Summary

Table of Content

Operator Training Simulator (OTS) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Operator Training Simulator Market Size

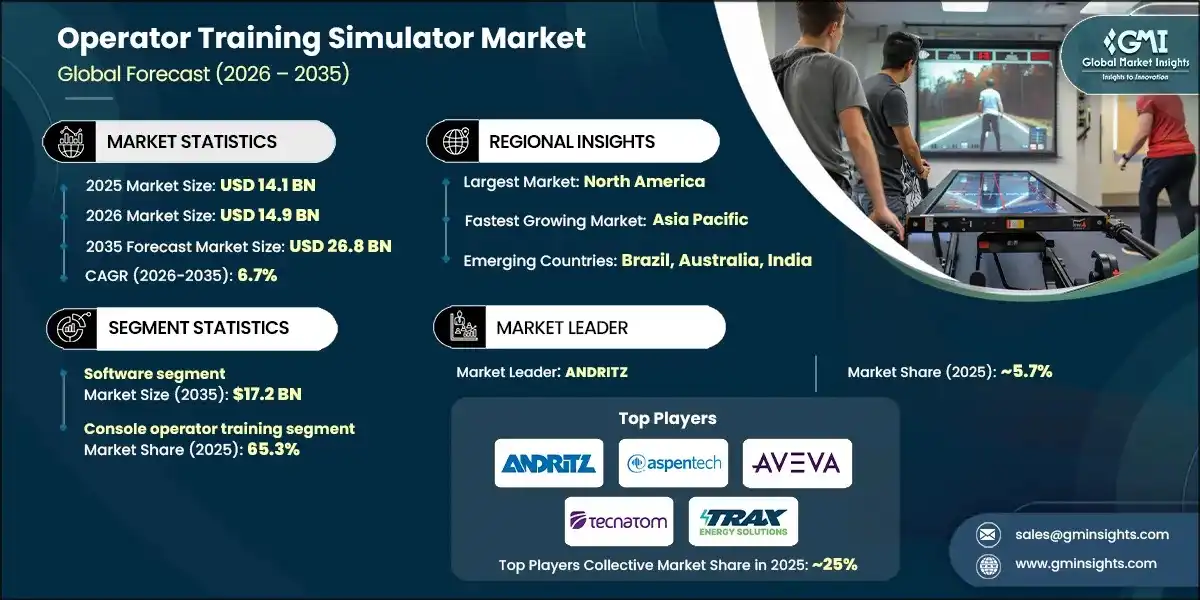

The global operator training simulator market was estimated at USD 14.1 billion in 2025. The market is expected to grow from USD 14.9 billion in 2026 to USD 26.8 billion in 2035, at a CAGR of 6.7%, according to latest report published by Global Market Insights Inc.

To get key market trends

Globally, stricter industrial safety regulations are forcing companies to implement technologies such as advanced training tools and methods. Falls, slips and trips accounted for 16 percent of all workplace fatalities in 2022 and roadway crashes were the number one reason for on-the-job deaths at 38 percent, according to the National Safety Council (NSC). These numbers demonstrate the urgent need for organizations to have comprehensive training programs for operators to address unintentional human error, which contributes to many industrial accidents. OTS provides operators with a safe place to practice their emergency responses and operational procedures so they can learn how to respond quickly and effectively to incidents, reducing the chances of serious accidents with significant costs. Safety-based training tools and equipment, like OTS, not only enable organizations to meet compliance standards, but also provide more dependable operations and reduce the amount of downtime. For example, AIChE estimates that unintentional human error is responsible for 42 percent of unplanned process industry shutdowns. By letting operators practice their skills in realistic situations under high-stress and abnormal conditions, OTS helps operators to develop their quick decision-making abilities. This type of proactive development assures that operators maintain continuous operations, thereby minimizing the risk to human life as well as the company's assets and overall brand image, and that is why safety compliance is a strong motivator for OTS use.

VR and AR technology is revolutionizing the way we perceive our training as an employee and providing us with an entirely new training experience through immersive technologies. With the help of these immersive technologies, learners can interact with their environment in three dimensions, just as they would in a real-world environment, creating an opportunity for the learner to engage actively as opposed to passively while learning. NSC's Work to Zero Study shows that VR training positively impacts worker's retention of knowledge and lowers the level of situational risk when working in dangerous conditions. This technology is of extreme importance in the oil and gas and power-generating industries because the consequences of making a mistake while performing an operation can be catastrophic. Furthermore, one of the logistical constraints of traditional training methods can be solved by utilizing VR and AR. By creating a VR/AR training environment, you can reduce the amount of time spent conducting a traditional training program, as well as reduce the cost associated with conducting the training, and the elimination of the exposure to real-life hazards. As more industries are becoming more technologically advanced and the need for digital training solutions becomes greater, the demand for the use of immersive learning technology is steadily increasing and thus will provide growth for OTS platforms going forward.

In many industries, a contributing factor to the increased skills gap between current employees and new hires is that a large percentage of the existing workforce is expected to retire in the next five years, as reported by the International Society for Automation (ISA). These anticipated retirements may result in vacancies being created by this large percentage of workers retiring from many sectors. Operational Training System (OTS) provides companies with a means to document operational expertise and accelerate the proficiency of new employees. New employees will be able to reach an independent level of performance many months earlier than if they were not assisted with OTS training. Based on data compiled by the National Center for Construction Education and Research (NCCER), it is reported that 60% of all accidents that occur in the construction industry occur within the first year of an employee’s employment. This data reinforces the need for structured safety and operational training prior to beginning work on a job site. OTS provides users with an opportunity to be trained on realistic simulations of complex operational processes, enabling them to develop confidence and competency in their job functions without endangering themselves or their production output. Due to the demographic shift of workers and the resulting skills gap, OTS will play an essential role in the maintenance of operational excellence.

Operator Training Simulator (OTS) Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 14.1 Billion |

| Market Size in 2026 | USD 14.9 Billion |

| Forecast Period 2026-2035 CAGR | 6.7% |

| Market Size in 2035 | USD 26.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Stringent government regulations to maintain safe and environmentally compliant operations | Drives global adoption of advanced Operator Training Simulators as industries seek cost-effective solutions to meet compliance standards and avoid penalties. |

| Focus on improvement in safety of the workforce & facility operational activities | Accelerate investment in immersive and high-fidelity training systems worldwide to minimize accidents, reduce downtime, and enhance operational reliability. |

| Pitfalls & Challenges | Impact |

| Data sharing concerns for customized simulator modeling | Limits collaboration and slows development of tailored OTS solutions, reducing adoption in industries with strict confidentiality requirements. |

| High initial cost of installation | Discourages small and mid-sized enterprises from investing in OTS, constraining overall market penetration and delaying ROI-driven decisions. |

| Opportunities: | Impact |

| Integration of AI and Predictive Analytics | Leveraging Artificial Intelligence (AI) and predictive analytics within OTS platforms can enable real-time performance monitoring, adaptive learning paths, and predictive failure analysis. |

| Expansion into Emerging Economies with Digitalization Initiatives | Rapid industrialization and government-led digital transformation programs in emerging economies (e.g., India’s Digital India, ASEAN smart manufacturing initiatives) present a huge untapped market for OTS solutions. |

| Market Leaders (2025) | |

| Market Leaders |

Market share of ~5.7% |

| Top Players |

Collective market share in 2024 is 25% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | North America |

| Emerging countries | Brazil, Australia, India |

| Future outlook |

|

What are the growth opportunities in this market?

Operator Training Simulator (OTS) Market Trends

Collaboration based training environments will likely be one of the main new developments that will support the growth of the Operator Training Simulator market between now and 2034. Collaborative training environments consist of simulators that allow multiple operators to work together in the same virtual environment. This allows for the development of cooperation and communication skills between operators. A good example of this is the collaboration between Schneider Electric and ETAP in June 2022 to integrate ETAP Power System Monitoring and Simulation (PSMS) and ETAP Operator Training Simulator (eOTS) with EcoStruxure Power Operation to provide operators and engineers with predictive analysis and model-based training for their electrical power systems. The integration of EcoStruxure Power Operation through real-time connectivity allows for the interface of EcoStruxure Power Operation Systems with the ETAP Electrical Digital Twin that allows operators to understand how their Power Systems will behave within a variety of scenarios. This allows for the development and validation of new procedures through the EcoStruxure Power Operation HMI without the risk of impacting live operations.

- Companies are using virtual reality (VR) and augmented reality (AR) to train their operators more effectively and efficiently than ever before. VR/AR technologies allow trainees to interact with simulated environments that look and feel real; complete complex tasks; and react to emergencies without having to face any real-life dangers. For example, both Ford and Siemens have introduced VR training to support their technical and industrial operator workforce, enabling them to have virtual experience with maintaining equipment and performing operations prior to ever working on actual equipment. As a result, they are improving knowledge retention, reducing errors, and increasing operator confidence, thus providing OTS Providers with an advantage with immersive technology.

- There has been a significant shift away from traditional on-premises OTS systems to cloud-based OTS solutions. The cloud deployment of OTS platforms provides large enterprises with the ability to train dispersed teams in multiple locations across the world, allows for real time updates to simulation models and decreases the total infrastructure costs associated with hosting training simulations. Industry forecasts indicate that cloud-based OTS is rapidly growing in popularity among the oil and gas and power generation industries, where it is necessary to have a centralized and yet flexible training platform to support their global operations. Additionally, this trend supports digital transformation strategy initiatives and helps support small- to medium-sized enterprises by lowering the barriers to entry to remote training using subscription models.

Operator Training Simulator Market Analysis

Learn more about the key segments shaping this market

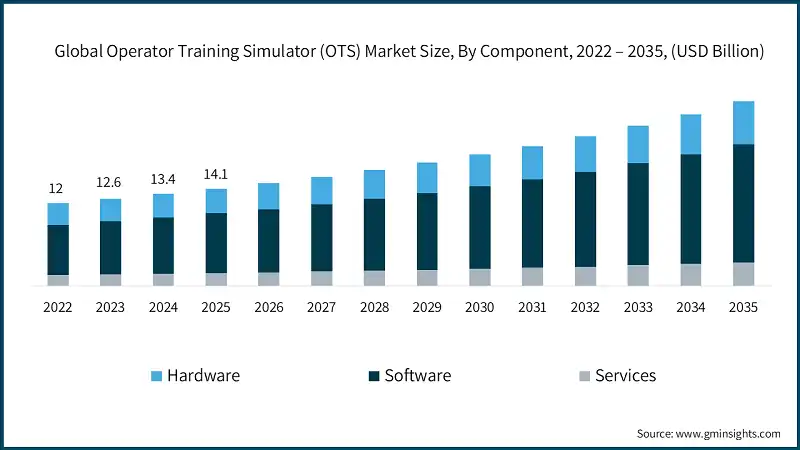

Based on the component, the operator training simulator market is segmented into hardware, software, and services. The software segment crossed USD 8.6 billion in 2025 and is projected to reach USD 17.2 billion by 2035.

- The software segment will also represent the largest percentage of the total market in 2024. The use of advanced technology by companies in the software industry and their ability to replicate physical laws/forces through simulation (via advanced physics engines, high-fidelity graphics, etc.) will make it easier for operators to learn. The desire for hands-on and engaging simulated experiences will help accelerate the momentum behind the creation and growth of new types of software solutions, including Virtual Reality (VR) and Augmented Reality (AR).

- The continuing development and implementation of new technologies include a transition to cloud computing, Artificial Intelligence (AI) use in conjunction with Products and/or Services that allow analytics execution on real-time data. As a direct result, these developments will be a major reason for ongoing growth in the software space. As such, the demand for sophisticated, intelligent software solutions that can replicate the complexities of the physical world continues to grow.

Learn more about the key segments shaping this market

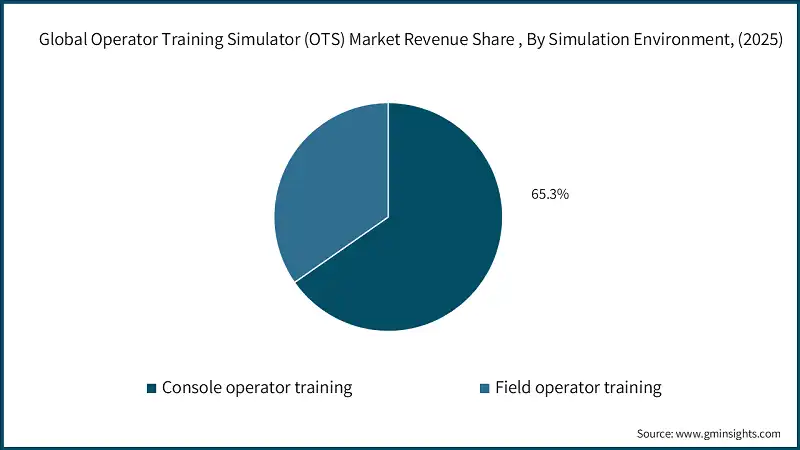

The operator training simulator market by simulation environment is segmented into console operator training and field operator training. The console operator training segment was the leading segment in this market in 2025 with a revenue of USD 9.2 billion and has a market share of around 65.3%.

- The market for training console operators is the largest segment due to most of the industry activity (including oil and gas, electricity generation and chemical manufacturing) occurring in a centralized control room environment. An operator's role typically requires them to not only monitor multiple systems simultaneously but also to analyze data and react rapidly. The significant level of pressure to make critical decisions under duress makes it imperative that console operators receive simulator training so they can respond appropriately to emergency situations, take corrective actions, and handle complicated system processes in a safe and viable manner. Due to the difficulties and risks associated with control room operation, training console operators in this manner represents an essential component of long-term operational viability.

- The financial impact associated with the cost of training console operators in an actual control room is dramatically higher than that of simulator training due to a variety of factors, including the potential impact of control room failure on the environment, the fact that many times, errors in handling control room processes result in catastrophic results, as well as the potential for lowering the operating cost of training console operators given that simulator training is less physically resource-intensive than field operator training. As such, increased use of simulator training for console operators represents the most significant long-term advantage to companies that utilize simulator training as a means of improving operating efficiency and cost-effectiveness on a global scale.

Looking for region specific data?

The U.S. operator training simulator market was valued at around USD 4.1 billion in 2025 and is anticipated to register a CAGR of 7% between 2026 and 2035.

- The workplace safety regulations enforced by the U.S. government are among the strictest in the world and have resulted in a significant demand for more advanced methods for training operators. The number of fatal work injuries was reported by OSHA at 5,283 in 2023, and there were approximately 2.6 million non-fatal injury/illness reports in private industry during 2023. This highlights the need for organizations to comply with safety regulations, which is being done through OTS platforms by providing emergency response and operational hazard simulations. The advertising budget for OSHA exceeded $632 million for the fiscal year 2023, which also serves to promote workplace safety and encourages companies to use high-fidelity training solutions.

- According to the Bureau of Labor Statistics, the U.S. industrial sector will continue to be the largest in North America, with projected manufacturing employment of 12.8 million in 2024 and remaining stable through at least 2034. In addition to manufacturing, the energy sector employed 8.35 million in 2023 and has continued to grow at an average annual rate of 3%, with 42% of that total being in clean energy. Both sectors are among the most process dependent and risk-heavy industries, which means operator competency is critical.

The Asia Pacific operator training simulator market was valued at around USD 3.6 billion in 2025 and is anticipated to register at a CAGR of 7.1% between 2026 and 2035.

- Due to increased investment in industrial infrastructure, Asia Pacific is seeing the fastest growth in terms of adoption of Operator Training Simulation (OTS) by employers for their employees. In fact, according to the United Nations Industrial Development Organization (UNIDO), Asia and Oceania accounted for 55% of global manufacturing value-added (MVA) and 48% of manufacturing exports in 2022. This explosive growth in industrial development has created a simultaneous increase in the need for the safe and efficient operation of equipment and processes in these leading high-hazard (chemicals, energy, heavy machinery) industries, as well as for a trained workforce. Further evidence of this need for training comes from the extent of occupational risk within the region; The International Labour Organisation (ILO) noted that the Asia Pacific region experienced 1.2 million work-related deaths and 55 million years of disability-adjusted life lost in 2016, highlighting the critical need for developing strong training systems to reduce incidents and improve regulatory compliance.

- Other than this growth driver, digitalization and Industry 4.0 are accelerating rapidly in Asia-Pacific; the IMF and UN ESCAP describe this region as the most advanced region globally with respect to digital transformation, and national initiatives (e.g., "Made in China 2025," Digital India, Smart Nation Singapore) are being developed to support automation and smart manufacturing. These initiatives focus on the use of cutting-edge technology (e.g., AI, IoT, VR/AR) to prepare employees to succeed in an increasingly complex and automated industrial environment using high-fidelity simulators. Consequently, as technology accelerates the digitalization of industry, increases the importance of safety, and develop advanced technologies, the Asia-Pacific region is experiencing rapid growth in the development of infrastructure for operation training systems.

Europe operator training simulator market was valued at around USD 4.3 billion in 2025 and is anticipated to register a CAGR of 6.6% between 2026 and 2035.

- Europe has a strong demand for OTS solutions because of their large industrial base and emphasis on worker safety. Eurostat reported that in 2022, the manufacturing sector in the EU employed 30 million people, creating $3.5 trillion in value-added (V.A.) and representing 24.1% of Europe’s business economy V.A. Because of the large amount of industrial activity, coupled with the complex operations that many industries are operating under, specifically chemicals, automotive and energy, there will be a high demand for advanced operator training to deliver operations efficiency and compliance. In addition, workplace safety continues to be an important area of concern. According to Eurostat, there were 3,298 fatalities resulting from a workplace accident and 2.82 million serious injuries resulting from a workplace accident in Europe during 2023. Therefore, it is critical to develop robust training programs that can reduce these types of incidents and meet the mandated safety regulations put forth by the EU.

- While safety remains a primary factor for the continued growth of OTS in Europe, it is also evident that the rapid digital transformation of Europe, coupled with the initiatives of Industry 4.0, are driving more European manufacturers to deploy OTS. With the European Commission's Digital Europe Programme investing USD 2.5 billion into various projects over the period from 2025-2027 for digital skills development, artificial intelligence (AI) integration, and enhancing cybersecurity within all sectors of industry, and with national-level initiatives, including Germany's Plattform Industrie 4.0 and France's Factory of the Future, working to upgrade and modernise the manufacturing sector through using automation and smart technology, this has resulted in a considerable increase in the number of OTS Vendors looking to integrate VR/AR and AI predictive analytics into their training platforms to support the EU's focus on the development of advanced manufacturing, as well as skilling the workers in Europe to take advantage of these technologies to increase productivity and enhance resilience in the industrial sector. Therefore, as manufacturers embrace a greater level of technology utilisation to adopt these advances in the industrial sector, Europe is positioning itself as a very promising market for OTS solutions.

Operator Training Simulator Market Share

- The top 5 companies in the operator training simulator industry, such as ANDRITZ, Aspen Technology Inc., AVEVA Group Limited, Tecnatom, and TRAX Energy Solutions hold a market share of 25%.

- ANDRITZ utilizes IDEAS, its dynamic simulation platform, and Metris OTS to provide high-fidelity and plant-specific training environments. The Pulp and Paper Process Sector and Process Industry are the primary clients of the ANDRITZ OTS business group. ANDRITZ has chosen to focus on market segments by promoting customized training environments and implementing early integration with customers so operators can train long before commissioning. This helps to ensure that ANDRITZ's customers can start their plants more quickly and realize a better return on investment. This also establishes ANDRITZ as a leader in operational readiness and safety compliance and a way to survive through operational specialization and measurable performance improvement.

- AspenTech has developed a competitive advantage through its DCS-agnostic OTS solutions utilizing Aspen HYSYS Dynamics, providing robust, maintainable simulations through all phases of the asset lifecycle. Their strategy is to implement OTS systems predominantly in the cloud by use of the AspenONE Engineering suite, significantly reducing IT costs and expediting the integration process. Additionally, AspenTech has incorporated digital twins with Industrial AI to develop predictive analytics and opportunity for adaptive learning technologies, all of which are expected to align to Industry 4.0 technologies and ways of work. AspenTech's OTS offerings incorporate the key elements of flexibility, scale and advanced analytics; therefore, AspenTech will have the tools to compete in the future and create greater market appeal for global corporations looking to digitally transform their operations through the adoption of new technologies.

- AVEVA focuses on high-fidelity dynamic simulation combined with emulated control systems (e.g., Triconex, Foxboro) to replicate real plant conditions. Their strategy includes cloud-enabled OTS deployment and integration with AVEVA Connect, supporting remote training and digital collaboration. By offering solutions that reduce start-up and commissioning times by 3-5 days and improve operator readiness, AVEVA delivers tangible cost savings and operational efficiency. Their emphasis on digital transformation, extended reality (XR), and predictive analytics ensures alignment with evolving industry needs, enabling AVEVA to maintain a strong competitive position in diverse sectors like oil & gas, chemicals, and power.

Operator Training Simulator Market Companies

Major players operating in the operator training simulator industry are:

- ABB Ltd.

- ANDRITZ

- Aspen Technology Inc.

- AVEVA Group Limited

- Designing Digitally Inc.

- DNV AS

- DuPont

- EON Reality

- ESI Group

- Hyperion Group

- Schneider Electric

- Siemens

- Tecnatom

- TRAX Energy Solutions

- Yokogawa Electric Corporation

Tecnatom offers industry standard simulators and replicas of control rooms, primarily to the nuclear, fossil, and renewable energy industries. Their strategy is built on developing engineering level simulator tools with industry-specific training programs using the SAT (Systematic Approach to Training) methodology. Tecnatom is also engaged in long-term projects such as ITER nuclear fusion to show its capability to support the challenges presented in a complex, high-risk environment. By integrating virtual reality, thermohydraulic codes, and stringent configuration control, Tecnatom ensures safety, compliance, and operational excellence, providing the ability to remain competitive through their technical depth and project-based relationships.

TRAX maintains its leadership position by providing high-accuracy simulators that are specific to the plants they model, mainly for fossil and combined-cycle power plants. They focus on creating customized lesson plans for instructors and implementing advanced ProTRAX modeling software to produce an exact replica of the operations of a plant. TRAX also uses simulation not only for trainer development but also as a strategic tool for performance optimization and compliance diagnostics. TRAX's emphasis on their extensive experience (over 30 years) in the industry, partnerships on carbon capture projects, and ongoing improvements in simulator accuracy helps to solidify their competitive advantage in an increasingly challenging energy marketplace.

Operator Training Simulator Industry News

- In May 2025, Liebherr-Werk Ehingen and Tenstar Simulation expanded their partnership to broaden mobile crane simulator portfolios, creating an immersive simulated crane world. This strategic collaboration enables Liebherr to enhance global training capabilities and reduce customer training costs.

- In January 2025, Emerson opened the world's largest Interactive Plant Environment facility in Shakopee, Minnesota, featuring 15 tanks and 600+ automation products. This expansion strengthens Emerson's position in immersive workforce training and accelerates digital workforce readiness.

- In 2024-2025, Airbus Helicopters Training Academy deployed H125 VR simulators across global locations including France, South Africa, and North America, achieving FAA Level 5 qualification. This deployment helps Airbus address pilot shortages and expand type-rating training access worldwide.

- In Q4 2024, Valmet secured an order to deliver high-fidelity recovery boiler and cooking simulators to Södra Cell Värö mill in Sweden. This helps Valmet strengthen its position in pulp industry training solutions while supporting customer operational efficiency goals.

The operator training simulator market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and from 2022 to 2035, for the following segments:

Market, By Component

- Hardware

- Software

- Control simulation

- Process simulation

- Immersive simulation

- Services

- Consulting

- Installation & environmental simulation

- Maintenance & support

Market, By Simulation Environment

- Console operator training

- Field operator training

Market, By End Use

- Aerospace & defense

- Chemical

- Energy & power

- Healthcare

- Industrial

- Oil & gas

- Pulp & paper

- Others

Market, By Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

What was the valuation of console operator training segment in 2025?

Console operator training held 65.3% market share and generated USD 9.2 billion in 2025.

Which region leads the operator training simulator market?

North America leads the market with the U.S. valued at USD 4.1 billion in 2025. Stringent safety regulations and advanced industrial infrastructure fuel the region's dominance.

What are the upcoming trends in the operator training simulator market?

North America leads the market with the U.S. valued at USD 4.1 billion in 2025. Stringent safety regulations and advanced industrial infrastructure fuel the region's dominance.

What is the current operator training simulator market size in 2026?

The market size is projected to reach USD 14.9 billion in 2026.

How much revenue did the software segment generate in 2025?

Software segment generated USD 8.6 billion in 2025 and is projected to reach USD 17.2 billion by 2035, leading the market with advanced simulation capabilities.

What is the market size of the operator training simulator in 2025?

vThe market size was USD 14.1 billion in 2025, with a CAGR of 6.7% expected through 2035 driven by stricter global industrial safety regulations and rising adoption of advanced training tools.

What is the projected value of the operator training simulator market by 2035?

The operator training simulator market is expected to reach USD 26.8 billion by 2035, propelled by immersive technologies like VR/AR, AI-powered predictive analytics, and emphasis on zero-incident operations.

Who are the key players in the operator training simulator market?

Key players include ABB Ltd., ANDRITZ, Aspen Technology Inc., AVEVA Group Limited, Designing Digitally Inc., DNV AS, DuPont, EON Reality, ESI Group, Hyperion Group, Schneider Electric, Siemens, Tecnatom, TRAX Energy Solutions, and Yokogawa Electric Corporation.

Operator Training Simulator (OTS) Market Scope

Related Reports