Summary

Table of Content

North America Residential Unitary HVAC Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Residential Unitary HVAC Market Size

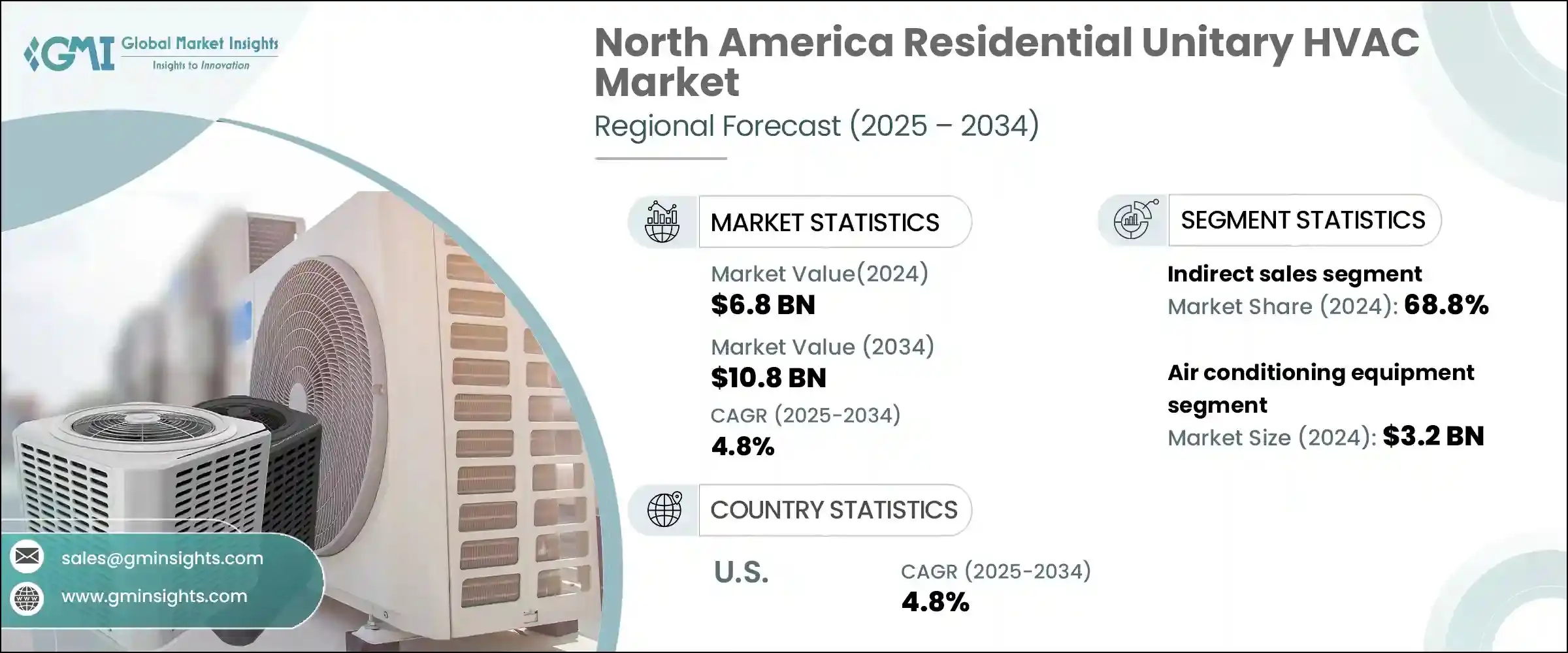

The North America residential unitary HVAC market was estimated at USD 6.8 billion in 2024. The market is expected to grow from USD 7.1 billion in 2025 to USD 10.8 billion in 2034, at a CAGR of 4.8%.

To get key market trends

The HVAC industry has expanded rapidly in the North America residential sector with many changes in the adoption of energy-efficient systems over the past few years. Moreover, builders and homeowners are increasingly utilizing units with higher SEER ratings, which means that these appliances are more efficient in energy usage and operation. There is also increasing support from the government through regulations and incentives that encourage the adoption of energy-efficient systems appliances. On the other hand, there is increasing demand from the consumers, as due to the increased concern about carbon footprint, they are considering purchasing appliances with high energy efficiency ratings, especially those systems that have the ENERGY STAR certification.

North America Residential Unitary HVAC Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 6.8 Billion |

| Forecast Period 2025 – 2034 CAGR | 4.8% |

| Market Size in 2034 | USD 10.8 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

These appliances are thought to be more energy efficient, which is why the government tends to encourage their usage through regulations and incentives for their implementation. For instance, the U.S. Department of Energy indicates these appliances are thought to be more efficient, estimating products with an ENERGY STAR certified mark can potentially reduce energy expenditure by 30%.

The growth in demand for North America unitary residential HVAC units is primarily attributed to the need for more energy-efficient and sustainable cooling solutions, which is clearly on the rise. In recent years, the shift in consumer behavior has been largely driven by the multifaceted spread of marketing, which has put manufacturers’ focus on sustainability and energy efficiency. Unitary HVAC systems that aid user comfort, energy preservation, and have a low ecological footprint are preferable.

North America Residential Unitary HVAC Market Trends

- The growth in awareness regarding clean air at home and work has made ventilation, heating, and air conditioning systems a necessity to improve indoor air quality in an environmentally friendly and affordable manner.

- Similarly, suppliers are always seeking new opportunities to sell advanced unitary HVAC products for residential use. These companies focus on developing new products and services. A good example of this would be the launch of new water source heat pumps by Bosch Home Comfort Group from the German conglomerate Robert Bosch GmbH in June 2024.

North America Residential Unitary HVAC Market Analysis

Learn more about the key segments shaping this market

- The North America residential unitary HVAC market by product type is segmented into air conditioning equipment, ducted heat pumps/ packaged terminal heat pumps (PTPHS), variable refrigerant flow (VRF) systems, packaged heating & cooling unit, and others such as air handlers, gas furnaces, evaporator coils, etc.

- In 2024, the air conditioning equipment segment dominated the market, generating a revenue of USD 3.2 billion.

- The split air conditioning (AC) systems segment, including both ducted and ductless units, continues to dominate the market. The increasing popularity of ductless mini-split systems, particularly in urban areas and renovations, is also contributing to this segment's growth.

Learn more about the key segments shaping this market

- Based on the distribution channel the North America residential unitary HVAC market is categorized into direct sales and indirect sales.

- Indirect sales dominate this market, accounting for 68.8% of the market share in 2024.

- Indirect selling involves a manufacturer selling their goods through a selling network comprising of distributors, wholesalers, and HVAC contractors. This method proves to have greater market coverage which results in a lower cost to the consumer.

- Among the other components in the indirect sales channel, the wholesale distribution channel is of particular importance. HVAC equipment wholesalers and distributors have developed sophisticated logistical and supply chain networks which allow them to serve contractors, installers, and retailers throughout North America.

Looking for region specific data?

- The U.S. residential unitary HVAC market was valued at around USD 4.7 billion in 2024 and is anticipated to register a CAGR of 4.8% between 2025 and 2034.

- The U.S. dominates the North America residential unitary HVAC market, accounting for 69.6% in 2024. This dominance is primarily driven by the sheer size of the U.S. population and its diverse climate zones. Warmer southern regions naturally experience a higher demand for air conditioning, while colder northern areas require efficient heating solutions.

North America Residential Unitary HVAC Market Share

- The top 5 companies in the North America residential unitary HVAC market such as Daikin Industries Inc., LG Electronics, Trane Technologies, Lennox International and Hisense HVAC equipment Co., Ltd. hold a market share of 25%-30%.

- Manufacturers are adopting strategic steps, such as mergers, acquisitions, partnerships, and collaboration, to meet the growing consumer demand and consolidate their position in the market.

North America Residential Unitary HVAC Market Companies

Major players operating in the North America residential unitary HVAC industry are:

- Carrier Group

- Daikin Industries Inc.

- Danfoss A/S

- GREE Electric Appliances, inc

- Haier Group

- Hisense HVAC equipment Co., Ltd.

- Johnson Controls Plc

- Lennox International

- LG Electronics

- Midea Group

- Mitsubishi Electric Group

- Panasonic Corporation

- Rheem Manufacturing Company

- Robert Bosch GmbH

- Trane Technologies

North America Residential Unitary HVAC Industry News

- In June 2024, Bosch Home Comfort Group, a unit of German industrial conglomerate Robert Bosch GmbH, introduced new water source heat pumps intended for use in both new buildings and renovation projects.

- In March 2024, Trane Technologies announced its new residential product portfolio with innovative design upgrades to its highly efficient heat pumps and air conditioners, including next-generation refrigerant with 78% less global warming potential (GWP).

- In March 2024, Mitsubishi Electric Trane HVAC US LLC announced the launch of Premier Wall-mounted Indoor Units (MSZ-GS/MSY-GS), an update to the former models (MSZ-GS/MSY-GL). The Premier Wall-mounted Indoor Units can heat or air-condition any residential room.

This North America residential unitary HVAC market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Air Conditioning Equipment

- Split AC (Ducted)

- Window AC (Ducted)

- Ducted Heat Pumps/ Packaged Terminal Heat Pumps (PTHPs)

- Variable Refrigerant Flow (VRF) Systems

- Packaged Heating & Cooling Unit

- Others (Air Handlers, Gas furnaces, evaporator coils, etc.)

Market, By Installation

- New Construction

- Replacement/Retrofit

Market, By Mounting Type

- Wall-Mounted Units

- Ceiling-Mounted Units

Market, By Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following countries:

- U.S.

- Canada

Frequently Asked Question(FAQ) :

Who are the key players in North America residential unitary HVAC industry?

Some of the major players in the industry include Carrier Group, Daikin Industries Inc., Danfoss A/S, GREE Electric Appliances, Inc., Haier Group, Hisense HVAC Equipment Co., Ltd., Johnson Controls Plc, Lennox International, LG Electronics, Midea Group, Mitsubishi Electric Group, Panasonic Corporation, Rheem Manufacturing Company, Robert Bosch GmbH, and Trane Technologies.

How much is the U.S. North America residential unitary HVAC market worth in 2024?

The U.S. North America market of residential unitary HVAC was worth over USD 4.7 billion in 2024.

How big is the North America residential unitary HVAC market?

The market size for residential unitary HVAC in North America was valued at USD 6.8 billion in 2024 and is expected to reach around USD 10.8 billion by 2034, growing at 4.8% CAGR through 2034.

What is the size of air conditioning equipment segment in the North America residential unitary HVAC industry?

The air conditioning equipment segment generated over USD 3.2 billion in 2024.

North America Residential Unitary HVAC Market Scope

Related Reports