Summary

Table of Content

Pet Obesity Management Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Pet Obesity Management Market Size

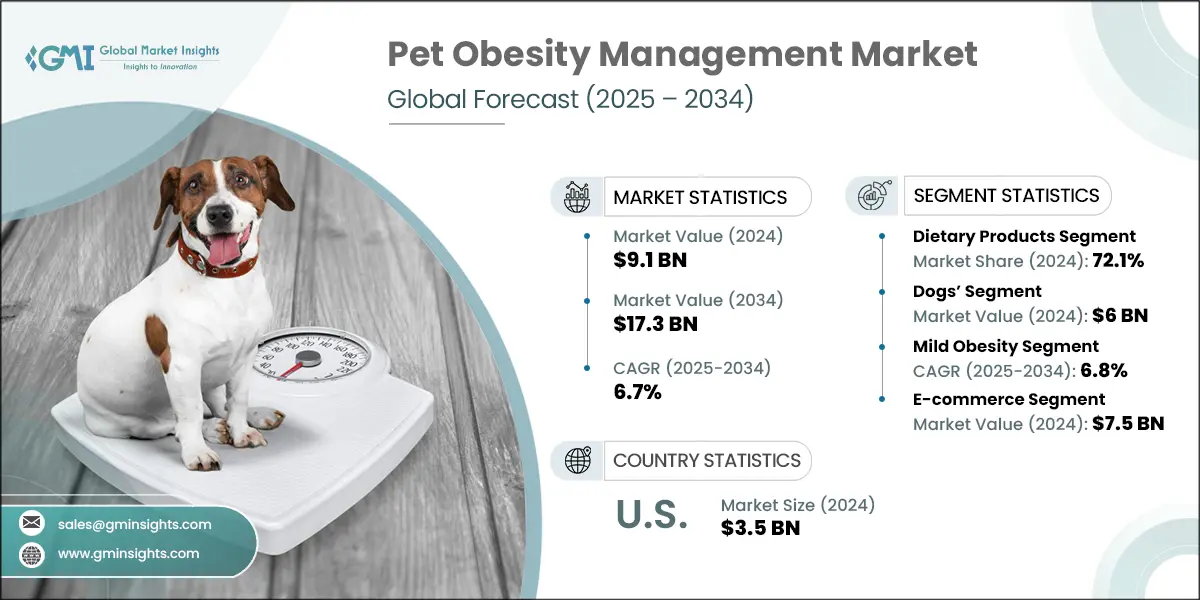

The global pet obesity management market was valued at USD 9.1 billion in 2024. The market is expected to grow from USD 9.7 billion in 2025 to USD 17.3 billion in 2034, at a CAGR of 6.7% during the forecast period. The growth in pet obesity management is driven by the increasing adoption of pets for companionship and rising pet healthcare expenditure.

To get key market trends

The shift from pet ownership to pet parenthood indicates that pets are increasingly considered family members. In 2024, according to the European Pet Food Industry, 90 million households (approximately 46% of the population) owned pets in Europe. This growing social acceptance of pets has led to increased pet adoption. Additionally, higher spending on pet healthcare, including regular health check-ups and advanced treatment solutions, has contributed to the expansion of the market.

The market focuses on products and services that help prevent, diagnose, and treat obesity in pets. It includes therapeutic diets, supplements, diagnostics, and vet care, driven by rising pet health awareness and chronic disease cases. Major players in the industry are Hills Pet Nutrition, Zoetis, FitPaws, Vivaldis and Pet Nutrition Alliance. These players dominated the market by offering innovative pet obesity management products inclusive of dietary products, pharmaceuticals, exercise and fitness equipment, establishing global distribution networks.

Pet Obesity Management Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 9.1 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.7% |

| Market Size in 2034 | USD 17.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing pet adoption for companionship | With rising pet adoption, companies are developing personalized nutrition plans, smart feeders, and fitness tools to help owners manage pet weight effectively. This trend is fueling innovation and expanding the market for obesity management solutions. |

| Rising prevalence of diabetes and chronic disease among pets | The rising prevalence of diabetes and chronic diseases among pets is intensifying the need for obesity management solutions. Conditions like hypothyroidism, arthritis, and metabolic disorders are increasingly linked to excess weight, prompting greater demand for therapeutic diets and veterinary care. |

| Growing pet healthcare expenditure | Growing pet healthcare expenditure is a key driver of the market. As pet owners increasingly view animals as family, spending on veterinary care, diagnostics, and therapeutic nutrition is rising. |

| Rise of smart pet devices and health monitoring | The rise of smart pet devices and health monitoring technologies is transforming the pet obesity management market. Devices like smart feeders, activity trackers, and health-monitoring collars allow pet owners to track calorie intake, exercise levels, and weight changes in real time. |

| Pitfalls & Challenges | Impact |

| Lack of awareness regarding pet obesity management in developing economies | Lack of awareness regarding pet obesity management in developing economies restrains market growth by limiting demand for specialized products and veterinary services. Many pet owners remain unaware of obesity-related health risks, reducing adoption of preventive care and therapeutic solutions. |

| Limited availability of obesity-specific pharmaceutical drugs | Limited availability of obesity-specific pharmaceutical drugs restrains market growth by narrowing treatment options for pets with severe or chronic obesity. Without targeted medications, veterinarians rely heavily on dietary and lifestyle interventions, which may not be sufficient for all cases, especially in advanced stages. |

| Opportunities: | Impact |

| Expansion of digital pet health and remote monitoring tools | Expansion of digital pet health and remote monitoring tools creates new opportunities by enabling real-time tracking of pet activity, diet, and weight. These technologies support early detection of obesity, personalized care plans, and improved owner engagement, driving market growth. |

| Growing veterinary chain networks and pet wellness clinics | Growing veterinary chain networks and pet wellness clinics are boosting the pet obesity management market by improving access to professional care. |

| Market Leaders (2024) | |

| Market Leaders |

35% market share in 2024 |

| Top Players |

Collective Market Share in 2024 is 75% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

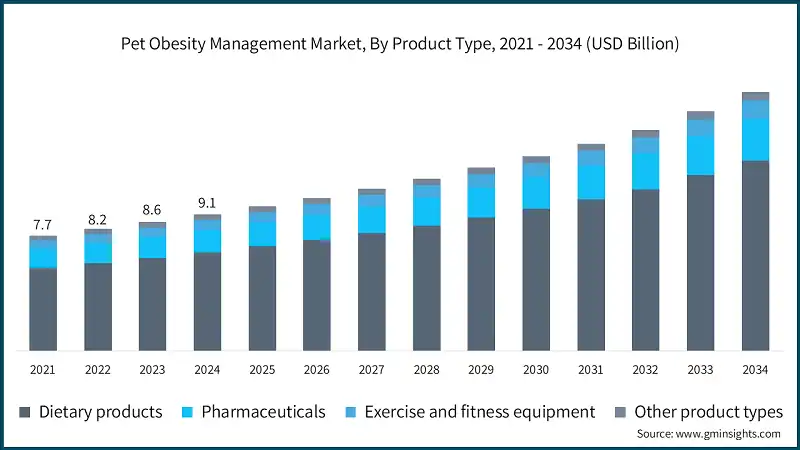

The pet obesity management market witnessed steady growth, growing from USD 7.7 billion in 2021 to USD 8.6 billion in 2023. The growth of the market is driven by rising demand for weight management formula. For instance, the brands like Hill’s Royal Canin, and Purina Vet Diets offer specialized products prescribed by veterinarians. Further, the growth of the market is driven by growing awareness of obesity-linked comorbidities such as diabetes, arthritis, cardiovascular issues and respiratory diseases in companion animals. For instance, as per the report published by Vetstem in October 2021 reported that dogs that are overweight or obese are 2.3 times more likely to be diagnosed with osteoarthritis. With obesity in pets on the rise, this has led to rising demand for osteoarthritis drugs, thereby contributing market growth. Additionally, the emergence of wearable pet tech such as introduction of advanced IoT based devices for activity tracking is revolutionizing obesity management. For instance, devices from Whistle, FitBark and PetPace offer calorie tracking and inactivity alerts, reshaping the future landscape of the pet obesity management market.

The increasing awareness of veterinary support and clinical programs offering structured obesity clinics, weight loss programs and personalized nutritional counseling drives the growth of the market. Vets use tools such as body condition scoring (BSC) and blood diagnostics to manage pet weight. For instance, as per American Animal Hospital Association report, more than 70% of U.S. veterinary practices now addressing obesity as a core preventive health priority, raising the demand for obesity solutions.

Also, the surge in customized and fresh pet food solutions, tailored to caloric needs, are in high demand. Brands like The Farmer’s Dog and PetPlate offer portion-controlled subscription diets which help combat pet obesity through accurate portion sizes and nutrition transparency. Moreover, pets in urban settings often live in small apartments with limited outdoor activity. This reduced mobility, coupled with high-calorie intake leads to faster weight gain. Thus, the growing demand for preventive veterinary healthcare, improved veterinary healthcare infrastructure and rising urban pet population globally, especially in Europe and Asia Pacific region, raises the demand for home-based weight management solutions, fostering growth within the pet obesity management market.

Obesity in pets occurs when excessive adipose tissue accumulates in the body due to metabolic and hormonal changes. Overfeeding, inadequate nutrition, lack of exercise, and sedentary lifestyles contribute to obesity, which can cause various chronic diseases. Pet obesity management requires a multi-faceted approach, including dietary adjustments, exercise plans, behavioral modifications, and specialized products or medications when necessary. This approach aims to help pets achieve and maintain healthy body weight, reduce health risks, and improve their overall well-being and longevity.

Pet Obesity Management Market Trends

The rising prevalence of pet obesity is driving market growth. According to the Association for Pet Obesity Prevention, in 2022, 59% of dogs and 61% of cats were classified as overweight or obese. Overweight pets face higher risks of developing conditions such as diabetes and liver disease, which can be fatal if untreated. The growing population of obese pets at risk of diabetes, combined with pet owners' increasing focus on improving their pets' health, longevity, and quality of life through the prevention and treatment of obesity-related disorders, will drive market growth during the forecast period.

- Moreover, the expansion of pet food startups offering custom-formulated diets based on pet breed, age and weight goals. Brands such as Ollie, and The Farmer’s Dog use AI to generated meal plans and control caloric intake precisely. These services provide pre-portioned meals delivered to the owner’s home, improving diet compliance and expanding market appeal among health conscious pet owners.

- Also, veterinary networks like Banfield and Greencross now offer monthly subscription plans that include weight assessment, vet consultation and nutrition counseling fueling market growth. These structured programs ensure consistent monitoring and early intervention for obesity. These trends reflect a shift from reactive to proactive care, improving long-term engagement, thereby raising demand for therapeutic diets and pet supplements.

- Furthermore, automatic and smart feeders are often integrated with machine learning to track feeding behavior, detect overeating and auto-adjust portions based on weight trends. Platforms like Sure Petcare and PortionPro Rx offer RFID-based portion control and AI feedback loops. These system reduces human error in feeding, improving compliance and support continuous obesity prevention at home or in clinical care.

- In addition, agencies such as AAHA and Royal College of Veterinary Surgeons (RVCS) now recognize obesity as a clinical disease. Standardized Body Condition Scoring (BCS) and weight management protocol have been integrated into annual checkups and preventive care programs. This regulatory recognition is driving more frequent diagnoses and prescription, boosting demand for structured interventions and diet products.

- The growing trend of developing pet food and supplements that address both obesity and its related conditions such as arthritis, diabetes or skin issues are gaining popularity. This approach improves compliance and clinical effectiveness, particularly for aging pets with multiple chronic issues.

- Moreover, the introduction of new products such as functional weight-control diets, smart feeders and AI-enabled fitness trackers, broadens the scope of obesity solutions available to pet owners and veterinarians. For instance, in June 2024, Virbac, a global leader in animal health, announced its strategic alliance with the Association for Pet Obesity Prevention (APOP) to confront the escalating health threat of pet obesity in the U.S. With an alarming 56% of dogs and 60% of cats classified as overweight or obese, the two organizations recognize the urgent need to address the hormonal and metabolic changes that occur following the spay or neuter procedure pre-disposing pets to obesity and obesity-related illness and health complications.

- Through collaborative efforts with APOP, Virbac aims to develop educational resources and tools for veterinary practices and pet owners, emphasizing the importance of tailored nutrition in maintaining pets' metabolic health.

- Overall, the market is evolving rapidly with the adoption of sustainable and nutrient-retentive processing techniques reducing calorie density. In addition, pharmaceutical companies are investing in small-batch and fresh food production models that allows real-time personalization of caloric content and ingredient mix.

Pet Obesity Management Market Analysis

Learn more about the key segments shaping this market

In 2021, the global market was valued at USD 7.7 billion. The following year, it saw a slight increase to USD 8.2 billion, and by 2023, the market further climbed to USD 8.6 billion.

Based on product type, the global market is divided into dietary products, pharmaceuticals, exercise and fitness equipment, and other product types. The dietary products segment accounted for 72.1% of the market in 2024 due to the high prevalence of pet obesity, growing demand for veterinary-recommended diets, and increasing awareness for natural and functional ingredients for weight management in companion animals. The segment is expected to reach USD 12.8 billion by 2034, growing at a CAGR of 7% during the forecast period. On the other hand, the pharmaceuticals segment is expected to grow with a significant CAGR of 6.5%. The growth of this segment can be attributed to increasing cases of severe and comorbid obesity and strategic collaboration and product line expansion.

- The dominance of dietary products in the global pet obesity management market driven by increasing demand for multimodal obesity treatment protocols. For instance, ingredients such as L-carnitine, green tea-extract and dietary fibers have clinical evidence supporting their role in improving metabolic health and reducing adiposity.

- Dietary supplements play a crucial role in obesity management for pets by providing targeted support and promoting healthy weight loss. These supplements are formulated with specific ingredients that aid in weight management, such as appetite control, metabolism support, and nutrient balance.

- Additionally, these supplements offer convenience and compliance, with easy administration and professional guidance, making them valuable tools for effective pet obesity management. Thus, the aforementioned factors are expected to significantly boost market growth.

- Moreover, another major factor that contributes to market growth include the growing demand for natural non-GMO, organic and grain-free supplements. Brands are responding with clean-label formulations free from artificial colors, fillers or synthetic additives contributes to market growth.

- Additionally, tech-driven platforms now offer personalized supplement formulations based on pet breed, age, weight, and health conditions. Lastly, several countries, particularly in North America and Europe, have established clearer guidelines for pet supplements claims, improving consumer confidence. For instance, the National Supplement Council (NASC) ensure compliance for over 300 pet supplements brands, facilitating safer adoption in obesity management plans.

Based on animal type, the pet obesity management market is bifurcated into dogs, cats and other pet animals. The dogs’ segment was anticipated to be worth of USD 6 billion in 2024 and is expected to grow at 6.9% CAGR during the forecast period.

- The increasing trend of treating pets as family members drives market growth, particularly in dog obesity management. Pet owners show greater willingness to invest in veterinary care, including chronic disease management. According to the American Pet Products Association, Americans spent USD 152 billion on pets in 2024, an increase from USD 147 billion in 2023. This higher spending supports the adoption of obesity management products.

- Obesity in dogs increases the risk of serious medical conditions, including diabetes, joint problems, and cardiovascular and respiratory issues. Certain dog breeds, such as Miniature Schnauzers, Pugs, and Bichon Frises, have a higher predisposition to obesity.

- Effective obesity management improves dogs' mobility and energy levels. Maintaining a healthy weight can extend a dog's lifespan and reduce veterinary costs associated with obesity-related conditions.

- On the other hand, the market for cats is anticipated to expand more promptly due to growing emotional bonding and humanization of cats, owners are more willing to invest in premium health solutions. Moreover, the easy availability of feline specialized products such as portion-controlled automatic feeders, indoor agility toys, low-calorie treats and feline focused wearables, fueling market growth.

Based on disease severity, the pet obesity management market is classified into mild obesity, moderate obesity and severe obesity. The mild obesity disease severity segment dominated the market in 2024 and is growing with a CAGR of 6.8% during the forecast period.

- The segment is gaining significant traction due to increasing awareness of obesity and associated health-risk, veterinarians now recommend therapeutic or calorie-restricted diets at the mild obesity stage to avoid comorbidities such as diabetes or osteoarthritis. In addition, the increasing popularization of pet fitness and wearable devices such as smart collars have enabled early detection and intervention in mild-obesity cases.

- Further, vets already assess obesity severity using body condition scores (BCS) and related metrics. These assessments can be standardized to define severity levels that helps in tailoring product offerings based on severity such as low-calorie food vs. medical-grade supplements, thereby driving the growth of the market.

- The second-largest segment, moderate obesity, held a market share of 32.7% in 2024. The market growth for moderate obesity disease severity is driven availability of targeted diet and supplement solutions. In addition, pets in the moderate obesity stage are at higher risk of progressing to severe obesity. As per the studies published in the Journal of Veterinary Internal Medicine indicates that over 25-30% of moderate cases develop chronic joint or metabolic disease within 12 to 18 months. This leads to increasing adoption of medical-grade solutions such as low-fat diets, supplements and digital monitoring devices. Thus, the presence of effective therapies for moderate obesity with proven clinical outcomes support market growth.

Learn more about the key segments shaping this market

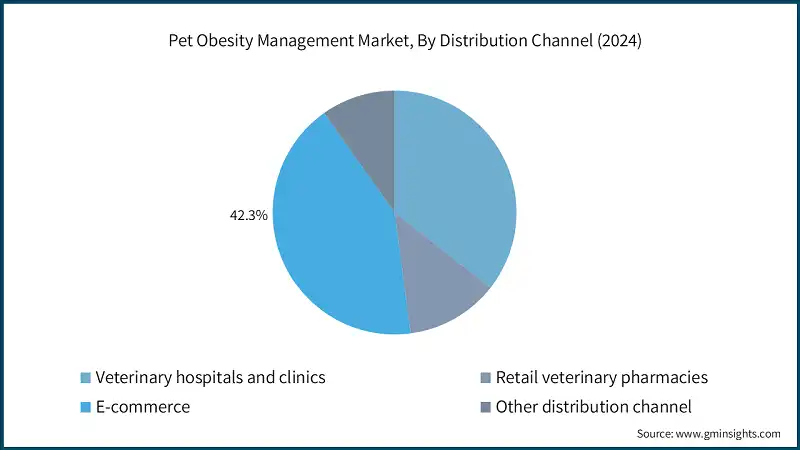

Based on end use, the pet obesity management market is classified into veterinary hospitals and clinics, retail veterinary pharmacies, E-commerce and other end users. The e-commerce segment dominated the market in 2024 and is expected to reach USD 7.5 billion within the forecast period.

- E-commerce platforms enable a wide range of products to be readily available, providing a comprehensive selection for customers. This allows pet owners to find specific products that suit their pets' needs.

- E-commerce platforms often offer detailed product information and customer reviews that aid in decision-making. Furthermore, e-commerce eliminates the need for physical retail space, reducing overhead costs and allowing broader reach to customers beyond geographical limitations.

- In addition, the online veterinary pharmacies have made obesity-related drugs such as dirlotapide or joint-supportive medications more accessible especially in regions with limited vet infrastructure.

- Moreover, e-commerce overcomes geographical limitations, ensuring access to specialized diets and obesity tools in areas lacking pet wellness retailers or veterinary clinics. For instance, in developing economies such as India and Brazil, e-commerce accounts for significant share of premium pet product sales in tier 2 and tier 3 cities, thereby significantly contributing to the growth of therapeutic and preventive obesity management.

- Thus, various advantages offered by e-commerce platform helps the pet owners to make sound decisions, thereby fostering market growth.

Looking for region specific data?

The North America pet obesity management market dominated the global market with a market share of 41.8% in 2024.

- Increasing adoption of pets coupled with rising awareness regarding pet obesity management is expected to boost the market growth. For instance, in 2024, as per the National Pet Owners Survey conducted by the American Pet Products Association (APPA), 66% of U.S. households, or about 86.9 million families own a pet.

- Thus, increasing trend of pet adoption along with rising concern among their owners regarding their health are prominent factors fueling the industry growth.

- Furthermore, the presence of key market players in the region and the growing prevalence of diabetes is expected to spur regional market growth for obesity management.

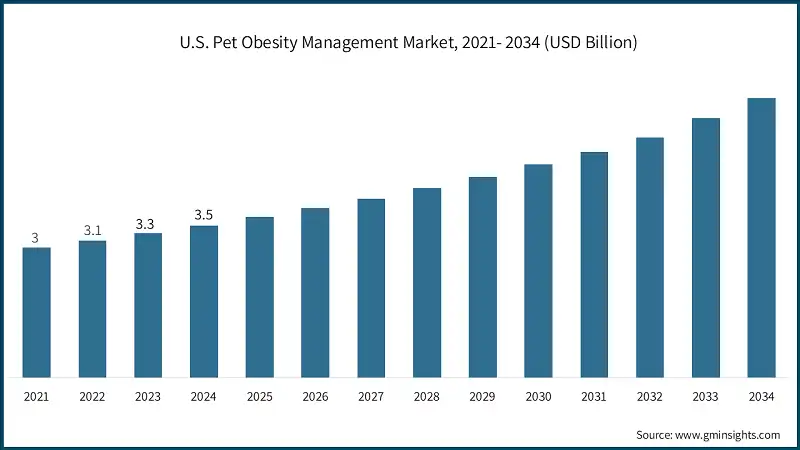

The U.S. pet obesity management market was valued at USD 3 billion and USD 3.1 billion in 2021 and 2022, respectively. The market size reached USD 3.5 billion in 2024, growing from USD 3.3 billion in 2023.

- The U.S. has a well-developed veterinary infrastructure with veterinary clinics offering specialized obesity programs, including customized weight plans, regular BCS assessments, and activity counseling. Moreover, organizations such as AAHA and Association for Pet Obesity Prevention (APOP) provide standard obesity screening protocols, encouraging proactive management drives the growth of the market.

- In addition, U.S. has seen rapid adoption of pet health monitoring tools with advanced AI-powered devices that track calories burned, steps and sleep, and providing real-time insights into pet weight trends.

- These technologies with AI integration empower pet owners to manage obesity at home integrated with mobile apps, contributing to a digitally driven expansion of the market.

Europe pet obesity management market accounted for USD 2.5 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- The increasing prevalence of overweight pets is a major growth driver. A European study found that 32% of dogs were overweight or obese based on BMI, and 56% based on Body Fat Index (BFI). This growing health concern is pushing demand for obesity management products and services, as pet owners seek to improve their pets’ quality of life and longevity.

- Companies are expanding their reach through acquisitions and new product lines. For example, Nestlé India acquired Purina Petcare, and Pinnacle Pet Group entered the UK market through acquisitions. These moves are enabling deeper market penetration of obesity management products, especially therapeutic foods.

- Europe has seen a surge in online purchasing of pet products, including weight management foods and fitness trackers. Platforms like Zooplus in Germany, Pets at Home in UK and Bitiba are offering subscription-based access to therapeutic diets, thereby fueling market growth.

Germany dominates the European pet obesity management market, showcasing strong growth potential.

- Veterinarians in Germany are actively promoting preventive care, including obesity screening and weight control programs. This professional guidance influences consumer behavior, increasing the adoption of vet-recommended diets and supplements. The structured veterinary infrastructure in Germany supports this trend, aligning with the market’s robust growth forecast, thereby supports market growth.

- Germany’s urban population continues to grow, leading to smaller living spaces and reduced outdoor activity for pets. This contributes to sedentary lifestyles and weight gain. Urban pet owners are increasingly seeking indoor-friendly weight management solutions, that drives the growth of the market.

The Asia Pacific pet obesity management market is anticipated to grow at the highest CAGR of 7.3% during the analysis timeframe.

- Pets are increasingly viewed as family members in Asia Pacific, especially in countries like Japan, South Korea, and India. This cultural shift is driving demand for premium pet care products.

- Asia Pacific’s booming e-commerce sector is making pet obesity management products more accessible. Online platforms offer therapeutic foods, supplements, and fitness trackers, often with subscription models. This digital convenience is accelerating product adoption, especially in urban centers, and contributing to the region’s position as the fastest-growing market globally for pet obesity management.

China pet obesity management market is estimated to grow with a significant CAGR, in the Asia Pacific market.

- Chinese consumers are increasingly opting for premium, low-calorie, and functional pet foods tailored to weight control. This shift is driven by rising health consciousness and the desire to prevent obesity-related complications drives the growth of the market.

- Moreover, China is experiencing a notable rise in pet ownership, particularly among dogs and cats, with the population surpassing 120 million in 2024, according to the China Pet Industry White Paper. This surge has led to a higher incidence of obesity-related conditions such as diabetes mellitus, and others. As a result, there is growing demand for obesity management solutions, including specialized diets, supplements, and veterinary interventions.

Latin American pet obesity management market, exhibiting remarkable growth during the analysis period.

- Veterinary infrastructure is expanding across Latin America, improving access to obesity diagnostics and treatment. Clinics are offering personalized diet plans and exercise programs, especially in Brazil and Argentina. This professional support is boosting the adoption of obesity management products and service.

- Veterinary clinics across Latin America are expanding their services to include educational programs on pet obesity, diet planning, and exercise routines. This outreach is helping pet owners understand the risks of obesity and adopt healthier practices. As veterinary infrastructure improves, especially in Brazil and Mexico, it is expected to significantly boost the adoption of obesity management products and services.

The Middle East and Africa pet obesity management market is expected to experience substantial growth in 2024.

- Middle East and Africa government and private players are increasingly focusing on animal health infrastructure including specialty veterinary clinics and diagnostic labs. In addition, the growing awareness about obesity in companion animals has increased the demand for dietary supplements and other product types including therapeutics, fueling market growth.

- Governments and private sectors are investing in veterinary clinics and pet wellness centers, especially in the Gulf Cooperation Council (GCC) countries. These facilities offer obesity screening, nutritional counseling, and weight management programs, thus driving market penetration for pet obesity management.

Pet Obesity Management Market Share

The market is characterized by diverse players competing in the industry. The top 5 players such as Royal Canin (Mars), Nestlé Purina PetCare Company, Hill’s Pet Nutrition, Zoetis and Blue Buffalo accounts for approximately 75% of the market share in the moderately consolidated global market. The prominent players in the market thrive through a combination of strategic initiatives, investing in research and development, meeting the specific needs of pet obesity management. The niche players or disruptors collectively hold a smaller portion of the market, primarily due to limited global reach or narrower product offerings.

The dominance of key players like Mars Inc., Nestlé Purina, and Hill’s Pet Nutrition will continue to shape the market through innovation and strategic expansion. Their investments in personalized nutrition, AI-driven health tracking, and veterinary collaborations will enhance product effectiveness and consumer trust. As pet humanization deepens globally, these companies are expected to lead the development of preventive care ecosystems, driving sustained market growth and influencing regulatory standards and consumer behavior.

Niche players are increasingly influencing the future growth of the pet obesity management market by introducing innovative, specialized solutions that cater to underserved segments. Companies like Vivaldis, FitPaws, and Auxthera LLC focus on targeted therapies, physical rehabilitation tools, and metabolic treatments, offering alternatives to mainstream products. Their agility allows them to quickly adapt to emerging trends such as personalized nutrition, holistic wellness, and tech-enabled pet care, fostering competition and driving diversification and innovation across the market landscape.

Pet Obesity Management Market Companies

Prominent players operating in the pet obesity management industry are as mentioned below:

- Auxthera

- Blue Buffalo

- FitPaws

- Hill’s Pet Nutrition

- KONG Company

- Park Vet Group

- Pet-Ag

- Pedigree

- Pet Nutrition Alliance

- Purina PetCare Company

- Royal Canin (Mars)

- Vivaldis

- Zoetis

- Royal Canin (Mars)

Mars leads with Royal Canin’s veterinary-exclusive therapeutic diets tailored for weight management and Pedigree’s mass-market reach. Their strength lies in scientific formulation, global distribution, and strong vet partnerships, making them a dominant force in both clinical and consumer segments.

- Hill’s Pet Nutrition

Hill’s is renowned for its prescription diet metabolic line, developed through clinical research and vet collaboration. Hill’s products are designed to activate pets’ natural metabolism for safe and sustain weight loss. The company’s science-backed nutrition, supported by clinical trials and vet endorsements, making it a trusted choice for managing obesity and related conditions in both dogs and cats.

- Zoetis

Zoetis brings a pharmaceutical and diagnostic edge to pet obesity management, focusing on hormonal therapies, metabolic health, and veterinary tools. With strong vet partnerships and a legacy in animal health, Zoetis is shaping the future of obesity care from a therapeutic standpoint.

- Blue Buffalo

Blue Buffalo offers natural, grain-free, and functional pet foods focused on weight control. The company’s holistic wellness approach, appealing to health-conscious pet owners seeking clean-label, nutrient-rich solutions for managing pet obesity.

Pet Obesity Management Industry News

- In October 2023, Drools Pet Food Pvt. Ltd. launched two groundbreaking initiatives in aimed at revolutionizing pet health services and veterinary practices nationwide. The first initiative, “Drools Vet Thrive,” is a visionary plan to enhance veterinary hospitals, elevating pet healthcare services.

- In August 2023, Mars Inc. invested Rs 800 (USD 95.94 million) crore for the phase-II expansion of its Telangana plant, Mars Petcare, which produces popular pet food brands like Pedigree and Whiskers, with a previous investment of Rs 200 crore (USD 23.98 million). The Telangana government and Mars Inc. have formed a comprehensive partnership to enhance initiatives focused on pet care and nutrition in India.

- In August 2022, Nestlé India acquired Purina Petcare's dog and cat food business, integrating Purina Petcare India into Nestle India. The move brought the two entities together, with Purina Petcare India, specializing in importing products, including the addition of wet cat foods under the Fancy Feast brand.

The pet obesity management market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 - 2034 for the following segments:

Market, By Product Type

- Dietary products

- Pharmaceuticals

- Exercise and fitness equipment

- Other product types

Market, By Animal Type

- Dogs

- Cats

- Other pet animals

Market, By Disease Severity

- Mild obesity

- Moderate obesity

- Severe obesity

Market, By Distribution Channel

- Veterinary hospitals and clinics

- Retail veterinary pharmacies

- E-commerce

- Other distribution channel

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the global pet obesity management market?

Key players include Auxthera, Blue Buffalo, FitPaws, Hill’s Pet Nutrition, KONG Company, Park Vet Group, and Pet-Ag.

What are the key factors driving the global pet obesity management market?

Key factors include the rising prevalence of pet obesity, increasing focus on pet health and longevity, and growing expenditure on veterinary care.

How much revenue did the dog segment generate in 2024?

The dog segment was valued at USD 6 billion in 2024 and is projected to grow at a CAGR of 6.9% during the forecast period.

Which segment dominated the market in 2024?

The mild obesity disease severity segment dominated the market in 2024 and is expected to grow at a CAGR of 6.8% during the forecast period.

Which region leads the global pet obesity management market?

North America led the market with a 41.8% share in 2024, driven by increasing pet adoption and rising awareness about pet obesity management.

What is the projected size of the global pet obesity management market in 2025?

The market is expected to reach USD 9.7 billion in 2025.

What is the projected value of the global pet obesity management market by 2034?

The market is expected to reach USD 17.3 billion by 2034, fueled by growing awareness of pet obesity and its associated health risks.

What was the market size of the global pet obesity management in 2024?

The market size was USD 9.1 billion in 2024, with a CAGR of 6.7% expected through 2034, driven by increasing pet adoption and rising pet healthcare expenditure.

Pet Obesity Management Market Scope

Related Reports