Summary

Table of Content

Payment Processing Solutions Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Payment Processing Solutions Market Size

The global payment processing solutions market size was valued at USD 66.8 billion in 2024 and is projected to grow at a CAGR of 11.7% between 2025 and 2034. The rise of online transactions is driving the market growth of market. According to Statista, the total transaction value for digital transactions is estimated to be more than USD 20 trillion by 2025.

To get key market trends

The rapid growth of online payments happens with the rise of e-commerce, mobile apps, and electronic wallets. This need for fast and easy payment hastens the pace of innovation and growth in the payment industry. The market for secure, fast, and scalable payment-processing solutions has taken the form of runaway growth as more and more customers are consistently channeled toward the purchase of goods and services on digital platforms.

Payment Processing Solutions Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 66.8 Billion |

| Forecast Period 2025 – 2034 CAGR | 11.7% |

| Market Size in 2034 | USD 198.9 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

With cyber threats and data breaches becoming normal, customers and companies are more concerned about secure transactions. Payment processors enhance the data protection procedure, ranging from encrypting data to installing fraud detection systems and multi-factor authentication to protect sensitive information.

Regulatory standards such as GDPR and PCI DSS are encouraging businesses to invest in solutions that possess good security features and meet global standards. For instance, The Payment Services Act (PSA) was introduced by the Monetary Authority of Singapore (MAS) in January 2022 in a bid to unify the governance of payment services within the nation. The Act integrates various payment provider’s regulatory structures into one single logical regulatory system.

Globalization of companies has also driven the payment processing solutions market. The intricacies of multiple currencies, time zones, and regulatory needs would allow payment processors to develop solutions that could easily process the international payments. The transition from a complicated payment system toward fast, cheap, and totally transparent transactions across borders is now on demand in the clientele and businesses alike; thus, there have been innovations in multi-currency processing, real-time conversion rates, and international compliance functions.

Payment Processing Solutions Market Trends

- One of the major trends in the payment processing solution industry is the adoption of block chain technologies, which uses decentralized systems and principles that would remove intermediaries leading to increased reliability and cheaper transactional costs. In 2024, the global blockchain market had a revenue of USD 18.3 billion. Blockchain allows for quick and inexpensive international payments and transfers without relying on various financial institutions or mechanisms for the movement of money, thus adopting blockchain parameters and principles.

- Contactless payment technology is quickly becoming an increasingly popular alternative to traditional card payments because it helps to process payments quickly, safely, and conveniently. Cashless and card payments done within seconds with the touch of the reader with a card or smartphone are getting more important these days as most people are leading very fast lives.

- Retailers, mass transit systems, and small organizations are implementing contactless options in order to add richness to their customers' experience. And because of concerns related to health and hygiene on the increase, contactless as an option to ensure minimal contact via payments becomes even safer. Increased demand also boosts pressure towards changing payment terminals as well as smartphone payment applications toward supporting tap-and-go functionality.

- AI has many applications and uses in the payment processing solutions market. The technology claims to improve the efficiency and security of payment systems. Fraud detection involves machine learning algorithms that analyze transactional activity and report suspicious activities in real-time.

- AI technologies are also employed to optimize payment bridges, which assure speed and reliability in transactions. AI platforms for payments have the upside benefit of providing a rich, safe, and straightforward experience for the consumer and better operating efficiencies with less fraud risk for the enterprise.

- The increasing usage of smartphones and digital wallets makes mobile payment solutions an integral part of the modern consumer experience. According to Statista, smartphone market expected revenue for 2025 is around USD 485 billion. More consumers are turning to mobile payment solutions, such as Apple Pay, Google Pay, and more, for secure and seamless transactions in physical stores, online retailers, and peer-to-peer transfers.

- It is more pronounced in the younger generations as they prefer to perform their financial transactions on their mobiles. Payment processors are more into developing solutions for mobile applications with high security, contactless capability, and cross-platform support to aid in the burgeoning growth of mobile payments.

Payment Processing Solutions Market Analysis

Learn more about the key segments shaping this market

Based on the technology, the payment processing solutions market is segmented into NFC, QR code, and EMW. In 2024, the NFC segment held a market revenue of over USD 28 billion and is expected to cross USD 70 billion by 2034.

- NFCs are more convenient than previously used cash payments as they allow customers for fast and contactless payments. This factor led to their adoption in the payment processing market.

- NFCs payments are also more secure because they use cryptography encryption algorithms. The transaction data is encrypted and only decrypted at the receiving end with the help of the dedicated key. This level of security increases the trust for people for NFCs for digital transactions.

- QR code is the fastest growing segment in the payment processing solution market due to its low implementation cost. These systems are cost effective for shoppers and shopkeepers, as they do not need to invest in any expensive hardware infrastructure to use QR code.

- QR code also does not require any kind of specialized technology for their deployment. This makes them easily integrated into any existing system without any hassle. This low barrier to entry has led to the rise of QR code into digital payment systems.

Learn more about the key segments shaping this market

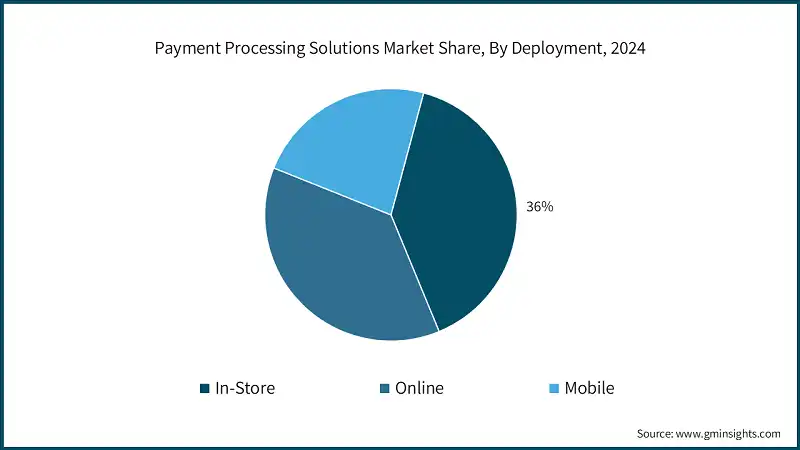

Based on the deployment, the payment processing solutions market is divided into in-store, online, and mobile. The in-store segment held a major market share of around 36% in 2024 and is expected to grow significantly over the forcast period.

- People have a sense of security when they directly see the transaction happening in front of them, and that’s what led to the dominance of in-store payment solutions.

- Physical stores are still the primary mode of shopping for most people. Many people still prefer to physically interact with the product before buying it, which leads to more in-store payments.

- The online segment has the fastest growth in the payment processing solutions market due to the globalization of businesses. According to Statista, in 2025, the e-commerce market is expected to gain revenue of around USD 4.3 billion. Online payments help businesses to cater to customers worldwide, with multiple currency and across-country transactions.

- Online payments are also on the rise because they are more convenient. This made the payments easier and faster, making the overall customer experience better.

Based on organization size, payment processing solutions market is categorised into large enterprise and SME. Large enterprise segment dominated the market and accounted for over USD 40 billion in 2024.

- Large enterprises segment is growing because they usually have the financial capacity to invest in technologies like AI-driven fraud detection or blockchain. Innovations like these give large enterprise USP in the payment processing market and that is the reason they are dominating.

- Large enterprises providers also support across-country transactions due to their global reach. They also provide tailored solutions to different markets, making them a viable choice in the payment processing solutions market.

- SMEs segment is the fastest growing in the market because of their cost-effective solutions. They also have flexible pricing solutions, which makes them great for new startups and low budget businesses.

Based on end use, payment processing solutions market is categorised into tourism and hospitality, retail and e-commerce, healthcare, BFSI, government and public sector, and others. Retail and e-commerce segment dominated the market and accounted for over USD 18 billion in 2024.

- The tourism and hospitality is witnessing large number of transactions. According to Statista, the revenue for travel and tourism market in 2025 is expected to be around USD 956 billion. With the large number of flight and hotel bookings in this sector, payment solutions provide a reliable solution.

- The tourism and hospitality segment has seen growth in this segment because they deal with people across regions and countries. Payment processing solutions help this sector by letting them make multi-currency payments.

- The retail and e-commerce segments are fast growing in the payment processing solutions market because of the rise in demand for fast transactions. Payment processing solutions are helping retailers and the e-commerce sector to provide seamless transactions to meet consumer expectations.

- The retail and e-commerce sector has seen globalization in recent years. Payment processing solutions are becoming viable solutions to provide payment across regions in these sectors.

Looking for region specific data?

North America dominated the global payment processing solutions market with a major share of over 35% in 2024 and U.S. leads the market in region.

- The dominance is due to the presence of the major companies that has the most market share in the market including Mastercard, Paypal, and Visa. These companies control most of the global payment processing, which shows U.S. dominance in this sector.

- U.S. has a high consumer spending. According to U.S. Bureau of Economic Analysis, the total consumer spending in U.S. was around 16.28 trillion in the last quarter of 2024. And most of these have been done through online digital payment using payment processing solutions.

- There is also rise of e-commerce sector in U.S. According to U.S. department of commerce, total U.S. e-commerce spending in the last quarter of 2024 was around USD 309 billion. Most of this involves digital payments via payment processing solutions because of their seamless services.

- Companies in U.S are also innovating in this payment processing market. For instance, ApplePay was the first company which give users the ability to make payments using Face or Touch ID. Innovations like these made digital payments more frictionless, leading to growth in the market.

The payment processing solutions market in Europe is expected to experience significant and promising growth from 2025 to 2034.

- The EU region growth is driven due to its good digital infrastructure. According to Statista, Eu’s 4G coverage by the end of 2025 is expected to be 99.81%. This has led to a rise in online payments and hence, in the payment processing solutions market.

- EU has also deployed strict government policies, like General Data Protection Regulation (GDPR). Regulations like these have increased the trust of people in the safety of online transactions, hence leading people into using more payment processing solutions.

- The EU also experienced a rise in the e-commerce sector in the region. According to Statista, by 2028, the region is expected to generate revenue of around USD 900 billion. Digital payments in e-commerce have led to the adoption of payment processing systems in the EU.

The payment processing solutions market in the Asia Pacific is anticipated to witness lucrative growth between 2025 and 2034.

- With the increase in online payments, the payment processing solution market is growing in the Asia Pacific countries such as China, India, and Japan. For example, over 60% of Indian and Chinese consumers were actively engaged in digital transactions, as per a 2024 report by Statista. The growth of payment processing platforms has been made possible by the consumer's preference for seamless online transactions.

- Asia pacific region also saw growth in e-commerce, especially China and India. For instance, as per Statista, e-commerce spending in China was over USD 1.5 billion in 2024. Since the majority of payments in this market are made online, therefore we see an increase in demand for payment processing solutions.

- The APAC has also developed some unique innovations in the payment processing solutions market, one of which is India's UPI. Such solutions have essentially made transactions frictionless, thereby enabling greater adoption of online payments and payment processing solutions.

Payment Processing Solutions Market Share

- Top 7 companies of payment processing solutions industry are Visa, Mastercard, Paypal, Stripe, Block, Inc. (Square), Adyen, FIS, collectively hold around 85% of the market in 2024.

- Visa works on expanding its payments ecosystem globally through partnerships with FinTechs, banks, and merchants to enhance digital payments. For instance, in February 2025, the company partnered with Philippines credit card association to empower the Filipino customers by giving them financial education. At the same time, the company has also partnered with Commerzbank, in which the bank will be allocating VISA debit and credit cards to its users.

- Mastercard intends to promote financial inclusion via the development in underdeveloped countries, with significant support from local banks and government. For instance, in February 2024, the company partnered with Tamara, a UAE FinTech company, to give more payment options for the UAE citizens using its global network.

- PayPal's strategy is to provide a seamless digital payment experience through various channels. The company is also seeking to leverage the enormous existing client base for the expanding crypto market by allowing individuals to purchase, sell and store virtual currencies on its platform.

- Stripe is expanding their international payments ecosystem through the development of new business AI tools, including paymentensics, automated reconcilliation, and embedded finance solutions. Stripe appears to be broadening their Enterprise Banking-as-a-Service focus as well.

- Block, Inc. (Square) is investing in AI technology to improve merchant payments and increase transaction accessibility. Additionally, the firm is diversifying its offerings by including blockchain payments in their growing portfolio of services targeted to SMEs.

- Adyen is using advanced payment optimization techniques and artificial intelligence to improve payment success rates and reduce transaction failures. The company is also broadening the geographical boundaries of its integrated commerce services which allow businesses and customers to make purchases across different channels effortlessly.

- FIS is building its payment automation ecosystem by adding AI-enabled fraud prevention, payment verification, and active monitoring of transactions. The company is also adding moresecure and efficient cloud paymentprocessing systemsto meet the needs of business customers.

Payment Processing Solutions Market Companies

Major players operating in the payment processing solutions industry include:

- Adyen

- Alphabet (Google Pay)

- Block (Square)

- FIS

- Fiserv

- Global Payments

- Mastercard

- PayPal Holdings

- Stripe

- Visa

The payment processing solution market is adopting blockchain and Artificial Intelligence (AI) increasingly as a move towards betterment of client experiences and increasing security. These technologies facilitate clear and secure records of transactions, and provide instant fraud detection capabilities, which is driving the market.

Companies in the market are also experiencing a rise in competition from a large number of tech giants, like Apple, Google, and Amazon, entering into the payment processing space. Rise in competition lead to the rise in different offerings from the competitors, leading to innovation within the market. To expand their product lines and customer base, payment processing market firms are now considering mergers or strategic partnerships more and more. Greater payment innovation is being enabled by alliances between fintech companies and traditional banks.

Payment Processing Solutions Industry News

- In February 2025, Adyen collaborated with Eats365, a POS provider for food and beverages (F&B). The two companies are going to develop a platform named 365pay, which will be utilized by the F&B merchants to make secure payment through Adyen payment network.

- In February 2025, FIS announced its partnership with Affirm, a company which provides payment networks. FIS in integrating Affirm in its plan for pay-over-time solutions for debit issuing bank clients and their customers. This partnership will provide flexible purchasing solutions for the customers.

- In February 2025, Visa partnered with Qatat International Islamic Bank (QIIB). The partnership provides new and innovative solutions for digital transformation and card payments, thereby enhancing the experience of the customer for both parties.

- In January 2025, Visa partnered with Elon Musk’s company X. The payment processing company will be the financial platform for “X money” feature. This feature is planned to be launched later this year on the X platform, where users can transfer money through debit cards and bank accounts into X money accounts and then use the platform for online transactions.

The payment processing solutions market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($Mn/Bn) from 2021 to 2034, for the following segments:

Market, By Technology

- NFC

- QR code

- EMV

Market, By Deployment

- In-store

- Online

- Mobile

Market, By Mode of Payment

- Credit cards

- Debit cards

- E-wallets

Market, By Organization Size

- Large enterprises

- SME

Market, By End Use

- Tourism and hospitality

- Credit cards

- Debits cards

- E-wallets

- Retail and e-commerce

- Credit cards

- Debit cards

- E-wallets

- Healthcare

- Credit cards

- Debit cards

- E-wallets

- BFSI

- Credit cards

- Debit cards

- E-wallets

- Government

- Credit cards

- Debit cards

- E-wallets

- Others

- Credit cards

- Debit cards

- E-wallets

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Nordics

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Southeast Asia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

How big is the payment processing solutions market?

The market of payment processing solutions was valued at USD 66.8 billion in 2024 and is expected to reach around USD 198.9 billion by 2034, growing at 11.7% CAGR through 2034.

What is the size of NFC segment in the payment processing solutions industry?

The NFC segment generated over USD 28 billion in 2024.

How much payment processing solutions market share captured by North America in 2024?

The North America market size of payment processing solutions held around 35% share in 2024.

Who are the key players in payment processing solutions industry?

Some of the major players in the industry include Adyen, Alphabet (Google Pay), Block (Square), FIS, Fiserv, Global Payments, Mastercard, PayPal Holdings, Stripe, and Visa.

Payment Processing Solutions Market Scope

Related Reports