Home > Energy & Power > Renewable Energy > Combined Heat and Power > North America Micro CHP Market

North America Micro CHP Market Analysis

- Report ID: GMI4637

- Published Date: Apr 2020

- Report Format: PDF

North America Micro CHP Market Analysis

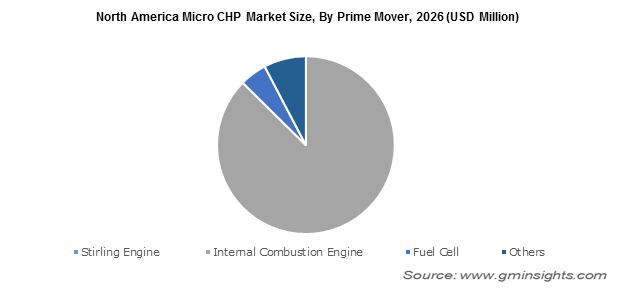

Internal combustion engine micro CHP exceeded an annual installation of 1 MW in 2019. Rising deployment of regeneration plants across residential establishments on account of their operability, applicability, and energy management toward low power range systems will drive the product demand. High flexibility, low operational & maintenance cost minimal noise pollution and low carbon emissions are some major features which will positively stimulate the North America micro CHP market landscape.

Fuel cell micro CHP will witness an upsurge on account of its low heat to power ratio and ability to utilize single fuel efficiently. Low fuel consumption, high electricity generation capability, and longer product lifecycle are the prominent features that will propel the product adoption.

Ongoing R&D investments toward cogeneration establishments to enhance electrical efficiency and reduce cost will further propel the North America micro CHP market outlook. For instance, BDR Thermea Group launched InnoGen a new fuel cell micro CHP system based on Proton Exchange Membrane technology with high power generation capability and higher efficiency.

Favorable government measures to reduce carbon footprint coupled with growing awareness toward adoption of cleaner fuel technologies will drive the market for residential micro CHP. Moreover, introduction of net metering and micro CHP policies providing incentives, tax reduction, subsidies and rebates will stimulate the industry landscape.

Growing adoption of these units across the U.S residential establishments to cater to electricity outages and electricity security in addition to its applicability toward space and water heating will further augment the North America micro CHP market demand.

Rapid commercialization across various states of Canada and the U.S as well as increasing electricity loads across the grid network will augment the commercial micro CHP segment. Growing electricity cost as well as easy installation without physical & aesthetic limitations will further accelerate the product adoption across the region. Ongoing advanced design to increase the unit’s applicability across traditional and new infrastructure will strengthen the North America micro CHP market scenario.

Limited area availability for landfills coupled with growing consumer awareness toward waste & incinerator management program will complement renewable based North America micro CHP market trends. For instance, in 2019, the U.S. government announced a revised self-generation incentive program to enhance the adoption of renewable fuels in fuel mixture ratio. Furthermore, favorable government subsidies, tariffs and rebates to increase the consumption of biofuels will positively strengthen the business dynamics.

Cost effectiveness and high efficiency along with ability to generate low carbon footprint are few factors which will drive natural gas based micro CHP industry. For instance, the U.S. introduced R&D programs which includes FutureGen 2.0 & climate change technology platform to improve integrated gasification combined-cycle technology.

In addition, stringent regulatory norms to reduce the reliance of CHP systems on traditional fuels coupled with growing inclination toward gas -fired cogeneration establishments will further boost the North America micro CHP market growth.

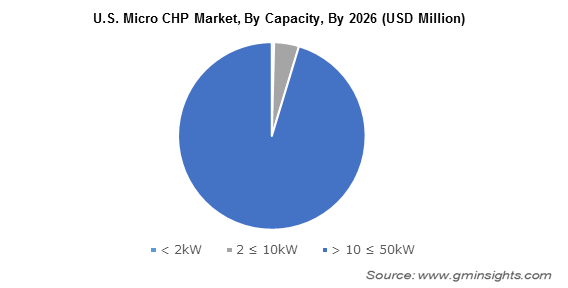

>10 ≤ 50 kW capacity was valued over USD 5 million in 2019. Increasing demand for captive power generation technologies coupled with growing inclination toward smart energy distribution network will stimulate the product demand. Moreover, rising electricity failures and risk will enhance the applicability of cogeneration units across commercial infrastructure including multi complexes, heath care centers and business units, which in turn will propel the North America micro CHP market value.

Compact design, low burning risks, longer product lifecycle, and high-power generation with low fuel consumption are some prominent factors which will drive the adoption of < 2 kW capacity micro CHP unit adoption. For instance, BDR Thermea Group in 2019 introduced first compact hydrogen powered boiler utilizing solar & wind energy and further reducing GHG emission up to 100% extent. Furthermore, replacement of large traditional boilers to minimize space requirement and reduce carbon footprint will propel the product deployment.

Replacement and restoration of conventional CHP systems as well as ongoing technological advancements to enhance reliability and efficiency of these units will drive the product adoption. In addition, favorable government initiatives, CHP-inclined policies and state incentives are some of the major measures which will complement the North America micro CHP market across the U.S.

Ongoing COVID-19 pandemic across the region will certainly restrain the deployment of these units. Moreover, non-operational manufacturing, logistics, and installation will further slow the industry growth. However, the need to sustainably cater to the growing energy demand as well as ongoing adoption of compact cogeneration systems across district heating distribution networks will boost the North America micro CHP market.