Summary

Table of Content

North America Used Cars Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Used Cars Market Size

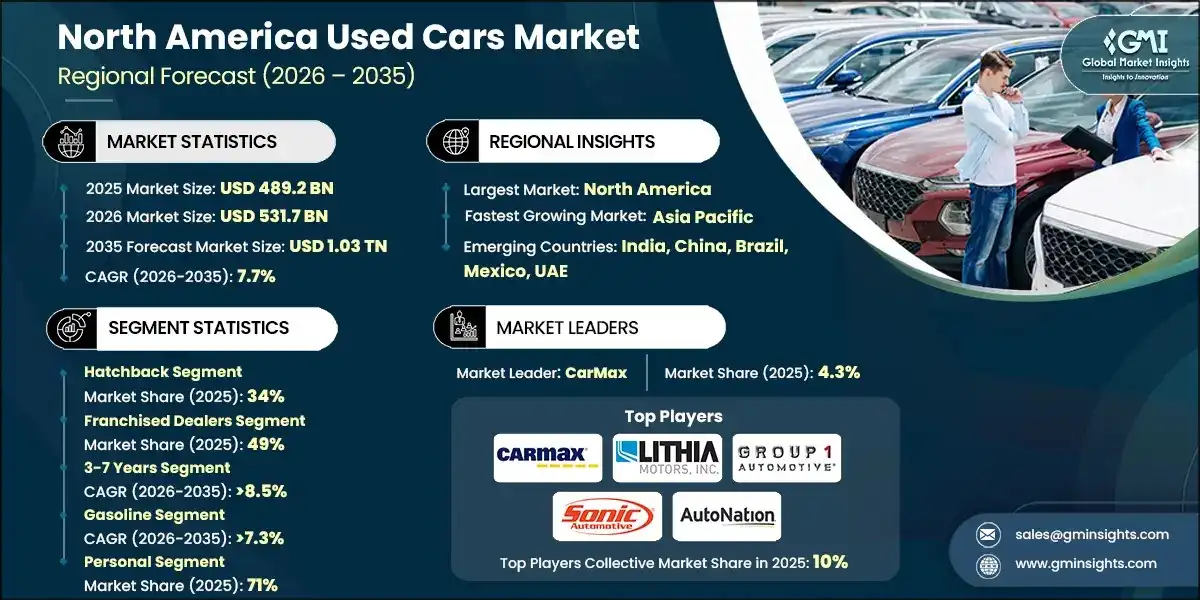

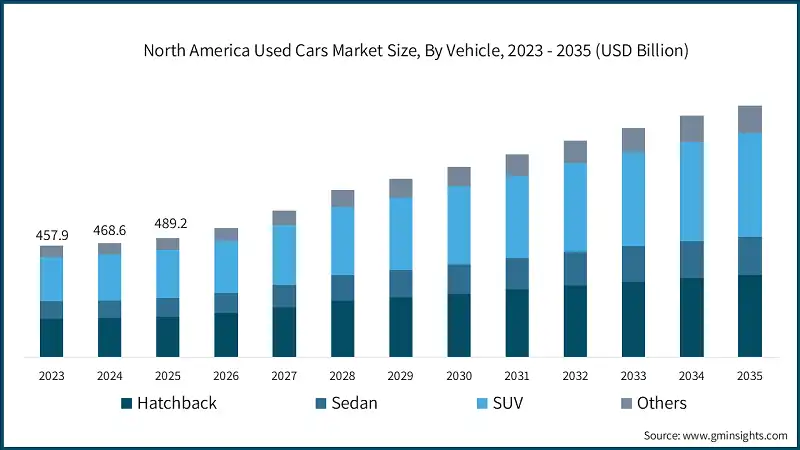

The North America used cars market size was estimated at USD 489.2 billion in 2025. The market is expected to grow from USD 531.7 billion in 2026 to USD 1.03 trillion in 2035, at a CAGR of 7.7%, according to the latest report published by Global Market Insights Inc.

To get key market trends

The growing gap in affordability between new and used vehicles is the main factor driving demand in the North American used car market. In September 2025, the average price for a new vehicle hit a record USD 50,080. This marks a 3.6% increase from the previous year and represents the largest annual rise since spring 2023. New vehicle prices have surged 22% since 2019, according to data from the Bureau of Labor Statistics. In comparison, used vehicle prices rose by 6% in the year ending August 2025, following spikes during the pandemic. The affordability crisis is especially tough for first-time buyers.

One in seven new car shoppers is looking for vehicles priced at USD 20,000 or less, a price point that is nearly nonexistent in the new vehicle market. This situation drives many buyers to the used market, where the segment priced below USD 15,000 has significant sales volumes, even though it only has 34 days of supply, 14 days less than the industry average indicating strong demand.

Additionally, consumers are keeping their vehicles longer. The average vehicle age rose from 12.5 to 12.6 years, while passenger cars now average 14 years. Both affordability issues and improved vehicle durability fuel demand for used cars as buyers seek reliable transportation at affordable prices.

The shift to a fully digital car-buying experience has significantly opened up the market for used vehicles. It has reduced barriers, improved price transparency, and let consumers handle much of the buying process from home. With 87% of buyers starting their search online and over 80% of dealer leads now generated digitally, the industry has reached a tipping point that favors retailers with strong online capabilities. A lot of investment has gone into digital infrastructure, including AI-driven pricing tools, virtual vehicle inspections, integrated financing, and home delivery logistics.

CarMax noted that 60% of customers start their search online before finalizing transactions in-store. Similarly, digital-first competitor Carvana has created a fully online model that generated USD 4.232 billion in revenue in Q1 2025, up 38% from the previous year. Digital transformation also benefits operations, specifically in inventory management. Advanced analytics help dealers reduce days-on-lot by 10-25% and align market prices better. Digital platforms offer transparent pricing, detailed vehicle history reports, and instant financing approval, which lower the search costs for consumers and speed up purchase decisions.

The growth of CPO programs addresses consumer concerns about vehicle condition, hidden problems, and maintenance history through standardized inspection checklists, detailed vehicle history reports, extended powertrain warranties, and roadside assistance. This quality assurance framework allows dealers to charge higher prices while also improving inventory turnover and gross profit per unit. For example, AutoNation reported a 14% increase in used vehicle gross profit in Q4 2024, partly due to the success of its CPO program and consistent pricing.

The CPO model is most effective for late-model, low-mileage vehicles (typically 0-5 years old with fewer than 75,000 miles), which is the fastest-growing part of the used market. Carvana's acquisition of a Stellantis franchise in March 2025 was aimed at gaining direct CPO rights and access to exclusive dealer auctions, highlighting the strategic advantage of CPO capabilities.

North America Used Cars Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 489.2 Billion |

| Market Size in 2026 | USD 531.7 Billion |

| Forecast Period 2026 - 2035 CAGR | 7.7% |

| Market Size in 2035 | USD 1.03 Trillion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for affordable mobility due to high new-car prices | This accelerates consumer shift toward used vehicles as households look for value and lower total cost of ownership. It strengthens demand across dealer networks and online platforms, supporting steady volume growth even during economic uncertainty. |

| Expansion of digital retailing and online-to-door used car platforms | Digital channels reduce friction in search, comparison, and financing, expanding the buyer pool beyond local markets. As platforms improve logistics, reconditioning, and inspection transparency, online conversions rise and market velocity improves. |

| Growth of Certified Pre-Owned (CPO) programs | CPO vehicles increase buyer confidence through warranty coverage and standardized inspections, encouraging purchases of higher-value, near-new cars. This also boosts dealer margins and stabilizes inventory turnover. |

| Increasing supply of used EVs entering the secondary market | As first-cycle EV leases expire, a structured used-EV segment is emerging with falling prices and better diagnostics. This widens consumer access to electrified mobility and lifts overall market value over time due to higher average ticket sizes. |

| Pitfalls & Challenges | Impact |

| High interest rates and tightened auto financing | Elevated financing costs reduce affordability for many retail buyers, especially in the mid-income segment. This can slow transaction velocity and push some consumers toward lower-priced or older vehicles, affecting mix and margins. |

| Fragmentation of the market and consumer trust issues | The used-car ecosystem is dominated by thousands of small and independent players, creating inconsistent quality, inspection, and disclosure standards. This fragmentation weakens buyer confidence and increases the need for strong verification protocols and regulated sales processes. |

| Opportunities: | Impact |

| Scaling of reconditioning operations and centralized refurbishment hubs | Investments in large-scale refurbishment centers improve vehicle turnaround, consistency, and warranty readiness. This allows sellers to command higher ASPs and operate with tighter cost controls, improving profitability. |

| Battery health diagnostics and new service models for used EVs | Reliable battery testing unlocks transparency in used-EV pricing and reduces buyer risk perception. It also opens new revenue pools for warranties, certified battery programs, and EV-specific reconditioning services. |

| Cross-border remarketing and export opportunities | Demand from Mexico, LATAM, and certain Canadian segments provides a strong outlet for models with slower domestic movement. This supports price stability and allows dealers to optimize inventory through multi-country channels. |

| Market Leaders (2025) | |

| Market Leaders |

4.3% market share |

| Top Players |

Collective market share in 2024 is Collective Market Share in 2025 is 10% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, China, Brazil, Mexico, UAE |

| Future Outlook |

|

What are the growth opportunities in this market?

North America Used Cars Market Trends

Digital-first consumer journeys are now the norm about 87% of used buyers start online, then either complete remotely or finish in-store after pre-qualifying and comparing inventory across markets. The retailers that fused pricing algorithms with omnichannel workflows reported >5% margin gains and materially faster turns, a flywheel that compounds working-capital efficiency in the North America market.

CarMax shows the hybrid model’s payoff roughly mid-30s days-to-turn while Carvana’s fully online playbook demonstrates how logistics and data alignment can push even faster velocity. Expect AI use cases pricing, inventory, personalization to keep expanding over the next two to three years in the North America used cars market.

Certified pre-owned (CPO) is a trust engine. Shoppers want assurance on condition and future costs, and manufacturers have leaned into tighter inspections, longer warranties, and battery-health disclosure for EVs Toyota’s program scale and dealer participation are good barometers for why CPO outpaced used volume growth in 2024. The real driver here is transparency: standardized checklists, clean title verification, and bundled roadside assistance let retailers’ prices confidently and move metal faster in the North America market.

Average used EV prices dropped more than 40% from Jan 2022 to Feb 2025, bringing many models into reach for mid-income households; Oregon even overtook California in EV share at a major national retailer, pointing to broader geographic adoption across the North America used cars market.

Policy support helped; the federal Used Clean Vehicle Credit of up to USD 4,000 (expired Sep 30, 2025) could be assigned at the point of sale to cut effective prices; certain states still stack incentives that keep the math compelling for qualified buyers. As new EV penetration rises, the used EV pipeline grows but charging access and battery confidence remain the gating factors 217,929 public outlets serving 6.5 million EVs implies about 30 EVs per port nationally, still tight for mainstream comfort in the North America used cars market.

Three-year lease returns are still below late-2010s norms after 2020–2022 disruptions, which keeps late-model prices firmer than many expected; wholesale indices fluctuated through 2025, while retail asking prices were stickier, squeezing spreads for dealers in the North America used cars market. Faster reconditioning, sharper pricing algorithms, and diversified sourcing (including closed auctions and OEM partnerships) have become core muscle.

The FTC’s CARS Rule was vacated in Jan 2025, but enforcement pressure didn’t fade; states from California to Pennsylvania advanced disclosure and pricing standards while the FTC’s Safeguards Rule tightened data-security obligations noncompliance carries real risk for retailers scaling digital operations in the North America market.

North America Used Cars Market Analysis

Learn more about the key segments shaping this market

Based on vehicle, the North America used cars market is divided into hatchback, sedan, SUV, and others. The hatchback segment dominated the market, accounting for around 34% in 2025 and is expected to grow at a CAGR of over 7.2% through 2035.

- SUVs are the volume and value anchor of the North America used cars market, supported by perceived safety, practicality, and residual strength that keeps pricing 25–30% above comparable sedans of similar age and mileage in many cases. Hatchbacks remain the urban efficiency play, while sedans still move big units because of their large installed base; specialty vehicles from convertibles to sports cars add mix value, with seasonality shaping price realization across regions. Electrified SUVs such as Model Y and Mustang Mach E are now visible in mainstream inventory flows, giving dealers more tools to meet fuel-cost and emissions preferences in the North America used cars market.

- Looking closer, CPO penetration is highest in late model SUVs and premium sedans, where warranty and inspection credentials justify premiums and accelerate turns, while older, higher mileage vehicles concentrate in independent and BHPH channels with different economics. Price sensitivity remains strong below USD 15,000, where days’ supply trails the overall market evidence that affordability drives throughput in the North America market.

Learn more about the key segments shaping this market

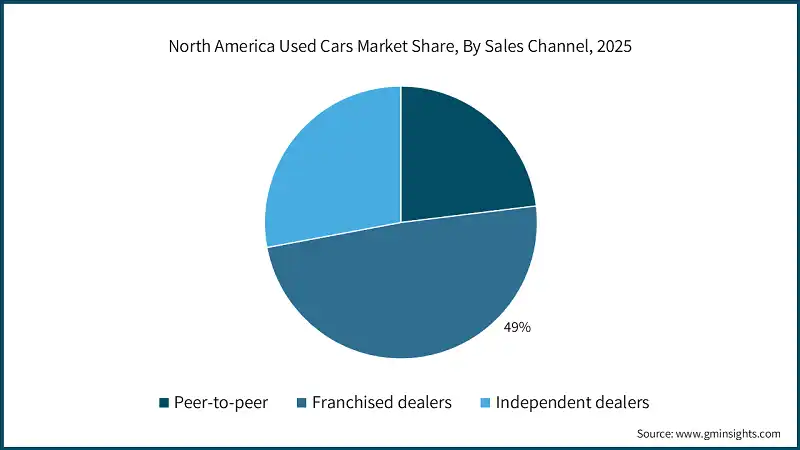

Based on sales channel, the North America used cars market is segmented into peer-to-peer, franchised dealers, and independent dealers. The franchised dealers segment dominates the market, accounting for around 49% share in 2025, and the segment is expected to grow at a CAGR of over 7.7% between 2026 and 2035.

- Franchised dealers dominate late model, higher value transactions thanks to OEM relationships, access to off-lease stock, and CPO programs; omnichannel platforms have closed the convenience gap, letting shoppers pre-qualify, price, and schedule delivery before stepping into a store in the North America used cars market. Peer to peer platforms is the fast growth channel, removing dealer margins for price-conscious buyers while layering in vehicle history, escrow, and inspection services to mitigate fraud risk; independent dealers continue to serve older vehicles and credit-constrained segments within house financing capabilities.

- Analytics-led pricing and diversified sourcing are table stakes. Dealers that standardize reconditioning, accelerate titles, and align list prices with market comps keep days-to-turn low and F&I attachment healthy core levers for resilient unit economics in the North America market.

Based on vehicle age, the North America used cars market is segmented into 0-3 years, 3-7 years, and above 7 years. The 3-7 years segment dominates the market, accounting for around 41% share in 2025, and the segment is expected to grow at a CAGR of over 8.5% between 2026 and 2035.

- The 3-7 year age group enjoys a strong position in the used vehicle market. It meets the need for modern features, technology, and safety systems without suffering the dramatic depreciation found during the first three years of ownership. These vehicles are typically able to retain 40-60% of their original MSRP, offering significant savings over new vehicles, yet still provide good reliability and are often still under warranty.

- Added to this, the segment enjoys various sources of supply, including offlease returns entering the 3-4 year range, trade-ins from buyers moving into new vehicles, and fleet disposals from rental car companies and corporate fleets. Popular models in this category include mainstream SUVs and sedans from brands such as Toyota, Honda, Ford, Chevrolet, and Nissan, all of which have both high levels of reliability and low costs.

- The growth experienced within the segment really is reflective of increasing sophistication by consumers in how they assess the total cost of ownership. Buyers appreciate that 3-7 year-old vehicles represent great value because they avoid new vehicle depreciation while still maintaining much of the value in modern features and reliability. There are certified pre-owned programs that work quite well in this area, as most manufacturers limit CPO eligibility to less than 6 years old with less than 75,000 miles.

Based on fuel, the North America used cars market is divided into gasoline, diesel, and electric. The gasoline segment dominated the market, accounting for around 59% share in 2025 and the segment is expected to grow at a CAGR of over 7.3% between 2026 and 2035

- Fuel type segmentation shows the gradual shift toward electrification in the used vehicle market while internal combustion engines still hold a strong position. Gasoline segment includes most used vehicle transactions, highlighting gasoline's long-standing dominance in the North American market and ongoing consumer preference for traditional engines. Gasoline vehicles have the advantage of widespread refueling stations, lower purchase costs compared to diesel and electric options, and general consumer familiarity.

- The segment features economy cars that achieve over 30 mpg combined fuel economy, mainstream sedans and SUVs averaging 25-28 mpg, and performance vehicles and larger trucks averaging 15-20 mpg. Popular models include the Honda Accord, Toyota Camry, Ford F-150, Chevrolet Silverado, Toyota RAV4, and Honda CR-V. Although the segment's growth rate lags slightly behind the overall market due to the gradual loss of market share to electric and hybrid options, the absolute volume and value growth remain strong.

- Buyers who need maximum towing capacity (up to 37,000 lbs for heavy-duty pickups), payload capability, and fuel efficiency for long trips often choose diesel powertrains. New diesel vehicles typically have a premium of USD 8,000-12,000 over gasoline counterparts, and while these premiums persist in the used market, they moderate to USD 4,000-8,000 for vehicles that are 3-5 years old.

- The diesel fuel prices are usually higher than gasoline prices by USD 0.30-0.60 per gallon, which somewhat offsets fuel economy benefits. The outlook for growth in this segment is moderate, with strong demand for heavy-duty trucks balanced by decreasing diesel availability in passenger cars and changing consumer preferences toward gasoline and electric options.

- The rapid growth in this segment comes from falling used EV prices (down more than 40% from January 2022 to February 2025), state and federal incentives, and better charging infrastructure. The Tesla Model 3 and Model Y lead the used EV sales, making up most transactions, while other models like the Ford Mustang Mach-E, Chevrolet Bolt EV/EUV, Nissan Leaf, and Volkswagen ID.4 also contribute to volume.

Based on end use, the North America used cars market is divided into personal and commercial. The personal segment dominated the market, accounting for around 71% share in 2025.

- Personal use refers to vehicles bought by a person for use in households, going to offices, and running errands and enjoyable drives. The segment represents approximately 71% of the used vehicle market and indicates the significance of a vehicle for life in North America, where public transport is poorly developed outside metropolitan areas. The buyers in this category have different preferences regarding the type of vehicle. SUVs and crossovers are the largest and fastest-growing segments, while sedans, hatchbacks, and pickup trucks trail them.

- The average time for loans can extend to 72 months and sometimes even 84 months to maintain reasonable monthly payments. More personal buyers are beginning their research online.

- Commercial use is anticipated to reach USD 140.8 billion in 2025 and increase further to USD 321.9 billion by 2035 at an annual growth rate of 8.5%, thereby setting the pace for personal use. This class includes fleet vehicles for business, delivery trucks and vans, ride-sharing and taxi services, rental car fleets, and commercial transportation.

- The commercial segment is very different, with fleet managers often opting for standardized vehicle setups that simplify maintenance and driver training. Tax benefits such as Section 179 deductions enable businesses to deduct the full purchase price of eligible vehicles in the year they purchase them, although subject to certain limits. Electric vehicles are gaining traction among commercial buyers in order to reduce operating costs and improve corporate sustainability.

- New electric delivery vans are coming to market, including the Ford E-Transit, Mercedes-Benz eSprinter, and BrightDrop Zevo. This segment is expected to exhibit strong growth, mainly underpinned by ongoing e-commerce expansion, increasing urbanization that creates added demand for deliveries, and the trend toward fleet electrification that will spur demand for used electric commercial vehicles as early adopters look to newer models.

Looking for region specific data?

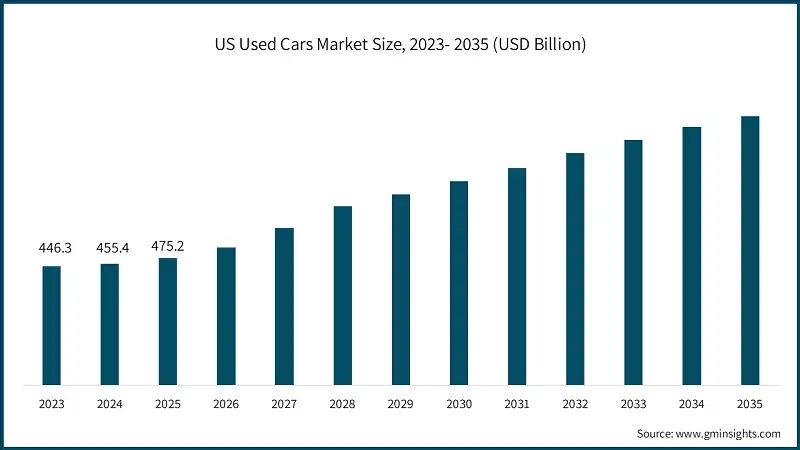

US dominated the North America used cars market with around 97% share and generated USD 475.2 Billion in revenue in 2025.

- The U.S. market shows clear differences in vehicle preferences, pricing, and trends across regions. Southern and Western states strongly prefer pickup trucks and SUVs. This is influenced by rural areas, outdoor activities, and business needs. In contrast, Northeastern states favor sedans and compact cars. This choice reflects urban density, limited parking, and higher fuel costs.

- California is the largest state market, making up about 12% of U.S. used vehicle sales. It also leads to electric vehicle adoption, with the highest EV rates and a well-developed charging network. Texas ranks second in market size, supported by a large population, strong economic growth, and a preference for pickups and SUVs. Florida, New York, and Pennsylvania round out the top five state markets. Climate significantly impacts vehicle values. Vehicles from Southern and Western states typically have higher prices because they are less affected by road salt corrosion. In contrast, vehicles from the Northeast and Midwest usually depreciate faster due to rust and weather-related damage.

- The U.S. market's growth is driven by ongoing affordability benefits compared to new cars, with the price gap exceeding $20,000 in 2024. Digital advancements enable online vehicle searches, financing, and home delivery. The rise of certified pre-owned programs also increases consumer trust. Gradual electrification is opening another growth area. However, challenges remain. High interest rates limit affordability. Average used car loan rates range from 7.15% to 21.58% depending on credit scores. Pricing changes make inventory management and consumer buying decisions more difficult.

- Supply issues exist for late-model vehicles because of production slowdowns during the pandemic. Regulatory changes add complexity with shifting federal and state rules for pricing transparency, consumer protection, and data security. Still, the U.S. market has a positive outlook. Growth is supported by demographic trends like population increases and more households forming. The ongoing expansion of the vehicle fleet and the trend toward used vehicles, driven by challenges in new vehicle affordability, also contribute.

Canada used cars market is expected to experience robust growth between 2026 and 2035. Canada represents a smaller but stable market at USD 14 billion in 2025, growing to USD 24.7 billion by 2035 at a 5.8% CAGR.

- The Canadian market shares many similarities with the U.S. market, but it obviously differs in a number of key areas. The ownership rate of vehicles is high, approximately 0.67 vehicles per person. The country has large rural areas; personal transportation is required, and winters are harsh, which accelerates vehicle depreciation and replacement cycles. There are some unique challenges facing Canada. It has a much lower population density-about 38 million people, mostly residing along the U.S. border. New vehicle prices are higher due to import duties and currency exchange rates. Also, provincial regulations surrounding used vehicle sales and safety inspections are more restrictive.

- By market share, Ontario is the most significant provincial market at about 38% of all used vehicle sales in Canada, followed by Quebec at 23%, British Columbia at 13%, and Alberta at 11%. Canadians favor SUVs and crossovers that can manage winter conditions; adding all-wheel drive often increases the price substantially. In the Western provinces, pickup trucks are very popular, with many jobs related to the resource industry and with outdoor recreation activities.

- Slower population growth-at about 1% per year compared with 0.5% in the U.S.-limits the overall expansion of the Canadian market. Some provinces also have higher new vehicle costs relative to income and a more concentrated dealer network with fewer independent sellers. Nevertheless, the market benefits from some of the same digital trends as the US, such as increased online vehicle searches and the adoption of omnichannel retail.

- Canadian consumers are very brand-loyal to domestic manufacturers such as Ford, General Motors, and Chrysler, as well as Japanese brands such as Toyota, Honda, and Mazda. Most European luxury brands have a much smaller market share than in the United States.

North America Used Cars Market Share

- The top 7 companies in the North America used cars industry are CarMax, AutoNation, Carvana, Lithia Motors, Penske Automotive Group, Group 1 Automotive, and Sonic Automotive contributed around 11% of the market in 2025.

- CarMax is the market leader with a 4.31% share by operating 250 stores across the country. It provides integrated online services that enable customers to search for inventory across all stores, complete financing applications, and schedule test drives, with options for either in-store pickup or home delivery. The company pioneered the no-haggle pricing model in the used vehicle market, which has set a very clear pricing benchmark throughout the industry. CarMax has its own financing through CarMax Auto Finance, which handles approximately 40% of customer loans and generates significant interest income and fees. Recently, it reported an inventory turnover of approximately 36 days versus the industry average of more than 45 days, reflecting very strong operational efficiency.

- Lithia Motors maintains the largest network of franchised dealerships across North America, with more than 300 locations within the United States and Canada. Lithia sells new and used vehicles while providing services, parts, and financing to build diverse income streams with long-lasting customer relationships. Lithia pursued an aggressive acquisition strategy, completing over 30 dealership buyouts in 2023-2024 to grow its geographic footprint and representation of brands.

- AutoNation operates approximately 230 locations for most major automotive brands. In Q4 2024, the company saw a 14% increase in used vehicle gross profit thanks to disciplined pricing, operational efficiencies, and a strong certified pre-owned program. Integrated service operations provide consistent revenue from vehicle maintenance and repair work. The service operations account for roughly 15% of gross profit while comprising less than 10% of total revenue.

- Group 1 Automotive combines new and used vehicle sales with service, parts, and financing, creating diversified revenue streams and continual customer touchpoints. Group 1 has expanded through strategic acquisitions, focusing on high-growth markets and premium brands. The AcceleRide digital platform allows online vehicle browsing, financing, valuing trades, and home delivery. Group 1 benefits from partnerships with manufacturers that supply off-lease vehicles, certified pre-owned programs, and marketing support. Key strategic objectives of the company revolve around the enhancement of its digital platform, further growth through targeted acquisitions in appealing markets, and enhancements to finance and insurance product offerings. Sonic Automotive has 1.15% market share, operating approximately 100 franchised dealerships under the Sonic Automotive and EchoPark brands.

North America Used Cars Market Companies

Major players operating in the North America used cars industry are:

- AutoNation

- CarMax

- Carvana

- Group 1 Automotive

- Hendrick Automotive Group

- Holman

- Ken Garff

- Larry H. Miller

- Lithia Motors

- Penske Automotive Group

- Sonic Automotive

- Automotive retail is a fragmented competitive landscape. Consumers generally prefer to purchase from dealers that are in close proximity for convenience, access to service, and local reputation. Digital transformation has enabled larger competitors to expand their reach through online vehicle searches, home delivery, and remote financing options.

- There has been some industry consolidation via mergers and acquisitions, although transaction volumes fell from around 700 in 2021 to 500 in 2024 due to mismatched valuations between buyers and sellers. Strategic buyers, including publicly traded dealer groups, private equity firms, and consolidation platforms, still have an appetite for acquiring dealerships in desirable markets.

- Target dealerships include those with high profits, desirable brand representation, and growth potential. The competitive outlook suggests further gradual consolidation. Large players are likely to increase market share organically, through acquisition, and by enhancing operational efficiency. Meanwhile, independent dealers will hold their ground through personalized service, local market knowledge, and flexible business models.

North America Used Cars Industry News

- In January 2025, the Fifth Circuit invalidated the FTC's CARS Rule on procedural grounds, creating a state of regulatory uncertainty among dealers. This led to increased federal and state enforcement actions targeting deceptive pricing and add-on disclosures.

- In February 2025, CarMax reported that used EV prices dropped over 40% since 2022, while those of ICE vehicles fell by 12%. Larger geographic dispersion outside of coastal markets was also observed in emerging EV adoption hotspots such as Oregon, Utah, New Mexico, Minnesota, and New Jersey.

- In March 2025, Carvana bought a Stellantis franchise dealership to capture direct CPO rights and obtain access to closed manufacturer auctions. This step helps the company with better sourcing of inventory, also revealing deeper linkages between digital retailers and OEM-linked channels.

- In September 2024, Rivian introduced a pre-owned program, which incorporated EV-specific warranties, battery health reports, and roadside assistance. It will increase consumer confidence and help residual value stability for the brand's electric trucks and SUVs.

- In September 2024, the expiry of the U.S. federal Used Clean Vehicle Credit reduced short-term incentives for used EV buyers. At the same time, state programs maintained support for EV demand in California, New York, and Colorado.

- In March 2024, General Motors teamed with CarMax in a used-vehicle certification deal, which allowed for GM-backed warranties on the inventory of CarMax. This highlighted how OEMs and retailers are continuing to collaborate in pursuit of value in this burgeoning CPO market.

- In 2024, U.S. dealership M&A activity declined about 30% from peak 2021 levels as valuation gaps and high interest rates took their toll. Still, strategic buyers and private equity firms continued targeting high-profit, high-growth franchise groups

- In 2024, industry surveys indicated that over 80% of dealers planned to invest in AI for pricing, inventory management, and customer personalization. Early adopters saw margin gains above 5% and improvements in inventory turnover of up to 30%.

- In 2024, the average age of vehicles in the U.S. increased to 12.6 years. Affordability pressures delayed new purchases among consumers and supported ongoing replacement-driven demand in the used car market.

The North America used cars market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($Bn) & shipments (units) from 2022 to 2035, for the following segments:

Market, By Vehicle

- Hatchback

- Sedan

- SUV

Market, By Sales Channel

- Peer-to-peer

- Franchised dealers

- Independent dealers

Market, By Vehicle Age

- 0-3 years

- 3-7 years

- Above 7 years

Market, By Fuel

- Gasoline

- Diesel

- Electric

- BEV

- HEV

- PHEV

- FCEV

Market, By End Use

- Personal

- Commercial

Market, By Price Range

- Under USD 7,000

- USD 7000-USD 10,000

- USD 10,000-15,000

- Above USD 15,000

The above information is provided for the following regions and countries:

- US

- Northeast

- New Jersey

- New York

- Pennsylvania

- New England

- Midwest

- Illinois

- Indiana

- Michigan

- Ohio

- Missouri

- Nebraska

- North Dakota

- South Dakota

- South

- Delaware

- Florida

- Georgia

- Maryland

- North Carolina

- South Carolina

- West

- Arizona

- Colorado

- Montana

- Alaska

- California

- Northeast

- Canada

- Ontario

- Quebec

- British Columbia

- Alberta

- Manitoba

Frequently Asked Question(FAQ) :

Who are the major players in the North America used cars industry?

Major players include AutoNation, CarMax, Carvana, Group 1 Automotive, Hendrick Automotive, Holman, Ken Garff, Larry H. Miller, Lithia Motor, Penske Automotive, and Sonic Automotive.

Which country dominated the North America used cars sector?

The United States dominated the market with a 97% share, generating USD 475.2 billion in revenue in 2025. Regional preferences varied, with Southern and Western states favoring pickup trucks and SUVs, while Northeastern states leaned towards sedans and compact cars.

What are the key trends in the North America used cars market?

Key trends include digital-first buying journeys, AI-based pricing and inventory tools, rising CPO vehicle demand, falling used EV prices, and supportive policies such as the federal Used Clean Vehicle Credit.

What was the market share of the 3-7 years vehicle segment in 2025?

The 3-7 years vehicle segment held a 41% market share in 2025 and is anticipated to observe over 8.5% CAGR up to 2035.

What was the market size of the North America used cars in 2025?

The market size was estimated at USD 489.2 billion in 2025, driven by the growing affordability gap between new and used vehicles.

What is the projected value of the North America used cars market by 2035?

The market is poised to reach USD 1.03 trillion by 2035, growing at a CAGR of 7.7% from 2026 to 2035.

What is the expected size of the North America used cars industry in 2026?

The market size is expected to reach USD 531.7 billion in 2026.

What was the market share of the hatchback segment in 2025?

The hatchback segment accounted for around 34% of the market in 2025 and is expected to grow at a CAGR of over 7.2% through 2035.

What was the market share of franchised dealers in 2025?

Franchised dealers dominated the market with a 49% share in 2025 and is set to expand at a CAGR of over 7.7% till 2035.

North America Used Cars Market Scope

Related Reports