- Building Automation & Smart Infrastructure

- Electronics & Semiconductor Manufacturing

- Energy, Utilities & Infrastructure

- Aerospace & Defense

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region leads the photoelectric sensor market?

Asia Pacific held 42.8% market share in 2025 and is expected to grow at the highest CAGR of 8.8% during the forecast period, driven by accelerated industrialization and expanding manufacturing bases.

Who are the key players in the photoelectric sensor market?

Key players include OMRON Corporation, Panasonic Industry Co. Ltd., SICK AG, KEYENCE CORPORATION, Rockwell Automation, Balluff Inc, OPTEX FA CO. LTD., Baumer, Pepperl+Fuchs SE, TAKEX EUROPE LTD., Wenglor, Schneider Electric, Banner Engineering Corp., Hans Turck GmbH & Co. KG, and Leuze electronic Pvt. Ltd.

What are the upcoming trends in the photoelectric sensor market?

Key trends include IoT and Industry 4.0 integration for real-time monitoring, compact and miniaturized designs, and advances in laser-based, AI-assisted sensing for logistics automation and smart buildings.

What is the growth outlook for the Through-Beam segment from 2026 to 2035?

The Through-Beam segment is projected to grow at a CAGR of 9.5% from 2026 to 2035, driven by growing demand for high-precision, long-range detection equipment and IoT-enabled sensing technologies.

What was the valuation of the LED-Based segment in 2025?

LED-Based segment held USD 831.8 million in 2025 and is anticipated to grow at a CAGR of 9.4% over the forecast years.

How much revenue did the Laser-Based segment generate by 2035?

The Laser-Based segment is anticipated to reach USD 1.8 billion by 2035, driven by increasing demand for high-precision, long-range detection in automated industrial environments.

What is the current photoelectric sensor market size in 2026?

The market size is projected to reach USD 2.5 billion in 2026.

What is the market size of the photoelectric sensor in 2025?

The market size was USD 2.4 billion in 2025, with a CAGR of 8.1% expected through 2035 driven by widespread adoption of industrial automation and Industry 4.0 technologies.

What is the projected value of the photoelectric sensor market by 2035?

The photoelectric sensor market is expected to reach USD 5.1 billion by 2035, propelled by IoT integration, smart manufacturing, and growing demand in packaging and logistics automation.

Photoelectric Sensor Market Scope

Related Reports