Summary

Table of Content

Offshore Support Vessel Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Offshore Support Vessel Market Size

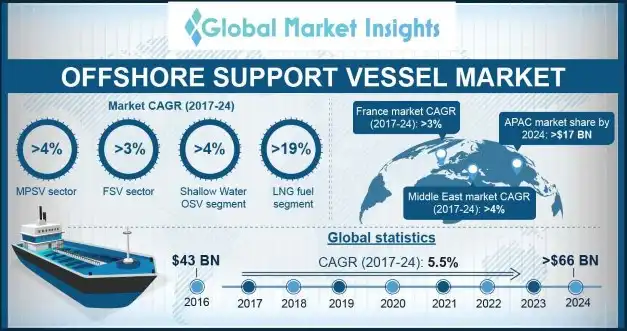

Offshore Support Vessel Market in 2016, was valued over USD 42 billion and the cumulative fleet count is anticipated to grow over 8,000 units by 2024.

To get key market trends

Global Offshore Support Vessel industry will witness robust growth on account of rising crude oil production to cater to the soaring energy demand. For instance, as per the Energy Information Administration, in 2018, the total production of crude oil across the U.S. increased to 10,990 thousand barrels from 7,467 thousand barrels per day in 2013. In addition, growing demand of logistics support for the growing offshore structures and availability of significant untapped hydrocarbon reserves are few of the key underlying factors that will further enhance the industry outlook over the forecast timeline. For instance, as per the BP p.l.c., the global crude oil consumption by transportation sector is anticipated reach over 2,710 million tons of oil equivalent by 2020.

Rising investments toward ultra-deep E&P activities coupled with growing industrial and commercial applications of crude oil & natural gas will positively influence the global OSV market size. In addition, growing investments toward subsea E&P activities and development of regasification terminals will further augment the business growth.

Offshore Support Vessel Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2016 |

| Market Size in 2016 | 42 Billion (USD) |

| Forecast Period 2017 - 2024 CAGR | 5.5% |

| Market Size in 2024 | 66 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Offshore Support Vessel Market Analysis

Platform Supply Vessel (PSV) industry will witness substantial growth due to the implementation of several highly efficient drilling techniques on account of enhancing the oil well production capacity. Furthermore, rising demand for dynamic posting fleet in order to achieve maximum flexibility across high sea operation will boost the boost the adoption of PSV.

Growing demand for advanced drilling technologies coupled with significant rise in rig count will drive the AHTS offshore support vessel industry. These products are designed specifically to tow ships, handle anchors and serve as a rescue vessel.

Offshore support vessel industry from Fast Support vessel (FSV) will witness growth over 3% by 2024. Dynamic ride control, water jet propulsion, and engine monitoring system are some prominent features that will increase the carrier deployment over other alternatives available in the industry

Shallow Water OSV industry is anticipated to witness gains over 4% by 2024. Significant rise in the demand for various petroleum products will subsequently drive the industry demand. Furthermore, limited technical integrities along with low cost and will drive the business outlook over the forecast period.

Surging investments toward deep and ultra-deep oil field explorations with growing technological advancements to enhance drill efficiency will raise the deep water OSV market size. For instance, as per the U.S. Energy Information Administration, in 2018, the total global production of crude oil from offshore deep-water projects is anticipated to expand over 2.5 million barrel per day between 2017 and 2040.

LNG offshore support vessel industry is set to expand over 19% by 2024. Shifting focus toward adoption of low carbon emission fuel owing to rising greenhouse gas emissions will drive the business growth. For instance, as per the EIA, the U.S. exported nearly 4.7 billion cubic feet per day of LNG in May 2019 to cater to the rising demand of across Asia Pacific and Europe region.

Asia Pacific OSV market size is expected to surpass over USD 17 billion by 2024. Positive economic outlook coupled with the rising E&P investments to explore the region’s untapped potential reserves will drive the business landscape. For instance, in 2019, Perdana Petroleum, Malaysia was awarded the contract from Petronas as a panel contractor, for the provision of services pertaining to drilling rigs, offshore installation & towing and anchor jobs with the help of OSVs.

Europe offshore support vessel industry will grow on account of rising investments toward expansion of ultra-deep offshore fields. In addition, the increasing trade of LNG coupled with the growing concerns toward GHG emissions will further complement the industry growth. For instance, in March 2019, the volume of LNG trade between the U.S. and EU has crossed more than 1.4 billion cubic meters.

Middle East offshore support vessel market will witness growth of over 4% by 2024. Growing investment toward new crude oil discoveries along with increasing concentration of mature and aging oilfield will further boost the industry outlook. For instance, in 2019, Khalid Al-Falih (Minister of Energy, Industry and Mineral Resources, Saudi Arabia) has announced the discovery of natural gas in Red Sea.

Offshore Support Vessel Market Share

Eminent players across the Offshore support vessel industry comprises

- Island Offshore

- Edison Chouset

- Bourbon

- Gulf

- Farstad

- Gulfmark

- Vroon

- Seacor Marine

- Tidewater

- Havila Shipping

- Siem

- REM Maritime

- Offshore

- Swire

Major industry players are focusing on development of new products to sustain a competitive advantage. Introduction & implementation of advanced technologies is the strategic move undertaken by the market participants on account of enhancing efficiency across the industry value chain.

Offshore Support Vessel Industry Background

Offshore support vessel are ships designed for logistics & transportation of crude oil and natural gas that operate deep in the oceans. The basic function of OSV is support the exploration and drilling activities as well as deliver supplies to the excavation and construction units situated at the deep sea.

Frequently Asked Question(FAQ) :

How much size did the global offshore support vessel market register in 2016?

The overall offshore support vessel market was valued at USD 42 bn in the year 2018.

How much is the global offshore support vessel market size expected to grow through 2024?

Overall offshore support vessel market would be pegged at a valuation of USD 66 bn in 2024.

Offshore Support Vessel Market Scope

Related Reports