Summary

Table of Content

North America Insect Protein Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Insect Protein Market Size

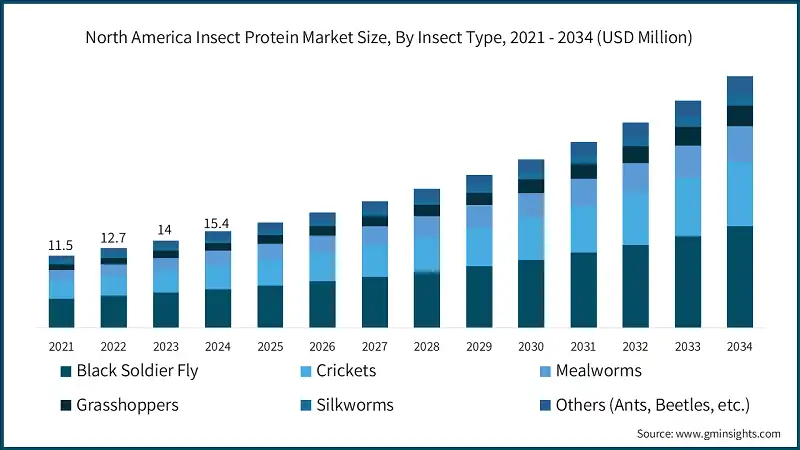

The North America insect protein market was valued at USD 15.4 million in 2024, with expectations to reach USD 40.3 million by 2034, growing at a CAGR of 10.2%. Insect protein industry is blossoming in North America, because of the high demand for alternative and eco-friendly proteins in food, livestock feed, and pet food industries. ‘Protein’ is most frequently obtained from black soldier fly larvae, crickets, and mealworms. These have extensive applications in animal feed, aquaculture, pet food, snack foods, protein bars, and meat analogues.

To get key market trends

In terms of applications, animal feed remains the largest segment owing to the favourable digestibility, high content of amino acids, and regulatory support of insect protein as a feed-grade ingredient. The pet food sector is also becoming a significant part of the market because of premiumization and clean-label trends. For human consumption, although niche, is growing through acceptance via protein powders, snacks, and insect protein flours.

North America Insect Protein Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 15.4 Million |

| Forecast Period 2025 - 2034 CAGR | 10.2% |

| Market Size in 2034 | USD 40.3 Million |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Marketing factors are influenced by the increasing food security issues, rising cost of producing traditional protein foods, and consumer perspective towards sustainable food production systems. However, cultural issues, regulatory vagueness, and high production costs serve as obstacles for further market growth. Acceptance and scalability improvements, along with government and corporate sponsored awareness programs, are expected to greatly benefit the region making North America highly potential for commercialization of insect protein.

For instances, United States has a robust poultry industry, with an inventory of over 520 million chickens and over 218 million turkeys. This positively impacts the market by driving adoption of insect-based ingredients as cost-effective, eco-friendly feed solutions, especially in poultry sectors seeking nutrient-rich additives.

North America Insect Protein Market Trends

The market is booming due to new technology, an increase in investment, and rising interest in sustainable protein. Yield and cost efficiency has dramatically improved due to automated insect farming, AI monitoring, and optimized rearing environments. These innovations are solving the quality problems associated with commercializing the industry which maintains consistency in quality during increased production.

The market is also expanding towards human food and nutraceuticals aside from solely animal feed. There is a major shift in the pet food sector as well due to premiumization and the use of new hypoallergenic ingredients. New regulations approval has boosted confidence within the industry.

For instance, total pet market sales have steadily increased in the U.S. over past years. Pet food and treats was the highest selling pet market product category in the United States in 2023. Approximately 64.4 billion U.S. dollars of pet food and treats were sold in 2023.

Strategic advantages exist in the areas of pharmaceuticals, biomedicine, and industries which make use of the functional attributes of lipids and proteins derived from insects. With heightened consumer awareness, increased investor interest, and ongoing innovation for new products, the North American market is poised for explosive growth and diversification in the next few years.

Tariff Impact

North America insect protein market might experience significant challenges because of the Trump tariffs. These protective measures may compromise the equilibrium of the existing supply chains, especially for businesses that source feed substrates, farming equipment, or packaging materials from Canada, Mexico, or China. Heightened trade relations could also restrict cross-border collaboration, stifling both innovation and joint insect farming research initiatives.

Moreover, businesses could be forced to adopt local sourcing or manufacturing due to the heightened production costs tariffs incur, thus increasing domestic innovation but straining smaller startups. Consumer pricing would increase, making insect-based foods and feeds less accessible, which would slow mainstream adoption. All in all, the growth momentum, investor confidence, and strategic focus of the tariffs will shift towards self-sufficiency and supply chain resilience.

North America Insect Protein Market Analysis

Learn more about the key segments shaping this market

Based on insect type the market is segmented into black soldier fly, crickets, mealworms, grasshoppers, silkworms, others. The black soldier fly accounted for 40.1% of the market share in 2024 and is expected to grow with the CAGR of 10.3% in 2034.

- Due to its feed conversion efficiency along with its sustainability, the black soldier fly (BSF) dominates the North American insect protein market as it is most ideal for large scale production. Further, black soldier fly larvae is especially treasured for its rich protein content which is extensively used in animal and pet food. Moreover, crickets have established a considerable market for themselves particularly in protein powders and snacks because of their nutritional value. Mealworms are also well known for their protein and fat content in animal feed and human use. Silkworms and grasshoppers, while lesser known do serve some specialized markets.

Learn more about the key segments shaping this market

Based on product form the market is segmented into whole insects, insect powder, insect meal, insect oil/fat, insect protein isolates/concentrates, others. Insect meal holds the market share of 35.1% in 2024 and expected to grow at a faster rate of 10.3% CAGR.

- Insect meals dominate the North America insect protein market because of its multifunctionality as well as its nutritional benefits, especially in animal feed. In aquaculture, poultry, and pet food industries insect meals are a highly digestible protein source as well as an alternative to other meals like fishmeal and soybean meal. It is also highly favored by feed manufacturers and stakeholders who prioritize sustainability due to its high digestibility and low environmental footprint. To keep up with demand companies are also increasing production capacity, making insect meals the most economically accessible and widely produced form of insect protein in the area.

Based on application the market is segmented into animal feed, pet food, food & beverages, pharmaceuticals & nutraceuticals, cosmetics, others. Animal feed segment holds a significant market size of USD 6.5 million of the market in 2024.

- The North America insect protein market is primarily focused on animal feed, as poultry, livestock, and aquaculture continue to surge in demand due to their need for sustainably and economically viable protein. Compared to soy and fishmeal, insect protein serves as a more digestible alternative and reduces environmental damage while also providing essential amino acids. The rapidly growing segment of pet food products from the pet care industry is gaining traction as consumers seek greener and more hypoallergenic choices.

- Focusing on the food and beverage industry, there is slow growth with considerable expansion on health and sport protein bars and flour blends which are popular among more daring and health-conscious consumers. Pharmaceuticals are also interested in insect protein because of its active ingredients and immunity-building benefits.

Looking for region specific data?

In the North America insect protein market, U.S. accounts the major share by accounting USD 11 million in 2024 and is expected to grow at a CAGR of 10.3% in 2034.

- The U.S. remains the unrivaled participant in the market because of its sophisticated research ecosystem; ample presence of leading insect protein startups; and favorable investment policy. Demand inflow across animal feed, pet food, and functional food is surging in the country due to the increased consumer advocacy towards sustainability and alt-proteins. Further strengthening the position of the US market is supportive regulatory changes and greater public partnership participation. In addition, large-scale insect farms and processing technology innovations further improve production effectiveness and scalability. With distribution systems and growing e-commerce channels, companies from the US are poised to dominate the regional market and meet the growing global market.

North America Insect Protein Market Share

Top 5 companies include Aspire Food Group, Entomo Farms, Protix, Ynsect, InnovaFeed. These are prominent companies within the global market operating in their respective regions. These companies hold strong positions globally due to their extensive experience in market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand for North America insect protein across various regions.

North America Insect Protein Market Companies

Aspire Food Group: Aspire Food Group is regarded as a leader in the North American insect protein sector owing to the fully automated cricket farming facility they operate in Texas. Often described as fully automated, the facility incorporates advanced technologies such as robotics and artificial intelligence, which the company claims further aids in sustainability and scaling of insect protein production. Aspire’s focus is on food, animal feed, and industrial uses of protein. It also maintains strategic partnerships with governments and other research bodies, aiming to position itself as a leader in mass production of insect protein.

Entomo Farms: Operating from Canada, Entomo Farms is one of the biggest manufacturers of cricket flour and whole roasted crickets in North America. The company serves the pet food and human food markets and prides itself in following organic farming and sustainability. Entomo Farms is proactive in marketing, branding, and education which raises the profile of insect consumption in North America. Lower prices coupled with wide distribution provide a competitive advantage in the retail and B2B sectors.

Protix: Protix is known for producing black soldier fly protein for animal feed, aquaculture, and pet food. Though headquartered in the Netherlands, Protix has North American strategic goals through partnerships and licensing its technology. Its main competitive advantage is integrated production systems and sustainable sourcing to supply chains that focus on eco-friendliness.

Ynsect: Ynsect is yet another European company that penetrate the North American market. Focused on mealworm protein, Ynsect’s funding targets include aquaculture feed, pet food. To expand to new markets, Ynsect capitalizes on patented vertical farming technologies and robust financial support. This North American venture represents a global strategy aimed at establishing a leadership position in the premium insect protein market for Ynsect.

InnovaFeed: InnovaFeed has been establishing its presence in North America. The company leverages its robust R&D capabilities and French black soldier fly production. InnovaFeed initially targets large agro-industrial partners in a bid to achieve scale. The main priority remains aquaculture, poultry, and pet feed. With sustainability at the core of its mission, the company aims to build competitive advantage InnovaFeed through tailored innovative and circular economy consortium projects.

North America Insect Protein Industry News:

- In October 2023, Tyson Foods, a major U.S. meat producer, revealed an investment in Protix, a Dutch company specializing in insect-based ingredients. The collaboration involves setting up a U.S. facility that will use animal by-products to rear black soldier flies. These insects will be processed into feed for poultry, fish, and pets. Tyson Foods emphasized that their initiative is centred on incorporating insect protein into animal feed, not for direct human consumption.

- Also in 2023, Innovafeed introduced a new brand aimed at tapping into the potential of insects for aquaculture and monogastric animal nutrition. The product line features insect oil developed specifically for aquaculture and insect protein formulated for monogastric species, broadening their offerings to support sustainable protein solutions across various sectors of animal agriculture.

The North America insect protein market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 – 2034 for the following segments:

Market, By Insect Type

- Black soldier fly

- Crickets

- Mealworms

- Grasshoppers

- Silkworms

- Others (Ants, Beetles, etc.)

Market, By Product Form

- Whole insects

- Insect powder

- Insect meal

- Insect oil/fat

- Insect protein isolates/concentrates

- Others

Market, By Application

- Animal feed

- Aquaculture feed

- Poultry feed

- Swine feed

- Other livestock feed

- Pet food

- Dog food

- Cat food

- Other pet food

- Food & beverages

- Protein bars & snacks

- Bakery products

- Meat substitutes

- Protein shakes & supplements.

- Others

- Pharmaceuticals & nutraceuticals

- Cosmetics

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

Frequently Asked Question(FAQ) :

Who are some of the prominent players in the North America insect protein market?

Key players in the market include Aspire Food Group, Entomo Farms, Protix, Ynsect, and InnovaFeed.

How much is the U.S. insect protein market worth?

The U.S. insect protein market was valued at USD 11 million in 2024 and is anticipated to grow at a CAGR of 10.3% by 2034.

How big is the North America insect protein market?

The North America insect protein industry was valued at USD 15.4 million in 2024 and is projected to grow at a CAGR of 10.2%, reaching USD 40.3 million by 2034.

What is the market share of insect meal in the North America insect protein industry?

Insect meal accounted for 35.1% of the market in 2024 and is expected to grow at a CAGR of 10.3% during the forecast period.

North America Insect Protein Market Scope

Related Reports