Summary

Table of Content

Paperboard Packaging Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Paperboard Packaging Market Size

Paperboard Packaging Market size was USD 142.3 billion in 2019 and will grow at 3.5% CAGR between 2020 and 2026. Rising consumption of packaged food, increasing demand from the packaged food business and favorable trends associated with sustainable packaging sector will support revenue generation.

Paperboard is a paper-based thick material used in packaging applications. The raw material used to produce paperboard is wood pulp. Paperboards are recycled in large amounts to reduce deforestation and waste. These are mainly used in the packaging of food & beverages, medical packaging, durable goods, non-durable goods, industrial packaging, and cosmetics.

To get key market trends

Paperboard packaging is the preferred choice for the packaged food industry. It is used for variety of food products such as soups, spices, dairy products, etc. Paperboard is generally coated with polymers or plastics to maintain hygiene and keep it untainted. It helps in reducing the total weight of the final product as compared to glass and metal, and at the same time, keeps the food product unchanged by maintaining freshness. Odor and taste neutrality of paperboard make it an ideal choice as a packaging material.

Consumers across the globe are increasingly becoming aware of the environmental issues associated with packaging and are shifting toward eco-friendly products. Consumers, government, and media are pressurizing manufacturing companies to make their products, packaging, and operations sustainable. People are willing to pay more for sustainable packaging options. Such trends will drive the paperboard packaging market growth.

Paperboard packaging can be substituted with plastics, metals, and glass packaging. Paperboard has been the traditional choice for packaging owing to their superior performance characteristics and ease of availability. However, with changing trends in the packaging industry, buyers of packaging materials are shifting toward plastics.

Paperboard Packaging Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 142,364.5 Million (USD) |

| Forecast Period 2020 to 2026 CAGR | 2.7% |

| Market Size in 2026 | 202,669.8 Million (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Plastics are highly durable and can sustain adverse logistics and transportation conditions. In addition, plastics have excellent visual appeal and superior barrier properties against moisture and air. Increasing popularity of plastics poses serious threats to the growth of paperboard packaging market in the future.

Paperboard Packaging Market Analysis

Learn more about the key segments shaping this market

In 2019, recycling segment held over 50% share in paperboard packaging market. A key advantage of paper and paper board is that it can be recycled as fiber and used to develop new paperboard products. Nearly 50% of world’s fibers for paper making are supplied through paper recycling. Increasing concerns relating to deforestation and the sinking forest cover across the globe have resulted in paperboard manufacturers opting for recycled sources.

Strong upward growth trajectory of paper recycling is expected to propel the paperboard packaging market segment over the forecast period. As recycling of paper causes its quality to deteriorate over time, fresh source needs to be added in proportion to keep the fiber strength to the mark.

Learn more about the key segments shaping this market

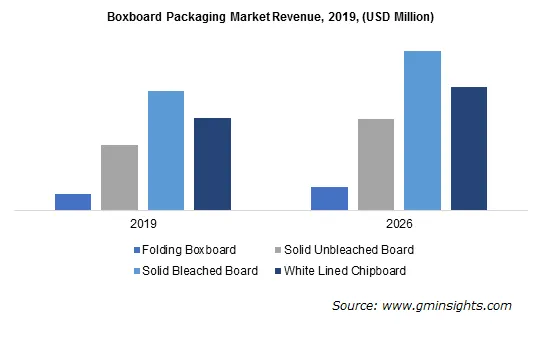

Folding boxboard segment will witness over 3% CAGR in boxboard packaging product segment by 2026. Folding boxboard is a grade of boxboard that can be bent without fracturing. It is manufactured from multiple layers of mechanical & chemical pulps. Folding boxboards are low density boards with high stiffness. These can be used to package beauty products, frozen foods, and pharmaceuticals.

Solid Unbleached Board (SUB) is a grade of boxboard that is made up of unbleached chemical pulp. It is usually available with two or three layers of pigment coatings. Recycled fibers can also be used instead of unbleached chemical pulp. Solid unbleached boards are generally used to package beverage carriers, detergents, toys, and others.

Solid Bleached Board (SBB) is a virgin grade of boxboard. It is manufactured from bleached chemical pulp and usually has synthetic or mineral coatings. SBB is a medium density boxboard; hence, it can be used for graphical or printed packaging applications. It is primarily used for flavor or aroma-sensitive products such as cosmetics, and cigarettes.

White lined chipboard is manufactured from layers of waste papers and recycled fibers. It is generally available with two to three layers of coatings on both the sides. White lined chipboard contains recycled materials; thus, direct contact with food leads to health issues.

Food & beverages have emerged as the key application segment in paperboard packaging market share, accounting for over 50% share in 2019.The application segment includes packaging of frozen foods, alcoholic and non-alcoholic beverages, candies, dairy products, fast foods, and fresh fruits & vegetables. The strong growth of this segment is attributable to excellent operational characteristics of paperboard packaging. This packaging is safe for food contact, can operate over a wide range of temperatures, and helps in maintaining organoleptic properties for a long period of time.

Looking for region specific data?

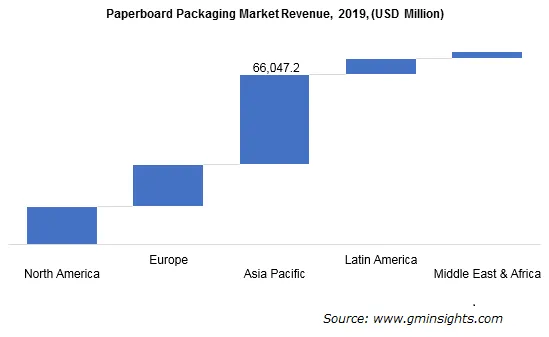

Asia Pacific paperboard packaging market will generate over USD 65 Billion in 2019. Globalization has led to an increase in trade activities in countries such as China, India, South Korea, and Malaysia over the past few years. Rapid urbanization, strong economic growth, and rising consumption of packaged food products are some of the major factors contributing to the growth of the packaging market in the region.

The highly competitive environment is expected to generate opportunities for the future market growth. Moreover, favorable trends associated with cosmetics and medical sectors will drive the paperboard packaging market sales within this region.

Paperboard Packaging Market Share

The paperboard packaging market participants are trying to increase their market share by strategic partnerships & collaborations, mergers & acquisitions, product differentiation & development and diversification of sales & distribution network. In October 2018, Mondi plc entered the market for ‘Saturating Kraft’ with its recently launched new specialty kraft paper grade Advantage Boost that will be mainly used in laminate applications in the European market. In April 2016, International Paper Company completed the purchase of Weyerhaeuser’s Pulp business for approximately USD 2.2 billion to strengthen its market share.

The key players in paperboard packaging industry include

- Nippon Paper Industries Co., Ltd.

- Stora Enso

- South African Pulp & Paper Industries

- Mondi plc

- ITC Limited

- Smurfit Kappa Group

- Oji Holding Corporation

- International Paper Group

- Svenska Cellulosa Aktiebolaget

The paperboard packaging market report includes in-depth coverage of the industry with estimates & forecast in terms of volume in kilo tons and revenue in USD million from 2016 to 2026, for the following segments:

By Raw Material

- Fresh source

- Wood pulp

- Others

- Recycled waste paper

By Product

- Boxboard

- Folding boxboard (FBB)

- Solid unbleached board (SUB)

- Solid bleached board (SBB)

- White lined chipboard (WLC)

- Containerboard

By Application

- Food & beverages

- Non-durable goods

- Durable goods

- Medical

- Others

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- Malaysia

- LATAM

- Brazil

- Mexico

- MEA

- South Africa

- GCC

Frequently Asked Question(FAQ) :

How will the Asia Pacific region emerge as a strong avenue for the global paperboard packaging industry?

Asia Pacific paperboard packaging market size is valued at over USD 65 Billion in 2019. Robust economic growth, rapid urbanization, and an increase in consumption of packed food will foster the industry growth in the coming years.

Which product is anticipated to push the global paperboard packaging market share?

The folding boxboard segment of the global paperboard packaging market share is expected to grow at a CAGR of over 3% through 2026.

How will paper recycling influence the global paperboard packaging industry size growth?

The recycling segment dominated the global paperboard packaging market size with a 50% share in 2019. The segment is projected to witness tangible growth due to the rising concerns towards deforestation and decreasing forest cover worldwide.

What factors will drive the growth of the global paperboard packaging market share?

The global paperboard packaging industry revenue was USD 142.3 billion in 2019 and is expected to surge at 3% CAGR through 2026 due to increasing packaged food consumption & rising demand from the packaged food business.

Paperboard Packaging Market Scope

Related Reports