Summary

Table of Content

North America Substation Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Substation Market Size

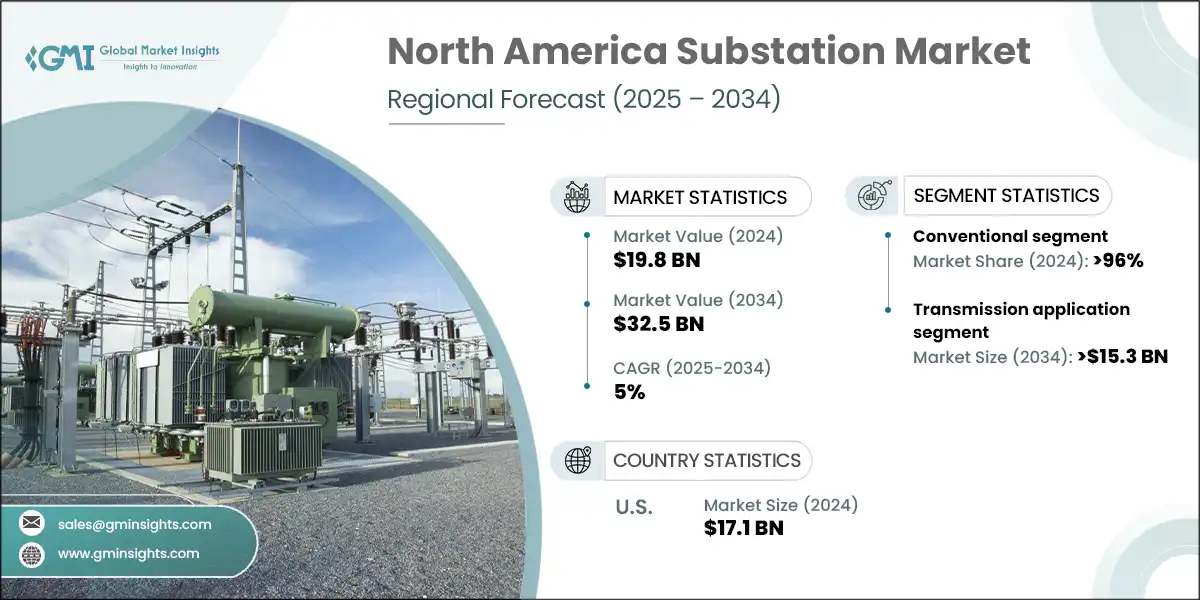

The North America substation market was estimated at USD 19.8 billion in 2024. The market is expected to grow from USD 21 billion in 2025 to USD 32.5 billion in 2034, at a CAGR of 5%.

To get key market trends

- Increased electrification of industrial processes and growth in data centers in North America are contributing immensely to the demand for substations. In accordance with the IEA's Electricity Mid-Year Update 2025, electricity demand boosted in early 2025 due to industrial and digital infrastructure expansion amid wider economic slowdowns. This consistent growth in power consumption requires strong upgrading of substations to support increased loads and provide grid reliability.

- The swift integration of solar and wind power in the U.S. is necessitating sophisticated substations to provide voltage stabilization and deal with intermittent generation. Over 150 GW of new solar capability by 2030 is forecasted by EIA's Annual Energy Outlook 2025, backed by over USD 100 billion of renewable investments since 2021. Such developments necessitate substations with variable energy sources integration into the transmission system.

- The grid modernization efforts of Canada are driving substation upgrades, especially through its Smart Grid Program. The federal government has financed over 20 projects within excess of USD 75 million USD since 2021 to increase grid reliability as well as enable the integration of clean energy. Such projects tend to include the upgrading of substations with digital automation and real-time monitoring technologies to enable distributed energy resources as well as optimizing operational efficiency.

- The accelerating use of electric vehicles (EVs) is boosting electricity consumption, leading utilities to upgrade substations for load management and rapid-charging functionality. The U.S. Department of Energy's 2023 EV Charging Infrastructure Strategy sets the stage for deploying 500,000 chargers by 2030, supported by USD 7.5 billion in federal investment through the Bipartisan Infrastructure Law. Substations must accommodate more dynamic and expanded grid operations to meet these demands.

- Resilience to extreme weather in hurricane-susceptible areas of the southeast U.S. is a key substation market driver. After Hurricane Ida in 2021, utilities started hardening, and in 2023, the DOE's GRIP program invested USD 10.5 billion to make the grid more resilient. This includes funding for substation upgrades like underground and storm-proofing to minimize outage threats and improve recovery capacity during natural disasters.

- Decentralized energy systems in western states such as California are demanding more flexible substations. In 2024, the California Energy Commission documented more than 15 GW of distributed solar capacity, triggering substation upgrades for bidirectional power flow and intelligent control systems. California has spent USD 1.3 billion on grid modernization since 2021, largely to upgrade substations to accept distributed generation.

- The substation infrastructure in the Midwest is an urgent issue, with most components well beyond their projected lifespan. The EIA Annual Energy Outlook 2025 reports that more than 70% of transformers in certain areas are antiquated, leading to utility investments in replacement and digital upgrades. Federal and state governments have invested USD 5 billion in grid modernization to address aging substations to enhance reliability and limit outages.

North America Substation Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 19.8 Billion |

| Forecast Period 2025 - 2034 CAGR | 5% |

| Market Size in 2034 | USD 32.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Expansion of Smart Grid Networks | Smart grid expansion drives substation market growth by integrating advanced communication and automation technologies. This enhances grid reliability, supports renewable energy sources, and enables real-time monitoring, requiring modern substations to manage complex, decentralized power distribution systems efficiently. |

| Rising Peak Load Demand | Increasing peak electricity demand from urbanization, electrification of transport, and industrial growth necessitates robust substations. These facilities ensure grid stability, manage load fluctuations, and prevent outages, prompting investments in upgrading and expanding substation infrastructure across North America. |

| Pitfalls & Challenges | Impact |

| High Dependency on Imports | Heavy reliance on imported substation components exposes North America to supply chain disruptions, price volatility, and geopolitical risks. This dependency can delay infrastructure projects, increase costs, and hinder domestic innovation, making the market vulnerable to external economic and trade pressures. |

| Opportunities: | Impact |

| Integration of Renewable Energy Sources | The growing adoption of solar and wind energy requires advanced substations to manage variable power inputs. This creates opportunities for innovation in grid infrastructure, including smart substations that support energy storage, real-time monitoring, and seamless renewable integration. |

| Modernization of Aging Infrastructure | Many existing substations in North America are outdated and require upgrades. Modernization efforts offer opportunities for deploying advanced technologies, improving efficiency, and enhancing grid resilience, while also aligning with sustainability goals and regulatory mandates for cleaner energy systems. |

| Market Leaders (2024) | |

| Market Leaders |

12.5% market share |

| Top Players |

Collective market share in 2024 is 45% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | U.S. |

| Fastest Growing Market | Mexico |

| Emerging Country | Mexico |

| Future outlook |

|

What are the growth opportunities in this market?

North America Substation Market Trends

- North America is seeing an increase in substations specifically for the integration of renewable energy, particularly in wind and solar-dominant areas. They are designed to support variable loads and bidirectional power flows. In 2025, the IEA published that U.S. electricity generation from renewables hit new heights, with a boost from expanding grid connections and substation enhancements to accommodate distributed generation.

- Substations are being increasingly configured to accommodate long-duration energy storage systems, which allow for greater grid stability and peak load management. As the U.S. Department of Energy's 2025 report states, market shifts are demanding substations that can handle 12 to 24-hour firm capacity storage, particularly in high-renewable penetration regions.

- Texas is fast upgrading its substation facilities to enhance reliability and handle increasing demand. ERCOT North, a premier power hub, has had continuous advances in substation automation and electronic controls. The EIA wholesale electricity market statistics indicate higher trading volumes and infrastructure investment for this area from 2021 to 2025.

- Utilities in North America are implementing AI and machine learning for predictive substation maintenance. The technologies mine sensor data to predict equipment failure and maximize asset performance. In 2024, a number of Canadian utilities initiated the implementation of AI platforms for monitoring transformer health as well as circuit breaker performance, cutting downtime and maintenance expenses. This aligns with Canada's drive for wiser grid operations in its Clean Electricity Regulations.

- California is at the forefront of environmentally friendly substations, substituting SF6 gas with low-GWP substations. In 2023, PG&E detailed plans to retrofit several substations with vacuum-insulated switchgear to advance state climate targets. This is in accordance with California's overall decarbonization plan and contributes to its target of carbon neutrality by 2045.

- Florida is investing in microgrid-ready substations to enhance disaster resilience. In 2022, the Florida Public Service Commission approved funding for utility-scale microgrid substations in hurricane-prone areas. These substations can operate independently during outages, supporting critical infrastructure like hospitals and emergency services, reflecting a growing trend in climate adaptation.

- Ontario utilities are increasingly leveraging digital twin technology to model substation operations and improve performance. In 2021, Hydro One initiated a pilot project leveraging digital twins to simulate substation behavior under various load conditions. This project aids in minimizing operational risks and enhancing planning for future grid growth in line with Canada's digital infrastructure ambitions.

North America Substation Market Analysis

Learn more about the key segments shaping this market

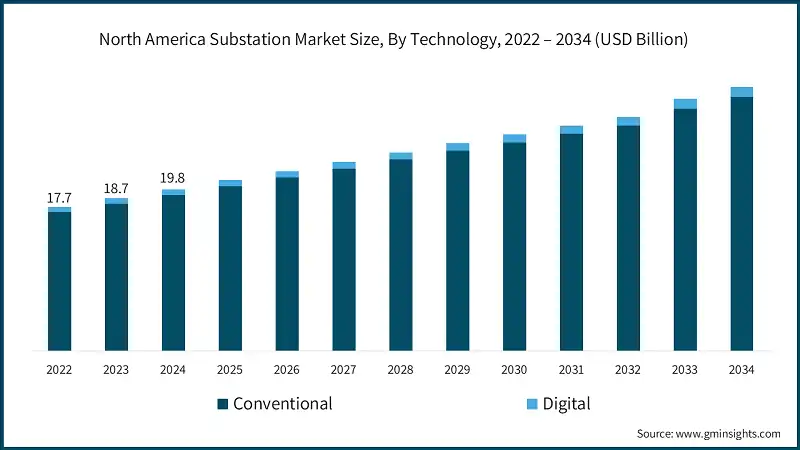

- Based on technology, the industry is segmented into digital and convention substations. The substation market in North America was valued at USD 17.7 billion, USD 18.7 billion, and USD 19.8 billion in 2022, 2023 and 2024 respectively. The conventional segment dominated over 96% market share in 2024 and is expected to grow at a CAGR of 4.9% through 2034.

- A major driver for conventional substations is the need to replace aging infrastructure. Many substations built in the mid-20th century are nearing the end of their operational life. Utilities across the U.S. and Canada are investing in upgrades to maintain reliability and safety. The U.S. DOE’s Grid Modernization Initiative highlights that over 70% of transmission infrastructure is over 25 years old, prompting large-scale refurbishment efforts.

- Conventional substations continue to be essential in supporting growing industrial and urban electricity demand. Regions with expanding manufacturing hubs and urban sprawl, such as the Midwest and Southern U.S., are seeing increased substation installations. The EIA’s 2023 Electricity Monthly Update reported a 3.5% rise in industrial electricity consumption, reinforcing the need for robust conventional grid infrastructure.

- Utilities are enhancing grid reliability by building redundant conventional substations to prevent outages during peak demand or equipment failure. This is especially critical in regions prone to extreme weather. In 2022, Canada’s Ontario Energy Board approved investments in backup substations to improve grid resilience in northern communities, where outages can be prolonged due to remote access challenges.

- Digital substations market in North America is anticipated to grow at a CAGR of 5.9% by 2034. These units are central to smart grid initiatives, enabling real-time monitoring, automation, and remote control. The U.S. DOE’s 2024 Smart Grid System Report emphasized digital substations as key components for achieving grid flexibility and resilience. These systems support dynamic load balancing and faster fault detection, making them vital for modern grid operations.

- Digital substations are better equipped to handle the variability and complexity of renewable energy inputs. Their advanced control systems allow seamless integration of solar and wind power. In 2023, the IEA reported that digital substations were instrumental in managing distributed energy resources in California, where renewables accounted for over 35% of electricity generation.

- As substations become more connected, cybersecurity and data analytics capabilities are driving digital substation adoption. These systems offer encrypted communication, intrusion detection, and predictive analytics. In 2025, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) partnered with utilities to deploy secure digital substation frameworks, reducing vulnerabilities in critical infrastructure.

Learn more about the key segments shaping this market

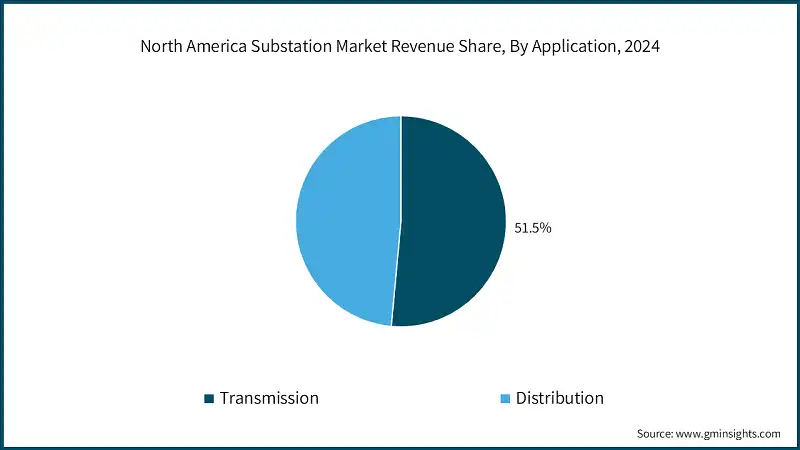

- Based on application, the North America substation market is segmented into transmission and distribution. Transmission application holds a market share of 51.5% in 2024 and is anticipated to reach over USD 15.3 billion by 2034. Growing interregional connections across North America will proliferate the business landscape in the coming years.

- The need to transmit electricity from remote renewable sources to urban centers is driving high-voltage substation growth. The U.S. DOE’s 2023 National Transmission Planning Study emphasized expanding transmission corridors to support clean energy integration. This includes new substations in regions like the Midwest and Southwest, where wind and solar capacity is rapidly increasing. These upgrades are essential for achieving national decarbonization goals and improving grid connectivity.

- Transmission substations are being modernized to withstand extreme weather and cyber threats. The EIA’s 2024 Electric Power Annual reported a USD 2.7 billion increase in transmission infrastructure investment from 2022 to 2023, with a focus on station equipment and automation. These upgrades are crucial for maintaining reliability during climate-induced disruptions and ensuring secure power delivery across regional markets.

- Efforts to improve interconnection between regional electricity markets are boosting transmission substation demand. The DOE’s 2023 Transmission Planning Study highlighted the importance of nodal-network models and contingency analysis to support seamless power flow across regions. This trend is especially strong in areas like the Northeast and Midwest, where inter-regional coordination is key to balancing supply and demand.

- Urban expansion and electrification of transport and heating are driving distribution substation installations. The EIA’s 2024 Electric Power Annual noted a $6.5 billion increase in distribution infrastructure investment between 2022 and 2023, largely due to transformer upgrades and new line installations. Cities like Chicago and Toronto are expanding their distribution networks to meet rising residential and commercial electricity demand.

- Distribution substations are being reinforced to handle climate-related stress, including storms and wildfires. The DOE’s 2023 Transmission Needs Study emphasized the importance of resilient distribution networks to meet future electricity demand under changing climate conditions. Utilities in Florida and California are investing in hardened substations with advanced protection systems to reduce outage risks.

- The rise of rooftop solar, EV chargers, and battery storage is driving demand for smart distribution substations. These substations manage bidirectional power flows and maintain voltage stability. The EIA’s 2024 report highlighted the role of distribution upgrades in managing renewable intermittency and supporting neighborhood-level grid flexibility, especially in states like New York and Colorado.

Looking for region specific data?

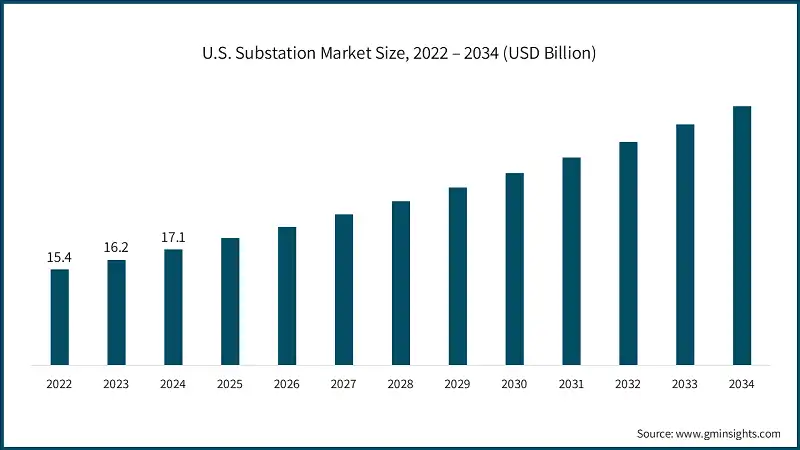

- The U.S. substation market was valued at USD 15.4 billion, USD 16.2 billion and USD 17.1 billion in 2022, 2023 and 2024 respectively. The nation held a share of 86% in 2024 across North American market and is projected to witness a noteworthy growth in the coming years.

- The U.S. is rapidly expanding its renewable energy capacity, requiring substations to manage variable generation and grid integration. According to the EIA, renewable electricity generation is projected to grow at 2.2% annually in 2025–2026, with Texas alone expecting a 7% demand increase in 2025 due to renewables and data centers. This surge necessitates advanced substation infrastructure to maintain grid reliability.

- The electrification of transportation, heating, and industrial processes is increasing electricity demand across the U.S., particularly in urban and suburban areas. Substations are being upgraded to support EV charging stations, electric heat pumps, and electrified manufacturing. States like California, New York, and Massachusetts are leading this transition with policy incentives and infrastructure investments, making substations a critical component in enabling a low-carbon economy and supporting future energy needs.

- Much of the U.S. substation infrastructure is aging, with many assets over 40 years old. This has led to increased investment in replacements and modernization to prevent outages and improve reliability. The EIA’s Electric Power Annual reported a steady rise in capital expenditures for substation equipment, reflecting utilities’ efforts to upgrade transformers, switchgear, and control systems. These upgrades are vital for maintaining service quality and meeting growing demand in both urban and rural areas.

- Canada’s transition to net-zero is driving substation upgrades to support electrification and renewable integration. The Energy Fact Book 2024–2025 reports over USD 14.6 billion invested in clean energy infrastructure between 2021 and 2024, with a significant portion directed toward grid modernization. These investments are enabling provinces like Quebec and British Columbia to expand hydro and wind capacity, requiring substations for load balancing and grid stability.

- Canada is investing in substation infrastructure to improve energy access in remote and Indigenous communities. These regions often rely on diesel generators, and new substations, often microgrid-ready, are enabling cleaner, more reliable power. Projects in northern Ontario and the Yukon are being supported by federal and provincial funding, aiming to reduce emissions and improve living standards. These efforts also support reconciliation and economic development in underserved areas.

- The substation market across Canada was valued at USD 850 million in 2024 and is projected to grow at a CAGR of 5.5% till 2034. Canada’s industrial sector is increasingly electrifying operations to meet sustainability goals and reduce carbon footprints. Substations are being upgraded or newly installed to support high-load facilities in mining, manufacturing, and processing. The State of Trade 2025 report notes rising exports of clean technologies, including substation components, driven by global demand and domestic innovation. This trend is strengthening Canada’s position as a leader in sustainable infrastructure development.

- Mexico holds a market share of 9% in 2024 and is projected to reach USD 4 billion by 2034. Mexico is expanding its transmission network to support renewable energy zones and improve grid reliability. According to the Red Nacional de Transmisión, the country has launched multiple substation projects in Oaxaca and Baja California to connect solar and wind farms. Between 2021 and 2025, transmission capacity has grown significantly, aligning with Mexico’s energy reform goals and increasing demand for high-voltage substations.

- Rapid urban growth in cities like Monterrey, Guadalajara, and Mexico City is driving demand for distribution substations. These upgrades are essential for managing increased residential and commercial electricity consumption, improving service quality, and reducing outages. Utilities are investing in smart grid technologies and automated substations to enhance operational efficiency and meet the needs of expanding urban populations.

- Mexico’s growing energy trade with the U.S. is encouraging substation development near border regions. These substations facilitate power exchange and grid stability, especially in northern states like Sonora and Chihuahua. The Sistema de Información Energética portal tracks infrastructure enhancements that support interconnection with U.S. grids, helping Mexico balance supply and demand while participating in regional energy markets.

North America Substation Market Share

- The top 5 companies in the North America substation industry are ABB, GE Vernova, Hitachi Energy, Siemens Energy, Schneider Electric, collectively contributing around 45% of the market in 2024.

- ABB holds a strong competitive edge through its extensive portfolio of substation automation solutions, including intelligent electronic devices (IEDs), digital control systems, and modular substations. Its commitment to innovation in grid digitalization and automation has positioned it as a leader in both transmission and distribution applications. ABB’s ability to deliver turnkey solutions and integrate advanced technologies like AI and IoT into substations gives it a distinct advantage in modernizing North America’s aging grid.

- ABB’s deep-rooted presence in North America, supported by local manufacturing and service centers, enables it to respond quickly to utility and industrial demands. The company has formed strategic partnerships with utilities and governments to support smart grid initiatives and renewable integration. Its involvement in large-scale infrastructure projects and its focus on sustainability and energy efficiency further reinforce its leadership in the substation market.

- GE Vernova leverages its expertise across power and renewable energy segments to offer integrated substation solutions that support grid modernization and clean energy goals. Its products span high-voltage equipment, digital substations, and grid software, making it a one-stop provider for utilities. GE’s strong presence in wind and hydro power complements its substation offerings, enabling seamless integration of renewables into the grid and supporting North America’s decarbonization efforts.

- GE Vernova’s competitive edge lies in its focus on digital transformation, including advanced analytics, asset performance management, and cybersecurity for substations. Its GridOS platform and digital twin technologies allow utilities to optimize operations and reduce downtime. With a robust R&D pipeline and collaborations with government agencies, GE continues to lead in deploying smart substations that meet evolving regulatory and operational requirements.

North America Substation Market Companies

Major players operating in the North America substation industry are:

- ABB

- CG Power & Industrial Solutions

- Cisco Systems

- Efacec

- Eaton

- Fuji Electric

- GE Vernova

- Hitachi Energy

- L&T Electrical and Automation

- Mitsubishi Electric Power Products

- NR Electric

- Open Systems International

- Powell Industries

- Rockwell Automation

- S&C Electric Company

- Schneider Electric

- Siemens Energy

- SIFANG

- Tesco Automation

- Texas Instruments Incorporated

- ABB maintains a strong presence in North America through its advanced substation automation systems and modular solutions. It offers digital substations, control systems, and grid integration technologies tailored for U.S. and Canadian utilities. ABB’s focus on smart grid innovation and local manufacturing facilities enhances its competitiveness. Its global revenue exceeded USD 32 billion in 2024, with a significant portion attributed to electrification and automation segments.

- GE Vernova leads in North America with its integrated grid solutions, including high-voltage equipment, digital substations, and renewable integration technologies. Its Power and Renewable Energy segments contributed 38.2% of GE’s total revenue in 2022, indicating strong market relevance. GE’s partnerships with U.S. utilities and its GridOS platform support its role in modernizing transmission infrastructure.

- Hitachi Energy has a robust footprint in North America, offering digital substations, HVDC systems, and grid automation solutions. Its collaboration with utilities and governments supports smart grid deployment and renewable integration. The company’s focus on sustainability and innovation, including AI-based grid management, strengthens its market position. Hitachi Energy is part of Hitachi Ltd., which reported USD 60+ billion in global revenue in 2024.

- Siemens Energy operates extensively across North America through its Smart Infrastructure segment, which includes substation technologies, grid control systems, and electrification solutions. In 2022, this segment accounted for 24.1% of Siemens’ total revenue, reflecting its strategic importance. Siemens supports digitalization and automation of substations, contributing to grid modernization and resilience.

- Schneider Electric is a key player in North America’s substation market, offering digital substations, protection systems, and energy management platforms. Its EcoStruxure Grid architecture enables real-time monitoring and control. Schneider’s strong presence in the U.S. and Canada is backed by local R&D and manufacturing. The company generated USD 36 billion in global revenue in 2024, with a significant share from energy automation.

- Powell Industries specializes in custom-engineered electrical equipment for substations, particularly in industrial and utility sectors across North America. It provides switchgear, control systems, and integration services. Headquartered in Texas, Powell benefits from proximity to major energy markets. Its niche focus and tailored solutions give it a competitive edge in specialized substation applications.

- Rockwell Automation contributes to the substation market through its industrial automation and control technologies. While not a traditional substation OEM, its software and hardware solutions are integrated into digital substations for monitoring and control. Rockwell’s partnerships with utilities and OEMs enhance its role in grid modernization. The company reported USD 9 billion in revenue in 2024.

North America Substation Industry News

- In March 2025, Schneider Electric announced plans to invest over USD 700 million in its U.S. operations through 2027 to support rising demand for digitalization, automation, and domestic manufacturing. This brought its total U.S. investment this decade to over USD 1 billion, supplementing USD 440 million committed since 2020. Moreover, the initiative aimed to enhance energy infrastructure, support AI-driven growth, and create over 1,000 new jobs.

- In August 2024, GE signed a MoU with Systems with Intelligence to co-develop advanced substation monitoring solutions by integrating SWI’s infrared thermography with GE Vernova’s DGA 900 Plus system. The collaboration leveraged AI, ML, and sensor technologies to enhance grid asset diagnostics and enable proactive issue detection. GE also planned to incorporate pan/tilt infrared sensors into its GridBeats Asset Vision platform to strengthen real-time monitoring and operational efficiency.

- In October 2024, Schneider Electric unveiled its latest smart grid innovations at Enlit 2024, including enhanced wildfire and storm mitigation, advanced DERMS deployment, and improved grid reliability. Additionally, the company demonstrated virtual substations by virtualizing the PowerLogic T300 RTU via the E4S Alliance to simplify substation design and operations. It also introduced comprehensive low-voltage network monitoring to enable efficient integration and management of low-carbon technologies.

- In August 2023, Siemens launched the SIRIUS 3UG5 line monitoring relays, designed for comprehensive monitoring of 3-phase grids from 200 V to 690 V with enhanced frequency range and IO-Link communication. Certified to SIL 1 and PL c standards, these relays ensured compliance with grid stability and quality requirements, supporting reliable operation in critical sectors like healthcare, process industries, and material handling.

The North America substation market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) and volume (Units) from 2021 to 2034, for the following segments:

Market, By Technology

- Conventional

- Digital

Market, By Component

- Substation automation system

- Communication network

- Electrical system

- Monitoring & control system

- Others

Market, By Application

- Transmission

- Distribution

Market, By Connectivity

- ≤ 33 kV

- > 33 kV to ≤ 110 kV

- > 110 kV to ≤ 220 kV

- > 220 kV to ≤ 550 kV

- > 550 kV

Market, By Voltage Level

- Low

- Medium

- High

Market, By End Use

- Utility

- Industrial

Market, By Category

- New

- Refurbished

The above information has been provided for the following countries across the region:

- U.S.

- Canada

- Mexico

Frequently Asked Question(FAQ) :

Who are the key players in the North America substation market?

Major key players includes Honeywell International, Inc., Itron, Inc., Iskraemeco Group, Kamstrup, Larsen & Toubro Limited, Landis + Gyr, Ningbo Water Meter Co., Ltd., Osaki Electric Co., Ltd., Raychem RPG Private Limited, Schneider Electric SE, Siemens, Sensus, Sontex SA, Wasion Group.

Which country leads the North America substation market?

U.S. held 86% share with USD 17.1 billion in 2024, owing to rapid renewable energy growth and the need for advanced substations.

What are the key trends driving the North America substation market?

Key trends include integration of renewable energy sources, AI and machine learning for predictive maintenance, microgrid-ready substations for disaster resilience, and digital twin technology for operational optimization.

Which application segment leads the North America substation market?

The transmission applications held 51.5% market share in 2024 and is anticipated to reach over USD 15.3 billion by 2034, due to growing interregional connections.

What is the growth outlook for digital substations technology from 2025 to 2034?

The digital substations technology is projected to grow at a CAGR of 5.9% by 2034, led by smart grid initiatives, real-time monitoring capabilities, and renewable energy integration requirements.

How much market share does the conventional technology segment hold in 2024?

The conventional substations dominated with over 96% market share in 2024 and are expected to grow at a CAGR of 4.9% through 2034.

What is the market size of the North America substation in 2024?

The market size was USD 19.8 billion in 2024, with a CAGR of 5% expected through 2034 driven by smart grid expansion and the adoption of advanced communication and automation technologies.

What is the projected value of the North America substation market by 2034?

The North America substation market is expected to reach USD 32.5 billion by 2034, propelled by grid modernization, renewable energy integration, and digital transformation initiatives.

North America Substation Market Scope

Related Reports