Summary

Table of Content

North America Medium Voltage Drives Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Medium Voltage Drives Market Size

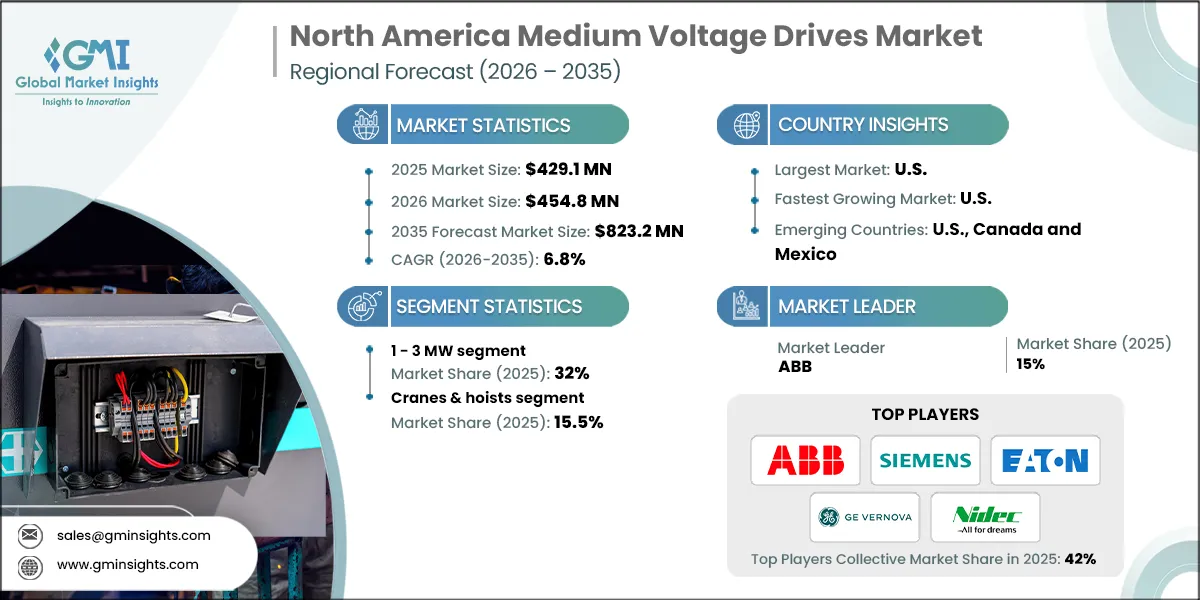

North America medium voltage drives market was estimated at USD 429.1 million in 2025. The market is expected to grow from USD 454.8 million in 2026 to USD 823.2 million in 2035, at a CAGR of 6.8%, according to a recent study by Global Market Insights Inc.

To get key market trends

- Flourishing investments toward industrial development and manufacturing upgradation coupled with increasing demand for energy-efficient motor control solutions is complementing business landscape. The push for process optimization and compliance with stringent energy regulations will further accelerate product adoption. Favorable initiatives aimed at reducing energy consumption and enhancing operational efficiency across diverse industrial applications will positively influence industry dynamics.

- For instance, in November 2025, Canada unveiled Budget 2025 called Canada Strong, which includes transformative measures for infrastructure, energy, and mining. The plan allocates USD 84 billion over five years, including USD 39.4 billion for core public infrastructure, USD 13.8 billion for indigenous and municipal projects, and USD 3.5 billion for trade and transport.

- The integration of advanced motor control systems in heavy-duty applications and the growing inclination toward adoption of advanced operating systems to ensure precise speed, control and efficiency will contribute to the industry growth. Shifting emphasis on reducing carbon emissions from industries together with introduction of favorable initiatives by respective authorities toward enhancing energy efficiency across industries will augment business outlook.

- For instance, in January 2024, the U.S. Department of Energy announced USD 171 million for 49 projects across 21 states as part of the Investing in America initiative, to advance industrial decarbonization and reduce greenhouse gas emissions. Additionally, an USD 83 million funding opportunity has been opened for hard-to-abate sectors. These efforts support DOE’s industrial heat shot and clean fuels programs, aligning with the national goal of achieving a net-zero economy by 2050.

- Stringent energy-efficiency regulations and growing emphasis on reducing operational costs through digitalization will stimulate industry outlook. Implementation of strict rules and policies to curb energy consumption and minimize losses, along with businesses prioritizing compliance and cost optimization, are accelerating the adoption of advanced MV drives technologies.

- For instance, in June 2025, the Climate Leadership Council released its America’s Carbon Advantage 2025 report, highlighting three core drivers of the U.S. carbon advantage: energy efficiency, electricity mix, and industrial energy consumption. Energy efficiency, measured by energy required per trillion dollars of industrial value-added, positions the U.S. as one of leaders owing to higher electrification and reduced heat losses across systems.

- Rising investments in industrial infrastructure development, coupled with growing need for advanced motor control solutions across manufacturing processes is driving adoption of innovative technologies to enhance efficiency will shape industry dynamics. Growing inclination toward adoption of clean energy transition policies, supported by modernization initiatives and automation to enable smarter, energy-conscious industrial operations will complement business outlook.

- For instance, in November 2025, according to the Association for Advancing Automation, robotics sector maintained strong growth momentum during the first half of 2025. Robotics orders rose by 4.3%, while revenue increased 7.5% compared to the same period in 2024, highlighting accelerating investment in automation technologies and enabling industrial efficiency across various sectors.

- The U.S. leads the North America medium voltage drives market and holds a dominant share owing to strong industrial base, advanced manufacturing capabilities, and adoption of automation technologies. Key sectors like oil & gas, mining, and power generation, rely on MV drives for energy efficiency and operational reliability. Increasing integration of IoT & predictive maintenance, rising investments in renewable energy projects, modernization of grid infrastructure by adoption of smart grids and digitalization is positively influencing industry dynamics.

- For instance, in October 2024, NVIDIA partnered with the U.S. Department of Energy under the Genesis Mission to strengthen America’s leadership in artificial intelligence across energy, research, and national security. This initiative aims to accelerate scientific breakthroughs, enhance energy dominance, and improve manufacturing efficiency through advanced AI platforms.

- Canada is emerging as one of the fastest-growing market in North America medium voltage drives industry on account of flourishing investments across heavy-duty industries, along with the expanding industrial automation. Government initiatives promoting sustainable energy and carbon reduction together with the integration of renewable energy sources is shaping industry dynamics. Modernization of mining operations, oil & gas projects, and other industrial facilities, which require reliable motor control solutions is complementing business landscape.

- For instance, in November 2024, Canada introduced a new emissions framework targeting a 35% reduction in oil and gas sector emissions by 2030, based on 2019 levels, focusing on pollution control. The plan incorporates a cap-and-trade system to allocate allowances, incentivize cleaner technologies, and provide offsets for high-emission facilities. Backed by USD 9.1 billion in tax credits for carbon capture, the strategy balances environmental objectives with projected production growth.

North America Medium Voltage Drives Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 429.1 Million |

| Market Size in 2026 | USD 454.8 Million |

| Forecast Period 2026 - 2035 CAGR | 6.8% |

| Market Size in 2035 | USD 823.2 Million |

| Key Market Trends | |

| Drivers | Impact |

| Significant development of large-scale industries and renewable power generation | Rapid industrial expansion and renewable projects increase demand for MV drives to optimize energy use, improve operational efficiency, and support large-scale electrification initiatives. |

| Positive outlook towards adoption of energy efficient technologies | Growing preference for energy-efficient solutions accelerate MV drive installations, reducing operational costs, enhancing sustainability, and meeting energy-saving objectives across industries. |

| Stringent regulatory measures for energy efficiency and reducing emissions | Strict regulations led industries to adopt energy efficient motor control solutions, which further helps to reduce emissions, improve energy performance, and support decarbonization goals. |

| Pitfalls & Challenges | Impact |

| High initial deployment cost | Substantial upfront investment limits product adoption among small and medium enterprises, delays modernization projects, and slows overall industry penetration. |

| Opportunities: | Impact |

| Industrial IoT integration | IoT-enabled MV drives enable predictive maintenance and real-time monitoring, reducing downtime, improving asset performance, and driving digital transformation across industrial sectors. |

| Integration of renewable energy sources | Increasing integration of renewable energy sources requires MV drives for grid stability and optimized power flow, supporting clean energy adoption. |

| Modernization of aging infrastructure | Upgrading prevailing industrial systems will accelerate demand for advanced medium voltage drives, improving energy efficiency, reducing maintenance costs, and supporting compliance with modern standards. |

| Adoption of smart manufacturing | Smart manufacturing initiatives increase demand for MV drives with advanced automation and connectivity, to improve productivity, reduce downtime, and enable real-time operational control |

| Market Leaders (2025) | |

| Market Leaders |

15% Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | U.S. |

| Fastest Growing Market | U.S. |

| Emerging Countries | U.S., Canada and Mexico |

| Future outlook |

|

What are the growth opportunities in this market?

North America Medium Voltage Drives Market Trends

- North America medium voltage drives market is anticipated to witness significant momentum, owing to growing emphasis on adoption of energy efficient systems and increasing need for reliable motor control across various industrial operations. The growing implementation of automation across industrial sectors, supported by proactive measures from manufacturers and regulatory bodies to enhance production standards, is contributing to industry growth.

- For instance, in November 2024, ABB upgraded its medium-voltage variable frequency drive for NASA at the National Transonic Facility in Virginia, extending its operational life by at least a decade. The upgrade replaced critical components within the existing footprint using company’s advanced technology, ensuring high efficiency, reliability, and minimal disruption.

- Development of industrial infrastructure, modernization initiatives coupled with stringent energy-efficiency mandates and emission-reduction policies, is further augmenting industry outlook. Furthermore, adoption of Industrial Internet of Things (IIoT) is enabling precise system configuration and optimizing energy utilization, thereby improving operational efficiency and positively influencing the industry dynamics.

- For instance, in October 2025, Canada, under its G7 Presidency, is advancing efforts to secure critical mineral supply chains essential for clean energy and advanced manufacturing. At the G7 meeting in Toronto, Canada announced 26 strategic investments and partnerships worth USD 6.4 billion under the Critical Minerals Production Alliance, aimed at accelerating projects, promoting standards-based markets, and strengthening international resource security.

- Increasing investments in heavy duty industrial sectors, along with the construction of advanced infrastructure equipped with technologies comprising large-scale HVAC systems, will complement industry landscape. The growing need for efficient power management solutions to improve operational performance and modernization across critical industrial sectors is set to further augment the industry outlook.

North America Medium Voltage Drives Market Analysis

Learn more about the key segments shaping this market

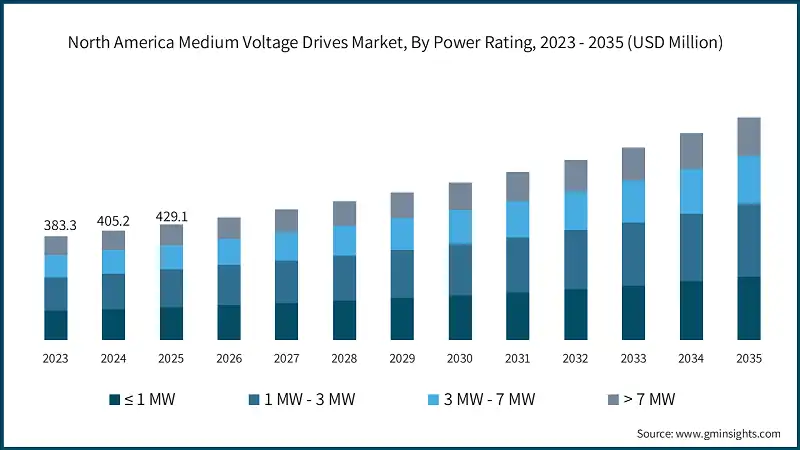

- Based on power range, the industry is segmented into ≤ 1 MW, 1 MW - 3 MW, 3 MW - 7 MW and > 7 MW. The 1 - 3 MW segment dominated North America medium voltage drives market accounting for around 32% market share in 2025 and is set to grow at a CAGR of 7% through 2035.

- Increasing adoption of automation, modernization of infrastructure, and integration of renewable energy systems further accelerating demand for these drives. Favorable initiatives toward energy optimization and reduced emissions encourage industries to replace older equipment with advanced MV drives, ensuring reliability, operational flexibility, and compliance with sustainability standards.

- For instance, in June 2024, INVT introduced its GD200A series inverter to replace traditional soft starters in water pumping stations, in Mexico, delivering over 40% energy savings and enhanced reliability. Featuring CE certification, advanced open-loop vector control, IoT-enabled remote monitoring, and salt-resistant coating for 10-year durability, this solution optimizes fan and pump performance. INVT’s technology has supported Los Mochis, Mexico water industry for five years, driving sustainability and efficiency.

- The ≤ 1 MW segment is set to surpass USD 230 million by 2035. Increasing demand for reliable, compact, and cost-effective solutions across small-scale industrial applications coupled with accelerating automation across manufacturing facilities and other sectors is driving product demand. Rising adoption of energy-efficient systems along with ongoing integration with smart grids, digital monitoring, and IIoT-enabled predictive maintenance for precise control, will augment product deployment.

- For instance, in April 2025, Invertek Drives USA showcased its Optidrive variable frequency drive solutions at the Data Center World, held in Washington D.C., U.S. With cooling and ventilation consuming up to 40% of data center energy, the company’s advanced VFDs enable precise control of HVAC-R fans, pumps, and compressors, cutting energy use by as much as 50%. The Optidrive range integrates BACnet and Modbus protocols for seamless building system connectivity.

- The 3 - 7 MW power range segment was evaluated at over USD 90 million in 2025. Increasing investments in energy-intensive industries, modernization of aging infrastructure, and expansion of LNG and mining projects will increase product penetration. Moreover, rising need for grid stability and electrification of industrial processes, ensuring compliance with stringent energy-efficiency and sustainability standards will augment product deployment.

- Medium voltage drives with > 7 MW power range is set to grow at a CAGR of over 6% by 2035. Rising demand for high-capacity motor control solutions across industries including oil & gas, power generation and marine along with expansion of renewable energy projects accelerating adoption of MV drives for optimized power conversion and grid integration. Electrification of heavy processes and the shift toward variable-speed control for large motors are key factors driving product deployment for better process optimization and lower maintenance costs.

Learn more about the key segments shaping this market

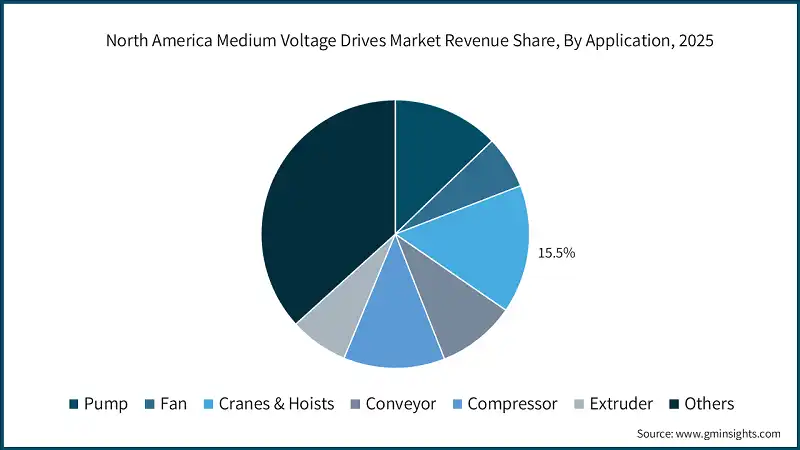

- Based on application, the North America medium voltage drives market is categorized into extruder, cranes & hoists, pump, compressor, fan, conveyor, and others. Cranes & hoists dominated North America MV drives market accounting for about 15.5% market share in 2025 and is set to expand at a growth rate of over 6.5% through 2035.

- The cranes and hoists segment is set to grow owing to rising need for precise control, energy efficiency, and improved safety in material handling operations across infrastructure projects, construction and modernization of ports. Industries including steel, automotive, ports, and construction rely on heavy-duty lifting equipment, where MV drives enable smooth acceleration, deceleration, and load positioning, reducing mechanical stress and downtime.

- For instance, in August 2024, Rockwell Automation introduces an innovative approach to optimize asset utilization through PowerFlex medium-voltage drives with sync-transfer technology. This system allows one MV drive to control multiple motors sequentially, reducing capital costs by up to 50% while improving redundancy and can control motors for conveyors, extruders, fans, hoists, cranes, among others. Common in oil and gas applications, it enables efficient operation of pumps and compressors, offering precise frequency matching and seamless transfer to utility power for maximum uptime and energy savings.

- North America medium voltage drives market from pump application is set to grow a CAGR of above 6.2% by 2035. Advancements in drive technology to enable precise regulation of pump speed and output, significantly improving operational efficiency and system performance will accelerate product deployment across pump applications. Growing inclination toward optimized energy consumption and enhanced process control across modern infrastructure and industrial applications to ensure smoother operation and reducing mechanical stress will accelerate product demand.

- For instance, in September 2025, Fuji Electric Corp. of America unveiled the FRENIC-MEGA (G2) AC drive, delivering a three-phase output of 1,386 HP. This next-generation model enhances the proven FRENIC platform with expanded functionality, combining multiple drive capabilities into one intelligent solution. Designed for constant and variable torque applications, it offers enhanced flexibility and efficiency for sectors such as manufacturing, HVAC, and pumping systems.

- The conveyor application is anticipated to cross USD 75 million by 2035. Rising demand from the cement industry, bulk material handling operations, and expanding mining sector requiring high-torque conveyor applications, delivering superior efficiency, precise speed regulation, and significant energy savings, will complement industry landscape. Increasing integration of automation and digitalization, and MV drives equipped with condition-based monitoring, predictive maintenance capabilities, to enhance reliability and operational continuity will further accelerate product adoption.

- Compressors application was evaluated at over USD 50 million in 2025 and is set to grow owing to evolving energy-efficiency standards and need for optimized industrial processes, driving adoption of MV drives. Growing investments in water treatment, power generation, and heavy-duty industrial operations require MV drives for precise control, optimize performance, and reduce maintenance costs, further augmenting industry outlook.

- Based on the drive, the North America medium voltage drives market is categorized into AC, DC and servo. The medium voltage AC drives have witnessed significant momentum owing to rising demand for reliable motor control solutions across heavy duty industries including oil & gas, power generation, marine and mining.

- Rising automation across industrial processes, increasing emphasis on energy efficiency, and rapid technological advancements are driving demand for advanced AC drives. These units provide precise electronic motor control and versatile connectivity options, enabling process optimization across diverse sectors which is set to augment product deployment. Growing adoption of efficient motor control systems, coupled with implementation of advanced manufacturing practices and initiatives toward reducing energy consumption, is positively shaping business dynamics.

- For instance, in February 2025, Innomotics’ medium-voltage AC drives were upgraded with artificial intelligence capabilities through the integration of Ansys multi-physics simulation and digital twin technology. Virtual testing and reduced-order modeling were applied to minimize development time and costs, allowing advanced design optimization and accelerating innovation in drive systems.

- Medium voltage DC drives market is set to grow on account of industries seeking precise speed control and operational efficiency along with focus on accurate regulation of motor speed, torque, and acceleration across industrial sectors. DC drives offer enhanced efficiency, improved power quality, and power factor correction compared to low-voltage alternatives, reducing energy consumption and operational costs while enabling optimized performance in large-scale industrial environments.

- The servo drives market is anticipated to grow owing to increasing demand for precision motion control across applications such as robotics, packaging, and electronics, requiring high accuracy and responsiveness. Expanding renewable energy projects, large-scale industrial operations, and rising need for energy-efficient systems across oil and gas, mining, and transportation sectors will augment industry outlook.

- For instance, in February 2025, Allient Rochester introduced the EC Series servo drive and SMLC-e multi-axis motion controller both controlled with EtherCAT, expanding its servo control solutions portfolio. Designed for high-performance applications across aerospace, medical, semiconductor, packaging, and industrial automation, these systems feature four models with full IEC 61131-3 compliance and CODESYS 3.5 programming for efficient motion and PLC control.

Looking for region specific data?

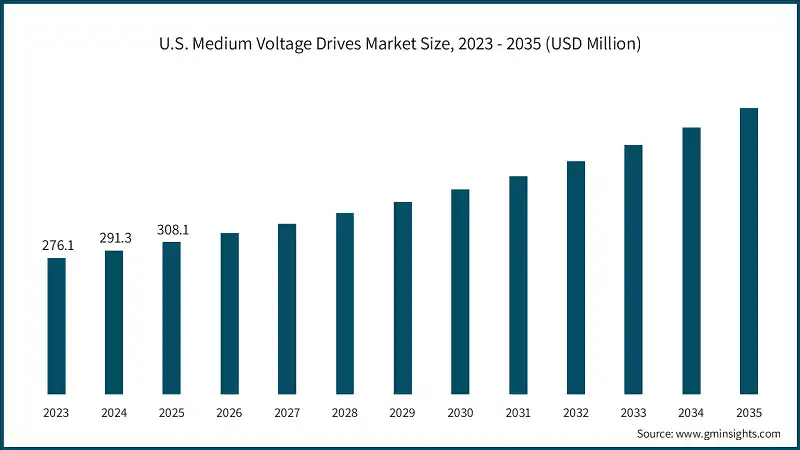

- U.S. dominated the North America medium voltage drives market with around 71.8% market share in 2025 and generated USD 308.1 million in revenue. Increasing investments toward modernizing industrial infrastructure along with rising demand for energy-efficient and reliable motor control solutions across diverse industrial applications will complement industry landscape. Favorable initiatives by authorities toward promoting sustainable technologies and improving energy efficiency across industries along with stringent mandates toward reducing carbon emissions will augment business outlook.

- For instance, in December 2025, the U.S. Department of Energy has introduced updated energy conservation standards for industrial electric motors, mandating the adoption of high-efficiency technologies across manufacturing and commercial sectors. This regulation is expected to significantly reduce national electricity consumption, lowering operational costs for businesses. Additionally, the rule is projected to prevent approximately 92 million metric tons of CO2 emissions over the next 30 years.

- Canada medium voltage drives market is anticipated to surpass USD 145 million by 2035. Flourishing investments in industrial automation, focusing on modernization across power generation, mining, and renewable energy sectors and government reforms toward energy conservation and industrial development will positively influence industry dynamics. Stringent energy-efficiency mandates and ongoing development of MV drives equipped with condition-based monitoring and predictive maintenance, reducing downtime and operating costs across industrial processes are accelerating product deployment.

- For instance, in December 2025, Canada approved Anglo American’s USD 36.5 billion acquisition of Teck Resources under the Investment Canada Act. This decision marks a pivotal moment for foreign investment in critical mining assets, highlighting regulatory framework balances openness with national safeguards. The clearance includes structured commitments and operational conditions, reinforcing large-scale international transactions.

- Mexico medium voltage drives market is set to witness a CAGR of over 7.5% from 2026 to 2035. Rapid development of industrial infrastructure along with rising foreign investments across sectors including oil & gas, power generation, manufacturing among others accelerate demand for reliable motor control solutions, further complementing business landscape. Ongoing renewable energy capacity expansion coupled with rising demand for advanced technologies to deliver superior control optimize performance, improve reliability and ensuring operational efficiency will contribute to industry growth.

- For instance, in February 2025, WEG delivered its first MVW3000 medium-voltage drive manufactured in Mexico for a combined cycle power plant in Cuautla, Morelos. Supplied via Beraterín, the system controls two 1,250 HP pumps at 4,160 V, ensuring precise water flow from the wastewater treatment plant to demineralized water systems.

North America Medium Voltage Drives Market Share

- Major 5 players operating across the North America medium voltage drives market include ABB, Siemens, Eaton, Nidec, and GE Vernova contribute around 42% of the market share in 2025.

- Key manufacturers operating across North America medium-voltage drives market are focusing on strategic partnerships, alliances, joint ventures collaborations, mergers and acquisitions to strengthen their industry presence. Major players are focusing on research & development initiatives to introduce advanced technologies and expand their product portfolios that deliver enhanced performance, energy efficiency, and offer integration with automation platforms.

- For instance, in October 2024, Siemens finalized the divestment of Innomotics to KPS Capital Partners, based in U.S. for approximately USD 3.7 billion. The divestment followed Siemens’ earlier announcement in May 2024 regarding its plan to transfer this major supplier of large-drive and electric motor systems. Innomotics was formed by consolidating Siemens’ operations in motor technologies and medium-voltage converters, leveraging shared resources and expertise.

- Over the past three years, the North America variable frequency drives market witnessed significant momentum, despite the economic uncertainties. In 2023 & 2024, improved supply chain, investments in advanced drive solutions and growing inclination on reducing energy consumption across industries has augmented product deployment. In 2025, the industry witnessed industrial infrastructure development, renewable power generation initiatives, favorable policies toward energy efficiency, and mandates to reduce energy consumption is contributing to industry growth.

- ABB MV AC drives portfolio includes power ranges from 200 kW to over 150 MW, offering reliable and superior performance solutions for industrial and utility applications. These drives support various processes including pumps, fans, compressors, rolling mills, grid simulation, conveyors, marine propulsion, and other high-power operations. These units feature advanced engineering and ensure superior energy efficiency, precise control, and enhanced performance across various industrial sectors.

- GE Vernova offers comprehensive portfolio of MV drives suitable for heavy-duty industrial operations including power generation, marine and oil & gas offering enhanced motor control. The company’s medium-voltage drive portfolio offers power ratings from 100 kW to over 100 MW deliver superior operational efficiency, enhanced power availability, precise control, and improved process performance. These solutions enabling industries to maximize throughput and achieve consistent productivity while meeting stringent reliability and energy optimization requirements.

- Nidec offers wide range of medium voltage drives that are designed to increase operational efficiency, reduce energy consumption and deliver long-term cost benefits. The company’s Silcovert TH series offers an advanced retrofit solution featuring torque pulsation, water cooling supports high power output, while compatibility with existing systems guarantees improved safety, reliability, and operational efficiency through customized modernization.

- Eaton offers a wide range of medium-voltage variable frequency drives designed for reliability and innovation featuring advanced configurations, including arc-resistant construction, and provide cost-effective integrated solutions for industrial applications. These drives serve sectors including oil and gas, water and wastewater management, forestry, and power generation, delivering enhanced safety, operational efficiency, and long-term performance.

North America Medium Voltage Drives Market Companies

Major players operating in the North America medium voltage drives market are:

- ABB

- Benshaw Inc

- Danfoss

- Delta Electronics

- Eaton

- Emerson Electric

- Emotron

- Fuji Electric Corp. of America

- GE Vernova

- Innomotics

- Nidec Industrial Solutions

- Rockwell Automation

- Schneider Electric

- Siemens

- Teco-Westinghouse

- TMEIC

- TRIOL CORPORATION

- VEM Group

- WEG

- Wolong Electric America, LLC

- Yaskawa America

- ABB reported USD 25.9 billion in revenue for nine months of 2025 and USD 32.9 billion revenue for 2024. The company’s medium-voltage drives deliver high-performance solutions for utility and industrial applications. These drives cater to diverse sectors, including mining, cement, water and wastewater, power generation, oil & gas, paper, amongst others ensuring efficiency and operational excellence.

- GE Vernova reported revenues of USD 27.1 billion for nine months of 2025. The company’s medium-voltage variable speed drive systems combine voltage source inverter or load commuted inverter technology with electric motors, delivering efficient control for diverse applications. Offering up to 47 MW per VSI panel and 100 MW with parallel configurations, these systems feature advanced topologies, redundancy, and optimized designs for reliability, reduced footprint, and superior performance in demanding industrial environments.

- Eaton offers SC9000 Encapsulated Powerpole (EP) medium-voltage variable frequency drive delivers up to 12,000 hp in a compact, reliable design. Engineered for efficiency and durability, this award-winning solution ensures superior power and control even in harsh environments. It is widely deployed across critical sectors, including oil and gas, utilities, mining, and water and wastewater applications. The company’s revenue for 9 months of 2025 was evaluated at USD 20.3 billion.

North America Medium Voltage Drives Industry News

- In December 2025, WEG supplied a medium-voltage variable speed drive for pump tests up to 1,500 HP and soft starters for a leading global flow-control manufacturer’s test lab in Mexico. The solution enables pump testing under real operating conditions, improving efficiency, reliability, and on-site certification capabilities. This first MV drive project for the customer strengthens WEG’s strategic partnership, showcasing advanced technology, modular design, and robust performance for high-power applications in critical industrial environments.

- In September 2025, Wolong Electric America introduced medium-voltage VFDs engineered for demanding industrial environments, including mining. Utilizing cascaded H-Bridge topology with IGBT-based multi-level inverters, these drives deliver low-distortion output, broad voltage flexibility comprising 3.3–13.8 kV, and compatibility with legacy and modern motors. These units are equipped with modular architecture, advanced cooling, and redundant fans, ensuring high reliability, easy maintenance, and long-term efficiency for critical applications including fans, pumps, compressors, blowers, and conveyors.

- In November 2024, ABB introduced the ACS8080, an advanced medium-voltage air-cooled drive delivering up to 98% efficiency. These drives offer MP3C motor control for reduced harmonics and enhanced motor performance, modular flexibility for new installations and retrofits. Integrated digital capabilities via Crealizer enable rapid customization and application-specific programming, minimizing external controller dependency. These units support diverse industrial applications with superior energy efficiency, reliability, durability and operational robustness.

- In April 2024, Rockwell Automation has enhanced its PowerFlex 6000T medium-voltage VFD with firmware supporting permanent magnet motor applications for high-speed operations up to 120 Hz. The drive offers predictive maintenance via TotalFORCE technology, real-time health monitoring, and CIP Security for cyber protection. Their compact design with integrated pre-charge reduces footprint, while flexible configuration options and advanced connectivity ensure energy efficiency, reliability and adaptability for critical industrial processes.

The North America medium voltage drives market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume (Units) and revenue (USD Million) from 2026 to 2035, for the following segments:

Market, By Power Range

- ≤ 1 MW

- 1 - 3 MW

- 3 - 7 MW

- > 7 MW

Market, By Drive

- AC

- DC

- Servo

Market, By Sales Channel

- Direct to end use

- Direct to machine builder

- Direct to systems integrator

- Distribution/partner

Market, By Application

- Pump

- Fan

- Cranes & hoists

- Conveyor

- Compressor

- Extruder

- Others

Market, By End Use

- Oil & gas

- Power generation

- Mining & metals

- Pulp & paper

- Marine

- Others

The above information has been provided for the following countries:

- U.S.

- Canada

- Mexico

Frequently Asked Question(FAQ) :

Who are the key players in the North America medium voltage drives market?

Key players include ABB, Siemens, Eaton, GE Vernova, Nidec Industrial Solutions, Schneider Electric, Rockwell Automation, Danfoss, Fuji Electric Corp. of America, and WEG. These companies focus on innovation, energy efficiency, and advanced motor control technologies.

Which country leads the North America medium voltage drives market?

The U.S. leads the North America medium voltage drives industry, holding approximately 71.8% share in 2025. Strong industrial base, automation adoption, renewable energy investments, and stringent energy-efficiency regulations support its dominance.

What are the key growth drivers for the medium voltage drives market?

Key growth drivers include industrial automation, integration of renewable energy sources, stringent energy-efficiency regulations, adoption of Industrial IoT, and modernization of aging industrial infrastructure across North America.

What are the upcoming trends in the medium voltage drives industry?

Major trends include AI-enabled predictive maintenance, Industrial IoT integration, smart manufacturing adoption, renewable energy grid modernization, and increased use of digital monitoring and condition-based maintenance systems.

What is the growth outlook for the pump application segment?

The pump application segment is projected to grow at a CAGR of over 6.2% through 2035. Rising demand for energy optimization, water treatment infrastructure, and process efficiency is accelerating adoption of medium voltage drives.

How much revenue did the ≤ 1 MW segment generate by 2035?

The ≤ 1 MW segment is projected to surpass USD 230 million by 2035. Increasing deployment across small-scale industrial applications, HVAC systems, and data centers is driving sustained demand.

What is the projected value of the North America medium voltage drives market by 2035?

The North America medium voltage drives market is expected to reach USD 823.2 million by 2035, growing at a CAGR of 6.8%. Market expansion is fueled by industrial electrification, energy-efficiency regulations, and widespread adoption of automation technologies.

Which power range segment dominated the market in 2025?

The 1 MW–3 MW power range segment dominated the market in 2025, accounting for around 32% share. Strong demand from manufacturing, mining, oil & gas, and power generation industries supported its leadership position.

What is the market size of the North America medium voltage drives industry in 2026?

The market size for North America medium voltage drives reached USD 454.8 million in 2026, reflecting steady expansion driven by renewable energy integration, digitalization, and increasing industrial investments.

What is the North America medium voltage drives market size in 2025?

The market size for is valued at USD 429.1 million in 2025. Growth is supported by rising adoption of energy-efficient motor control solutions, industrial automation, and modernization of aging infrastructure across key industries.

North America Medium Voltage Drives Market Scope

Related Reports