Home > Animal Health & Nutrition > Pet Nutrition > Pet Food and Treats Market

Pet Food and Treats Market Analysis

- Report ID: GMI11314

- Published Date: Sep 2024

- Report Format: PDF

Pet Food and Treats Market Analysis

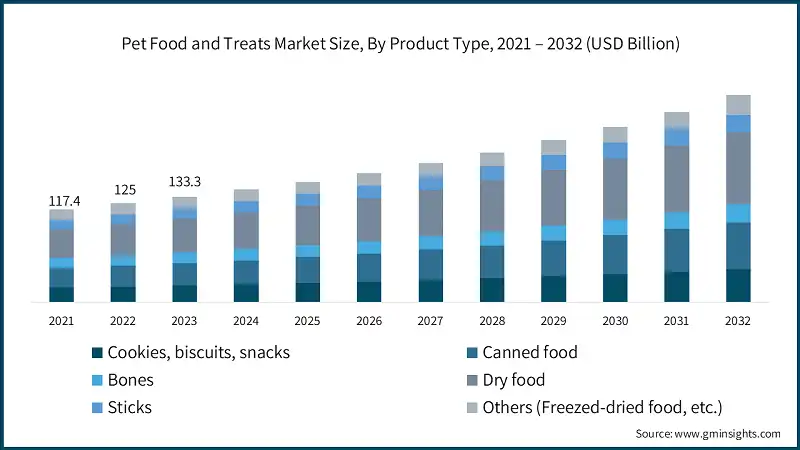

Based on product type, the market is segmented into cookies, biscuits, snacks, canned food, bones, dry food, sticks and others (freeze-dried food, etc.). Dry food dominated the market in 2023, generating a revenue exceeding USD 42.7 billion, and is expected to reach USD 90.7 billion by 2032. Dried food dominates the market due to its convenience, long shelf life, and cost-effectiveness compared to wet or fresh alternatives. Pet owners prefer dried food because it is easy to store, less prone to spoilage, and often more affordable, making it a practical choice for everyday feeding.

Additionally, dried pet food is nutritionally balanced, providing essential vitamins, minerals, and proteins in a concentrated form, which appeals to health-conscious pet owners. The rise of premium and specialized dried food formulas, such as grain-free and hypoallergenic options, has also contributed to its widespread popularity, offering tailored nutrition for various pet dietary needs.

Based on pet type, the pet food and treats market is classified into dogs, cats and others (fish, birds, hamsters, etc.). Dogs dominated the market in 2023, with revenue exceeding USD 67.4 billion, and is expected to reach USD 137.4 billion by 2032. Dogs dominate the pet food and treat market primarily due to their status as the most popular pets globally, particularly in regions like North America and Europe. According to the American Pet Products Association (APPA), nearly 63.4 million households in the U.S. alone own a dog, reflecting a significant consumer base that drives demand for a wide variety of dog-specific foods and treats.

Additionally, dogs typically require more food than smaller pets like cats or birds, contributing to higher overall consumption and spending. The strong emotional bond between dog owners and their pets also encourages the purchase of premium and specialized products, further solidifying dogs' dominance in the market.

North America emerged as the dominant region, generating a substantial revenue of USD 45.9 billion, and is expected to reach USD 91.2 billion by 2032. North America dominates the pet food and treat market due to a combination of high pet ownership rates and a strong cultural emphasis on pet care. The region, particularly the United States, has one of the highest percentages of households with pets, with nearly 70% of households owning at least one pet, according to the American Pet Products Association (APPA). This widespread pet ownership is complemented by a significant willingness to spend on pet wellness, leading to robust demand for premium, natural, and specialized pet foods and treats.

North America: The U.S. dominated the market with revenue of around USD 36.1 billion in 2023 and with a CAGR of 8% for the forecast period of 2024 to 2032. The U.S. dominates the global pet food and treat market due to its large pet-owning population, advanced market infrastructure, and high consumer spending on pet care. With nearly 90 million dogs and 94 million cats, the U.S. has one of the highest rates of pet ownership in the world, driving substantial demand for a diverse range of pet food products. The country's well-established retail and e-commerce networks make pet food easily accessible, further boosting sales.

Europe: The Germany dominated the market with revenue of around USD 5.5 billion in 2023 and with a CAGR of 8.5% for the forecast period of 2024 to 2032. Germany dominates the European pet food and treat market due to its robust pet ownership rates and strong market infrastructure. As one of the largest pet markets in Europe, Germany benefits from a high level of pet ownership, with millions of households owning pets, particularly dogs and cats. The country is known for its emphasis on pet health and wellness, which drives demand for high-quality and premium pet food products.

Asia Pacific: China spearheaded the market with revenue of around USD 12.7 billion in 2023 and is growing at a CAGR of 8.7% for the forecast period of 2024 to 2032. China's dominance in the pet food and treat market is driven by its rapidly growing pet ownership rates and increasing disposable incomes. As urbanization and economic growth continue to rise, more Chinese households are adopting pets, particularly dogs and cats, leading to a significant expansion in the pet care market. The increasing middle-class population is also contributing to higher spending on premium and specialized pet foods, reflecting a shift towards treating pets as valued family members.