Summary

Table of Content

North America Microspheres Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Microspheres Market Size

North America microspheres market size to surpass USD 1.5 Billion, in 2019 and is estimated to grow over 9% CAGR between 2020 and 2026. Growing demand for light weight and eco-friendly components in manufacturing industries will drive the industry growth.

Microspheres are classified as freely flowing powders that are contains proteins or synthetic polymers that are biodegradable. Microspheres consists of various types including magnetic, polymeric, bio adhesive, biodegradable polymeric, radioactive, synthetic polymeric and floating microspheres. These microspheres generally have particle spheres less than 200 μm.

To get key market trends

The booming pharmaceutical and medical industries, along with the increasing demand for innovative drug delivery systems, are projected to drive the North America microspheres market growth. Microspheres are witnessing demand growth for bone tissue engineering and radioembolization to treat liver cancer along with the development of biopharmaceuticals.

North America Microspheres Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 1,557.2 Million (USD) |

| Forecast Period 2020 to 2026 CAGR | 9.3% |

| Market Size in 2026 | 2,880.6 Million (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

However, companies are investing in new technological developments and production capacity expansions to enhance their product portfolio. For example, in September 2015, 3M released its latest 3M glass bubble which is a low-density and high strength additive. Through this launch, the company will be able to enhance its product portfolio.

COVID 19 outbreak has led to imposition of shutdown of manufacturing units, travel ban and offices & marketplaces by governments across the world. Owing to such measures has resulted in undermining value chain across the globe. This has adversely affected raw materials supply for microspheres. This outbreak has led to global manufacturing plants shutdown which may decrease microspheres utilization.

North America Microspheres Market Analysis

Learn more about the key segments shaping this market

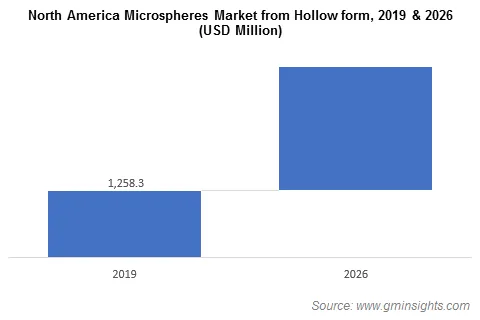

Hollow form segment is estimated to witness significant gains over 8.5% by the end of 2026. Based on the form, the microsphere market is segmented into solid and hollow microspheres. The hollow microspheres have low density and are mainly used to reduce the weight in composites especially in aerospace, automotive and oil & gas which should boost the North America microspheres market share.

Hollow microspheres help reduce component weight owing to their low density as compared to conventional mineral additives such as talc, silica, mica and gypsum. These products help lower the density of materials they are added to which reduces shipping costs, enhances the ease of transport and overall weight. Hollow microspheres find widespread adoption in coatings, catalysis and drug delivery, owing to their ability to enhance the packability & flowability when compared to raw drug crystals. The U.S. paint & coating sector was valued at USD 27.5 billion in 2018 which represents healthy potential for North America microspheres market growth.

Learn more about the key segments shaping this market

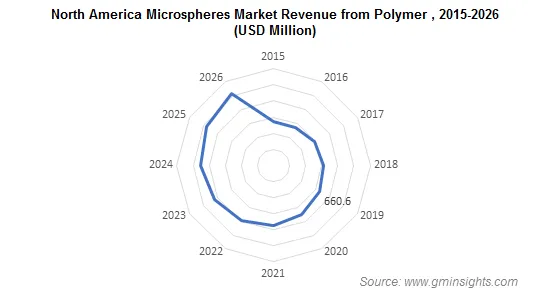

North America microspheres market from polymer based is anticipated to reach over USD 1 billion by 2026. Based on material, microspheres market is segmented into polymers, glass, ceramic, metallic and fly as materials. Polymer microspheres are increasingly used in the electronics industry, owing to its extensive usage in the electronic equipment displays along with several other applications in the electronics sector, including usage in mobile phone screens, LCD screens and monitors. Natural and synthetic polymers are used in production of microspheres. Synthetic polymers such as polystyrene, polyethylene among several others are widely used in application industries.

These products are also ideal for biomedical applications on account of their ability to facilitate procedures such as immune precipitation and cell sorting. Moreover, the high sphericity of polymer microspheres coupled with the availability of fluorescent and colored microspheres makes them well-suited for microscopy techniques, health sciences, flow visualization and research application.

Looking for region specific data?

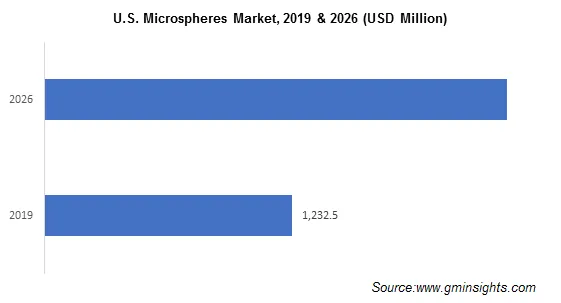

U.S. microsphere business is estimated to witness significant gains over 8.5% by the end of 2026. U.S will witness a significant growth in the North America microspheres market owing to the increased expenditure on renovation activities of commercial, industrial, and residential infrastructures. Rising microspheres utilization in manufacturing construction composites owing to persuading attributes including dimensional stability, low density, improved impact strength, enhanced thermal insulation, smoother surface finish, cost savings, easier machinability and faster cycle times.

U.S. public residential construction spending was over USD 6 billion in 2018 owing to rapid construction & renovation activities which shows huge opportunity for microspheres sector. Besides, increasing spending capacities on construction activities for renovation purposes or new residential buildings will further provide a strong outlook for the North America microspheres market microspheres market across the country.

Market participants are heavily investing in U.S. market owing to cater rising demand in order to gain strong market position. For instance, in 2019, Omya International AG announced its acquisition of Termolita S.A.P.I. de C.V., a company specializing in expanded perlite products in U.S. and Mexico, to strengthen its global distribution network, R&D and to cater wide range of customers in North America.

North America Microspheres Market Share

North America microspheres industry share is moderately consolidated with major players including:

- 3M

- Luminex

- Potters Industry

- Trelleborg

- Akzo Nobel.

Participants in North America microspheres market are incorporating strategies including capacity expansions, mergers & acquisitions, new product launches and partnerships & collaborations. For instance, In February 2020, Sirtex Medical announced its collaboration with MIM Software Inc. Through this collaboration, the company will sustain its market position in the U.S. & Europe, offering products such as SIR-Spheres Y-90 resin microspheres.

In January 2019, Luminex Corporation completed the acquisition of Millipore Sigma. Through this acquisition, the company enhanced its product portfolio and market position in the market.

North America microspheres market report includes in-depth coverage of the industry trends, with estimates & forecast in terms of volume (Kilo Tons) and revenue (USD Million) from 2015 to 2026, for the following segments:

By Form

- Solid

- Hollow

By Material

- Glass

- Polymer

- Natural

- Synthetic

- Ceramic

- Fly ash

- Metallic

By Application

- Construction

- Paints & Coatings

- Healthcare

- Oil & Gas

- Cosmetics & Personal Care

- Automotive

- Others

The above information has been provided for the following countries:

By Country

- U.S.

- Canada

- Mexico

Frequently Asked Question(FAQ) :

Which material will gain momentum in microspheres market in North America?

North America microspheres industry share from polymer material may cross USD 1 billion by 2026, as polymer microspheres are majorly used in the electronics industry.

What factors are expected to drive North America microspheres market size?

In 2019, North America microspheres market size exceeded USD 1.5 billion. Driven by rising demand for eco-friendly, lightweight components in manufacturing, the industry may depict 9% CAGR through 2026.

Why will hollow forms gain traction in North America microspheres industry?

North America hollow form microspheres market share may exhibit 8.5% through 2026, as the hollow forms possess low density and are therefore deployed in aerospace and automotive sectors.

Where in North America will microspheres industry share depict an upsurge?

U.S. microspheres market size may register 8.5% CAGR through 2026, driven by rising expenditure on residential, commercial, and industrial infrastructural development.

North America Microspheres Market Scope

Related Reports