Summary

Table of Content

Pet Food Ingredients Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Pet Food Ingredients Market Size

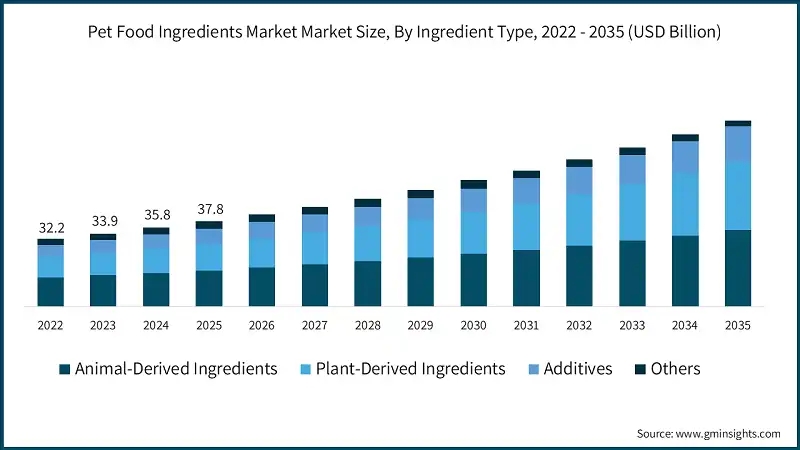

The global Pet Food Ingredients Market was valued at USD 37.8 billion in 2025. It is projected to grow from USD 39.8 billion in 2026 to USD 64.5 billion by 2035, representing 5.5% CAGR from 2026 to 2035, according to latest report published by Global Market Insights Inc.

To get key market trends

- The market of pet food ingredients is witnessing healthy growth due to the rising number of pets and the changing preferences of consumers towards high-quality nutrition. Growing urbanization and rising disposable income level is prompting pet owners to consider pets as family members thus demand high quality and nutritious pet foods. There is a significant change of basic feed to functional ingredients that are healthy, including proteins, vitamins, and probiotics. Consequently, the manufacturers are diversifying their product range to contain specialized and fortified blends of ingredients to suit particular life stages and dietary requirements.

- The other high growth factor is the emerging awareness of consumers on the significance of pet health and wellness. The owners of pets are now more informed about how diet and general health performance are connected, thus choosing natural, organic, and sustainable food sources. This is driving the innovation in plant-based proteins, omega fatty acids, and antioxidant-enhancing additives. To satisfy this need, companies are pumping resources into research and development to produce more sophisticated solutions to ingredients, including the digestive health, immunity-enhancing, and obesity-controlling issues.

- Market expansion is also being affected by regulatory trends and quality standards. Higher safety standards and labeling regulations are placed on ingredient suppliers forcing them to make their supply chains more transparent and traceable. This has increased consumer confidence and prompted the brands to embrace clean label ingredients with verifiable origin. The market is also experiencing growth in the high-end niche with owners ready to pay a premium to buy certified, non-GM, and sustainably sourced components ready to meet regulatory requirements.

- The emergence of direct-to-consumer sales channels and e-commerce is increasing the pace at which the market is growing through the enhancement of accessibility and choice. Digital platforms help the consumer to have access to a greater variety of ingredient-centric pet foods and supplements, which promotes competitive pricing and differentiation. The use of social media and influenced endorsements to conduct marketing campaigns is further informing owners of the benefits of ingredients, which strengthens buying choices. Taking together these trends are making the market a vibrant and growing market with a growing range of opportunities throughout geographic areas and product lines.

Pet Food Ingredients Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 37.8 Billion |

| Market Size in 2026 | USD 39.8 Billion |

| Forecast Period 2026 - 2035 CAGR | 5.5% |

| Market Size in 2035 | USD 64.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising pet ownership globally | Expands demand for diverse and innovative pet food product |

| Humanization of pets | Drives premium and functional ingredients for better pet health |

| Increasing awareness of pet nutrition | Boosts demand for high-quality, health-focused food formulations |

| E-commerce growth in pet food sales | Enhances accessibility and accelerates innovation in ingredient offerings |

| Pitfalls & Challenges | Impact |

| Stringent regulatory compliance | Raises operational complexity and delays product launch timelines |

| Volatility in raw material prices | Pressures profit margins and impacts pricing strategies significantly |

| Risk of ingredient recalls and safety issues | Damages brand reputation and reduces consumer trust in products |

| Opportunities: | Impact |

| Expansion in plant-based and alternative protein sources | Creates sustainable options for eco-conscious pet owners worldwide |

| Growing demand in functional ingredients for health benefits | Enables targeted solutions for digestion, immunity, and skin health |

| Expansion in emerging economies | Unlocks new markets with rising disposable income and pet adoption |

| Customized and breed-specific formulations | Supports premiumization and differentiation in competitive pet food market |

| Market Leaders (2025) | |

| Market Leaders |

Market Share Approximately 8% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Middle East & Africa |

| Emerging countries | UAE, Saudi Arabia, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Pet Food Ingredients Market Trends

- The market for pet food ingredients is experiencing an apparent trend of moving toward clean-label and simplified formulations with shorter and more transparent ingredient lists. Manufacturers are redefining the products to be devoid of artificial colors, flavors and preservatives and replace them with natural and less processed food stuffs. This direction is shifting sourcing policies and compelling the suppliers to turn to ingredient purity and recognizability. Consequently, differentiation is becoming more ingredient-focused, as opposed to the formulation-based differentiation.

- The integration of functional ingredients has become one of the most popular market trends, and the increasing trends towards health-oriented nutrition as opposed to generic formulations. Pro-gut, pro-immunity, pro-skin, and pro-joint ingredients are also being systematically introduced within product lines. It is a trend that is shaping the innovation cycles of ingredients and influencing cross-learning in human nutrition. It is also causing increased adoption of condition specific ingredient blends both on the mass and the high-end market.

- The positioning and selection of the ingredients of pet food is being reshaped by personalization and nutrition that is specific to the life-stage. Companies are moving towards matching the ingredient content of their products with the breed size, age and activity of pets. The trend is influencing diversification of ingredient companies and greater need of customizable and versatile ingredient solutions. Suppliers of ingredients are acting by providing customizable mixes to promote differentiable product development.

- The other trend that is currently affecting the market structure is sustainability-led ingredient transformation. Experimentation on alternative proteins, by-products and responsibly sourced raw materials is on the increase to enhance environmental performance. This trend is affecting the procurement models and long term supplier alliances in the industry. Sustainability factor is increasingly being incorporated in ingredient decisions as opposed to being a value addition.

Pet Food Ingredients Market Analysis

Learn more about the key segments shaping this market

The market based on ingredient type is segmented into animal-derived ingredients, plant-derived ingredients, additives, and others. The animal-derived ingredients segment was valued at USD 16.9 billion in 2025, and it is anticipated to expand to 5.3% of CAGR during 2026-2035.

- There is growth in the market in animal-derived, plant-derived and additive ingredients as the formulations of pet foods are becoming more nutritionally based. Animal-derived ingredients are still included in terms of protein quality and palatability whereas plant-derived ingredients are being increasingly used as a source of fiber, carbohydrates and alternative proteins balancing. Vitamins, minerals, antioxidants, enzymes, among others, are also being used increasingly to provide nutritional value and functionality. This is a diversified ingredient mix that is aiding innovation with both standard and specialized formulations of pet food.

- Experimentation of blended ingredient solution is another factor that has contributed to growth in this segment by combining animal and plant ingredients. The growing emphasis on ingredient compatibility, digestibility, and stability by manufactures is driving the growing need to use processed and value-added ingredient forms. The others category, which consists of novel and specialty ingredients, is slowly beginning to be used in niche and high-end formulations. In general, segmentation on the basis of ingredient type is an indication of movement in favor of more tailor-made and application-specific ingredient selection.

Pet food ingredients market based on pet type is segmented into dogs, cats, birds, fish, and others. The dogs segment was valued at USD 20.5 billion in 2025, and it is anticipated to expand to 5.2% of CAGR during 2026-2035.

- The demand for ingredients is changing under the influence of particular nutritional needs of dogs, cats, birds, fish, and other association animals. The formulations of dog and cat food are still fostering a widespread use of ingredients, and the nutrition of birds and fish is contributing to the rise of particular proteins, oils, and micronutrients. Small mammals and reptiles are also increasing the market of niche ingredients, and this factor attracts suppliers to build specific nutritional profiles. In this segmentation, accentuates grow difference in ingredient composition among species.

- Due to increased interest among pet owners in species-specific food needs, product developers are evolving in line with this. This has created a higher demand for refined sources of protein as well as controlled level of fats and functional additives specific to each type of pet. The diversification of the pet categories is enhancing the general ecosystem of ingredients, and the reliance on a specific category of consumption.

Pet food ingredients market based on form is segmented into dry ingredients, wet ingredients, and liquid ingredients. The dry ingredients segment was valued at USD 23.2 billion in 2025, and it is anticipated to expand to 5.2% of CAGR during 2026-2035.

- The use of dry ingredients is still common owing to convenience and extended shelf life whereas the wet ingredients promote the formulations that are rich in texture and those that are moisture fortified. The use of liquid ingredients in enhancing gravies, supplements and palatability enhancers are gaining momentum and are no longer limited to niche applications. It is this diversity in forms that enables manufacturers to cover various feeding patterns and product format.

- Supplier of ingredients are making more production technologies that maximize stability and performance in forms. There is an increasing demand for multi-functional ingredients, which can be utilized either in the dry form or the wet form. Flexibility in the form of ingredients is becoming one of the principal factors contributing to market growth as product innovation is on the rise.

Pet food ingredients market based on source is segmented into conventional and organic. The conventional segment was valued at USD 33.9 billion in 2025, and it is anticipated to expand to 5.4% of CAGR during 2026-2035.

- The market is growing both in the conventional and organic sources of ingredients because of different consumer expectations and pricing policies. Traditional ingredients are still serving to uphold large scale production and the cost effective formulations. Products are being positioned on organic ingredients, which are being adopted selectively on the items that focus on naturalness and ingredient transparency. This sourcing model co-existence enables the brands to serve more consumers.

- Sourcing strategies and supplier certifications are being impacted by the slow shift to using organic sources. Suppliers are juggling supply, price and consistency as they embrace organic ingredients into certain product lines.

Learn more about the key segments shaping this market

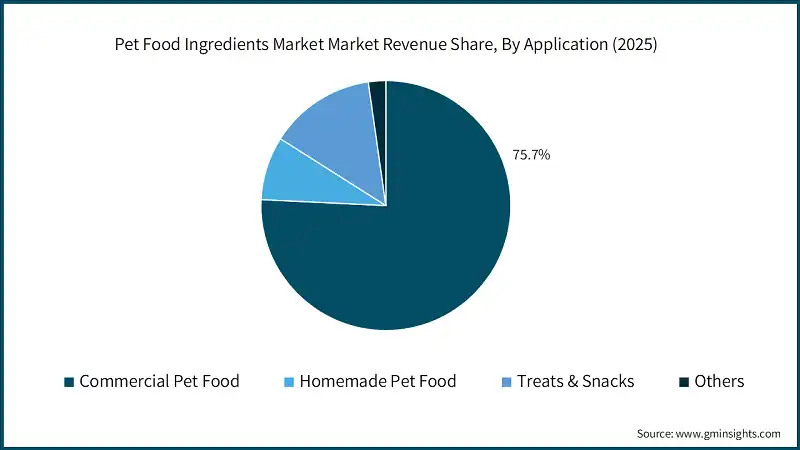

Pet Food Ingredients market based on application is segmented into commercial pet food, homemade pet food, treats & snacks, and others. The commercial pet food segment was valued at USD 28.6 billion with a market share of with a market share of 75.7% in 2025, and it is anticipated to expand to 5.4% of CAGR during 2026-2035.

- The commercial pet food market is still a highly significant application sector, which accounts for consistent demand in a broad spectrum of ingredients in formulations. The ingredients applied in this segment are aimed at helping to maintain consistency, scalability, and regulatory compliance. Treats and snacks are becoming a significant usage, and ingredients are geared towards taste, texture, and functional advantages. Such diversification is expanding the use of ingredients beyond the basic meal products.

- There is a slow shift in ingredient demand by homemade pet food and other applications to simple, recognizable, and functional ingredients. Suppliers of ingredients are reacting by providing flexible ingredients that can be used in large as well as small batches. The diversification to various applications is forming a stronger and diversified demand system of pet food ingredients.

Looking for region specific data?

The North America pet food ingredients market accounted for USD 13.9 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

North America market is expanding due to the sustained reformulations and pet nutrition innovations. Growing demand in ingredients is boosted by rising demands in functional additives, balanced protein mixes, and diversified forms of ingredients in commercial pet food and treats. To facilitate the differentiation of products and the personalization of nutrition, manufacturers are increasing the number of ingredients in portfolios. It also has a good processing infrastructure and continuous integration of superior ingredient solutions in various pet categories that have facilitated growth.

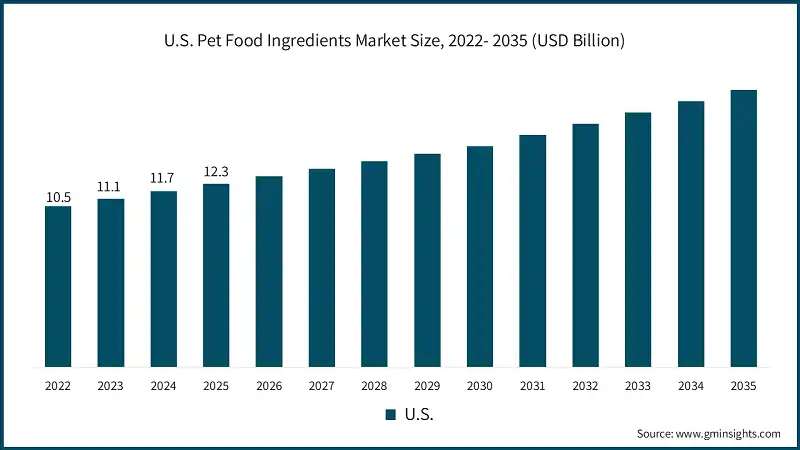

U.S. dominates the North America pet food ingredients market, showcasing strong growth potential.

The growth is faster in the U.S. whereby more specialized and value-added ingredients are being incorporated. Ingredient suppliers are enjoying an increase in the demand for health-conscious formulation, snacks, and supplements. Increased consumption of tailored blends and selective sourcing of organics are favoring increased consumption of ingredients. The continued product innovation and dry to wet product diversification has ensured that the demand of ingredients in the U.S. market is still growing.

The Europe pet food ingredients market accounted for USD 10.5 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

The market of the pet food ingredients of Europe is growing steadily due to the changing formulation practices and sourcing strategies. The focus on functional integration, compliance with quality, and nutritional consistency is influencing ingredient demand. The growth is being facilitated by increased utilization of plant-derived ingredients and additives in commercial pet food and snacks. The organization of manufacturing in the region allows the gradual yet consistent growth of ingredient applications.

Germany dominates the Europe pet food ingredients market, showcasing strong growth potential.

Germany is recording quicker development as the consumption of ingredients is rising in both high-end and designed pet food formula. Refined animal and vegetarian ingredients and functional additives are being integrated by manufacturers to improve nutritional values. The demand for ingredients is being supported by a balanced use of both conventional and organic sources. High production capacities and emphasis on formulation efficiencies are strengthening growth in the market in the country.

Asia Pacific pet food ingredients market accounted for 24.2% market share in 2025 and is anticipated to show lucrative growth over the forecast period.

The market for Asia Pacific pet food ingredients is developing fast as a result of the increased commercial production of pet food. The demand for ingredients is growing in proteins, carbohydrates, and additives to sustain a variety of pets and feeding systems. Ingredient solutions are increasingly standardized because manufacturers want to enhance consistency and scale. This is a shift in informal to formal production and the region is growing at a sustainable rate.

China pet food ingredients market is estimated to grow with a significant CAGR, in the Asia market.

China is experiencing faster growth with domestic production of pet food growing up. The consumption of ingredients is increasing where there is increased attention towards fortified and nutritionally balanced formulations. There has been a growth in demand in respect to the animal derived proteins, plant based constituents and functional additives in commercial pet food and treats. Investment in processing and quality control is also contributing to ingredient consumption in China.

Latin America pet food ingredients market is anticipated to grow at a CAGR of 6.1% during the analysis timeframe.

The market in Latin America with regard to pet food ingredients is increasing at an accelerating rate as packaged pet foods are becoming more and more prominent in Latin America. The demand for ingredients is increasing in conventional proteins, plant-based inputs, and additives as manufacturers enhance the quality of formulations. The usage of the ingredients is also being supported by expansion of treats and snacks. The source at low cost is helping to achieve steady volume growth in applications.

Brazil leads the Latin America pet food ingredients market, exhibiting remarkable growth during the analysis period.

The growth in Brazil is accelerating due to the growing production of pet food and products differentiation. The consumption of ingredients is spreading in the dry and damp formulation that is fueled by better structuring of nutrition. Increased application of additives and blended ingredient solutions is increasing product consistency. The rise in commercial pet food is still boosting the ingredients demand in the country.

Middle East & Africa pet food ingredients market is expected to grow at a CAGR of 6.4% during the analysis timeframe.

The market of the Middle East & Africa pet food ingredients remains developing slowly as the adoption of packaged pet food grows. The demand for ingredients is growing in both dry and wet forms, especially in commercial use. The emphasis is on structuring the formulation and nutritional balance in the hands of the manufacturers. The consciousness of pet nutrition is contributing to stable market development of ingredients.

Saudi Arabia pet food ingredients market to experience substantial growth in the Middle East and Africa market in 2025.

The increasing investment in the pet foods manufacture is making Saudi Arabia a market that is growing quicker. The use of ingredients is on the rise in proteins, additives and processed dry ingredients to facilitate uniform formulations. Growth in the organized retail and the availability of high-quality products is enhancing the demand for ingredients. These are the forces that are favoring the consistent growth in the market in the country.

Pet Food Ingredients Market Share

- Cargill, Incorporated, Archer-Daniels-Midland Company (ADM), DSM-Firmenich, BASF SE, and Darling Ingredients Inc. are a significant part of the market and with further standing of being fragmented with the top five players steadily holding 36% market share in the year 2025.

- The market has companies that are interested in continuous product innovation to meet the changing nutritional expectations. They also make investments in the development of functional, differentiated, and application-specific ingredient solutions that facilitate differentiation among the types of pet and food formats.

- The research and development give strong focus on enhancing ingredient digestibility, stability, and nutritional efficiency. It enables companies to react swiftly to formulation designs and remain pertinent in the commercial pet food, treats and specialty products.

- The process is done using strategic sourcing and supply chain optimization to guarantee the uniform quality and supply of raw materials. The diversified sourcing networks that are maintained by the companies decrease supply risks and enable globally based companies to produce on a scale.

- Manufacturers are working towards enhancing their relationship with pet food brands by supporting them with long term supply contracts and development of products. This assimilation into customer innovation pipelines aids in the regulation of recurring demand and adds to the market positioning.

- Increase in processing capacity and investment in sophisticated manufacturing technology allow the companies to provide value added and processed forms of ingredients. The capabilities enhance cost efficiency as well as facilitating versatile use of the capabilities in dry, wet and liquid formulations.

- Companies also dwell on the diversification of their portfolios, by having a wide selection of animal, plant based as well as functional ingredients. This enables them to cut across various price segments and to adjust to changing formulation preferences without relying too heavily on one category.

- It is important to consider regulatory compliance and quality assurance as they are important in ensuring a competitive position. To work with changing standards and gain an understanding with pet food manufacturers, firms invest in the certifications and testing, as well as traceability systems.

- The issue of sustainability-focused operations such as responsible sourcing and waste minimization are being integrated in business operations. Such activities shape the buying choices and make the companies become long-term partners in an evolving market scenario.

- Global expansion and localized production strategies also add to the power of this market. The presence of regional presence and technical support enables the firms to be more responsive to their customers and solidifies their presence in the development of the ingredient employment in the entire pet food ingredients industry.

Pet Food Ingredients Market Companies

The major players operating in pet food ingredients industry include:

- Cargill, Incorporated

- Archer-Daniels-Midland Company (ADM)

- DSM-Firmenich

- BASF SE

- Darling Ingredients Inc.

- Others

- Cargill maintains its role as a vertically integrated source and bulk processing of animal and plant-based products as ingredients in the feed of pets. The company concentrates on the consistency of their formulation, reliability of their supply and development of functional ingredients to aid the commercial pet food and treat manufacturers.

- ADM is preserving its market share through its competitive advantage of plant-based proteins, fibers, and functional nutrition ingredients that are optimized to satisfy pet food. ADM can keep up with changing formulation demands due to its continued investments in nutrition science and tailored ingredient solutions.

- DSM-Firmenich is specializing in high value nutritional additives which include vitamins, minerals, enzymes, and specialty functional ingredients to incorporate in pet food designs. To maintain the position, the company relies on the power of science-based innovation, regulatory experience, and close partnership with the pet food manufacturers.

- BASF promotes its position on the market of pet food ingredients with the help of advanced additive solutions, such as antioxidants, vitamins, and performance-enhancing ingredients. High focus on the efficiency of formulations, quality control and scalability of production have helped to make it relevant over long-run use in the application.

- Darling Ingredients is now competitive as it turns animal by-products to value added protein and fat-nutrition products to its pets. The fact that it focuses on efficient rendering processes, sustainable sourcing and consistent quality of ingredients help it maintain consistent demand among the large scale pet food manufacturers.

Pet Food Ingredients Market News

- In November 2025, Cargill Animal Nutrition and Health expanded its plant at Engerwitzdorf, Austria, adding approximately 50% capacity to micronutrition production to keep up with the growing demand of microelements nutrition; this will help in the availability of more functional ingredients in the manufacture of premium pet food.

- In August 2025, as part of its strategy to expand in Asia-Pacific and to fit the requirements of the make in India initiative, DSM-Firmenich opened a new plant in Jadcherla, Hyderabad, that produces Animal Nutrition and Health feed additives. The plant featured a specific production line of mycotoxin risk management solutions and a high-tech warehouse, which created a combined location with its current premix plant.

- In June 2025, DSM-Firmenich sells its stake in the Feed Enzymes Alliance to Novonesis, releasing a total of 1.5 billion in cash to focus more on core nutrition and the innovation of pet food ingredients in remaining feed divisions, which worsens the competition situation in the enzyme supply market and consolidates the market in pet food enzyme solutions.

- In June 2025, ADM established a new 1,600 sq meter biotics R&D facility in Lausanne, Switzerland based on industry trends of gut health and biotic ingredient innovation in pet food formulations.

The pet food ingredients market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) & volume (Kilo Tons) from 2022 to 2035, for the following segments:

By Ingredient Type

- Animal-Derived Ingredients

- Meat Products

- Fish Products

- Animal Fats

- Plant-Derived Ingredients

- Cereals & Grains (corn, wheat, rice)

- Oilseeds & Pulses (soybean, peas)

- Fruits & Vegetables

- Additives

- Vitamins & Minerals

- Enzymes

- Probiotics & Prebiotics

- Flavors & Colorants

- Preservatives

- Others

- Novel Proteins (insect protein, algae)

- Functional Ingredients (omega-3, antioxidants)

By Pet Type

- Dogs

- Cats

- Birds

- Fish

- Others

By Form

- Dry Ingredients

- Wet Ingredients

- Liquid Ingredients

By Source

- Conventional

- Organic

By Application

- Commercial Pet Food

- Homemade Pet Food

- Treats & Snacks

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Which region leads the pet food ingredients market?

North America led the market with USD 13.9 billion in 2025 and is anticipated to experience lucrative growth during the forecast period, driven by strong demand for premium pet food products.

Who are the key players in the pet food ingredients market?

Key players include Cargill, Incorporated; Archer-Daniels-Midland Company (ADM); DSM-Firmenich; BASF SE; Darling Ingredients Inc.; and others.

What are the upcoming trends in the pet food ingredients market?

Key trends include the shift toward clean-label formulations, the integration of functional ingredients for health-oriented nutrition, and increased adoption of condition-specific ingredient blends.

What is the projected size of the pet food ingredients market in 2026?

The market is projected to reach USD 39.8 billion in 2026.

How much revenue did the animal-derived ingredients segment generate?

The animal-derived ingredients segment generated USD 16.9 billion in 2025 and is expected to grow at a CAGR of 5.3% from 2026 to 2035.

What was the valuation of the dry ingredients segment?

The dry ingredients segment was valued at USD 23.2 billion in 2025 and is projected to grow at a CAGR of 5.2% from 2026 to 2035.

What was the market size of the pet food ingredients market in 2025?

The market size was USD 37.8 billion in 2025, with a CAGR of 5.5% expected from 2026 to 2035, driven by clean-label trends and the integration of functional ingredients.

What is the projected value of the pet food ingredients market by 2035?

The market is expected to reach USD 64.5 billion by 2035, fueled by demand for natural, minimally processed ingredients and condition-specific nutrition blends.

Pet Food Ingredients Market Scope

Related Reports