Summary

Table of Content

Ophthalmic Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Ophthalmic Devices Market Size

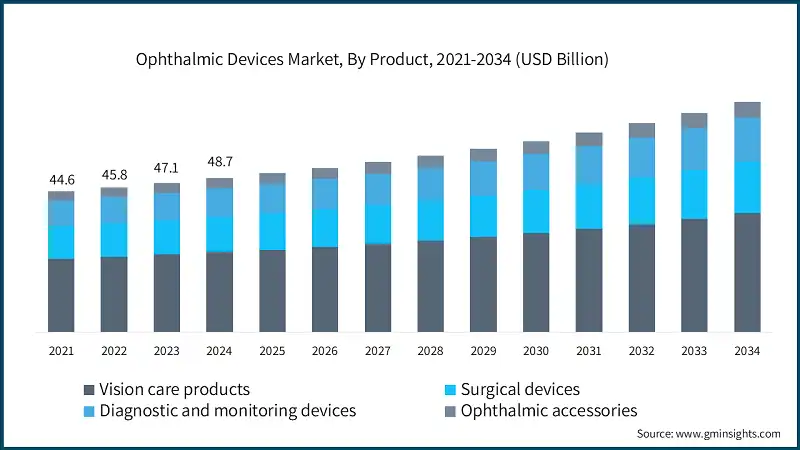

The global ophthalmic devices market was estimated at USD 48.7 billion in 2024. The market is expected to grow from USD 50.2 billion in 2025 to USD 72.7 billion in 2034, at a CAGR of 4.2% during the forecast period, according to the latest report published by Global Market Insights Inc. The market is driven by growing demand and preference for minimally invasive surgeries, an increase in the number of people suffering from ophthalmic disorders, technological advancements in products, and rising adoption of contact lenses and spectacles, among other factors.

To get key market trends

The rise in the number of procedures for different ophthalmic disorders, the focus on early diagnosis, and the surging geriatric population are among the key variables fueling the market growth. Essilor, Alcon, ZEISS, Johnson & Johnson, CooperVision, and Bausch+Lomb are among the leading players operating in the market. These players mainly focus on product innovation, expanding their product offering and distribution network, and improving patient comfort, enabling ophthalmic clinics worldwide to improve efficiency and service quality.

The market grew from USD 44.6 billion in 2021 to USD 47.1 billion in 2023. Rising prevalence of vision problems, such as nearsightedness, farsightedness, and astigmatism, has led more people to opt for contact lenses and spectacles. Modern urban lifestyles, prolonged screen time, and the shift to online learning have contributed to a surge in vision-related issues, particularly among younger populations. Consumers increasingly demand eyewear that combines style and functionality, prompting companies to enhance lens materials, coatings, and designs. Additionally, there is growing adoption of daily disposable contact lenses, smart lenses, and blue-light filtering glasses.

Innovations in ophthalmic devices have transformed how doctors diagnose and treat eye conditions, leading to better outcomes for patients. Advanced technologies such as optical coherence tomography (OCT), femtosecond lasers, and AI-powered imaging systems help doctors detect eye problems earlier and treat them with minimal invasion. For instance, according to recent trials in Australia, AI-powered eye scans recorded a significant 93% accuracy in detecting diabetic eye disease.

The introduction of smart contact lenses and wearable vision aids gives patients access to real-time monitoring and a better experience. These improvements make eye care procedures more efficient, reduce healing time, and lower the risk of complications, helping more people access quality eye care. As research continues and digital health tools become more integrated, the market is expected to grow further.

Eye disorders such as cataracts, glaucoma, diabetic retinopathy, and age-related macular degeneration continue to affect more people worldwide. For instance, according to the data reported by the World Glaucoma Association, the number of patients suffering from glaucoma is expected to reach over 111 million by 2040. People over 60 face a higher risk of vision problems as they age. Modern lifestyle choices, like spending long hours in front of screens, poor dietary habits, and health conditions such as diabetes, make people more susceptible to eye problems at an earlier age. As more people seek treatment for these conditions, the need for diagnostic tools, surgeries, and vision correction products has grown substantially.

Ophthalmic devices are specialized medical tools that doctors use to diagnose, monitor, and treat various eye conditions and diseases. These devices range from surgical instruments to advanced diagnostic equipment. They also include everyday vision correction products such as contact lenses and intraocular lenses. Healthcare professionals rely on these devices to help patients with eye disorders such as cataracts, glaucoma, and refractive errors, working to restore or improve their vision.

Ophthalmic Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 48.7 Billion |

| Market Size in 2025 | USD 50.2 Billion |

| Forecast Period 2025 - 2034 CAGR | 4.2% |

| Market Size in 2034 | USD 72.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increase in number of people suffering from ophthalmic disorders | Rising cases of cataracts, glaucoma, and myopia are driving consistent demand for diagnostic and surgical devices globally. |

| Technological advancements in products | AI, laser systems, and smart diagnostics are improving accuracy and efficiency, making eye care more accessible and effective. |

| Favorable government initiatives | Public health programs and subsidies are expanding access to eye care, especially in rural and underserved regions. |

| Growing demand and preference for minimally invasive surgeries | Patients are opting for faster, safer procedures, boosting demand for advanced surgical tools. |

| Rising adoption of contact lenses and spectacles | Lifestyle changes and digital exposure are increasing the need for vision correction products across all age groups. |

| Pitfalls & Challenges | Impact |

| High cost of the ophthalmic devices | Advanced devices remain unaffordable for many, limiting adoption in low-income regions. |

| Increasing adoption of refurbished ophthalmic devices | Budget constraints are pushing clinics to opt for second-hand equipment, affecting new device sales. |

| Opportunities: | Impact |

| Growing adoption of premium IOLs and phacoemulsification devices | As awareness and affordability improve, demand for high-end surgical solutions will rise significantly. |

| Expansion in emerging markets | Rising healthcare investments and infrastructure development in Asia, Africa, and Latin America will unlock vast growth potential. |

| Market Leaders (2024) | |

| Market Leaders |

Around 15% |

| Top Players |

Collective market share in 2024 is ~ 45% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, Mexico, UAE, etc. |

| Future Outlook |

|

What are the growth opportunities in this market?

Ophthalmic Devices Market Trends

The market evolves as demands for better care and new technologies for the target population rise. By integrating artificial intelligence (AI) and machine learning in their diagnostic instruments, physicians are able to diagnose eye diseases in a shorter timeframe with improved precision and also generate individualized treatment plans, particularly for patients with glaucoma and diabetic retinopathy.

- Patients are benefiting from surgical interventions that are less invasive than traditional approaches. These include laser-assisted cataract surgeries and micro-incision glaucoma procedures. Newer instruments also support faster recovery and improved outcomes. As these technologies advance, outpatient procedures are expected to become more popular, driving demand for portable surgical instruments.

- Increased screen time among younger populations has contributed to a higher prevalence of vision problems requiring corrective eyewear. In response, manufacturers are developing specialized solutions, including blue-light-filtering contact lenses, smart glasses, and daily disposable lenses that offer both comfort and practicality.

- Eye care services are becoming more accessible in rural and underserved areas via remote consultations and diagnostics. Cloud-based imaging and mobile technology now allow doctors to assess and interact with patients in real-time, expanding the reach of quality eye care.

Ophthalmic Devices Market Analysis

Learn more about the key segments shaping this market

In 2021, the market was valued at USD 44.6 billion, rising to USD 45.8 billion in 2022 and reaching USD 47.1 billion by 2023. Increasing awareness among the younger population, the availability of affordable, high-quality treatments in developing countries, and the growing adoption of contact lenses are expected to drive the market growth.

Based on product, the global ophthalmic devices market is segmented into vision care products, surgical devices, diagnostic and monitoring devices, and ophthalmic accessories. The vision care products segment accounted for a leading share of 51.9% in 2024. The vision care products segment is further bifurcated into spectacle lenses and contact lenses. Increasing need for spectacles and lenses due to longer working hours over digital devices among a significant percentage of individuals worldwide is projected to fuel the product demand. The segment is expected to exceed USD 37.3 billion by 2034, growing at a CAGR of 4.1% during the forecast period.

- The growing adoption of vision care products has made spectacle lenses increasingly important, as more people seek solutions for myopia, hyperopia, and digital eye strain. With prolonged screen exposure, consumers demand blue-light filtering lenses, anti-reflective coatings, and photochromic lenses that adjust to changing light conditions. Lightweight, impact-resistant materials such as polycarbonate and Trivex are also preferred to ensure comfort and durability.

- Consumers increasingly want glasses tailored to their specific prescriptions and daily activities, particularly progressive lenses. Designer frames compatible with high-performance lenses are in demand, combining style with function. Virtual try-on tools and personalized fittings at optical stores are enhancing the shopping experience, while rising awareness of eye health continues to drive improvements in lens technology.

- Valued at USD 4.3 billion in 2024, the contact lens segment is gaining traction as consumers seek convenient vision correction options suitable for long hours of screen time. Young urban populations, in particular, favor contact lenses for sports, appearance, and everyday use. Manufacturers are responding with daily disposables, lenses for astigmatism, and multifocal designs to address age-related vision changes.

- The introduction of silicone hydrogel materials has improved comfort by allowing greater oxygen permeability, reducing dryness and discomfort. In addition, smart contact lenses are being developed with health monitoring and augmented reality capabilities, offering added functionality to users.

- Contact lenses are increasingly available through online stores and subscription-based models, enhancing convenience for consumers. These technological and distribution advancements are expected to support continued growth in the contact lens market over the coming years.

Learn more about the key segments shaping this market

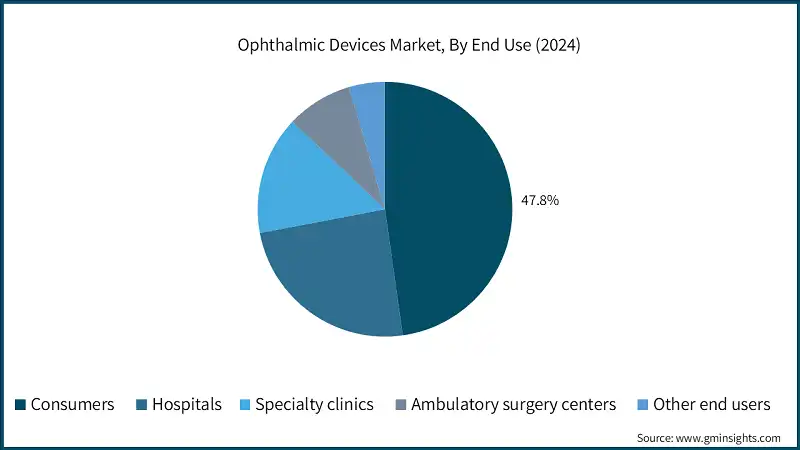

Based on end use, the ophthalmic devices market is segmented into consumers, hospitals, specialty clinics, ambulatory surgery centers, and other end users. The consumer segment accounted for the majority market share of 47.8% in 2024 due to growing adoption of vision care products such as spectacles and lenses among younger age groups.

- Globally, people are becoming more conscious of eye health due to the risks associated with vision problems and increased screen time. Consumers now seek vision correction products that combine effectiveness, comfort, and style, including contact lenses and fashionable eyewear. Convenient solutions such as daily disposable lenses, online eye checkups, and home delivery of eye care products are increasingly preferred.

- Younger adults are prioritizing eye care early, driven by frequent digital device use, while older adults seek solutions for age-related issues like presbyopia and cataracts. This evolving behavior motivates companies to develop user-friendly, technology-enhanced products that cater to diverse customer needs.

- Valued at USD 11.8 billion in 2024, hospitals play a critical role in the adoption of advanced eye care devices, particularly for surgical and diagnostic purposes. The growing demand for cataract and glaucoma surgeries has increased the need for precision tools such as phacoemulsification systems and optical coherence tomography (OCT) machines, along with comprehensive diagnostic systems that improve efficiency and patient outcomes.

- The specialty eye clinics segment is expected to witness the fastest growth, with a CAGR of 5% over the forecast period. These clinics are gaining popularity by offering expert care, faster services, and personalized attention, driving their adoption among patients seeking high-quality eye care.

Looking for region specific data?

North America Ophthalmic Devices Market

North America market accounted for a leading share of 36.8% in 2024 in the global market and is anticipated to show lucrative growth over the forecast period.

- The North America holds a key position in the market, supported by its well-developed healthcare system, widespread understanding of eye health importance, and ready acceptance of new technologies.

- As the population in the region ages, they require increased treatment for diseases, such as cataracts and glaucoma. For example, the University of Florida Health's Department of Ophthalmology reported a yearly total of approximately four million cataract surgeries performed each year in the U.S. This number is expected to continue to grow because of accessible healthcare systems, an aging population, and growing patient awareness of diseases affecting the eyes.

- In addition, the region's comprehensive insurance coverage and supportive reimbursement landscape assist patients in opting for surgical and diagnostic procedures they need.

- Further, various leading manufacturers and research centers in the region work together to develop new AI-based diagnostic tools, laser systems, and vision care products. Healthcare providers are increasingly using teleophthalmology, especially in rural areas, making eye care more accessible to everyone.

- Lastly, by combining advanced technology, healthcare spending, and public awareness of eye health, North America continues to shape the ophthalmic devices industry's growth in an upward trajectory.

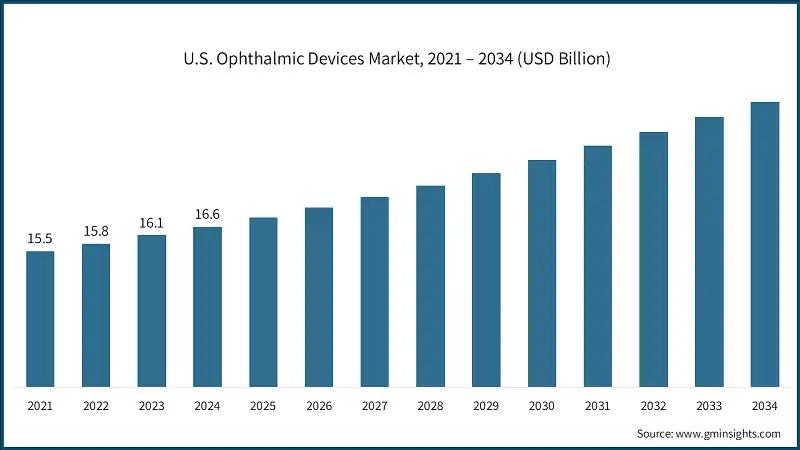

The U.S. ophthalmic devices market was valued at USD 15.5 billion and USD 15.8 billion in 2021 and 2022, respectively. In 2024 the market size was valued at USD 16.6 billion from USD 16.1 billion in 2023. The significant focus on early disease diagnosis from the local population due to high disease burden is a key variable in fueling the market growth.

- The U.S. has the largest market in North America due to its high level of spending on healthcare, ongoing R&D initiatives, and supportive regulatory framework. A robust network of hospitals, specialty clinics, and eye care facilities around the country incorporate the latest surgical and diagnostic technologies.

- Additionally, due to rising number of people developing age-related eye diseases such as macular degeneration and diabetic retinopathy, the demand for precise instruments and less invasive surgical techniques also increases. For example, according to the data reported by Prevent Blindness in 2021, around 26% of the diabetes patients have diabetic retinopathy in the country.

- In addition, patients can obtain vision correction products easily via retail outlets and online stores, giving them access to both contact lenses and prescription eyewear.

- Eye care practices now use more advanced technology, including artificial intelligence for imaging, smart contact lenses, and laser surgery systems. Government programs and private insurance help people access preventive eye care and screenings. Modern consumers who embrace technology are asking for more digital and personalized solutions for their eye care needs.

- Further, the U.S. market continues to grow as companies work together, introduce new products, and create newer ways for patients to receive care at outpatient facilities and in their homes.

Europe Ophthalmic Devices Market

Europe accounted for a substantial share in the market and was valued at USD 13.7 billion in 2024.

- The European ophthalmic devices market is growing with healthy growth owing to the strength of the regional healthcare system, increasing elderly population, and regulatory environments that promote innovation.

- Countries such as Germany, France, and Italy invest significantly in modern surgical instrumentation and diagnostic equipment powered by artificial intelligence in an effort to improve patients care.

- Additionally, product manufacturers are shifting towards sustainable and eco-friendly evolution, utilizing environmentally friendly materials and packaging.

- Healthcare providers carry out eye screenings and run awareness campaigns on a regular basis to make people aware of managing different conditions such as cataracts and macular degeneration. In addition, the growing screen time among people is a major concern propelling the demand for vision correction solutions.

- Lastly, the market continues to grow owing to ongoing collaboration between European countries, including EU-wide health programs. For example, local researchers and universities are assisting in the innovation of eye care, and an inclusive approach to health care policy has heightened access to treatment in a number of neighboring European countries.

UK held significant share of the European ophthalmic devices market, showcasing strong growth potential.

- In the UK, the healthcare system consists of public healthcare (NHS) and private healthcare providers in order to cater to different patient needs. Increasing levels of myopia and diabetic retinopathy necessitate greater access to early diagnosis and better treatment options.

- In addition, the UK government is also working hard to promote preventative eye care measures and digital health approaches to treatment.

- Further, the healthcare system is investing considerably in developing its research institutions and clinical testing program to create more effective surgical instruments and quality smart devices for vision care.

- Moreover, the growing number of clinics and eyewear stores may present new options for patients to receive more personalized eye care within their residential area.

Asia Pacific Ophthalmic Devices Market

The Asia Pacific market is anticipated to grow at the highest CAGR of 5.1% during the analysis timeframe.

- The Asia Pacific market continues to expand as countries invest more in healthcare, and people become more aware of the importance of eye health. Countries such as India, Japan, and South Korea are bringing in advanced diagnostic equipment and building more surgical facilities.

- Additionally, many people in the region suffer from vision problems and cataracts, especially older residents and those living in rural communities. Governments and NGOs are working to make basic eye care more accessible to everyone.

- While local firms are producing low-cost eye care products, international organizations are teaming with local partners and developing manufacturing in the region.

- Further, eye care services are being delivered to rural areas using telemedicine and mobile eye clinics. Asia Pacific offers opportunities for new developments in technology because of the diversity of populations and health care needs.

China ophthalmic devices market is estimated to grow with a healthy CAGR in the Asia Pacific market.

- With rising concerns about myopia in children and young adults, the Chinese government has introduced supportive vision screening programs and eye care services in schools.

- While local companies focus on making affordable yet high-quality devices, international companies are partnering with Chinese firms to enter the market.

- More private eye hospitals and specialty clinics are opening, making it easier for people to access advanced eye treatments. People can now conveniently buy contact lenses and spectacles through online platforms, which offer digital fitting tools and subscription options.

- Further, as China continues to modernize its healthcare system and embrace digital solutions, it remains a key player in the market.

Latin America Ophthalmic Devices Market

Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period.

- The market for ophthalmic devices in Brazil continues to expand, benefitting from the country's large population, rising awareness of eye-related health issues, and government initiatives to reduce preventable blindness.

- Public health campaigns and mobile eye clinics now reach individuals living in remote, underserved regions who are limited to basic or no eye care. Historically, Brazil has had problems with both cataracts and refractive errors among the population, particularly individuals in rural areas.

- The private hospital and clinics have invested heavily in new surgical instruments and diagnostic devices, while the public hospital and clinics have provided basic eye care services. Further, changes in regulations and an increase in partnerships with international manufacturers have made eye care devices more affordable and available.

- Brazil's public and private healthcare infrastructure allows adequate room for innovation and outreach intervention, making it a viable market as the eye care industry in Latin America starts to expand.

Middle East and Africa Ophthalmic Devices Market

Saudi Arabia market is expected to experience substantial growth in the Middle East and Africa market in 2024.

- The Saudi Arabian ophthalmic devices market continues to grow as the country increases its healthcare investments, adapts to changing lifestyles, and implements government modernization initiatives.

- The government's Vision 2030 plan is to help strengthen healthcare infrastructure by focusing on specialized care and digital health solutions.

- Local private healthcare facilities now use AI-based imaging systems and minimally invasive surgical instruments to treat patients. Through public health campaigns and school screening programs, more people can detect vision problems early.

- In addition, young people in Saudi Arabia are increasingly using contact lenses and spectacles, influenced by fashion trends and their digital lifestyle.

- Further, with its commitment to healthcare innovation and accessibility, Saudi Arabia is becoming an important market for ophthalmic devices in the Middle East.

Ophthalmic Devices Market Share

Leading companies operating in the market, such as Alcon, Essilor, ZEISS, Johnson & Johnson, and Bausch+Lomb, among others, have a significant presence in the industry. These players maintain their key position by combining a strong product portfolio, regulatory clearances, wide distribution capability, and partnerships with local players.

Surgical devices, especially intraocular lenses (IOLs) and phacoemulsification systems, hold a substantial market share as more patients undergo cataract surgeries. Diagnostic devices such as optical coherence tomography (OCT) systems have become essential tools for doctors to detect diseases early and accurately. Vision care products, such as contact lenses and spectacles, remain fundamental to the market's financial health.

As industry evolves, artificial intelligence in diagnostic tools, tele-ophthalmology services, and minimally invasive surgical techniques are changing how doctors treat patients. Medical device companies now focus on developing portable, smaller, more efficient equipment with built-in analytics to better serve patients in outpatient settings.

Further, while FDA and CE regulations continue to set high standards for market entry, affecting products time-to-market and their costs, new opportunities emerge in developing markets. This encourages companies to develop products that are both affordable and easy to transport, helping more people access quality eye care.

Ophthalmic Devices Market Companies

Few of the prominent players operating in the global ophthalmic devices industry include:

- Alcon

- Bausch+Lomb

- Canon

- COBURN TECHNOLOGIES

- CooperVision

- Essilor

- HAAG-STREIT GROUP

- HEINE

- HOYA

- Johnson & Johnson

- NIDEK

- ophtec

- TOPCON Healthcare

- VISIONIX

- ZEISS

- ziemer OPHTHALMOLOGY

Essilor held a leading position in the ophthalmic devices market with a share of around 15% in 2024. Essilor Luxottica leverages a vertically integrated business model, combining lens technology and iconic eyewear under one roof. The company develops medical wearables, manages popular eyewear brands, and promotes sustainable practices. By integrating most of the processes from manufacturing to retail stores and online sales, EssilorLuxottica makes sure people worldwide can access quality vision care.

Alcon helps patients through two main operational categories, including surgical innovation and vision care. Its surgical division creates advanced intraocular lenses and develops minimally invasive procedures, while the vision care team works on digital tools and high-quality contact lenses. The company uses artificial intelligence to improve diagnostics and works closely with insurance providers to make treatments more accessible, especially in developing countries.

Johnson & Johnson's MedTech team focuses on creating new medical solutions and reaching more patients globally. They plan to introduce many new products by 2027, including advances in robotics, digital health, and surgical technologies. The company carefully invests its resources, acquires promising companies, and develops new treatments for growing medical needs.

Ophthalmic Devices Industry News:

- In August 2025, Alcon agreed to acquire rival eyecare specialist STAAR Surgical in an equity deal valued at around USD 1.5 billion. The addition of STAAR’s EVO ICL will complement its laser vision correction business and positively impact profit margins in the coming years.

- In July 2025, Essilor Luxottica signed an agreement with the South Korean-based PUcore for the acquisition of all its assets and entities involved in the development, manufacturing, and sale of monomers used in the production of high-index ophthalmic lenses. The transaction is expected to close by the end of 2025, pending regulatory approvals and other customary closing conditions. The deal will improve the industry positioning of the company.

- In April 2025, Hoya launched its VisuPro All Day and VisuPro Flex advanced focus spectacle lenses. These lenses are designed to assist people that are beginning to experience presbyopia. This development may enable the company to cement its position in the regional market.

The global ophthalmic devices market research report includes an in-depth coverage of the industry with estimates and forecasts in terms of revenue in (USD Million) from 2021 - 2034 for the following segments:

Market, By Product

- Vision care products

- Contact lenses

- Soft contact lenses

- Rigid gas permeable lenses (RGP)

- Toric

- Other contact lenses

- Spectacle lenses

- Contact lenses

- Surgical devices

- Cataract surgery devices

- Intraocular lenses

- Phacoemulsification devices

- Ophthalmic viscoelastic devices

- Cataract surgical Lasers

- Iol injectors

- Others cataract surgery devices

- Glaucoma surgery devices

- Glaucoma drainage devices

- Glaucoma lasers

- Minimally invasive glaucoma surgery (MIGS)

- Other glaucoma surgery devices

- Refractive surgery devices

- Excimer lasers

- Femtosecond lasers

- Other refractive surgery devices

- Vitreoretinal surgery devices

- Photocoagulation lasers

- Illumination devices

- Vitreoretinal packs

- Vitrectomy machines

- Vitrectomy probes

- Other Vitreoretinal surgery devices

- Cataract surgery devices

- Diagnostic and monitoring devices

- Autorefractor

- Biometer

- Corneal topography systems

- Fundus cameras

- Keratometers

- Lensmeters

- Ophthalmic ultrasound imaging systems

- Ophthalmoscopes

- Optical biometry systems

- Optical coherence tomography scanner

- Pachymeter

- Perimeters/Visual field analyzers

- Phoropters

- Retinoscopes

- Slit Lamps

- Specular microscopes

- Tonometer

- Wavefront aberrometers

- Other diagnostic and monitoring devices

- Ophthalmic accessories

Market, By End Use

- Consumers

- Hospitals

- Specialty clinics

- Ambulatory surgery centers

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the projected size of the ophthalmic devices market in 2025?

The market is expected to reach USD 50.2 billion in 2025.

How much revenue did the vision care products segment generate?

The vision care products segment accounting for a leading 51.9% share of the market.

What are the upcoming trends in the ophthalmic devices industry?

Key trends include the integration of artificial intelligence and machine learning in diagnostic tools, the rise of minimally invasive surgical procedures, and increasing demand for portable surgical instruments for outpatient procedures.

Who are the key players in the ophthalmic devices market?

Key players include Alcon, Bausch+Lomb, Canon, COBURN TECHNOLOGIES, CooperVision, Essilor, HAAG-STREIT GROUP, HEINE, HOYA, Johnson & Johnson, NIDEK, and ophtec.

What was the valuation of the consumer segment?

The consumer segment held a 47.8% market in 2024, driven by the growing adoption of spectacles and lenses among younger demographics.

Which region leads the ophthalmic devices market?

North America led the market with a 36.8% share in 2024. The region's dominance is attributed to advanced healthcare infrastructure and high adoption of innovative ophthalmic technologies.

What is the market size of the ophthalmic devices in 2024?

The market size was USD 48.7 billion in 2024, with a CAGR of 4.2% expected through 2034, driven by the increasing prevalence of ophthalmic disorders, technological advancements, and rising adoption of vision care products.

What is the projected value of the ophthalmic devices market by 2034?

The market is expected to reach USD 72.7 billion by 2034, fueled by demand for minimally invasive surgeries, advancements in diagnostic tools, and growing adoption of spectacles and contact lenses.

Ophthalmic Devices Market Scope

Related Reports