Summary

Table of Content

Patient Handling Equipment Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Patient Handling Equipment Market Size

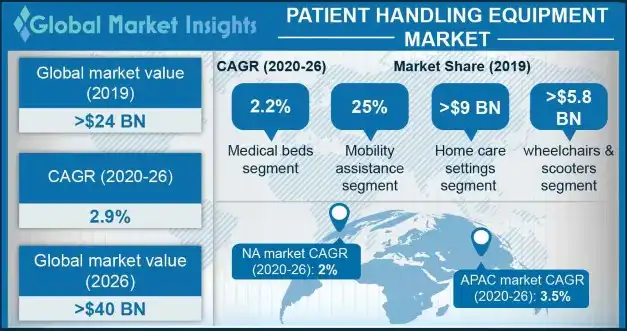

Patient Handling Equipment Market size was estimated over USD 24 billion in 2019 and the industry will grow at 2.9% CAGR through 2026.

To get key market trends

Patient handling equipments are used for patients that require physical assistance, as well as for people under medication or illness. The patient handling equipments are generally used at hospitals, home care settings, elderly care facilities and rehabilitation centre among others. The patient handling equipment ensures the safety of doctors as well as caregivers while handling patients. Moreover, it also reduces the possibility of patient injuries, thereby driving the adoption of patient handling equipment.

Patient Handling Equipment Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | USD 25.5 Billion |

| Forecast Period 2020 to 2026 CAGR | 2.9% |

| Market Size in 2026 | USD 42.2 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Patient Handling Equipment Market Trends

The increasing disabled population across the globe drives the adoption of patient handling equipment. According to the WHO, in 2019, around 15% of the world’s population lives with a certain form of disability, and amongst them 2% to 4% experience difficulties in functioning. The number of disabled people is escalating due to rapid spread of chronic diseases. Disabled people need patient handling equipment to carry out their daily activities smoothly. The rising cases of disability will significantly propel patient handling equipment market growth over the analysis period.

Furthermore, due to the COVID-19 outbreak, there is a drastic rise in the demand for medical beds across the globe. The increasing corona cases across the globe are forcing governments of developed and emerging countries to increase their patient handling capacities. The public health systems are providing funds to procure the required hospital infrastructure with medical beds that are one of the important requirements. The upsurge in fundraising for associated with patient handling equipment are some other major factors that will positively impact on the market growth.

However, insufficient training to caregivers for accessing patient handling equipment and problems in manual handling of bariatric patients are some of the factors that may hinder the market growth.

Patient Handling Equipment Market Analysis

Learn more about the key segments shaping this market

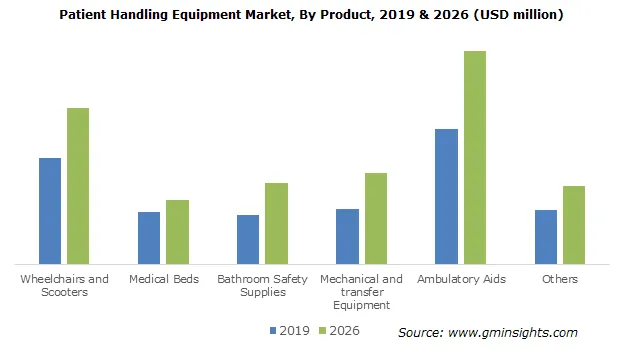

The wheelchairs and scooters segment was valued over USD 5.8 billion in 2019. Wheelchairs and scooters cover manual wheelchair, powered wheelchair, and mobility scooters. The rising number of accidental injuries resulting in disabilities will upsurge the demand for wheelchairs and scooters.

Additionally, people of age 65 and above are more prone to injuries and fall as compared to other age groups. This age group generally requires wheelchairs and scooters for enhanced safety, thereby driving segmental growth. Moreover, the growing geriatric population will further escalate the demand for wheelchairs and scooters. Since countries like Germany and Italy have a high percentage share of the population aged 60 and older, these countries are worst affected by COVID-19. The patient handling equipment demand has increased significantly in a way that several medical bed manufacturers have ramped up the production to meet the soaring market demand.

The acute & critical care segment accounted for around 18% revenue share in 2019. The increasing population suffering from chronic disorders such as myocardial infarction and stroke will drive the segmental growth during the forecast period. Moreover, rising number of patient admissions due to increasing prevalence of chronic disease drives segmental growth. Furthermore, adoption of innovative technologies for acute & critical care patient handling will further drive the overall market growth.

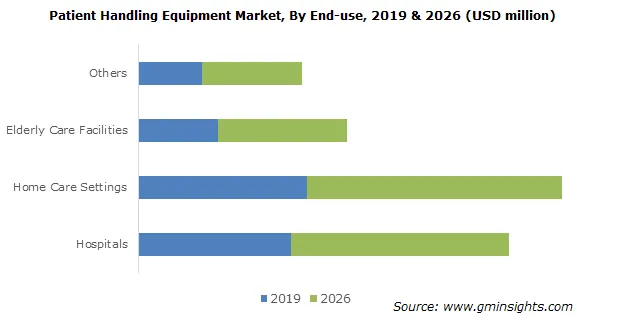

Learn more about the key segments shaping this market

The hospitals segment accounted for over 30% of overall patient handling equipment market share in 2019. Rising number of patients requiring critical care in hospitals along with advanced healthcare infrastructure will boost the segmental growth during the forecast period. Hospitals provide technologically advanced patient handling equipment including, ICU beds, sling lifts, transfer chairs, slide boards, etc. Thus, increasing demand for technologically advanced patient handing instruments will drive the market growth.

North America held maximum revenue share in 2019 and will witness around 2% CAGR during 2020 to 2026. The advanced healthcare infrastructure and increasing prevalence of chronic diseases are some of the factors driving the market growth in the region. As per the UN statistics, in 2017, the number of elderly populations aged 60 years and above is expected to increase from 78.5 million in 2017 to 123.9 million in 2050. Thus, the growing population with disability increases the need for patient handling equipment, thereby fostering the business growth.

The presence of major industry players along with well-established and advanced healthcare facilities will propel the U.S. market growth. Moreover, availability of well-trained nursing staff in the U.S. will propel the regional market expansion.

Patient Handling Equipment Market Share

Some of the prominent market players operating in the patient handling equipment market share include :

- Getinge

- Stryker

- Invacare

- Hill Rom Services

- Guldmann

- Stiegelmeyer

- LINET

- Joerns Healthcare

- HoverTech International

- Handicare

- Prism Medical

- Ossenberg

- Drive Medical

- Antano Group

- ORTHOS XXI

The foremost market competitors are strategically implementing numerous organic and inorganic growth strategies such as mergers and acquisitions to expand the market share.

Some of the recent industry developments: The patient handling equipment industry research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2015 to 2026, for the following segments:

By Product

- Wheelchairs and scooters

- Manual wheelchair

- Folding frame manual wheelchairs

- Rigid frame manual wheelchairs

- Powered wheelchair

- Mobility scooters

- Manual wheelchair

- Medical beds

- Acute care beds

- Long term care beds

- Bariatric beds

- Others

- Mechanical lifting & transfer equipment

- Ambulatory aid devices

- Bathroom safety supplies

- Others

By Application

- Acute & critical care

- Long term care

- Mobility assistance

- Fall prevention

- Others

By End-use

- Hospitals

- Home care settings

- Elderly care facilities

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- Japan

- China

- India

- Australia

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

How much market share of patent handling equipment was held by acute & critical care segment in 2019?

The acute & critical care segment accounted for around 18% revenue share in 2019.

Which is the leading region in global patient handling equipment market?

North America is the leading market which is expected to grow at around 2% CAGR during 2020 to 2026.

What was the market valuation of wheelchairs and scooters segment in 2019?

The wheelchairs & scooter segment was valued at over USD 5.8 billion in 2019.

How much will the patient handling equipment industry share grow during the forecast timeline?

The industry share of patient handling equipment is predicted to expand at 2.9% CAGR during 2020 to 2026.

How much size did the global patient handling equipment market register in 2019?

The market size of patient handling equipment exceeded USD 24 billion in 2019.

Patient Handling Equipment Market Scope

Related Reports