Summary

Table of Content

North America Utility Solar EPC Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Utility Solar EPC Market Size

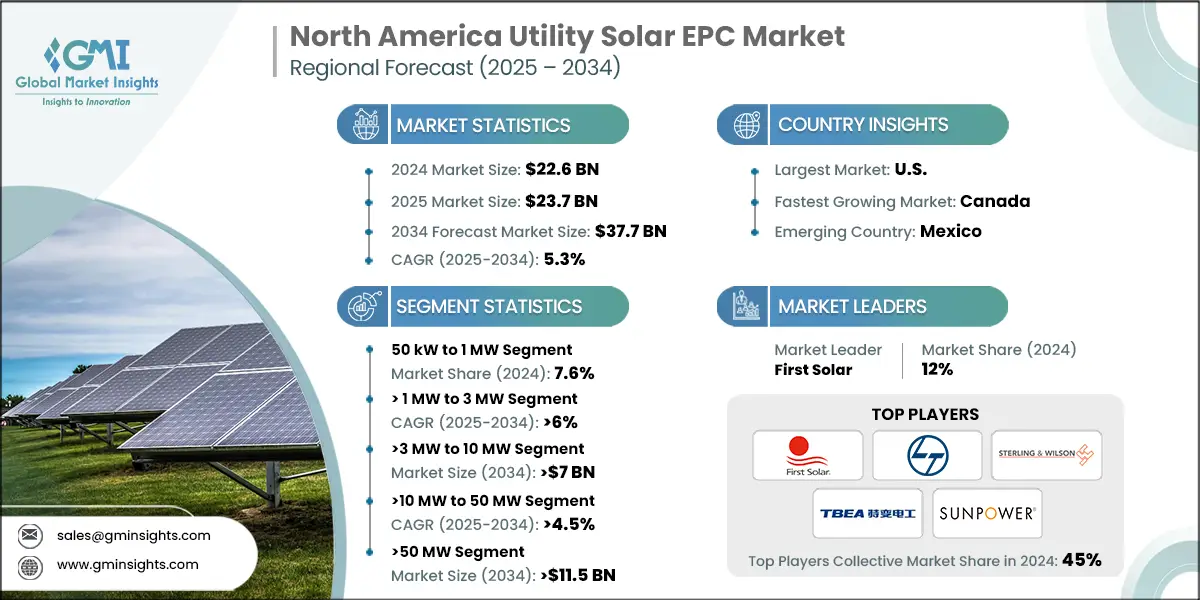

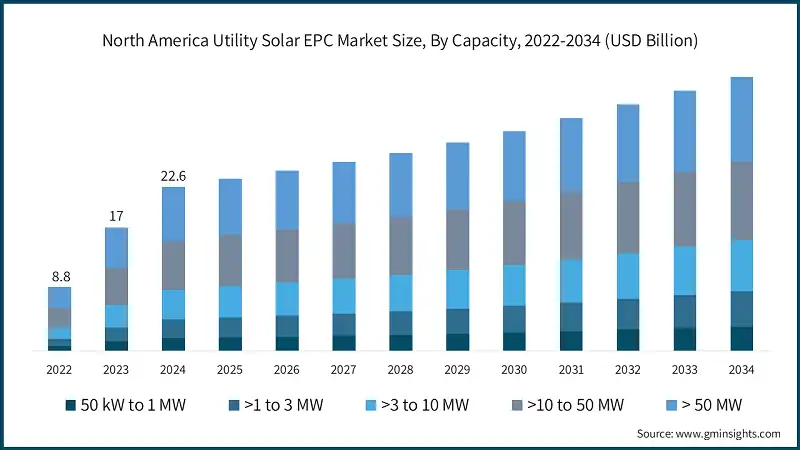

North America utility solar EPC market was valued at USD 22.6 billion in 2024. The market is expected to grow from USD 23.7 billion in 2025 to USD 37.7 billion in 2034, at a CAGR of 5.3%, according to Global Market Insights, Inc.

To get key market trends

- Government proposed incentives, norms, and strategies to support various facilities with renewable means along with favorable government efforts to improve grid reliability and ensure clean energy supply will enhance the business scenario. Rising fundings by institutes and organizations to boost solar deployment along with growing presence of robust plans for clean energy adoption will drive the North America utility solar EPC market scenario.

- Continuous development of advanced technologies delivering affordable and secure power supply across various end uses will complement the business dynamics. Robust fundings by major institutes for increased solar deployment in line with increasing intervention of major players introducing advanced technologies will complement the industry statistics. Strategic private and public sector partnership coupled with the presence of a robust regulatory framework along with favorable government investments and incentives will enhance the North America utility solar EPC market potential.

- For instance, in April 2022, the U.S. Department of Energy’s Solar Energy Technologies Office (SETO) introduced Renewables Advancing Community Energy Resilience (RACER) investment opportunity of USD 33 million to support solar & solar plus storage projects across the country.

- Various strategies to restore electricity facilities to avoid power disruptions and a positive outlook toward clean environment will stimulate the industry landscape. Ongoing introduction of planning methodologies, technologies, and tools by major researchers along with favorable industry collaborations to deploy large scale projects will accelerate the business outlook. For instance, in July 2022, the U.S. Department of Energy launched initiatives to drop down the electricity bills, support solar power growth in underserved communities and introduce digital platforms to introduce accessible solar power, thereby positively influencing the North America utility solar EPC market growth across the country.

- Robust engagement of local authorities to improve solar installation facilities coupled with the strategic efforts of government bodies to explore possibilities for clean energy infrastructural development will drive the market growth. Financing mechanisms like power purchase agreements (PPAs) and the availability of government incentives, have made utility-scale solar projects more attractive for developers and investors.

- Noticeable adoption of large scale utility projects with battery energy storage systems (BESS) to provide more reliable, dispatchable power primarily in states like California and Texas will allow developers to take advantage of existing infrastructure and avoid land use challenges, contributing to the utility solar EPC market growth.

- Ontario is the leader in solar installations in Canada, driven by supportive government policies like the Feed-in Tariff (FIT) program. Rising utility solar projects in Alberta spurred by its liberalized electricity market and competitive power prices will stimulate the market growth. Additionally, vast land area in Quebec and strong government support for renewable energy, is attracting more investment in solar energy, thereby strengthening the North America utility solar EPC market outlook.

- Furthermore, government policies at both the federal and regional levels across the region play a significant role in driving the growth of utility installations. The Investment Tax Credit (ITC) offers a 30% tax credit for utility-scale solar projects, significantly reducing upfront costs. States like California, New York, and Texas have ambitious renewable energy targets that promote large-scale projects.

North America Utility Solar EPC Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 22.6 Billion |

| Market Size in 2025 | USD 23.7 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.3% |

| Market Size in 2034 | USD 37.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Government initiatives & targets for renewable sources | Growing carbon emission concerns coupled with stringent government norms to achieve climate action goals have shifted consumer inclination toward sustainable sources, thereby driving interest in solar adoption. Government-proposed incentives, norms, and strategies to support various facilities with renewable means along with favorable government efforts to improve grid reliability and ensure clean energy supply will enhance the business scenario. |

| Rising deployment of utility scale projects | Adoption of best practices, project designs and systems by major EPC providers is a key enabler driver to improve the competitiveness, flexibility and reliability of solar technologies which in turn drive the market growth. Noticeable adoption of large scale utility projects with battery energy storage systems (BESS) to provide more reliable, dispatchable power primarily in states coupled with deployment of floating solar plants on large bodies of water will allow developers to take advantage of existing infrastructure and avoid land use challenges, contributing to the market growth. |

| Pitfalls & Challenges | Impact |

| Longer payback period | Utility-scale solar projects of high capacity, require significant upfront capital to cover costs such as land acquisition, permitting, design, engineering, and the procurement of solar panels, inverters, and other necessary infrastructure. Additionally, costs related to land preparation, transmission infrastructure, and energy storage further increase the upfront capital requirements. |

| Opportunities: | Impact |

| Expansion of large capacity solar projects | Many early generation solar farms, specifically in California and Nevada, are being repowered with more efficient technology, expanding capacity beyond the original design. This will further yield substantial opportunities for EPC firms to capture repowering and expansion contracts. |

| Solar & Energy Storage Integration & Hybrid Systems | Solar developers increasingly demand integrated battery energy storage systems (BESS) to enhance grid stability, offer peak shaving/load shifting, and access new revenue streams. EPCs that combine solar PV with storage, and even hybrids with other renewables like wind or biomass, will be highly competitive. |

| Digitalization, Automation & Smart Grid Integration | EPC firms adopting digital tools including AI-driven predictive maintenance, drones, IoT asset monitoring, and digital twins that can significantly improve efficiency, reduce costs, and differentiate their offerings. Integration with smart-grid infrastructure and advanced grid controls will become essential as the utilities demand more responsive solar–storage systems. |

| Market Leaders (2024) | |

| Market Leaders |

12% market share |

| Top Players |

Collective market share in 2024 is 45% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | U.S. |

| Fastest Growing Market | Canada |

| Emerging Countries | Mexico |

| Future outlook |

|

What are the growth opportunities in this market?

North America Utility Solar EPC Market Trends

- Many corporations are turning to Power Purchase Agreements (PPAs) to secure large volumes of renewable energy from utility-scale solar projects. This shift helps provide a stable revenue stream for developers and supports companies in achieving their sustainability objectives, thereby shaping the business landscape.

- Many solar facilities require less land, which can make them more suitable for areas with limited space or complex permitting requirements. Additionally, the permitting process for projects of this scale is often less time consuming and complicated than for larger facilities, speeding up the timeline for deployment, fueling the industry outlook.

- Increasing adoption of scalable capacities by both developers and utilities will complement the mid-size project deployment, allowing additional capacity to be added as energy demand increases or as renewable energy goals grow. The ability to scale a project over time also ensures that stakeholders can optimize investments and adapt to evolving energy needs.

- Ongoing technological innovations, including high-efficiency photovoltaic (PV) modules and advanced inverters, will make mid-scale projects more cost-effective thereby improving the overall industry outlook. Furthermore, rising adoption of digital tools for performance monitoring and grid integration enhances operational efficiency, thereby improving the project viability.

- Rising deployment of smaller capacity projects to fulfil localized energy needs in rural or semi-urban areas, offering cost-effective solutions for small communities will accelerate the product adoption. Increasing investment in the mid-size solar systems owing to its affordability and high energy output, providing viable options aiming to expand their renewable energy portfolios, will drive the market growth.

North America Utility Solar EPC Market Analysis

Learn more about the key segments shaping this market

- Based on capacity, the market is segmented into 50 kW to 1 MW, >1 MW to 3 MW, >3 MW to 10 MW, >10 MW to 50 MW and >50 MW. The 50 kW to 1 MW segment dominates with 7.6% market share and will grow more than USD 3 billion by 2034.

- Growth in distributed energy resource (DER) adoption in North America, driven by the transition toward localized energy generation, will boost the product deployment. This will provide communities and small businesses with affordable, reliable, and sustainable energy.

- Increasing federal tax credits, such as the Investment Tax Credit (ITC), and state-specific policies including California's Net Energy Metering (NEM) program aimed to incentivize solar adoption in this capacity range will uplift the business statistics. Additionally, Renewable Portfolio Standards (RPS) in states such as New York, Texas, and Massachusetts will drive the demand for mid-sized solar installations.

- > 1 MW to 3 MW is set to grow at a CAGR of over 6% through 2034, on account of rising preference for these systems by many community and cooperative solar initiatives in the region. Furthermore, these projects strike a balance between cost and energy output, making solar energy accessible to a wider audience, including households, small businesses, and local governments, thereby stimulating the business landscape.

- Easy grid integration of projects, offering flexibility in supporting the existing infrastructure will foster the capacity adoption. Furthermore, mid-sized systems offer capabilities to get easily integrated into both rural and urban grid networks without significant modifications will drive the industry scenario.

- >3 MW to 10 MW will cross more than USD 7 billion by 2034 owing to rising popularity of community solar programs. This range is perfect for such programs as it can serve several thousand households or commercial users, making solar energy accessible to those who cannot install systems on their own property. Furthermore, community solar also reduces the upfront cost burden for consumers, driving broader adoption and expanding the market.

- Growing demand owing to its enhanced grid stability and resilience, particularly in areas with aging infrastructure or frequent outages will strengthen the market growth. Additionally, these systems can be paired with energy storage, providing backup power during grid outages or periods of high demand.

- The >10 MW to 50 MW market will grow at a CAGR of more than 4.5% through 2034, driven by rising utilities and governments push for larger shares of renewable energy in their energy mixes. Furthermore, growing implementation of strict renewable energy mandates will foster the mid capacity adoption to fulfill the utilities obligations efficiently while providing a steady, scalable source of clean power.

- Furthermore, these solar facilities require less land, which can make them more suitable for areas with limited space or complex permitting requirements. Additionally, the permitting process for projects of this scale is often less time consuming and complicated than for larger facilities, speeding up the timeline for deployment, fueling the industry outlook.

- The >50 MW is likely to exceed USD 11.5 billion by 2034, on account of rising aggressive state and federal renewable energy mandates across the region. Renewable Portfolio Standards (RPS) and clean energy initiatives, will encourage the utilities to turn to large-scale solar projects of >50 MW to meet these ambitious goals. Furthermore, these large scale systems allow them to rapidly scale up their renewable energy portfolios, contributing significantly to meeting the carbon reduction targets.

- Reduced investment associated with large scale solar installations will compel the product adoption. Cost reductions in solar panels, inverters, and other key components have enhanced the financial feasibility of projects. Furthermore, growing ambitious renewable energy goals and incentives tailored to large-scale solar installations will complement the market growth.

Learn more about the key segments shaping this market

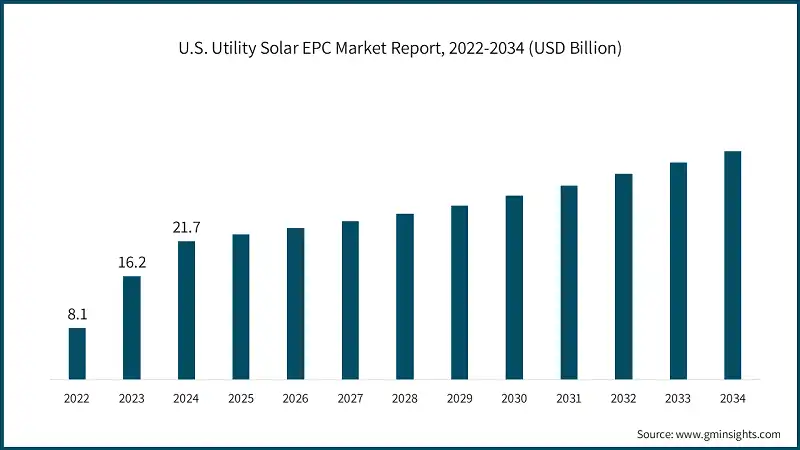

- The U.S. utility solar EPC market recorded a valuation of over USD 8.1 billion in 2022, rising to USD 16.2 billion in 2023 and reaching USD 21.7 billion in 2024. Rising policy support and incentives, including the Investment Tax Credit (ITC), offering a 30% tax credit for solar installations, aimed at encouraging investments in large-scale solar projects, will augment the product adoption. Additionally, Renewable Portfolio Standards (RPS) in states such as California, Texas, and New York, mandate utilities to procure a specific percentage of their energy from renewable sources, leading to foster the demand for solar EPC services.

- Growing collaborations between public entities and private solar developers to accelerate the adoption of renewable energy will propel the business statistics. Active participation of government agencies and utility providers with EPC providers to streamline permitting, secure financing, and ensure compliance with environmental standards will foster an ecosystem where large-scale solar projects can be developed efficiently, contributing to the growth of the solar EPC sector.

- Canada utility solar EPC market is set to surpass USD 420 million by 2034. The country’s renewable energy initiatives, such as the Pan-Canadian Framework on Clean Growth and Climate Change, will provide a solid foundation for the adoption of utility-scale solar projects. Furthermore, increasing provincial policies such as Ontario's Long-Term Energy Plan and Alberta's Renewable Electricity Program offers specific incentives, including feed in tariffs, tax credits, and renewable energy auctions, encouraging investment in large-scale solar projects. These policies will boost the demand for EPC services to design and construct these installations.

- Rising countries’ focus on transitioning from fossil fuels to renewable energy including modernizing their grid infrastructure will stimulate the project integration with energy storage solutions to support grid stability and peak demand management, further incentivizing the adoption of EPC services for seamless project execution.

- Growing adoption of advanced solar technologies, such as bifacial solar panels and single axis tracking systems, aimed to transform the utility solar landscape in Canada will enhance the industry scenario. These technologies are designed to increase energy output and efficiency, making solar projects more viable in varying climatic conditions.

- Mexico utility solar EPC market is anticipated to grow more than CAGR 8% till 2034. Increasing abundance of solar resources, particularly in regions comprising of Sonora, Baja California, and Chihuahua will benefit the utility-scale solar projects, leading to higher energy yields and improved project economics, which drives the adoption of EPC services to develop these large-scale installations.

- Growing ambitious renewable energy goals, including generating 35% of its electricity from clean sources by 2024 coupled with supported policies such as the General Law on Climate Change and various renewable energy incentive programs will create a supportive regulatory environment, thereby driving the product demand.

- Furthermore, declining cost of solar photovoltaic (PV) modules, inverters, and other components will make large-scale projects more financially feasible. Lower costs will enable EPC firms to offer competitive project pricing, attracting utilities and private developers looking for affordable, scalable renewable energy solutions thereby improving the industry projections.

North America Utility Solar EPC Market Share

- The top five players in the North America utility solar EPC industry include L&T, First Solar, Sterling & Wilson, TBEA and SunPower. The market is competitive, featuring a mix of special solar EPCs, vertically integrated manufacturers, and large general contractors. Growing import tariffs along with policy shifts affect the turnkey costs and competitiveness, thereby favoring local content or vertically integrated suppliers.

- Collaboration is central to project execution, primarily as the projects grow larger and increasingly pair with storage. Strategic collaborations between developers, module suppliers, and EPC providers will mitigate tariff and supply chain risks. These collaborations allow stakeholders to reduce risk, access financing more easily, and accelerate construction timelines in a market constrained by interconnection delays and labor shortages.

- Large engineering and construction conglomerates have entered or expanded their renewable EPC offerings by acquiring specialized solar contractors or partnering with developers to build scale quickly. Financial players and infrastructure funds are backing EPCs or hybrids, enabling them to secure larger projects. Furthermore, integration with storage, scale and financing capabilities are key differentiators leading to market growth.

- Matrix Renewables is a global renewable energy IPP which builds, develops, finances, and operates green energy assets. The company operates projects in the U.S., with a portfolio totaling more than 1,182 MW. In December 2024, the company secured commitments from MUFG-led lender consortium and Microsoft for a 210 MW solar project in Texas.

- ACME Solar has a fully integrated in-house EPC and O&M capability to build, develop, and operate utility-scale solar, firm & dispatchable renewable energy (FDRE) projects. The total renewable energy portfolio stood at 6,970 MW, including both contracted and operational capacity.

North America Utility Solar EPC Market Companies

Eminent players operating in the North America utility solar EPC industry are:

- ACME Solar

- Borea Construction

- Blattner Company

- Black & Veatch

- Bechtel

- Core Development Group

- CS Energy

- First Solar

- KEC International

- PLC Constructors

- Risen Energy

- Larsen & Toubro

- SOLV Energy

- Sterling and Wilson Renewable Energy Limited

- Swinerton Incorporated

- SunPower

- SUNGROW

- TBEA Solar

- Tata Power Solar Systems

- Waaree Energies

- First Solar is a vertically integrated U.S. firm known for large utility-scale project deliveries and thin-film (CdTe) PV modules. The company reported revenue of USD 4.2 billion in 2024. Further, in April 2024, First Solar announced the acquisition of Evolar to accelerate the solar cell development, thereby strengthening the competitive position in the utility solar EPC market.

- Sterling & Wilson Renewable Energy delivers utility solar PV projects across the U.S., Europe, Africa, Asia Pacific and Middle East with a strong O&M portfolio and EPC. In September 2024, the company secured various EPC orders for large scale solar projects in India, thereby reinforcing its position as a leading global utility EPC contractor. In addition, the company recorded a revenue of USD 344.5 million in 2024.

- Larsen & Toubro has a diversified engineering & construction group with a strong renewable EPC division. The company executes large scale solar farms, grid integration, and balance-of-plant for utility PV projects worldwide. In July 2024, the company’s Power Transmission & Distribution division announced a significant EPC contract in the Middle East, thereby strengthening its global renewables EPC footprint. Additionally, in 2024 the company amounted to USD 25.1 billion revenue in 2024.

- TBEA is an electrical equipment and energy EPC provider, active in PV inverters, module supply, transformers, and utility-scale EPC services globally. In 2024, the company recorded the revenue of USD 13.7 billion. In June 2024, the company announced the completion of the first phase of a 1 GW solar project in Uzbekistan, underscoring the global solar EPC reach.

- SunPower is engaged in engaged in utility and C&I solar. In 2024, the company recorded the revenue for USD 108.7 million. Moreover, in December 2024, Complete Solaria completed its acquisition of SunPower’s assets, relaunch as SunPower in 2025, thereby preserving the brand in the solar EPC and services market.

North America Utility Solar EPC Industry News

- In September 2025, Greenskies Clean Energy entered in a 20 year agreement with Middletown Avenue, U.S. to provide 1,920 solar panels to produce more than 1.4 million kWh in a year. This will further generate more than USD 1.4 million in revenue for the city. In addition, this will enhance the overall solar footprint of the city.

- In November 2024, Matrix Renewables secured USD 376 million in financing for the construction of its 210 MW Stillhouse Solar project in Bell County, Texas. The project’s funding was sourced from multiple channels, including equity from U.S. investor Acadia Infrastructure and Microsoft’s purchase of environmental attribute certificates. Debt financing was provided by four banks: MUFG, HSBC, ING, and BBVA. Furthermore, this financing will escalate the project’s development and construction, contributing to the expansion of clean energy in the region.

- In October 2024, Lightsource announced the commercial operation of its 188MW Honeysuckle Solar project in St. Joseph County, Indiana. The project utilized 85% of local labor during construction and supported corporate investment, with Google securing a power purchase agreement (PPA) for the electricity. The solar farm provided a USD 30 million economic boost to the local community and delivered a USD 3 million development payment to St. Joseph County.

This North America utility solar EPC market research report includes an in-depth coverage of the industry with estimates & forecast in terms of volume and revenue in “(MW & USD Million)” from 2021 to 2034, for the following segments:

Market, By Capacity

- 50 kW to 1 MW

- >1 to 3 MW

- >3 to 10 MW

- >10 to 50 MW

- > 50 MW

The above information has been provided for the following countries:

- U.S.

- Canada

- Mexico

Frequently Asked Question(FAQ) :

Who are the key players in the North America utility solar EPC market?

Key players include ACME Solar, Borea Construction, Blattner Company, Black & Veatch, Bechtel, Core Development Group, CS Energy, First Solar, KEC International, PLC Constructors, Risen Energy, Larsen & Toubro, SOLV Energy, Sterling and Wilson Renewable Energy Limited, Swinerton Incorporated, SunPower, Sungrow, TBEA Solar, Tata Power Solar Systems, Waaree Energies.

What are the upcoming trends in the North America utility solar EPC market?

Key trends include solar-plus-storage integration, digitalization with AI-driven maintenance, repowering of early-generation solar farms, and adoption of advanced technologies like bifacial panels and tracking systems.

What is the growth outlook for the >1 MW to 3 MW segment from 2025 to 2034?

The >1 MW to 3 MW segment is set to grow at a CAGR of over 6% through 2034, due to community solar initiatives and balanced cost-to-energy output ratio.

Which region leads the North America utility solar EPC market?

The U.S. utility solar EPC market reached USD 21.7 billion in 2024

How much market share does the 50 kW to 1 MW capacity segment hold?

The 50 kW to 1 MW segment dominates with 7.6% market share and is expected to grow to more than USD 3 billion by 2034.

What is the current North America utility solar EPC market size in 2025?

The market size is projected to reach USD 23.7 billion in 2025.

What is the market size of the North America utility solar EPC in 2024?

The market size was USD 22.6 billion in 2024, with a CAGR of 5.3% expected through 2034 driven by government incentives, renewable energy targets, and increasing deployment of utility-scale solar projects.

What is the projected value of the North America utility solar EPC market by 2034?

The North America utility solar EPC market is expected to reach USD 37.7 billion by 2034, propelled by the Inflation Reduction Act, solar-plus-storage integration, and growing corporate renewable energy demand.

North America Utility Solar EPC Market Scope

Related Reports