Summary

Table of Content

North America Residential Water Heater Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Residential Water Heater Market Size

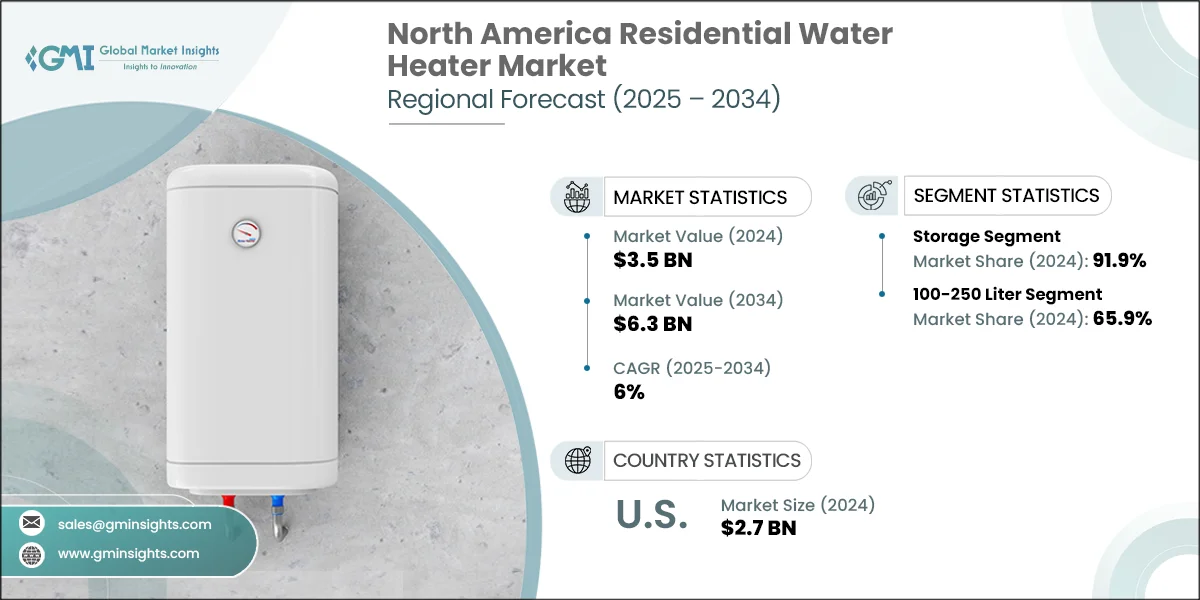

According to a recent study by Global Market Insights Inc., the North America residential water heater market registered a valuation of USD 3.5 billion in 2024. The market is projected to reach USD 6.3 billion by 2034, while growing at a CAGR of over 6%. Increasing improvement in living standards on account of rising per capita income coupled with shifting consumer focus toward energy efficient systems to reduce energy bills will boost the business scenario.

To get key market trends

- Favorable government plans toward building infrastructures coupled with ongoing development of smart products equipped with Wi-Fi connectivity and advanced communication features will drive the industry outlook. For instance, in June 2022, the U.S. DOE introduced Bipartisan legislation bill directed to manufacture residential water heaters with hardware & software capabilities to moderate their energy utilization.

- Residential water heater is an appliance designed to heat water for household uses including cooking, bathing, and space heating. It operates by using an energy source comprising of natural gas, electricity, propane, or solar power. Increasing requirement for efficient water heating systems across various applications will stimulate the North America residential water heater market statistics.

- Continuous construction of smart city projects by government authorities along with ongoing measures for adoption of efficient heating systems to reduce energy consumption will boost the business scenario. Additionally, growing manufacturers interest to introduce improved systems allowing significant cost savings and delivering remote monitoring will enhance the business statistics across the industry.

- Shifting consumer preferences toward smart & modern water heating appliances in line with growing integration of smart technologies and ongoing product innovations will boost the business scenario. Additionally, continuous infrastructural development along with rising replacement of conventional hot water systems with energy efficient solutions will positively impact the North America residential water heater market dynamics.

- Rising urbanization along with improvement in living standards on account of growing per capita income have directed the consumers toward the adoption of more energy efficient heating technologies. Increasing point of connections for electrical access have led to the adoption of water heaters over the conventional heating methods.

- Industry players are actively investing in research to improve the economic feasibility of the systems by minimizing the installation and manufacturing cost. For instance, in September 2022, Midea launched its advanced water heater offering enhanced durability, IPX4 grade waterproof body, enhanced safety and Class I protection against electric shocks, thereby strengthening its business landscape.

North America Residential Water Heater Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.5 Billion |

| Forecast Period 2025 - 2034 CAGR | 6% |

| Market Size in 2034 | USD 6.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Replacement of conventional heating systems | Accelerates smart heating systems adoption across the residential establishments, leading to refurbishment of the conventional units. |

| Growing demand for energy efficient water heaters | Strengthens the demand for advanced water heating units, providing immense potential for product upgrades and advancements. |

| Pitfalls & Challenges | Impact |

| High upfront cost | Limits wide scale adoption as it creates a financial barrier for households, especially in low- to middle-income segments. Additional maintenance costs can deter consumers from upgrading or replacing older models. |

| Opportunities: | Impact |

| Smart and connected water heating systems | Integration with IoT and home automation systems, supporting last-mile delivery and expanding market accessibility in regions lacking fixed infrastructure. |

| Eco-Friendly and Low-Carbon Heating Solutions | Bundling PV with electric water heaters creates cross-selling potential for solar EPCs and HVAC contractors. |

| Replacement & Retrofit Market | Retrofitting old tank systems with high-efficiency or tankless models presents an opportunity for retailers and installers. |

| Water Heating-as-a-Service Models | Subscription-based or lease-to-own models for high efficiency systems could appeal to customers |

| Market Leaders (2024) | |

| Market Leaders |

35% market share |

| Top Players |

Collective market share in 2024 is 65% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | U.S. |

| Fastest Growing Market | U.S. |

| Emerging Countries | Canada |

| Future outlook |

|

What are the growth opportunities in this market?

North America Residential Water Heater Market Trends

- Increasing availability of high-efficiency alternatives across the region, will drive the demand for advanced technologies, witnessing a significant growth from installers and homeowners. Furthermore, favorable regulatory prospects coupled with positive customer outlook in reference to adoption of energy-efficient technologies will thrust the North America residential water heater market growth.

- The regulators have been providing rebates for homeowners to develop efficient products with an aim to ensure savings at the customer end. Ongoing improvement in the efficiencies has considerably led to a decline in the overall life cycle costs incurred by these products, augmenting the market growth. Additionally, rapid development of efficient auxiliary heating technologies will institute a competitive industrial scenario.

- Some high-efficiency water heaters use advanced features comprising of modulation and on-demand operation, ensuring the system only operates when hot water is needed, reducing the energy consumption during idle periods. Further, properly designed systems ensure optimal combustion, minimizing energy waste and the release of pollutants, influencing the North America residential water heater market statistics.

- Increasing awareness toward achieving a clean energy future, growing concerns about the climate change, larger investments in the infrastructure development, along with ongoing preconstruction and under construction projects undertaken by the state-owned enterprises will contribute to the overall business scenario.

- Surging demand of natural gas for power production coupled with production advancements leading to delay in gas prices will augment the industry landscape. For instance, in 2023, nearly 32.5 trillion cubic feet (Tcf) of natural gas was delivered to about 77.7 million consumers, thereby augmenting the North America residential water heater market growth.

- Rising LNG exports from North America, technological innovations including the introduction of hydrogen in the NG pipelines along with ramping up of the state level decarbonization policies and targets specifically across the developed economies will drive the product demand in the coming times.

- The industry players are making significant investments toward upgradation of the existing water heater systems to minimize the standby losses and cut down the cost of energy. Further, to achieve respective efficiency goals across the residential establishments, the state authorities have introduced building standards & codes. The customers are deploying newly designed models to limit the carbon emissions and comply with the laid standards, which will positively influence the business scenario.

North America Residential Water Heater Market Analysis

Learn more about the key segments shaping this market

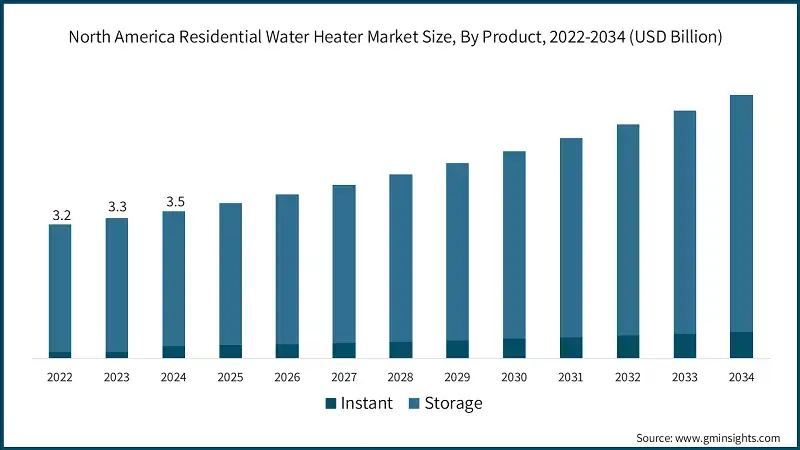

- Based on product, the market is segmented into instant and storage. The storage segment dominated around 91.9% market share in 2024 and is expected to grow at a CAGR of over 5.5% through 2034.

- Ongoing developments regarding the accessibility of electricity across rural areas in line with government incentives & programs pertaining to rural electrification will augment the adoption of storage units. Growing prominence of space & central heating systems is anticipated to drive the demand in the coming times.

- For instance, in January 2022, HEH Holdings LLC, acquired RECO that provides storage tanks and water heating equipment across the U.S. This has further strengthened the company’s product portfolio and its market presence to offer its customers with large capacities of water heating along with storage solutions.

- Furthermore, respective government authorities have introduced strict guidelines & provisions for installing heating systems across commercial & residential properties. Features including simple designs in combination with user-friendly interface will surge product adoption. The low-cost storage units have captured most of the market share owing to features including ready-to-install designs that are highly adaptable and offer a range of products suitable for multiple heating applications, thereby driving the industry landscape.

- Instant segment will grow at a CAGR of over 8% till 2034. Increasing point of connections for electrical access have led to the adoption of water heaters over conventional heating methods including firewood and fossil fuels. Ongoing regulatory regimes and standards concerning the energy efficiency and carbon emissions will further lead to the product adoption.

- Technological developments including Wi-fi connectivity, corrosion resistance, communication, and control options along with leakage detection system will lead to the adoption of instant heating technologies during the forecast period. These systems are widely adopted across multifamily apartments owing to its 24/7 hot water supply and high heating output. Further, growing penetration across states with extreme climatic conditions across the region will complement the market growth.

- For example, in February 2022, Rinnai partnered with Advantage Alliance to enable the contractors related to residential cooling, heating & plumbing to offer homeowners with a cost-effective approach for home comfort & maintenance.

Learn more about the key segments shaping this market

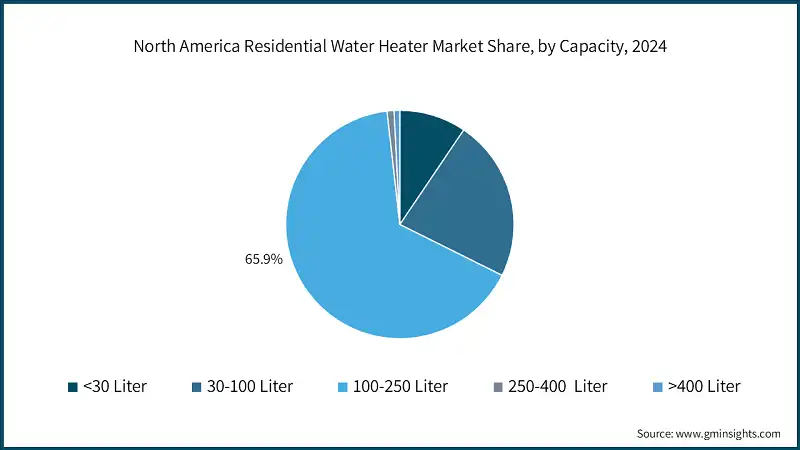

- Based on capacity, the North America residential water heater market is segmented into <30 liter, 30 -100 liter, 100-250 liter, 250-400 liter and >400 liter. The 100-250 liter capacity segment captured 65.9% revenue share in 2024 and is projected to grow at a CAGR of over 5.5% through 2034, driven by growing hot water demand.

- This size range is often chosen by families with multiple occupants. Larger tank sizes are associated with higher recovery rates, allowing these gas tank water heaters to replenish hot water more quickly after consumption, benefitting households with higher demand for hot water during peak periods, thereby driving product adoption. Moreover, ongoing advancements in the tank design including energy-efficient features, such as improved insulation or advanced burner technology will contribute to higher overall energy efficiency, aligning with consumer preferences for environmentally conscious choices.

- For instance, in May 2022, GE Appliances inaugurated a USD 70 million water heating manufacturing facility in the U.S. The vertically integrated plant makes products, beginning from steel coils to high-quality water heaters.

- The 30-100 liter residential water heater market will grow more than CAGR 5.5% through 2034. These units are commonly utilized across condos, apartments, small households, and point-of-use installations including under the sink. Increasing retrofitting of the existing appliances will further augment the product adoption. Moreover, lower capital cost and simple installation makes the systems more attractive for low consumption households.

- The <30 liter residential water heater market hold a revenue share of 9.5% in 2024. The capacity range is well-matched with average-sized homes with moderate hot water demand. It adequately supplies hot water for activities including laundry, showers, and dishwashing coupled with lower operating costs and upfront costs of the gas tank heaters will augment the product adoption.

- The >400 liter will grow more than 5.5% CAGR till 2034. Families with multiple bathrooms, appliances, and fixtures or larger households with high number of occupants and those with significant simultaneous hot water needs often require a larger water heater. The larger tank size ensures that these fixtures can be filled without running out of hot water, providing a more satisfying bathing experience.

- Moreover, some residential spaces may include home-based businesses or workshops that require hot water for various purposes, such as cleaning, processing, or production activities. They are capable of handling the increased demand associated with the activities, thereby contributing to the business landscape.

Looking for region specific data?

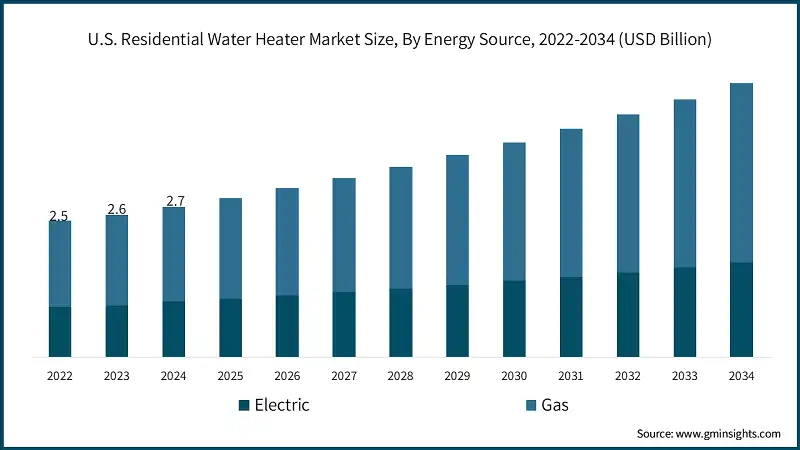

- The U.S. dominated 79.6% share in the North America residential water heater market with around USD 2.7 billion revenue in 2024. Ongoing development in the service sector along with presence of major water heater manufacturers including A.O. Smith, Bradford White and Rheem manufacturing among others, is set to augment the industry landscape.

- Rising per capita income coupled with improving living standards have further surged the product demand. The customers are opting for systems with attractive designs and additional features including remote monitoring and automatic control eliminating all hassles, contributing to the North America residential water heater market momentum.

- North America is projected to surge over USD 6 billion by 2034. Ongoing upgradation and replacement of existing models with more efficient and compact designs have accelerated the business growth. The government is inclined toward the promotion of deployment of energy efficient heating appliances primarily across new building establishments, which is set to augment the product adoption. Further, Increasing availability of abundant natural gas reserves and required infrastructure will augment the product penetration.

- Canada residential water heater market was evaluated at USD 700 million in 2024. Introduction of a variety of rebates, incentives, or tax credits by the government and utility companies to encourage the installation of energy-efficient appliances, comprising gas water heaters will drive the business scenario.

- In addition, introduction of financial incentives will motivate the homeowners to choose water heating appliances which will contribute to the business momentum. For instance, in August 2022, the federal government signed the Inflation Reduction Act providing USD 400 billion for clean energy and climate change, including USD 8.8 billion for Home Energy Rebates.

North America Residential Water Heater Market Share

- The top five companies leading the North America residential water heater industry are A.O. Smith, Rheem, Bradford White, Bosch and Rinnai possess a distinct competitive edge. Manufacturers are further forming closer alliances with contractor networks, national retail chains, and installer platforms to accelerate product roll-outs and secure replacement market share.

- Bosch Thermotechnology, through its extensive portfolio of gas, electric, and tankless, water heating solutions holds a significant position in the North American residential water heater market. The company invests in R&D to advance condensing technology and connectivity, along with integration to renewable energy systems.

- Multiple small specialist manufacturers have been absorbed by larger incumbents to lock in distribution channels and broaden portfolios. Moreover, they are acquiring upstream and downstream assets for product differentiation and service offerings Growing decarbonization targets and enhancing efficiency will push companies to buy modern water heating product offerings thereby contributing to the North America residential water heater market landscape.

- Ariston Thermo has a diversified portfolio of electric and gas water heaters and maintains a strong market presence in the residential water heating industry. The company capitalizes on advanced energy-efficiency technologies equipped with user-centric designs and smart connectivity features to meet the different consumer needs. In addition, growing focus on renewable integration, aligns with the global sustainability trends, thereby driving adoption across multiple geographies.

North America Residential Water Heater Market Companies

Eminent players operating in the North America residential water heater industry are:

- A.O. Smith

- Ariston Thermo

- American Standard Water Heaters

- Bradford White Corporation

- EcoSmart Green Energy Products

- GE Appliances

- Giant Factories

- HTP Comfort Solutions

- Hubbell Water Heaters

- John Wood

- Lennox International

- Noritz America

- Navien

- Racold

- Rheem Manufacturing Company

- Rinnai America Corporation

- State Industries

- State Water Heaters

- Whirlpool Corporation

- Westinghouse Electric Corporation

- Rinnai, is the leading brand of tankless gas water heaters in North America, with sales of over 3 million units in North America. The company operates a key manufacturing facility in Georgia producing its RE-Series and other tankless models locally. These developments are further supported by with strong technical support, dealer networks, along with focus on quality control.

- Bosch is a global engineering conglomerate with significant operations in energy and building technology, including residential water heating. The company, the company offers tankless, point-of-use, and heat pump electric water heaters in both Canada and the U.S. The company will expand by integrating brands including Worcester, Vulcano, and Buderus to further strengthen its heating and water heating portfolio.

- Rheem holds a leading position as a manufacturer and provider in water heating and HVAC industry. The company produces a wide range of residential as well as commercial heating, cooling, and water heating solutions. Additionally, the company spend USD 9.08 Billion in R&D expenses and has manufacturing facilities and distribution centers across Ford Smith, Montgomery and Randleman & Brampton respectively.

North America Residential Water Heater Market News

- In May 2025, A.O. Smith received a 2025 Silver Edison Award for the new high efficiency instant water heaters. They are recognized under the Sustainable Consumer Products category. It is the world's first instant water heater equipped with fully integrated scale prevention technology, which will eliminate the need for costly annual maintenance and extend the product lifetime by three times.

- In January 2024, GE Appliances introduced the RealMAX gas water heaters line at Air Conditioning, Heating, and Refrigeration Expo 2024 in Chicago. The aim is to expand its atmospheric offering with ultra-NOx and power vent gas water heaters, which will provide more choices for customers in areas with stringent emission standards. This will support the company strengthen its product portfolio and presence across the region.

- In February 2024, Ariston Holding added to its business development resources, entering the U.S. builder segment. The company, with the support of other business leaders, intends to bring its water heater products to the builder segment. This will further expand its presence and support the electrification transition across the industry.

The North America Residential water heater market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue and volume (USD Billion & ‘000 Units) from 2021 to 2034, for the following segments:

Market, By Product

- Instant

- Storage

Market, By Capacity

- <30 Liters

- 30-100 Liters

- 100-250 Liters

- 250-400 Liters

- >400 liters

Market, By Energy Source

- Electric

- Gas

- Natural Gas

- LPG

The above information has been provided for the following countries:

- U.S.

- Canada

Frequently Asked Question(FAQ) :

Which country leads the North America residential water heater market?

The U.S. leads with around 79.6% market share and generated USD 2.7 billion in 2024.

What are the upcoming trends in the North America residential water heater market?

Key trends include smart and connected heating systems with IoT integration, eco-friendly low-carbon solutions, replacement and retrofit market growth, and water heating-as-a-service subscription models.

What is the growth outlook for instant water heaters from 2025 to 2034?

The instant segment is projected to grow at a CAGR of over 8% till 2034, due to technological developments including Wi-Fi connectivity, corrosion resistance, and 24/7 hot water supply capabilities.

How much market share did the storage segment hold in 2024?

The storage segment dominated the market with 91.9% share in 2024 and is expected to grow at a CAGR of over 5.5% through 2034.

What was the market share of the 100-250 liter capacity segment in 2024?

The 100-250 liter segment dominated with 65.9% market share in 2024 and is projected to grow at a CAGR of 5.5% through 2034.

What is the market size of the North America residential water heater in 2024?

The market size was USD 3.5 billion in 2024, with a CAGR of 6% expected through 2034 driven by rising living standards, energy-efficient system adoption, and smart technology integration.

What is the projected value of the North America residential water heater market by 2034?

The North America residential water heater market is expected to reach USD 6.3 billion by 2034, propelled by replacement of conventional systems, smart connectivity features, and government energy efficiency initiatives.

Who are the key players in the North America residential water heater market?

Key players include A.O. Smith, Rheem, Bradford White, Bosch, Rinnai, Ariston Thermo, American Standard Water Heaters, EcoSmart Green Energy Products, GE Appliances, Giant Factories, HTP Comfort Solutions, Hubbell Water Heaters, John Wood, Lennox International, Noritz America, Navien, Racold, State Industries, State Water Heaters, Whirlpool Corporation, and Westinghouse Electric Corporation.

North America Residential Water Heater Market Scope

Related Reports